Market Overview

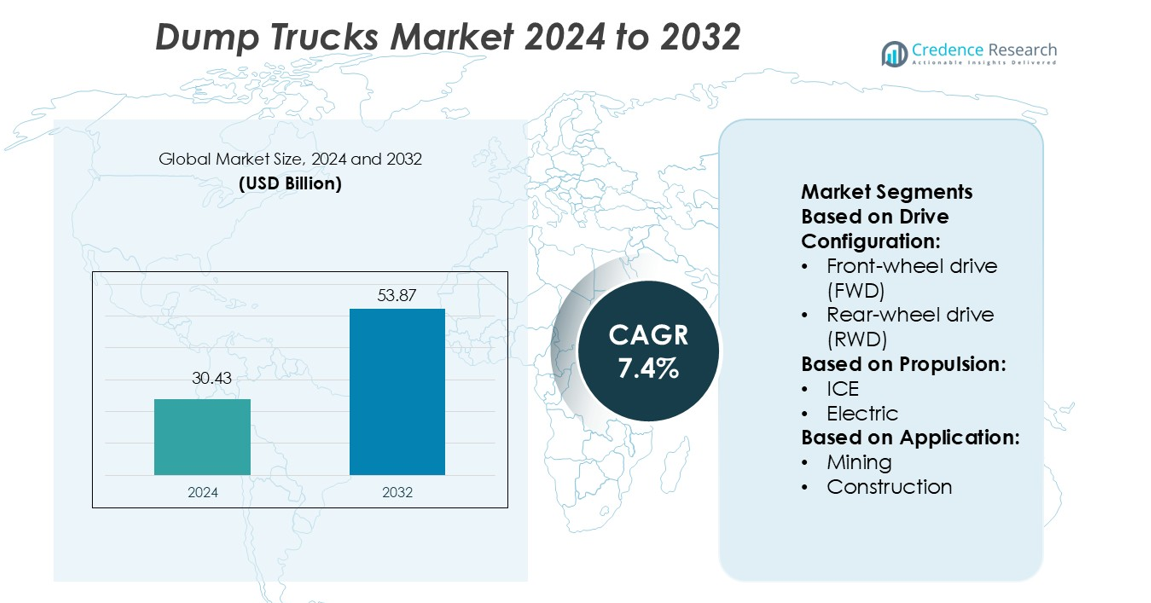

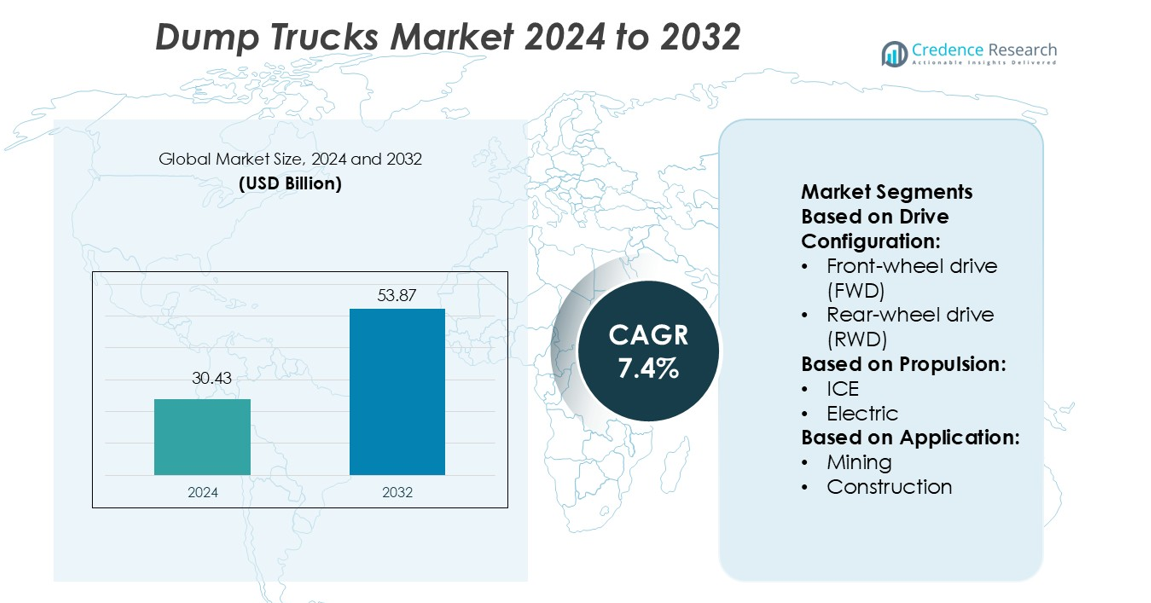

Dump Trucks Market size was valued USD 30.43 billion in 2024 and is anticipated to reach USD 53.87 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dump Trucks Market Size 2024 |

USD 30.43 billion |

| Dump Trucks Market, CAGR |

7.4% |

| Dump Trucks Market Size 2032 |

USD 53.87 billion |

The dump trucks market is shaped by major players such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, Terex Corporation, Bell Equipment, Doosan Infracore, Deere & Company, and Sany Heavy Industry Co., Ltd. These companies focus on advanced engine technology, payload optimization, and autonomous operation systems to strengthen their global presence. They invest in R&D, expand product portfolios, and form strategic partnerships to enhance operational efficiency and fleet productivity. Asia Pacific leads the global market with a 42% share, driven by rapid infrastructure development, mining activities, and large-scale construction projects across China, India, and Southeast Asia.

Market Insights

- The Dump Trucks Market was valued at USD 30.43 billion in 2024 and is projected to reach USD 53.87 billion by 2032, growing at a CAGR of 7.4%.

- Rapid infrastructure development and increased mining activities are driving strong demand, supported by government investments in transportation and construction projects.

- Manufacturers such as Caterpillar Inc., Komatsu Ltd., and Volvo Construction Equipment are advancing autonomous driving, payload optimization, and fuel-efficient engines to gain market advantage.

- High initial investment costs and maintenance expenses remain key restraints, particularly in emerging economies with limited fleet modernization budgets.

- Asia Pacific dominates with a 42% market share, led by China and India, while the construction segment holds the largest share by application due to large-scale urbanization and industrial expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drive Configuration

Rear-wheel drive (RWD) dominates the dump trucks market with the largest share. RWD dump trucks offer better traction and weight distribution, which improves performance on rough terrains. Their ability to handle heavy loads makes them the preferred option for construction and mining operations. The strong torque delivery at the rear wheels supports reliable hauling over long distances. Demand for RWD models continues to rise as manufacturers enhance payload capacity and durability, driving widespread adoption in key industrial sectors.

- For instance, Hitachi’s rigid-frame RWD model EH4000AC‑3 features a nominal payload of 221 tonnes (221 000 kg) and a travel speed of 56 km/h. Its strong torque delivery at the rear wheels supports reliable hauling over long distances.

By Propulsion

Internal combustion engine (ICE) dump trucks lead the market with a dominant share. ICE vehicles provide strong torque output and extended operational range, making them ideal for heavy-duty applications. The well-established refueling infrastructure also supports continuous fleet operations without significant downtime. Fleet operators prefer ICE models due to their proven reliability and lower upfront cost compared to electric or hybrid variants. While electrification is growing, ICE remains the primary propulsion choice for large-scale mining and construction activities.

- For instance, Caterpillar’s rigid-frame haul truck model 797F is powered by the Cat C175-20 20-cylinder diesel engine rated at 4,000 hp (2,983 kW) under SAE J1995, with a net output of 3,793 hp (2,828 kW) under SAE J1349.

By Application

The construction segment holds the largest share in the dump trucks market. Dump trucks play a crucial role in transporting aggregates, sand, gravel, and debris across infrastructure projects. Rapid urbanization and rising investments in road and building construction drive strong demand. Their high load capacity and operational efficiency make them essential equipment on job sites. Manufacturers are introducing advanced features like automated controls and telematics to improve fleet performance, further reinforcing construction’s leadership in overall market share.

Key Growth Drivers

Rising Infrastructure and Construction Projects

Expanding infrastructure development is a major driver of the dump trucks market. Large-scale projects such as highways, bridges, and urban housing require efficient material transportation, boosting demand for high-capacity trucks. Governments are investing heavily in road expansion and smart city initiatives, increasing the need for reliable hauling equipment. Construction companies prefer dump trucks for their strong payload capacity and adaptability to rough terrain. The continuous rise in infrastructure spending is expected to sustain steady demand for both heavy-duty and medium-duty dump trucks across key markets.

- For instance, Parker lists hydraulic pumps for direct PTO mounting rated at 400 bar (≈ 5,800 psi) and variable-flow systems for implement control within construction-grade machines.

Growing Mining Activities and Resource Extraction

The global rise in mineral exploration and extraction significantly drives dump truck demand. Mining operations depend on high-performance trucks to move overburden, ore, and other materials efficiently. Leading mining nations are expanding production capacity, increasing fleet sizes to support output targets. Rigid and articulated dump trucks are favored for their load-bearing strength and off-road mobility. The integration of advanced engine technology also enhances fuel efficiency and uptime. This surge in mining investments strengthens the market position of dump trucks in heavy-duty applications.

- For instance, SANY’s electric-off-highway model SKT90E features a 422 kWh battery capacity, supports driving time of 9–10 hours on flat work roads, and can haul a load weight of 60 t.

Technological Advancements in Fleet Efficiency

Advancements in telematics, automation, and electric powertrains are boosting operational efficiency. Modern dump trucks feature GPS tracking, route optimization, and real-time diagnostics that reduce downtime and operating costs. Automated controls enhance driver safety and improve load handling accuracy in construction and mining sites. Electric and hybrid models are gaining interest as companies aim to reduce emissions and meet regulatory standards. These innovations support cost-effective fleet management and increase the appeal of technologically advanced dump trucks to large-scale operators.

Key Trends & Opportunities

Shift Toward Electrification and Sustainable Fleets

The dump truck industry is witnessing a shift toward electric and hybrid powertrains. Manufacturers are investing in battery technology to reduce emissions and fuel costs while maintaining performance. Governments are offering incentives for adopting cleaner vehicles, accelerating the transition. Electric dump trucks provide lower operating costs, reduced noise, and improved energy efficiency. Fleet operators are exploring green fleet strategies to align with environmental goals. This trend creates opportunities for companies offering advanced propulsion solutions and sustainable vehicle designs.

- For instance, Liebherr’s T 264 Battery Electric truck offers a payload class of 240 t and a gross vehicle weight (GVW) of 416 t, using its Litronic Plus AC drive system with IGBT technology.

Integration of Automation and Smart Features

Automation and smart control systems are becoming a key trend in dump truck operations. Features like collision avoidance, driver assistance, load monitoring, and predictive maintenance are improving productivity and safety. Telematics allows real-time performance monitoring and efficient route planning, reducing fuel consumption. These technologies help operators minimize downtime and increase fleet utilization rates. As automation adoption grows, manufacturers offering integrated digital solutions are likely to capture significant market share.

- For instance, Scania’s Autonomous Mining Solutions include a 40-tonne autonomous heavy tipper now available for order. These trucks use GPS, lidar and sensor arrays for obstacle detection and route optimisation.

Expansion in Emerging Economies

Emerging markets in Asia, Africa, and Latin America present major opportunities for growth. These regions are investing heavily in mining, construction, and infrastructure development. Low-cost labor and abundant resources attract global companies to expand operations. The rising demand for affordable yet durable dump trucks in these areas offers manufacturers a strong revenue stream. Localization strategies and regional assembly units further boost competitiveness in these high-growth markets.

Key Challenges

High Initial and Maintenance Costs

The high purchase and maintenance costs of dump trucks pose a significant challenge. Heavy-duty models require substantial upfront investment, which can strain smaller contractors and fleet operators. Maintenance of engines, tires, and hydraulic systems adds recurring expenses, increasing total cost of ownership. These costs limit the ability of smaller firms to scale their fleets quickly. Addressing this challenge requires cost-efficient leasing models and improved component durability to reduce lifecycle expenses.

Environmental and Regulatory Pressures

Strict emissions regulations are creating operational challenges for traditional diesel-powered dump trucks. Many countries are enforcing carbon reduction targets, pushing companies to upgrade or replace older fleets. This transition involves high capital investment and compliance costs. Additionally, the lack of charging infrastructure for electric dump trucks in developing regions slows adoption. Manufacturers and operators must balance regulatory compliance with cost-effectiveness, which may impact market growth in the short term.

Regional Analysis

North America

North America holds a significant share of the dump trucks market, accounting for 28% of the global share. Strong infrastructure modernization programs and extensive mining operations drive regional growth. The U.S. and Canada lead due to large-scale construction and energy projects. High adoption of advanced telematics and automation in fleets enhances operational efficiency. Stringent emission standards are accelerating the shift toward hybrid and electric dump trucks. Established manufacturers and rental fleet operators strengthen market competition, while steady investments in urban development projects further boost demand for heavy-duty and articulated dump trucks across the region.

Europe

Europe accounts for 22% of the dump trucks market, driven by investments in sustainable infrastructure and strict environmental regulations. Countries like Germany, France, and the U.K. are leading in electrification efforts, promoting electric and hybrid dump trucks. Smart construction technologies and green fleet initiatives support regional market growth. The demand for mid-capacity and articulated models is rising in urban redevelopment and renewable energy projects. Fleet modernization programs and telematics integration are improving productivity. Government incentives and zero-emission goals continue to shape the competitive landscape, encouraging manufacturers to focus on energy-efficient and low-emission solutions.

Asia Pacific

Asia Pacific dominates the global dump trucks market with a 36% share. Rapid urbanization, large-scale infrastructure expansion, and mining projects in China, India, and Southeast Asia fuel strong demand. Government-led investments in highways, bridges, and housing increase the deployment of heavy-duty trucks. Mining activities in Australia and Indonesia also drive fleet expansion. Manufacturers are expanding local production to meet rising demand for cost-effective models. The region is witnessing gradual adoption of telematics and electric vehicles, supported by industrialization and favorable trade policies. This combination of infrastructure growth and fleet modernization positions Asia Pacific as the leading regional market.

Latin America

Latin America represents 8% of the global dump trucks market share. Mining and construction sectors in Brazil, Chile, and Peru play a central role in driving demand. Expansion of copper, iron ore, and lithium projects boosts the use of rigid and articulated dump trucks. Infrastructure investment programs aimed at improving transportation networks further support market growth. However, high import costs and limited local manufacturing capacity pose operational challenges. Despite these factors, growing foreign investments and fleet modernization initiatives are creating opportunities for global manufacturers to strengthen their presence in the region.

Middle East & Africa

The Middle East & Africa region holds 6% of the dump trucks market share. Infrastructure development in the Gulf Cooperation Council (GCC) countries and mining activities in South Africa drive regional demand. Mega projects, such as smart cities and transportation corridors, increase the use of heavy-duty trucks. Governments are investing in resource extraction and construction sectors, creating steady demand. However, reliance on diesel fleets and slower electrification adoption remain challenges. Manufacturers are focusing on durable and high-capacity models suited for harsh environments, ensuring steady growth opportunities across both the construction and mining industries in the region.

Market Segmentations:

By Drive Configuration:

- Front-wheel drive (FWD)

- Rear-wheel drive (RWD)

By Propulsion:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dump trucks market is shaped by key players such as Hitachi, Caterpillar, Parker Hannifin, SANY, Liebherr, Scania, Komatsu, BelAZ, Cummins, and Volvo. The dump trucks market is defined by rapid innovation, technology integration, and strategic expansion. Manufacturers focus on improving payload capacity, fuel efficiency, and operational safety to meet diverse industry demands. Companies are actively investing in electrification and automation to align with sustainability goals and regulatory requirements. Strategic collaborations and acquisitions enhance their ability to offer advanced solutions and strengthen service networks. Regional manufacturing facilities are also expanding to reduce production costs and improve delivery timelines. With growing demand from construction and mining, competition is intensifying, pushing companies to innovate and differentiate through performance, durability, and smart fleet solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, SANY India launched India’s first locally manufactured hybrid mining dump truck, SKT130S, a 100-ton hybrid truck, at its Chakan, Pune facility in Maharashtra.

- In July 2024, Vale, a prominent mining company, special technologies developer Komatsu, and Cummins Inc., a key participant in the power solutions market, announced a collaboration aimed at developing large trucks with payload capacity of 230 to 290 tons, empowered by ethanol and diesel. The Dual Fuel project emphasizes Vale’s strategy to reduce scope 1 and 2 carbon emissions significantly.

- In June 2024, XCMG Machinery, one of the top companies in the construction machinery market, introduced a new hydrogen fuel cell dump truck, EHSL552F. The new truck has a high-power battery system and a 120kW hydrogen fuel cell. This addition to its portfolio is expected to assist mining industry users in significantly reducing daily carbon emissions.

- In January 2024, Hitachi Construction Machinery and the Traction Division of ABB made major progress on their collaboration for a fully electric dump truck designed for heavy-duty mining applications. The first prototype of the truck completed initial in-factory testing and was shipped to the Kansanshi copper-gold mine in Zambia for final testing and demonstration planned for mid-2024

Report Coverage

The research report offers an in-depth analysis based on Drive Configuration, Propulsion, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for dump trucks will grow with large-scale infrastructure and mining projects.

- Electric and hybrid dump trucks will gain more market adoption.

- Telematics and automation will enhance operational efficiency and fleet control.

- Manufacturers will focus on improving payload capacity and fuel efficiency.

- Regulatory pressure will drive faster shifts toward low-emission technologies.

- Emerging economies will become major growth hubs for new fleet deployments.

- Smart connectivity features will become standard in high-performance dump trucks.

- Rental and leasing services will expand to meet flexible demand needs.

- Collaboration between OEMs and tech firms will accelerate innovation.

- Upgraded safety systems and real-time monitoring will strengthen fleet reliability.