Market Overview:

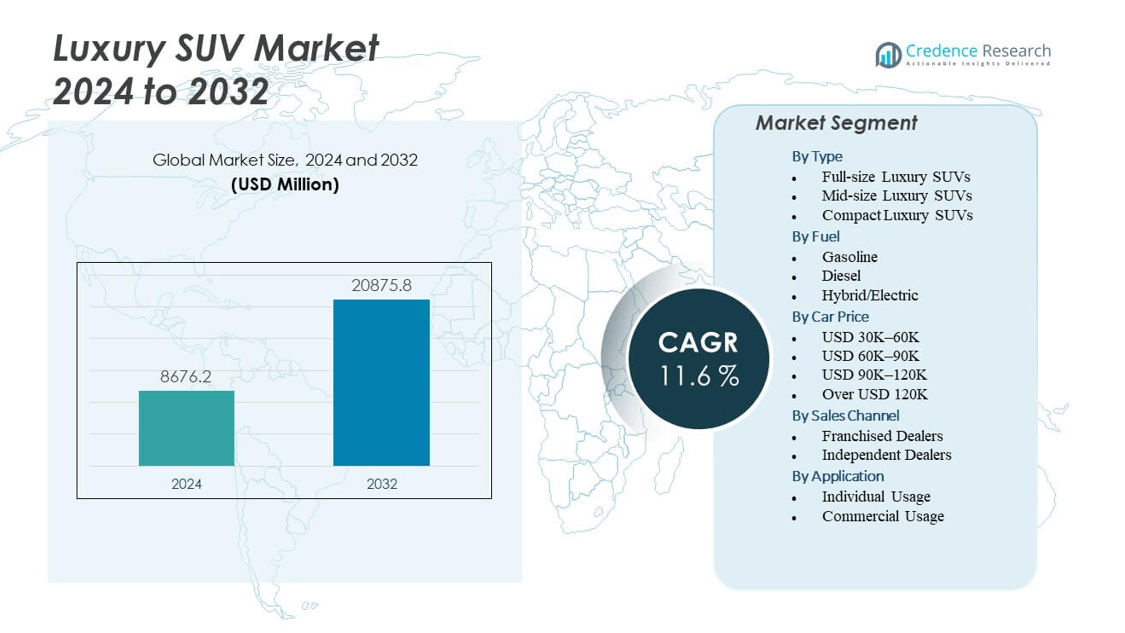

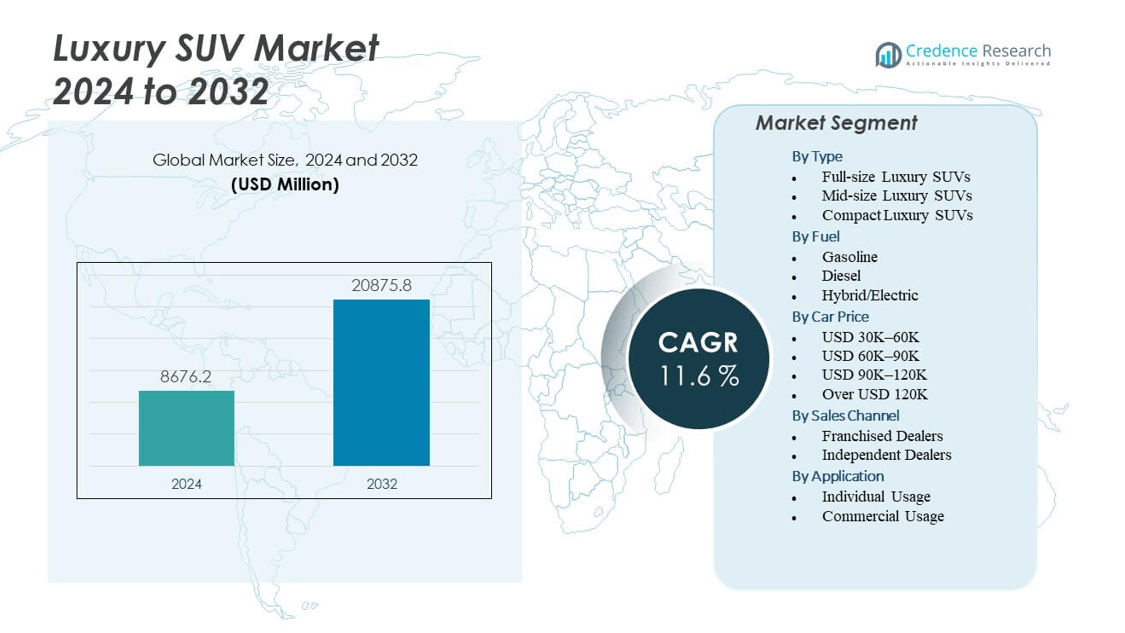

The Luxury SUV Market is projected to grow from USD 8,676.2 million in 2024 to an estimated USD 20,875.8 million by 2032, with a compound annual growth rate (CAGR) of 11.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury SUV Market Size 2024 |

USD 8,676.2 million |

| Luxury SUV Market, CAGR |

11.6% |

| Luxury SUV Market Size 2032 |

USD 20,875.8 million |

The market growth is driven by rising consumer preference for premium vehicles that combine performance, comfort, and advanced technology. Increasing disposable incomes, especially among affluent urban populations, are fueling demand for luxury SUVs. Automakers are integrating cutting-edge features such as AI-based driver assistance, advanced infotainment systems, and sustainable hybrid or electric models to attract buyers. Furthermore, shifting lifestyle trends toward spacious vehicles with superior off-road and city-driving capabilities are accelerating adoption.

Regionally, North America and Europe lead the market due to their strong base of luxury car buyers, mature automotive infrastructure, and established premium brands. The United States and Germany remain key contributors, supported by demand for innovation and advanced safety features. In contrast, Asia-Pacific, particularly China and India, is emerging rapidly as growing middle-class wealth and urbanization boost luxury vehicle adoption. The Middle East also represents a lucrative region, driven by high purchasing power and preference for large, premium SUVs suited to diverse terrains.

Market Insights:

- The Luxury SUV Market is projected to grow from USD 8,676.2 million in 2024 to USD 20,875.8 million by 2032, registering a CAGR of 11.6%.

- Rising disposable incomes and demand for premium comfort and performance drive adoption of luxury SUVs globally.

- Growing preference for hybrid and electric variants strengthens market expansion, supported by regulatory incentives.

- High production costs and supply chain disruptions limit profit margins for automakers.

- Stringent emissions regulations challenge traditional fuel-powered SUV growth, requiring heavy investments in electrification.

- North America leads the market with a 38% share, followed by Europe at 29%, supported by strong luxury consumer bases.

- Asia-Pacific shows the fastest growth trajectory, driven by urbanization, rising affluence, and expanding middle-class demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Affluence and Increasing Preference for High-End Automotive Experiences

Growing disposable income among affluent consumers has created a strong appetite for premium vehicles with superior comfort and performance. Buyers seek advanced safety technologies, personalized interiors, and seamless connectivity that elevate the driving experience. The Luxury SUV Market benefits from this rising demand, with customers associating SUVs with prestige, versatility, and reliability. It reflects a shift from conventional sedans to larger vehicles that provide both luxury and utility. Automakers are focusing on crafting vehicles with powerful engines and refined features to capture this segment. The strong aspiration for exclusive brands continues to strengthen market expansion.

- For example, the Mercedes-Benz GLS luxury SUV, equipped with a 4.0L V8 biturbo engine with EQ Boost, delivers 510 horsepower in its latest GLS 580 variant, reinforcing its reputation for power and luxury. Earlier versions of the GLS with the same engine configuration were rated at 483 horsepower.

Expansion of Hybrid and Electric Models Supporting Environmental Awareness

Rising awareness of environmental concerns is shifting buyer preference toward sustainable vehicles. Automakers invest heavily in hybrid and electric SUV models to meet regulatory expectations and appeal to eco-conscious consumers. The Luxury SUV Market gains momentum from this transition, with premium electric SUVs combining green credentials with advanced technology. It supports automakers in differentiating their offerings in competitive markets. Governments encourage adoption through subsidies and charging infrastructure investment. Luxury buyers increasingly view eco-friendly choices as part of their lifestyle, reinforcing market growth. The industry responds by accelerating innovation in battery efficiency and range.

- For example, Tesla’s Model X Long Range SUV currently offers an EPA-rated range of up to 335 miles per charge with 20-inch wheels, while the version with 22-inch wheels delivers about 322 miles, highlighting the brand’s strength in sustainable luxury mobility.

Advanced Technology Integration Reinforcing Consumer Appeal and Demand

Automakers equip premium SUVs with innovations such as AI-based driver assistance, adaptive cruise control, and high-resolution digital displays. These features enhance both safety and convenience, creating a premium ownership experience. The Luxury SUV Market thrives on this wave of technological innovation, which sets premium vehicles apart from mainstream models. It allows manufacturers to capture consumer loyalty by delivering smart, connected, and secure driving solutions. Buyers value features that integrate with smartphones and home devices, improving convenience and personalization. The demand for advanced driving aids highlights the significance of research and development investment. Increasing competition motivates brands to offer superior technology packages.

Lifestyle Shifts Toward Spacious and Versatile Premium Vehicles

Urban buyers are showing preference for SUVs that combine city comfort with long-distance travel reliability. Families and professionals increasingly prioritize vehicles that offer flexible seating, cargo space, and luxury features. The Luxury SUV Market responds by offering models that balance performance, design, and practicality. It reflects changing consumer lifestyles where cars serve both functional and aspirational roles. Automakers invest in distinctive styling, luxurious interiors, and enhanced safety measures to align with these shifts. The popularity of SUVs in both developed and emerging markets demonstrates how preferences are evolving. Premium positioning ensures buyers perceive these vehicles as status symbols.

Market Trends:

Growing Influence of Digital Retail Platforms in Luxury Vehicle Purchases

The luxury vehicle purchasing process is evolving with the rapid adoption of digital retail platforms. Buyers increasingly expect virtual showrooms, online customization tools, and remote consultation with dealerships. The Luxury SUV Market adapts to these expectations by offering seamless digital experiences that align with the convenience-driven mindset of modern buyers. It strengthens the connection between brands and consumers through personalized interactions. Enhanced digital channels create opportunities for showcasing vehicle features in immersive formats. Online platforms reduce reliance on traditional dealerships while maintaining exclusivity. This trend emphasizes the role of technology in shaping luxury retail.

Personalization and Customization Setting New Standards for Ownership

High-net-worth buyers prioritize vehicles that reflect individuality and lifestyle preferences. Automakers now provide extensive customization options for interiors, exteriors, and technology packages. The Luxury SUV Market is increasingly defined by the ability of brands to deliver personalized experiences that go beyond standard offerings. It enhances exclusivity and creates stronger emotional connections between buyers and brands. Manufacturers focus on unique trims, premium materials, and bespoke finishes that appeal to elite customers. Customization drives higher margins and brand loyalty. Buyers value differentiation that reinforces their identity and social standing through vehicle ownership.

- For example, BMW Individual offers extensive bespoke options, including unique paint finishes and handcrafted interior choices, allowing customers to tailor vehicles precisely to their preferences. While order volumes are not disclosed, the program emphasizes exclusivity and personalization in the Luxury SUV Market.

Integration of Autonomous Driving Features Enhancing Future Readiness

The push toward autonomous mobility has entered the premium SUV segment, with automakers experimenting with semi-autonomous and self-parking technologies. Consumers associate these advancements with luxury, safety, and convenience. The Luxury SUV Market witnesses strong demand for vehicles that integrate intelligent features enabling hands-free driving in controlled environments. It positions premium brands as leaders in innovation. The inclusion of autonomous functions elevates the perception of value among buyers seeking futuristic experiences. Automakers continue refining sensors, AI systems, and adaptive learning algorithms to expand adoption. The trend reflects how premium markets act as early adopters of breakthrough technologies.

- For example, Audi developed the Traffic Jam Pilot a Level 3 autonomous driving system originally envisioned for the A8 sedan to manage slow highway traffic up to around 37 mph, but there’s no evidence it has been implemented in the Q8 or deployed widely to customers.

Sustainability and Circular Economy Practices Driving Brand Value

Luxury brands are increasingly emphasizing sustainable sourcing of materials and eco-friendly production methods. Customers expect premium vehicles to align with ethical and environmental values. The Luxury SUV Market integrates circular economy practices such as recycled interior components and carbon-neutral production facilities. It strengthens brand reputation among environmentally conscious buyers. The adoption of bio-based leathers, recycled plastics, and low-emission manufacturing processes reinforces credibility. Automakers highlight transparency in supply chains to appeal to discerning buyers. This trend ensures sustainability becomes central to luxury positioning. The shift also enhances competitiveness against new entrants promoting eco-luxury concepts.

Market Challenges Analysis:

High Production Costs and Supply Chain Disruptions Limiting Profit Margins

Premium SUVs demand advanced materials, sophisticated electronics, and high-performance engines, which elevate production costs. Global supply chain disruptions for semiconductors, batteries, and rare metals further increase manufacturing challenges. The Luxury SUV Market experiences pressure as rising costs threaten profitability and delay product launches. It pushes automakers to invest heavily in local sourcing and resilient supply chains. Unpredictable geopolitical conditions and fluctuating raw material prices exacerbate risks. Luxury brands face the difficulty of balancing exclusivity with affordability. The industry remains vulnerable to prolonged shortages that directly affect delivery timelines.

Stringent Regulations and Growing Competition Affecting Long-Term Stability

Governments enforce stricter emissions regulations and safety standards, creating compliance challenges for luxury automakers. Traditional fuel-powered SUVs face rising scrutiny, requiring costly investments in electrification. The Luxury SUV Market faces intense competition from both established brands and disruptive entrants. It forces companies to differentiate with innovation while managing regulatory pressures. New startups focused on premium electric SUVs create competitive intensity. Compliance costs reduce margins for established players, challenging their long-term growth strategies. The evolving regulatory landscape requires continuous adaptation and higher R&D budgets, which stretch profitability and slow expansion.

Market Opportunities:

Expanding Emerging Market Demand and Rising Middle-Class Affluence

Emerging economies present strong growth opportunities due to rapid urbanization, rising disposable incomes, and lifestyle shifts. The Luxury SUV Market benefits from growing aspirations among middle-class buyers in regions such as Asia-Pacific and Latin America. It enables automakers to capture demand from new consumer segments that view luxury SUVs as status symbols. Manufacturers can expand dealership networks, invest in localized production, and tailor offerings to cultural preferences. The increasing penetration of premium SUVs in urban centers reinforces this opportunity. The untapped potential of younger demographics further boosts the long-term outlook.

Technological Innovation and Electrification Unlocking New Growth Pathways

Advances in autonomous driving, AI-powered safety, and sustainable electrification create long-term opportunities for luxury brands. The Luxury SUV Market evolves as automakers introduce vehicles with extended range, faster charging, and improved connectivity. It allows companies to align with environmental regulations while appealing to technology-focused buyers. Investment in hydrogen fuel cell vehicles and next-generation battery systems creates new avenues for expansion. Opportunities also emerge from integrating luxury with digital ecosystems such as smart homes and IoT devices. Premium consumers demand futuristic features, pushing innovation to become a key differentiator in the market.

Market Segmentation Analysis:

The Luxury SUV Market is segmented

By type into full-size, mid-size, and compact categories. Full-size luxury SUVs hold a dominant share due to their superior cabin space, towing capacity, and strong multi-terrain performance. Mid-size SUVs appeal to buyers seeking a balance of advanced features and comfort, while compact SUVs attract urban consumers valuing efficiency and maneuverability.

- For example, compact luxury SUVs attract urban consumers valuing efficiency and maneuverability. The premium electric ZEEKR X measures 4,432 mm in length with a 2,750 mm wheelbase, offering a design well-suited for megacities and busy streets while projecting refined, urban styling.

By fuel, gasoline-powered SUVs remain most preferred for refinement and availability, while hybrid and electric models are gaining strong traction with sustainability-focused buyers. Diesel retains relevance in select regions with demand for torque and efficiency.

- For example, the Lexus LX 600 gasoline variant powers its drivetrain with a 3.4-liter twin-turbo V6 engine producing 409 horsepower and 479 lb-ft of torque, paired with a 10-speed automatic transmission to deliver smooth and reliable performance in the Luxury SUV Market.

By car price, the market spans USD 30K–60K, USD 60K–90K, USD 90K–120K, and above USD 120K. Vehicles priced above USD 120K strengthen brand exclusivity and cater to affluent buyers seeking advanced performance and bespoke features. The USD 60K–90K range shows strong demand, appealing to consumers who balance luxury and affordability.

By sales channel, franchised dealers dominate with exclusive networks and premium services, while independent dealers retain a smaller share through flexible pricing.

By application, individual usage leads, driven by consumer preference for personal comfort and performance, while commercial usage grows in executive transport, hospitality, and premium fleet services.

Segmentation:

By Type

- Full-size Luxury SUVs

- Mid-size Luxury SUVs

- Compact Luxury SUVs

By Fuel

- Gasoline

- Diesel

- Hybrid/Electric

By Car Price

- USD 30K–60K

- USD 60K–90K

- USD 90K–120K

- Over USD 120K

By Sales Channel

- Franchised Dealers

- Independent Dealers

By Application

- Individual Usage

- Commercial Usage

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Luxury SUV Market with 38%. Strong demand in the United States and Canada is driven by high consumer purchasing power, a preference for full-size premium vehicles, and the presence of leading automakers. It benefits from mature automotive infrastructure, established dealer networks, and consistent innovation in advanced safety and infotainment features. Consumers in the region favor spacious SUVs that combine luxury and utility for urban and off-road use. Premium brands continue to strengthen market leadership through innovative launches and exclusive offerings.

Europe accounts for 29% of the Luxury SUV Market, supported by a strong base of luxury car manufacturers and an affluent consumer demographic. The region demonstrates consistent demand for mid-size and compact models that combine performance with advanced sustainability features. It benefits from strict emission regulations that encourage adoption of hybrid and electric SUVs. Germany, the United Kingdom, and France remain leading contributors with a focus on engineering excellence and technology integration. Consumers in Europe prioritize safety, design, and innovation, sustaining a competitive premium market environment.

Asia-Pacific represents 23% of the Luxury SUV Market and shows the fastest growth rate. Rising affluence in China and India, urbanization, and expanding middle-class wealth drive strong adoption. It attracts both international brands and local manufacturers targeting premium segments. Consumers value luxury SUVs for their status appeal, versatility, and advanced features, making the region highly dynamic. Latin America contributes 6% with steady growth led by Brazil and Mexico, while the Middle East & Africa hold 4%, supported by strong purchasing power and demand for rugged premium SUVs. It reflects a balanced regional distribution with clear dominance in developed markets and rising momentum in emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BMW

- Mercedes-Benz

- Audi

- Porsche

- Rolls-Royce

- Lamborghini

- Aston Martin

- Ferrari

- Cadillac

- Land Rover

- Lexus

- Tesla

- Genesis

- Lincoln

- Volvo

- Jeep

Competitive Analysis:

The Luxury SUV Market features intense competition driven by established automakers and emerging players entering the premium segment. Leading brands such as BMW, Mercedes-Benz, Audi, and Land Rover dominate with extensive product portfolios and strong global presence. It emphasizes continuous innovation in advanced safety systems, electric drivetrains, and connected technologies to maintain market leadership. Companies like Tesla and Genesis challenge traditional luxury brands with innovative designs and electric offerings. Ultra-luxury manufacturers including Rolls-Royce, Lamborghini, and Aston Martin expand their presence with niche models, enhancing exclusivity. Competitive differentiation relies on brand reputation, technology integration, and after-sales service excellence.

Recent Developments:

- In Aug 2025, BMW launched the highly anticipated BMW X8, a flagship luxury SUV combining cutting-edge technology and powerful performance. The X8 offers a range of powertrains including a twin-turbocharged V8 and a plug-in hybrid, with the top-tier X8M model delivering over 600 horsepower and featuring an advanced all-wheel-drive system for a dynamic yet smooth ride.

- In August 2024, BYD partnered with Huawei to integrate advanced autonomous driving technology into its upcoming Fangchengbao luxury SUV lineup. This partnership highlights the emphasis on cutting-edge autonomous features in luxury SUVs, enhancing safety and smart functionality.

Market Concentration & Characteristics:

The Luxury SUV Market reflects a moderately concentrated structure dominated by global premium automakers with diversified product lines. It demonstrates strong brand loyalty, high entry barriers, and significant investment in research, design, and advanced technologies. Competitive intensity is defined by continuous innovation, luxury personalization, and sustainability-focused strategies, ensuring premium positioning and long-term consumer engagement. It shows resilience to economic fluctuations due to affluent consumer bases. It continues to evolve with a growing emphasis on electric mobility and digital transformation across leading brands.

Report Coverage:

The research report offers an in-depth analysis based on Type, Fuel, Car Price, Sales Channel, and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Luxury SUV Market will expand with rising consumer preference for premium vehicles that combine comfort, performance, and advanced technology.

- Demand for hybrid and electric SUVs will grow as sustainability and stricter environmental regulations reshape automotive strategies.

- Emerging economies will contribute significantly due to rising affluence, urbanization, and a growing middle-class base.

- Luxury automakers will prioritize innovation in autonomous driving features to strengthen brand positioning.

- Premium personalization and customization options will remain key factors in enhancing consumer loyalty.

- Digital retail platforms and virtual showrooms will redefine luxury purchasing experiences and broaden customer engagement.

- Strong competition from traditional brands and disruptive entrants will drive continuous product innovation.

- Integration of eco-friendly materials and circular economy practices will become central to luxury vehicle manufacturing.

- The ultra-luxury segment will see niche growth supported by exclusive launches from elite automotive brands.

- Strategic investments in electrification, smart connectivity, and sustainable production will shape the long-term direction of the market.