Market Overview:

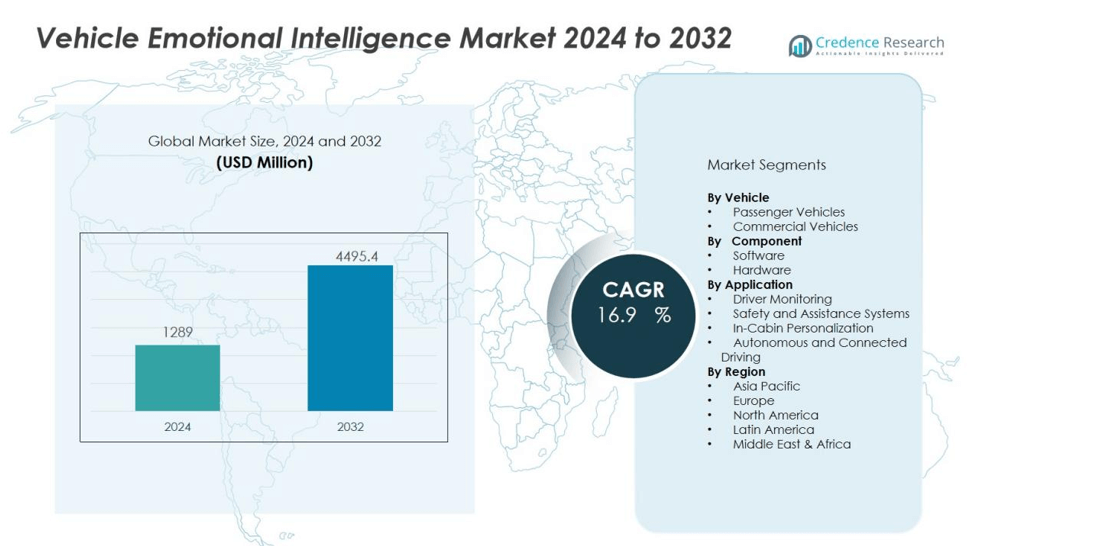

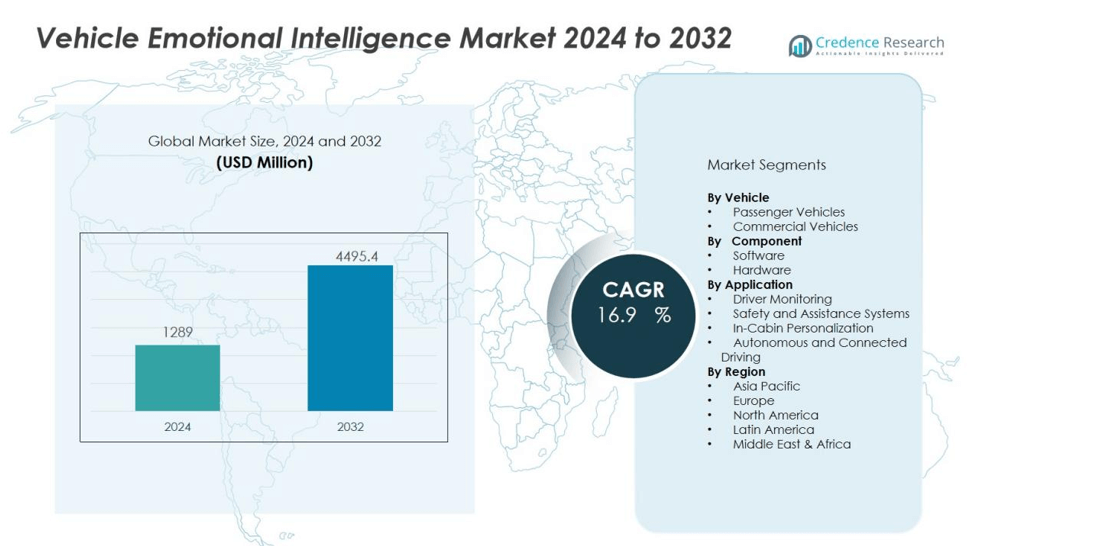

The Vehicle emotional intelligence market size was valued at USD 1289 million in 2024 and is anticipated to reach USD 4495.4 million by 2032, at a CAGR of 16.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Emotional Intelligence Market Size 2024 |

USD 1289 million |

| Vehicle Emotional Intelligence Market, CAGR |

16.9% |

| Vehicle Emotional Intelligence Market Size 2032 |

USD 4495.4 million |

Key drivers include increasing focus on driver safety, growing regulatory support for advanced driver assistance systems, and rising consumer acceptance of AI-based personalization features. The integration of biometric sensors, natural language processing, and machine learning is enabling vehicles to adapt to driver emotions in real time, reducing stress and improving attention. Partnerships between automotive OEMs, AI developers, and electronics companies are also accelerating innovation and deployment across both luxury and mid-segment vehicles.

Regionally, North America leads the vehicle emotional intelligence market due to strong investments in autonomous driving and connected car technologies, followed closely by Europe with its emphasis on safety regulations and innovation. Asia-Pacific is emerging as the fastest-growing region, driven by high vehicle production in China, Japan, and South Korea, coupled with increasing consumer demand for smart mobility solutions. This global expansion highlights the market’s pivotal role in shaping next-generation automotive intelligence.

Market Insights:

- The Vehicle emotional intelligence market size reached USD 1289 million in 2024 and is forecast to achieve USD 4495.4 million by 2032, reflecting a CAGR of 16.9% during 2024–2032.

- Rising demand for driver safety and fatigue monitoring is driving adoption of AI-powered systems that detect stress, drowsiness, and emotional states to prevent accidents.

- Growing regulatory mandates for driver state monitoring and advanced assistance systems are positioning emotional AI as a compliance-focused innovation in modern vehicles.

- High costs, technical complexity, and data privacy concerns remain major challenges, highlighting the need for secure infrastructure and affordable solutions.

- North America leads with 38% share, Europe follows with 31%, and Asia-Pacific is emerging as the fastest-growing region supported by large-scale vehicle production and smart mobility initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Enhanced Driver Safety and Monitoring:

The Vehicle emotional intelligence market is driven by the growing need to improve driver safety through emotion and fatigue detection systems. Automakers are integrating AI-powered sensors that track facial expressions, heart rate, and voice tone to identify stress, anger, or drowsiness. It strengthens accident prevention by alerting drivers or adjusting vehicle controls in real time. This growing focus on proactive safety measures is creating significant adoption across passenger and commercial vehicles.

- For instance, Smart Eye’s Driver Monitoring System software has been installed in over 2 million vehicles globally across 365 car models from 23 OEMs, with BMW initiating series production in 2018 and achieving widespread deployment.

Integration of AI for Personalized In-Cabin Experience:

Consumers increasingly expect vehicles to provide intelligent, adaptive experiences tailored to their emotions and preferences. The Vehicle emotional intelligence market benefits from AI systems that adjust climate control, music, and lighting based on driver mood. It enhances customer satisfaction by delivering comfort and personalization that improve the overall driving journey. Automakers view these features as differentiators in a highly competitive industry.

- For instance, BMW’s Intelligent Personal Assistant can analyze driver behavior patterns to automatically adjust settings, with the system capable of processing over 250TOPS trillion operations per second through NVIDIA DRIVE Orin technology.

Regulatory Push Toward Advanced Driver Assistance Features:

Governments across key automotive markets are mandating advanced monitoring and assistance technologies to strengthen road safety. The Vehicle emotional intelligence market gains momentum from these regulatory pressures, which encourage adoption of driver state monitoring systems. It positions emotional AI as a core feature in compliance-focused automotive innovation. This regulatory framework provides long-term stability for investment in the technology.

Collaboration Between Automakers and Technology Leaders:

Partnerships between automotive manufacturers, AI startups, and electronics firms are accelerating the commercialization of emotional intelligence solutions. The Vehicle emotional intelligence market benefits from joint ventures that integrate biometrics, machine learning, and natural language processing into vehicles. It supports faster scaling of intelligent features across luxury and mass-market segments. These collaborations ensure rapid innovation and broader consumer access to advanced mobility solutions.

Market Trends:

Adoption of Multimodal Emotion Recognition for Smarter Vehicles:

The Vehicle emotional intelligence market is experiencing a shift toward multimodal recognition systems that combine facial analysis, voice tone detection, and physiological monitoring. Automakers are moving beyond single-mode detection to deliver higher accuracy and reliability in identifying driver states. It supports advanced personalization by integrating mood recognition with adaptive infotainment and comfort features. Growing deployment of AI and deep learning models enables vehicles to continuously learn and refine emotional responses. This trend is not limited to luxury vehicles but is gradually extending into mid-range models to meet consumer expectations. The focus on holistic emotion recognition is reshaping the role of cars as intelligent companions rather than just transport machines.

- For instance, Hyundai Motor integrated Affectiva’s multimodal emotion AI into its vehicle prototypes, enabling real-time analysis of 34 emotional and cognitive states from drivers. This collaboration allowed Hyundai to personalize in-cabin experiences with over 90% accuracy in distinguishing stress versus calm states.

Integration of Emotional AI with Autonomous and Connected Driving:

The Vehicle emotional intelligence market is also trending toward integration with autonomous driving and connected car ecosystems. It enables vehicles to adapt driving styles and decision-making processes based on the driver’s emotional condition and passenger well-being. Manufacturers are exploring use cases where emotional AI complements advanced driver assistance systems to improve trust in automation. Increasing connectivity allows vehicles to link emotional data with navigation, entertainment, and cloud-based services for real-time optimization. Strategic collaborations between automakers and technology firms are leading to faster adoption of emotional AI across mobility platforms. This alignment of emotional intelligence with autonomy and connectivity is positioning vehicles as highly intuitive and interactive environments.

- For instance, Nissan’s Brain-to-Vehicle (B2V) technology provides real-time detection and analysis of brain activity related to driving, enabling the system to predict driver actions 0.2 to 0.4 seconds before they occur and adapt autonomous driving configurations based on driver preferences, such as lane positioning on highways, to create more responsive and intuitive journeys.

Market Challenges Analysis:

High Implementation Costs and Technical Complexities Restrain Growth:

The Vehicle emotional intelligence market faces challenges due to high development and integration costs associated with advanced AI, biometric sensors, and real-time analytics. It requires sophisticated hardware and software systems that significantly increase the overall cost of vehicles. Many mid-range and entry-level segments struggle to justify these expenses, slowing widespread adoption. Technical complexities in ensuring accuracy across diverse demographics, driving environments, and cultural variations further complicate deployment. Automakers must balance affordability with innovation to expand adoption beyond premium segments. Limited consumer awareness about the benefits of emotional intelligence in vehicles adds another barrier to rapid market penetration.

Privacy, Data Security, and Regulatory Uncertainty Limit Expansion:

The Vehicle emotional intelligence market also faces concerns around data privacy and compliance with evolving regulations. It depends heavily on continuous collection and processing of sensitive biometric and behavioral data, raising fears of misuse or breaches. Lack of standardized global frameworks for emotional AI in automotive applications creates uncertainty for manufacturers. Different regions impose varied compliance requirements, which slow harmonized adoption. Consumer trust remains fragile, and mismanagement of data could lead to reputational risks for automakers. These factors highlight the urgent need for transparent policies and secure infrastructure to ensure sustainable growth.

Market Opportunities:

Expanding Role of Emotional AI in Next-Generation Mobility Solutions:

The Vehicle emotional intelligence market presents strong opportunities through integration with autonomous driving, connected cars, and smart mobility ecosystems. It can enhance trust in self-driving systems by adapting responses to driver emotions and ensuring passenger comfort during transitions between manual and autonomous modes. Emotional AI also supports fleet operators, ride-sharing companies, and logistics providers by improving safety, efficiency, and customer satisfaction. Growing investment in intelligent mobility platforms creates scope for broader adoption across personal and commercial vehicles. Automakers can leverage emotional AI as a differentiator to meet rising consumer expectations for safety and personalization. This evolving role positions emotional intelligence as a key component of the future automotive landscape.

Growth Potential in Emerging Markets and Mid-Range Vehicle Segments:

The Vehicle emotional intelligence market is set to benefit from rising demand in emerging economies where smart vehicle adoption is accelerating. It offers automakers an opportunity to introduce affordable emotional AI systems tailored for mid-range segments, widening access beyond luxury vehicles. Strong demand for connected and intelligent mobility solutions in Asia-Pacific and Latin America supports large-scale growth. Partnerships with local technology providers and OEMs can further accelerate penetration in price-sensitive markets. Increasing urbanization and expanding consumer awareness about safety and comfort features are creating favorable conditions for adoption. These opportunities highlight the untapped potential of emotional AI in shaping inclusive and scalable automotive innovation.

Market Segmentation Analysis:

By Vehicle:

The Vehicle emotional intelligence market is segmented into passenger vehicles and commercial vehicles, with passenger vehicles holding the dominant share. Automakers are integrating emotional AI in mid-range and premium cars to enhance safety, comfort, and personalization. It supports features such as fatigue monitoring, adaptive infotainment, and mood-based adjustments that appeal strongly to individual buyers. Commercial vehicles are gradually adopting emotional AI to improve fleet safety and reduce accident risks, particularly in logistics and public transportation. Rising investment in smart mobility platforms is expected to increase adoption across both categories.

- For instance, Volvo Trucks partnered with Bendix to deploy the SafetyDirect SDP5 Full processor featuring driver-facing cameras with infrared technology that continuously record up to 145 hours of high-resolution footage for fleet safety analysis.

By Component:

The market is divided into software and hardware components, with software accounting for the larger portion of revenue. It is driven by AI algorithms, natural language processing, and machine learning capabilities that enable accurate emotion recognition. Hardware, including biometric sensors, cameras, and control modules, plays a critical role in collecting and transmitting real-time driver and passenger data. Automakers are focusing on combining robust hardware with scalable software platforms to ensure efficiency and reliability. The growing need for multimodal recognition strengthens opportunities for both components.

- For instance, Tesla’s new mmWave radar sensor operating in the 60-64 GHz frequency band can detect breathing patterns and heart rates to monitor children in vehicles, achieving a 10 Percent duty cycle efficiency.

By Application:

Applications span driver monitoring, safety enhancement, in-cabin personalization, and advanced assistance systems. The Vehicle emotional intelligence market benefits strongly from the rising demand for driver monitoring, which reduces fatigue-related accidents. It also enhances user experience through personalized adjustments in entertainment, lighting, and climate control. Integration with advanced driver assistance systems is creating opportunities for intelligent decision-making in semi-autonomous and autonomous vehicles. This expanding scope highlights the versatility of emotional AI across multiple automotive applications.

Segmentations:

By Vehicle:

- Passenger Vehicles

- Commercial Vehicles

By Component:

By Application:

- Driver Monitoring

- Safety and Assistance Systems

- In-Cabin Personalization

- Autonomous and Connected Driving

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 38% market share in the Vehicle emotional intelligence market, supported by strong demand for connected and autonomous vehicles. The region benefits from heavy investments by automakers and technology firms in AI-driven driver monitoring and personalization features. It is further reinforced by regulatory initiatives that mandate driver safety systems and support integration of advanced driver assistance technologies. Leading OEMs and AI developers in the United States and Canada are actively collaborating to commercialize emotional intelligence solutions. Growing consumer acceptance of intelligent in-cabin experiences strengthens adoption in luxury and premium segments. The region’s early adoption of innovative automotive technologies ensures a steady path for expansion.

Europe:

Europe accounts for 31% market share in the Vehicle emotional intelligence market, driven by stringent safety regulations and sustainability goals. Governments across the region mandate driver monitoring systems to reduce accidents and improve road safety. It has led to significant adoption in both premium and mid-range vehicles, particularly in countries like Germany, France, and the United Kingdom. Strong presence of global automotive manufacturers and suppliers further accelerates integration of emotional AI solutions. Europe also emphasizes R&D partnerships with universities and technology providers to advance multimodal recognition systems. Rising consumer focus on personalized mobility experiences supports steady growth across the region.

Asia-Pacific:

Asia-Pacific secures 24% market share in the Vehicle emotional intelligence market and is expected to expand rapidly due to high vehicle production in China, Japan, and South Korea. It benefits from strong consumer demand for intelligent, connected vehicles and expanding middle-class purchasing power. Automakers in the region actively integrate AI-powered driver assistance features into both luxury and mass-market vehicles. Government initiatives promoting smart mobility and urban transportation innovation provide further momentum. Partnerships between global technology firms and local OEMs accelerate commercialization of cost-effective emotional AI systems. Rising adoption in India and Southeast Asia enhances the region’s role as a major growth hub for the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Affectiva

- AVATR Technology

- Antolin

- Robert Bosch GmbH

- BMW AG

- Cerence

- Forvia

- Eyeris AI

- Harman International

- Kia Corporation

Competitive Analysis:

The Vehicle emotional intelligence market is moderately competitive, driven by established automotive leaders and specialized AI firms focusing on emotion recognition and driver monitoring. Key players such as Affectiva and Cerence emphasize advanced AI algorithms, multimodal emotion detection, and real-time personalization features. AVATR Technology and Antolin are investing in integrating emotional AI with next-generation mobility and in-cabin systems to strengthen user experience. Robert Bosch GmbH leverages its strong position in automotive electronics to expand emotional intelligence capabilities across both hardware and software platforms. BMW AG integrates emotional AI into premium vehicles, reinforcing its reputation for innovation and driver-centric design. It reflects a landscape shaped by partnerships, acquisitions, and continuous R&D efforts, with competition centered on accuracy, cost efficiency, and regulatory compliance. This dynamic competitive environment ensures steady innovation while expanding applications across luxury and mass-market vehicles.

Recent Developments:

- In September 2024, Affectiva launched a groundbreaking calibration-free eye tracking feature that eliminates calibration exercises and works through standard webcams, enhancing user experience in market research.

- In July 2025, AVATR unveiled a new 5G-AI factory capable of building one car every 60 seconds and teased a flagship SUV developed with Huawei.

- In July 2025, Bosch signed a Memorandum of Understanding with Tata Electronics to collaborate strategically in electronics and semiconductor manufacturing and technology, including upcoming chip packaging and manufacturing facilities in India.

Market Concentration & Characteristics:

The Vehicle emotional intelligence market reflects moderate concentration with a mix of established automotive OEMs, technology leaders, and emerging AI-focused startups shaping competition. It is characterized by continuous innovation in multimodal emotion recognition, biometric integration, and real-time analytics for enhanced driver safety and in-cabin personalization. Leading companies focus on strategic partnerships, acquisitions, and collaborations to expand product portfolios and accelerate deployment across premium and mid-range vehicles. It demonstrates high entry barriers due to significant R&D investment, data privacy compliance, and the need for advanced AI expertise. Regional adoption patterns vary, with North America and Europe leading in regulatory-driven integration while Asia-Pacific emerges as a fast-growth hub. The market structure highlights a balance of global innovation and regional specialization, supporting sustainable long-term growth.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle, Component, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Vehicle emotional intelligence market will evolve as a core enabler of next-generation mobility by combining AI, biometrics, and advanced analytics.

- Automakers will integrate emotion recognition systems into mainstream vehicle models to expand adoption beyond premium segments.

- Growth in autonomous driving will strengthen demand for emotional AI to improve trust and passenger experience during transitions from manual to automated control.

- The use of multimodal recognition systems that merge facial, voice, and physiological data will deliver higher accuracy and reliability.

- Partnerships between automotive OEMs, AI developers, and electronics suppliers will accelerate commercialization of innovative emotional intelligence solutions.

- Regional growth in Asia-Pacific will intensify as consumers adopt smart vehicles and governments support intelligent mobility initiatives.

- The role of emotional AI in connected car ecosystems will expand through integration with infotainment, navigation, and cloud-based services.

- Rising consumer awareness of safety and personalized comfort will create stronger demand across passenger and commercial vehicle fleets.

- Data privacy frameworks and ethical AI practices will gain importance to ensure trust and regulatory compliance.

- Continuous advancements in machine learning and natural language processing will shape vehicles into highly adaptive, interactive environments.