Market Overview

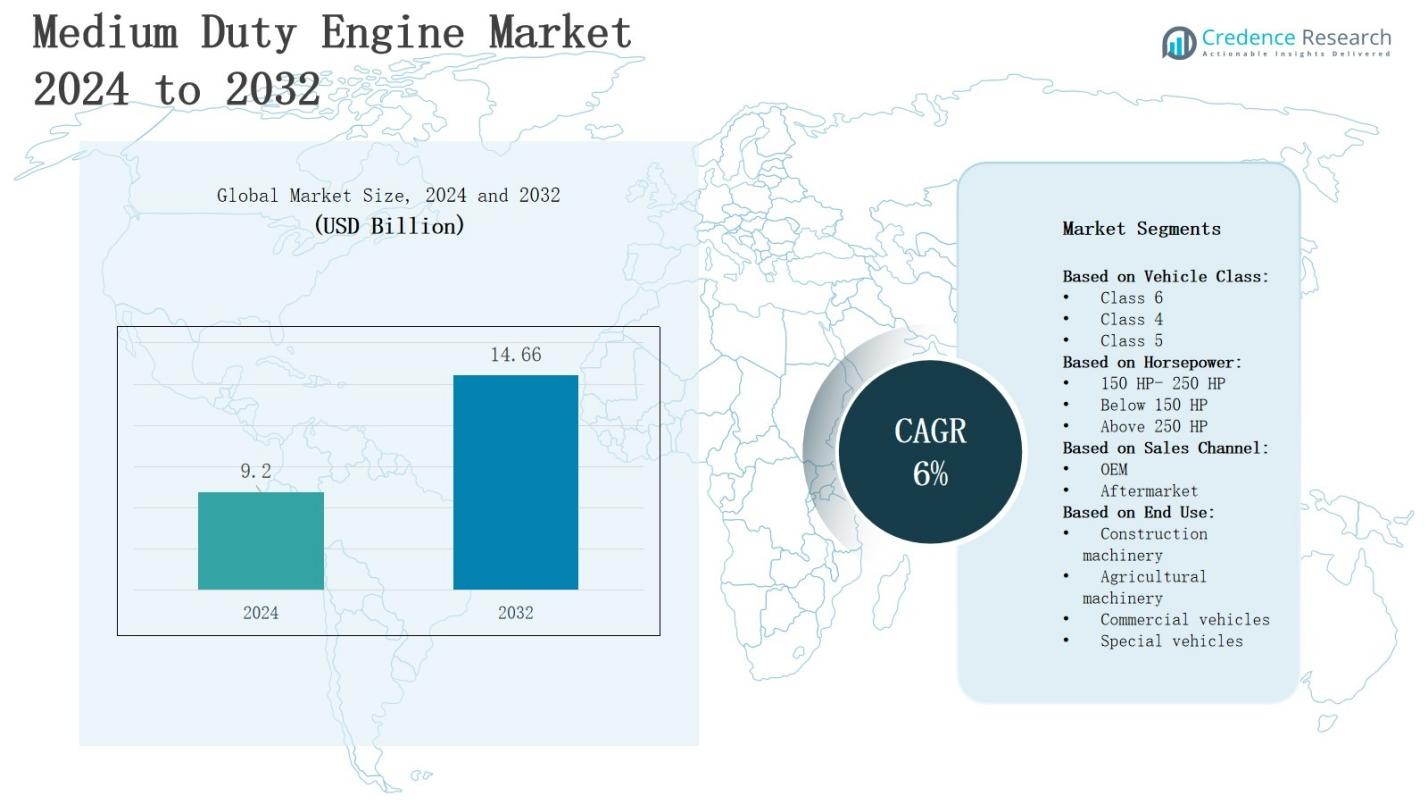

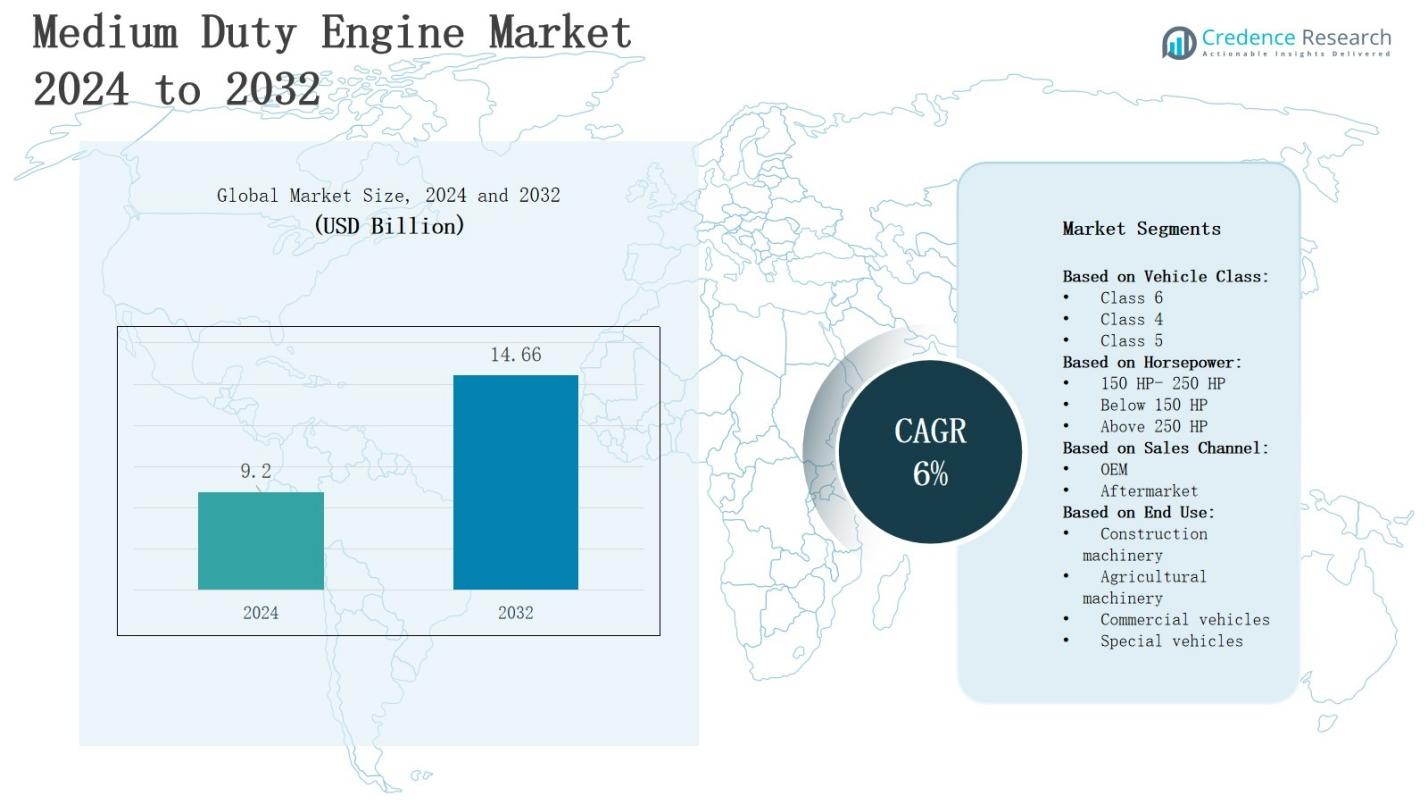

The medium duty engine market is projected to grow from USD 9.2 billion in 2024 to USD 14.66 billion by 2032, registering a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Duty Engine Market Size 2024 |

USD 9.2 billion |

| Medium Duty Engine Market, CAGR |

6% |

| Medium Duty Engine Market Size 2032 |

USD 14.66 billion |

The medium duty engine market grows as demand for efficient transportation, logistics, and construction equipment rises across developing and developed economies. Governments enforce stringent emission standards, driving innovation in cleaner, fuel-efficient engines, while the shift toward hybrid and alternative fuel technologies expands adoption. Urbanization and e-commerce accelerate the need for medium-duty trucks, boosting engine demand. Advancements in engine design, digital monitoring, and lightweight materials enhance performance and durability, supporting fleet modernization. Trends such as electrification, connectivity, and aftermarket customization further shape market dynamics, positioning medium duty engines as a vital segment within the evolving mobility and industrial ecosystem.

The Medium duty engine market shows diverse geographical presence with Asia Pacific leading at 32%, followed by North America at 28% and Europe at 25%, while Latin America holds 7% and the Middle East & Africa accounts for 8%. It benefits from rapid industrialization in Asia Pacific, strict emission norms in Europe, and strong logistics growth in North America. Latin America and Middle East & Africa contribute through infrastructure and resource-driven demand. Key players include Cummins, Volvo, Mercedes Benz, MAN, Tata Motors, Hyundai, Scania, Isuzu, PACCAR, and CNH Industrial.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The medium duty engine market is projected to grow from USD 9.2 billion in 2024 to USD 14.66 billion by 2032, registering a CAGR of 6%, driven by demand for efficient transportation, logistics, and construction equipment.

- By vehicle class, Class 6 holds about 50% share, dominating due to higher load capacity, durability, and suitability for heavy-duty operations. Class 4 and Class 5 together account for nearly 35%, growing steadily in urban logistics and medium-load applications.

- By horsepower, the 150 HP–250 HP range leads with around 55% share, offering versatility, efficiency, and cost-effectiveness across transport, construction, and agriculture. Below 150 HP engines make up roughly 20%, while above 250 HP covers about 25%, focused on heavy-duty tasks.

- By sales channel, OEM sales represent close to 65% share, supported by strong manufacturer-fleet partnerships and compliance-focused buyers. The aftermarket contributes nearly 35%, expanding with rising demand for upgrades, replacements, and maintenance solutions.

- Regionally, Asia Pacific leads with 32%, followed by North America at 28%, Europe at 25%, Latin America at 7%, and the Middle East & Africa at 8%, with key players including Cummins, Volvo, Mercedes Benz, MAN, Tata Motors, Hyundai, Scania, Isuzu, PACCAR, and CNH Industrial.

Market Drivers

Rising Demand from Transportation and Logistics

The medium duty engine market benefits from strong growth in transportation and logistics, driven by expanding e-commerce, urbanization, and regional trade. It supports trucks and delivery vehicles that require reliable, fuel-efficient engines for daily operations. Growing infrastructure projects in developing economies further strengthen demand. Fleet operators prioritize engines with low maintenance and high durability. Increasing freight volumes create consistent engine requirements, positioning medium duty engines as essential to regional and last-mile logistics.

- For instance, Daimler Trucks reported delivering over 526,000 vehicles in 2023, with strong demand for its medium-duty Freightliner and Mercedes-Benz trucks used in logistics fleets.

Stringent Emission Regulations Driving Innovation

The medium duty engine market experiences significant influence from stringent emission norms introduced by governments worldwide. It compels manufacturers to invest in fuel-efficient and low-emission engine technologies. Cleaner combustion systems, advanced fuel injection, and after-treatment solutions reduce environmental impact while meeting compliance standards. Companies focus on integrating hybrid and natural gas-based solutions to balance sustainability with performance. These regulatory frameworks accelerate innovation and create long-term opportunities in both developed and emerging economies.

- For instance, Cummins’ new X10 diesel—launching for 2026—targets U.S. EPA 2027 compliance and is engineered to emit 75% less NOx than required at launch, using an optimized after-treatment heater and 48-V alternator architecture.

Technological Advancements Enhancing Efficiency

The medium duty engine market leverages technological innovations that improve efficiency, reliability, and adaptability. It benefits from digital monitoring, telematics, and predictive maintenance tools that reduce downtime for fleet operators. Lightweight materials and advanced cooling systems enhance fuel economy and engine performance. Hybridization and alternative fuels extend versatility across multiple industries. OEMs focus on delivering engines with longer life cycles and lower operational costs, ensuring competitive positioning across global and regional applications.

Expansion of Construction and Industrial Activities

The medium duty engine market witnesses growth from expanding construction, agriculture, and industrial applications that demand robust and efficient power solutions. It supports equipment such as loaders, excavators, and generators essential to infrastructure and agricultural projects. Urban development initiatives in Asia-Pacific and Latin America significantly increase engine adoption. Manufacturers prioritize engines offering durability and high torque output. Growing mechanization trends reinforce long-term prospects, making medium duty engines indispensable in multiple end-use industries.

Market Trends

Adoption of Hybrid and Alternative Fuel Engines

The medium duty engine market is witnessing a growing shift toward hybrid and alternative fuel technologies driven by global sustainability goals and rising fuel costs. It benefits from the integration of compressed natural gas, biofuels, and electric-hybrid systems that reduce emissions while maintaining power efficiency. Manufacturers focus on balancing environmental performance with cost-effectiveness to appeal to fleet operators. Expanding charging and fueling infrastructure further encourages adoption. This trend highlights the industry’s alignment with cleaner mobility solutions.

- For instance, Eaton introduced a variable valve actuation system with Late Intake Valve Closing (LIVC) technology in 2023 to improve fuel efficiency and lower emissions in medium-duty trucks in the American market.

Integration of Digitalization and Telematics

The medium duty engine market reflects increasing integration of digital technologies that enhance engine monitoring, predictive maintenance, and performance optimization. It leverages telematics systems to provide real-time data, reduce downtime, and improve operational efficiency. Fleet operators use advanced analytics to maximize fuel economy and extend engine life. Smart connectivity helps identify issues before they escalate, ensuring cost savings. Growing acceptance of IoT-enabled engines reinforces the digital transformation of transportation and industrial equipment operations globally.

- For instance, US truck manufacturer Kenworth introduced its “TruckTech+” telematics system for medium-duty trucks, enabling fleet managers to monitor engine performance in real-time, optimize maintenance schedules, and reduce downtime.

Focus on Lightweight Materials and Efficiency

The medium duty engine market emphasizes innovation in lightweight materials and fuel efficiency to meet evolving performance demands. It incorporates aluminum alloys, composite materials, and advanced cooling systems to reduce overall weight and optimize combustion. OEMs design engines with longer lifespans and lower operating costs to appeal to cost-sensitive buyers. These advancements improve vehicle payload capacity while reducing fuel consumption. Efficiency-focused developments remain critical as companies address both economic and environmental considerations.

Growing Customization and Aftermarket Solutions

The medium duty engine market demonstrates rising interest in customization and aftermarket solutions as operators seek tailored performance. It supports demand for engines optimized for specific applications such as logistics, construction, and agriculture. Aftermarket upgrades, including turbochargers, emission control systems, and electronic control units, enhance durability and compliance. Manufacturers collaborate with service providers to expand offerings. This trend highlights how customization ensures operational flexibility while strengthening long-term engagement with diverse end-user industries globally.

Market Challenges Analysis

High Compliance Costs and Emission Standards

The medium duty engine market faces significant challenges from increasingly strict global emission standards, which demand continuous innovation and investment. It compels manufacturers to allocate substantial resources toward research, advanced materials, and cleaner technologies, raising overall production costs. Smaller players struggle to match the compliance capabilities of larger firms, creating competitive pressure. Meeting diverse regional regulations further complicates design and manufacturing processes. High compliance expenses reduce profit margins while slowing adoption in cost-sensitive markets.

Rising Competition from Electrification and Alternative Powertrains

The medium duty engine market encounters growing pressure from rapid advancements in electric and hybrid powertrains. It must adapt to shifting preferences for low-emission and fuel-efficient solutions, particularly in urban logistics and regulated environments. Electric vehicle adoption challenges traditional engine demand by offering lower operating costs and reduced maintenance. Infrastructure development for charging accelerates this transition. Market players face the dual burden of sustaining conventional engine demand while investing in alternative powertrain innovations to remain competitive.

Market Opportunities

Expansion in Emerging Economies and Infrastructure Development

The medium duty engine market presents strong opportunities in emerging economies where rapid urbanization, industrialization, and infrastructure projects are driving demand. It supports applications in logistics, construction, and agriculture, sectors that continue to expand in regions such as Asia-Pacific, Latin America, and Africa. Governments invest heavily in transportation and public works, creating a steady need for reliable engines. Rising disposable incomes and growing trade networks also increase fleet expansion. These factors position medium duty engines as essential growth enablers in developing markets.

Advancements in Alternative Fuels and Hybrid Technologies

The medium duty engine market offers opportunities through the growing adoption of alternative fuels and hybrid technologies. It aligns with global sustainability targets by supporting compressed natural gas, biofuels, and hybrid solutions that reduce emissions while maintaining operational efficiency. Fleet operators increasingly prefer engines that balance cost-effectiveness with compliance, strengthening long-term adoption. Manufacturers gain an edge by offering tailored solutions across logistics and industrial applications. This trend creates space for innovation and differentiation in highly competitive global markets.

Market Segmentation Analysis:

By Vehicle Class

In the medium duty engine market, Class 6 vehicles hold the dominant share of around 50%, driven by their higher load capacity, durability, and suitability for heavy-duty transportation needs. This segment benefits from fleet expansion in logistics and infrastructure projects, where reliability and efficiency are key performance factors. Class 4 and Class 5 vehicles collectively account for about 35%, continuing steady growth supported by urban logistics and medium-load applications. The strong preference for Class 6 reflects its versatility and stronger adoption among large-scale commercial operators.

- For instance, Freightliner’s M2 106 has become one of the most widely adopted Class 6 trucks in North America, used extensively in utility services and urban delivery fleets.

By Horsepower

The 150 HP–250 HP segment leads with nearly 55% share, supported by its balance of power, efficiency, and cost-effectiveness. It caters to a wide range of applications, from regional freight transport to construction and agriculture, making it the most versatile category. Engines below 150 HP account for around 20%, serving lighter-duty, niche applications, while above 250 HP holds about 25%, concentrated in heavy-duty transport and construction tasks. The mid-range dominates due to operational flexibility and fuel economy advantages.

- For instance, John Deere’s 6M Series tractors (ranging 150–250 HP) are widely used by farmers for both tillage and hauling, combining fuel efficiency with multipurpose utility.

By Sales Channel

OEM sales command about 65% share of the medium duty engine market, as manufacturers directly supply engines integrated into new vehicles and equipment. This channel benefits from strong partnerships with fleet operators and large-scale buyers who prioritize reliability, warranty coverage, and emission compliance. The aftermarket segment contributes roughly 35%, growing on the back of demand for replacement parts, upgrades, and maintenance solutions. OEM remains dominant due to consistent new vehicle production and customer trust.

Segments:

Based on Vehicle Class:

Based on Horsepower:

- 150 HP- 250 HP

- Below 150 HP

- Above 250 HP

Based on Sales Channel:

Based on End Use:

- Construction machinery

- Agricultural machinery

- Commercial vehicles

- Special vehicles

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Medium duty engine market in North America holds a 28% share, supported by strong demand from logistics, construction, and infrastructure projects. It benefits from the expansion of e-commerce and last-mile delivery, which creates consistent requirements for reliable and efficient engines. The United States leads adoption with its established transportation network and strict emission norms that push innovation. Canada supports demand through investments in construction and resource-based industries. Fleet modernization initiatives further strengthen the region’s market presence.

Europe

Europe accounts for 25% of the Medium duty engine market, driven by strict environmental regulations and high adoption of fuel-efficient engines. It shows strong growth in countries such as Germany, France, and the United Kingdom, where logistics and industrial applications remain critical. Government policies supporting low-emission vehicles influence demand trends significantly. The construction and agriculture sectors also create steady requirements for mid-range engines. Innovation in hybrid and natural gas engines ensures Europe maintains a competitive position globally.

Asia Pacific

The Medium duty engine market in Asia Pacific dominates with 32% share, supported by rapid urbanization, industrialization, and large-scale infrastructure projects. China and India lead demand due to high freight movement, agricultural modernization, and construction activity. It benefits from rising vehicle production and a growing logistics sector. Southeast Asia also contributes significantly with expanding trade and transport networks. The region’s emphasis on economic growth and modernization positions it as the most influential global market.

Latin America

Latin America holds 7% share of the Medium duty engine market, supported by growing agricultural mechanization and infrastructure development. Brazil and Mexico lead regional adoption, driven by demand for medium-duty trucks and equipment. It benefits from expanding trade activity and rising investment in road connectivity. Limited access to advanced emission technologies creates challenges, but cost-effective and durable engines find strong acceptance. The region’s steady growth highlights its importance as an emerging contributor to global demand.

Middle East & Africa

The Medium duty engine market in the Middle East & Africa represents 8% share, supported by industrial development, mining, and construction activity. Countries such as Saudi Arabia, the UAE, and South Africa drive adoption through infrastructure and oil-related projects. It shows potential growth with increasing logistics and transportation requirements. Limited local manufacturing capacity creates reliance on imports, but fleet expansion fuels opportunities. The region’s focus on diversification strengthens demand for medium-duty power solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Medium duty engine market demonstrates strong competition shaped by global and regional players focusing on innovation, regulatory compliance, and customer-specific solutions. It is driven by established companies such as Cummins, Volvo, Mercedes Benz, MAN, Tata Motors, Hyundai, Scania, Isuzu, PACCAR, and CNH Industrial, each leveraging technology and scale to strengthen market presence. Companies invest in hybrid and alternative fuel engines to align with emission standards while enhancing efficiency and durability. Strategic alliances, product diversification, and aftermarket support form core approaches to expand reach and build long-term customer loyalty. Competitive intensity remains high as firms prioritize cost optimization, advanced materials, and digital monitoring capabilities to improve performance and reduce downtime. Manufacturers target both OEM and aftermarket channels, balancing innovation with affordability to capture broader adoption. Regional players compete by offering cost-effective solutions, while global firms emphasize advanced technologies and sustainability-driven designs. Continuous investment in R&D and alignment with fleet modernization trends ensures that leading companies maintain influence over evolving industry dynamics.

Recent Developments

- In March 2025, Kenworth introduced the Cummins B6.7 Octane gasoline engine for its Class 5–7 medium-duty trucks at NTEA Work Truck Week. The engine, rated 200–300 hp with up to 660 lb-ft torque, is EPA 2027 and CARB low-NOx compliant, achieves ~10% better fuel efficiency, and eliminates the need for DEF and active regens through a 3-way catalyst system.

- In January 2025, Cummins India introduced its advanced HELM engine platforms during the Bharat Mobility Global Expo 2025, reinforcing its commitment to advancing medium-duty engine technology in the Indian market.

- In August 2025, Motiv Electric Trucks and Workhorse Group announced a merger, forming a combined manufacturer focused on scaling medium-duty electric vehicle (EV) adoption—specifically Classes 4–6—across North America.

- In March 2025, Cummins unveiled the B7.2 diesel engine for medium-duty and vocational trucks at the NTEA Work Truck Week in Indianapolis. The engine features a 7.2 L displacement, delivers 240–340 hp and 650–1,000 lb-ft of torque, and includes advanced HELM architecture—offering Higher Efficiency, Lower Emissions, and Multiple fuel compatibility.

Market Concentration & Characteristics

The Medium duty engine market reflects a moderately concentrated structure where a mix of global and regional players compete through technology, scale, and customer reach. It is characterized by high entry barriers due to capital requirements, emission compliance standards, and the need for advanced R&D capabilities. Leading companies such as Cummins, Volvo, Mercedes Benz, MAN, Tata Motors, Hyundai, Scania, Isuzu, PACCAR, and CNH Industrial dominate through innovation, extensive distribution networks, and strong OEM partnerships. It shows steady demand across logistics, construction, and agriculture, driven by urbanization, infrastructure projects, and fleet modernization. Competition focuses on cleaner technologies, digital integration, and cost optimization to meet evolving regulatory and customer needs. The aftermarket segment offers opportunities but OEM channels remain dominant. Market characteristics highlight strong regional variations in adoption, with Asia Pacific leading growth, North America emphasizing advanced compliance, and Europe prioritizing sustainable engine solutions to strengthen competitiveness across diverse applications.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Class, HorsePower, Sales Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The medium duty engine market will expand with rising demand from logistics and e-commerce deliveries.

- Stricter emission norms will drive adoption of cleaner and fuel-efficient engine technologies.

- Hybrid and alternative fuel engines will gain traction in urban and regulated transport environments.

- Digital monitoring and telematics will improve engine performance and reduce downtime.

- Lightweight materials and advanced designs will enhance efficiency and durability of engines.

- OEM dominance will continue, supported by strong partnerships with fleet operators.

- Aftermarket growth will increase with demand for replacements, upgrades, and compliance solutions.

- Asia Pacific will maintain its lead, supported by industrialization and infrastructure expansion.

- Europe will prioritize sustainable solutions with emphasis on hybrid and natural gas engines.

- North America will strengthen innovation with investments in advanced emission technologies and fleet modernization.