Market Overview

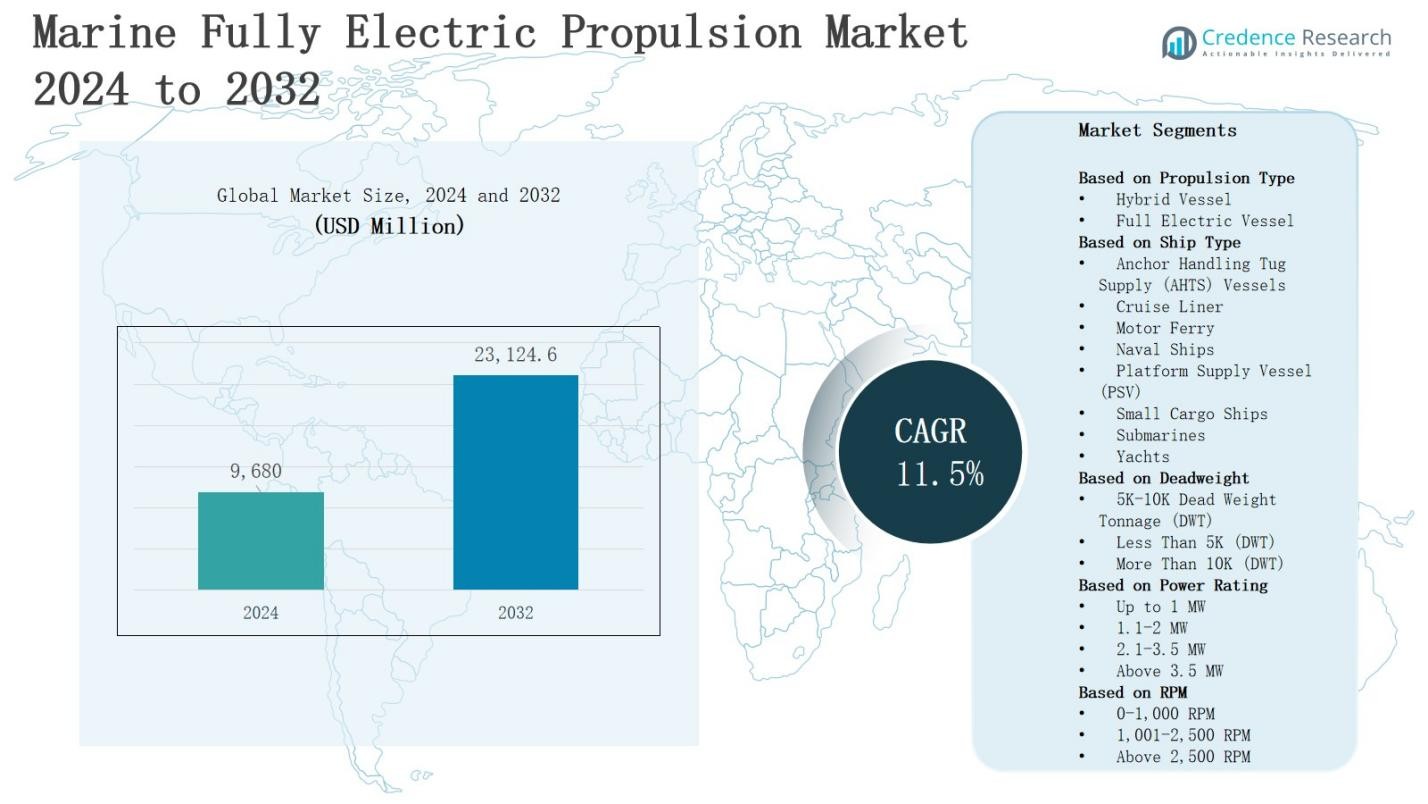

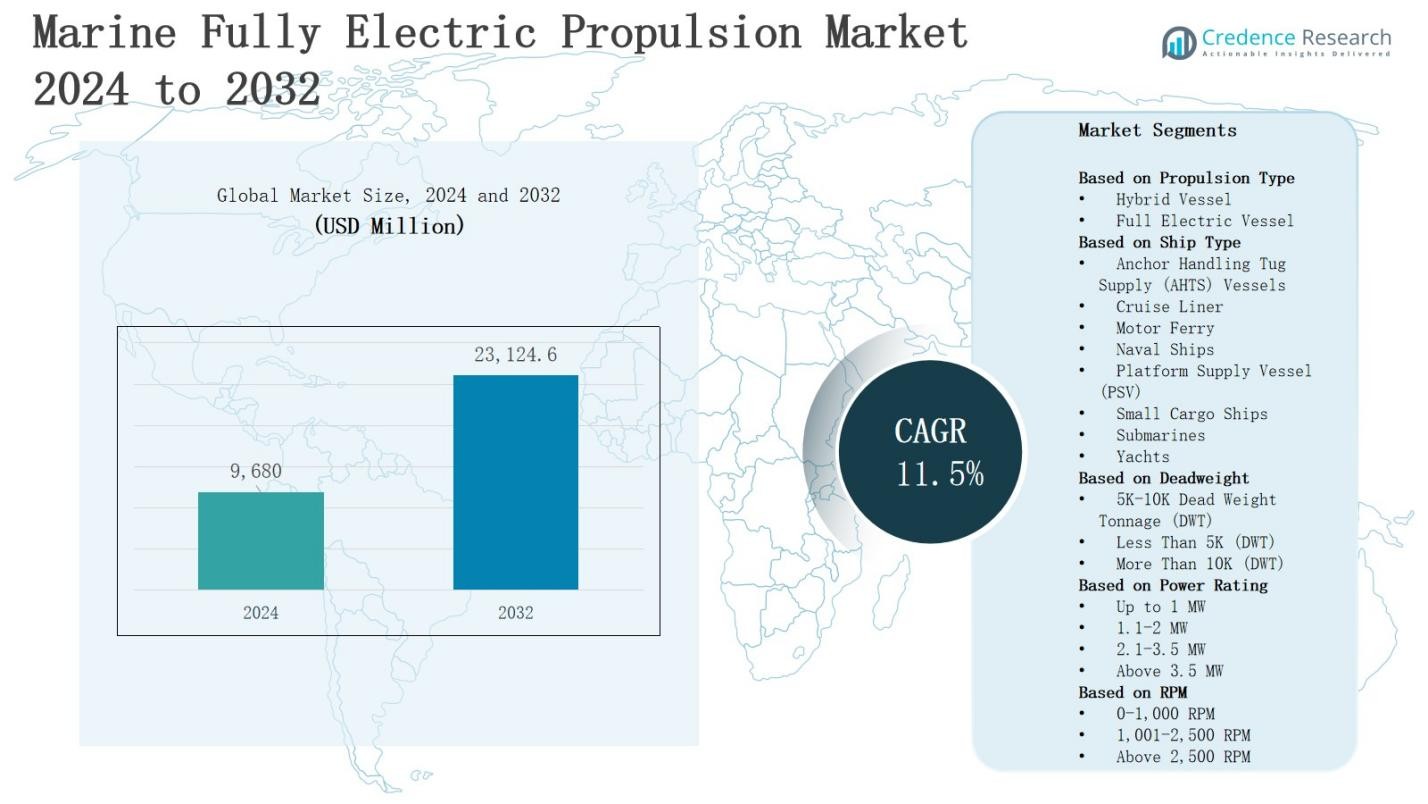

The Marine Fully Electric Propulsion Market is projected to grow from USD 9,680 million in 2024 to USD 23,124.6 million by 2032, registering a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Fully Electric Propulsion Market Size 2024 |

USD 9,680 Million |

| Marine Fully Electric Propulsion Market, CAGR |

11.5% |

| Marine Fully Electric Propulsion Market Size 2032 |

USD 23,124.6 Million |

The Marine Fully Electric Propulsion Market grows with rising demand for sustainable and energy-efficient maritime solutions driven by stringent environmental regulations and the global shift toward decarbonization. Shipbuilders and operators increasingly adopt fully electric systems to reduce greenhouse gas emissions, lower fuel dependency, and optimize operational costs. Advancements in battery technologies, including higher energy density and faster charging capabilities, enhance vessel performance and range, boosting adoption across ferries, cruise ships, and cargo vessels. Trends include integration of hybrid-electric architectures, development of megawatt-scale propulsion systems, and growing investments in port electrification to support large-scale deployment.

The Marine fully electric propulsion market shows strong geographical diversity, with Europe holding the largest share driven by strict emission norms and advanced ferry electrification, while Asia Pacific grows rapidly with China, Japan, and South Korea leading shipbuilding adoption. North America advances with regulatory support and infrastructure development, whereas Latin America sees early growth in Brazil and Chile. The Middle East & Africa expand gradually through port modernization and yacht electrification. Key players include ABB Ltd., Siemens AG, Wärtsilä Corporation, Rolls-Royce Holdings plc, Damen Shipyards Group, and CSIC.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Marine Fully Electric Propulsion Market is projected to grow from USD 9,680 million in 2024 to USD 23,124.6 million by 2032, at a CAGR of 11.5%, driven by rising demand for sustainable and energy-efficient maritime solutions.

- Stringent environmental regulations and the IMO 2050 goals push shipowners to adopt fully electric systems, reducing greenhouse gas emissions and supporting carbon neutrality commitments.

- Advancements in battery technology with higher density, longer lifecycle, and fast-charging capabilities enhance vessel performance, reduce fuel dependency, and lower maintenance costs.

- Rising fuel costs and the need for greater operational efficiency drive adoption, with electric propulsion offering quieter operations, reduced vibration, and extended vessel lifespan.

- Commercial and passenger vessels such as ferries, cruise liners, and short-haul cargo ships lead adoption, supported by urban port authorities investing in shore power and clean energy infrastructure.

- Market challenges include high initial investment, limited charging infrastructure in emerging economies, energy density constraints, and range limitations for large vessels.

- Europe holds 34% market share, Asia Pacific 28%, North America 26%, while Latin America and Middle East & Africa account for 6% each, supported by regional initiatives and infrastructure projects.

Market Drivers

Stringent Environmental Regulations and Decarbonization Goals

The Marine fully electric propulsion market grows steadily with global regulations targeting emission reduction across the maritime sector. Governments and international agencies enforce strict norms on greenhouse gas emissions, sulfur oxides, and nitrogen oxides, creating a clear shift toward electric alternatives. Shipowners view full electrification as a viable solution to comply with International Maritime Organization (IMO) 2050 goals. It enables sustainable operations while addressing carbon neutrality commitments. Companies adopt electric propulsion to maintain competitiveness in an evolving regulatory landscape.

- For instance, JPMorgan launched biometric-enabled POS terminals called JPMorgan Paypad and Pinpad in 2025 in the U.S., featuring facial recognition and infrared palm vein scanning to boost secure, touchless payments. This is JPMorgan’s first proprietary move into biometric payment tech.

Advancements in Battery Technology and Energy Storage

The Marine fully electric propulsion market benefits from innovations in battery technology, which strengthen vessel performance and operational efficiency. Energy storage systems with higher density, longer lifecycle, and fast-charging capabilities expand the feasibility of electric propulsion for large vessels. It reduces operational costs by minimizing reliance on fossil fuels and lowering maintenance requirements. Enhanced safety features, modular designs, and scalable capacity solutions accelerate adoption across diverse vessel types. Battery breakthroughs create opportunities for long-distance maritime electrification.

- For instance, Norwegian ferry operator Fjord1 integrated large-scale lithium-ion battery systems in their electric ferries, enabling fast charging and increased voyage distances while cutting emissions significantly.

Rising Fuel Costs and Operational Efficiency Needs

The Marine fully electric propulsion market experiences strong demand driven by volatile fuel prices and the need to optimize operational expenditures. Operators pursue electrification to cut fuel dependency and achieve predictable cost structures. It supports efficiency by eliminating complex mechanical systems, reducing vibration, and lowering noise pollution. Electric propulsion also extends vessel lifespan by minimizing engine wear. Shipping companies gain competitive advantages through reduced downtime, simplified maintenance, and improved overall vessel reliability.

Growing Adoption Across Commercial and Passenger Vessels

The Marine fully electric propulsion market expands as commercial operators and passenger service providers adopt electrification for long-term sustainability. Ferry services, cruise operators, and short-haul cargo vessels prioritize electric solutions to meet environmental and customer expectations. It aligns with urban port authorities investing in shore power infrastructure and clean energy integration. Rising demand for eco-friendly transport solutions stimulates adoption in tourist regions and commercial shipping hubs. Broader industry collaboration accelerates scaling of electric propulsion technologies.

Market Trends

Integration of Hybrid-Electric and Fully Electric Systems

The Marine fully electric propulsion market shows a clear trend toward combining hybrid and fully electric systems to enhance flexibility in maritime operations. Hybrid solutions allow vessels to switch between conventional engines and electric propulsion depending on operational requirements. It helps extend range and reduce fuel consumption while ensuring compliance with emission regulations. Shipbuilders adopt modular propulsion designs to scale power systems across vessel types. This integration creates a smoother transition toward complete electrification across the industry.

- For instance, Wärtsilä’s HY hybrid power module, which integrates engines, energy storage, and power electronics with an energy management system to optimize performance across various vessel types like ferries and shuttle tankers.

Development of High-Capacity and Megawatt-Scale Solutions

The Marine fully electric propulsion market advances with the development of high-capacity and megawatt-scale propulsion systems. Increasing vessel size and demand for higher operational power drive innovation in large-scale energy storage and propulsion units. It ensures efficient navigation for ferries, cruise ships, and cargo vessels that operate on demanding routes. Engineering progress in energy distribution systems and cooling technologies supports performance. Larger propulsion capacities enable electric solutions to penetrate traditionally fuel-dominated shipping sectors.

- For instance, GE Vernova Naval Systems is prototyping a megawatt-scale hybrid modular converter designed to support propulsion power in submarines, aircraft carriers, and surface warships, integrating next-generation semiconductors to boost fault tolerance and efficiency.

Port Electrification and Shore Power Expansion

The Marine fully electric propulsion market gains momentum with global investments in port electrification and shore power infrastructure. Ports across Europe, North America, and Asia introduce onshore charging systems to support large fleets. It reduces emissions during docking and aligns with zero-emission port initiatives. Governments provide incentives for infrastructure upgrades that enable seamless vessel charging. Shore power integration strengthens the adoption of electric propulsion by ensuring operational continuity and wider geographic coverage for electric vessels.

Digitalization and Smart Energy Management Systems

The Marine fully electric propulsion market evolves with the adoption of digitalization and advanced energy management platforms. Ship operators deploy real-time monitoring, predictive maintenance, and smart grid systems to optimize power consumption. It allows vessels to balance load distribution and extend battery life while maintaining operational efficiency. Integration of artificial intelligence and IoT-driven analytics creates data-driven decision-making in propulsion operations. These technologies enable more efficient fleet management, reducing costs and improving environmental sustainability in maritime transport.

Market Challenges Analysis

High Initial Investment and Infrastructure Limitations

The Marine fully electric propulsion market faces challenges due to high upfront costs associated with advanced battery systems, power electronics, and specialized propulsion units. Shipowners often hesitate to commit to electrification because return on investment depends on long-term operational savings, which vary with fuel prices and regulations. It also struggles with limited charging infrastructure at ports, especially in emerging economies. Delays in global port electrification create barriers for operators who require consistent charging facilities. These financial and infrastructural obstacles slow widespread adoption despite growing interest in sustainability.

Technical Constraints and Range Limitations

The Marine fully electric propulsion market also contends with technical hurdles, particularly concerning energy density and vessel range. Large ships demand higher power output, but current battery technology restricts operational distance without frequent charging. It raises concerns about reliability in long-haul or transoceanic shipping where refueling flexibility is essential. Weight and space requirements for energy storage systems further complicate vessel design. Operators worry about maintenance expertise, battery lifecycle, and recycling practices. These technical challenges limit deployment in heavy-duty applications and call for continuous innovation.

Market Opportunities

Expansion into Short-Sea Shipping and Passenger Transport

The Marine fully electric propulsion market holds strong opportunities in short-sea shipping, ferries, and passenger transport services. Growing demand for clean and quiet transportation in urban waterways drives adoption of electric vessels for commuter and tourist routes. It supports operators in reducing emissions, lowering noise, and enhancing passenger experience. Governments promote clean public transport solutions through subsidies and grants, creating favorable conditions. Rising interest from ferry operators in Europe and Asia strengthens growth potential. This segment provides a scalable pathway for wider adoption of electric propulsion technologies.

Innovation in Energy Storage and Renewable Integration

The Marine fully electric propulsion market benefits from opportunities tied to innovation in energy storage and renewable energy integration. Advances in solid-state batteries, hydrogen fuel cells, and hybrid energy systems open pathways for longer range and higher efficiency. It enables operators to align with global decarbonization initiatives while reducing operational costs. Integration with offshore renewable sources such as wind and solar creates sustainable charging ecosystems. Collaboration between technology developers, shipbuilders, and port authorities fosters faster commercialization. These advancements position electric propulsion as a central solution for the future of maritime transport.

Market Segmentation Analysis:

By Propulsion Type

The Marine fully electric propulsion market divides into hybrid vessels and full electric vessels, with hybrid systems currently dominating due to their flexibility and extended operational range. Hybrid propulsion allows operators to optimize between traditional engines and electric systems, reducing fuel use while ensuring reliability. It gains traction in large vessels where range limitations remain critical. Full electric vessels show rapid growth in ferries and passenger crafts as battery advancements improve range and charging speed. This segment aligns strongly with global decarbonization initiatives.

- For instance, Leonardo DRS supplies hybrid electric drive systems for large vessels, such as the U.S. Coast Guard Offshore Patrol Cutter, featuring power-dense motors rated up to 625 HP that reduce refueling needs and improve mission endurance.

By Ship Type

The Marine fully electric propulsion market spans diverse ship categories including anchor handling tug supply (AHTS) vessels, cruise liners, motor ferries, naval ships, platform supply vessels (PSVs), small cargo ships, submarines, and yachts. Motor ferries and cruise liners lead adoption due to regulatory pressure and demand for quiet, emission-free operations. It finds growing applications in yachts and naval ships where low noise and stealth operations matter. Cargo vessels and PSVs gradually integrate electric propulsion, supported by port electrification projects. Submarines remain niche but benefit from silent propulsion advantages.

- For instance, HH Ferries Group operates two full electric ferries between Helsingborg (Sweden) and Helsingör (Denmark), each carrying around 1,100 to 1,250 passengers and 240 cars over a 4 km route.

By Deadweight

The Marine fully electric propulsion market segments by deadweight into less than 5K DWT, 5K–10K DWT, and more than 10K DWT vessels. Vessels under 5K DWT dominate adoption as ferries, small cargo ships, and yachts fit within this category, benefiting from shorter routes and easier charging. It experiences moderate traction in the 5K–10K DWT range where operational efficiency becomes critical. Larger vessels above 10K DWT face adoption challenges due to energy density limitations, though advancements in battery and hybrid technologies are opening gradual opportunities.

Segments:

Based on Propulsion Type

- Hybrid Vessel

- Full Electric Vessel

Based on Ship Type

- Anchor Handling Tug Supply (AHTS) Vessels

- Cruise Liner

- Motor Ferry

- Naval Ships

- Platform Supply Vessel (PSV)

- Small Cargo Ships

- Submarines

- Yachts

Based on Deadweight

- 5K-10K Dead Weight Tonnage (DWT)

- Less Than 5K (DWT)

- More Than 10K (DWT)

Based on Power Rating

- Up to 1 MW

- 1.1-2 MW

- 2.1-3.5 MW

- Above 3.5 MW

Based on RPM

- 0-1,000 RPM

- 1,001-2,500 RPM

- Above 2,500 RPM

By Application

- Commercial

- Logistics

- Naval

- Offshore Drilling

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Marine fully electric propulsion market in North America accounts for 26% share, driven by strong regulatory frameworks and government funding for clean energy projects. The United States leads with investments in hybrid and fully electric ferries, particularly across coastal cities and inland waterways. Canada supports electrification through initiatives targeting reduced emissions in passenger transport and naval modernization. It benefits from advanced infrastructure development, including shore charging facilities in major ports. Partnerships between technology providers and shipbuilders accelerate deployment, ensuring long-term market growth.

Europe

Europe dominates the Marine fully electric propulsion market with 34% share, supported by strict International Maritime Organization (IMO) standards and strong adoption across Norway, Denmark, and Germany. The region’s leadership in ferry electrification sets benchmarks for global shipping. It benefits from established charging infrastructure and aggressive decarbonization policies. Cruise liners and passenger ferries form the largest application base, while naval and cargo vessels also see steady adoption. Government subsidies and research investments strengthen Europe’s position as a leader in marine electrification.

Asia Pacific

The Marine fully electric propulsion market in Asia Pacific holds 28% share, with China, Japan, and South Korea driving expansion. Governments in the region promote electric propulsion through subsidies, R&D funding, and port electrification projects. It gains momentum from the region’s dominance in global shipbuilding, providing strong opportunities for large-scale adoption. Passenger ferries in coastal and island nations such as Japan and Indonesia see increasing electrification. Integration of advanced battery technologies strengthens adoption, while expanding maritime trade drives demand across cargo and logistics vessels.

Latin America

Latin America captures 6% share of the Marine fully electric propulsion market, with growth supported by rising interest in sustainable port operations and coastal passenger services. Brazil and Chile lead adoption with early deployment of hybrid ferries and infrastructure projects. It remains at an early stage, hindered by limited large-scale investment and charging facilities. Regional governments encourage adoption through environmental regulations and incentives for clean transport. The presence of strong shipping routes across coastal areas supports gradual growth prospects.

Middle East & Africa

The Marine fully electric propulsion market in the Middle East & Africa holds 6% share, with adoption driven by diversification strategies in Gulf countries and port modernization projects. The United Arab Emirates and Saudi Arabia focus on clean shipping initiatives to align with long-term sustainability targets. It remains limited in large vessels due to infrastructure gaps but shows strong interest in yachts and smaller passenger ferries. Africa witnesses emerging opportunities, particularly in South Africa, where port electrification projects begin shaping market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wärtsilä Corporation (Finland)

- CSIC (China State Shipbuilding Corporation) (China)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Rolls-Royce Holdings plc (UK/Norway)

- Damen Shipyards Group (Netherlands)

- Incat Tasmania Pty Ltd (Australia)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- Kawasaki Heavy Industries Ltd. (Japan)

- Siemens AG (Germany)

- ABB Ltd. (Switzerland)

- Samsung Heavy Industries Co., Ltd. (South Korea)

Competitive Analysis

The Marine fully electric propulsion market features strong competition with global players focusing on innovation, partnerships, and large-scale deployment strategies. Companies such as ABB Ltd. and Siemens AG lead with advanced propulsion technologies and integrated power solutions that support efficiency and compliance with emission standards. Wärtsilä Corporation strengthens its position through battery-powered systems and digital energy management platforms, while Rolls-Royce Holdings plc invests in high-capacity electric and hybrid propulsion for naval and commercial vessels. Damen Shipyards Group and Incat Tasmania Pty Ltd emphasize ferry and passenger vessel electrification, targeting regional demand for sustainable transport. Asian leaders including Mitsubishi Heavy Industries Ltd., Hyundai Heavy Industries Co., Ltd., Samsung Heavy Industries Co., Ltd., and Kawasaki Heavy Industries Ltd. expand their portfolios by integrating advanced energy storage and propulsion technologies into large vessels. CSIC (China State Shipbuilding Corporation) drives adoption in China with government-backed shipbuilding initiatives, strengthening domestic capabilities. The market reflects high collaboration between shipbuilders, energy storage providers, and port authorities, as it evolves toward scalable electrification across diverse vessel categories.

Recent Developments

- In May 2025, Wärtsilä Corporation secured a contract to supply fully electric propulsion systems for three high-speed battery-electric ferries in San Francisco, marking the USA’s first zero-emission ferries.

- In January 2024, Yamaha Motor (Japan) completed the acquisition of Torqeedo (Germany), a manufacturer specializing in electric marine propulsion systems, motors, and batteries.

- In May 2025, Incat Tasmania launched Hull 096, which is the world’s largest battery-electric ferry. This ferry features a 40 MWh battery and capacity for approximately 2,100 passengers and 225 vehicles.

- In February 2025, Seavolt partnered with RAD Propulsion to supply complete electric propulsion solutions across Australia and the Pacific for fleets and marinas.

Market Concentration & Characteristics

The Marine fully electric propulsion market demonstrates moderate to high concentration, with a mix of established global corporations and specialized regional players shaping industry growth. Leading companies such as ABB Ltd., Siemens AG, Wärtsilä Corporation, Rolls-Royce Holdings plc, Hyundai Heavy Industries, and CSIC drive technological innovation and secure a significant share through integrated solutions, large-scale shipbuilding capacity, and strategic collaborations. It reflects strong entry barriers due to high capital requirements, advanced engineering expertise, and the need for port-side infrastructure investment. The market shows characteristics of rapid technological evolution, with trends centered on high-capacity batteries, hybrid-electric integration, and port electrification projects. Demand grows across passenger ferries, cruise liners, and naval vessels, where emission compliance and operational efficiency create clear adoption pathways. Regional variation is evident, with Europe and Asia Pacific leading in large-scale deployment, while North America, Latin America, and the Middle East & Africa gradually expand adoption through policy incentives and infrastructure support.

Report Coverage

The research report offers an in-depth analysis based on Propulsion Type, ShipType, Deadlift, Power Rating, RPM, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Marine fully electric propulsion market will grow steadily as global emission regulations tighten worldwide.

- Shipbuilders will adopt advanced battery technologies to improve vessel efficiency, range, and sustainability in operations.

- Hybrid-electric propulsion systems will act as transitional solutions before full electrification gains larger maritime adoption.

- Expansion of port electrification infrastructure will enable reliable charging, supporting widespread adoption of electric vessels.

- Passenger ferries and cruise liners will dominate adoption due to sustainability goals and stricter emission standards.

- Cargo vessels and naval ships will gradually integrate electric propulsion as energy storage technologies mature.

- Collaboration among shipbuilders, technology providers, and governments will accelerate deployment of electric propulsion in shipping.

- Solid-state batteries and hydrogen fuel cells will create opportunities for long-distance maritime electrification and efficiency.

- Operators will adopt electric propulsion to reduce fuel dependency and stabilize long-term maritime operational costs.

- Investments in smart energy management systems will enhance efficiency, reliability, and lifespan of electric propulsion systems.