Market Overview

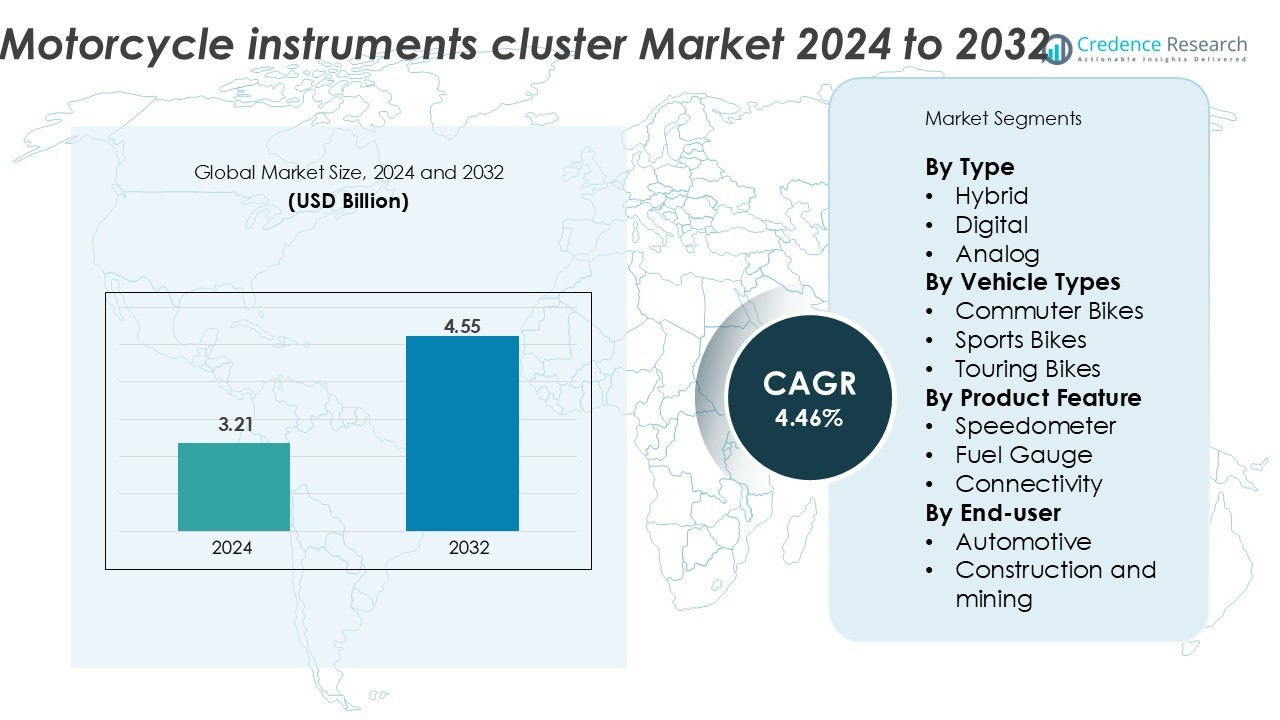

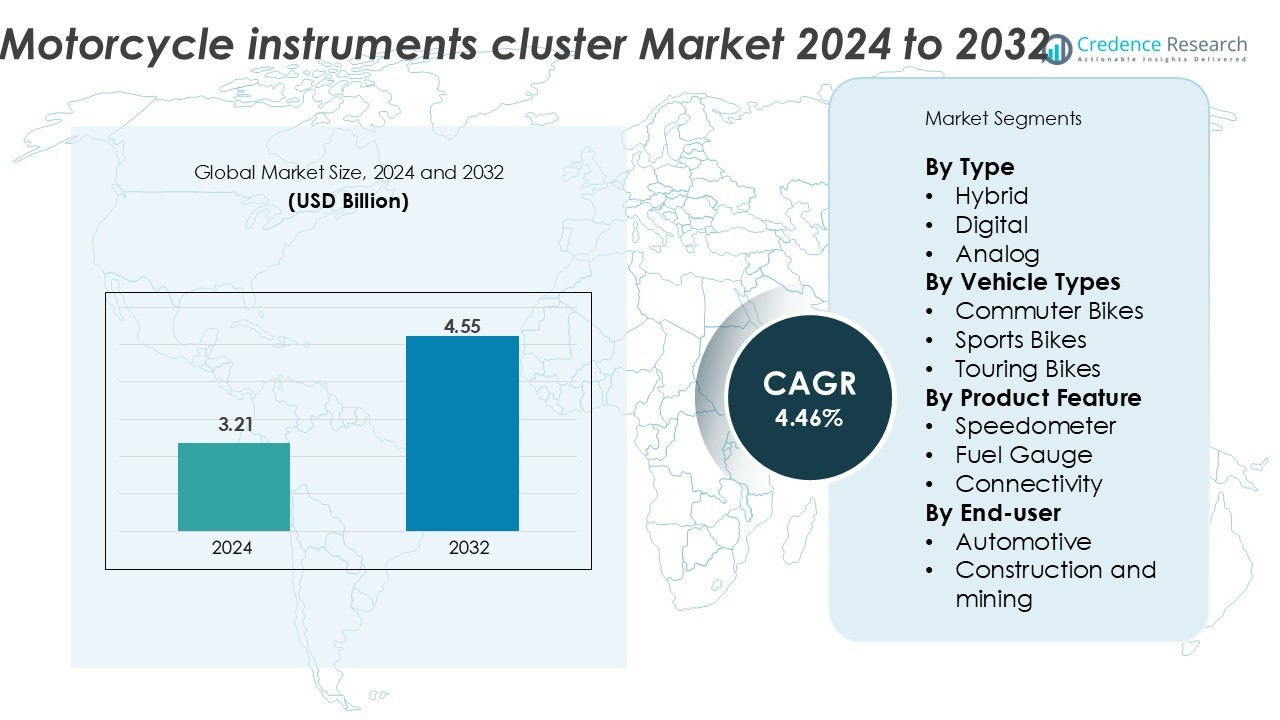

The Motorcycle Instrument Cluster Market was valued at USD 3.21 billion in 2024 and is projected to reach USD 4.55 billion by 2032, growing at a CAGR of 4.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motorcycle Instrument Cluster Market Size 2024 |

USD 3.21 Billion |

| Motorcycle Instrument Cluster Market, CAGR |

4.46% |

| Motorcycle Instrument Cluster Market Size 2032 |

USD 4.55 Billion |

The motorcycle instrument cluster market is highly competitive, with key players such as Yamaha Motor Co., Ltd., Visteon Corporation, Bosch Limited, Suzuki Motor Corporation, Denso Corporation, Magneti Marelli S.p.A., Continental AG, Nippon Seiki Co., Ltd., Honda Motor Co., Ltd., and Pricol Limited leading global operations. These companies focus on digital transformation, advanced TFT display integration, and connected technologies to enhance rider experience and safety. Asia-Pacific dominates the market with a 41% share, driven by large-scale motorcycle production and growing adoption of hybrid and digital clusters. Europe and North America follow, collectively accounting for 46% of the market, supported by premium motorcycle manufacturing and early technology adoption.

Market Insights

- The motorcycle instrument cluster market was valued at USD 3.21 billion in 2024 and is projected to reach USD 4.55 billion by 2032, growing at a CAGR of 4.46% during the forecast period.

- Growing demand for digital and hybrid clusters drives market expansion, supported by increasing adoption of connected display technologies across commuter and sports motorcycles.

- Advancements in TFT and LCD displays, combined with rising integration of Bluetooth, GPS, and telematics, shape market trends toward smart, interactive dashboards.

- The market remains competitive with leading players such as Bosch, Continental, Visteon, Nippon Seiki, and Denso, focusing on R&D and OEM partnerships, though high production costs restrain adoption in low-cost models.

- Asia-Pacific holds 41% of the market share, followed by Europe at 25% and North America at 21%; the digital cluster segment leads globally due to strong demand for advanced and customizable display systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The digital segment holds the dominant share of the motorcycle instrument cluster market, driven by the rising integration of TFT and LCD displays. These clusters offer advanced features such as GPS navigation, Bluetooth connectivity, and customizable interfaces that enhance rider experience and safety. Manufacturers are shifting toward digital and hybrid models to meet consumer demand for real-time information and aesthetics. For instance, Bosch introduced its 10.25-inch TFT display offering split-screen functionality, allowing simultaneous display of speed and navigation data, enhancing situational awareness for riders.

- For instance, Bosch launched a 10.25-inch TFT display for motorcycles that incorporates a split-screen function and 2 600-rider survey input.

By Vehicle Type

Commuter bikes represent the leading segment due to their high production volume and affordability across developing regions. Rising demand for efficient and user-friendly displays in this category drives the installation of hybrid and basic digital clusters. Sports and touring bikes are also adopting premium display technologies to support performance tracking and connectivity. For instance, Continental AG’s digital instrument solutions enable customizable layouts and smartphone integration, catering to diverse rider preferences and improving convenience during long-distance travel.

- For instance, Continental AG introduced its MultiViu Sports platform, including a 7-inch TFT display with a resolution of 800 × 480 pixels and a brightness of 1 000 cd/m², enabling customizable layouts and smartphone integration tailored to varied rider preferences.

By Product Feature

The speedometer segment dominates the market, as it remains an essential component of all motorcycle clusters. However, connectivity features are gaining rapid traction, driven by the growing demand for smart and networked vehicles. Modern systems integrate Bluetooth and navigation for improved rider communication and safety. For instance, Nippon Seiki’s LCD cluster with smartphone pairing allows riders to access call alerts and route guidance directly on the dashboard, combining safety with enhanced user experience.

Key Growth Drivers

Increasing Demand for Advanced Display Technologies

The adoption of advanced display technologies such as TFT and LCD panels is a major growth driver for the motorcycle instrument cluster market. Manufacturers are integrating high-resolution screens with features like smartphone connectivity, navigation, and real-time diagnostics. This shift enhances user experience and aligns with the growing preference for premium motorcycles equipped with digital interfaces. The demand for interactive and multifunctional displays is particularly strong in electric motorcycles, where digital clusters provide critical range and performance data. For instance, Bosch and Visteon have introduced smart TFT systems with integrated communication modules, allowing seamless information access and greater safety visibility for riders.

- For instance, Bosch Group launched its “TFT Connect” platform featuring a display with over 200 ppi resolution, 1500 nit brightness, a contrast ratio of 1250:1, and Bluetooth 5.2 plus dual-band WiFi for seamless connectivity.

Rising Motorcycle Production and Urban Mobility Needs

Rapid urbanization and increasing two-wheeler adoption for daily commuting continue to drive instrument cluster demand. Developing economies such as India, Indonesia, and Vietnam are witnessing surging motorcycle sales, supported by affordability and convenience. As production expands, OEMs are upgrading vehicle dashboards to meet regulatory and consumer expectations for better visibility and design aesthetics. Hybrid and digital clusters with compact, efficient layouts are becoming standard in commuter models. For instance, Honda integrates digital-analog combinations in several entry-level bikes, enhancing functionality while maintaining cost-effectiveness. The rise of ride-sharing and delivery fleets further fuels demand for durable and reliable display systems.

- For instance, Yamaha’s FZ-X features a negative LCD cluster capable of displaying 12 distinct riding metrics, including gear position, fuel economy, and Bluetooth alerts, enhancing commuter convenience and user interaction.

Integration of Connectivity and Smart Features

The growing focus on connected mobility is accelerating the adoption of smart instrument clusters. Modern motorcycles increasingly feature Bluetooth, GPS, and telematics-enabled dashboards that deliver notifications, navigation, and performance insights. This integration improves both safety and convenience for riders. For instance, Yamaha’s Y-Connect technology and TVS SmartXonnect allow synchronization with smartphones for call alerts, fuel data, and maintenance reminders. Such advancements strengthen brand differentiation while meeting rider expectations for digital integration. The trend also supports over-the-air updates and predictive maintenance, aligning with the broader evolution toward intelligent, IoT-enabled vehicle ecosystems.

Key Trends & Opportunities

Transition Toward Fully Digital and Hybrid Clusters

The market is experiencing a rapid shift from analog to fully digital and hybrid instrument clusters, supported by declining display costs and increased adoption of compact electronics. These modern clusters combine functional efficiency with aesthetic appeal, offering customization options for themes and data presentation. Manufacturers are exploring augmented reality and HUD (Head-Up Display) integration to enhance rider safety and visual clarity. For instance, Continental and Panasonic are developing next-generation projection-based clusters designed for improved visibility under variable lighting. The growing acceptance of digital dashboards in both commuter and premium bikes opens opportunities for differentiation and technological partnerships among OEMs.

- For instance, Continental AG launched its MultiViu Sports platform featuring a 7-inch TFT display with a resolution of 800×480 pixels, 1,000 cd/m² brightness, and a contrast ratio of 1,000:1.

Expansion of Electric Motorcycles Boosting Instrument Innovation

The global shift toward electric mobility is creating strong opportunities for advanced instrument cluster integration. Electric motorcycles rely heavily on smart displays to convey battery status, regenerative braking data, and range analytics. As EV adoption rises, OEMs are prioritizing lightweight, energy-efficient digital clusters compatible with electric powertrains. For instance, Revolt Motors and Zero Motorcycles incorporate cloud-linked TFT displays offering live diagnostics and performance tracking. This transition not only enhances operational awareness but also aligns with the sustainability goals of major manufacturers. The EV trend thus opens new avenues for innovation in software-driven, energy-optimized display systems.

- For instance, Zero Motorcycles equips its FX model with a full-color 5-inch TFT instrument cluster that displays state of charge, power output, and speed in real-time

Growing Aftermarket Demand for Customizable Displays

The aftermarket segment is witnessing rising demand for customizable and retrofit digital instrument clusters. Riders are increasingly personalizing motorcycles with advanced dashboards that feature enhanced brightness, multi-color displays, and integrated navigation. Suppliers are responding with modular systems compatible with multiple brands. For instance, Koso and Trail Tech offer plug-and-play digital clusters with adjustable parameters and waterproof designs for adventure motorcycles. This trend extends the lifecycle of older models while creating new revenue streams for component manufacturers and distributors. The customization opportunity also supports small-scale tech firms entering the market with innovative, affordable display solutions.

Key Challenges

Key Challenges

High Cost of Advanced Digital Clusters

The integration of sophisticated digital and hybrid clusters increases the overall cost of motorcycles, limiting adoption in price-sensitive markets. Advanced TFT and LCD systems require high-quality sensors, processors, and software interfaces, adding to production expenses. Manufacturers must balance technology and affordability, especially in the commuter segment where cost competitiveness drives sales. For instance, entry-level motorcycles in emerging economies often retain analog or semi-digital designs to maintain affordability. Additionally, supply chain complexities and fluctuating semiconductor prices can further raise costs, constraining large-scale deployment of digital clusters in low-margin models.

Durability and Environmental Resistance Issues

Motorcycle instrument clusters face durability challenges due to exposure to heat, moisture, vibration, and dust. Ensuring long-term performance in harsh conditions requires robust materials and sealing technologies, which increase design complexity. Failures in display clarity or sensor accuracy can compromise rider safety and customer trust. For instance, extreme temperature variations often affect LCD visibility and electronic stability. Manufacturers such as Nippon Seiki and Pricol are addressing these issues by developing weather-resistant coatings and reinforced housings. However, maintaining consistent performance across diverse environments remains a significant engineering challenge in the global market.

Regional Analysis

North America

North America holds a 21% share of the motorcycle instrument cluster market, driven by strong demand for premium and high-performance motorcycles. The region benefits from advanced technological integration, with manufacturers focusing on connected and digital TFT display systems. The U.S. leads due to the presence of major brands such as Harley-Davidson and Polaris, which emphasize infotainment and navigation features in their models. Increasing adoption of adventure and touring bikes supports growth in digital clusters. Rising consumer interest in smart and safety-enhancing dashboard solutions continues to strengthen market development across the region.

Europe

Europe accounts for a 25% market share, supported by high motorcycle penetration and the presence of renowned OEMs such as BMW Motorrad, Ducati, and Triumph. The region emphasizes advanced driver information systems with enhanced connectivity, navigation, and telematics integration. Stringent safety and emission regulations promote the use of intelligent clusters that improve vehicle monitoring. Germany, Italy, and the UK are leading markets due to strong R&D investment and adoption of premium models. The growing popularity of electric motorcycles across Western Europe further boosts demand for customizable digital instrument displays.

Asia-Pacific

Asia-Pacific dominates the global motorcycle instrument cluster market with a 41% share, led by countries such as India, China, Indonesia, and Japan. The region’s dominance stems from high motorcycle production volumes and growing consumer preference for digital and hybrid clusters. Affordable commuter bikes continue to drive mass-market demand, while electric two-wheelers are pushing digital adoption. Major manufacturers like Yamaha, Hero MotoCorp, and Honda integrate compact TFT and LED displays across various models. Rapid urbanization, rising disposable incomes, and expanding two-wheeler exports further strengthen the region’s position in the global market landscape.

Latin America

Latin America represents a 7% market share, primarily driven by growing motorcycle sales in Brazil, Argentina, and Colombia. The region’s rising demand for commuter and sports bikes supports gradual adoption of hybrid and digital clusters. Increasing middle-class income levels and expanding motorcycle assembly operations attract investment from global OEMs. Brazil leads the market, emphasizing cost-effective clusters with essential digital functions. Manufacturers such as Magneti Marelli and Valeo are exploring localized production to reduce costs and enhance availability. Gradual technological transition and affordability remain key factors shaping regional growth.

Middle East & Africa

The Middle East & Africa hold a 6% share of the motorcycle instrument cluster market, supported by steady demand for commercial and recreational motorcycles. Countries like South Africa, the UAE, and Egypt are witnessing increased adoption of mid-range bikes with hybrid display systems. Rising imports of Japanese and European motorcycles further contribute to digital cluster penetration. Infrastructure development and leisure motorcycling trends in Gulf countries are expanding the premium segment. Local distributors are partnering with global suppliers to introduce durable and weather-resistant clusters suited for regional climatic conditions.

Market Segmentations:

By Type

By Vehicle Types

- Commuter Bikes

- Sports Bikes

- Touring Bikes

By Product Feature

- Speedometer

- Fuel Gauge

- Connectivity

By End-user

- Automotive

- Construction and mining

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The motorcycle instrument cluster market features strong competition among global and regional manufacturers focusing on technological innovation, design efficiency, and connectivity. Key players include Bosch, Continental AG, Visteon Corporation, Nippon Seiki, Pricol Limited, Delphi Technologies, Marelli Holdings, Calsonic Kansei Corporation, Yazaki Corporation, and Denso Corporation. These companies emphasize digital transformation through advanced TFT and LCD display solutions integrated with telematics, Bluetooth, and GPS functions. Strategic collaborations with OEMs enable customized cluster designs for specific motorcycle models, enhancing user experience and brand identity. For instance, Bosch’s 10.25-inch TFT display supports split-screen navigation and speed visualization, while Nippon Seiki focuses on compact, cost-effective hybrid systems for commuter bikes. The market also sees rising R&D investment in lightweight materials, smart sensors, and adaptive display brightness to ensure performance under diverse environmental conditions. Continuous product innovation, partnerships, and software-driven upgrades remain critical to maintaining competitiveness in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yamaha Motor Co., Ltd. (Japan)

- Visteon Corporation (United States)

- Bosch Limited (Germany)

- Suzuki Motor Corporation (Japan)

- Denso Corporation (Japan)

- Magneti Marelli S.p.A. (Italy)

- Continental AG (Germany)

- Nippon Seiki Co., Ltd. (Japan)

- Honda Motor Co., Ltd. (Japan)

- Pricol Limited (India)

Recent Developments

- In January, 2025, Honda Motorcycle & Scooter India (HMSI) launched the 2025 Honda Livo, now compliant with OBD2B regulations. The updated Livo features a fully digital instrument cluster displaying real-time mileage, distance to empty, gear position indicator, service due reminders, and an Eco indicator. This update enhances the rider’s experience by providing comprehensive information at a glance.

- In February, 2025, Harley-Davidson announced plans to introduce new small cruiser motorcycles to attract a broader customer base. Following a challenging end to 2024, the company aims to expand its lineup with entry-level models, including the Nightster 440, developed in partnership with Hero MotoCorp. These models are expected to feature modern instrument clusters to appeal to new riders.

- In February, 2025, Ducati launched the DesertX Discovery in India, featuring advanced instrumentation tailored for off-road enthusiasts. While specific details about the instrument cluster were not disclosed, Ducati’s commitment to integrating cutting-edge technology suggests enhancements in this area.

Report Coverage

The research report offers an in-depth analysis based on Type, vehicle types, Product features, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital and hybrid clusters will continue replacing traditional analog systems across all motorcycle categories.

- Integration of connectivity features like Bluetooth and GPS will become standard in mid-range models.

- Manufacturers will focus on lightweight, energy-efficient display modules suitable for electric motorcycles.

- Advancements in TFT and LCD technology will enhance screen brightness and visibility under sunlight.

- Collaboration between OEMs and display technology providers will drive faster product innovation.

- Increasing demand for personalized dashboards will boost software-based customization options.

- The aftermarket segment will expand with retrofit digital cluster installations.

- Asia-Pacific will remain the dominant production and consumption hub for instrument clusters.

- Europe will lead in adopting high-end and smart display technologies for premium motorcycles.

- Continuous R&D investment will improve durability, reducing maintenance and environmental impact in extreme conditions.

Key Challenges

Key Challenges