Market Overview

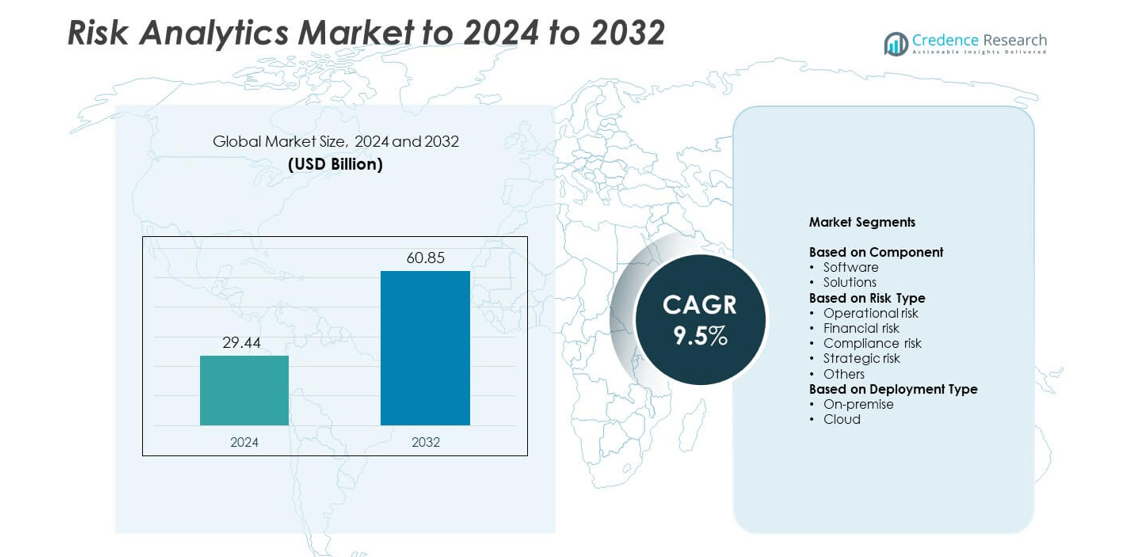

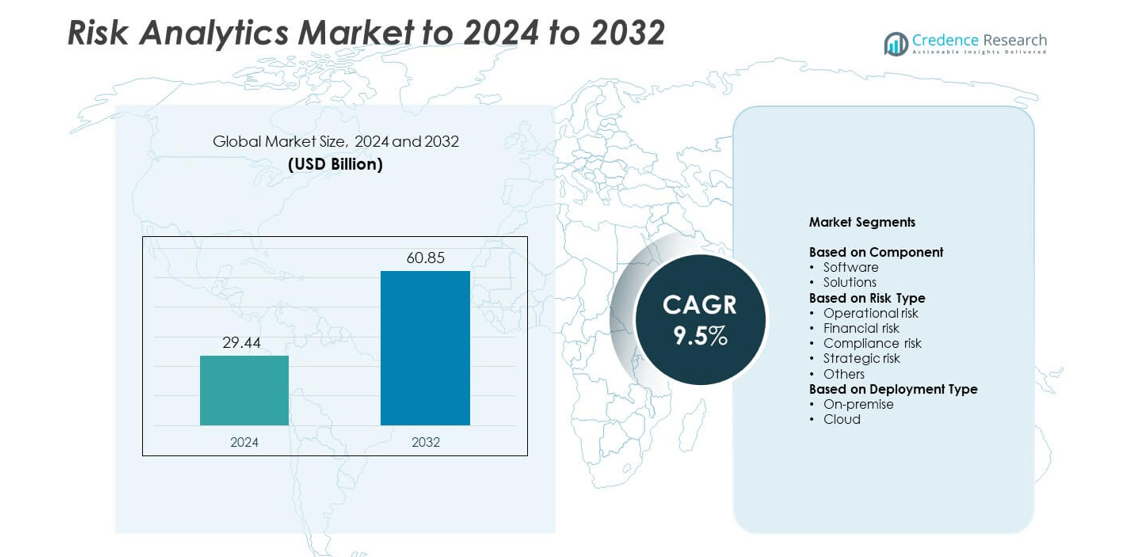

The Risk Analytics Market size was valued at USD 29.44 billion in 2024 and is anticipated to reach USD 60.85 billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Risk Analytics Market Size 2024 |

USD 29.44 billion |

| Risk Analytics Market, CAGR |

9.5% |

| Risk Analytics Market Size 2032 |

USD 60.85 billion |

The Risk Analytics Market is led by major players such as IBM, Oracle Corporation, SAS Institute, Moody’s Analytics, and FICO, which are driving innovation through AI-enabled analytics, cloud-based risk platforms, and advanced predictive modeling tools. These companies focus on integrated risk management solutions that combine compliance automation, financial risk assessment, and cybersecurity analytics. North America dominated the global market with a 36% share in 2024, supported by strong digital infrastructure and high adoption among financial institutions. Europe followed with a 29% share, driven by strict data governance standards and increasing regulatory compliance initiatives.

Market Insights

- The Risk Analytics Market was valued at USD 29.44 billion in 2024 and is projected to reach USD 60.85 billion by 2032, growing at a CAGR of 9.5%.

- Rising regulatory compliance requirements, growing financial digitalization, and increased adoption of AI-driven analytics tools are key market drivers.

- The software segment led the market with a 63% share, driven by strong demand for predictive and real-time risk modeling solutions.

- The market is highly competitive, with major players investing in AI, machine learning, and cloud-based risk platforms to strengthen their global footprint.

- North America held the largest regional share of 36% in 2024, followed by Europe at 29% and Asia-Pacific at 25%, driven by rapid digital transformation and growing adoption of cloud-based risk management frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment dominated the Risk Analytics Market in 2024 with a 63% share. This dominance is driven by the growing integration of AI, ML, and big data technologies in risk modeling and predictive analytics. Software solutions enable real-time data monitoring, fraud detection, and automated risk assessment across industries such as banking and insurance. The increasing demand for advanced visualization dashboards and cloud-based analytical tools continues to boost adoption. Continuous enhancements in user interfaces and integration capabilities further strengthen software-led risk intelligence frameworks globally.

- For instance, as of August 2024, FICO solutions protect more than 4 billion payment cards worldwide.

By Risk Type

The financial risk segment held the largest share of 41% in 2024, supported by the rising adoption of risk modeling tools in banking, asset management, and fintech sectors. Financial institutions increasingly rely on analytics to identify credit, liquidity, and market risks while ensuring regulatory compliance. The growing complexity of financial transactions and the adoption of Basel III standards have accelerated demand. Advanced tools offering portfolio stress testing and scenario-based forecasting continue to drive investments in financial risk analytics platforms.

- For instance, NICE Actimize monitors over 5 billion transactions per day, with its solutions protecting over 1,000 organizations and safeguarding assets worth over $6 trillion daily.

By Deployment Type

The cloud segment accounted for a dominant 58% share in 2024 due to its scalability, cost-efficiency, and integration flexibility. Enterprises are shifting from on-premise systems to cloud-based risk analytics platforms to enhance agility and reduce infrastructure costs. Cloud deployment supports faster updates, multi-location access, and real-time data synchronization. Increasing adoption of SaaS-based models by BFSI and healthcare organizations further drives growth. The growing emphasis on cybersecurity and encrypted data storage is also strengthening confidence in cloud-driven risk analytics adoption worldwide.

Key Growth Drivers

Rising Demand for Predictive Risk Management

Organizations are increasingly adopting predictive analytics to forecast and mitigate potential business risks. The integration of AI and machine learning enables early detection of anomalies in financial transactions and operational processes. This proactive approach minimizes losses and enhances decision-making accuracy. The expansion of digital ecosystems in sectors such as banking, insurance, and energy further amplifies the need for predictive tools to manage complex data and evolving threats.

- For instance, as of the 2024 fiscal year, Quantexa had over 16,000 active users of its Decision Intelligence Platform.

Increasing Regulatory Compliance Requirements

Growing global regulations like Basel III, GDPR, and SOX have heightened the need for comprehensive risk analytics platforms. Enterprises are implementing advanced compliance analytics tools to meet audit requirements and reduce penalties. Automated compliance monitoring systems streamline data validation, ensuring transparency and traceability. This regulatory pressure drives demand for integrated analytics capable of monitoring real-time risk exposure and aligning reporting practices with global compliance standards.

- For instance, Moody’s Orbis provides data on 600 million+ entities for KYC and due diligence.

Growth in Cloud-Based Analytics Adoption

The rapid shift toward cloud-based architectures is enabling flexible and scalable risk management frameworks. Cloud solutions provide real-time risk assessment and secure access to analytical dashboards across distributed teams. They reduce infrastructure costs while improving data agility and model deployment speed. The rising adoption of SaaS platforms by BFSI, healthcare, and manufacturing sectors continues to strengthen market expansion for cloud-driven risk analytics.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

AI and ML technologies are reshaping the risk analytics landscape through automation and advanced pattern recognition. These tools enhance fraud detection, credit scoring, and threat prediction capabilities. Businesses are leveraging AI models for self-learning risk assessments, improving accuracy over time. This trend creates opportunities for vendors offering AI-embedded platforms that deliver deeper insights and faster decision support in high-risk industries.

- For instance, SAS ranked No. 2 in RiskTech100® 2025 and won 6 solution awards.

Expansion of Real-Time Data Analytics

The shift from static to real-time data analytics enables faster identification of emerging threats. Businesses are deploying streaming analytics to track risk indicators and detect anomalies instantly. Industries such as finance and energy benefit from these capabilities to ensure operational continuity. The growing use of IoT and connected systems further expands opportunities for real-time monitoring and predictive control in dynamic environments.

- For instance, Dataminr’s AI platform is trusted by thousands of corporate, public sector, and news organizations in more than 100 countries.

Key Challenges

Data Privacy and Security Concerns

The growing volume of sensitive financial and operational data poses significant privacy risks. Breaches and unauthorized access can compromise trust and regulatory compliance. Companies must invest heavily in encryption, secure data pipelines, and governance frameworks. Striking a balance between data transparency and confidentiality remains a persistent challenge, particularly in sectors like banking and healthcare that handle critical information.

Integration Complexity Across Legacy Systems

Many organizations face challenges integrating modern analytics solutions with existing IT infrastructure. Legacy systems often lack compatibility with advanced data analytics platforms, creating inefficiencies and higher operational costs. The migration process requires specialized skills, leading to implementation delays. Ensuring seamless data flow across heterogeneous systems remains a key obstacle in achieving end-to-end risk visibility and automation.

Regional Analysis

North America

North America held the largest share of 36% in the Risk Analytics Market in 2024, driven by the strong presence of major financial institutions and advanced regulatory frameworks. The U.S. leads regional adoption due to high investments in AI-based risk modeling and cybersecurity analytics. Increasing data breaches and the need for predictive compliance tools are fueling demand. The region’s mature cloud infrastructure and presence of leading analytics providers continue to support innovation in financial, operational, and enterprise risk assessment solutions.

Europe

Europe accounted for a 29% share in the global Risk Analytics Market in 2024, supported by stringent data protection laws and rising compliance automation. The region’s focus on GDPR implementation has accelerated demand for governance and fraud detection analytics. Financial and insurance institutions are adopting advanced risk modeling tools to strengthen transparency and reporting accuracy. The United Kingdom, Germany, and France lead regional adoption, with growing emphasis on integrating AI and predictive analytics to improve real-time monitoring and regulatory conformity.

Asia-Pacific

Asia-Pacific captured a 25% share of the Risk Analytics Market in 2024, driven by rapid digitalization and financial sector growth. Emerging economies such as China, India, and Japan are investing heavily in risk assessment technologies to enhance operational resilience. The expansion of fintech ecosystems and increasing cyber threats are key drivers for analytics deployment. Governments in the region are also introducing data governance frameworks, encouraging enterprises to adopt AI-driven and cloud-based analytics solutions for proactive risk management.

Latin America

Latin America represented an 8% share of the global Risk Analytics Market in 2024, led by growing adoption across banking, telecom, and energy sectors. Countries like Brazil and Mexico are investing in predictive analytics to manage credit, compliance, and fraud risks. Regional enterprises are shifting toward cloud-based models to optimize cost and scalability. The need to strengthen data governance and meet international reporting standards continues to fuel adoption, while local vendors are expanding analytics offerings tailored to regional regulatory needs.

Middle East & Africa

The Middle East & Africa accounted for a 6% share of the Risk Analytics Market in 2024, supported by digital transformation initiatives and rising cyber risk awareness. Financial institutions in the UAE, Saudi Arabia, and South Africa are investing in AI-powered analytics for regulatory and operational risk management. Governments are promoting digital infrastructure modernization, encouraging enterprises to integrate predictive risk tools. The increasing reliance on digital banking, coupled with regional cybersecurity mandates, continues to drive gradual but steady adoption across industries.

Market Segmentations:

By Component

By Risk Type

- Operational risk

- Financial risk

- Compliance risk

- Strategic risk

- Others

By Deployment Type

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

Key players in the Risk Analytics Market include IBM, Oracle Corporation, SAS Institute, Moody’s Analytics, FICO, Accenture, Fidelity National Information Services, Verisk Analytics, OneSpan, AxiomSL, Gurucul, Risk Edge Solutions, ACL Services Ltd., dba Galvanize, and Eurorisk Systems Ltd. The market is highly competitive, with companies focusing on AI integration, cloud-based platforms, and advanced data visualization tools to enhance risk intelligence. Vendors are prioritizing end-to-end risk management suites that combine predictive analytics, compliance automation, and cybersecurity monitoring. Strategic partnerships with financial institutions and cloud service providers are expanding global reach and improving platform interoperability. Continuous investments in machine learning algorithms, real-time analytics, and scalable architectures are strengthening market positioning. Vendors are also emphasizing user-friendly interfaces and customizable dashboards to address diverse enterprise needs. The increasing demand for automated compliance and multi-domain risk analysis continues to drive innovation and intensify competition among technology providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM

- Oracle Corporation

- SAS Institute

- Moody’s Analytics

- FICO

- Accenture

- Fidelity National Information Services

- Verisk Analytics

- OneSpan

- AxiomSL

- Gurucul

- Risk Edge Solutions

- ACL Services Ltd.

- dba Galvanize

- Eurorisk Systems Ltd.

Recent Developments

- In 2025, IBM and Telefónica Tech collaborated to develop security solutions addressing threats posed by future quantum computing, strengthening proactive risk assessments.

- In 2025, FICO Launched “financial foundation models” to bolster its risk analytics offerings.

- In 2023, Moody’s and Microsoft announced a strategic partnership to combine Moody’s proprietary data and analytics with the power of Microsoft’s Azure OpenAI service. The collaboration’s aim was to create advanced generative AI-powered solutions for enhanced research and risk assessment

Report Coverage

The research report offers an in-depth analysis based on Component, Risk Type, Deployment Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven predictive risk solutions will continue to rise across industries.

- Cloud-based deployment models will dominate due to scalability and lower operational costs.

- Integration of big data and IoT analytics will enhance real-time risk detection.

- Financial institutions will expand adoption to improve compliance and fraud prevention.

- Regulatory requirements will drive continuous innovation in automated reporting tools.

- Partnerships between analytics vendors and cloud providers will increase global accessibility.

- Cybersecurity risk analytics will gain priority amid growing digital threats.

- SMEs will adopt affordable SaaS-based risk management solutions.

- Advanced visualization dashboards will support faster, data-driven decision-making.

- Emerging economies will witness strong adoption driven by digital transformation initiatives.