Market Overview

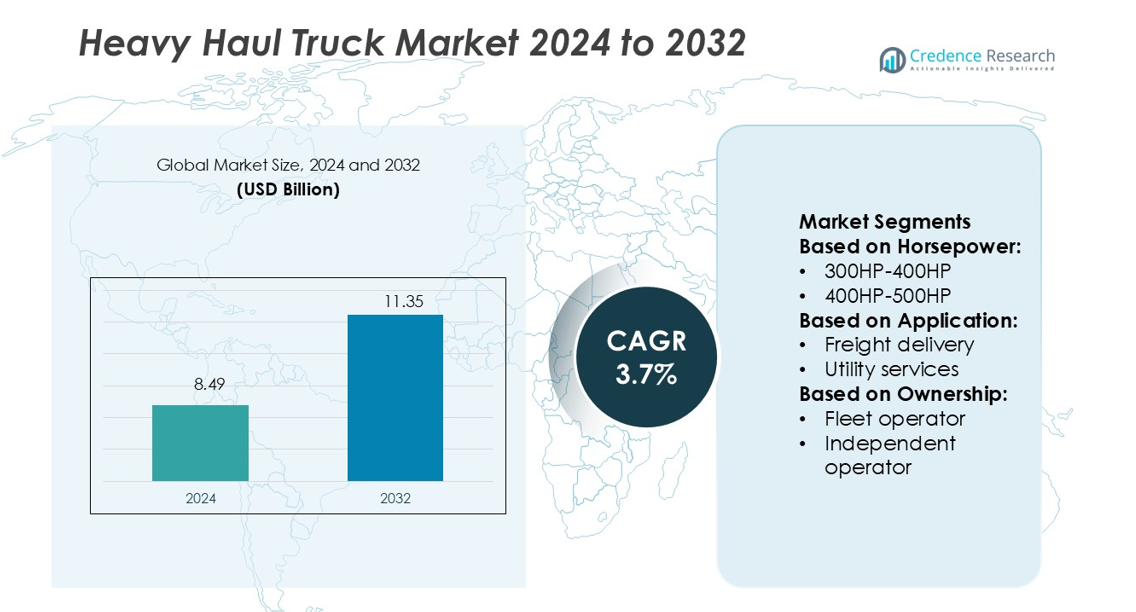

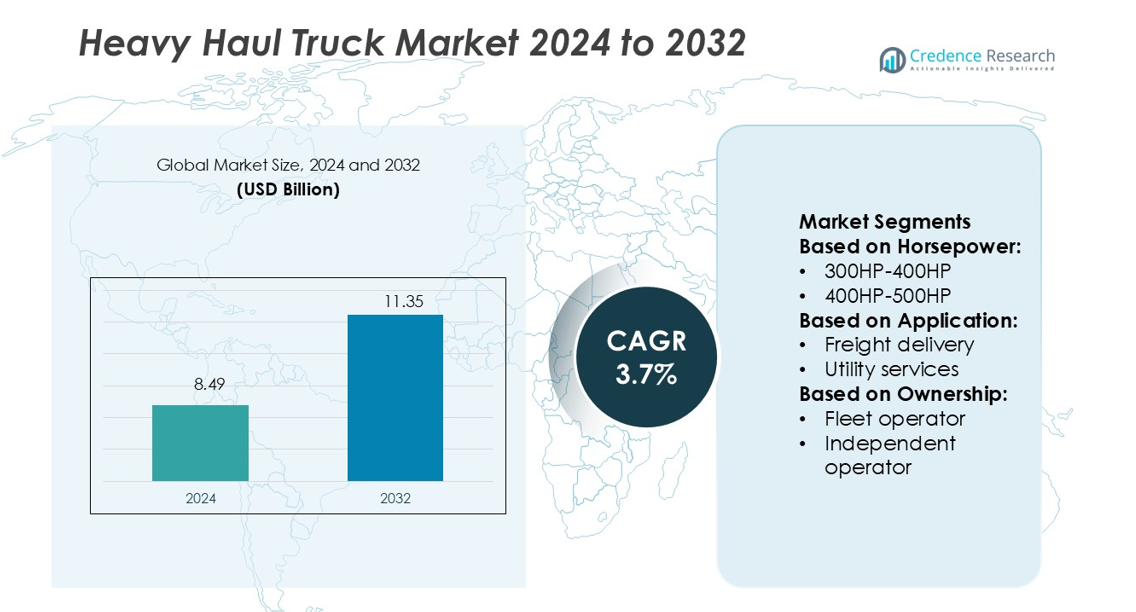

Heavy Haul Truck Market size was valued USD 8.49 billion in 2024 and is anticipated to reach USD 11.35 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Haul Truck Market Size 2024 |

USD 8.49 billion |

| Heavy Haul Truck Market, CAGR |

3.7% |

| Heavy Haul Truck Market Size 2032 |

USD 11.35 billion |

The Heavy Haul Truck Market is led by major companies including Navistar, Kenworth, Volvo Trucks, Peterbilt, Freightliner, Isuzu Motors, Scania AB, Mack Trucks, MAN, and Daimler. These players focus on advanced powertrains, digital fleet solutions, and emission-compliant designs to strengthen their global positions. Strategic collaborations with logistics and construction firms enhance product reach and service support. The market benefits from continuous investments in electrification and telematics to boost operational efficiency. Asia Pacific leads the market with a 34% share, driven by large-scale infrastructure projects, mining operations, and expanding logistics networks, making it the most dominant and fastest-growing region.

Market Insights

- The Heavy Haul Truck Market size was valued at USD 8.49 billion in 2024 and is expected to reach USD 11.35 billion by 2032, growing at a CAGR of 3.7%.

- Key market drivers include rising infrastructure development, expanding mining activities, and growing freight movement across major trade routes.

- The market is witnessing strong trends toward electrification, digital fleet management, and adoption of advanced telematics to improve operational efficiency.

- Competition is shaped by leading players focusing on cleaner powertrains, safety systems, and strategic logistics partnerships, while high investment and operating costs act as restraints.

- Asia Pacific leads with 34% share, supported by strong construction and logistics activity, while the 400HP–500HP segment remains dominant due to its balance of power and efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Horsepower

The 400HP–500HP segment dominates the Heavy Haul Truck Market with the largest share. This power range delivers a strong balance of hauling capacity and fuel efficiency. It supports heavy loads while keeping operating costs manageable, making it popular among logistics and construction fleets. Demand is driven by infrastructure expansion, rising freight volumes, and improved powertrain technologies. Many manufacturers are introducing advanced engine systems with better torque output and emission compliance. This segment remains a preferred choice for both long-distance freight and off-road construction activities.

- For instance, EP’s lithium batteries are rated for 3,000 cycles or more versus 500–1,000 cycles for lead acid. Warehouse forklifts and reach trucks follow closely, driven by e-commerce expansion and automation in storage facilities.

By Application

The construction and mining segment leads the Heavy Haul Truck Market with the highest market share. These trucks play a critical role in moving aggregates, ores, and construction materials over long and short distances. Increased investment in infrastructure and mining operations continues to boost demand. The segment benefits from strong fleet replacement cycles and improved payload efficiency. Heavy-duty truck makers are focusing on high-performance drivetrains and durable chassis designs. Strong economic activity in emerging markets further supports the dominance of this segment.

- For instance, Labrie Automizer side loader, which features a 12-foot-reach arm and a 1,000 lb lifting capacity, is designed for high productivity in tight spaces. Depending on the model, it can achieve an average of 180 pick-ups per hour.

By Ownership

The fleet operator segment holds the largest share in the Heavy Haul Truck Market. Large operators offer greater route coverage, structured maintenance programs, and predictable capacity, which improves operational efficiency. Their ability to invest in modern, high-horsepower trucks also strengthens performance and lowers fuel costs. Fleet owners often leverage telematics and real-time monitoring to optimize logistics. Rising demand for contract freight services is driving this segment’s growth. Strategic investments in high-capacity trucks by logistics firms keep this ownership model ahead of independent operators.

Key Growth Drivers

Rising Infrastructure and Industrial Development

Rapid expansion of road, rail, and energy infrastructure is driving the Heavy Haul Truck Market. Large-scale construction and mining projects need powerful trucks to move heavy loads efficiently. Governments and private developers are investing in highways, ports, and industrial facilities. These investments increase demand for high-horsepower trucks that offer reliable performance and extended uptime. The growth of industrial zones and logistics hubs also strengthens fleet expansion plans. As project sizes increase, the requirement for durable and high-capacity trucks continues to rise globally.

- For instance, Mack now offers the LRe (LR Electric refuse model) fitted with the fully electric Heil RevAMP Automated Side Loader body, enabling shake-free, 8-second arm cycles, powered by a 46 kWh body battery that supports more than 1,200 container pickups on a single overnight charge.

Expansion of Freight and Logistics Activities

The surge in freight movement, fueled by global trade and e-commerce, supports market growth. Heavy haul trucks play a crucial role in transporting oversized goods, raw materials, and construction equipment. Fleet operators are upgrading their fleets to handle longer routes and heavier payloads. Advanced engines, improved fuel efficiency, and digital tracking systems make these trucks ideal for logistics. The increasing adoption of just-in-time delivery models further strengthens demand. This driver remains central to growth in both developed and emerging economies.

- For instance, FULONGMA’s BEV side-load electric truck, equipped with a CATL battery, offers a capacity of 218.54 kWh, supports a driving range of at least 420 km, and lifts approximately 4.5 m³ of waste. Its main motor delivers a peak power of 160 kW at 3000 rpm, while the lifting arm completes its cycle in under 20 seconds.

Technological Advancements in Heavy-Duty Vehicles

Manufacturers are integrating advanced powertrain technologies, telematics, and automation to enhance truck performance. These innovations improve fuel efficiency, reduce maintenance needs, and support environmental compliance. Smart diagnostics and real-time monitoring improve vehicle uptime, making heavy trucks more cost-efficient. Electrification and hybrid systems are also emerging to meet stricter emission regulations. Automated driving assistance and fleet management platforms increase safety and operational control. These technology-driven developments are helping fleet operators achieve higher productivity and reduced operating costs.

Key Trends & Opportunities

Adoption of Alternative Powertrains

The Heavy Haul Truck Market is witnessing growing interest in electric and hybrid trucks. Fleet operators are exploring cleaner power options to meet emission norms and reduce fuel expenses. Advancements in battery technology are extending the operational range of electric heavy-duty vehicles. Governments are introducing incentives to support cleaner fleets, especially for long-haul applications. Hybrid trucks that combine diesel power with electric drive systems are gaining popularity. This trend is opening opportunities for new product launches and fleet modernization programs.

- For instance, Dennis Eagle adopted a video-enabled driver protection solution for its service engineer vans.The system was rolled out to 112 vans operating from a network of 18 national sites.

Integration of Digital Fleet Management Solutions

Fleet operators are increasingly using telematics, IoT platforms, and real-time analytics to manage operations. These solutions enable efficient route planning, predictive maintenance, and better fuel management. Digital tracking helps reduce downtime, improve asset utilization, and increase safety. Companies are investing in advanced sensors and AI-powered monitoring systems to ensure compliance with transport regulations. As logistics networks expand globally, digital solutions enhance coordination between shippers and carriers. This trend provides strong opportunities for technology suppliers and service providers.

- For instance, XCMG’s MQH37A Container Side Lifter supports both 20-ft and 40-ft containers with a maximum lifting capacity of 37,000 kg, a stabilizer outreach of 3,200 mm, and a working range of 4,000 mm, all housed in a unit weighing 7,000 kg.

Increased Customization for Specific Applications

Demand for application-specific heavy haul trucks is growing across industries such as mining, construction, and utilities. Manufacturers are offering customizable models with tailored horsepower, axle configurations, and specialized attachments. These designs improve load handling, efficiency, and durability in demanding conditions. Construction and resource sectors prefer rugged, purpose-built trucks to reduce wear and extend lifespan. Customization also supports fleet optimization, lowering operating costs over time. This shift creates opportunities for companies to offer modular, flexible truck platforms.

Key Challenges

High Initial Investment and Operating Costs

Heavy haul trucks require significant capital investment, making fleet expansion difficult for smaller operators. Maintenance and fuel costs also remain high, especially for long-haul and heavy-load operations. Rising raw material prices increase the overall cost of manufacturing these vehicles. Fleet operators face pressure to balance operating margins while maintaining modern fleets. High costs limit adoption among independent operators and small logistics firms. Addressing cost efficiency remains a key challenge for market expansion, especially in developing economies.

Stringent Emission and Safety Regulations

Tighter emission standards and road safety regulations increase compliance costs for manufacturers and operators. Developing cleaner powertrains involves heavy R&D investments, affecting profitability. Fleet owners must also upgrade older vehicles to meet new regulatory norms. Safety standards require integration of advanced systems, adding further cost pressure. Non-compliance can lead to penalties and restricted operations. These regulations, while supporting sustainability, create operational and financial challenges for companies in the Heavy Haul Truck Market.

Regional Analysis

North America

North America holds a 31% share of the Heavy Haul Truck Market, driven by robust infrastructure projects and logistics expansion. The U.S. leads the region with large-scale road freight operations, while Canada supports demand through mining and energy sectors. High fleet replacement rates and adoption of advanced telematics strengthen market penetration. Fleet operators invest heavily in high-horsepower trucks for long-haul freight. Government funding for highway upgrades further boosts the market. Established OEMs and technology integration keep North America a key hub for innovation and production.

Europe

Europe accounts for 27% of the Heavy Haul Truck Market, supported by strong regulatory frameworks and modern logistics networks. Germany, France, and the UK lead demand, with growing emphasis on emission compliance and fleet modernization. The construction, utility, and freight sectors remain major buyers. Fleet operators are investing in hybrid and alternative fuel trucks to meet strict EU standards. Advanced road infrastructure and cross-border trade drive long-distance heavy-haul operations. OEMs in Europe also focus on energy-efficient designs and safety technologies, ensuring strong market competitiveness.

Asia Pacific

Asia Pacific dominates the Heavy Haul Truck Market with a 34% share, supported by rapid industrialization and infrastructure growth. China and India lead demand with massive construction, mining, and logistics investments. Expanding highways, ports, and industrial hubs increase the need for powerful heavy-duty trucks. Fleet operators are growing quickly to support manufacturing and resource sectors. OEMs are investing in production facilities to meet rising local demand. Government-backed infrastructure programs further accelerate growth. Asia Pacific remains the fastest-growing region due to its large fleet base and cost-efficient manufacturing.

Latin America

Latin America captures 5% of the Heavy Haul Truck Market, with Brazil and Mexico as key contributors. Infrastructure development, especially in mining and energy, supports rising demand. Fleet expansion focuses on improving logistics efficiency and supporting agricultural exports. High reliance on imported trucks and parts limits faster adoption. However, growing investment in road connectivity projects strengthens regional opportunities. Fleet operators are also upgrading to modern trucks with improved performance and lower emissions. Market players are targeting partnerships to expand service networks and reduce operational costs.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the Heavy Haul Truck Market. Strong oil and gas projects and mining activity drive demand for high-capacity trucks. Gulf countries invest in logistics infrastructure and mega construction projects, creating steady growth. Africa shows increasing demand through mining and trade corridor developments. Limited local manufacturing and high import dependency remain challenges. However, fleet modernization and rising infrastructure spending are boosting adoption. International OEMs are expanding service networks to meet growing needs in strategic industrial zones.

Market Segmentations:

By Horsepower:

By Application:

- Freight delivery

- Utility services

By Ownership:

- Fleet operator

- Independent operator

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Heavy Haul Truck Market is shaped by leading players such as Navistar, Kenworth, Volvo Trucks, Peterbilt, Freightliner, Isuzu Motors, Scania AB, Mack Trucks, MAN, and Daimler. The Heavy Haul Truck Market remains highly competitive, driven by product innovation, powertrain advancements, and digital integration. Manufacturers are focusing on developing high-horsepower trucks with improved fuel efficiency, lower emissions, and enhanced safety features. Advanced telematics, predictive maintenance, and real-time monitoring systems are becoming standard to increase operational uptime and optimize logistics. Companies are investing in hybrid and electric powertrain technologies to meet strict emission regulations and reduce operating costs. Strategic partnerships with logistics providers, along with robust service networks, further strengthen market positioning. Continuous R&D investment supports product differentiation and global market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Navistar

- Kenworth

- Volvo Trucks

- Peterbilt

- Freightliner

- Isuzu Motors

- Scania AB

- Mack Trucks

- MAN

- Daimler

Recent Developments

- In April 2025, IKEA, a supply part of the Inter IKEA Group, and BLR Logistiks deployed the first electric heavy-duty truck to run on the public road network in India.

- In April 2025, California regulators released a new proposal to allow the testing of self-driving heavy-duty trucks on public roads. The proposal has unlocked the opportunities for companies to test self-driving technology.

- In May 2024, Volvo Financial Services and Volvo Trucks North America partnered to launch Volvo on Demand, an initiative to increase the adoption of BEVs. Through the initiative, the company offers an accessible solution for acquiring BEVs, reducing the need for significant upfront investments.

- In May 2024, BAE Systems and Eaton Corp. expanded their partnership to encompass EV solutions for heavy-duty trucks. The partnership aims to provide original equipment manufacturers and commercial vehicle modifiers with a comprehensive, efficient, advanced, and adaptable EV system suitable for various zero-emission platforms

Report Coverage

The research report offers an in-depth analysis based on Horsepower, Application, Ownership and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of high-horsepower trucks to support heavy freight operations.

- Electrification and hybrid technology will gain traction as emission rules tighten.

- Fleet operators will expand investments in digital platforms to optimize efficiency.

- Manufacturers will focus on lighter materials to improve fuel economy and payload.

- Infrastructure development projects will continue to boost regional demand.

- Telematics and predictive maintenance will become standard features across fleets.

- Emerging economies will drive strong sales through construction and mining activities.

- Autonomous and driver-assist technologies will enhance safety and performance.

- Strategic partnerships between OEMs and logistics firms will strengthen market reach.

- Regulatory support for clean transport solutions will shape future truck design.