Market Overview

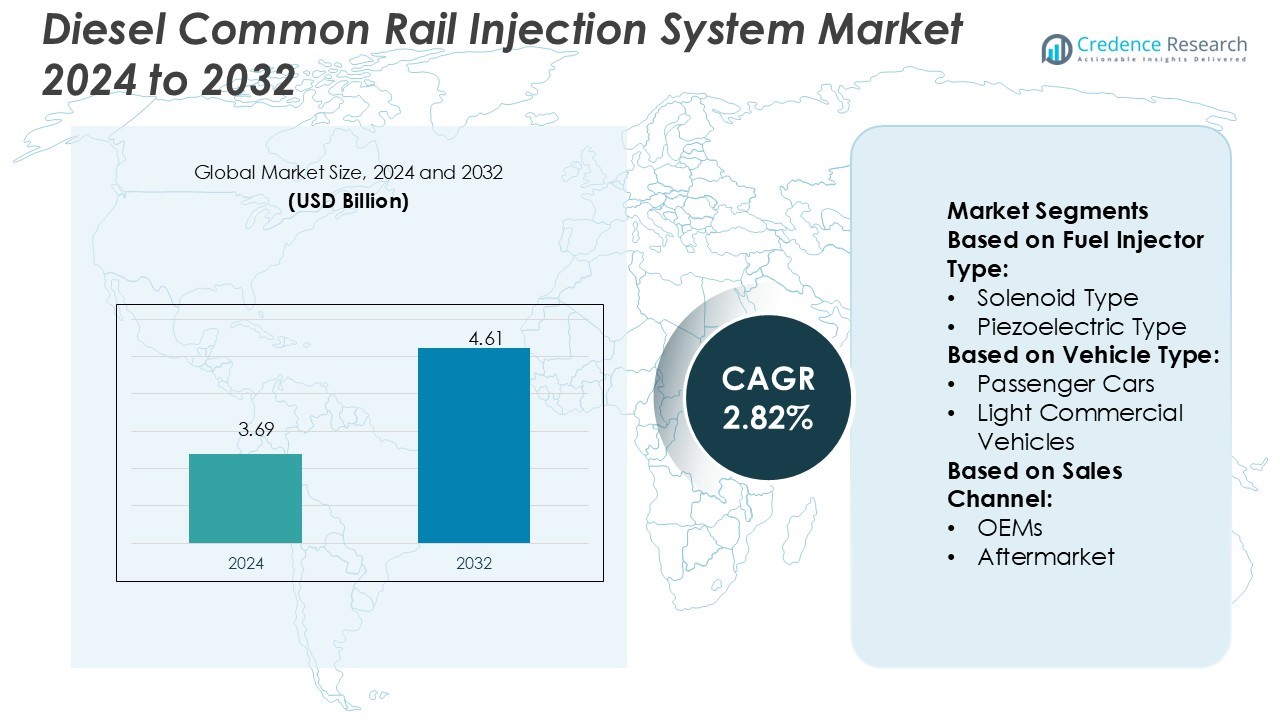

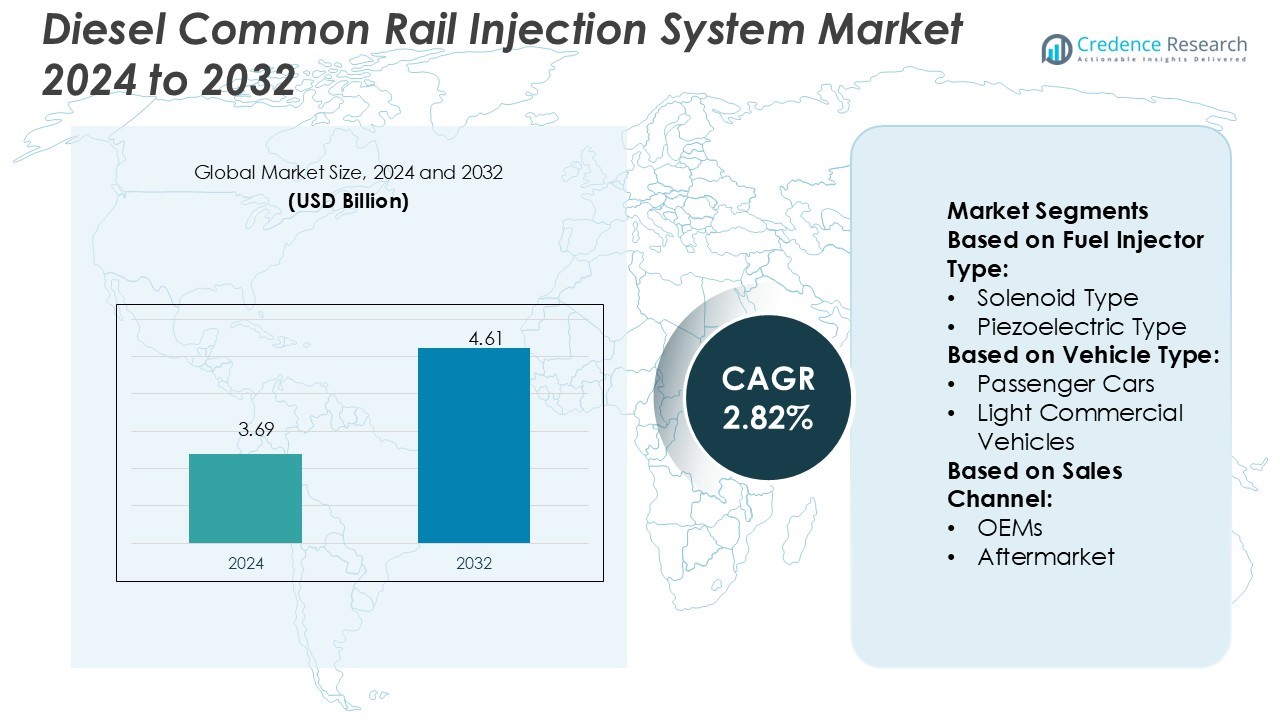

Diesel Common Rail Injection System Market size was valued USD 3.69 billion in 2024 and is anticipated to reach USD 4.61 billion by 2032, at a CAGR of 2.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Common Rail Injection System Market Size 2024 |

USD 3.69 Billion |

| Diesel Common Rail Injection System Market, CAGR |

2.82% |

| Diesel Common Rail Injection System Market Size 2032 |

USD 4.61 Billion |

The Diesel Common Rail Injection System Market is driven by top players such as Cummins Inc., Kohler Co., Rolls-Royce plc, Honda India Power Products Ltd., Generac Power System Inc., Doosan Portable Power, Caterpillar, Wartsila Corporation, Atlas Copco AB, and AKSA Power Generation Company. These companies focus on advanced injection technologies, emission control solutions, and digital engine management to strengthen their global presence. Asia Pacific leads the market with a 34% share, supported by strong automotive production in China, India, and Japan. Strategic investments in high-pressure systems, localized manufacturing, and R&D enhance the region’s dominance. Expanding transportation and industrial activities further boost demand, positioning Asia Pacific as the key growth hub for diesel injection technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diesel Common Rail Injection System Market was valued at USD 3.69 billion in 2024 and is projected to reach USD 4.61 billion by 2032, growing at a CAGR of 2.82%.

- Rising demand for fuel-efficient diesel engines and strict emission norms are driving market expansion across automotive, construction, and industrial sectors.

- Asia Pacific holds a 34% share of the market, supported by high automotive production and investments in advanced injection systems, while Europe and North America follow with steady demand growth.

- Key players focus on developing high-pressure injection technologies, digital engine management, and localized manufacturing to strengthen their market presence.

- Limited electrification in heavy-duty applications and cost constraints in system upgrades act as restraints, but strong regional demand and product innovation sustain market competitiveness.

Market Segmentation Analysis:

By Fuel Injector Type

The solenoid type segment holds the dominant market position with a 64% share in the diesel common rail injection system market. This segment leads due to its lower manufacturing cost, robust performance, and compatibility with a wide range of diesel engines. Automakers prefer solenoid injectors for their reliability in high-pressure applications and ease of integration with existing engine designs. The rising demand for commercial and passenger vehicles in emerging economies further drives adoption. Continuous improvements in injector precision and durability also strengthen the solenoid type’s leadership in this segment.

- For instance, Cummins Inc. is a leader in high-pressure fuel injection systems, including its XPI ultra-high-pressure common rail system, which can achieve pressure ratings up to 2,600 bar and is designed to reduce emissions and improve fuel efficiency.

By Vehicle Type

Passenger cars account for the largest market share of 57% in the diesel common rail injection system market. This dominance is driven by the widespread use of diesel engines in passenger vehicles, especially in regions with strong demand for fuel-efficient transportation. Automakers focus on advanced injection systems to meet stricter emission norms and improve fuel economy. Increased production of diesel-powered sedans and SUVs, coupled with rising consumer preference for high-mileage vehicles, supports this growth. The expanding urban population and growing disposable incomes further enhance the adoption rate in this segment.

- For instance, Kohler Co. equips its KDI 3404 engine with a 2,000 bar high-pressure common rail system and an electronically controlled EGR valve for cleaner combustion.The KDI line offers a max torque of 500 Nm at 1,400 rpm in variants compliant with Stage V / Tier 4 standards.

By Sales Channel

OEMs lead the market with a 71% share in the diesel common rail injection system segment. Original equipment manufacturers dominate as most injection systems are integrated during vehicle production to meet performance and regulatory standards. The growing adoption of advanced diesel technologies by major automakers strengthens OEM supply chains. Continuous technological upgrades, such as improved injection pressure and precision control, increase OEM dependence on reliable injector systems. Rising global vehicle production, especially in Asia-Pacific and Europe, further fuels this segment’s leadership position over the aftermarket.

Key Growth Drivers

Rising Demand for Fuel-Efficient Vehicles

The increasing focus on fuel efficiency is driving the adoption of diesel common rail injection systems. This technology enables precise fuel delivery at high pressure, improving combustion and reducing fuel consumption. Automakers integrate these systems to meet stricter emission norms and enhance mileage. For example, Bosch’s CRI systems operate at pressures exceeding 2,500 bar, improving efficiency and power output. The growing preference for diesel engines in commercial vehicles and passenger cars is further accelerating market growth.

- For instance, Rolls-Royce plc, through its mtu brand, manufactures advanced common-rail injection systems for its Series 4000 engines, designed to continuously improve fuel efficiency and reduce emissions.

Stringent Emission Regulations

Global emission norms are becoming stricter, compelling manufacturers to adopt advanced injection technologies. Common rail injection systems help meet Euro 6, Bharat Stage VI, and EPA standards by ensuring cleaner combustion and lower NOx emissions. Companies like Denso are investing in injection systems with improved atomization for better emission control. This regulatory pressure encourages OEMs to replace older systems with modern CRI systems, boosting market expansion across developed and emerging economies.

- For instance, Honda’s 1.5L i-DTEC engine, part of the Earth Dreams Technology family, features a common rail system, a variable geometry turbocharger, and a 16.0:1 compression ratio. In BS4 and BS6 configurations, this engine is known to produce 200 Nm of torque at 1,750 rpm.

Advancements in Injection Technology

Rapid technological innovation is transforming diesel engine performance. Next-generation common rail systems deliver ultra-high injection pressures, multiple injection events, and precise control through electronic units. For instance, Delphi’s advanced injectors enhance power output while minimizing particulate emissions. These innovations enable OEMs to offer engines with better performance, lower noise, and improved durability. The continuous R&D investment by key players supports the widespread integration of CRI systems in modern diesel vehicles.

Key Trends & Opportunities

Integration with Electrified Powertrains

The market is witnessing a shift toward hybrid and mild-hybrid diesel vehicles. CRI systems are being adapted for hybrid architectures to balance power and efficiency. Manufacturers are integrating intelligent ECUs with advanced sensors to optimize injection timing. For example, Continental’s systems support hybrid configurations by enabling low-load efficiency improvements. This trend creates new opportunities for system suppliers to serve both traditional and electrified vehicle platforms.

- For instance, Generac’s SDMD2500 industrial diesel generator is equipped with a 65.6-L Baudouin M55 engine. The M55 engine features a high-pressure common rail fuel system for improved performance and reliability in demanding applications.

Adoption of Digital Control and AI Technologies

Digitalization and AI-driven controls are improving injection precision and predictive maintenance. AI algorithms enable real-time adjustments for load variations, reducing emissions and wear. Companies like Bosch and Denso are incorporating self-learning ECU software to boost reliability and lifecycle performance. This transition toward intelligent injection systems positions manufacturers to meet future emission standards and enhance engine performance.

- For instance, Caterpillar released its Cat C2.8 and C3.6 industrial power units, which both feature common-rail direct injection controlled by an engine control module (ECM). This electronically controlled system precisely manages the fuel injection process to optimize performance and meet emissions standards.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Africa, and Latin America offer strong growth potential. Rising vehicle production, urbanization, and infrastructure projects drive the need for efficient diesel engines. CRI systems are being adopted in commercial fleets to improve fuel economy and reduce maintenance costs. This creates lucrative opportunities for OEMs and component suppliers to expand their regional footprints.

Key Challenges

High System Cost and Complexity

The advanced design and components of CRI systems increase overall vehicle cost. These systems require high-precision injectors, pumps, and ECUs, which are expensive to produce and maintain. For example, high-pressure pumps can cost several times more than conventional injection systems. This cost factor limits adoption in cost-sensitive markets and low-priced vehicle segments.

Shift Toward Electrification

The global automotive industry is gradually transitioning toward electric mobility. Governments offer incentives for EVs, and OEMs are reducing diesel investments. This shift may slow CRI system demand, especially in passenger cars. Suppliers must adapt their strategies, focusing on hybrid integration and commercial applications to sustain market relevance amid changing powertrain landscapes.

Regional Analysis

North America

North America holds a 29% share of the diesel common rail injection system market. The U.S. and Canada drive demand through their strong automotive and commercial vehicle sectors. Heavy-duty trucks and light commercial vehicles rely on high-efficiency injection systems to meet fuel economy and emission standards. Companies such as Bosch and Delphi expand their presence through advanced injector technologies and emission control solutions. Growing investments in hybrid diesel systems also support regional growth. Rising logistics activities and government mandates on fuel efficiency further boost adoption across key transportation and construction industries.

Europe

Europe accounts for a 26% share of the market, supported by strict Euro 6 emission standards. Germany, France, and the U.K. lead demand through advanced automotive manufacturing and clean diesel technologies. OEMs focus on integrating high-pressure injection systems to meet emission norms while maintaining engine performance. Companies like Continental AG and Bosch drive innovation with low-emission injector solutions. The presence of a well-established vehicle manufacturing base enhances market expansion. Increasing investments in green mobility and cleaner engines also accelerate system upgrades across both passenger and commercial vehicle fleets.

Asia Pacific

Asia Pacific leads the market with a 34% share, driven by rapid automotive production in China, India, and Japan. Rising demand for commercial vehicles and off-road machinery strengthens the region’s position. OEMs invest in cost-efficient and advanced common rail injection systems to meet stricter emission regulations like BS VI and China VI. Companies including Denso and Bosch have expanded their production capacity in the region. Growing logistics, construction, and industrial activities further fuel diesel engine demand. Technological upgrades and localized manufacturing give the region a strong cost advantage.

Latin America

Latin America holds an 8% share of the global market. Brazil and Mexico dominate with expanding automotive assembly plants and agricultural machinery demand. OEMs are focusing on modernizing diesel engines with efficient injection systems to improve performance and reduce emissions. Global suppliers are forming partnerships with local manufacturers to meet cost targets and emission standards. The region’s demand is also supported by rising transportation activities and infrastructure development. Adoption remains moderate but steady, supported by government initiatives to modernize commercial vehicle fleets and construction equipment.

Middle East & Africa

The Middle East & Africa region represents a 3% share of the market. Demand is concentrated in GCC countries, South Africa, and Egypt, driven by the construction, mining, and logistics sectors. Diesel-powered commercial vehicles and equipment dominate due to limited electrification. OEMs and system suppliers focus on reliable, high-durability injection technologies suitable for harsh operating conditions. Bosch and Denso strengthen distribution networks to support service demand. Infrastructure development and energy sector activities also create steady market growth, though regulatory enforcement on emissions remains less stringent than in developed regions.

Market Segmentations:

By Fuel Injector Type:

- Solenoid Type

- Piezoelectric Type

By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

By Sales Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diesel Common Rail Injection System Market is shaped by Cummins Inc., Kohler Co., Rolls-Royce plc, Honda India Power Products Ltd., Generac Power System Inc., Doosan Portable Power, Caterpillar, Wartsila Corporation, Atlas Copco AB, and AKSA Power Generation Company. The Diesel Common Rail Injection System Market is defined by strong technological innovation and strategic expansion. Leading companies are investing heavily in R&D to enhance fuel injection precision, reduce emissions, and improve engine performance. Many manufacturers focus on integrating high-pressure systems and smart electronic control units to meet global emission standards. Strategic partnerships, mergers, and collaborations help expand production capacity and strengthen supply chain networks. Companies are also investing in localized manufacturing to reduce costs and improve delivery timelines. Advanced injector designs, improved fuel atomization, and digital monitoring solutions provide a strong competitive edge. These efforts position leading market participants to cater to rising demand from automotive, construction, agriculture, and industrial sectors worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, Hatz Americas Inc. expanded its power generation product portfolio to include AC and DC mobile diesel generators for recreational vehicle and industrial markets, following its acquisition of rights to RV generators previously produced by Dometic Italy SPA, reinforcing Hatz’s position in diesel/electric hybrid applications.

- In October 2024, French power firm Baudouin launched a new range of diesel generator sets for data centers, offering integrated solutions with outputs between 2000 kVA and 5250 kVA, powered by the M33 and M55 series.

- In November 2023, Hitachi Energy announced a new emission-free alternative like hydrogen power generators for diesel-powered generators. Hydrogen power generators provide heat for hard-to-decarbonize and megawatt (MW) power, which is beneficial for hospitals, data centers, remote venues, and construction sites.

- In August 2023, Mitsubishi Heavy Industries Engine and Turbocharger, Ltd (MHIET) launched a new 3000 KVA class generator, MGS3100R, for industrial needs including data centers, hospitals, commercial buildings, and factories for supplying power at the time of disasters, power failures, and power crunches.

Report Coverage

The research report offers an in-depth analysis based on Fuel Injector Type, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising diesel engine demand in commercial vehicles.

- Manufacturers will focus on developing high-pressure injection systems for better fuel efficiency.

- Stricter global emission standards will push companies to adopt cleaner combustion technologies.

- Integration of smart sensors and electronic controls will enhance system performance.

- Demand from construction, agriculture, and marine industries will support long-term expansion.

- Localized manufacturing and cost optimization will become a key strategy for global players.

- Advanced injector materials and designs will improve durability and reduce maintenance needs.

- Hybrid diesel systems will gain traction as industries aim for lower emissions.

- Strategic collaborations will accelerate innovation and strengthen global supply chains.

- Digital diagnostics and predictive maintenance features will enhance operational reliability.