Market Overview

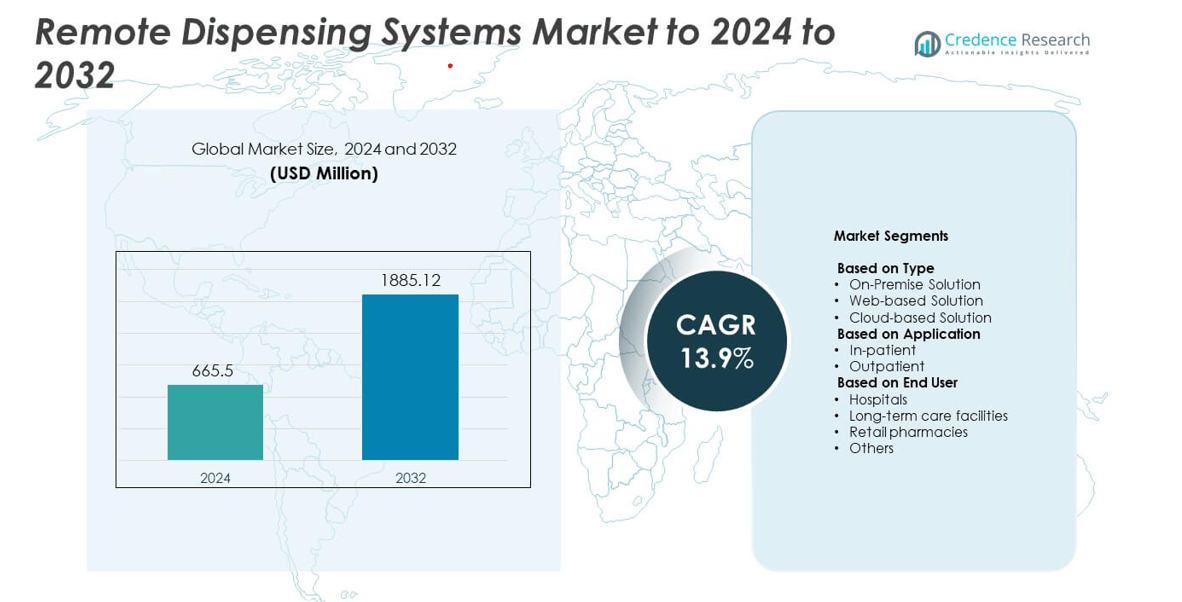

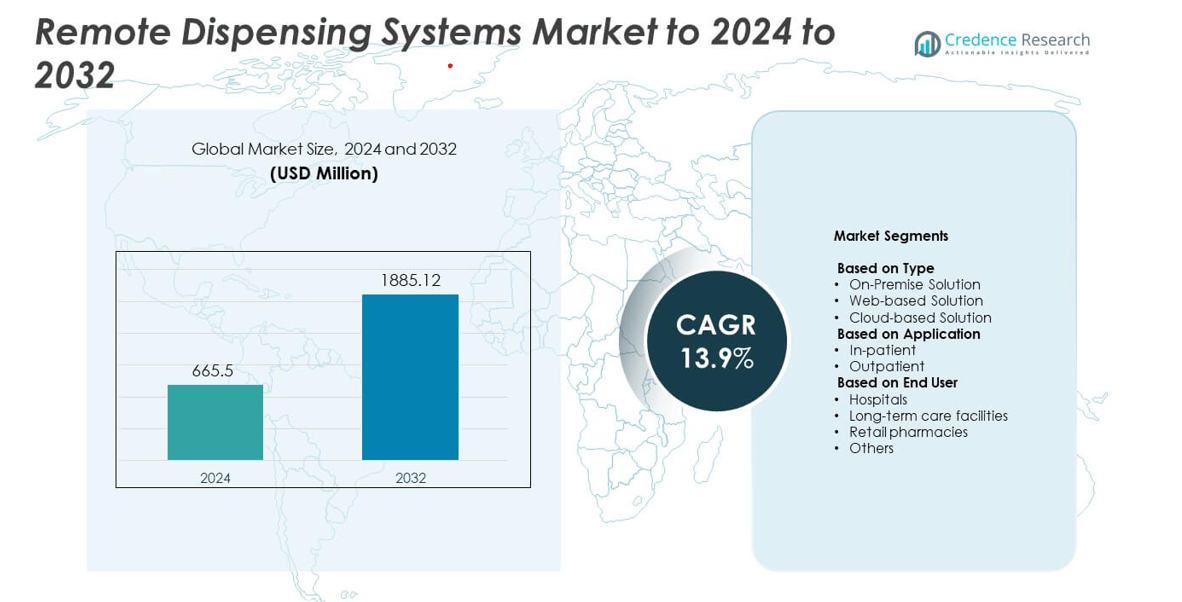

The remote dispensing systems market size was valued at USD 665.5 million in 2024 and is anticipated to reach USD 1,885.12 million by 2032, growing at a CAGR of 13.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Remote Dispensing Systems Market Size 2024 |

USD 665.5 million |

| Remote Dispensing Systems Market, CAGR |

13.9% |

| Remote Dispensing Systems Market Size 2032 |

USD 1,885.12 million |

The remote dispensing systems market is dominated by key players such as Omnicell Inc, BD, McKesson Corporation, ARxIUM Inc, MedAvail Technologies Inc, Talyst, Cerner Corporation, JVM, and RxSafe. These companies maintain their leadership through advanced automation technologies, AI integration, and strategic partnerships with healthcare institutions. Their focus on enhancing medication safety, workflow efficiency, and compliance with global health regulations strengthens market competitiveness. North America emerged as the leading region in 2024, accounting for 41.8% of the total market share, driven by strong healthcare infrastructure, rapid adoption of digital pharmacy solutions, and expanding telepharmacy networks.

Market Insights

- The remote dispensing systems market was valued at USD 665.5 million in 2024 and is projected to reach USD 1,885.12 million by 2032, growing at a CAGR of 13.9%.

- Growing demand for automation in hospitals and pharmacies, along with increased telepharmacy adoption, is driving market expansion globally.

- The market is witnessing a strong shift toward cloud-based solutions, which held a 47.3% share in 2024 due to real-time data access and scalability.

- Competition is intensifying as major players focus on AI-driven analytics, interoperability, and secure cloud-based integration to enhance medication management.

- North America led the market with a 41.8% share in 2024, followed by Europe at 28.6% and Asia Pacific at 18.7%, reflecting strong regional adoption supported by healthcare digitization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The cloud-based solution segment dominated the remote dispensing systems market in 2024, accounting for 47.3% of the total share. Its leadership is driven by increasing adoption of Software-as-a-Service platforms that enable real-time prescription management, automatic medication tracking, and secure data access across multiple locations. Cloud deployment reduces infrastructure costs and enhances scalability, attracting hospitals and retail chains. Growing integration of AI-driven analytics and interoperability with electronic health records (EHRs) further boosts adoption. Continuous investments by vendors in cybersecurity and compliance with HIPAA standards strengthen confidence among healthcare providers.

- For instance, Omnicell reports ties with over half of the top 300 U.S. health systems. Cloud workflows support real-time inventory and EHR links. Hospitals choose SaaS to scale securely.

By Application

The in-patient segment held the largest share of 58.6% in 2024, supported by the rising need for accurate, on-demand medication dispensing in hospital wards and ICUs. Automated dispensing units minimize human errors, enhance medication safety, and improve workflow efficiency for nursing staff. The surge in chronic disease admissions and the expansion of hospital automation projects are driving segment growth. Integration with centralized inventory management systems ensures better stock utilization and reduced wastage. Increasing hospital investments in closed-loop medication management systems continue to reinforce segment leadership.

- For instance, in a specific study involving the deployment of Pyxis MedBank automated dispensing cabinets in a long-term care setting, BD documented a 71% reduction in non-controlled medication retrieval time compared to using manual emergency kits

By End User

Hospitals dominated the market in 2024, capturing a 62.4% share due to widespread implementation of automated dispensing systems for patient safety and efficiency. High prescription volumes, stringent regulatory requirements, and demand for optimized pharmacy workflows fuel adoption. Hospitals benefit from reduced dispensing time, real-time drug monitoring, and enhanced traceability. Long-term care facilities and retail pharmacies are witnessing gradual uptake as they adopt remote dispensing units to improve medication adherence. Ongoing digital transformation initiatives across large healthcare networks further accelerate adoption in the hospital segment.

Key Growth Drivers

Rising Demand for Medication Safety and Accuracy

Growing emphasis on patient safety and accurate drug dispensing is a major growth driver in the remote dispensing systems market. Automated systems minimize human errors, improve compliance with prescription protocols, and enhance medication traceability. Hospitals and pharmacies are increasingly deploying these systems to ensure proper dosage control and prevent adverse drug events. The integration of barcode verification and electronic prescription systems further improves workflow accuracy, supporting global adoption across healthcare facilities aiming to achieve higher medication safety standards.

- For instance, In December 2019, ARxIUM’s RIVA robotic IV compounding systems did surpass the 10 million dose milestone.

Expanding Telepharmacy and Remote Healthcare Infrastructure

The rapid expansion of telepharmacy and remote healthcare models fuels the adoption of remote dispensing systems. These solutions enable licensed pharmacists to dispense medications from centralized locations while maintaining regulatory compliance. Rising demand in rural and underserved regions, coupled with the need to reduce operational costs, accelerates implementation. Governments and private providers are investing in digital infrastructure to support remote consultations and automated dispensing, strengthening healthcare access and efficiency. This transformation positions remote dispensing systems as a core component of telehealth ecosystems.

- For instance, Asteres announced 1,000 ScriptCenter units across 38 U.S. states. Remote pickup extends access in underserved areas. Central pharmacists supervise dispensing compliance.

Integration of Advanced Technologies and AI Analytics

Integration of artificial intelligence, machine learning, and IoT technologies enhances system performance and efficiency. AI-driven analytics predict prescription patterns, optimize inventory, and detect potential dispensing errors in real time. Automation of data tracking improves medication adherence and enables predictive maintenance of dispensing units. These technological advancements make systems smarter and more adaptive, appealing to healthcare providers seeking precision and cost efficiency. Continuous innovation in data analytics platforms further strengthens adoption across both large hospital networks and pharmacy chains.

Key Trends and Opportunities

Adoption of Cloud-Based and Web-Based Platforms

The shift toward cloud and web-based remote dispensing platforms presents major opportunities for scalability and data integration. Cloud deployment offers flexibility, remote access, and improved interoperability with EHR and hospital management systems. Vendors are focusing on developing secure, compliant platforms with end-to-end encryption and advanced analytics. This transition also enables centralized monitoring across multiple locations, reducing IT costs and improving data transparency. The growing reliance on cloud solutions supports the creation of connected, intelligent healthcare delivery networks worldwide.

- For instance, Walgreens’ automated centers handle about 16 million prescriptions monthly. High-volume hubs push API-driven, analytics-ready workflows. Cloud links unify forecasting and fulfillment.

Focus on Decentralized Pharmacy Automation

Decentralization of pharmacy operations is emerging as a strong trend within the market. Remote dispensing units placed in community centers, care facilities, and retail outlets allow faster access to medications and relieve the burden on hospital pharmacies. Integration with teleconsultation platforms enhances patient convenience and engagement. This model promotes equitable healthcare access, particularly in regions with limited clinical infrastructure. As healthcare systems move toward automation and decentralized care, adoption of these systems is expected to accelerate further.

- For instance, PickPoint’s Remote Dispensing System has been deployed in more than 120 remote clinics across rural Alaska, supervised remotely by pharmacists to deliver medications safely even where no local pharmacy exists.

Key Challenges

High Initial Implementation and Maintenance Costs

The substantial investment required for installation, integration, and training poses a challenge for small and mid-sized healthcare facilities. Hardware procurement, software licensing, and regular maintenance increase financial burden. Although long-term efficiency benefits are evident, the upfront expenditure delays adoption, especially in developing regions. Limited access to funding and skilled technical staff further complicates large-scale deployment. Cost optimization and government support programs will be critical in addressing this adoption barrier in the coming years.

Data Security and Compliance Concerns

Ensuring patient data privacy and compliance with healthcare regulations remains a significant challenge. Remote dispensing systems handle sensitive patient and prescription data, making them targets for cyberattacks. Non-compliance with standards such as HIPAA and GDPR can lead to penalties and loss of trust. Maintaining secure cloud environments and continuous monitoring to prevent breaches is essential. Vendors are investing heavily in encryption, authentication protocols, and risk management frameworks to strengthen data integrity and regulatory adherence across healthcare networks.

Regional Analysis

North America

North America dominated the remote dispensing systems market in 2024 with a 41.8% share. The region’s leadership is supported by advanced healthcare infrastructure, high adoption of automation technologies, and strong regulatory compliance frameworks. The presence of established vendors and increasing use of telepharmacy across hospitals and long-term care facilities drive demand. Rising healthcare digitization and integration with electronic health record systems further enhance adoption. Continuous investment in AI-enabled medication management solutions and increasing emphasis on patient safety strengthen the region’s position in the global market.

Europe

Europe held a 28.6% share of the remote dispensing systems market in 2024. The region benefits from growing healthcare automation initiatives and favorable government policies promoting digital pharmacy systems. Increasing use of e-prescription services and focus on reducing medication errors contribute to market expansion. Hospitals and outpatient clinics are increasingly adopting cloud-based solutions to streamline pharmacy operations. Countries such as Germany, the United Kingdom, and France lead adoption due to robust healthcare infrastructure and digital transformation strategies supporting remote dispensing implementation.

Asia Pacific

Asia Pacific accounted for 18.7% of the remote dispensing systems market in 2024, driven by rising healthcare investments and expanding telemedicine adoption. Countries such as China, Japan, and India are accelerating deployment to improve access in rural areas. The growing elderly population and demand for continuous care encourage hospitals to adopt automated dispensing solutions. Government programs promoting healthcare digitization and the emergence of local technology providers enhance regional growth. The shift toward affordable, scalable cloud-based systems supports greater adoption among both public and private healthcare facilities.

Latin America

Latin America captured a 6.3% share of the remote dispensing systems market in 2024. Increasing healthcare modernization efforts and rising awareness about medication safety are driving adoption. Countries such as Brazil and Mexico are expanding investments in digital pharmacy infrastructure to reduce human error and improve access. The rise of private hospital chains and telehealth initiatives further strengthens regional growth. However, high implementation costs and limited regulatory support slow wider adoption, though ongoing partnerships between healthcare providers and technology firms continue to improve system accessibility.

Middle East & Africa

The Middle East & Africa region held a 4.6% share of the remote dispensing systems market in 2024. Growth is supported by expanding healthcare infrastructure and gradual adoption of automated systems in hospitals and clinics. The Gulf Cooperation Council countries, particularly the United Arab Emirates and Saudi Arabia, are leading with strong government investments in digital healthcare transformation. Adoption remains slower in Africa due to budget constraints, yet telepharmacy initiatives are emerging to improve rural healthcare access. Increasing focus on efficiency and patient safety will sustain long-term market growth.

Market Segmentations:

By Type

- On-Premise Solution

- Web-based Solution

- Cloud-based Solution

By Application

By End User

- Hospitals

- Long-term care facilities

- Retail pharmacies

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The remote dispensing systems market is led by major players such as Omnicell Inc, BD, McKesson Corporation, ARxIUM Inc, MedAvail Technologies Inc, Talyst, Cerner Corporation, JVM, and RxSafe. These companies compete through product innovation, strategic partnerships, and expansion of automated pharmacy solutions across hospitals, long-term care facilities, and retail pharmacies. Market participants are focusing on integrating AI-driven analytics, robotics, and IoT connectivity to enhance medication accuracy, workflow efficiency, and patient safety. Investments in cloud-based platforms and telepharmacy capabilities are enabling remote prescription management and real-time inventory monitoring. Leading vendors are strengthening their global footprints through collaborations with healthcare networks and technology providers, while also prioritizing compliance with regulatory standards such as HIPAA and GDPR. Continuous R&D initiatives and an increasing focus on data security, interoperability, and modular design are expected to shape the competitive dynamics of the market during the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Omnicell Inc

- BD

- McKesson Corporation

- ARxIUM Inc

- MedAvail Technologies Inc

- Talyst

- Cerner Corporation

- JVM

- RxSafe

Recent Developments

- In 2025, BD launched the next-generation BD Pyxis™ Pro Dispensing Solution. The new system features expanded capacity, enhanced security, and AI-powered analytics to improve inventory management and medication safety.

- In 2024, Omnicell Launched XT Amplify, a multi-year innovation project to optimize its XT Automated Dispensing Systems

- In 2023, JVM launched a new automated drug dispensing machine in the European market. This system featured a high-end robotic arm named ‘MENITH’.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth driven by increasing hospital automation and digital transformation.

- Integration of AI and machine learning will enhance dispensing accuracy and operational efficiency.

- Cloud-based systems will continue to gain traction due to scalability and remote accessibility.

- Telepharmacy adoption will expand in rural and underserved regions to improve medication access.

- Vendors will focus on cybersecurity and regulatory compliance to strengthen data protection.

- Long-term care facilities and retail pharmacies will emerge as key adopters of remote systems.

- Integration with electronic health records will streamline workflow and improve patient safety.

- Government initiatives promoting healthcare digitization will accelerate technology deployment.

- Partnerships between technology firms and healthcare providers will drive product innovation.

- The focus on cost-effective, interoperable, and AI-enabled solutions will define future market evolution.