Market Overview

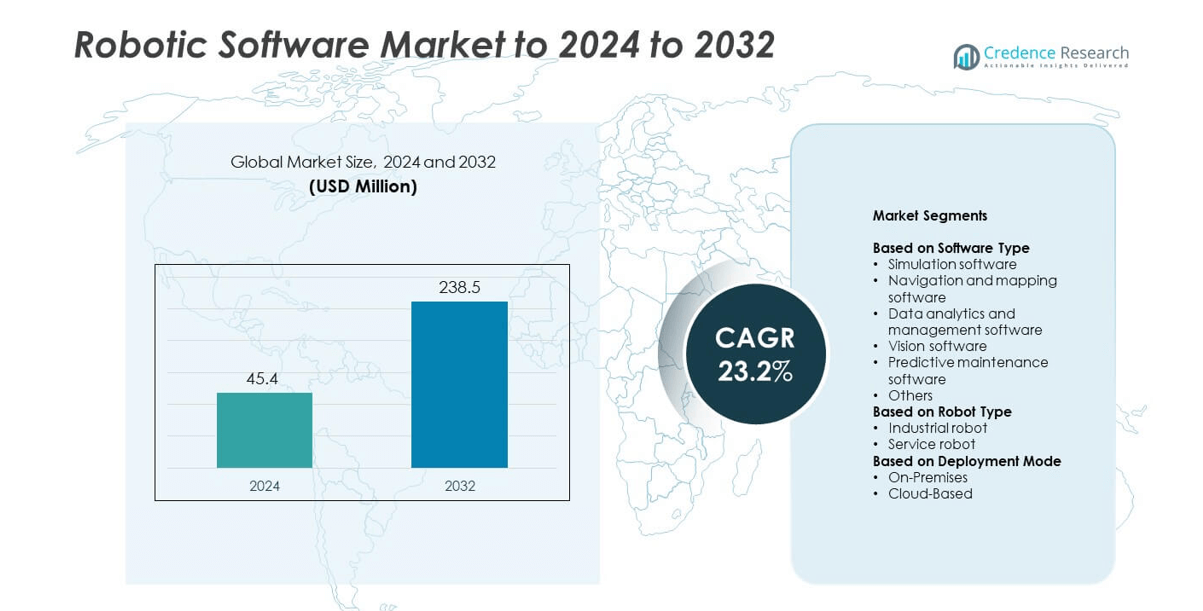

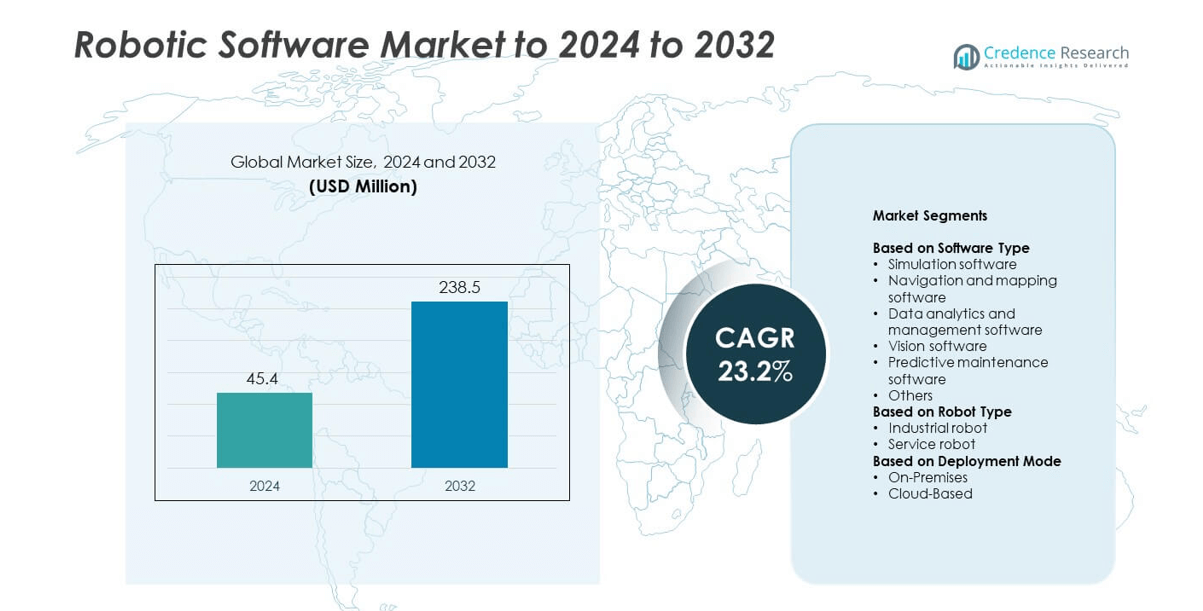

Robotic Software Market size was valued at USD 45.4 million in 2024 and is anticipated to reach USD 238.5 million by 2032, at a CAGR of 23.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Software Market Size 2024 |

USD 45.4 million |

| Robotic Software Market, CAGR |

23.2% |

| Robotic Software Market Size 2032 |

USD 238.5 million |

The robotic software market is led by major players such as NVIDIA Corporation, IBM Corporation, Universal Robots A/S, ABB Ltd, Dassault Systèmes, Clearpath Robotics, and CloudMinds Technology Inc. These companies drive innovation through AI-powered algorithms, cloud-based platforms, and simulation software that enhance automation, flexibility, and predictive capabilities. Their focus on integrating robotics with IoT and machine learning technologies has strengthened industrial efficiency and operational intelligence. Regionally, North America held the largest share of 38% in 2024, supported by advanced manufacturing ecosystems, strong R&D infrastructure, and rapid adoption of intelligent automation across industries.

Market Insights

- The robotic software market was valued at USD 45.4 million in 2024 and is projected to reach USD 238.5 million by 2032, growing at a CAGR of 23.2%.

- Rising automation across manufacturing, logistics, and healthcare sectors is a major growth driver, supported by increasing integration of AI and machine learning technologies.

- Emerging trends include adoption of cloud-based robotic platforms, digital twin simulation, and collaborative robots that enable flexible, real-time operations.

- The market is competitive, with leading players focusing on AI-driven solutions, modular software design, and cybersecurity enhancements to strengthen their global footprint.

- North America dominated the market with a 38% share in 2024, followed by Europe at 27% and Asia-Pacific at 25%, while simulation software led by segment with a 33% share due to its critical role in optimizing robotic performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Software Type

The simulation software segment dominated the robotic software market with a 33% share in 2024. This leadership is attributed to its critical role in optimizing robot performance, testing operations, and reducing deployment risks. Manufacturers use simulation tools to validate workflows before physical implementation, saving time and resources. Growing adoption in manufacturing, logistics, and automotive sectors accelerates demand for advanced simulation platforms. Companies are integrating AI-based modeling and real-time 3D visualization to enhance process accuracy and productivity, driving continued dominance of simulation software across industrial automation applications.

- For instance, NVIDIA’s ORBIT framework ships with 16 robotic platforms and 20+ benchmark tasks for training and testing in Isaac Sim, supporting 4 sensor modalities and 10 motion generators, enabling robust pre-deployment validation.

By Robot Type

The industrial robot segment held the largest market share of 64% in 2024, supported by high deployment across automotive, electronics, and metal fabrication industries. These robots use advanced software for motion control, process automation, and quality inspection. The surge in smart manufacturing and Industry 4.0 initiatives boosts demand for programmable software solutions. Increased use of collaborative robots with flexible programming interfaces further strengthens this segment. Industrial robots remain key enablers for precision and efficiency in repetitive tasks, ensuring consistent growth of software integration for factory automation.

- For instance, according to FANUC’s official website and reports, the company surpassed the milestone of 1 million robots installed worldwide in 2023

By Deployment Mode

The cloud-based segment accounted for a 58% share in 2024, emerging as the dominant mode of deployment. Cloud-based robotic software enables remote monitoring, real-time data access, and scalable storage for automation systems. Industries prefer cloud solutions for lower upfront costs and seamless integration with IoT and AI platforms. This model enhances operational flexibility and supports predictive analytics through centralized data management. Growing adoption of Robotics-as-a-Service (RaaS) and increased investments in smart factory ecosystems continue to drive the transition from on-premises to cloud-based robotic software.

Key Growth Drivers

Rising Industrial Automation Adoption

The growing integration of automation across manufacturing, logistics, and healthcare sectors is a major growth driver for the robotic software market. Industries are deploying robots with advanced software to enhance precision, safety, and productivity. The need to automate repetitive tasks and reduce operational costs has fueled adoption, especially in automotive and electronics production. Companies are investing in software that enables flexible programming and real-time control, supporting mass customization and efficiency gains across modern industrial environments.

- For instance, KUKA operated with 15,000 employees in 2024, supporting large-scale production and integration programs that hinge on programmable robot software across automotive and electronics lines.

Advancements in Artificial Intelligence and Machine Learning

The expansion of AI and ML technologies has significantly enhanced robotic software capabilities. These technologies enable robots to learn from data, adapt to new environments, and perform complex tasks autonomously. AI-driven robotic software improves object recognition, path planning, and decision-making in dynamic industrial settings. Companies are integrating AI-based algorithms to enable predictive analytics and adaptive learning, improving efficiency and uptime. The synergy between AI and robotics is accelerating the shift toward intelligent automation across industries.

- For instance, NVIDIA’s ORBIT-Surgical provides 14 benchmark surgical tasks and demonstrated sim-to-real transfer on a physical dVRK system, validating AI-driven perception and policy learning.

Expansion of Cloud and Edge Computing

Cloud and edge computing are transforming robotic software by enabling real-time data processing and remote management. Cloud platforms provide scalable infrastructure for robotics applications, allowing multi-location coordination and analytics-driven decision-making. Edge computing enhances latency-sensitive operations such as autonomous navigation and process control. This combination empowers industries to deploy flexible and connected robotic ecosystems. The growing reliance on digital connectivity and smart infrastructure continues to support the expansion of cloud-enabled robotic software solutions globally.

Key Trends & Opportunities

Integration of Digital Twins and Simulation Technologies

Digital twin technology is emerging as a major trend, enabling real-time virtual replication of robotic systems. This integration allows operators to simulate performance, predict maintenance needs, and optimize workflows before deployment. Robotic software embedded with digital twin capabilities enhances design accuracy and operational safety. Companies are adopting these tools for faster prototyping and predictive optimization. The growing use of simulation software in robotics development offers strong opportunities for vendors focusing on AI-integrated modeling platforms.

- For instance, ABB hosted the WARA Mobile Manipulation Challenge at its Corporate Research center in December 2024, where teams validated digital-twin-driven autonomy; the event reported 4 distinct system approaches.

Rising Demand for Collaborative Robots (Cobots)

The demand for collaborative robots has created new opportunities in robotic software development. Cobots rely on advanced motion control and vision software to work safely alongside humans. Their user-friendly programming and adaptability drive adoption in small and medium-sized enterprises. Robotic software solutions are evolving to support intuitive interfaces and easy reconfiguration, allowing operators without coding expertise to manage tasks. The surge in human-robot collaboration across production lines and logistics centers enhances software innovation and market penetration.

- For instance, according to Universal Robots’ own academy pages, the company offers training courses through its academy and a network of training partners in over 50 locations worldwide, and this number continues to expand.

Key Challenges

High Software Integration and Maintenance Costs

The complexity of integrating robotic software into existing systems poses a major challenge. Many industries face high costs for customization, compatibility testing, and maintenance of multi-vendor robotic environments. Software updates and security management further increase expenses. These challenges hinder adoption among small and medium enterprises with limited budgets. Companies are focusing on modular and standardized software architectures to address interoperability concerns and lower total ownership costs across robotics deployments.

Cybersecurity and Data Privacy Risks

The increased connectivity of robotic systems through cloud and IoT platforms heightens cybersecurity risks. Unauthorized access or system breaches can disrupt operations, leading to production losses and safety concerns. Protecting sensitive operational and user data remains a critical challenge for developers. Vendors are integrating advanced encryption, secure communication protocols, and real-time threat monitoring into robotic software. Strengthening data governance frameworks and compliance standards is essential to ensure secure and resilient automation environments.

Regional Analysis

North America

North America dominated the robotic software market with a 38% share in 2024, driven by strong adoption across manufacturing, logistics, and defense sectors. The United States leads the region with extensive use of AI-integrated robots in automotive and semiconductor industries. Growing investment in Industry 4.0 initiatives and rising demand for collaborative robots support market expansion. Leading software developers and cloud service providers enhance technological advancements. The presence of key players and government support for automation continue to strengthen North America’s leadership in intelligent robotic systems.

Europe

Europe accounted for a 27% share in 2024, supported by the region’s robust industrial base and advanced automation infrastructure. Germany, France, and the United Kingdom are major contributors, emphasizing robotics integration in automotive, electronics, and food processing sectors. The European Union’s focus on digital transformation and sustainable manufacturing drives demand for efficient robotic software solutions. Rising use of simulation and predictive maintenance tools enhances productivity across factories. Continuous R&D investments and government-funded robotics programs reinforce Europe’s strong position in the global market.

Asia-Pacific

Asia-Pacific held a 25% share in 2024 and is expected to witness the fastest growth through 2032. The expansion of manufacturing hubs in China, Japan, South Korea, and India drives widespread adoption of robotic software for automation. The region’s increasing focus on AI, IoT, and cloud robotics supports software innovation. Governments promoting smart factory initiatives and labor efficiency improvements further boost market expansion. Strong participation of regional players and rising exports of industrial robots enhance Asia-Pacific’s growing influence in the global robotic software ecosystem.

Latin America

Latin America captured a 6% share in 2024, led by increasing automation in logistics, mining, and automotive industries. Brazil and Mexico are key markets, investing in robotic software to enhance production efficiency. Rising collaboration with global technology firms and adoption of cloud-based robotics platforms are improving operational capabilities. Regional industries are gradually shifting toward digital manufacturing to address labor shortages and cost challenges. Although growth is moderate, supportive policies and emerging industrial automation projects are likely to strengthen the region’s market presence.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share in 2024, with growing adoption of robotic software in oil and gas, construction, and logistics sectors. Countries such as the United Arab Emirates and Saudi Arabia are investing heavily in automation as part of economic diversification plans. Technological collaborations with international firms are improving robotics capabilities. Limited infrastructure and high implementation costs currently restrain widespread adoption, but ongoing digital transformation initiatives and industrial modernization projects are expected to accelerate growth in the coming years.

Market Segmentations:

By Software Type

- Simulation software

- Navigation and mapping software

- Data analytics and management software

- Vision software

- Predictive maintenance software

- Others

By Robot Type

- Industrial robot

- Service robot

By Deployment Mode

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The robotic software market is highly competitive, with key players such as NVIDIA Corporation, IBM Corporation, Universal Robots A/S, ABB Ltd, Dassault Systèmes, Clearpath Robotics, and CloudMinds Technology Inc. leading global innovation. These companies focus on developing AI-driven, cloud-integrated, and simulation-based robotic software to enhance automation efficiency and flexibility. The market is witnessing a surge in strategic collaborations between software developers and hardware manufacturers to deliver end-to-end automation solutions. Advancements in machine learning, edge computing, and predictive maintenance software are shaping new growth avenues. Vendors are prioritizing modular and scalable architectures to cater to diverse industrial applications, from manufacturing and logistics to healthcare. Additionally, increased emphasis on interoperability and cybersecurity compliance drives competitive differentiation. Continuous investment in R&D, partnerships with AI start-ups, and expansion into emerging economies are central strategies strengthening their presence in the rapidly evolving robotic software ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, ABB released the OmniCore controller family, which features new software capabilities for motion control and advanced programming.

- In 2023, NVIDIA enhanced its Isaac robotic software platform with advanced AI capabilities for perception and manipulation, allowing developers to program robots for more complex and varied tasks.

- In 2023, Universal Robots expanded its UR+ ecosystem, a platform offering certified components and applications.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Robot Type, Deployment Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The robotic software market will experience strong growth driven by automation in manufacturing and logistics.

- AI and machine learning integration will enhance autonomous decision-making and adaptive robot performance.

- Cloud-based robotic software will continue to gain traction due to scalability and remote access benefits.

- Collaborative robots will expand across small and medium enterprises supported by user-friendly programming tools.

- Digital twin technology will enable real-time monitoring and predictive maintenance in robotic systems.

- Software vendors will focus on interoperability and modular design to improve system integration efficiency.

- Increased adoption of robotics in healthcare and retail sectors will diversify software applications.

- Cybersecurity enhancements will become a major priority as connected robotic systems grow.

- Edge computing will reduce latency and improve response time in mission-critical robotic operations.

- Strategic collaborations among robotics developers and cloud providers will drive innovation and market expansion.