Market Overview

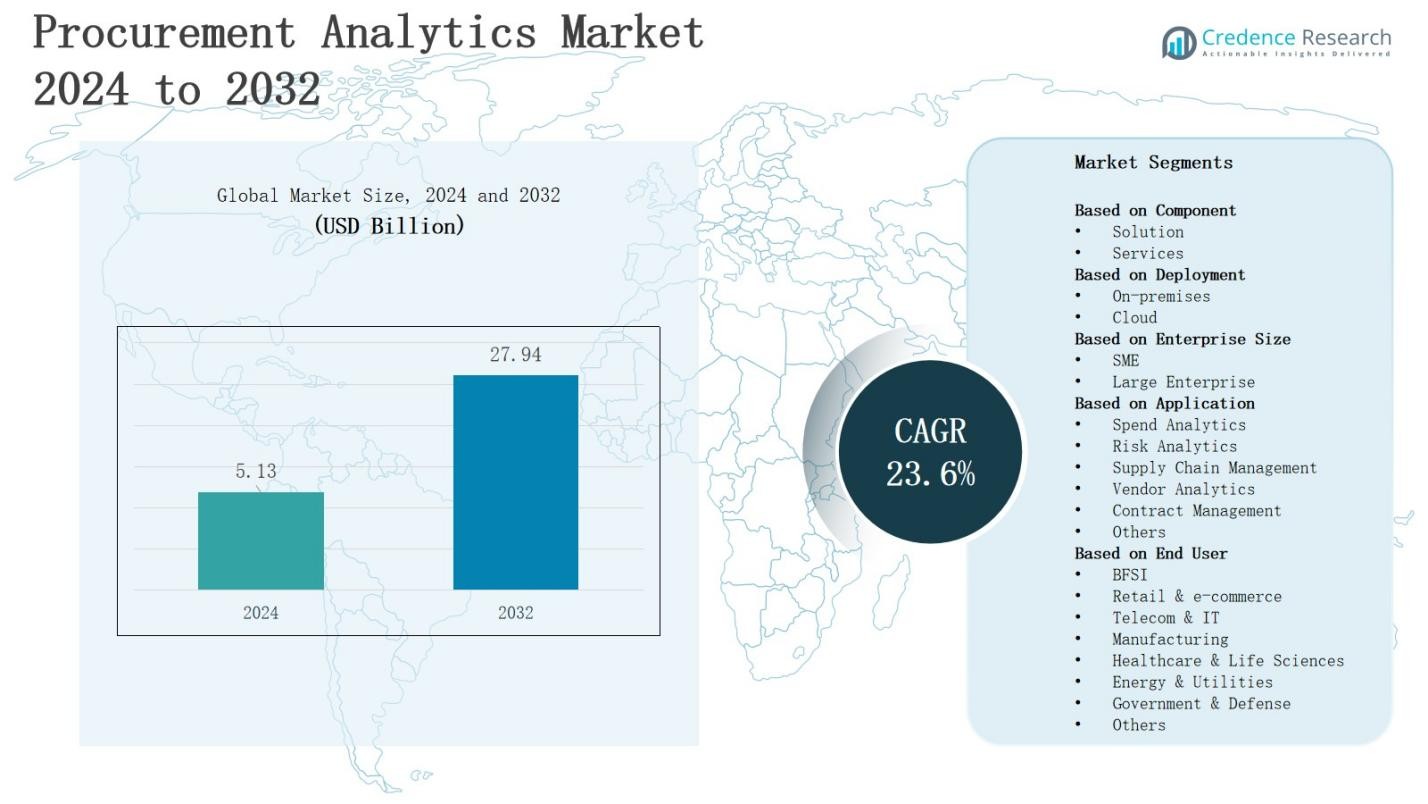

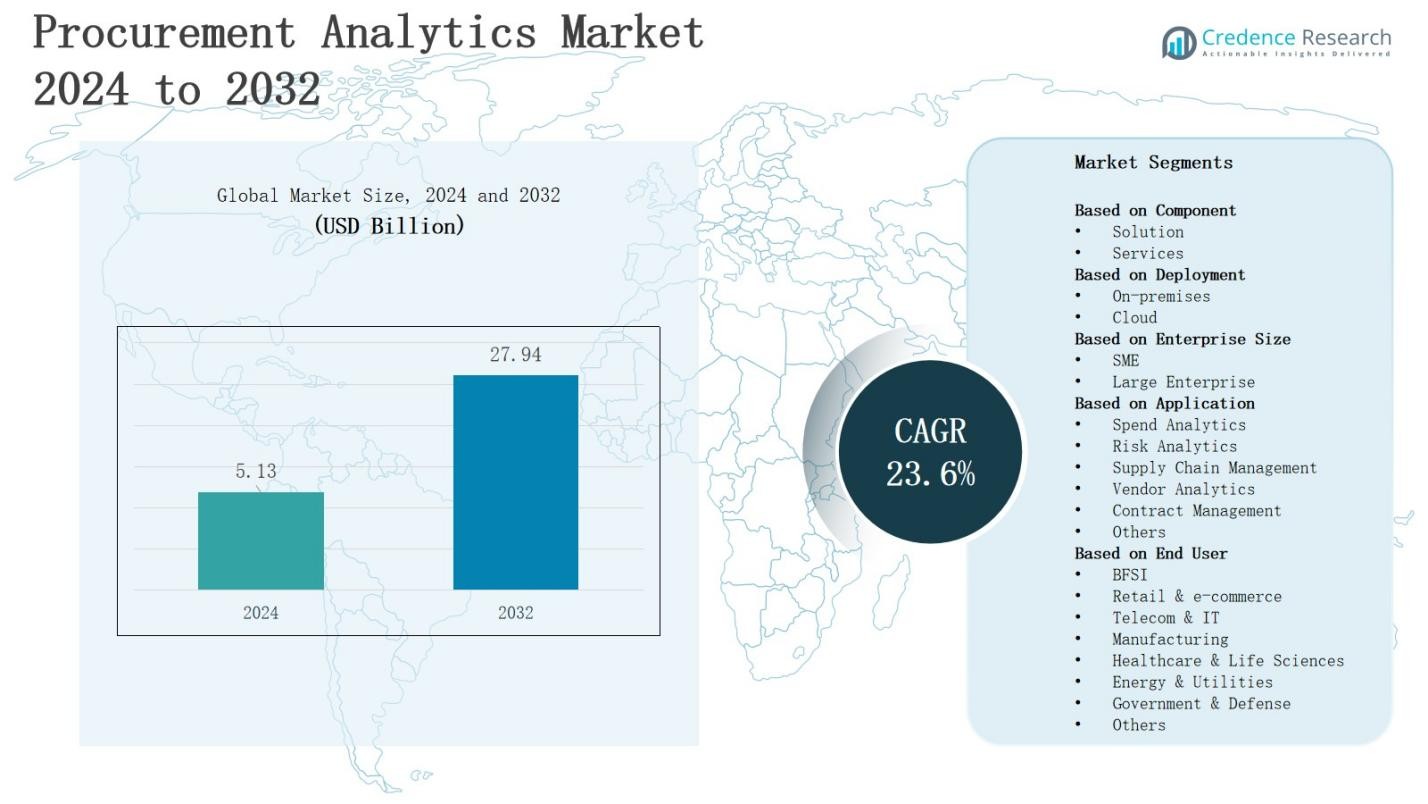

In the procurement analytics market, revenue is projected to surge from USD 5.13 billion in 2024 to USD 27.94 billion by 2032, registering a remarkable CAGR of 23.6%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Procurement Analytics Market Size 2024 |

USD 5.13 Billion |

| Procurement Analytics Market, CAGR |

23.6% |

| Procurement Analytics Market Size 2032 |

USD 27.94 Billion |

The procurement analytics market is driven by the growing need for organizations to enhance cost efficiency, optimize supply chain operations, and improve strategic sourcing decisions. Rising adoption of advanced technologies, including artificial intelligence, machine learning, and cloud-based analytics platforms, enables real-time data insights, predictive forecasting, and risk mitigation. Increasing pressure on businesses to maintain compliance, reduce operational costs, and achieve procurement transparency further fuels market growth. Additionally, the trend toward digital transformation and data-driven decision-making across industries accelerates the deployment of procurement analytics solutions, allowing companies to enhance supplier performance, streamline procurement cycles, and gain a competitive edge in dynamic markets.

The procurement analytics market exhibits strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, driven by increasing demand for cost optimization, supplier performance monitoring, and digital transformation. North America leads, followed by Europe and Asia-Pacific, while Latin America and the Middle East & Africa show emerging potential. Key players, including SAP SE, Cisco Systems, Inc., Coupa Software, Genpact Itd, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute, and Zycus Inc., focus on expanding regional presence, enhancing solutions, and adopting cloud-based and AI-driven platforms to capture market share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The procurement analytics market is projected to grow from USD 5.13 billion in 2024 to USD 27.94 billion by 2032, registering a CAGR of 23.6%, driven by cost efficiency and strategic sourcing demands.

- Adoption of AI, machine learning, and cloud-based analytics enables real-time insights, predictive forecasting, and risk management, helping organizations optimize procurement cycles and enhance supplier performance across industries.

- North America leads with 35% share, followed by Europe at 25% and Asia-Pacific at 20%, while Latin America and Middle East & Africa each hold 10%, supported by digital transformation initiatives.

- By component, the solution segment dominates with 65% share, offering actionable insights into spend management and supplier performance, while services hold 35%, facilitating integration, consulting, and ongoing platform optimization.

- Cloud deployment leads with 60% share, providing scalability, flexibility, and real-time access, whereas on-premises holds 40% for enhanced data security; large enterprises dominate with 70% share over SMEs’ 30%.

Market Drivers

Rising Demand for Cost Optimization and Strategic Sourcing

Organizations increasingly focus on cost reduction and strategic sourcing to maintain competitiveness. The procurement analytics market enables companies to analyze spend patterns, identify savings opportunities, and negotiate better supplier contracts. It provides actionable insights that support informed decision-making across procurement processes. By integrating data from multiple sources, businesses can optimize supplier selection, reduce operational expenses, and improve procurement efficiency. Enhanced visibility into spending drives measurable financial benefits and strengthens overall supply chain performance.

- For instance, Starbucks applies predictive analytics to forecast coffee bean price fluctuations due to weather and market trends, enabling proactive supplier contracts that stabilize supply and cost.

Adoption of Advanced Technologies and Data-Driven Insights

Businesses deploy artificial intelligence, machine learning, and predictive analytics to enhance procurement operations. Procurement analytics solutions convert large volumes of structured and unstructured data into actionable intelligence. It allows organizations to forecast demand, manage supplier risks, and improve procurement planning. Real-time dashboards and automated reporting empower decision-makers to monitor performance and detect anomalies quickly. Companies leverage these technological capabilities to gain operational efficiency, improve supplier collaboration, and strengthen strategic sourcing strategies, driving market growth.

- For instance, Moglix uses AI-powered procurement platforms that have enabled businesses to reduce their procurement cycle times by up to 50% and achieve inventory reductions of up to 40%, significantly improving operational efficiency.

Regulatory Compliance and Risk Management Focus

Organizations face increasing pressure to comply with procurement regulations, ethical standards, and industry norms. Procurement analytics solutions provide visibility into supplier performance, contract adherence, and audit readiness. It supports risk identification, fraud detection, and mitigation of supply chain disruptions. By monitoring compliance and evaluating supplier reliability, businesses reduce operational and reputational risks. The ability to maintain governance while optimizing procurement workflows encourages widespread adoption, strengthening organizational resilience and promoting sustainable procurement practices across sectors.

Digital Transformation and Supply Chain Optimization

Companies embrace digital transformation to improve procurement efficiency and agility in a dynamic market environment. Procurement analytics facilitates real-time data integration, performance tracking, and operational forecasting. It enhances supplier collaboration, shortens procurement cycles, and supports proactive decision-making. Businesses can identify bottlenecks, measure supplier performance, and improve overall supply chain responsiveness. The increasing reliance on data-driven solutions drives organizations to adopt analytics platforms, which optimize processes, reduce costs, and maintain competitive advantage in evolving industries.

Market Trends

Integration of Artificial Intelligence and Machine Learning

The procurement analytics market increasingly adopts artificial intelligence and machine learning to improve operational efficiency. It delivers predictive insights that enable organizations to anticipate demand fluctuations, identify supply chain risks, and optimize sourcing strategies. Businesses leverage AI-driven algorithms to automate data analysis, streamline procurement processes, and improve decision-making accuracy. Real-time intelligence helps companies respond quickly to market changes, enhance supplier collaboration, and reduce costs, reinforcing digital procurement transformation across industries and increasing overall competitiveness.

Shift Toward Cloud-Based Procurement Solutions

Cloud-based procurement analytics solutions gain traction due to their scalability, flexibility, and cost-effectiveness. It enables organizations to access centralized data, perform comprehensive analytics, and maintain real-time visibility into procurement operations. Cloud platforms support seamless integration with enterprise resource planning systems, facilitating collaborative supplier management and improving workflow efficiency. Companies adopt cloud solutions to enhance data security, reduce infrastructure costs, and quickly deploy analytics capabilities, promoting agile procurement strategies and driving consistent operational improvements in dynamic market environments.

- For instance, Oracle’s Fusion Cloud Procurement automates source-to-settle processes, enabling real-time visibility into supplier performance and risk management through centralized data and integrated analytics.

Emphasis on Supplier Performance and Risk Management

Organizations prioritize supplier performance evaluation and risk mitigation to strengthen procurement operations. Procurement analytics solutions provide detailed insights into supplier reliability, contract compliance, and financial stability. It allows companies to identify potential disruptions, enforce accountability, and enhance supply chain resilience. By monitoring supplier behavior and evaluating procurement outcomes, businesses improve vendor relationships, reduce operational vulnerabilities, and ensure regulatory compliance. This trend supports strategic sourcing initiatives and fosters long-term supplier partnerships that drive efficiency and profitability.

- For instance, Toyota uses its Supplier Parts Tracking System to monitor supplier quality in real time, enabling quick detection of irregularities and helping prevent recalls by addressing issues before they escalate.

Focus on Data-Driven Decision-Making and Analytics Adoption

Enterprises increasingly rely on data-driven strategies to optimize procurement functions. Procurement analytics delivers actionable intelligence from historical and real-time data, enabling informed decision-making and improved resource allocation. It helps organizations identify cost-saving opportunities, forecast procurement needs, and track key performance indicators effectively. Businesses utilize analytics to enhance operational transparency, monitor procurement cycles, and measure supplier effectiveness. Widespread adoption of analytics platforms reflects a strategic shift toward evidence-based procurement management and sustained competitive advantage.

Market Challenges Analysis

Data Integration and Quality Issues

Organizations face significant challenges in integrating diverse data sources for procurement analytics. The procurement analytics market encounters obstacles related to inconsistent, incomplete, or unstructured data from multiple systems. It requires robust data management frameworks to ensure accuracy, reliability, and standardization. Businesses often struggle to consolidate legacy systems with modern analytics platforms, limiting visibility and decision-making efficiency. Poor data quality can lead to flawed insights, inaccurate forecasting, and suboptimal procurement strategies, affecting overall operational performance and supplier management.

High Implementation Costs and Skilled Resource Shortage

Implementing procurement analytics solutions demands substantial financial investment and specialized expertise. It involves software acquisition, system integration, and ongoing maintenance expenses, which can be prohibitive for small and mid-sized organizations. The market also faces a shortage of skilled professionals capable of leveraging advanced analytics tools effectively. Limited technical knowledge and insufficient training can hinder adoption and reduce the value derived from analytics platforms. Overcoming these challenges is crucial for organizations seeking to maximize efficiency and achieve strategic procurement goals.

Market Opportunities

Expansion of Cloud-Based and AI-Driven Solutions

The procurement analytics market presents significant opportunities through the adoption of cloud-based and AI-driven solutions. It enables organizations to access scalable platforms, perform advanced data analysis, and gain real-time insights into procurement operations. Businesses can leverage these technologies to optimize supplier selection, reduce operational costs, and improve strategic decision-making. The shift toward digital transformation and automation creates avenues for software providers to introduce innovative solutions that enhance efficiency, agility, and competitive advantage across industries worldwide.

Emerging Focus on Sustainable and Risk-Aware Procurement

Growing emphasis on sustainability and risk management offers new opportunities for procurement analytics adoption. It helps organizations monitor supplier compliance, assess environmental and social impacts, and mitigate supply chain risks. Companies can use analytics to support responsible sourcing, ensure regulatory adherence, and strengthen vendor accountability. The increasing demand for transparent and ethical procurement practices encourages the deployment of analytics tools, enabling businesses to align operational objectives with long-term sustainability goals while improving efficiency and overall procurement performance.

Market Segmentation Analysis:

By Component

In the procurement analytics market, the solution segment dominates with a market share of 65%, driven by the growing need for advanced analytics platforms to optimize procurement processes. Solutions provide actionable insights into spend management, supplier performance, and strategic sourcing, enabling organizations to enhance efficiency and cost savings. The services segment holds 35% share, supported by increasing demand for consulting, integration, and support services that facilitate implementation, customization, and continuous optimization of procurement analytics platforms.

- For instance, SAP’s Ariba Network helps companies such as Unilever manage global supplier collaboration, contract compliance, and sourcing efficiencies.

By Deployment

The cloud deployment segment leads with 60% market share, fueled by the flexibility, scalability, and real-time access it offers. Organizations prefer cloud-based procurement analytics for seamless integration, reduced infrastructure costs, and faster deployment of updates and features. The on-premises segment accounts for 40% share, driven by companies requiring enhanced data security, control, and compliance with internal IT policies. Both segments benefit from growing digital transformation and demand for data-driven procurement decisions.

- For instance, IBM offers on-premises procurement analytics solutions that are widely adopted in highly regulated industries such as healthcare and finance, where strict data residency and compliance mandates apply.

By Enterprise Size

Large enterprises dominate the procurement analytics market with 70% share, driven by complex procurement operations, higher budgets, and a strong focus on strategic sourcing. It allows these organizations to leverage analytics for spend optimization, supplier risk management, and performance monitoring at scale. SMEs hold 30% share, supported by increasing awareness of cost efficiency and access to affordable cloud-based solutions that enable smaller organizations to gain insights and improve procurement outcomes without heavy upfront investment.

Segments:

Based on Component

Based on Deployment

Based on Enterprise Size

Based on Application

- Spend Analytics

- Risk Analytics

- Supply Chain Management

- Vendor Analytics

- Contract Management

- Others

Based on End User

- BFSI

- Retail & e-commerce

- Telecom & IT

- Manufacturing

- Healthcare & Life Sciences

- Energy & Utilities

- Government & Defense

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the procurement analytics market with a 35% share, driven by early technology adoption, digital transformation, and high investment in supply chain optimization. It benefits from the presence of major software providers, advanced infrastructure, and strong demand for data-driven procurement decisions. Companies leverage analytics solutions to enhance supplier performance, optimize spend, and reduce operational costs. The region focuses on AI, machine learning, and cloud-based platforms to maintain competitiveness and improve procurement efficiency across industries.

Europe

Europe holds 25% share in the procurement analytics market, supported by strict regulatory compliance requirements and the need for sustainable procurement practices. It emphasizes transparency, supplier risk management, and performance monitoring, encouraging adoption of analytics platforms. Organizations implement cloud and on-premises solutions to streamline procurement processes, enhance cost efficiency, and strengthen supply chain resilience. Technological investments, digital transformation initiatives, and increasing awareness of strategic sourcing drive market expansion in the region.

Asia-Pacific

Asia-Pacific captures 20% share of the market, fueled by rapid industrial growth, rising digital adoption, and increasing procurement complexity in manufacturing and retail sectors. It enables organizations to optimize procurement cycles, manage supplier risks, and gain real-time visibility into operations. The adoption of cloud-based analytics and AI-driven solutions grows steadily, supported by government initiatives promoting technology integration. Businesses in the region focus on cost reduction, operational efficiency, and strategic sourcing to maintain competitiveness in a dynamic market.

Latin America

Latin America represents 10% share in the procurement analytics market, driven by increasing interest in digital procurement and supply chain efficiency. It helps companies monitor supplier performance, control costs, and improve transparency across procurement operations. Organizations in key economies adopt cloud solutions and analytics tools to manage procurement risks and optimize sourcing strategies. Market growth benefits from rising awareness of data-driven decision-making and strategic procurement among medium and large enterprises.

Middle East & Africa

Middle East & Africa hold 10% share, supported by investments in digital infrastructure and growing adoption of advanced procurement solutions. It enables organizations to enhance supplier collaboration, monitor compliance, and reduce operational inefficiencies. Companies focus on implementing cloud-based and AI-driven analytics to improve decision-making and optimize procurement strategies. Regional growth is encouraged by expanding industrial sectors, rising technological awareness, and government initiatives promoting efficient and transparent procurement practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zycus Inc.

- IBM Corporation

- Microsoft Corporation

- Coupa Software

- SAP SE

- Oracle Corporation

- Genpact Itd

- Cisco Systems, Inc.

- SAS Institute

Competitive Analysis

The procurement analytics market is highly competitive, driven by rapid technological advancements and increasing demand for data-driven procurement solutions. Key players, including SAP SE, Cisco Systems, Inc., Coupa Software, Genpact Itd, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute, and Zycus Inc., focus on developing innovative platforms, expanding service portfolios, and strengthening global presence to capture market share. It emphasizes solution differentiation, customer-centric offerings, and strategic partnerships to enhance analytics capabilities and address diverse enterprise needs. Companies invest in cloud-based deployments, AI-driven analytics, and predictive tools to improve spend management, supplier performance, and procurement efficiency. Competitive strategies also include mergers, acquisitions, and collaborations to expand regional reach and integrate complementary technologies. It encourages continuous product enhancement and customization to meet the requirements of large enterprises and SMEs, supporting cost optimization, risk mitigation, and strategic sourcing initiatives. The market’s growth depends on players’ ability to innovate, provide scalable solutions, and deliver measurable value to customers across multiple industries.

Recent Developments

- In June 2023, EY launched EY Spend Insights on Snowflake Data Cloud, providing organizations with comprehensive procurement spend visibility and enhanced supply chain management capabilities.

- In 2025, Altium acquired Part Analytics on January 21, integrating AI-driven procurement and supply chain analytics into its electronics design systems to improve component planning and procurement efficiency.

- In 2025, Procure Analytics acquired Seaforth Analytical Services on June 11, expanding its AI-powered spend management capabilities and strengthening analytics solutions for procurement professionals.

Market Concentration & Characteristics

The procurement analytics market exhibits a moderately concentrated structure, with a few major players holding significant market share while numerous smaller vendors compete for niche opportunities. It is characterized by rapid technological innovation, increasing adoption of AI, machine learning, and cloud-based platforms, and a strong focus on cost optimization, supplier performance, and risk management. Companies such as SAP SE, Cisco Systems, Inc., Coupa Software, Genpact Itd, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute, and Zycus Inc. emphasize product differentiation, strategic partnerships, and global expansion. It demonstrates high growth potential in both large enterprises and SMEs, driven by digital transformation and the demand for data-driven procurement decisions. Competitive dynamics encourage continuous enhancement of analytics capabilities, customizable solutions, and value-added services, enabling organizations to optimize procurement cycles, improve transparency, and maintain operational efficiency across diverse industry sectors.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Enterprise Size, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Organizations will increasingly adopt AI-driven analytics to enhance procurement efficiency and decision-making.

- Cloud-based procurement solutions will gain wider acceptance due to scalability and real-time accessibility.

- Companies will focus on integrating predictive insights to manage supplier risks and optimize sourcing strategies.

- Large enterprises will continue to lead adoption, while SMEs will gradually increase usage of affordable analytics tools.

- Digital transformation initiatives will drive the deployment of advanced procurement analytics platforms across industries.

- Businesses will prioritize transparency and compliance in procurement processes using data-driven solutions.

- Supplier performance monitoring will become a central focus to strengthen strategic sourcing and vendor relationships.

- Adoption of integrated platforms combining spend management, forecasting, and risk analysis will increase.

- Companies will invest in customized analytics solutions to meet specific operational and industry needs.

- Continuous technological innovation will enable organizations to optimize procurement cycles and reduce operational inefficiencies.