Market Overview:

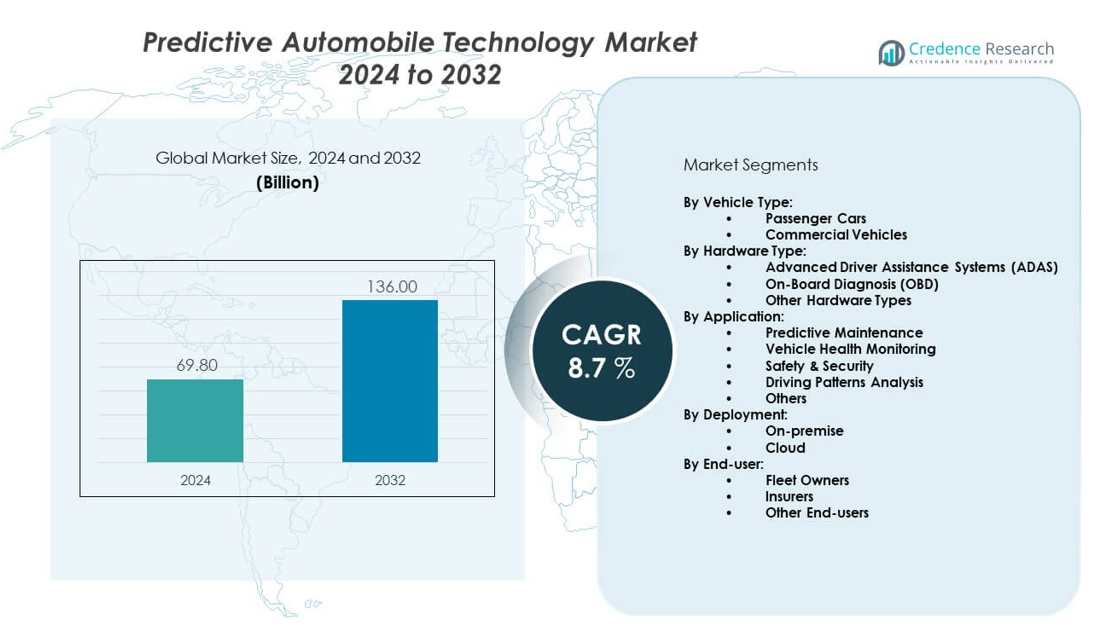

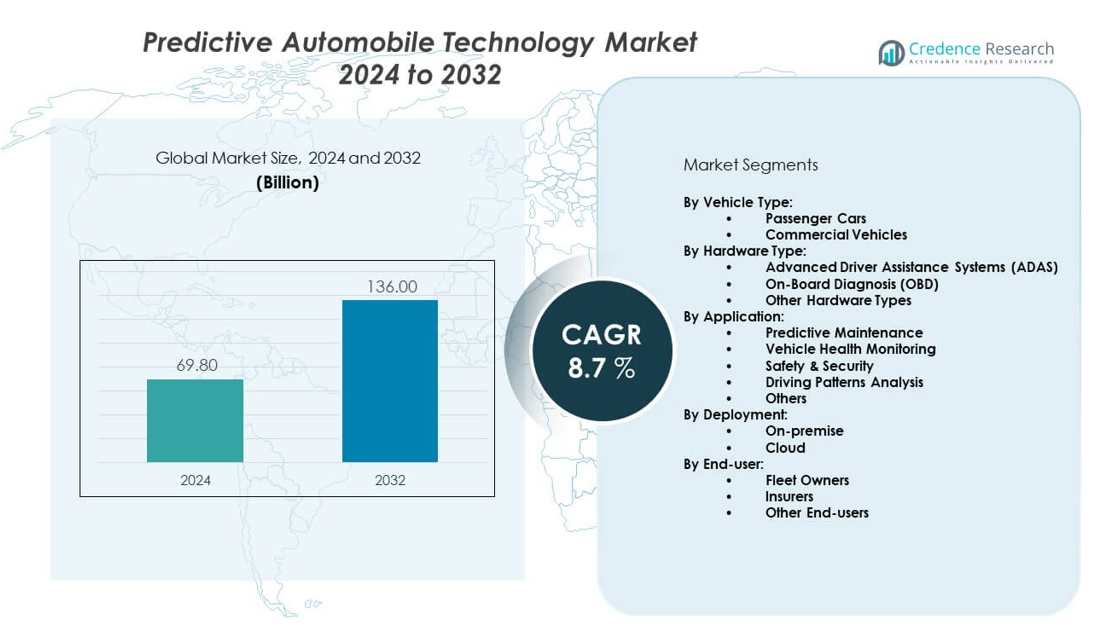

The Predictive automobile technology market is projected to grow from USD 69.8 billion in 2024 to an estimated USD 136 billion by 2032, with a compound annual growth rate (CAGR) of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Predictive Automobile Technology Market Size 2024 |

USD 69.8 billion |

| Predictive Automobile Technology Market, CAGR |

8.7% |

| Predictive Automobile Technology Market Size 2032 |

USD 136 billion |

\Rising demand for safety, fuel efficiency, and real-time monitoring is driving the predictive automobile technology market. Automakers are integrating predictive maintenance, driver behavior analysis, and intelligent infotainment systems to meet consumer expectations. The adoption of AI and machine learning supports proactive fault detection, reducing vehicle downtime and repair costs. Growing emphasis on autonomous and semi-autonomous features also boosts the demand for predictive solutions, as they enhance decision-making capabilities and improve overall driving experiences.

North America leads the predictive automobile technology market, supported by advanced automotive infrastructure, high adoption of connected vehicles, and strong presence of leading manufacturers. Europe follows with strong regulatory support for safety innovations and sustainability initiatives. Asia Pacific is emerging rapidly due to rising vehicle production, growing urbanization, and increasing adoption of smart mobility technologies in countries like China, Japan, and India. Latin America and the Middle East are also showing potential, supported by expanding automotive industries and gradual integration of digital technologies.

Market Insights:

- The predictive automobile technology market is valued at USD 69.8 billion in 2024 and is projected to reach USD 136 billion by 2032, growing at a CAGR of 7%.

- Market drivers include rising demand for predictive maintenance, advanced safety systems, and AI-based real-time monitoring.

- Growing integration of connected and smart vehicle technologies is accelerating adoption across passenger and commercial vehicles.

- High implementation costs and integration complexities act as restraints, especially for small and mid-sized automakers.

- Data privacy concerns and varying global compliance regulations limit wider deployment of predictive systems.

- North America leads due to strong automotive infrastructure and adoption of connected mobility technologies.

- Asia Pacific is the fastest-growing region, driven by rapid urbanization, EV adoption, and government-backed smart mobility initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Need for Predictive Maintenance and Vehicle Safety:

The predictive automobile technology market is strongly driven by the growing need for predictive maintenance and enhanced vehicle safety features. Vehicle owners and fleet operators seek systems that can forecast potential failures before they occur. Predictive solutions use real-time sensor data and analytics to monitor engine performance, brake wear, and battery health. These features reduce unplanned breakdowns and improve vehicle lifespan. Automakers are embedding predictive algorithms in connected systems to alert drivers in advance. The ability to prevent accidents and ensure driver safety remains a strong growth factor. Consumers view predictive maintenance as a cost-saving feature that improves ownership value. This demand ensures steady adoption across both passenger and commercial vehicles.

- For instance, Continental AG has produced over 200 million radar sensors as of May 2025, a key technology in ADAS that enhances vehicle safety and predictive capabilities.

Integration of Artificial Intelligence and Data Analytics:

The integration of artificial intelligence and advanced data analytics drives the predictive automobile technology market. Automakers use AI models to process large sets of driver, vehicle, and road data. These predictive models can identify abnormal behavior in real-time, supporting timely decision-making. The rising role of AI in self-learning vehicle systems enhances adaptive safety features. Data-driven predictions also assist in optimizing fuel consumption and improving navigation. Automakers actively invest in AI to remain competitive in a data-intensive mobility environment. It is expanding through partnerships between automobile companies and technology firms. AI-based predictive capabilities offer personalization and advanced control to drivers. The momentum will continue as AI technologies evolve further.

- For instance, Robert Bosch GmbH collaborates in the Automated Driving Alliance, focusing on AI-driven Level 2 and Level 3 automated driving systems tested across various regions as of mid-2025.

Rising Demand for Connected and Smart Vehicles:

Consumer demand for connected and smart vehicles plays a vital role in shaping the predictive automobile technology market. Modern vehicles are increasingly equipped with IoT sensors, wireless connectivity, and cloud-based platforms. Predictive features leverage these connected ecosystems to deliver real-time insights. Drivers gain alerts on traffic, weather conditions, and potential mechanical issues. Connected systems also enhance insurance, fleet management, and infotainment experiences. Manufacturers view predictive functions as a core element of smart mobility. It is supporting both individual customers and enterprises managing transport operations. The growing smart city initiatives globally also encourage faster adoption of predictive technologies.

Government Regulations and Safety Mandates Driving Adoption:

Government policies and strict safety regulations fuel growth in the predictive automobile technology market. Authorities across developed and emerging regions promote advanced driver-assistance systems and predictive analytics in vehicles. These measures aim to reduce accident rates and enhance passenger safety. Regulations often mandate installation of sensors, automatic emergency braking, and predictive diagnostic tools. Compliance pressures encourage automakers to integrate predictive technologies into new models. Regulatory support aligns with sustainability goals by improving efficiency and reducing emissions. It is strengthening the position of predictive systems in global automotive production. Public awareness campaigns also push consumer demand for safer vehicles. The regulatory push ensures that predictive technologies become standard features over time.

Market Trends:

Emergence of Autonomous Driving and Predictive Intelligence:

The predictive automobile technology market is witnessing strong influence from autonomous driving adoption. Autonomous and semi-autonomous vehicles depend heavily on predictive intelligence to function safely. Predictive models analyze traffic flows, pedestrian movements, and road hazards to make instant decisions. The demand for precision in autonomous mobility encourages investment in predictive systems. Companies developing autonomous fleets integrate predictive algorithms as a critical feature. It is transforming driving from reactive control to proactive planning. Predictive technology also reduces system failures in autonomous navigation. This trend positions predictive intelligence as a backbone of future autonomous transport.

- For instance, Aptiv PLC introduced its AI-powered Gen 6 ADAS platform at CES 2025, featuring machine learning-based predictive technology and hands-free urban assist aimed at enhancing autonomous capabilities.

Cloud-Based Platforms Enabling Predictive Insights:

The adoption of cloud-based platforms is shaping the predictive automobile technology market with enhanced integration. Cloud computing supports storage and processing of massive volumes of vehicle data. Predictive features rely on cloud systems to offer drivers real-time updates. Automakers use cloud-driven tools to provide software updates and predictive alerts. This connectivity strengthens relationships between drivers, service providers, and manufacturers. It is enabling remote diagnostics and proactive repair scheduling. Cloud integration reduces reliance on traditional workshops by shifting monitoring online. The scalability of cloud platforms ensures wider adoption across global markets. This trend accelerates the digitalization of automotive ecosystems.

- For instance, NXP Semiconductors completed the acquisition of TTTech Auto in June 2025, significantly enhancing its software-defined vehicle cloud capabilities and safety middleware integration for real-time predictive insights.

Expansion of Predictive Technologies in Electric Vehicles:

The growth of electric vehicles is creating new momentum for the predictive automobile technology market. Electric vehicles depend on predictive features to optimize battery performance and energy consumption. Predictive analytics forecast charging requirements and detect irregularities in energy usage. This capability helps avoid range anxiety and enhances reliability for drivers. Automakers integrate predictive charging guidance for efficient travel planning. It is supporting wider consumer trust in electric vehicles. Predictive intelligence also improves lifecycle management of EV batteries. The synergy between EV adoption and predictive systems will strengthen as demand for electrification increases globally.

Personalization and Driver-Centric Predictive Features:

The predictive automobile technology market is embracing personalization as a key trend. Automakers focus on predictive tools that adapt to individual driving habits. These systems analyze behavior to customize vehicle settings and infotainment preferences. Predictive personalization extends to safety alerts, suggesting routes based on past travel. It is boosting consumer satisfaction by creating intuitive user experiences. Manufacturers view personalized predictive tools as competitive differentiators. Predictive personalization also supports customer loyalty by providing tailored services. The trend highlights a shift toward human-centric automotive intelligence. Its influence is expanding across premium as well as mass-market vehicles.

Market Challenges Analysis:

High Implementation Costs and Complexity in System Integration:

The predictive automobile technology market faces challenges related to high implementation costs and integration complexity. Developing predictive models requires significant investments in sensors, data platforms, and AI algorithms. Smaller automakers often find these costs prohibitive, slowing widespread adoption. System integration across multiple vehicle models adds technical challenges. Variations in hardware and software standards hinder smooth deployment. It is difficult for manufacturers to balance affordability with advanced predictive features. Consumers in cost-sensitive markets hesitate to pay premiums for predictive tools. This cost barrier creates a gap between advanced and emerging automotive markets. The challenge continues as demand grows but affordability lags.

Concerns About Data Privacy and Reliability of Predictions:

The predictive automobile technology market also faces challenges related to data privacy and reliability. Predictive systems collect large volumes of driver and vehicle data, raising privacy risks. Concerns about data misuse and lack of secure frameworks slow adoption in sensitive regions. Inconsistent data quality can reduce the accuracy of predictive insights. Drivers may lose trust in systems that provide false or delayed alerts. Automakers must ensure transparency to maintain consumer confidence. It is vital for predictive systems to meet regulatory compliance for data use. Global differences in data protection laws complicate international deployment. These issues create uncertainty and demand stronger governance in predictive solutions.

Market Opportunities:

Adoption of Predictive Solutions in Fleet and Mobility Services:

The predictive automobile technology market has strong opportunities in fleet and mobility service applications. Fleet operators demand predictive analytics for maintenance scheduling and fuel optimization. Predictive features reduce downtime and extend vehicle usability in commercial transport. Shared mobility services also integrate predictive tools for real-time monitoring. It is creating demand across logistics, ride-hailing, and car-sharing industries. Businesses value predictive capabilities that minimize operational costs and increase efficiency. The expansion of mobility-as-a-service platforms enhances this opportunity further.

Emerging Growth in Developing Automotive Markets:

The predictive automobile technology market is set to expand in developing regions where smart mobility is advancing. Rapid urbanization and rising middle-class populations drive vehicle adoption. Automakers target predictive features to attract consumers seeking safety and convenience. It is fostering adoption in Asia Pacific, Latin America, and the Middle East. Government-backed smart city projects support integration of predictive tools in transportation systems. Growing investments in connected infrastructure create a foundation for predictive adoption. These factors make emerging regions critical growth zones for global market expansion.

Market Segmentation Analysis:

By Vehicle Type

The predictive automobile technology market shows dominance of passenger cars, holding nearly 74% share in 2024. The adoption of predictive safety and maintenance tools in mid-range and premium models strengthens this lead. Commercial vehicles are the fastest-growing segment, projected to record an 8% CAGR between 2024 and 2029. Fleet operators use predictive insights to reduce downtime and extend vehicle life cycles. It highlights the growing importance of predictive systems in logistics and transportation.

- For instance, ZF Friedrichshafen AG strategically focuses on hybrid and electric commercial vehicles, developing modular electric axle drives to optimize predictive maintenance and fleet uptime as of mid-2025.

By Hardware Type

Advanced Driver Assistance Systems (ADAS) lead the market with about 57% share in 2024. ADAS delivers predictive features such as collision alerts, adaptive cruise control, and lane departure warnings. On-Board Diagnosis (OBD) plays a critical role in predictive fault detection. Other hardware types, including semiconductors, microcontrollers, and telematics devices, provide the backbone for connectivity and real-time processing. It underscores hardware’s contribution in enabling predictive intelligence.

- For instance, Continental AG orders for radar sensors reached approximately €1.5 billion in Q1 2025 with production ramp-ups planned for 2026-2027, demonstrating strong demand for ADAS hardware.

By Application, Deployment, and End-user

Predictive maintenance is the largest application, valued for preventing failures and lowering repair costs. Vehicle health monitoring, safety and security, and driving pattern analysis expand adoption across consumer and fleet use. Deployment models include on-premise systems, offering secure analytics, and cloud-based platforms, gaining traction for scalability and remote access. By end-user, fleet owners dominate adoption due to maintenance and cost benefits. Insurers integrate predictive data into risk models, while other end-users, such as mobility providers and private owners, continue to broaden application scope.

Segmentation:

By Vehicle Type:

- Passenger Cars (dominates market with approx. 74% share in 2024)

- Commercial Vehicles (fastest-growing segment with 8% CAGR projected from 2024–2029)

By Hardware Type:

- Advanced Driver Assistance Systems (ADAS) (dominates with approx. 57% market share in 2024)

- On-Board Diagnosis (OBD)

- Other Hardware Types (semiconductors, microcontrollers, telematics devices)

By Application:

- Predictive Maintenance (largest application segment)

- Vehicle Health Monitoring

- Safety & Security

- Driving Patterns Analysis

- Others

By Deployment:

By End-user:

- Fleet Owners

- Insurers

- Other End-users

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading with Strong Technological Adoption

North America dominates the predictive automobile technology market with a share of 38%. The region benefits from advanced automotive infrastructure, high consumer awareness, and strong adoption of connected vehicles. Automakers collaborate with technology companies to integrate AI, data analytics, and predictive safety features into mainstream models. Government policies also emphasize road safety, pushing adoption of predictive systems in both passenger and commercial vehicles. It continues to expand through partnerships between manufacturers and digital service providers. The presence of leading technology firms supports innovation and accelerates market penetration.

Europe: Focus on Safety and Sustainability Regulations

Europe holds a significant 30% share of the predictive automobile technology market, driven by strict regulatory standards and strong automotive production capabilities. Regional authorities promote predictive safety systems through legislation, ensuring higher integration in new vehicles. Automakers invest heavily in advanced driver-assistance technologies to comply with safety requirements. It is also supported by the push toward sustainable mobility, where predictive solutions help improve efficiency and reduce emissions. Germany, France, and the UK remain key hubs due to strong manufacturing ecosystems. The European market emphasizes research and innovation, making predictive tools a standard feature in upcoming vehicle launches.

Asia Pacific: Fastest-Growing with Expanding Smart Mobility

Asia Pacific accounts for 22% of the predictive automobile technology market and is expected to grow at the fastest pace. Rising urbanization, increasing vehicle production, and rapid adoption of electric vehicles drive strong regional demand. Countries like China, Japan, and India lead the transformation, supported by government-backed smart city initiatives. It is further accelerated by investments in connected infrastructure and partnerships with global technology providers. Consumers in emerging economies show growing interest in predictive safety and convenience features. The region’s vast automotive manufacturing base ensures scalability and positions Asia Pacific as a major growth engine in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Robert Bosch GmbH (Germany)

- Aptiv PLC (UK)

- Valeo (France)

- Garrett Motion (Switzerland)

- Aisin Seiki (Japan)

- NXP Semiconductors (Netherlands)

- Mitsubishi Electric

- Siemens

- IBM

- SAP SE

- Microsoft

- Oracle

Competitive Analysis:

The predictive automobile technology market is highly competitive, shaped by established automotive suppliers, semiconductor companies, and technology firms. Leading players such as Continental AG, Bosch, ZF Friedrichshafen, and Aptiv dominate with strong expertise in hardware and integrated systems. Technology providers including IBM, Microsoft, and SAP strengthen the market with advanced data analytics and AI-driven platforms. It is influenced by partnerships between automakers and digital companies to deliver predictive maintenance, safety, and connected services. Continuous investment in research, product innovation, and regional expansion ensures competition remains dynamic and intense.

Recent Developments:

- In December 2024, Continental AG showcased its latest innovations at CES 2025, highlighting advancements in software-defined vehicles and autonomous driving capabilities. The company revealed a modular and scalable ADAS portfolio, radar-based parking solutions, and the industrialization of Aurora Driver, an SAE L4 autonomous driving system for trucking planned for production in 2027. Continental also introduced an “Intelligent Vehicle Experience Car” with biometric access features, emphasizing a future of seamless human-vehicle interaction.

- In June 2025, Robert Bosch GmbH expanded its collaborative development efforts with CARIAD through the Automated Driving Alliance. The alliance is advancing Level 2 and Level 3 automated driving systems using AI technologies, with systems currently undergoing testing across multiple regions. Bosch also emphasized its focus on generative AI to improve automated driving functions and reduce test miles needed for validation.

- In January 2025, Aptiv PLC unveiled its Gen 6 ADAS platform powered by AI and machine learning at CES 2025. It features hands-free urban assist, ML-based predictive technology for human-like driving, and new perception solutions combining bird’s-eye-view cameras and ultrashort-range radar. Aptiv also demonstrated an AI-powered in-cabin personalization system for enhanced user experience.

- In July 2025, Valeo unveiled next-generation vehicle technologies at IAA MOBILITY 2025, focusing on software-defined vehicles, advanced driver assistance systems, electrified vehicle solutions, and smart lighting to accelerate safer, more sustainable mobility.

- In July 2025, Garrett Motion reported a fiscal 2025 outlook upgrade driven by advancements in zero-emission and hybrid product wins amidst pressures from the electric vehicle transition. Despite a modest revenue increase, the company is advancing in new technology areas like E-Powertrain systems and fuel cell compressors.

Market Concentration & Characteristics:

The predictive automobile technology market reflects moderate-to-high concentration with global leaders dominating key hardware and software segments. It is characterized by strong collaborations between traditional automotive companies and technology providers. Innovation in ADAS, predictive maintenance, and cloud connectivity drives market competitiveness. Regional leaders adapt strategies to regulatory conditions and customer demand, creating diverse adoption rates. Market growth is shaped by continuous advancements in AI and connectivity, ensuring predictive solutions remain central to the future of mobility.

Report Coverage:

The research report offers an in-depth analysis based on vehicle type, hardware type, application, deployment, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing integration of AI and machine learning in predictive vehicle systems.

- Rising adoption of cloud-based platforms for real-time monitoring and diagnostics.

- Expansion of predictive solutions in electric and autonomous vehicles.

- Increasing demand for predictive safety features among passenger car buyers.

- Stronger adoption of predictive maintenance in commercial fleets.

- Growing collaboration between automakers and technology firms.

- Rising importance of predictive data in insurance and risk assessment.

- Government regulations promoting safety and sustainability driving adoption.

- Asia Pacific expected to record fastest growth with EV and smart mobility.

- Expansion of personalization and driver-centric predictive experiences.