Market Overview

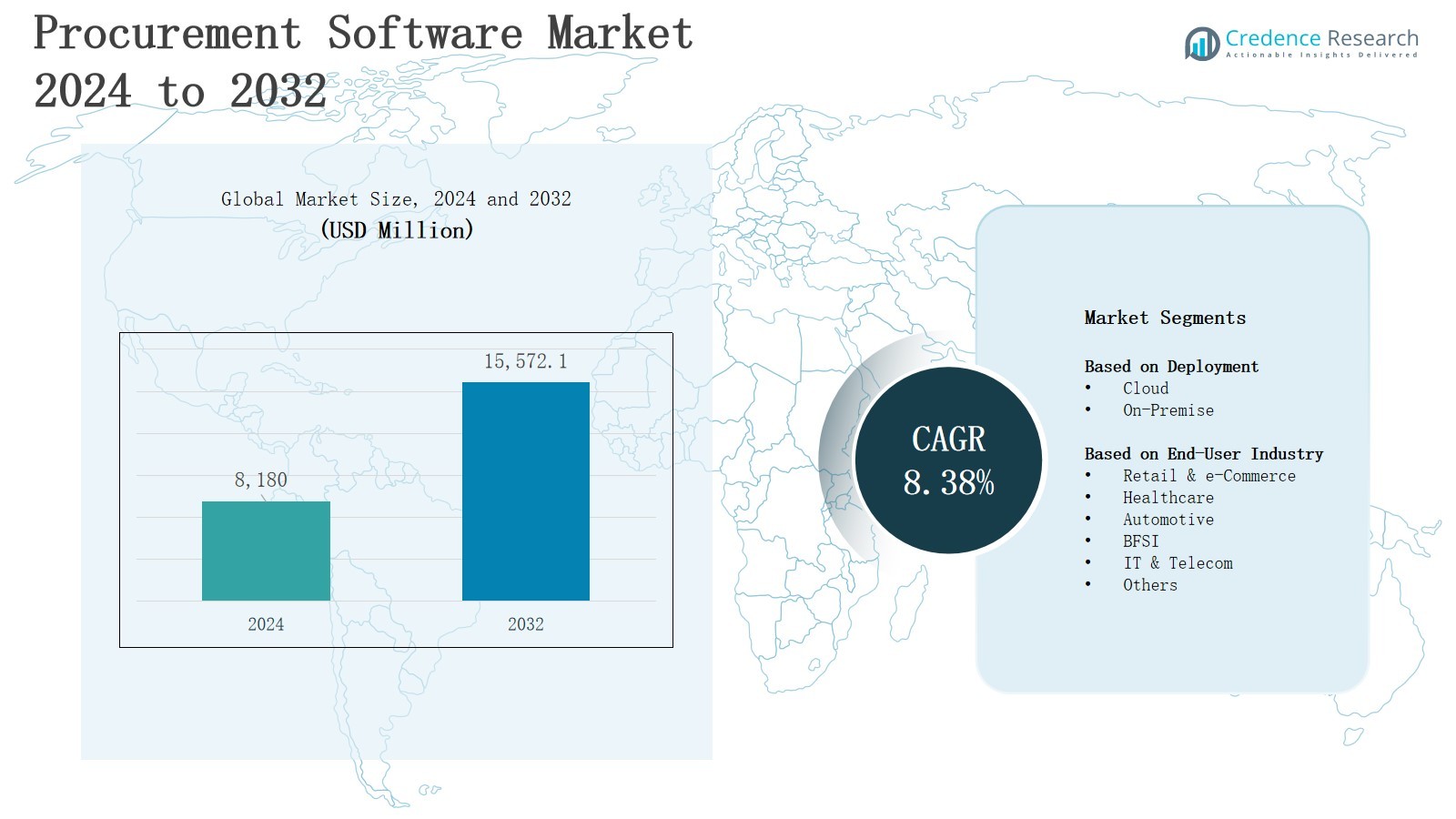

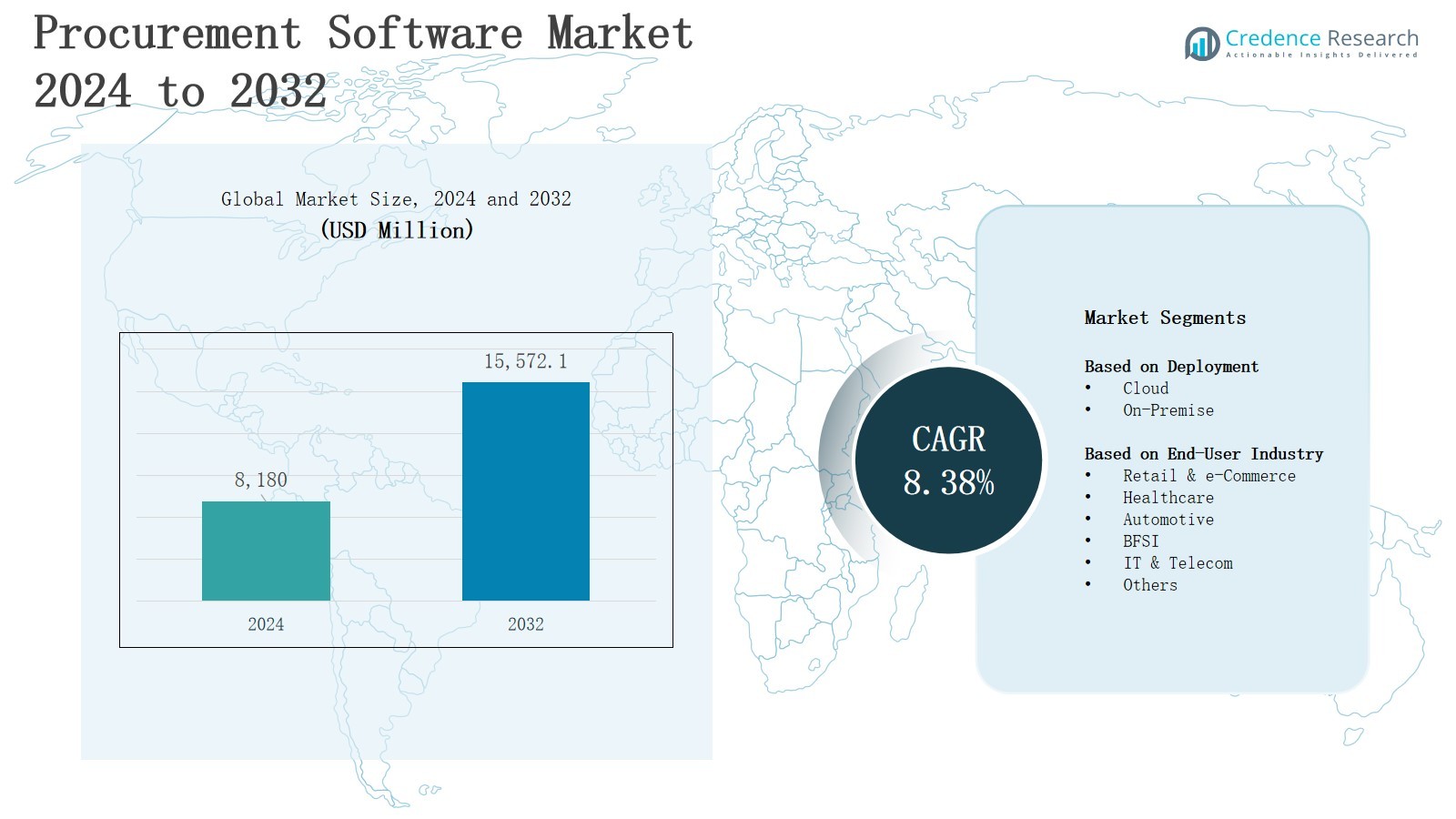

The procurement software market is projected to grow from USD 8,180 million in 2024 to USD 15,572.1 million by 2032, registering a CAGR of 8.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Procurement Software Market Size 2024 |

USD 8,180 Million |

| Procurement Software Market, CAGR |

8.38% |

| Procurement Software Market Size 2032 |

USD 15,572.1 Million |

The procurement software market grows with rising demand for cost optimization, efficiency, and regulatory compliance across industries. Organizations adopt advanced platforms to automate sourcing, enhance supplier collaboration, and mitigate risks in global supply chains. It benefits from digital transformation initiatives, with cloud-based and AI-enabled solutions driving real-time insights and predictive decision-making. Trends such as sustainable procurement practices, ethical sourcing, and integration with ERP and financial ecosystems strengthen adoption. Businesses increasingly view procurement software as a strategic tool to enhance transparency, resilience, and long-term competitiveness in evolving global markets.

The procurement software market demonstrates strong geographical diversity, with North America leading at 34% share driven by digital transformation and compliance needs. Europe holds 28% share supported by sustainability-focused adoption, while Asia Pacific captures 25% share with rapid digitalization and global supply chain expansion. Latin America accounts for 7% share, driven by modernization in Brazil and Mexico, and Middle East & Africa hold 6% share with rising government-led digital initiatives. Key players include SAP SE, Oracle Corporation, Microsoft Corporation, Coupa Software Inc., Zycus Inc., Ivalua Inc., Jaggaer Inc., Basware AS, GEP Corporation, Proactis Holdings PLC, and Ginesys.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The procurement software market is projected to grow from USD 8,180 million in 2024 to USD 15,572.1 million by 2032, registering a CAGR of 8.38%.

- Rising demand for cost optimization and efficiency drives adoption, with enterprises automating sourcing, contract management, and supplier evaluation.

- Digital transformation initiatives fuel growth, supported by AI, cloud platforms, and integration with ERP and financial systems.

- Compliance and risk management needs push organizations to adopt solutions ensuring supplier transparency and regulatory alignment.

- High implementation costs, integration complexities, and data security concerns remain key challenges slowing adoption.

- North America leads with 34% share, followed by Europe at 28%, Asia Pacific at 25%, Latin America at 7%, and Middle East & Africa at 6%.

- Key players include SAP SE, Oracle Corporation, Microsoft Corporation, Coupa Software Inc., Zycus Inc., Ivalua Inc., Jaggaer Inc., Basware AS, GEP Corporation, Proactis Holdings PLC, and Ginesys.

Market Drivers

Growing Emphasis on Cost Optimization and Efficiency

The procurement software market expands with enterprises seeking advanced solutions to reduce costs and streamline purchasing activities. It enables organizations to automate sourcing, supplier evaluation, and contract management, minimizing manual errors and delays. Rising competition across industries compels firms to prioritize cost efficiency and supplier performance. Adoption increases as procurement leaders focus on standardizing workflows, ensuring compliance, and leveraging analytics to identify savings opportunities that directly enhance financial performance and operational agility.

- For instance, Siemens uses SAP Ariba to digitize procurement workflows, allowing real-time supplier risk assessment and achieving measurable savings through spend visibility.

Rising Demand for Digital Transformation Across Enterprises

The procurement software market benefits from rapid digital adoption across global businesses. It supports organizations in modernizing traditional procurement methods through cloud platforms, AI, and data-driven tools. Firms invest in procurement systems to enhance real-time decision-making, track supplier performance, and strengthen collaboration. Growing demand for centralized platforms drives adoption among large and mid-sized enterprises. Integration with ERP and financial systems ensures greater transparency, resilience, and adaptability to evolving supply chain requirements.

- For instance, Coupa offers comprehensive contract and catalog management combined with simplified buying processes that increase procurement speed and control.

Increasing Regulatory Compliance and Risk Management Needs

The procurement software market grows with rising focus on compliance and risk mitigation in supply chain operations. It enables companies to monitor supplier adherence to industry standards, labor practices, and sustainability requirements. Stricter global trade regulations compel organizations to adopt robust systems for audit trails and documentation. Procurement software provides visibility into vendor risks, ensuring resilience and continuity. Businesses rely on these solutions to safeguard reputation and maintain operational compliance across complex procurement networks.

Expanding Global Supply Chains and Supplier Collaboration

The procurement software market strengthens with expanding global supply networks and increasing supplier partnerships. It facilitates seamless communication, contract enforcement, and performance monitoring across diverse geographies. Organizations adopt procurement platforms to improve supplier onboarding and manage multi-tier networks effectively. Growing cross-border trade and outsourcing strategies create demand for real-time procurement visibility. Enterprises depend on these solutions to ensure collaboration, drive innovation, and maintain competitive advantage in a dynamic international procurement environment.

Market Trends

Adoption of AI and Predictive Analytics in Procurement

The procurement software market witnesses a strong trend toward integrating artificial intelligence and predictive analytics. It empowers organizations to forecast demand, optimize supplier selection, and analyze spending patterns with greater accuracy. Companies use AI-driven insights to identify risks, enhance negotiation strategies, and improve compliance. Predictive analytics provides real-time visibility into supply chain disruptions. This trend strengthens procurement’s role as a strategic business function, supporting data-backed decision-making and long-term operational resilience across industries.

Shift Toward Cloud-Based and SaaS Procurement Platforms

The procurement software market experiences rising adoption of cloud-based and Software-as-a-Service platforms. It enables enterprises to scale operations quickly, reduce infrastructure costs, and gain access to procurement tools remotely. Cloud deployment supports seamless updates, cybersecurity enhancements, and integration with other enterprise systems. Businesses choose SaaS models for flexibility and reduced upfront investment. This trend accelerates digital transformation initiatives and ensures organizations can adapt to evolving global procurement requirements with agility and transparency.

- For instance, CloudEagle.ai offers an AI-powered SaaS management and procurement platform that simplifies vendor negotiations and contract renewals, helping companies like RingCentral achieve a threefold return through app rationalization and cost optimization.

Growing Focus on Sustainable and Ethical Procurement Practices

The procurement software market evolves with an increasing emphasis on sustainability and ethical sourcing. It assists organizations in tracking supplier compliance with environmental, social, and governance standards. Businesses adopt procurement systems to monitor carbon footprints, manage waste reduction goals, and ensure ethical labor practices. Rising stakeholder pressure for transparent and responsible supply chains drives demand for advanced platforms. This trend positions procurement as a critical enabler of corporate responsibility and long-term brand value.

- For instance, TrusTrace leverages AI, blockchain, and IoT technologies to map suppliers across tiers and validate certifications, identifying risks such as forced labor and tracking carbon footprints to achieve transparency and sustainability goals.

Integration of Procurement with Broader Digital Ecosystems

The procurement software market advances through integration with ERP, CRM, and financial systems. It provides organizations with a unified view of procurement activities aligned with overall business operations. Enhanced interoperability improves collaboration between procurement, finance, and operations teams. Businesses gain real-time insights across functions, driving efficiency and accountability. This trend accelerates the move toward connected digital ecosystems, ensuring procurement aligns with strategic objectives while supporting innovation and enterprise-wide digital transformation efforts.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The procurement software market faces challenges due to significant upfront costs and complex integration requirements. It demands investment in infrastructure, training, and change management, which creates barriers for small and mid-sized enterprises. Integration with existing ERP, CRM, and financial systems often requires customization, extending timelines and increasing expenses. Organizations struggle to achieve seamless interoperability when legacy systems are outdated. These challenges slow adoption and limit the ability of firms to fully leverage procurement software capabilities across operations.

Data Security Concerns and Resistance to Change

The procurement software market encounters hurdles from rising cybersecurity threats and internal resistance to digital transformation. It involves the handling of sensitive supplier contracts, financial data, and regulatory records, making security breaches a critical risk. Many organizations hesitate to migrate operations to cloud-based platforms due to compliance concerns. Employees accustomed to manual procurement processes often resist adopting automated systems. This reluctance hampers efficiency gains and prevents businesses from realizing the full potential of modern procurement platforms.

Market Opportunities

Expansion through AI, Automation, and Advanced Analytics

The procurement software market presents strong opportunities with the adoption of AI, robotic process automation, and advanced analytics. It enables organizations to automate repetitive tasks, forecast demand, and improve supplier negotiations with data-driven insights. Predictive tools enhance risk management by identifying disruptions early. Businesses can strengthen decision-making and reduce operational costs by leveraging machine learning models. These innovations position procurement as a strategic enabler, allowing firms to achieve greater efficiency, transparency, and competitiveness in global markets.

Growing Demand for Sustainable and Cloud-Based Solutions

The procurement software market benefits from rising demand for sustainable sourcing and flexible cloud-based platforms. It supports organizations in meeting environmental, social, and governance requirements by tracking supplier compliance and reducing carbon footprints. Cloud solutions offer scalability, cost efficiency, and seamless integration with enterprise systems, attracting both large corporations and SMEs. Expansion of global supply chains creates further opportunities for digital procurement platforms. Companies that adopt these solutions gain improved collaboration, agility, and resilience in evolving market conditions.

Market Segmentation Analysis:

By Deployment

The procurement software market is segmented into cloud and on-premise deployment. Cloud-based solutions dominate due to scalability, cost efficiency, and ease of integration with enterprise systems. It enables real-time data access, supports remote procurement operations, and offers frequent updates without heavy infrastructure investments. On-premise deployment appeals to organizations with strict data security and regulatory needs, especially in highly regulated industries. While cloud adoption grows rapidly, on-premise models continue to serve enterprises prioritizing control and customization.

- For instance, SAP Ariba delivers its procurement suite entirely via the cloud, enabling companies like Unilever to manage supplier collaboration and sourcing globally.

By End-User Industry

The procurement software market serves diverse industries, including retail & e-commerce, healthcare, automotive, BFSI, IT & telecom, and others. It supports retail and e-commerce with supplier management and streamlined purchasing to meet dynamic consumer demands. Healthcare relies on it for compliance, inventory management, and supplier transparency. Automotive and BFSI industries use procurement solutions to optimize global supply chains and ensure cost efficiency. IT and telecom sectors benefit from vendor collaboration and agile sourcing, strengthening long-term competitiveness.

- For instance, in automotive, Ford Motor Company adopted Oracle Procurement Cloud to automate sourcing and purchasing while integrating it with supply chain systems. This enhanced coordination, delivered considerable cost savings, and boosted agility by enabling quick responses to supply chain disruptions.

Segments:

Based on Deployment

Based on End-User Industry

- Retail & e-Commerce

- Healthcare

- Automotive

- BFSI

- IT & Telecom

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 34% share of the procurement software market, driven by strong adoption across enterprises focusing on digital transformation and supply chain resilience. It benefits from early integration of AI, cloud, and analytics, supporting strategic procurement functions. Large organizations in the United States and Canada invest heavily in compliance, automation, and supplier transparency. It also gains momentum from regulatory frameworks that demand accountability. High demand from retail, BFSI, and healthcare industries strengthens the region’s leadership.

Europe

Europe accounts for 28% share of the procurement software market, supported by advanced regulatory environments and emphasis on sustainable sourcing. It benefits from rapid adoption across industries such as automotive, retail, and manufacturing. Businesses in Germany, the UK, and France deploy procurement platforms to enhance supplier collaboration and meet ESG targets. Strong demand for cloud platforms drives efficiency and cost savings. It continues to evolve with digital ecosystems that align procurement with corporate sustainability goals.

Asia Pacific

Asia Pacific captures 25% share of the procurement software market, led by rising investments in digital infrastructure and global supply chain expansion. It experiences strong demand from manufacturing, retail, and IT sectors. Countries such as China, India, and Japan embrace procurement platforms to manage supplier networks and ensure transparency. It is boosted by government initiatives promoting digital adoption. Increasing outsourcing and cross-border trade drive market growth, positioning Asia Pacific as a rapidly expanding regional hub.

Latin America

Latin America holds 7% share of the procurement software market, supported by growing enterprise modernization and regulatory improvements. It witnesses adoption across retail, automotive, and BFSI industries, where efficiency and compliance are top priorities. Brazil and Mexico lead deployments, leveraging cloud platforms to improve procurement visibility. It faces challenges of infrastructure gaps and uneven digital adoption. Strong potential remains as enterprises in the region seek cost efficiency and risk mitigation through digital procurement tools.

Middle East & Africa

Middle East & Africa represent 6% share of the procurement software market, expanding with rising investments in enterprise digitalization. It benefits from increasing demand across healthcare, construction, and BFSI sectors. Governments in the Gulf states encourage digital adoption to diversify economies and strengthen transparency. South Africa leads adoption in Africa, driven by modernization goals. It also grows with demand for cloud platforms that support flexibility and resilience, despite challenges of limited infrastructure and slower adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle Corporation

- Ginesys

- Zycus Inc.

- Basware AS

- Ivalua Inc.

- Microsoft Corporation

- Jaggaer Inc.

- Proactis Holdings PLC

- GEP Corporation

- SAP SE

- Coupa Software Inc.

Competitive Analysis

The procurement software market is highly competitive, with global and regional players focusing on innovation, scalability, and integration to strengthen their positions. It is shaped by established technology giants and specialized procurement solution providers addressing diverse industry needs. Key players such as SAP SE, Oracle Corporation, Microsoft Corporation, and Coupa Software Inc. dominate with extensive product portfolios and strong enterprise adoption. Companies like Zycus Inc., Ivalua Inc., Jaggaer Inc., and Basware AS emphasize AI-driven analytics, supplier management, and automation to gain market share. GEP Corporation and Proactis Holdings PLC target cost-conscious enterprises through flexible cloud-based offerings, while Ginesys builds presence in emerging markets with tailored solutions for retail and e-commerce. Intense competition drives continuous investment in cloud platforms, predictive analytics, and sustainable procurement features. Strategic partnerships, acquisitions, and product enhancements remain central growth strategies, enabling vendors to expand into new geographies and industries. It continues to evolve with a balance of established leaders and agile innovators catering to the rising demand for efficient, transparent, and resilient procurement operations.

Recent Developments

- In May 2025, Confiex Data Room Private Limited launched two enterprise-class platforms- DocullyVDR E-Tender and DocullyVDR E-Audit to strengthen procurement and auditing processes in India.

- In January 2025, Honeywell partnered with Verizon to integrate Honeywell’s advanced hardware, software, and services with Verizon’s 5G connectivity, aiming to optimize retail lifecycle procurement and contracting processes.

- In November 2024, Jabil Inc. formed a joint venture called ID8 Global with Cyferd Inc., an AI innovator, to create a generative AI-powered platform for autonomous supply chain and procurement management globally.

- In August 2024, Vista Equity Partners acquired Jaggaer, a prominent procurement software provider, highlighting Jaggaer’s growth and advanced software impact on procurement processes.

Market Concentration & Characteristics

The procurement software market demonstrates moderate to high concentration, with a mix of global technology leaders and specialized vendors shaping competition. It is dominated by established players such as SAP SE, Oracle Corporation, Microsoft Corporation, and Coupa Software Inc., which leverage strong portfolios and global reach to secure large enterprise clients. Mid-tier companies including Zycus Inc., Ivalua Inc., Jaggaer Inc., and Basware AS enhance competitiveness by focusing on innovation, AI integration, and cloud-driven platforms. Regional firms like Proactis Holdings PLC and Ginesys target niche markets with tailored solutions for specific industries. The market is characterized by rapid digital adoption, strong demand for cloud-based deployment, and growing emphasis on sustainability and regulatory compliance. It reflects dynamic competition where pricing strategies, technology differentiation, and service quality play critical roles. Vendors invest in partnerships, acquisitions, and advanced analytics to expand capabilities, while buyers seek platforms that ensure transparency, scalability, and operational resilience.

Report Coverage

The research report offers an in-depth analysis based on Deployment, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven procurement solutions will expand to improve predictive decision-making and supplier risk management.

- Cloud-based platforms will continue to dominate due to scalability, cost efficiency, and seamless integration with enterprise systems.

- Sustainable and ethical sourcing will become a priority, with software enabling organizations to track ESG compliance.

- Integration with ERP, CRM, and financial ecosystems will increase to deliver unified business insights.

- SMEs will adopt procurement platforms more actively as vendors introduce affordable and flexible solutions.

- Cybersecurity and data protection will remain critical focus areas for buyers and vendors.

- Advanced analytics will play a larger role in spend visibility, supplier evaluation, and contract optimization.

- Regional adoption will strengthen in Asia Pacific and Latin America with growing digital infrastructure investments.

- Vendors will pursue partnerships and acquisitions to expand technological capabilities and geographic reach.

- User experience and automation of manual tasks will drive platform differentiation and competitiveness.