Market Overview:

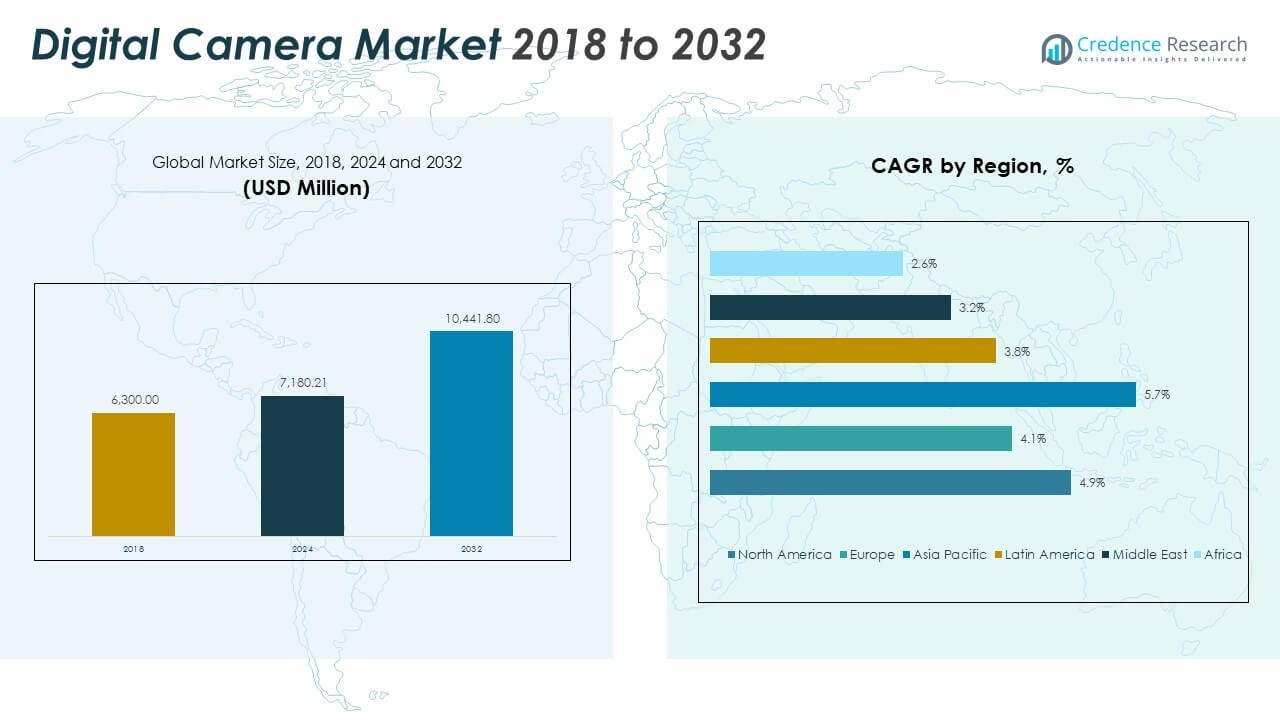

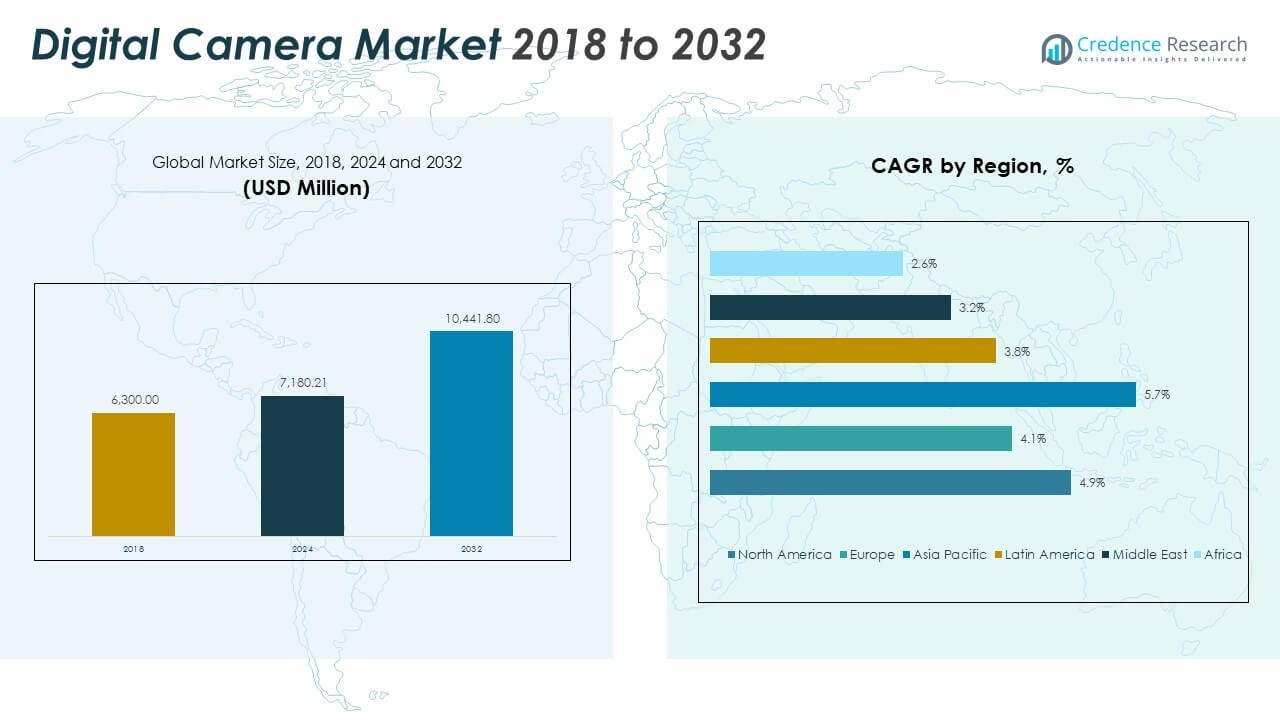

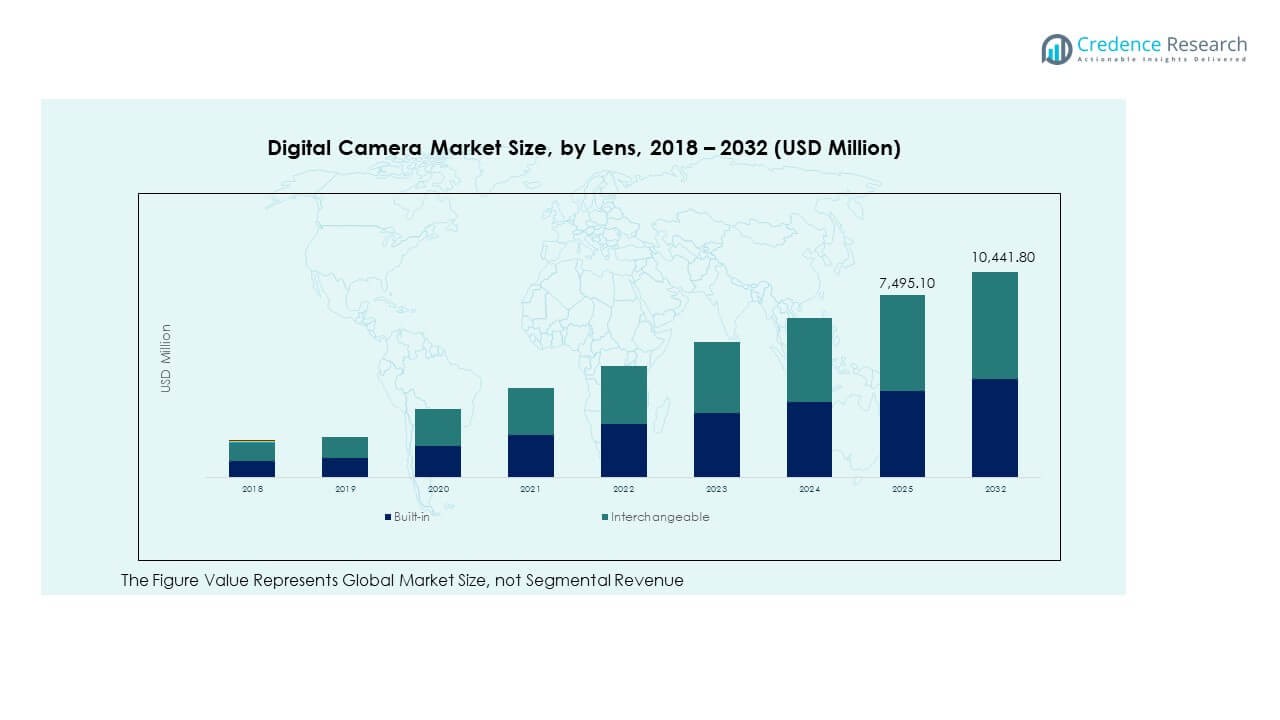

The Digital Camera Market size was valued at USD 6,300.00 million in 2018 to USD 7,180.21 million in 2024 and is anticipated to reach USD 10,441.80 million by 2032, at a CAGR of 4.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Camera Market Size 2024 |

USD 7,180.21 Million |

| Digital Camera Market, CAGR |

4.85% |

| Digital Camera Market Size 2032 |

USD 10,441.80 Million |

Strong consumer demand for high-quality imaging, coupled with rapid technological innovation, is driving market expansion. Mirrorless systems, compact cameras, and hybrid imaging devices are seeing increasing adoption. AI-enabled autofocus, high-resolution sensors, and improved low-light capabilities support both professional and casual users. The rise of influencer culture and content creation further boosts product demand. Manufacturers focus on continuous product development, advanced features, and flexible pricing to expand their user base and strengthen market reach.

North America and Europe lead the market due to high consumer spending, advanced product adoption, and strong retail networks. Asia Pacific shows the fastest growth, supported by rising disposable income and expanding creator communities. Latin America, the Middle East, and Africa are emerging markets where improved accessibility, e-commerce penetration, and expanding tourism support camera adoption. This geographic spread reflects a balanced mix of mature and growth-driven regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Digital Camera Market was valued at USD 6,300.00 million in 2018, reached USD 7,180.21 million in 2024, and is projected to attain USD 10,441.80 million by 2032, growing at a CAGR of 4.85%.

- North America (29%), Asia Pacific (40%), and Europe (25%) lead the market, driven by advanced product adoption, strong consumer spending, and robust manufacturing bases.

- Asia Pacific is the fastest-growing region, supported by rising disposable income, expanding creator communities, and a strong production ecosystem in Japan, China, and South Korea.

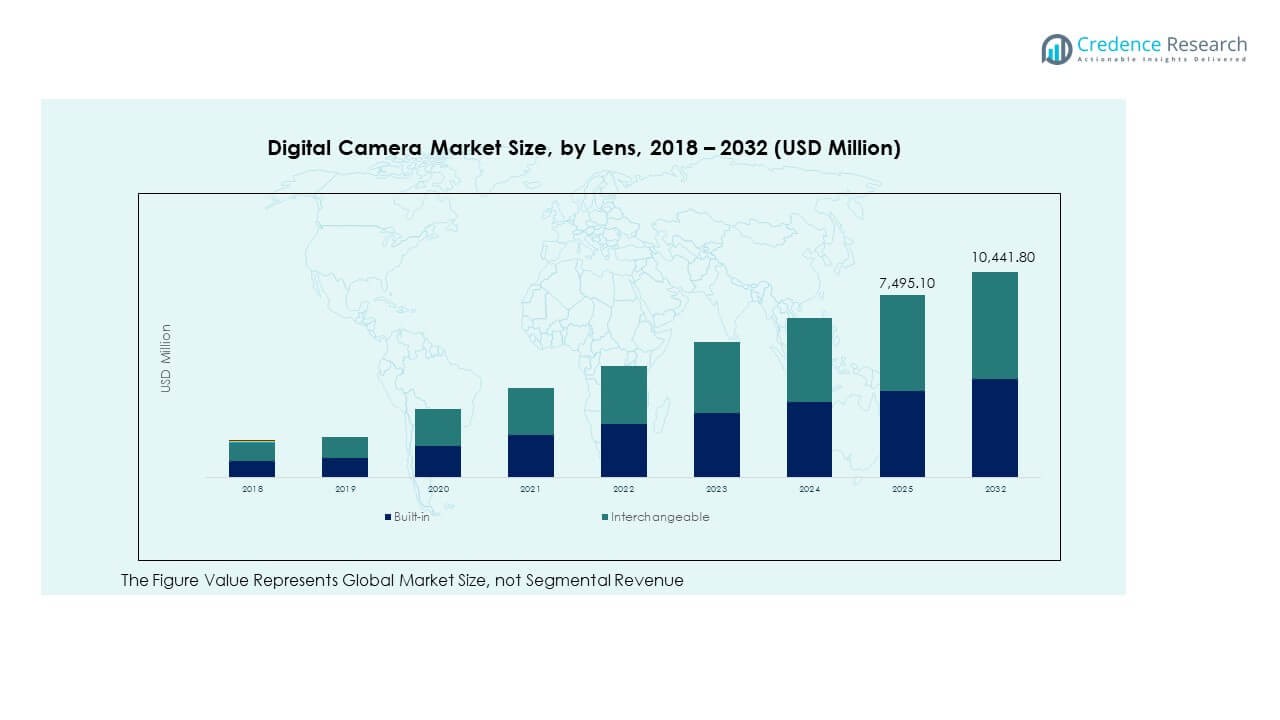

- Interchangeable lenses account for roughly 60% of the market, reflecting higher demand from professionals and prosumers, while built-in lenses hold the remaining 40%.

- The segment structure highlights increasing demand for flexible, high-performance camera systems, reinforcing manufacturers’ focus on innovation and hybrid imaging solutions.

Market Drivers

Rising Consumer Demand for High-Quality Visual Content and Advanced Imaging Capabilities

The demand for superior image and video quality is fueling rapid product innovation. Consumers prefer advanced sensors, faster autofocus, and enhanced low-light performance. Professional creators seek sharper detail and higher dynamic range. Compact mirrorless systems and DSLRs offer improved portability and ease of use. It benefits from content creators, vloggers, and photographers investing in premium devices. AI-driven features like face detection and real-time tracking boost usability. Manufacturers expand product lines to meet varied customer needs. Continuous enhancement of optical technology strengthens competitive positioning.

- For instance, Canon’s EOS R5 Mark II features a 45 MP stacked CMOS sensor, supports 8K video recording up to 60 fps, and delivers 30 fps continuous shooting with its electronic shutter. It includes Eye Control AF, adapted from the EOS R3, and achieves autofocus sensitivity down to –6 EV.

Growing Influence of Social Media Platforms and Content Creation Activities

The popularity of visual platforms is shaping purchasing behavior across diverse age groups. Content creators rely on high-quality cameras to produce engaging and shareable visuals. The demand for sharper visuals encourages brands to upgrade autofocus and stabilization features. It experiences higher adoption among influencers, professionals, and hobbyists. Brands launch cameras with integrated streaming functions to support modern workflows. Compact and lightweight designs increase portability during travel or outdoor use. Advanced video capabilities help create appealing digital content. Strong user engagement fuels sales growth in key segments.

- For instance, Sony’s Alpha 7R V features a 61 MP Exmor R BSI CMOS sensor, AI-based real-time tracking autofocus, and a BIONZ XR processor. It supports 8K 24p and 4K 60p 10-bit video recording and offers 8-stop five-axis image stabilization for stable handheld shooting.

Expanding Professional Applications in Specialized Industries and Creative Sectors

Professional fields such as advertising, cinematography, wildlife, and journalism are driving premium camera adoption. High-resolution sensors and superior optics support advanced creative work. It aligns with the increasing demand for commercial-quality output. Broad adoption in education and healthcare further expands its application base. Professional videographers seek advanced frame rates and clean HDMI outputs. Manufacturers integrate hybrid photo-video capabilities to meet diverse needs. The growing event management and studio production ecosystem boosts equipment investments. Continuous innovation strengthens the relevance of professional-grade devices.

Advancements in Mirrorless Camera Technologies and Smart Integration with Connected Devices

Ongoing improvements in mirrorless designs enhance flexibility and efficiency. Features like electronic viewfinders, silent shutters, and rapid burst rates attract buyers. Compact structures meet consumer preferences for lighter gear. It leverages Bluetooth and Wi-Fi connectivity to enable seamless file transfers. Smart integration supports instant sharing, editing, and storage. Manufacturers invest heavily in miniaturization and battery optimization. Evolving firmware upgrades maintain product competitiveness. These advancements reshape consumer preferences and drive long-term industry expansion.

Market Trends

Increasing Integration of Artificial Intelligence and Computational Photography Features

AI-powered autofocus and subject recognition systems are reshaping product design. Predictive algorithms deliver faster response and improved image clarity. It benefits from software-based stabilization and real-time tracking features. Enhanced automation simplifies shooting for both professionals and amateurs. AI-enabled editing tools provide instant optimization with minimal user effort. Manufacturers highlight adaptive exposure controls and smart scene detection. New models focus on advanced facial and object recognition. This trend enhances image precision and usability across multiple segments.

Growing Popularity of Hybrid Photo and Video Devices for Content Production

Consumers value cameras that deliver strong performance in both photography and videography. Compact systems with powerful processors enable 4K and 8K video output. It responds to the rising preference for hybrid workflows among creators. Manufacturers design products with improved thermal control and efficient codecs. Lenses and accessories support multi-functional use cases. This trend appeals to commercial users, filmmakers, and event creators. Expanded firmware capabilities keep devices relevant for longer cycles. Market adoption grows steadily with professional and semi-professional segments.

Rapid Development of Sustainable and Eco-Friendly Camera Manufacturing Processes

The industry is adopting sustainable material sourcing and energy-efficient production. Eco-conscious consumers value responsible design and recyclability. It encourages companies to shift toward low-impact manufacturing. Compact packaging and durable components reduce waste. Supply chain transparency builds stronger brand reputation. Manufacturers explore alternative power sources to reduce carbon footprint. Firmware updates extend product life cycles, supporting sustainable use. This trend aligns with global environmental goals and changing buyer expectations.

- For instance, Fujifilm Manufacturing Europe B.V. implemented an electric boiler system powered by renewable energy, aiming to cut energy-related CO₂ emissions by 26% by fiscal year 2025. The facility already operates entirely on wind power as part of Fujifilm’s net-zero commitment.

Rise of Modular Camera Systems and Customizable Product Designs

Modular components allow users to personalize devices according to their needs. Detachable accessories provide flexibility for different shooting scenarios. It supports rapid upgrades without replacing entire systems. Manufacturers focus on compact yet expandable form factors. Customization attracts professionals seeking workflow efficiency. Lenses, grips, and audio modules enable adaptable configurations. This trend lowers long-term costs for users and boosts brand loyalty. Flexible architecture fosters innovation and new business models.

- For instance, RED Digital Cinema’s KOMODO-X features a 6K Super 35 global shutter sensor and supports 6K recording at up to 80 fps. It offers a modular design with integrated I/O expansion and swappable components to enhance flexibility for professional cinematic workflows.

Market Challenges Analysis

Intense Competition from Smartphones with Advanced Integrated Imaging Systems

Smartphones integrate multiple lenses, advanced sensors, and AI-driven image processing. Compactness and ease of use give them a clear advantage among casual users. It faces pressure from consumers shifting away from entry-level devices. Flagship phones offer exceptional low-light performance and computational enhancements. Camera manufacturers must differentiate through superior optical and manual control. Market consolidation affects smaller players struggling to maintain profitability. High R&D costs limit the speed of counter-innovation. The growing gap between smartphone convenience and traditional design presents a lasting challenge.

High Product Costs and Limited Consumer Replacement Cycles for Premium Devices

Premium cameras often carry a significant price tag, slowing upgrade frequency. Consumers prefer retaining devices longer due to reliable performance. It affects sales volume, especially in mid-range segments. Economic uncertainties further delay purchase decisions. Professional gear requires additional accessories, increasing total investment. Emerging brands find it difficult to penetrate cost-sensitive markets. Price competition pressures margins across manufacturers. Addressing affordability without diluting quality remains a persistent industry challenge.

Market Opportunities

Expanding Adoption in Emerging Economies Driven by Content Creation Growth

Emerging economies present strong growth opportunities for manufacturers. Rising disposable incomes and active creator communities support increased demand. It benefits from growing tourism, weddings, and cultural documentation. Affordable mirrorless models attract new buyers in Asia Pacific and Latin America. Localized marketing strategies help build brand presence. Manufacturers can expand distribution networks and strengthen after-sales service. Strategic pricing can increase penetration in price-sensitive segments. Expanding consumer bases enhance market resilience.

Increasing Integration with Advanced Technologies to Strengthen Product Differentiation

Technological advancements offer strong opportunities for differentiation. Integration with cloud storage, IoT, and AR applications drives adoption. It creates value through smart workflows and real-time collaboration. Manufacturers can partner with software developers to expand functionality. Enhanced connectivity appeals to professionals seeking efficient solutions. Strategic product launches can capture growing hybrid work trends. Advanced customization attracts enterprise customers and creative agencies. This opportunity supports long-term growth and innovation leadership.

Market Segmentation Analysis:

The Digital Camera Market is structured across lens type, product type, and end use.

By lens segment includes built-in and interchangeable lenses. Built-in lenses dominate entry-level models for casual users who prefer convenience and compactness. Interchangeable lenses hold strong appeal among professionals and enthusiasts seeking flexibility in focal length and image quality. This structure supports both mass-market accessibility and advanced photographic capabilities.

By Product segmentation features compact digital cameras, DSLR, and mirrorless models. Compact cameras attract budget-conscious users and travelers who value portability. DSLRs remain popular for their optical performance and reliability in professional settings. Mirrorless models continue to gain traction due to lightweight designs, fast autofocus, and advanced video capabilities. It reflects growing consumer preference for high performance in a smaller form factor.

- For instance, the Ricoh GR IV, introduced in October 2025, combines a 25MP APS‑C sensor, 5-axis stabilization, and a fixed 28mm f/2.8 lens in a body weighing only 262g, allowing handheld stability and instant start-up under one second—confirmed by Amateur Photographer’s 2025 review.

By End use segmentation includes pro photographers, prosumers, and hobbyists. Pro photographers demand premium image quality, manual control, and lens flexibility. Prosumers seek hybrid models with professional-grade features at competitive prices. Hobbyists prefer affordable, user-friendly options with simple operation. Each group drives unique innovation needs, shaping product positioning and marketing strategies across segments.

- For instance, Canon’s EOS R1, announced in July 2024, features a 24.2 MP full-frame stacked CMOS sensor, supports 8K video recording, and offers up to 8.5 stops of in-body image stabilization when paired with compatible lenses. It targets professional sports and wildlife photographers with advanced autofocus and speed capabilities.

Segmentation:

By Lens Segment

By Product Segment

- Compact Digital Camera

- DSLR

- Mirrorless

By End Use Segment

- Pro Photographers

- Prosumers

- Hobbyists

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Digital Camera Market size was valued at USD 1,719.90 million in 2018 to USD 1,928.56 million in 2024 and is anticipated to reach USD 2,799.46 million by 2032, at a CAGR of 4.9% during the forecast period. North America accounts for 29% of the global market. Strong demand from professional photographers and advanced content creators drives market growth. The region benefits from high consumer spending and early adoption of mirrorless technology. It gains strength from established distribution channels and strong after-sales networks. Major brands focus on product launches with AI-driven features and enhanced connectivity. The U.S. leads regional sales supported by its mature photography ecosystem. Canada and Mexico show steady expansion driven by increasing creator communities. Competitive pricing strategies and strong retail infrastructure further support market expansion.

Europe

The Europe Digital Camera Market size was valued at USD 1,543.50 million in 2018 to USD 1,685.72 million in 2024 and is anticipated to reach USD 2,305.05 million by 2032, at a CAGR of 4.1% during the forecast period. Europe holds 25% of the global market. The region benefits from a strong heritage of camera manufacturing and innovation hubs. Demand from professional photographers and tourism sectors remains strong. It demonstrates steady interest in mirrorless and high-end DSLR systems. Germany, the UK, and France lead regional adoption through well-developed retail channels. AI-enabled features and advanced stabilization technologies strengthen competitiveness. Travel and cultural activities continue to influence purchasing trends. Growing integration of digital workflows ensures sustained demand across key countries.

Asia Pacific

The Asia Pacific Digital Camera Market size was valued at USD 2,312.10 million in 2018 to USD 2,713.01 million in 2024 and is anticipated to reach USD 4,221.63 million by 2032, at a CAGR of 5.7% during the forecast period. Asia Pacific represents 40% of the global market. Rising disposable incomes and expanding creator communities drive regional growth. It benefits from strong manufacturing bases in Japan, China, and South Korea. Competitive pricing and continuous technological upgrades attract large consumer groups. Growing tourism and influencer culture stimulate mirrorless and compact camera demand. India and Southeast Asia emerge as fast-growing markets. Local distribution improvements enhance accessibility. Regional momentum supports both entry-level and professional product segments.

Latin America

The Latin America Digital Camera Market size was valued at USD 379.26 million in 2018 to USD 427.87 million in 2024 and is anticipated to reach USD 575.03 million by 2032, at a CAGR of 3.8% during the forecast period. Latin America holds 8% of the global market. Tourism, weddings, and influencer activity support regional camera sales. Brazil and Argentina lead demand with strong urban photography cultures. It benefits from growing interest in semi-professional and budget-friendly products. Mirrorless and compact models dominate due to affordability. Expanding e-commerce platforms improve product reach. Retail partnerships enhance distribution in secondary cities. Creative professionals and content creators strengthen long-term demand.

Middle East

The Middle East Digital Camera Market size was valued at USD 201.60 million in 2018 to USD 212.49 million in 2024 and is anticipated to reach USD 272.59 million by 2032, at a CAGR of 3.2% during the forecast period. The Middle East represents 4% of the global market. Cultural tourism and event coverage support steady camera demand. It benefits from increasing investments in luxury retail and content creation. GCC countries dominate sales with a strong preference for premium mirrorless models. Israel and Turkey show growing adoption in professional segments. Expanded retail networks improve accessibility. Manufacturers target high-end consumers with smart connectivity features. The region shows potential in influencer-led market expansion.

Africa

The Africa Digital Camera Market size was valued at USD 143.64 million in 2018 to USD 212.56 million in 2024 and is anticipated to reach USD 268.03 million by 2032, at a CAGR of 2.6% during the forecast period. Africa accounts for 3% of the global market. Rising photography interest and event-driven demand shape growth. It benefits from gradual expansion of retail access in urban areas. Compact and entry-level DSLRs are preferred due to affordability. South Africa leads the regional market supported by tourism. Kenya, Egypt, and Nigeria show increasing adoption among hobbyists and semi-professionals. Manufacturers focus on targeted distribution strategies. E-commerce platforms strengthen market presence and product availability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Canon Inc.

- Eastman Kodak Company

- FUJIFILM Holdings Corporation

- Leica Camera AG

- Nikon Corporation

- Olympus Corporation

- OM Digital Solutions Corporation

- Panasonic Corporation

- Ricoh Imaging Company, Ltd.

- SIGMA Corporation

- Sony Corporation

- Hasselblad

Competitive Analysis:

The Digital Camera Market is defined by strong competition among global brands focusing on innovation, performance, and design. Leading players such as Canon Inc., Nikon Corporation, Sony Corporation, FUJIFILM Holdings Corporation, and Panasonic Corporation dominate with wide product portfolios covering mirrorless, DSLR, and compact segments. It emphasizes continuous R&D investment to improve autofocus, sensor performance, and connectivity. Strategic mergers, lens innovations, and regional expansions strengthen brand positioning. Smaller brands focus on niche offerings and cost-effective solutions to attract emerging user groups. The competitive landscape is shaped by rapid technological advancements, influencer partnerships, and strong retail networks. Market leaders leverage global distribution and after-sales service to maintain customer loyalty and capture new segments.

Recent Developments:

- In October 2025, Fujifilmannounced the global launch of its new mirrorless digital camera, the FUJIFILM X-T30 III, on October 23, 2025. This upgraded model in the well-known X-T30 series focuses on providing photographers with enhanced film simulation modes, superior autofocus performance, and extended battery life.

- In September 2025, Canon Inc.unveiled its new EOS C50 7K Full-Frame Cinema Camera, a professional-grade model positioned within Canon’s Cinema EOS lineup. Set to ship in Q4 2025, this camera emphasizes advanced video performance, targeting filmmakers and content creators requiring high-resolution cinematic output.

- In March 2025, Leica Camera AGexpanded its collaboration with Xiaomi by continuing development of Leica-branded imaging systems for smartphones — most notably the Xiaomi 15 Series, launched earlier in March 2025, featuring Leica Summilux lenses. The move reinforces Leica’s strategic presence in mobile imaging while celebrating the brand’s 100th anniversary.

Report Coverage:

The research report offers an in-depth analysis based on Lens Segment, Product Segment and End Use Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expanding mirrorless camera adoption will drive product diversification and enhance market penetration.

- AI-powered imaging solutions will strengthen device performance and user experience across professional segments.

- Integrated connectivity features will support seamless workflows for content creators and enterprises.

- Sustainability practices will influence manufacturing strategies and shape future product lines.

- Premium product innovation will focus on advanced autofocus, enhanced stabilization, and real-time processing.

- Hybrid imaging and video applications will expand demand across prosumer and professional categories.

- Regional expansion in Asia Pacific, Latin America, and Africa will accelerate overall market momentum.

- Strategic alliances between hardware and software firms will improve ecosystem integration.

- Retail and e-commerce advancements will increase product accessibility in emerging markets.

- Competitive positioning will rely on continuous R&D investment and brand-driven differentiation.