Market Overview

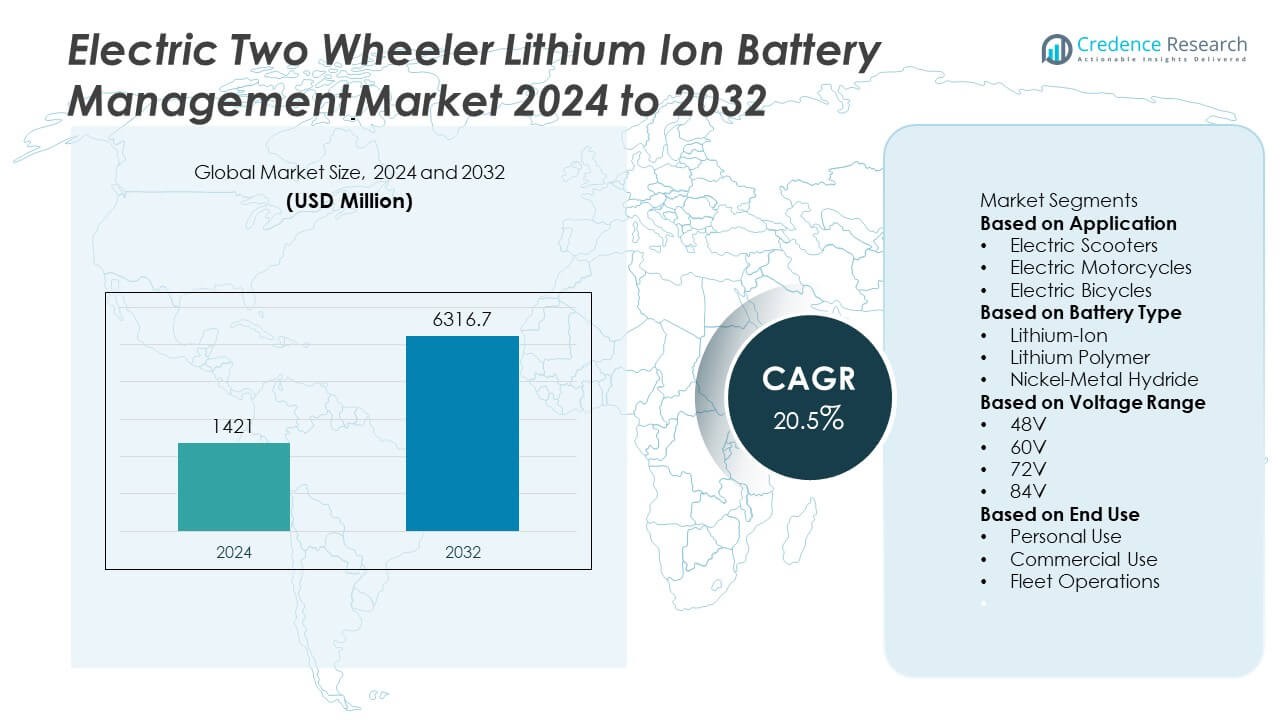

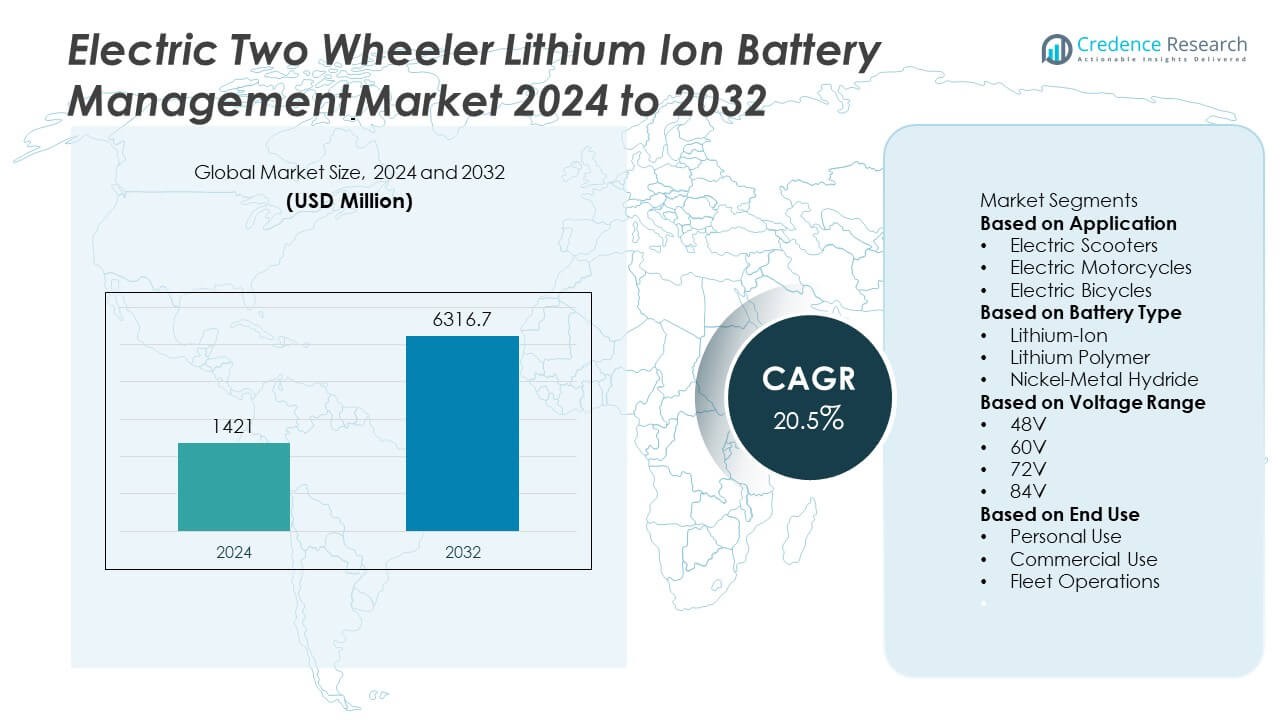

The Electric Two-Wheeler Lithium-Ion Battery Management market was valued at USD 1,421 million in 2024 and is projected to reach USD 6,316.7 million by 2032, growing at a CAGR of 20.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Two-Wheeler Lithium Ion Battery Management Market Size 2024 |

USD 1,421 Million |

| Electric Two-Wheeler Lithium Ion Battery Management Market, CAGR |

20.5% |

| Electric Two-Wheeler Lithium Ion Battery Management Market Size 2032 |

USD 6,316.7 Million |

The Electric Two-Wheeler Lithium Ion Battery Management Market advances on rising adoption of electric scooters and motorcycles to meet sustainability goals, supported by government incentives and expanding charging infrastructure. Demand grows for battery systems with enhanced efficiency, safety, and lifecycle management. Technological progress in IoT-enabled monitoring, AI-driven analytics, and modular swappable battery designs strengthens operational reliability and user convenience. Manufacturers focus on lightweight, compact BMS units to optimize vehicle performance and range.

Asia-Pacific leads the Electric Two-Wheeler Lithium Ion Battery Management Market due to strong manufacturing capabilities, government subsidies, and widespread adoption of electric scooters in China and India. Europe follows with robust regulatory frameworks and high demand for premium electric motorcycles, while North America focuses on performance-driven models and fleet electrification. Latin America sees steady growth from urban delivery services, and the Middle East & Africa witness gradual adoption through infrastructure investments and commercial mobility solutions. Key players shaping the market include Contemporary Amperex Technology Co., known for advanced lithium-ion solutions; LG Chem, offering high-energy-density battery systems; Bosch, delivering integrated BMS technologies; and Samsung SDI, recognized for innovation in battery safety and performance optimization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Two-Wheeler Lithium Ion Battery Management Market was valued at USD 1,421 million in 2024 and is projected to reach USD 6,316.7 million by 2032, registering a CAGR of 20.5% during the forecast period.

- Growing adoption of electric scooters and motorcycles to reduce carbon emissions, supported by favorable government policies and expanding charging infrastructure, continues to fuel market growth.

- Advancements in IoT-enabled battery monitoring, AI-driven analytics, and modular swappable battery technologies are improving operational efficiency, safety, and convenience for both individual users and fleet operators.

- Competitive dynamics are shaped by global leaders such as Contemporary Amperex Technology Co., LG Chem, Bosch, and Samsung SDI, which focus on enhancing energy density, safety features, and lifecycle management capabilities in their BMS solutions.

- High production costs driven by raw material price volatility and semiconductor shortages, along with safety concerns linked to thermal management challenges, remain key restraints for manufacturers.

- Asia-Pacific dominates the market due to strong manufacturing ecosystems and widespread electric two-wheeler adoption, followed by Europe’s emphasis on high-performance, safety-compliant models, and North America’s growing fleet and performance segment demand.

- Emerging opportunities lie in developing markets of Latin America, the Middle East, and Africa, where infrastructure investments, local assembly initiatives, and commercial e-mobility services are driving gradual yet steady adoption.

Market Drivers

Rising Adoption of Electric Two-Wheelers to Reduce Carbon Emissions

The Electric Two-Wheeler Lithium Ion Battery Management Market benefits from the growing shift toward eco-friendly transportation. Governments enforce stricter emission norms, compelling manufacturers to accelerate electric model production. Urban areas experience rising demand for two-wheelers with zero tailpipe emissions, which strengthens the need for reliable battery performance. Consumers value lower operating costs and government subsidies, which further drive sales. Battery management systems ensure optimal charging cycles, preventing performance degradation. This adoption trend supports market growth by aligning with global sustainability goals.

- For instance, Yamaha established ENYRING GmbH in Berlin with operations slated for the first half of 2025 to deploy subscription-based swappable batteries and a closed-loop reuse and recycling model, expanding access to managed packs in European cities.

Technological Advancements Enhancing Battery Efficiency and Safety

It experiences strong momentum from rapid advancements in battery management technologies. Modern systems integrate advanced sensors and software to maintain cell balance and monitor temperature. Enhanced safety features reduce risks of overheating or short circuits, improving user trust. High energy density cells require precise management to extend lifecycle and maintain power delivery. Manufacturers focus on developing compact, lightweight systems without compromising performance. These innovations encourage wider adoption among electric two-wheeler producers seeking competitive advantages.

- For instance, CATL specifies its Qilin cell-to-pack platform at 255 Wh/kg energy density, while Bosch introduced a 2 kW drive control unit that combines inverter, motor control, and vehicle control in one compact module for small two-wheelers—both requiring precise BMS coordination to manage power and heat.

Expanding Urban Mobility Solutions and Shared E-Mobility Platforms

The Electric Two-Wheeler Lithium Ion Battery Management Market gains traction from the rise of shared mobility services in congested cities. Operators of electric scooter rental fleets demand efficient battery systems to maximize uptime and reduce maintenance. BMS technologies enable accurate state-of-charge monitoring, ensuring optimal fleet utilization. Growing smartphone integration allows real-time performance tracking, supporting operational efficiency. Rising consumer preference for on-demand mobility boosts fleet expansion plans. These factors create consistent demand for advanced battery management solutions.

Government Incentives and Infrastructure Development Supporting Market Expansio

It is driven by favorable policies, including purchase incentives, tax benefits, and reduced registration fees for electric vehicles. Governments invest in charging infrastructure, making electric two-wheelers more viable for daily commutes. Standardization of charging protocols improves interoperability and consumer confidence. Public-private partnerships accelerate infrastructure deployment in both developed and emerging markets. Import duty reductions on critical battery components support lower production costs. This policy support strengthens the long-term outlook for battery management technology adoption.

Market Trends

Integration of Smart Battery Management Systems with IoT and AI Capabilities

The Electric Two-Wheeler Lithium Ion Battery Management Market is witnessing a clear shift toward intelligent, connected solutions. IoT-enabled BMS platforms provide real-time data on battery health, charging status, and predictive maintenance needs. AI algorithms analyze usage patterns to optimize charging cycles and extend battery lifespan. Manufacturers incorporate cloud-based monitoring for remote diagnostics, enhancing user experience and operational efficiency. These smart features support proactive service models for fleet operators and individual owners. The integration trend strengthens product value propositions and fosters stronger customer loyalty.

- For instance, Maxvolt Energy Industries Ltd., a lithium battery manufacturer, launched a new generation of electric two-wheeler battery packs that combine advanced safety features with enhanced performance.

Adoption of Modular and Swappable Battery Technologies

It is experiencing increased interest in modular battery systems designed for quick replacement. Swappable battery technology reduces downtime for fleet operators and individual riders. Standardized battery formats simplify logistics and promote cross-brand compatibility. This approach supports faster charging network expansion and wider adoption in urban areas. Battery management systems play a critical role in ensuring safe operation during frequent swaps. The modular trend aligns with growing demand for convenience and operational flexibility in electric mobility.

- For instance, Gogoro states its prototype solid-state swappable battery increases capacity from 1.7 kWh to 2.5 kWh, and reports daily swaps with cumulative swaps on its network.

Focus on Lightweight and Compact Battery Management Designs

The Electric Two-Wheeler Lithium Ion Battery Management Market is moving toward smaller, lighter, and more energy-efficient designs. Compact BMS units enable integration in limited chassis spaces without compromising performance. Lightweight materials improve overall vehicle efficiency and extend travel range. Engineers develop streamlined layouts to reduce wiring complexity and assembly costs. The emphasis on weight reduction aligns with consumer expectations for better handling and energy savings. This trend supports enhanced market competitiveness among leading manufacturers.

Rising Demand for High-Voltage Battery Systems for Performance Models

It is seeing greater adoption of high-voltage lithium-ion systems to meet the performance needs of premium electric two-wheelers. Higher voltage platforms deliver stronger acceleration, longer range, and improved thermal stability. Advanced BMS solutions are required to manage these power levels safely and efficiently. Performance-oriented models attract urban commuters seeking faster travel times and enthusiasts valuing speed. Manufacturers position these systems as premium offerings in their product portfolios. The shift toward high-voltage solutions drives technological innovation and differentiates brands in competitive markets.

Market Challenges Analysis

High Production Costs and Supply Chain Constraints Limiting Scalability

The Electric Two-Wheeler Lithium Ion Battery Management Market faces challenges from elevated production costs driven by expensive raw materials and advanced electronic components. Lithium, cobalt, and nickel price volatility increases manufacturing uncertainty for both battery and BMS producers. Limited availability of high-quality semiconductor chips disrupts production schedules, delaying product launches. Supply chain fragmentation in emerging markets adds complexity to sourcing critical parts. Manufacturers struggle to balance cost efficiency with the need for advanced features and safety compliance. These constraints slow large-scale adoption and hinder competitive pricing strategies.

Thermal Management and Safety Risks Affecting Consumer Confidence

It must address persistent safety concerns linked to overheating, short circuits, and thermal runaway incidents. Poor thermal regulation in high-performance battery packs increases the risk of damage and operational failure. Variations in climate and operating conditions challenge BMS designs to deliver consistent safety performance. Instances of battery-related accidents reduce consumer trust and prompt stricter regulatory scrutiny. Manufacturers must invest in advanced thermal management solutions and rigorous testing protocols to meet safety standards. Addressing these technical risks remains critical to sustaining market growth and public acceptance.

Market Opportunities

Expansion Potential in Emerging Economies with Growing E-Mobility Adoption

The Electric Two-Wheeler Lithium Ion Battery Management Market holds strong potential in regions where e-mobility adoption is accelerating. Rapid urbanization, rising fuel costs, and supportive government incentives create favorable conditions for electric two-wheeler penetration. Developing markets in Asia-Pacific, Latin America, and parts of Africa are witnessing infrastructure upgrades that support wider EV usage. Local manufacturing initiatives reduce import dependency and open opportunities for cost-competitive BMS production. Partnerships between global technology providers and domestic vehicle makers enable faster market entry. These conditions present a scalable pathway for revenue growth across untapped geographies.

Technological Innovations Enabling Differentiation and Premium Offerings

It can capitalize on breakthroughs in energy management, artificial intelligence, and connectivity to create advanced BMS solutions. Integration of predictive analytics and real-time diagnostics offers enhanced performance visibility for both consumers and fleet operators. Innovations in fast-charging compatibility and energy recovery systems extend operational efficiency and range. Customizable software platforms allow manufacturers to tailor battery behavior to specific vehicle models. These capabilities position BMS technologies as value-added features in premium electric two-wheelers. Continuous innovation strengthens competitive differentiation and opens higher-margin product segments.

Market Segmentation Analysis:

By Application

The Electric Two-Wheeler Lithium Ion Battery Management Market covers applications in electric scooters, motorcycles, and other two-wheeled electric mobility solutions. Electric scooters hold the largest share due to their affordability, ease of use, and suitability for urban commutes. Fleet operators in ride-sharing services prefer scooters for short-distance travel, increasing the demand for efficient BMS solutions. Electric motorcycles are gaining traction among performance-focused consumers seeking higher speeds and longer ranges. Specialized BMS features such as advanced thermal regulation and real-time monitoring enhance performance reliability. Other two-wheeler applications, including mopeds and delivery vehicles, contribute to steady demand in commercial sectors.

- For instance, Gogoro reports a network with 12,500 battery-swapping stations at over 2,500 locations, more than 1.3 million smart batteries, and roughly 400,000 swaps per day.

By Battery Type

It segments by battery type into lithium iron phosphate (LiFePO4), lithium nickel manganese cobalt oxide (NMC), and other lithium-ion chemistries. LiFePO4 batteries are valued for their safety, thermal stability, and long cycle life, making them a preferred choice for entry-level electric scooters. NMC batteries dominate premium and high-performance two-wheelers due to their higher energy density and lighter weight. Manufacturers integrate specialized BMS protocols to match the specific charging and discharging profiles of each chemistry. Other lithium-ion variants, including lithium titanate, find use in niche applications requiring extreme fast-charging capabilities. The diversity of chemistries drives tailored BMS development to optimize performance and safety for each type.

- For instance, CATL’s Qilin (CTP 3.0) specification lists NMC pack energy density up to 255 Wh/kg, a benchmark that guides BMS calibration for current, voltage, and thermal limits at the pack level.

By Voltage Range

The Electric Two-Wheeler Lithium Ion Battery Management Market is classified by voltage range into low voltage (below 48V), medium voltage (48V–72V), and high voltage (above 72V) systems. Low-voltage systems dominate mass-market electric scooters designed for short-range commuting. Medium-voltage platforms serve mid-tier two-wheelers that balance performance and cost. High-voltage systems are used in performance motorcycles and premium models, offering enhanced acceleration, range, and stability. BMS solutions in high-voltage configurations require advanced thermal management and fault detection systems to ensure safety. This voltage-based segmentation reflects the broad spectrum of consumer needs and vehicle performance profiles across the market.

Segments:

Based on Application

- Electric Scooters

- Electric Motorcycles

- Electric Bicycles

Based on Battery Type

- Lithium-Ion

- Lithium Polymer

- Nickel-Metal Hydride

Based on Voltage Range

Based on End Use

- Personal Use

- Commercial Use

- Fleet Operations

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia-Pacific

Asia-Pacific holds the dominant position in the Electric Two-Wheeler Lithium Ion Battery Management Market with a market share of 58%, driven by rapid adoption of electric scooters and motorcycles across China, India, Japan, and Southeast Asian nations. China leads in production capacity, technological advancements, and large-scale deployment of shared mobility fleets. India experiences fast growth due to government-backed incentives such as FAME-II subsidies and expanding charging infrastructure in metropolitan areas. Japan focuses on high-quality, safety-compliant battery systems, with strong R&D initiatives from domestic manufacturers. Southeast Asia benefits from the rising popularity of electric mopeds for urban deliveries and personal transportation. The region’s strong manufacturing ecosystem and local supply chain integration enable cost-effective BMS production, strengthening its global competitiveness.

Europe

Europe accounts for 18% of the Electric Two-Wheeler Lithium Ion Battery Management Market, supported by stringent carbon reduction targets and the shift toward sustainable transportation. Countries such as Germany, France, and the Netherlands lead in the adoption of premium electric motorcycles and scooters. EU regulations mandate high safety and performance standards, creating demand for advanced BMS technologies with enhanced diagnostics and connectivity features. The region benefits from mature charging infrastructure and growing investment in battery gigafactories. Urban centers with low-emission zones encourage the use of electric two-wheelers for commuting and last-mile delivery services. Strong collaboration between vehicle manufacturers and technology providers drives innovation in lightweight and compact BMS designs.

North America

North America holds 12% of the Electric Two-Wheeler Lithium Ion Battery Management Market, with the United States and Canada driving adoption through a mix of consumer demand and commercial fleet deployments. The popularity of high-performance electric motorcycles in the US creates demand for high-voltage battery systems with advanced safety controls. Government incentives at both federal and state levels support consumer adoption, while increasing investments in EV infrastructure strengthen the market environment. Delivery services in urban areas increasingly adopt electric scooters to meet sustainability goals. Domestic manufacturers focus on integrating AI-driven battery monitoring systems to enhance vehicle range and reliability.

Latin America

Latin America represents 7% of the Electric Two-Wheeler Lithium Ion Battery Management Market, with growth concentrated in Brazil, Mexico, and Colombia. Rising fuel prices and traffic congestion in major cities encourage consumers to adopt electric two-wheelers as cost-effective mobility solutions. Government programs in Brazil and Mexico provide tax benefits for electric vehicle purchases. Local assembly plants in these countries reduce costs and improve supply availability for BMS components. Delivery and ride-hailing services expand their electric fleets, driving steady demand for reliable battery management systems.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the Electric Two-Wheeler Lithium Ion Battery Management Market, with emerging adoption in the United Arab Emirates, South Africa, and select North African countries. High fuel dependency and growing urban pollution concerns drive interest in electric mobility. Governments in the UAE and Saudi Arabia invest in EV infrastructure and promote green transport initiatives. Africa’s adoption is supported by the rising use of electric motorcycles for commercial deliveries and passenger transport in congested urban centers. Limited manufacturing capacity encourages imports of BMS technologies from Asia-Pacific and Europe, though local assembly opportunities are beginning to emerge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung SDI

- Yamaha Motor

- LG Chem

- Contemporary Amperex Technology Co

- Bosch

- Nissan

- Tesla

- Acer

- BMW

- Crown Battery Manufacturing

Competitive Analysis

The competitive landscape of the Electric Two-Wheeler Lithium Ion Battery Management Market features leading players such as Contemporary Amperex Technology Co., LG Chem, Bosch, Samsung SDI, Yamaha Motor, Tesla, Nissan, BMW, Crown Battery Manufacturing, and Acer. These companies compete on technological innovation, product reliability, and strategic partnerships with electric two-wheeler manufacturers. Contemporary Amperex Technology Co. leverages large-scale production capabilities and advanced cell chemistry to supply high-performance battery solutions globally. LG Chem focuses on high-energy-density batteries and tailored BMS designs to meet diverse application needs. Bosch integrates intelligent control algorithms and safety protocols into its systems, strengthening market appeal for premium models. Samsung SDI emphasizes safety, fast-charging compatibility, and extended battery lifecycles. Automotive brands like Yamaha Motor, Tesla, Nissan, and BMW incorporate proprietary BMS technology to optimize performance across their electric mobility portfolios. Crown Battery Manufacturing and Acer enhance competition by offering cost-effective and scalable solutions for varied market segments. Continuous R&D, partnerships, and supply chain optimization remain core strategies for sustaining competitive advantage.

Recent Developments

- In May 2025, Yamaha announced its upcoming mass-market electric scooter, codenamed RY01 (based on the River Indie), incorporating the same powertrain and BMS system.

- In October 2024, At EICMA 2024 in Milan, Bosch showcased six new radar-based assistance systems and introduced a 2 kW drive control unit tailored for smaller electric two-wheelers.

- In December 2023, Yamaha Motor launched ENYRING GmbH, a new company offering subscription-based swappable battery services for compact urban electric vehicles, with a closed-loop recycling model.

Market Concentration & Characteristics

The Electric Two-Wheeler Lithium-Ion Battery Management Market demonstrates a moderately concentrated structure, with a mix of global leaders and regional manufacturers competing on technology, cost efficiency, and integration capabilities. Leading companies such as Contemporary Amperex Technology Co., LG Chem, Bosch, Samsung SDI, and Yamaha Motor leverage strong R&D capabilities, large-scale production, and strategic alliances with vehicle OEMs to secure competitive positioning. It is characterized by rapid technological advancement in areas such as IoT-enabled monitoring, AI-driven optimization, and thermal management innovations. Product differentiation focuses on safety, energy efficiency, and compact design to meet the diverse performance requirements of electric scooters, motorcycles, and fleet applications. The market also features a growing presence of regional players offering cost-effective solutions tailored to local regulations and operating conditions. Supply chain resilience, raw material security, and compliance with evolving safety standards are critical competitive factors that influence market dynamics and growth potential.

Report Coverage

The research report offers an in-depth analysis based on Application, Battery Type, Voltage Range, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of electric two-wheelers will continue to rise due to stricter emission norms and government incentives.

- Demand for advanced battery management systems will grow with the shift toward higher-performance electric scooters and motorcycles.

- Integration of AI and IoT in BMS will enhance predictive maintenance and operational efficiency.

- Modular and swappable battery technologies will expand, improving convenience for fleet operators and consumers.

- Lightweight and compact BMS designs will become standard to optimize vehicle range and handling.

- High-voltage battery systems will gain traction in premium electric two-wheeler segments.

- Regional manufacturing capabilities will strengthen to reduce import dependence and improve cost competitiveness.

- Safety-focused innovations in thermal management and fault detection will see increased investment.

- Partnerships between battery technology firms and vehicle OEMs will drive faster product development cycles.

- Emerging markets will present significant growth opportunities through expanding urban mobility solutions.