Market Overview:

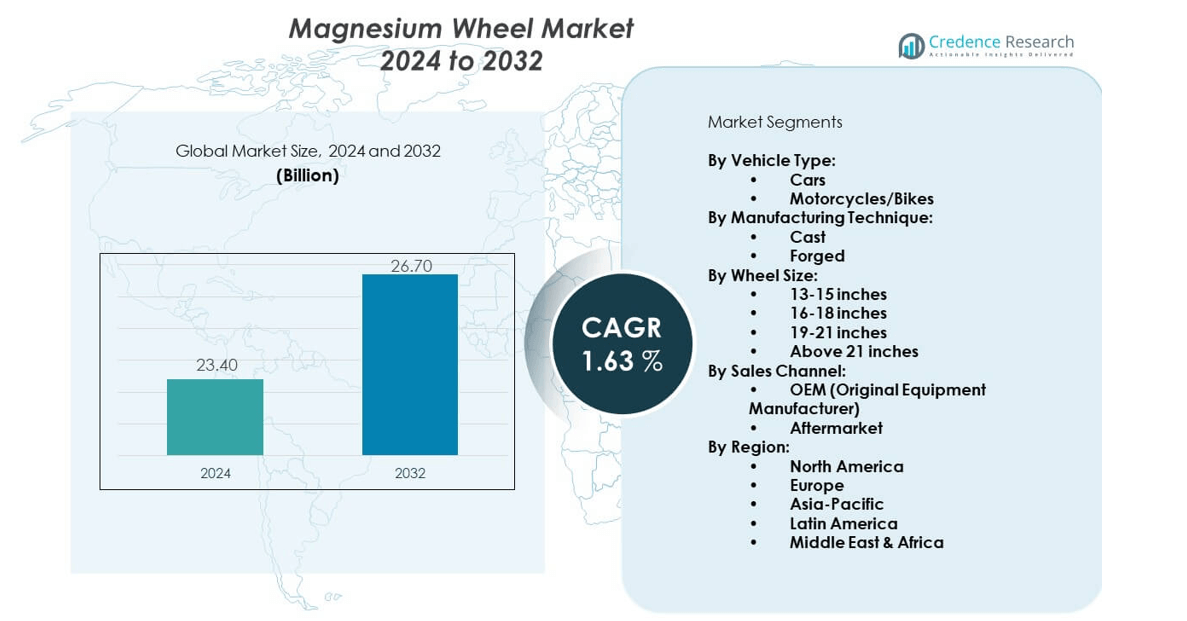

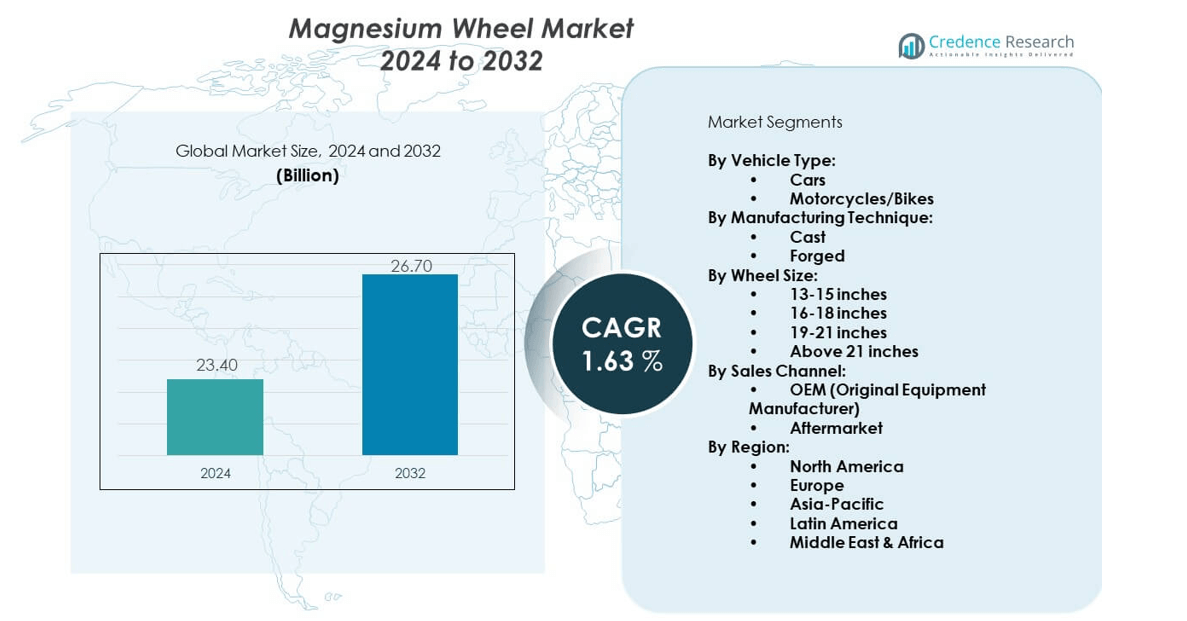

The Magnesium wheel market is projected to grow from USD 23.4 billion in 2024 to an estimated USD 26.7 billion by 2032, with a compound annual growth rate (CAGR) of 1.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnesium Wheel Market Size 2024 |

USD 23.4 billion |

| Magnesium Wheel Market, CAGR |

1.63% |

| Magnesium Wheel Market Size 2032 |

USD 26.7 billion |

The magnesium wheel market is driven by multiple factors, including the global shift toward fuel efficiency and emission reduction. Automakers are increasingly focusing on lightweight materials, with magnesium wheels offering significant weight advantages over traditional steel and aluminum. Their high strength-to-weight ratio enhances acceleration, braking, and fuel economy, making them highly desirable in sports and premium cars. Expanding electric vehicle production is also boosting demand, as lightweight wheels contribute to extended battery range and improved vehicle handling. Growing consumer preference for aesthetic appeal further supports adoption.

Geographically, Asia-Pacific leads the magnesium wheel market due to the strong presence of automotive manufacturers in China, Japan, and South Korea, combined with high consumer demand for performance vehicles. Europe follows closely, driven by stringent environmental regulations and automakers’ focus on reducing carbon emissions. North America maintains a steady share with rising penetration of luxury and electric vehicles. Emerging markets in Latin America and the Middle East are witnessing growing interest, fueled by urbanization, rising incomes, and increasing demand for premium vehicles with advanced wheel designs.

Market Insights:

- The Magnesium wheel market is projected to grow from USD 23.4 billion in 2024 to USD 26.7 billion by 2032, at a CAGR of 1.63% during the forecast period.

- Growth is driven by rising demand for lightweight materials that improve fuel efficiency and vehicle performance.

- Increasing adoption of magnesium wheels in luxury and sports vehicles supports premium segment expansion.

- High production costs and limited raw material availability act as key restraints for market penetration.

- Safety perceptions and lack of consumer awareness further restrict widespread adoption across mid-range vehicles.

- Asia-Pacific dominates due to strong automotive manufacturing in China, Japan, and South Korea.

- Emerging regions like Latin America and the Middle East show rising interest with expanding vehicle ownership and urbanization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Lightweight Materials to Enhance Vehicle Efficiency and Performance:

The Magnesium wheel market benefits from the global focus on lightweight automotive solutions that improve efficiency and lower emissions. Automakers adopt magnesium alloys because they weigh significantly less than steel and aluminum, reducing overall vehicle mass. It enables better fuel economy, extended driving range in electric vehicles, and superior performance. Consumers demand vehicles with improved acceleration and handling, which magnesium wheels support effectively. Stronger material properties with advanced designs add further appeal. Government policies promoting reduced emissions create steady growth momentum. Increased investments in research and production technologies enhance wheel performance and durability. Global competition among automakers accelerates magnesium wheel adoption across multiple vehicle categories.

- For instance, Porsche AG utilizes magnesium alloy wheels that reduce weight by approximately 11.5 kilograms compared to traditional options, significantly enhancing handling and performance in their Porsche 911 GT3 RS and GT2 RS models.

Increased Adoption of Premium and Luxury Vehicles with Aesthetic Appeal:

The demand for high-end vehicles drives growth in the Magnesium wheel market, supported by consumer preference for style and performance. Premium buyers favor wheels that combine lightweight efficiency with unique visual appeal. It improves brand perception for automakers offering magnesium wheels as standard or optional features. Sports cars, luxury sedans, and high-performance SUVs commonly adopt these wheels. Global sales of premium vehicles continue to expand, boosting market penetration. The desire for advanced wheel designs enhances customization trends. Automakers focus on creating attractive finishes and unique styling to capture interest. Increased competition encourages continuous product upgrades and greater availability across premium models.

- For instance, Forgiato is a US-based manufacturer specializing in custom forged wheels built and finished in-house, serving luxury and high-performance automotive markets. The company is recognized for its innovation and craftsmanship in magnesium forged wheels.

Expansion of Electric Vehicle Production to Drive Magnesium Wheel Adoption:

Global EV production growth directly benefits the Magnesium wheel market because lighter wheels extend battery range. Manufacturers use magnesium alloys to reduce load, improving efficiency in electric vehicles. It enables faster acceleration, improved braking, and enhanced driving dynamics. Governments worldwide push EV adoption through subsidies and incentives, expanding magnesium wheel opportunities. Automakers invest in dedicated lightweight platforms that integrate magnesium wheels. Technological advances in alloy design improve wheel safety and strength, boosting acceptance. Consumer demand for environmentally friendly vehicles with advanced features continues to rise. Expanded EV sales across global regions make magnesium wheels increasingly vital to future mobility.

Growing Automotive Manufacturing in Emerging Markets Boosting Demand:

The expansion of automotive production in emerging regions strongly supports the Magnesium wheel market. Rising incomes and urbanization increase demand for modern cars with advanced features. It creates opportunities for magnesium wheels to enter mid-range vehicle categories. Countries like China, India, and Brazil show high growth potential due to increasing vehicle ownership. Governments encourage local production, leading to greater material adoption in domestic manufacturing. Global automakers establish production hubs in these regions, further increasing demand. Affordable access to advanced manufacturing technologies makes magnesium wheels more practical. Enhanced distribution networks ensure broader availability, supporting long-term demand growth across developing markets.

Market Trends:

Advancements in Alloy Composition and Manufacturing Techniques for Stronger Wheels:

The Magnesium wheel market is shaped by technological innovation in material science and manufacturing. Advanced alloy compositions improve strength, corrosion resistance, and fatigue life. It ensures longer durability even in demanding driving conditions. Innovative casting and forging techniques reduce production costs and enhance wheel quality. Automation in manufacturing increases efficiency and consistency. 3D printing applications open new possibilities for complex wheel designs. Investments in R&D bring forward wheels with superior properties. Consumer acceptance grows as performance benefits become more evident. Continuous advancements make magnesium wheels more reliable and accessible in mainstream markets.

- For instance, Research led by the University of Manchester developed a class of high-performance magnesium alloys that combines low density with the highest strength among magnesium alloys, facilitating weight savings of up to 35% over aluminum alternatives, which benefits automotive and aerospace applications.

Integration of Smart Technologies and Sensors in Magnesium Wheels:

Smart wheel technologies influence the Magnesium wheel market by combining sensors with wheel designs. Integration of tire pressure monitoring and real-time data improves safety. It provides valuable feedback to drivers and supports vehicle performance optimization. Automakers explore advanced wheel systems that enhance connectivity. The shift toward intelligent vehicles strengthens this integration trend. Increased demand for telematics and safety features creates opportunities. Technology firms collaborate with automakers to develop next-generation smart wheel solutions. Adoption of connected features boosts overall value for consumers and enhances competitive differentiation. Smart integration strengthens magnesium wheels’ role in advanced vehicle ecosystems.

- For instance, Brembo entered the mountain bike market in 2025 through a partnership with Specialized Gravity Racing, bringing advanced braking technology paired with forged magnesium rims for enhanced racing performance, demonstrated in the UCI MTB World Series.

Rising Customization and Aftermarket Demand for Stylish and Unique Wheels:

Customization trends significantly impact the Magnesium wheel market, as consumers demand personalized designs. Buyers seek unique finishes, colors, and styling options that reflect personal identity. It drives growth in aftermarket sales of magnesium wheels. Car enthusiasts and performance drivers form a strong customer base. Expanding digital platforms enable direct-to-consumer sales and custom design services. Automakers also partner with aftermarket players to meet these demands. Global growth in luxury modifications expands magnesium wheel relevance. Increased product availability across online channels makes customization easier and more affordable. The aftermarket segment strengthens overall market penetration and consumer choice.

Sustainable Manufacturing Practices and Recycling of Magnesium Alloys:

Sustainability trends shape the Magnesium wheel market through environmentally conscious production practices. Recycling of magnesium alloys becomes a major focus for reducing waste. It improves cost efficiency and supports global sustainability targets. Automakers and suppliers adopt energy-efficient methods to lower emissions in production. Governments encourage circular economy approaches, boosting recycled magnesium usage. Environmental certifications strengthen consumer confidence in sustainable wheels. Companies highlight eco-friendly branding to attract customers. Increased collaboration across industries accelerates green innovation. These trends reinforce magnesium wheels as a responsible choice in the modern automotive supply chain.

Market Challenges Analysis:

High Production Costs and Limited Raw Material Supply Restrict Wider Adoption:

The Magnesium wheel market faces challenges linked to high costs of production and limited raw material availability. Extracting and processing magnesium alloys is more expensive compared to aluminum and steel. It limits cost competitiveness and adoption in mid-range vehicle categories. Manufacturers struggle with price-sensitive markets where affordability is critical. Supply chain disruptions also create risks of shortages and price volatility. Dependence on specific regions for magnesium production intensifies vulnerability. Global demand fluctuations impact consistency in supply. These constraints restrict mass adoption, slowing growth across broader automotive segments. Addressing cost barriers remains a priority for long-term expansion.

Safety Perceptions, Technical Limitations, and Lack of Consumer Awareness:

Safety concerns and limited consumer awareness challenge the Magnesium wheel market. Some buyers perceive magnesium wheels as less durable than traditional materials. It reduces acceptance in regions where consumer education is low. Technical challenges such as corrosion risks and fatigue resistance limit widespread confidence. Manufacturers work to improve alloy composition, but perceptions persist. Automotive companies must focus on awareness campaigns to highlight real performance benefits. Regulatory hurdles around safety testing also complicate adoption. Limited expertise among repair and service providers further hinders usage. Overcoming these barriers requires coordinated efforts across the industry to build trust and awareness.

Market Opportunities:

Rising Electric Mobility and Global Focus on Performance Vehicles Driving Market Growth:

The Magnesium wheel market presents opportunities through the rise of electric mobility and performance-focused vehicles. Lightweight wheels help EVs extend range while improving handling. It allows automakers to promote better performance and efficiency. High consumer interest in sports cars and premium models supports demand. Regional subsidies and incentives for EVs expand magnesium wheel applications. Integration into new designs creates visibility in global markets. Consumer awareness of benefits enhances adoption. Long-term focus on sustainable mobility strengthens opportunities in this industry.

Expansion of Aftermarket Customization and Penetration in Emerging Economies:

Opportunities in the Magnesium wheel market expand with growing aftermarket customization and emerging economies. Consumers demand personalized wheels that match individual tastes. It drives steady aftermarket sales and service networks. Growth in digital platforms enables direct access to customization. Emerging markets offer rising vehicle ownership and demand for advanced components. Automakers and suppliers invest in local production, making wheels more accessible. Regional economic growth supports higher disposable incomes. These conditions create strong opportunities for industry participants to expand globally.

Market Segmentation Analysis:

By Vehicle Type Segment

The Magnesium wheel market serves both cars and motorcycles. Cars dominate due to their higher volume and increasing focus on reducing vehicle weight to boost fuel efficiency and handling. Motorcycles also contribute to growth, especially in performance and premium segments. It plays a crucial role in expanding lightweight wheel adoption across diverse vehicle categories.

- For instance, Yamaha Motor Co., Ltd. uses AM60 magnesium alloy die-cast wheels in their supersport motorcycle models, delivering high strength-to-weight ratios essential for improved performance.

By Manufacturing Technique Segment

The market divides into cast and forged wheels. Cast magnesium wheels hold the majority share due to lower production costs and scalable manufacturing. Forged wheels target high-performance vehicles by offering enhanced strength-to-weight ratios but come with higher costs. It reflects industry trends balancing cost efficiency with performance demands.

- For instance, Forged magnesium wheels inspired by Formula 1 racing, like those produced by Litespeed Racing, offer significantly lower density and improved strength, reducing unsprung mass and enhancing high-speed performance in motorsports.

By Wheel Size Segment

Wheel sizes range from 13-15 inches to above 21 inches. The 16-18 inch range is the most common, aligning with typical passenger cars. Larger wheel sizes are preferred in premium and sports cars for aesthetics and performance advantages. This segmentation directly ties to vehicle design and consumer preferences.

By Sales Channel Segment

Sales are split between OEM and aftermarket channels. OEM demand grows as manufacturers integrate magnesium wheels for factory-installed lightweight solutions, particularly in electric and premium cars. The aftermarket segment capitalizes on consumer interest in upgrades and customization, enhancing market growth through post-sale sales.

Segmentation:

By Vehicle Type:

By Manufacturing Technique:

By Wheel Size:

- 13-15 inches

- 16-18 inches

- 19-21 inches

- Above 21 inches

By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America holds nearly 28% share of the Magnesium wheel market, supported by the strong presence of luxury and performance vehicle manufacturers. Consumers in the region value advanced features, premium styling, and lightweight efficiency, which directly benefits magnesium wheel adoption. It gains momentum through rising demand for electric vehicles that require reduced vehicle mass to extend driving range. Government policies promoting clean mobility encourage automakers to integrate advanced alloys into vehicle platforms. Europe follows with about 25% share, driven by stringent emission regulations and automakers’ focus on reducing carbon footprints. Strong demand for high-performance cars and premium sedans ensures consistent adoption of magnesium wheels in this region.

Asia Pacific

Asia Pacific dominates the Magnesium wheel market with nearly 35% share, led by China, Japan, and South Korea. High automotive production capacity and expanding consumer markets make the region a critical growth hub. It benefits from rising disposable incomes, urbanization, and a strong appetite for premium and electric vehicles. Governments support domestic production and clean energy adoption, creating favorable conditions for magnesium wheel manufacturers. Local suppliers also invest in research to enhance alloy quality and reduce costs, improving competitiveness. Regional aftermarket sales expand as customization and performance upgrades attract younger consumers, further strengthening growth potential.

Latin America and Middle East & Africa

Latin America accounts for about 7% share of the Magnesium wheel market, with growth supported by rising vehicle ownership and increasing adoption of premium models. Countries like Brazil and Mexico see higher demand for customization and luxury-oriented upgrades. The Middle East & Africa region represents nearly 5% share, fueled by luxury vehicle imports and growing consumer preference for performance styling. It shows potential as income levels rise and automotive investments expand. Both regions remain smaller contributors compared to global leaders but are emerging markets with significant long-term opportunities. It relies on strong distribution networks and rising consumer awareness to increase adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BBS USA

- Brembo

- Enkei Corporation

- Forgiato

- MKW Alloy

- OZ Group

- Rays Wheels

- Ronal Group

- Vorsteiner

- Vossen Wheels

Competitive Analysis:

The Magnesium wheel market is defined by strong competition among established global brands and specialized regional players. Companies focus on innovation in alloy design, advanced manufacturing processes, and premium styling to strengthen their positions. It benefits from growing demand in both OEM and aftermarket channels, with suppliers competing to align with automakers producing luxury and electric vehicles. Leading players invest in R&D to improve strength, reduce corrosion, and lower production costs. Customization demand also pushes companies to expand their design portfolios. Strategic partnerships with OEMs enhance supply stability and global reach. Distribution efficiency and brand reputation remain key differentiators. The market is highly competitive, with firms targeting niche segments and premium buyers to secure growth.

Recent Developments:

- In June 2025, Brembo entered a strategic partnership with Specialized Gravity Racing to supply customized braking systems and forged magnesium rims for the MotoGP season. This marks Brembo’s return to competitive mountain biking after nearly 20 years, aiming to push performance boundaries in downhill racing.

- Rays Wheels debuted its MID RACING R07 Type S wheel in February 2025, reinforcing its position in performance-oriented magnesium wheels with advanced designs for motorsport applications.

- Ronal Group completed the sale of its subsidiary SPEEDLINE S.r.l. in October 2023, enabling both entities to focus on their core competencies. Ronal Group continues to concentrate on aluminum and magnesium wheels for premium OEM customers.

Market Concentration & Characteristics:

The Magnesium wheel market demonstrates moderate concentration, with a mix of dominant multinational brands and niche manufacturers. It is characterized by continuous innovation, growing integration into premium and electric vehicles, and high competition based on technology and aesthetics. Suppliers differentiate through advanced designs, lightweight advantages, and brand value in both OEM and aftermarket segments. The market remains price-sensitive, yet it consistently rewards firms that combine innovation with cost efficiency. Global expansion strategies, strong distribution, and sustainability practices further define industry competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on vehicle type, manufacturing technique, wheel size, sales channel, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing integration in electric vehicles to support lightweight efficiency.

- Increasing demand for forged magnesium wheels in premium segments.

- Rising aftermarket customization trends driving personalized wheel designs.

- Advances in alloy technology to improve corrosion resistance and strength.

- Greater adoption in emerging markets due to rising vehicle ownership.

- Expansion of sustainable manufacturing and recycling practices.

- Strong OEM partnerships to enhance market presence globally.

- Broader acceptance in mid-range vehicles with cost reductions.

- Development of smart wheels integrating sensors and connectivity.

- Focus on aesthetics and brand appeal to attract younger buyers.