Market Overview:

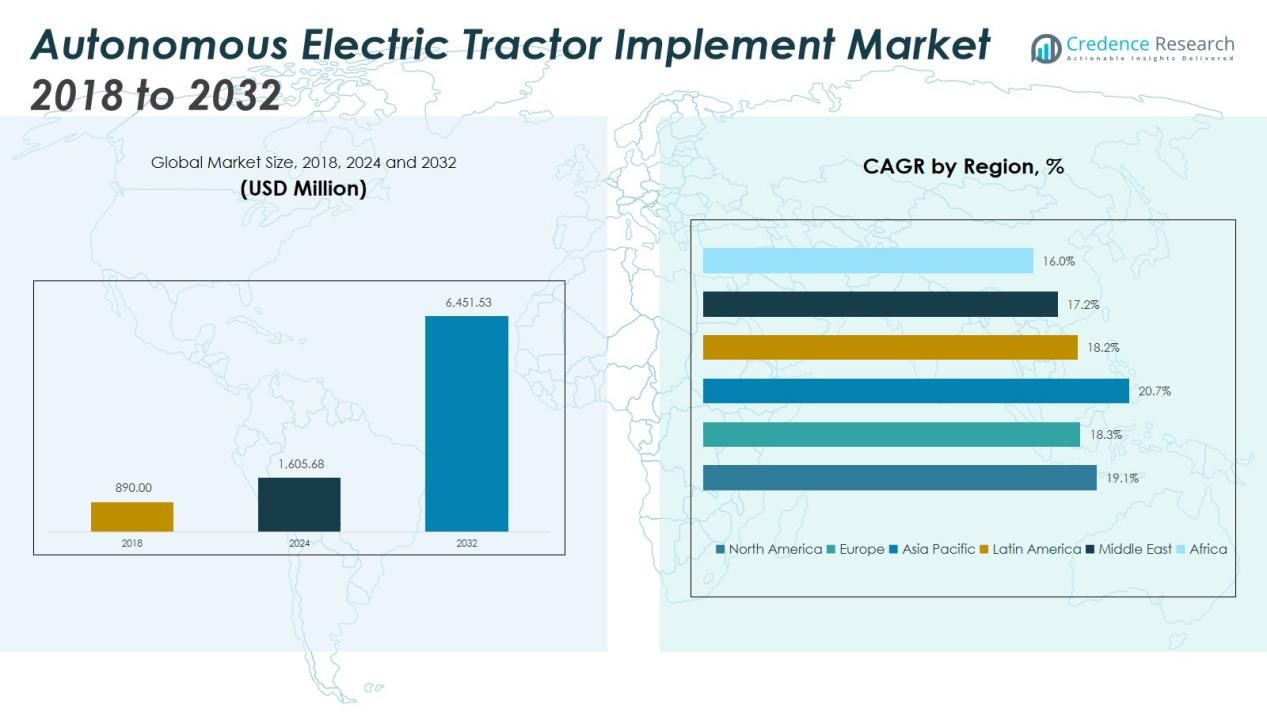

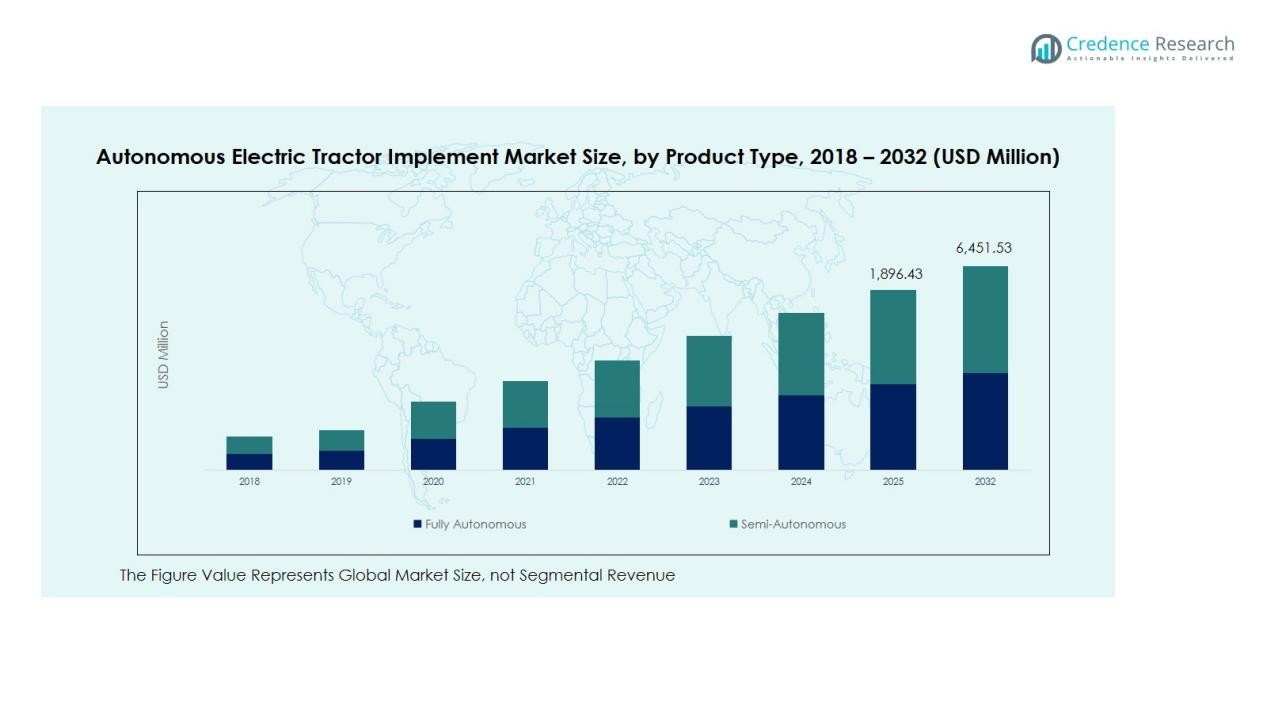

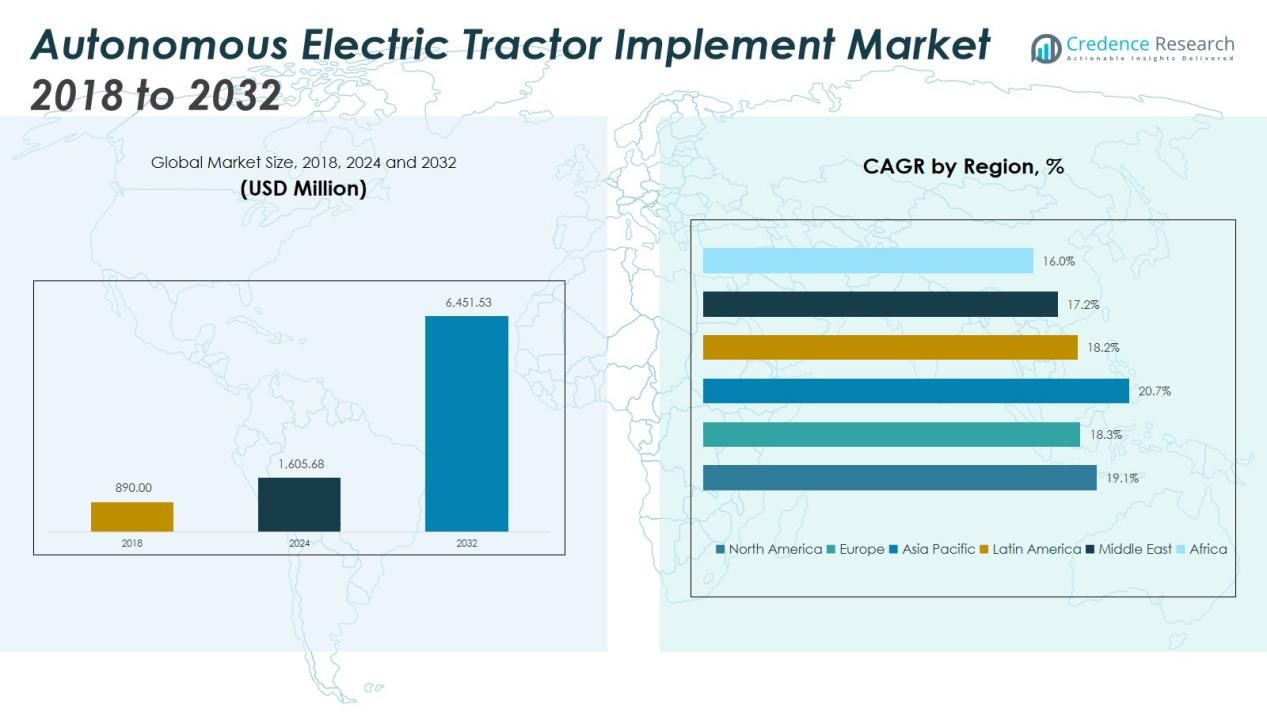

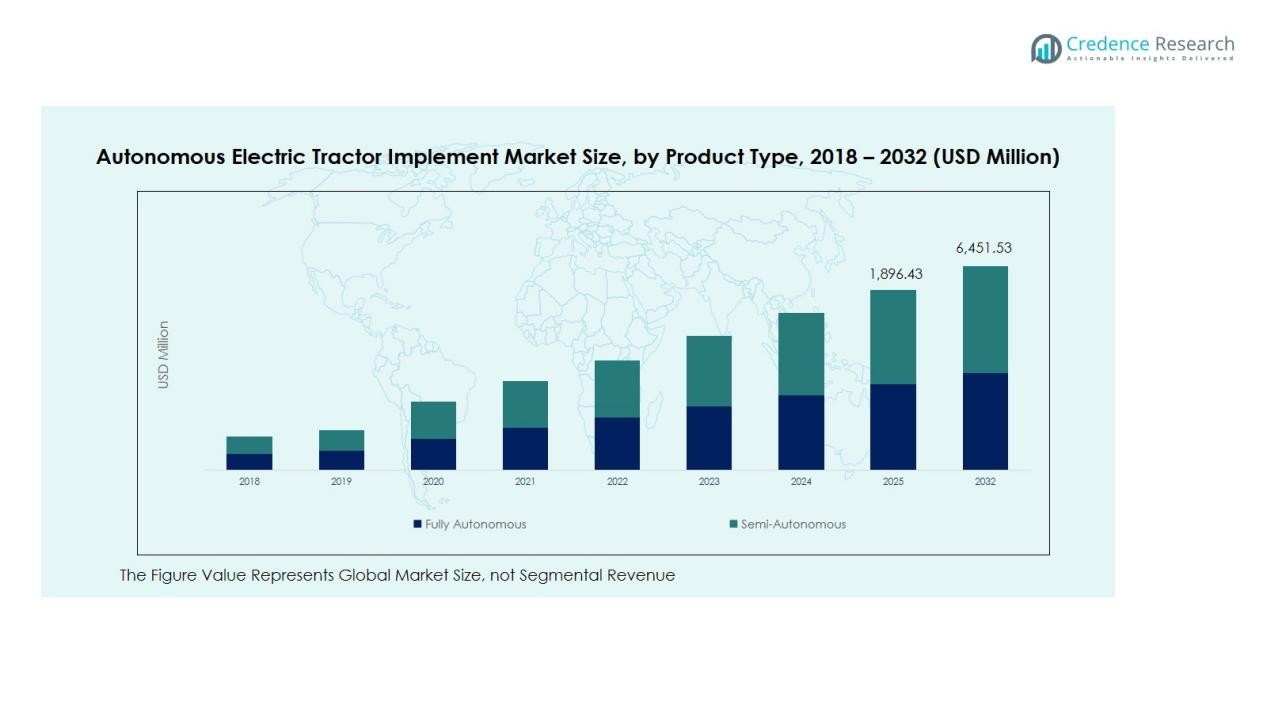

The Autonomous Electric Tractor Market size was valued at USD 890.00 million in 2018 to USD 1,605.68 million in 2024 and is anticipated to reach USD 6,451.53 million by 2032, at a CAGR of 19.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Autonomous Electric Tractor Market Size 2024 |

USD 1,605.68 Million |

| Autonomous Electric Tractor Market, CAGR |

19.11% |

| Autonomous Electric Tractor Market Size 2032 |

USD 6,451.53 Million |

Market growth is primarily fueled by increasing labour shortages in farming, higher demand for precision agriculture, and government incentives promoting electric vehicles. Farmers are adopting autonomous electric tractors to reduce dependence on manual labour and achieve higher productivity. Advances in artificial intelligence, GPS guidance, and energy storage technologies are improving the reliability and affordability of these machines. The push toward low-carbon and smart farming practices also drives manufacturers to develop more efficient and sustainable tractor models.

Regionally, North America dominates the market due to large-scale farms, strong technological infrastructure, and early adoption of automation. Europe follows closely, supported by stringent emission standards and agricultural subsidies. Asia-Pacific is the fastest-growing region, driven by rapid mechanization in China and India and increasing government support for smart and sustainable agriculture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Autonomous Electric Tractor Market was valued at USD 890.00 million in 2018, reached USD 1,605.68 million in 2024, and is projected to reach USD 6,451.53 million by 2032, registering a CAGR of 19.11% during the forecast period.

- North America leads the market with a 35% share in 2024, supported by large-scale mechanized farms and strong adoption of automation technologies across the United States and Canada.

- Europe holds 28% of the market share, driven by strict emission standards, government subsidies, and advanced smart farming practices across Germany, France, and the UK.

- Asia Pacific ranks third with a 25% market share and is the fastest-growing region due to rapid agricultural mechanization, population growth, and rising government support for electric mobility in China and India.

- By product type, fully autonomous tractors account for 62% of global revenue, while semi-autonomous models hold 38%, reflecting a growing preference for high-efficiency, driverless operations.

Market Drivers:

Rising Demand for Sustainable and Zero-Emission Farming Equipment

The Global Autonomous Electric Tractor Market benefits from the global shift toward cleaner and more sustainable farming practices. Governments are enforcing emission standards that encourage electric alternatives to diesel-powered tractors. Farmers adopt these machines to meet sustainability goals and reduce fuel costs. Companies are developing electric tractors that deliver high torque with zero tailpipe emissions. This shift aligns with national targets for carbon neutrality and modern agricultural transformation.

- For instance, Monarch Tractor’s MK-V autonomous electric tractor, launched in 2023, delivers over 40 horsepower with zero tailpipe emissions and is being used in commercial vineyards across California.

Advancements in Automation, Artificial Intelligence, and Sensor Technologies

The market gains momentum from technological progress in automation, AI, and sensor integration. Electric tractors equipped with GPS, LiDAR, and computer vision enable precise navigation and optimized field operations. It reduces manual errors and ensures uniform seeding, plowing, and spraying activities. Machine learning algorithms allow autonomous decision-making, enhancing productivity and efficiency. Continuous improvements in automation technologies increase adoption among both large and medium-scale farmers.

- For instance, John Deere’s autonomous 8R tractor employs six pairs of stereo cameras and deep neural networks to detect obstacles and determine movement, achieving precise field navigation with geofence accuracy within less than 25 mm

Labour Shortages and Rising Cost of Agricultural Operations

Declining availability of skilled agricultural labour drives the adoption of autonomous tractors. Rural-to-urban migration and aging farming populations have intensified this challenge. The Global Autonomous Electric Tractor Market addresses this gap through driverless operation and remote monitoring capabilities. It allows continuous operation during peak farming seasons and minimizes labour dependency. Reduced operational costs and consistent performance strengthen the appeal of electric autonomous machinery.

Government Incentives and Supportive Agricultural Policies

Government programs and subsidies supporting electric and smart farming equipment strongly influence market growth. Policies promoting renewable energy integration and low-emission agricultural machinery encourage farmers to invest in advanced tractors. Tax benefits, grants, and funding for research stimulate innovation in electric tractor manufacturing. It fosters public-private collaboration to accelerate deployment in rural areas. Such initiatives create a favorable environment for market expansion across developed and emerging economies.

Market Trends:

Integration of Advanced Connectivity and Precision Farming Technologies

The Global Autonomous Electric Tractor Market is witnessing a strong shift toward connected and data-driven operations. Integration of IoT, cloud computing, and real-time analytics allows tractors to communicate with farm management systems for precise decision-making. Manufacturers are embedding telematics, GPS tracking, and predictive maintenance features to optimize energy use and operational efficiency. It supports smart farming by enabling continuous monitoring of soil health, crop conditions, and machinery performance. Autonomous electric tractors equipped with 5G connectivity and AI platforms deliver higher accuracy in field mapping and route planning. These technological improvements enhance overall yield quality while reducing resource wastage and downtime during farming activities.

- For instance, John Deere successfully implemented its JDLink telematics on over 500,000 connected machines globally by early 2024, enabling farmers to use real-time data analysis of tractor usage patterns to significantly improve efficiency and reduce fuel consumption.

Emergence of Modular and Scalable Tractor Designs for Diverse Farm Applications

Manufacturers are adopting modular designs to expand flexibility across small, medium, and large-scale farms. The trend toward scalable tractor architectures enables farmers to customize attachments and battery capacities based on operational needs. It promotes cost efficiency and adaptability in varied agricultural environments. The Global Autonomous Electric Tractor Market benefits from innovations such as swappable battery systems, lightweight materials, and self-diagnostic features. Companies are also focusing on compact, low-horsepower models suitable for orchards and precision horticulture. Growing preference for autonomous units capable of performing multiple field tasks with minimal human intervention reinforces the transition toward intelligent and sustainable agriculture.

- For instance, ONOX’s modular electric tractor features an integrated 20-kWh battery pack with room for additional swappable packs of 30 kWh each, allowing operators to extend runtime by 3-8 hours depending on load requirements, making it ideal for diverse farm conditions.

Market Challenges Analysis:

High Initial Costs and Limited Charging Infrastructure

The Global Autonomous Electric Tractor Market faces significant challenges due to high acquisition costs and inadequate charging infrastructure. Advanced sensors, AI modules, and large-capacity batteries increase the overall cost of production and ownership. Many small and medium-scale farmers find these tractors financially inaccessible without subsidies or credit support. It also depends on reliable charging facilities, which remain underdeveloped in rural and remote areas. Limited access to fast-charging networks restricts operational efficiency during peak farming hours. These financial and infrastructural constraints slow the pace of adoption in developing economies.

Technical Complexity and Lack of Skilled Workforce

The introduction of autonomous electric tractors demands specialized technical knowledge for operation and maintenance. Farmers often lack training in managing AI-driven or sensor-based machinery. The Global Autonomous Electric Tractor Market experiences slower adoption in regions with limited access to digital literacy programs. It also faces integration challenges when connecting to traditional farming equipment or software platforms. Technical failures, sensor misalignment, or software bugs can disrupt field operations and increase downtime. Building awareness and training programs is essential to overcome the human skill gap and ensure long-term operational success.

Market Opportunities:

Expansion of Smart and Sustainable Farming Practices

The Global Autonomous Electric Tractor Market holds strong opportunities in the shift toward smart and sustainable agriculture. Governments and private players are investing heavily in low-emission and intelligent farming solutions. It aligns with global initiatives promoting climate-resilient agriculture and resource efficiency. Integration with renewable energy sources, such as solar-powered charging systems, enhances operational sustainability. The growing use of data analytics and precision tools opens new avenues for customized and efficient farm management. Rising consumer demand for sustainably sourced produce further encourages large farms to adopt autonomous electric tractors.

Emerging Demand from Developing Agricultural Economies

Expanding mechanization across developing nations offers vast potential for market penetration. Rapid rural electrification and government-backed digital farming programs create favorable conditions for adoption. The Global Autonomous Electric Tractor Market is expected to benefit from rising incomes and farm modernization efforts in Asia-Pacific, Latin America, and Africa. It creates opportunities for low-cost models tailored to smallholder farmers. Collaborations between manufacturers and local distributors can support efficient after-sales services and training. Strong policy support and regional manufacturing partnerships can accelerate market growth and improve accessibility for diverse farming communities.

Market Segmentation Analysis:

By Product Type

The Global Autonomous Electric Tractor Market is segmented into fully autonomous and semi-autonomous models. Fully autonomous tractors are gaining rapid traction due to their capability to operate without human intervention and deliver consistent performance. It enhances operational efficiency and minimizes human errors during repetitive farming tasks. Semi-autonomous tractors remain popular among medium-scale farms seeking partial automation at lower investment levels. Growing advancements in navigation, AI control, and safety features continue to strengthen adoption across both categories.

- For instance, Monarch Tractor’s MK-V autonomous electric tractor achieved up to 14 hours of runtime on a single charge with 5-6 hour recharge capability using an 80-ampere charger, enabling continuous field operations at speeds up to 11.6 kilometers per hour while maintaining centimeter-level accuracy through GPS guidance.

By Application

The market is categorized into ploughing, seeding, harvesting, tillage, spraying, and others. Harvesting and tillage applications dominate due to high demand for precision and time-efficient solutions. It enables improved crop yield and resource optimization through real-time field data and automated control systems. Ploughing and seeding segments are expanding due to increasing awareness of precision farming benefits. The integration of GPS-guided systems supports uniform coverage and reduces fuel consumption during key field operations.

- For instance, John Deere’s See & Spray™ technology saved farmers an estimated 8 million gallons of herbicide mix on more than 1 million acres during the 2024 growing season with an average herbicide savings of 59%, while the See & Spray™ Select model demonstrated 77% average herbicide savings through AI-powered weed-sensing cameras that scan over 2,100 square feet of crop per second as the sprayer moves at up to 15 mph.

By Power Source

Based on power source, the market includes battery electric and hybrid electric tractors. Battery electric models lead due to zero-emission benefits and lower maintenance requirements. It aligns with the global push toward sustainable farming and renewable energy integration. Hybrid electric tractors are gaining traction in regions with limited charging infrastructure, offering longer operational range and flexibility. Continuous improvements in lithium-ion batteries and energy management systems are expected to boost efficiency and adoption rates.

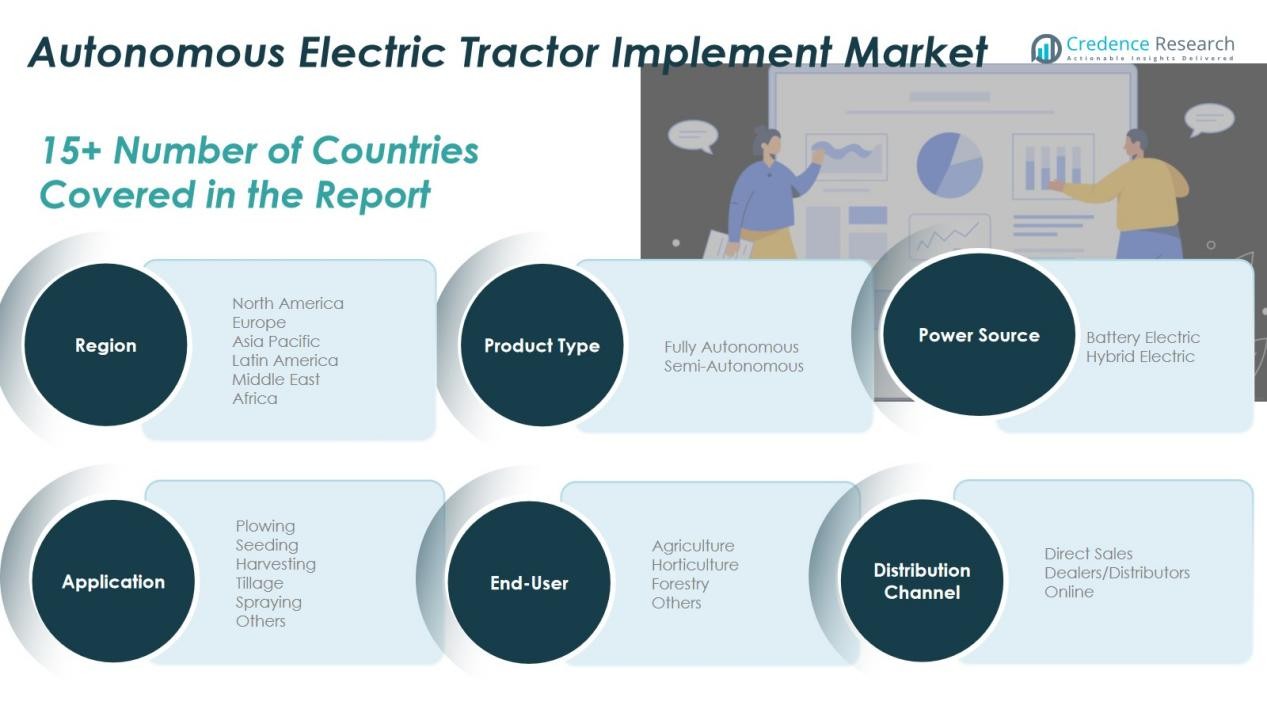

Segmentations:

By Product Type:

- Fully Autonomous

- Semi-Autonomous

By Application:

- Ploughing

- Seeding

- Harvesting

- Tillage

- Spraying

- Others

By End-User:

- Agriculture

- Horticulture

- Forestry

- Others

By Power Source:

- Battery Electric

- Hybrid Electric

By Distribution Channel:

- Direct Sales

- Dealers/Distributors

- Online

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Autonomous Electric Tractor Market size was valued at USD 336.78 million in 2018 to USD 600.52 million in 2024 and is anticipated to reach USD 2,409.66 million by 2032, at a CAGR of 19.1% during the forecast period. North America holds 35% of the global market share in 2024. The region benefits from advanced agricultural technologies, strong research infrastructure, and high investment in farm automation. It leads in adopting driverless and electric tractors supported by widespread smart farming systems in the United States and Canada. Government incentives promoting emission-free machinery further boost adoption. Increasing demand for large-scale precision farming strengthens the market’s dominance across the region.

Europe

The Europe Global Autonomous Electric Tractor Market size was valued at USD 244.31 million in 2018 to USD 424.34 million in 2024 and is anticipated to reach USD 1,614.51 million by 2032, at a CAGR of 18.3% during the forecast period. Europe captures 28% of the global market share. Strong environmental regulations and government subsidies for electric and autonomous tractors drive regional growth. It benefits from technological collaboration between equipment manufacturers and software developers. Countries such as Germany, France, and the United Kingdom lead in developing sustainable and intelligent farming systems. The focus on reducing agricultural emissions and improving efficiency continues to fuel market expansion.

Asia Pacific

The Asia Pacific Global Autonomous Electric Tractor Market size was valued at USD 199.36 million in 2018 to USD 377.09 million in 2024 and is anticipated to reach USD 1,685.79 million by 2032, at a CAGR of 20.7% during the forecast period. Asia Pacific holds 25% of the global market share and is the fastest-growing regional segment. Rapid agricultural mechanization, growing population, and increasing government investment in smart farming drive market development. It benefits from strong manufacturing bases in China, Japan, and India that enable cost-effective production. Rising awareness about sustainable agriculture and the need for high-yield farming accelerate adoption. Regional initiatives promoting electric mobility also support long-term growth.

Latin America

The Latin America Global Autonomous Electric Tractor Market size was valued at USD 65.86 million in 2018 to USD 117.84 million in 2024 and is anticipated to reach USD 444.32 million by 2032, at a CAGR of 18.2% during the forecast period. Latin America holds 7% of the global market share. Brazil and Argentina dominate the region’s adoption, driven by their extensive farmlands and modernization programs. It experiences strong demand for electric and autonomous tractors through precision agriculture initiatives. Enhanced access to agricultural financing and partnerships with global manufacturers support steady market penetration. Export-oriented farming practices are encouraging farmers to adopt advanced equipment for productivity improvement.

Middle East

The Middle East Global Autonomous Electric Tractor Market size was valued at USD 27.59 million in 2018 to USD 45.91 million in 2024 and is anticipated to reach USD 161.97 million by 2032, at a CAGR of 17.2% during the forecast period. The Middle East accounts for 3% of the global market share. Growing focus on agricultural automation and efficient resource management supports regional growth. It benefits from investments in renewable energy and smart farming pilot programs in the UAE, Israel, and Saudi Arabia. Technological integration helps optimize limited arable land and improve productivity. Regional governments are promoting sustainable practices to enhance food security through modern mechanization.

Africa

The Africa Global Autonomous Electric Tractor Market size was valued at USD 16.11 million in 2018 to USD 39.99 million in 2024 and is anticipated to reach USD 135.28 million by 2032, at a CAGR of 16.0% during the forecast period. Africa holds 2% of the global market share. Rising investment in agricultural mechanization and technology-driven farming supports gradual market growth. It faces infrastructure and affordability challenges but benefits from international collaborations promoting digital agriculture. Governments are introducing initiatives to improve access to modern machinery for small and medium-scale farmers. Expanding training programs and local manufacturing capacity are expected to strengthen adoption across the continent.

Key Player Analysis:

- John Deere

- AGCO Corporation

- CNH Industrial

- Kubota Corporation

- Mahindra & Mahindra

- Yanmar Co., Ltd.

- Fendt

- Sonalika International

- Escorts Limited

- Deere & Company

- Trimble Inc.

- Kinze Manufacturing

- Zimeno Inc. (Monarch Tractor)

- Smart Ag

- Raven Industries

Competitive Analysis:

The Global Autonomous Electric Tractor Market is highly competitive, driven by rapid innovation and strong product diversification. Key players include John Deere, AGCO Corporation, CNH Industrial, Kubota Corporation, Mahindra & Mahindra, and Yanmar Co., Ltd. These companies focus on integrating AI, IoT, and advanced sensor systems to enhance operational precision and energy efficiency. It emphasizes product development, regional expansion, and strategic partnerships to strengthen market presence. John Deere and CNH Industrial lead through large-scale automation programs and strong global distribution networks. Kubota and Mahindra & Mahindra expand in emerging economies with cost-effective models tailored for small and medium farms. AGCO Corporation and Yanmar Co., Ltd. invest in research collaborations to improve electric drivetrain performance and reduce charging time. The competitive landscape reflects a shift toward sustainable, connected, and fully autonomous solutions in agricultural machinery.

Recent Developments:

- In August 2025, Deere & Company releases updates and press coverage highlighting upgrades and strategic initiatives across autonomy, AI-enabled agriculture technology, and precision farming features in 2025 product lines.

- In August 2025, AGCO publishes updates to its North American distribution network, signaling broader dealer reach and improved service infrastructure in 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-User, Power Source, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Autonomous Electric Tractor Market will witness significant expansion driven by rapid adoption of precision and sustainable farming technologies.

- Growing demand for emission-free equipment will push manufacturers to develop advanced battery-powered and hybrid tractor models.

- Integration of AI, IoT, and machine learning will enhance automation, operational accuracy, and predictive maintenance capabilities.

- Technological innovation in battery efficiency and charging infrastructure will extend operational time and reduce downtime.

- Manufacturers will increasingly focus on modular and scalable tractor designs to cater to farms of varying sizes.

- Government support through subsidies and sustainability programs will accelerate adoption across developing and developed regions.

- Collaborations between technology firms and agricultural equipment manufacturers will foster faster innovation and global commercialization.

- Farmers will increasingly rely on data analytics and connected platforms for better resource management and decision-making.

- Expansion in emerging markets such as India, China, and Brazil will create new revenue opportunities for global players.

- Growing focus on carbon-neutral farming and automation efficiency will shape the next generation of electric tractors worldwide.