Market Overview

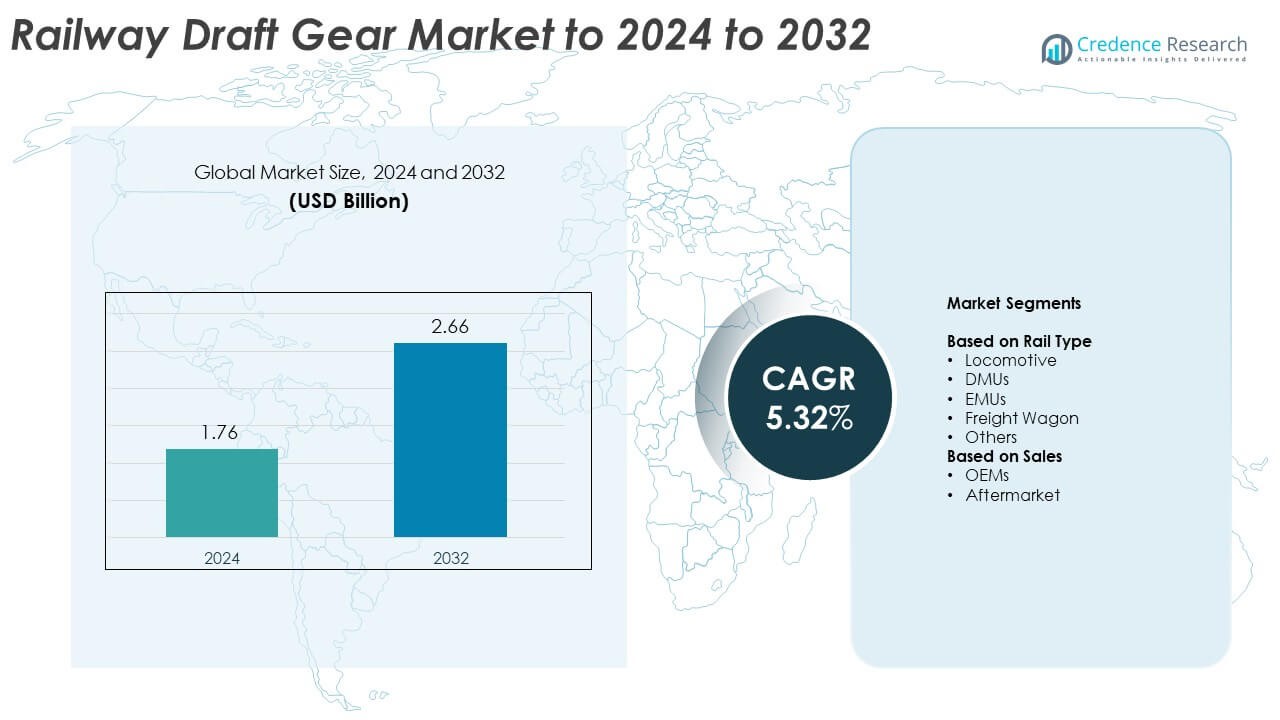

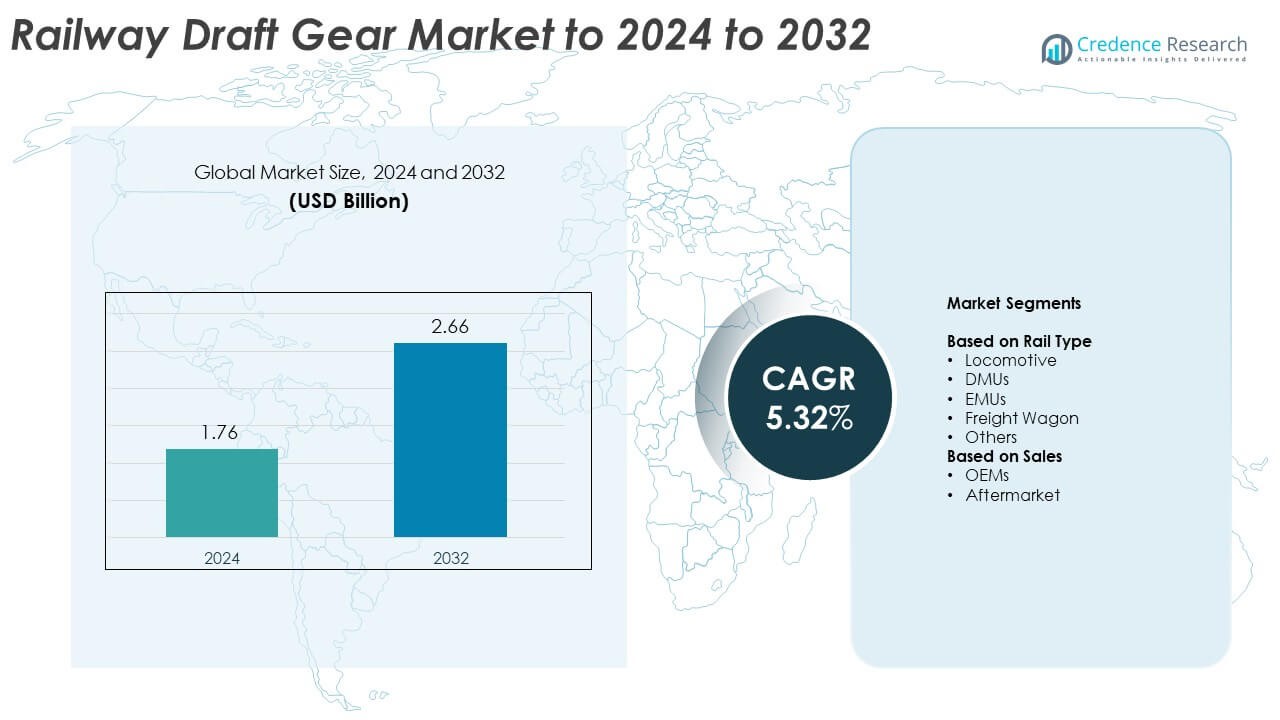

Railway Draft Gear market size was valued USD 1.76 billion in 2024 and is anticipated to reach USD 2.66 billion by 2032, at a CAGR of 5.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Railway Draft Gear Market Size 2024 |

USD 1.76 Billion |

| Railway Draft Gear Market, CAGR |

5.32% |

| Railway Draft Gear Market Size 2032 |

USD 2.66 Billion |

The railway draft gear market is led by major players including Knorr-Bremse, Bombardier, Alstom, Amsted Rail, Mitsubishi Heavy Industries, Pandrol, Schneider Electric, Voith, CAF, and Wabtec. These companies dominate through advanced product portfolios, durable materials, and partnerships with global OEMs. North America led the market in 2024 with a 36.2% share, driven by extensive freight operations and modernization programs. Europe followed with 27.6% due to strong focus on rail safety and sustainability initiatives. Asia-Pacific accounted for 25.8%, emerging as the fastest-growing region with large-scale infrastructure investments and expanding freight corridors supporting strong market demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The railway draft gear market was valued at USD 1.76 billion in 2024 and is projected to reach USD 2.66 billion by 2032, expanding at a CAGR of 5.32%.

- Market growth is driven by rising freight rail demand, modernization of rolling stock, and investments in energy-efficient and low-maintenance gear systems.

- Trends include the adoption of composite materials, digital monitoring solutions, and smart maintenance technologies improving durability and operational safety.

- The competitive landscape is moderately consolidated, with global players focusing on lightweight designs, performance enhancement, and strategic collaborations with OEMs.

- North America led with a 36.2% share in 2024, followed by Europe at 27.6% and Asia-Pacific at 25.8%; the freight wagon segment dominated with a 46.8% share, supported by increasing global logistics and heavy-haul operations.

Market Segmentation Analysis:

By Rail Type

The freight wagon segment dominated the railway draft gear market in 2024 with a 46.8% share. Freight wagons experience higher coupling and impact loads, requiring robust energy absorption systems to prevent damage and ensure stability during transport. Growing freight transport volumes and expansion of heavy-haul operations in regions such as North America and Asia-Pacific support this dominance. The locomotive and EMU segments are also expanding due to modernization initiatives, while DMUs gain traction in regional passenger transport driven by rising demand for efficient intercity rail solutions.

- For instance, The Miner Enterprises TP-17 draft gear provides approximately 70 kJ of nominal energy capacity with a 63.5 mm total stroke (travel).

By Sales

The OEMs segment held the largest market share of 61.4% in 2024, driven by continuous railway network expansion and fleet modernization programs. Railway manufacturers increasingly integrate advanced draft gear systems during production to enhance safety, durability, and shock resistance. Government investments in new high-speed rail and freight corridors further boost OEM demand. The aftermarket segment also shows steady growth due to periodic maintenance and replacement of worn components, especially in aging rolling stock fleets across emerging economies.

- For instance, the Amsted Rail Endurance 325 draft gear is reported in company literature and industry publications to offer 3-1/4 in (inches) travel

Key Growth Drivers

Expansion of Freight Transportation Networks

The expansion of global freight rail networks remains a major growth driver for the railway draft gear market. Governments and private operators are investing in modern rail corridors to improve goods transport efficiency. This creates strong demand for advanced draft gear systems that enhance load handling, safety, and impact absorption. The need to improve the durability and reliability of freight rolling stock further accelerates adoption. Continuous infrastructure development supports the replacement of outdated components with high-performance gear systems across key freight transport markets.

- For instance, Oleo International hydraulic gear dissipates >95% of impact energy, improving control at speed.

Technological Advancements in Rail Components

Advancements in materials and mechanical engineering are driving innovation in draft gear systems. Manufacturers are introducing new designs that offer better energy absorption, reduced maintenance, and higher durability. Integration of smart monitoring and digital diagnostic tools enhances system reliability and predictive maintenance efficiency. These innovations improve operational safety and cost-effectiveness for rail operators. The trend toward automation and modernization continues to push the adoption of next-generation draft gear solutions in both passenger and freight applications.

- For instance, Amsted Rail specifies AAR M901E approval on Endurance 325 with optimized housing for longer life.

Government Investments and Modernization Programs

Rising government investments in rail infrastructure modernization strongly influence market growth. Many countries are prioritizing the upgrade of existing fleets and expansion of new rail corridors. This modernization focus aims to improve safety, efficiency, and sustainability across national rail networks. Integration of advanced draft gear systems aligns with these objectives, ensuring better performance under high-load and high-speed conditions. Supportive policies, funding programs, and public-private partnerships continue to drive consistent adoption of improved draft gear technologies worldwide.

Key Trends and Opportunities

Adoption of Lightweight and Composite Materials

The adoption of lightweight materials represents a key trend in draft gear manufacturing. Rail producers are shifting toward advanced composites and alloys that reduce train weight while maintaining strength. These materials improve energy efficiency, reduce wear, and enhance performance under dynamic loading. Growing environmental awareness promotes the use of recyclable and corrosion-resistant components. This shift offers significant opportunities for manufacturers developing sustainable, high-durability solutions that meet evolving global standards for performance and environmental compliance.

- For instance, The Dellner portfolio includes various draft-gear force–stroke designs, typically offering a high degree of energy absorption (low recoil), and may list specific characteristics like up to 70% reversible efficiency depending on the specific product line and application within their extensive range of train connection systems.

Integration of IoT and Predictive Maintenance

Digitalization is reshaping the rail equipment market through IoT integration and predictive maintenance. Smart sensors embedded in draft gear systems allow operators to monitor performance, vibration, and stress in real time. Predictive analytics helps identify faults before failures occur, reducing maintenance downtime. The adoption of these technologies improves safety, reliability, and operational efficiency. Manufacturers leveraging connected technologies are gaining competitive advantages by offering value-added maintenance and monitoring capabilities to railway operators.

- For instance, Deutsche Bahn–KONUX deployments covered 650 switches initially, expanding to 3,500 assets.

Key Challenges

High Initial Installation and Retrofit Costs

The high cost of installing and retrofitting advanced draft gear systems poses a significant challenge. Many operators, especially in emerging markets, face budget constraints that limit upgrades. The complexity of installation and the need for compatible designs further add to operational expenses. Extended replacement times can disrupt service schedules, affecting fleet productivity. These factors collectively slow the rate of new technology adoption despite long-term savings and reliability benefits.

Stringent Certification and Compliance Standards

Compliance with diverse international safety and performance standards remains a key industry challenge. Draft gear manufacturers must meet region-specific regulations related to strength, durability, and impact resistance. Certification processes require extensive testing and validation, increasing development time and cost. Frequent updates to global safety norms compel ongoing design adjustments. These strict requirements can strain smaller producers and delay product launches, impacting competitiveness in the global railway components market.

Regional Analysis

North America

North America held the largest share of 36.2% in the railway draft gear market in 2024. The United States and Canada drive growth through extensive freight operations and high adoption of heavy-haul trains. The region’s strong focus on rail safety, efficiency, and modernization of rolling stock supports steady demand for advanced draft gear systems. Increasing investment in intermodal transport networks and replacement of aging fleets further enhances market growth. Key manufacturers are integrating energy-absorbing and maintenance-free designs to comply with stringent rail safety standards, reinforcing North America’s leadership in global market share.

Europe

Europe accounted for 27.6% of the global railway draft gear market share in 2024. Growth is driven by the modernization of freight wagons, adoption of lightweight rail components, and expansion of cross-border high-speed corridors. Countries such as Germany, France, and the United Kingdom are investing in sustainable and efficient rail networks. The European Union’s Green Deal policies promoting low-emission transport also encourage technological innovation in rail components. Manufacturers in the region emphasize high-performance materials and digital integration to meet strict safety and environmental regulations, supporting continuous regional growth.

Asia-Pacific

Asia-Pacific captured 25.8% of the railway draft gear market share in 2024, supported by rapid urbanization and infrastructure investments. China, India, and Japan lead through extensive rail expansion and freight corridor projects. Rising domestic freight volumes and government-led electrification programs drive strong demand for durable and energy-absorbing draft gear systems. Local manufacturers are partnering with global suppliers to enhance product performance and meet international standards. Increasing emphasis on cost-efficient and high-capacity rail systems positions Asia-Pacific as the fastest-growing regional market during the forecast period.

Latin America

Latin America held an 6.1% share of the railway draft gear market in 2024. The region’s market growth is primarily driven by expansion of freight transport in Brazil, Mexico, and Argentina. Modernization of mining and agricultural transport networks enhances the need for advanced draft gear to manage high-impact loads. Governments are prioritizing rail infrastructure development to improve logistics efficiency and reduce road congestion. Gradual investments in passenger rail also create opportunities for OEM suppliers to introduce improved gear systems with longer operational life and reduced maintenance costs.

Middle East & Africa

The Middle East & Africa accounted for 4.3% of the railway draft gear market share in 2024. Ongoing projects in Saudi Arabia, South Africa, and the UAE are contributing to regional development. Investments in intercity and cross-border rail corridors aim to support trade and industrial logistics. Demand for draft gear systems is growing as new freight and passenger rail lines adopt global safety and performance standards. Although growth remains moderate, increasing public-private partnerships and government funding for sustainable transport are expected to boost long-term adoption of modern draft gear technologies.

Market Segmentations:

By Rail Type

- Locomotive

- DMUs

- EMUs

- Freight Wagon

- Others

By Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The railway draft gear market features key players such as Knorr-Bremse, Bombardier, Alstom, Amsted Rail, Mitsubishi Heavy Industries, Pandrol, Schneider Electric, Voith, CAF, Wabtec, Toshiba, Bogie Systems, Hepworth Railway, Siemens, and Stadler Rail. The competitive landscape is defined by continuous product innovation, technological integration, and long-term supply contracts with major rail operators. Companies emphasize the development of energy-efficient, low-maintenance, and lightweight draft gear systems to meet modern performance standards. Strategic partnerships with OEMs and infrastructure authorities strengthen market presence across regions. Firms also invest in digital monitoring and predictive maintenance capabilities to enhance system reliability. The growing focus on sustainability and adherence to evolving safety regulations further intensify competition, encouraging players to expand global distribution networks and strengthen aftermarket services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Knorr-Bremse

- Bombardier

- Alstom

- Amsted Rail

- Mitsubishi Heavy Industries

- Pandrol

- Schneider Electric

- Voith

- CAF

- Wabtec

- Toshiba

- Bogie Systems

- Hepworth Railway

- Siemens

- Stadler Rail

Recent Developments

- In 2025, Voith expanded the application and supply of its intelligent automatic couplers, such as the CargoFlex, to improve freight transport efficiency and safety.

- In 2025,Knorr-Bremse secured a contract from BEML to supply braking, entrance, air conditioning, and sanitary systems for India’s first high-speed train prototypes.

- In 2025, Wabtec and Rio Tinto SimFer unveiled the first ES43ACi locomotive for the Simandou iron ore project in Guinea.

Report Coverage

The research report offers an in-depth analysis based on Rail Type, Sales and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The railway draft gear market will witness steady growth due to rising freight rail operations.

- Increasing modernization of passenger and freight fleets will enhance demand for advanced gear systems.

- Manufacturers will focus on lightweight and durable materials to improve fuel efficiency and lifespan.

- Integration of digital monitoring systems will support predictive maintenance and safety optimization.

- Expansion of international freight corridors will create consistent opportunities for OEM suppliers.

- Government-backed infrastructure investments will drive long-term market stability and innovation.

- Asia-Pacific will emerge as the fastest-growing region supported by large-scale rail projects.

- Adoption of sustainable materials and recyclable components will align with global green standards.

- Growing collaboration between OEMs and technology firms will accelerate product advancements.

- Continuous regulatory updates will shape design improvements and strengthen market competitiveness.