Market Overview:

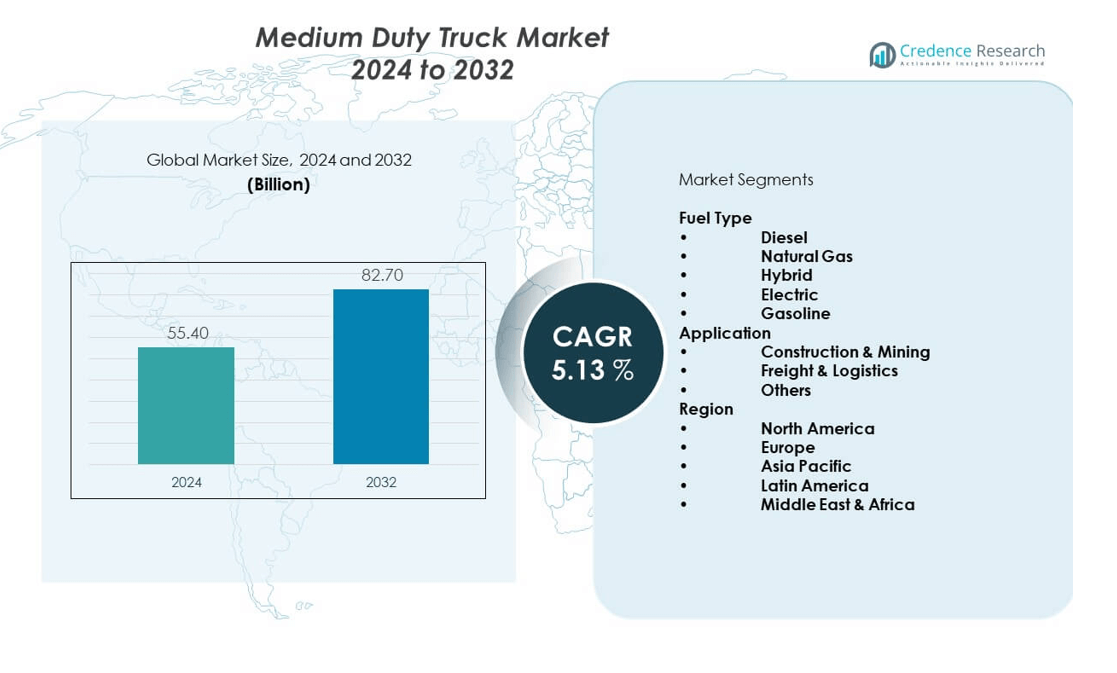

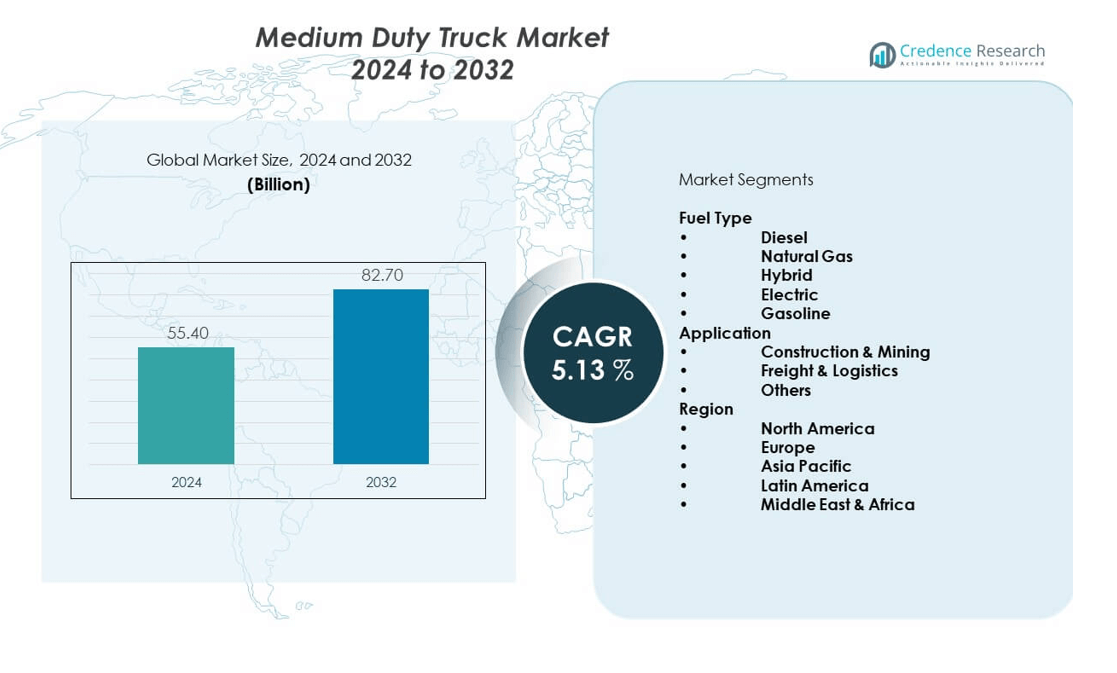

The medium duty truck market is projected to grow from USD 55.4 billion in 2024 to an estimated USD 82.7 billion by 2032, registering a compound annual growth rate (CAGR) of 5.13% during the forecast period. Growth is influenced by expanding logistics, infrastructure development, and the rising need for efficient transportation across multiple industries.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Duty Truck Market Size 2024 |

USD 55.4 billion |

| Medium Duty Truck Market, CAGR |

5.13% |

| Medium Duty Truck Market Size 2032 |

USD 82.7 billion |

The market drivers center on increased urbanization, e-commerce expansion, and stricter emission regulations that push demand for cleaner vehicles. Manufacturers are investing in fuel-efficient engines, electric drivetrains, and telematics integration to meet operational and regulatory needs. Fleet operators also seek medium duty trucks for their cost balance between payload capacity and fuel economy, which enhances adoption in distribution and regional transport.

Regionally, North America leads the medium duty truck market, supported by strong logistics networks and high freight volumes. Europe shows steady adoption due to stringent environmental regulations and advanced technology integration. Asia Pacific is the fastest-growing region, driven by rapid industrialization, expanding infrastructure, and a booming e-commerce sector in China and India. Latin America and the Middle East are emerging markets, benefitting from increasing investments in construction and trade activities.

Market Insights:

- The medium duty truck market is projected to grow from USD 55.4 billion in 2024 to USD 82.7 billion by 2032, at a CAGR of 13% during the forecast period.

- Rising demand for logistics, e-commerce expansion, and infrastructure development drives market growth.

- Environmental regulations are pushing manufacturers toward hybrid, electric, and alternative fuel-powered trucks.

- High initial costs of electrification and underdeveloped charging infrastructure restrain widespread adoption.

- Supply chain disruptions and skilled labor shortages further limit operational efficiency in the market.

- North America leads the market due to strong logistics networks and high freight volumes.

- Asia Pacific emerges as the fastest-growing region, supported by rapid industrialization, urbanization, and booming e-commerce activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expanding Urbanization and Infrastructure Growth:

Urbanization and infrastructure development strongly drive the medium duty truck market. Rapid population growth in cities increases demand for construction, logistics, and municipal services. Governments are expanding road networks, industrial parks, and residential projects, which require reliable medium duty trucks for transport and support. Fleet operators find these vehicles cost-efficient for navigating urban roads compared to heavy-duty models. It creates higher adoption in regional cargo and utility distribution. Rising investments in smart cities strengthen the demand base. Companies align product designs to meet these evolving infrastructure needs. The medium duty truck market benefits significantly from this large-scale urban transformation.

- For instance, Daimler Trucks has engineered medium duty models with optimized chassis friction and aerodynamic enhancements that contribute to a 29% fuel consumption reduction in real-world urban cycles compared to baseline models.

E-commerce Expansion and Last-Mile Delivery Needs:

The rapid expansion of e-commerce plays a crucial role in shaping the medium duty truck market. Online retail growth boosts requirements for timely distribution, warehousing, and last-mile delivery services. Logistics providers adopt medium duty trucks for their balance between payload capacity and fuel efficiency. Retailers prefer these vehicles for handling short-to-medium range deliveries efficiently. Rising consumer expectations for faster delivery timelines intensifies fleet upgrades. Manufacturers integrate telematics for route optimization and fleet management. It ensures smoother distribution and reduced operational costs. With e-commerce evolving globally, demand for medium duty trucks continues its steady increase.

- For instance, the International S13 Integrated powertrain boasts a 5% improvement in fuel economy through the integration of engine, transmission, and aftertreatment systems, crucial for route efficiency and cost-effective last-mile deliveries in highly dynamic e-commerce logistics networks.

Environmental Regulations and Cleaner Technologies:

Stricter emission norms create a strong push toward cleaner vehicles in the medium duty truck market. Governments worldwide implement policies to reduce carbon footprints across transport systems. Manufacturers invest in hybrid and electric models to comply with regulations. Alternative fuel technologies such as natural gas are also gaining attention. Fleet operators adopt these options to avoid penalties and enhance brand image. It encourages innovation in vehicle design and engine efficiency. Growing awareness among businesses about sustainable logistics strengthens adoption. The medium duty truck market witness’s steady transformation under this regulatory pressure.

Cost Efficiency and Operational Versatility:

Medium duty trucks provide an effective balance between heavy-duty trucks and light commercial vehicles. This balance drives adoption across industries like logistics, utilities, and construction. Operators value lower fuel consumption compared to larger trucks. Their operational versatility allows use in both urban centers and regional distribution networks. Companies find them ideal for fleet optimization, reducing total ownership costs. It supports higher profitability for businesses managing competitive markets. Maintenance requirements are lower, enhancing lifecycle performance. The medium duty truck market thrives on this mix of efficiency and adaptability for diverse business needs.

Market Trends:

Rising Electrification of Fleet Operations:

The shift toward electrification defines a key trend in the medium duty truck market. Electric medium duty trucks are increasingly launched by global manufacturers. Governments encourage adoption through subsidies, charging infrastructure development, and regulatory mandates. Fleet operators adopt electric trucks for sustainability and lower fuel costs. This trend strengthens as cities push low-emission zones. It influences design focus toward longer battery life and higher payload capacity. Partnerships between automakers and energy providers accelerate infrastructure rollout. The medium duty truck market steadily evolves with electrification shaping the long-term outlook.

- For instance, the UC Davis study highlights that battery-powered delivery trucks can achieve a 50-60% reduction in CO2 emissions in urban stop-and-go driving cycles compared to diesel counterparts, demonstrating the advanced capacity of electric models to meet municipal and commercial fleet sustainability targets.

Integration of Advanced Telematics and Connectivity:

Smart technologies dominate adoption patterns across the medium duty truck market. Telematics systems now allow real-time fleet monitoring and predictive maintenance. Connectivity features improve route planning and fuel management. Operators use telematics for driver behavior analysis, reducing accidents and insurance costs. Cloud-based platforms enhance communication between vehicles and logistics hubs. It improves delivery timelines and customer satisfaction. Manufacturers partner with software providers to expand offerings. The medium duty truck market gains strong momentum from this digital transformation in vehicle operations.

- For instance, Volvo integrates telematics platforms that enable real-time driver behavior monitoring and predictive maintenance analytics, helping fleets reduce accidents and maintenance downtime by notable margins, thus optimizing fleet efficiency and safety.

Customization for Industry-Specific Applications:

Industry-specific customization is shaping growth in the medium duty truck market. Logistics, construction, and municipal service sectors demand tailored solutions. Manufacturers design specialized bodies, chassis, and configurations. These trucks now integrate refrigerated compartments for food delivery or reinforced structures for construction use. Operators demand flexibility to meet sector requirements. Customization enhances utility and lifecycle efficiency for businesses. It reflects a broader shift toward purpose-built vehicles in competitive industries. The medium duty truck market gains higher customer loyalty through this trend of application-specific design.

Leasing and Fleet-as-a-Service Models:

Leasing and fleet-as-a-service models are transforming ownership patterns in the medium duty truck market. Businesses adopt leasing for flexibility, reduced upfront costs, and lower risk. Fleet-as-a-service providers handle maintenance, insurance, and upgrades. Operators benefit from predictable monthly costs and newer vehicles. This trend expands as logistics providers face volatile demand cycles. It helps companies optimize working capital and scale operations efficiently. Automakers collaborate with finance and leasing companies to strengthen offerings. The medium duty truck market sees leasing as a growing channel for fleet modernization.

Market Challenges Analysis:

High Cost of Electrification and Technology Adoption:

The transition toward electric and hybrid models creates significant cost challenges in the medium duty truck market. Electric trucks require high initial investments compared to conventional models. Battery costs remain a major burden, despite ongoing improvements. Charging infrastructure is still underdeveloped in several regions, limiting adoption. Smaller fleet operators find the shift financially restrictive. Integrating advanced telematics also adds to overall expenses. It creates barriers for medium-scale enterprises. The medium duty truck market experiences slower adoption of advanced technologies due to these economic pressures.

Supply Chain Constraints and Skilled Labor Shortages:

The global supply chain faces disruptions affecting the medium duty truck market. Shortages of semiconductor chips delay production cycles. Rising raw material costs increase vehicle prices, reducing affordability. Logistics operators face higher lead times for vehicle availability. At the same time, there is a shortage of skilled drivers and maintenance staff. It restricts the operational capacity of fleets. Governments attempt to address labor shortages with training programs, yet gaps persist. The medium duty truck market continues to struggle with aligning supply capacity and workforce availability.

Market Opportunities:

Expansion in Emerging Economies and Trade Corridors:

Emerging economies create significant opportunities for the medium duty truck market. Industrialization in Asia Pacific, Latin America, and Africa increases freight volumes. Trade corridors and cross-border logistics projects strengthen regional transport networks. Infrastructure development initiatives create higher demand for medium duty trucks. Governments invest heavily in improving road connectivity. Fleet operators expand into new routes with versatile trucks. It positions manufacturers to target untapped growth regions. The medium duty truck market gains momentum from these new economic developments.

Innovation in Alternative Fuel Technologies and Services:

Alternative fuel adoption presents a strong growth opportunity for the medium duty truck market. Demand for compressed natural gas, hydrogen, and biofuel-powered trucks rises. It reduces dependency on conventional diesel and aligns with sustainability goals. Manufacturers innovate with flexible engines supporting multiple fuel options. Service providers expand with charging and refueling infrastructure solutions. This opportunity also includes expanding aftermarket services such as fleet management, predictive maintenance, and telematics. It creates a full-service ecosystem that improves adoption and customer satisfaction. The medium duty truck market benefits from this innovative approach.

Market Segmentation Analysis:

By Fuel Type, the diesel segment continues to dominate the medium duty truck market. Diesel trucks are favored for their superior torque, durability, and fuel efficiency, making them reliable for heavy payloads and long-distance hauling. Natural gas trucks are gaining gradual adoption, driven by lower emissions and operating costs, while hybrid and electric trucks are emerging under stricter emission norms. Gasoline trucks remain limited to specific markets due to lower efficiency in comparison. The diesel segment remains the cornerstone, but alternative fuels are shaping future opportunities.

- For example, PACCAR’s advancements with downsized diesel engines show potential fuel savings of 6-12% at average loads, demonstrating efficiency improvements tailored to operational needs.

By Application, the freight and logistics segment holds the largest revenue share. Growth in e-commerce, retail supply chains, and regional cargo transport drives adoption of medium duty trucks in this category. The construction and mining sector also represents a key application area, requiring trucks for material handling, equipment movement, and site operations. Other applications include municipal services, utilities, and specialized industry needs. The freight and logistics segment sets the pace for consistent expansion in the market.

- For instance, Isuzu’s medium duty trucks are engineered to balance payload and maneuverability, with models supporting operational uptime that meets the demanding schedules of retail supply chains and regional transport.

Segmentation:

Fuel Type

- Diesel

- Natural Gas

- Hybrid

- Electric

- Gasoline

Application

- Construction & Mining

- Freight & Logistics

- Others

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America holds a leading position in the medium duty truck market with a 38% share. Strong logistics infrastructure, high freight volumes, and demand from e-commerce continue to drive adoption. Fleet operators prefer medium duty trucks for their cost efficiency and suitability for regional transport. The U.S. leads the region, supported by replacement demand and innovation in electric fleets. Europe follows with a 27% share, driven by strict emission regulations and advanced adoption of hybrid and electric trucks. Germany, France, and the UK dominate sales, reflecting strong commercial vehicle demand. The market in these regions benefits from regulatory support and advanced automotive ecosystems.

Asia Pacific

Asia Pacific accounts for a 24% share of the medium duty truck market and is the fastest-growing region. China and India lead adoption, supported by industrial growth, expanding e-commerce, and infrastructure investments. Fleet operators in these countries rely on medium duty trucks for cost-effective logistics and construction support. Manufacturers invest heavily in this region, offering models tailored to urban and rural demands. Japan and South Korea contribute with advanced technology integration and hybrid model launches. It reflects a strong shift toward sustainable logistics solutions. Asia Pacific remains a key growth hub, driven by rising urbanization and economic expansion.

Latin America and Middle East & Africa

Latin America represents a 6% share of the medium duty truck market, supported by growing mining and construction activities. Brazil and Mexico dominate, with rising trade activities fueling demand for freight and logistics. Medium duty trucks are preferred for their ability to adapt to diverse terrains and moderate infrastructure. The Middle East & Africa hold a 5% share, with demand led by construction and energy projects. Gulf countries invest in fleets to support large-scale infrastructure expansion. Africa sees gradual adoption, limited by economic challenges but supported by trade corridor growth. It highlights steady opportunities for global players targeting emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Daimler Trucks

- Volvo Group

- PACCAR Inc.

- Ford Motor Company

- Isuzu Motors Ltd.

- Tata Motors Limited

- Navistar International Corporation

- Hino Motors Ltd.

- Ashok Leyland

- Eicher Motors Limited

- Freightliner

- MAN Truck & Bus SE

- Scania AB

- Iveco S.p.A.

- Traton SE

Competitive Analysis:

The medium duty truck market is highly competitive, with global and regional manufacturers focusing on product innovation, sustainability, and market expansion. Leading players such as Daimler Trucks, Volvo Group, PACCAR Inc., Ford, Isuzu Motors, and Tata Motors dominate with broad product portfolios and extensive dealer networks. It remains characterized by strong competition across North America, Europe, and Asia Pacific, with emphasis on electrification, hybrid technologies, and advanced telematics integration. Companies adopt strategies such as partnerships, acquisitions, and regional expansions to strengthen their positions. Local manufacturers in Asia, including Ashok Leyland and Eicher Motors, maintain cost advantages, while European leaders such as MAN, Scania, and Iveco push advanced technology adoption. The medium duty truck market reflects a balance between established players and emerging innovators, all targeting efficiency, sustainability, and adaptability.

Recent Developments:

- In August 2025, Isuzu Motors and Volvo Group announced a collaborative development initiative focused on medium heavy-duty trucks. This partnership aims to combine expertise from both companies to advance medium duty truck technologies, enhancing performance and sustainability in the segment. The collaboration reflects growing trends toward joint innovation in the commercial vehicle industry.

- PACCAR Inc. expressed optimism in July 2025 about an upswing in truck orders for the second half of 2025 and into 2026, citing regulatory pre-buy incentives and market stabilization. The company is investing heavily in manufacturing growth, including a major expansion at its Kenworth Chillicothe plant, targeted at boosting production capacity and testing capabilities of medium-duty trucks.

- Ford Motor Company showcased its 2025 medium duty trucks, such as the F-650 and F-750, designed with revamped trim offerings and powertrain improvements aimed at durability and low operational costs. These models, built at the Avon Lake assembly plant, provide GVWRs from 25,600 to 37,000 lbs, addressing diverse commercial needs in the medium-duty segment.

- Tata Motors unveiled six electric commercial vehicles at Auto Expo 2025, including trucks across mini, pickup, intermediate, and heavy-duty categories. The lineup features advanced battery technology and fast charging capabilities, including the Prima E.55S electric heavy-duty truck with a 470 kW powertrain and a range of 200-350 km, emphasizing Tata’s push towards electrification in commercial vehicles.

Market Concentration & Characteristics:

The medium duty truck market demonstrates moderate concentration, with a mix of global leaders and regional competitors. It is defined by diverse product offerings, ranging from diesel-powered models to advanced hybrid and electric trucks. Manufacturers compete on reliability, cost efficiency, and compliance with emission norms. Strategic alliances and collaborations are common, aimed at technology sharing and regional penetration. The market benefits from strong demand in freight and logistics while construction and municipal sectors add consistent revenue. It continues to evolve under regulatory frameworks that promote sustainable mobility. The medium duty truck market shows characteristics of steady innovation and rising competition, with both global leaders and regional specialists shaping the landscape.

Report Coverage:

The research report offers an in-depth analysis based on Fuel Type, Application, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of electric and hybrid medium duty trucks driven by sustainability policies.

- Increasing investment in hydrogen and natural gas-powered vehicles to diversify fleets.

- Strong demand growth from e-commerce and last-mile logistics expansion.

- Asia Pacific expected to emerge as the fastest-growing regional market.

- Telematics integration to enhance fleet management and predictive maintenance.

- Shift toward leasing and fleet-as-a-service models for cost optimization.

- Global players strengthening presence in emerging economies through partnerships.

- Advanced customization of trucks for sector-specific applications.

- Supply chain improvements to reduce production delays and enhance availability.

- Rising regulatory pressure to accelerate cleaner vehicle adoption worldwide.