Market Overview

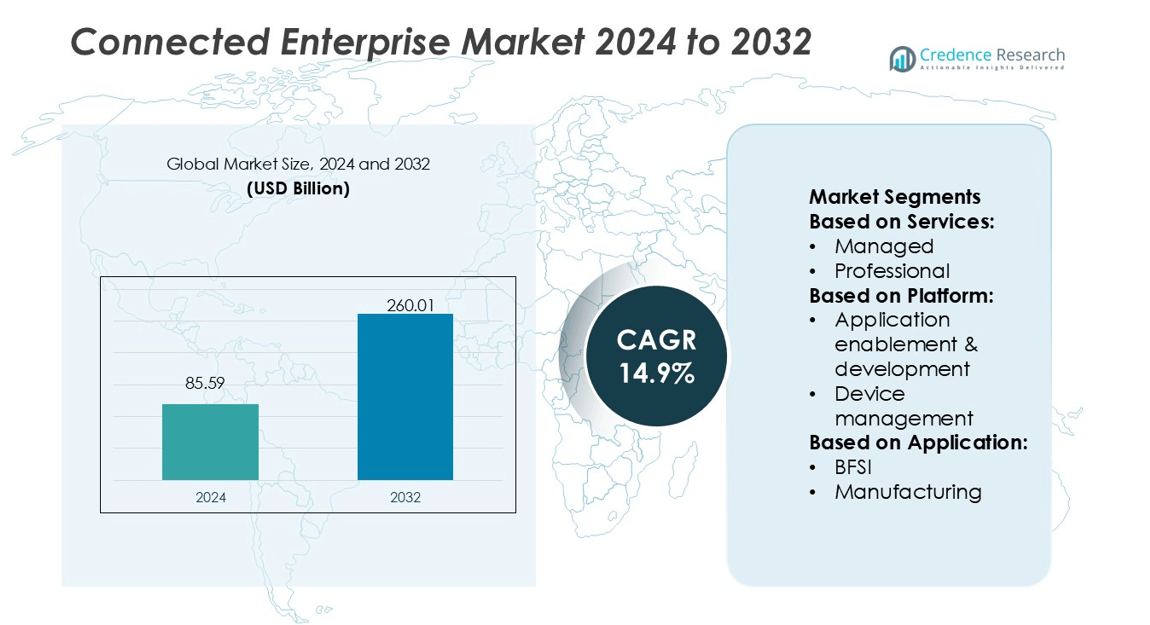

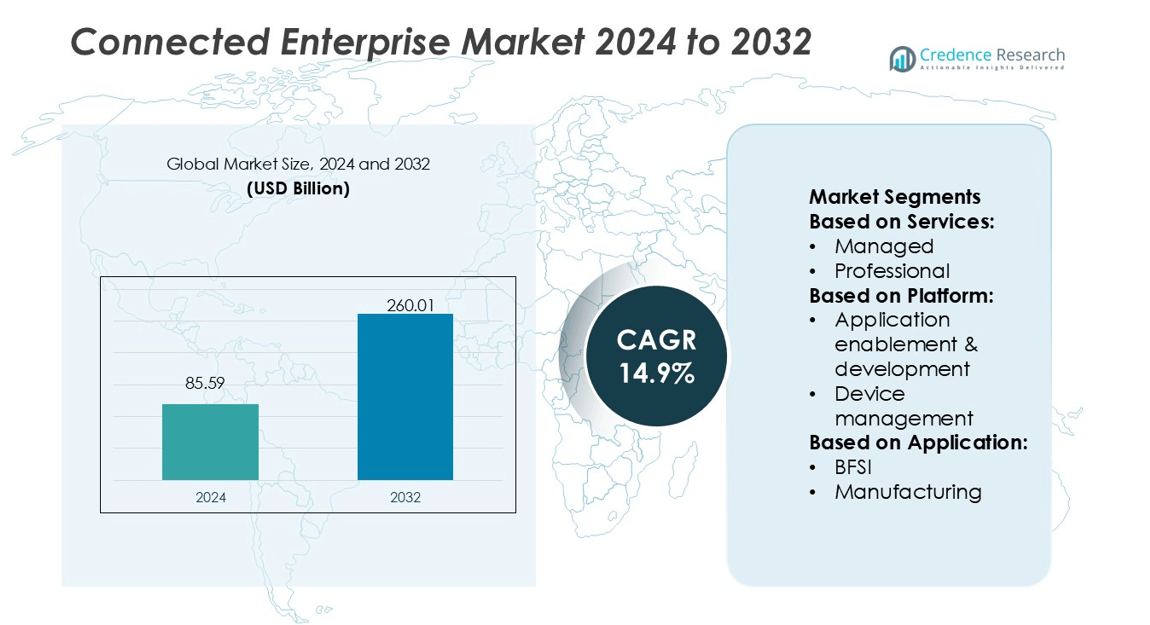

Connected Enterprise Market size was valued USD 85.59 billion in 2024 and is anticipated to reach USD 260.01 billion by 2032, at a CAGR of 14.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Enterprise Market Size 2024 |

USD 85.59 billion |

| Connected Enterprise Market, CAGR |

14.9% |

| Connected Enterprise Market Size 2032 |

USD 260.01 billion |

The Connected Enterprise Market is driven by leading companies such as LTIMindtree Limited, PTC, GE Digital (GE Vernova), UiPath, Robert Bosch GmbH, Honeywell International, Accelerite, Rockwell Automation, Cisco Systems, Inc., and IBM. These players focus on advanced connectivity, automation, and digital transformation to improve enterprise productivity and real-time decision-making. Their strategies include integrating IoT, AI, and cloud platforms to deliver intelligent, scalable solutions. North America leads the global Connected Enterprise Market with a 36% share in 2025, supported by early technology adoption, strong digital infrastructure, and continuous innovation in industrial IoT and cloud-based systems.Top of Form

Market Insights

- The Connected Enterprise Market was valued at USD 85.59 billion in 2024 and is expected to reach USD 260.01 billion by 2032, growing at a CAGR of 14.9% during the forecast period.

- Market growth is driven by rising demand for IoT-enabled systems, automation, and real-time analytics across manufacturing, BFSI, and healthcare sectors.

- Key trends include rapid adoption of cloud computing, AI integration, and edge analytics, enabling seamless enterprise connectivity and improved operational efficiency.

- The market is highly competitive, with major players focusing on digital transformation, cybersecurity, and smart enterprise platforms to strengthen global presence.

- North America leads with a 36% share in 2025, followed by Europe at 28%, while the managed services segment dominates with 62% share, driven by the growing need for remote monitoring and predictive maintenance solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Services

The managed services segment held the dominant share of the Connected Enterprise Market, accounting for 62% in 2025. Managed services enable organizations to outsource infrastructure, analytics, and network management, ensuring seamless connectivity across business operations. The rising need for remote monitoring, predictive maintenance, and real-time analytics is driving adoption. Businesses rely on managed service providers to improve uptime, enhance data security, and lower operational costs. This shift allows companies to focus on strategic goals while leveraging specialized expertise for network and IoT device management.

- For instance, LTIMindtree Limited operates over 120 global delivery centers and manages digital transformation for more than 700 enterprise clients. The company’s automation-led managed services model supports large-scale IoT deployments with over 10,000 monitored network devices and 24/7 analytics-based infrastructure optimization.

By Platform

The application enablement and development segment led the platform category with 45% share in 2025. This dominance stems from growing enterprise demand for low-code and cloud-based platforms to build, integrate, and scale connected applications. These platforms simplify IoT deployment by connecting data from devices and applications into unified systems. The strong uptake of AI, APIs, and edge computing also supports this segment’s growth. Businesses prefer scalable, secure, and easily customizable platforms to enhance operational agility and accelerate digital transformation.

- For instance, PTC ThingWorx 10.0 includes advanced analytics capabilities that support edge-to-cloud connectivity. Separately, PTC’s ServiceMax AI, featuring multi-agent orchestration, enhances field service management to help improve first-time fix rates.

By Application

The manufacturing segment accounted for the largest share of 31% in 2025 within the Connected Enterprise Market. Manufacturers increasingly adopt IoT-enabled systems for predictive maintenance, asset tracking, and process automation. These technologies help reduce downtime, optimize resource use, and improve productivity. The integration of industrial IoT (IIoT), robotics, and analytics strengthens end-to-end visibility across production lines. As Industry 4.0 expands, connected manufacturing ecosystems continue to drive major investments and partnerships across global supply chains.

Key Growth Drivers

Rising Adoption of Industrial IoT and Automation

The growing integration of Industrial IoT (IIoT) technologies is a major driver in the Connected Enterprise Market. Companies are automating production, logistics, and asset monitoring to improve efficiency and reduce downtime. Connected devices provide real-time visibility and predictive maintenance capabilities, enabling cost-effective operations. Industries such as manufacturing, logistics, and energy benefit from smart sensors, robotics, and cloud analytics. This digital transformation enhances productivity, safety, and decision-making, creating long-term growth opportunities for connected enterprise solutions globally.

- For instance, GE Vernova’s SmartSignal platform drives over 350 asset digital twins, and its managed services team monitors more than 7,000 critical assets globally. GE’s Autonomous Tuning software builds a machine-learning twin of gas turbines to continuously adjust combustion parameters, lowering emissions and optimizing fuel use per operating hour.

Growing Demand for Real-Time Data Analytics

The need for real-time insights across enterprises fuels market expansion. Businesses leverage data analytics to monitor processes, track performance, and forecast operational risks. Advanced analytics platforms integrate data from connected systems, enabling faster and smarter decision-making. Organizations in sectors like BFSI, retail, and healthcare are using real-time analytics to optimize workflows and customer engagement. This growing reliance on data-driven strategies strengthens the adoption of connected systems and fosters innovation in data management and business intelligence.

- For instance, UiPath’s Maestro Process Apps deliver real-time dashboards of key process metrics and KPI alerts across all active workflows. UiPath claims its new intelligent agents aim for 95 %+ accuracy in enterprise tasks under controlled agency.

Expansion of Cloud-Based and Edge Computing Solutions

The adoption of cloud and edge computing solutions is accelerating connected enterprise development. Cloud platforms allow centralized management, scalability, and enhanced security for enterprise networks. Meanwhile, edge computing supports low-latency data processing close to the source, improving speed and reliability. Together, these technologies support advanced IoT applications, autonomous operations, and seamless cross-departmental communication. The ability to handle large data volumes with minimal delays strengthens enterprise connectivity, driving efficiency and agility across industries.

Key Trends & Opportunities

Integration of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming connected enterprise operations. These technologies enable predictive analytics, process optimization, and intelligent automation. AI-driven systems can detect anomalies, predict failures, and improve decision-making accuracy. The growing use of ML algorithms enhances cybersecurity by identifying unusual network behaviors in real time. As AI integration deepens, companies gain new opportunities to enhance productivity and develop self-learning systems, ensuring greater resilience and adaptability in dynamic business environments.

- For instance, Bosch’s AI Analytics Platform operates on over 1,400 production lines globally, reading more than 1 billion lines of data daily to detect anomalies.In its manufacturing pilot, Bosch used generative AI to shorten deployment time of AI solutions—from months to mere weeks—in two plants.

Growing Emphasis on Cybersecurity Solutions

Cybersecurity is becoming a central trend in connected enterprise development. With the rise in IoT devices and data exchange, safeguarding enterprise networks from cyber threats is essential. Companies are investing in advanced encryption, blockchain, and zero-trust frameworks to secure connected ecosystems. The increasing focus on regulatory compliance and data privacy further drives cybersecurity innovation. This trend opens new opportunities for vendors offering specialized security analytics and automated threat detection tools tailored for enterprise networks.

- For instance, Honeywell’s Secure Media Exchange (SMX) intercepted a trojan that made up 37 % of blocked files in one quarter — highlighting real usage of decoy and quarantine strategies in industrial environments.

Emergence of 5G and Smart Connectivity

The rollout of 5G networks is unlocking new possibilities for connected enterprises. High-speed connectivity supports real-time communication and massive IoT deployments across industries. 5G enhances the performance of edge devices, AR/VR systems, and autonomous equipment. Enterprises are leveraging this capability for faster data transmission and improved customer experiences. As 5G infrastructure expands globally, it enables ultra-reliable connections and paves the way for next-generation smart factories, connected logistics, and remote operations.

Key Challenges

High Implementation and Integration Costs

The deployment of connected enterprise solutions requires substantial capital investment. Many organizations face financial barriers in upgrading legacy systems, integrating IoT platforms, and maintaining cybersecurity. Complex infrastructures demand skilled personnel and continuous monitoring to ensure seamless operation. These high costs often discourage small and medium enterprises from adopting advanced technologies. Without cost-effective solutions and clear ROI models, market penetration may remain limited, especially in emerging economies with constrained digital budgets.

Data Security and Privacy Concerns

The rapid growth of connected devices and data sharing increases vulnerability to cyberattacks. Enterprises face challenges in maintaining data integrity, preventing breaches, and complying with strict regulations. Unauthorized access to sensitive business information can disrupt operations and damage brand reputation. The absence of standardized security frameworks across regions further complicates protection efforts. Addressing these risks through robust encryption, authentication, and governance models is crucial to sustain trust in connected enterprise ecosystems.

Regional Analysis

North America

North America held the largest share of 36% in 2025 in the Connected Enterprise Market. The region benefits from strong digital infrastructure, early IoT adoption, and high enterprise IT spending. The United States leads due to advancements in automation, data analytics, and cloud computing. Key players such as Cisco Systems, IBM, and Microsoft are investing in AI-driven enterprise solutions and edge connectivity. Growing adoption across manufacturing, BFSI, and healthcare sectors drives market demand. Supportive government initiatives promoting smart infrastructure further strengthen the region’s leadership in connected enterprise technologies.

Europe

Europe accounted for 28% share in 2025, driven by digital transformation across industrial sectors and strict data protection standards. Countries like Germany, the U.K., and France are promoting Industry 4.0 adoption through government-led initiatives. European enterprises emphasize sustainability, cybersecurity, and interoperable IoT platforms to enhance operational transparency. Major players such as Siemens AG and Schneider Electric contribute to market expansion with automation and connectivity solutions. The demand for secure and compliant cloud services, coupled with strong R&D investments, continues to position Europe as a significant market for connected enterprise development.

Asia-Pacific

Asia-Pacific captured 25% share in 2025 and is expected to register the fastest growth through 2035. Rapid industrialization, smart city projects, and expanding 5G networks are key growth drivers. China, Japan, India, and South Korea are leading in IoT integration, cloud adoption, and manufacturing automation. Local enterprises are investing in AI-enabled platforms and IoT-based analytics for improved productivity. Government programs supporting digital transformation and smart infrastructure create favorable conditions for connected enterprise solutions. The growing ecosystem of startups and technology providers further strengthens Asia-Pacific’s dynamic market outlook.

Latin America

Latin America accounted for 7% share in 2025, supported by increasing investments in digital connectivity and enterprise modernization. Brazil and Mexico lead the region due to expanding cloud adoption, data analytics usage, and industrial automation projects. Enterprises in retail, manufacturing, and banking are integrating IoT and mobile platforms to enhance efficiency. Despite challenges like limited infrastructure and high implementation costs, digital transformation initiatives and partnerships with global technology firms are improving adoption rates. The growing SME sector’s interest in connected solutions is expected to boost regional growth over the forecast period.

Middle East & Africa

The Middle East & Africa region represented 4% share in 2025, with emerging potential across smart city development and industrial automation. The UAE and Saudi Arabia are leading adopters, supported by Vision 2030 and smart governance programs. Investments in cloud computing, telecom infrastructure, and enterprise digitization are driving market expansion. Sectors such as oil and gas, logistics, and construction are rapidly adopting connected platforms to optimize operations. Although the market is still developing, rising government focus on digital transformation and public-private partnerships will accelerate connected enterprise adoption across the region.

Market Segmentations:

By Services:

By Platform:

- Application enablement & development

- Device management

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Connected Enterprise Market features strong competition among major players such as LTIMindtree Limited, PTC, GE Digital (GE Vernova), UiPath, Robert Bosch GmbH, Honeywell International, Accelerite, Rockwell Automation, Cisco Systems, Inc., and IBM. The Connected Enterprise Market is characterized by intense competition, driven by rapid technological advancements and digital transformation initiatives. Companies are focusing on developing intelligent connectivity solutions that integrate IoT, AI, and cloud computing to enhance operational visibility and efficiency. Continuous innovation in automation, analytics, and edge computing is reshaping enterprise operations across industries. Market participants are investing heavily in cybersecurity and data management to ensure secure and seamless connectivity. Strategic collaborations, mergers, and acquisitions are common as firms aim to expand their service portfolios and strengthen their presence in high-growth regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LTIMindtree Limited

- PTC

- GE Digital (GE Vernova)

- UiPath

- Robert Bosch GmbH

- Honeywell International

- Accelerite

- Rockwell Automation

- Cisco Systems, Inc.

- IBM

Recent Developments

- In July 2024, IBM and Telefónica Tech announced a new collaborative agreement to advance AI, analytics, and data management solutions for enterprises. The collaboration aims to help enterprises accelerate their digital transformation journeys, focusing on AI, Analytics, and Data management.

- In April 2024, LTIMindtree announced a collaboration with Vodafone to deliver connected smart IoT solutions. This partnership is expected to enable industry X.0 and digital transformation across multiple vertical sectors, offering connected and smart IoT solutions. The collaboration aims to solve complex business challenges and empowers clients to maximize their efforts in sustainability, revenue acceleration, and cost efficiency.

- In April 2024, AVEVA, a global leader in industrial software driving digital transformation and sustainability, has chosen Hannover Messe to unveil CONNECT, the world’s fastest-growing industrial intelligence platform.

- In March 2023, Wipro Limited, a leading technology services and consulting company, announced the launch of its ‘5G Def-i’ platform. This integrated platform empowers businesses to seamlessly transform their infrastructure, networks, and services

Report Coverage

The research report offers an in-depth analysis based on Services, Platform, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Connected Enterprise Market will expand rapidly with growing IoT and AI integration.

- Cloud-based and edge computing platforms will drive real-time decision-making.

- Demand for automation and predictive analytics will continue to rise across industries.

- 5G connectivity will enhance network reliability and data transmission speed.

- Cybersecurity solutions will become central to enterprise connectivity strategies.

- Smart manufacturing and Industry 4.0 initiatives will accelerate technology adoption.

- Increasing digital transformation in SMEs will open new growth opportunities.

- Collaboration between IT and OT systems will improve operational efficiency.

- Governments will support digital infrastructure development and smart city projects.

- Vendors will focus on AI-driven platforms and scalable enterprise management systems.