Market Overview:

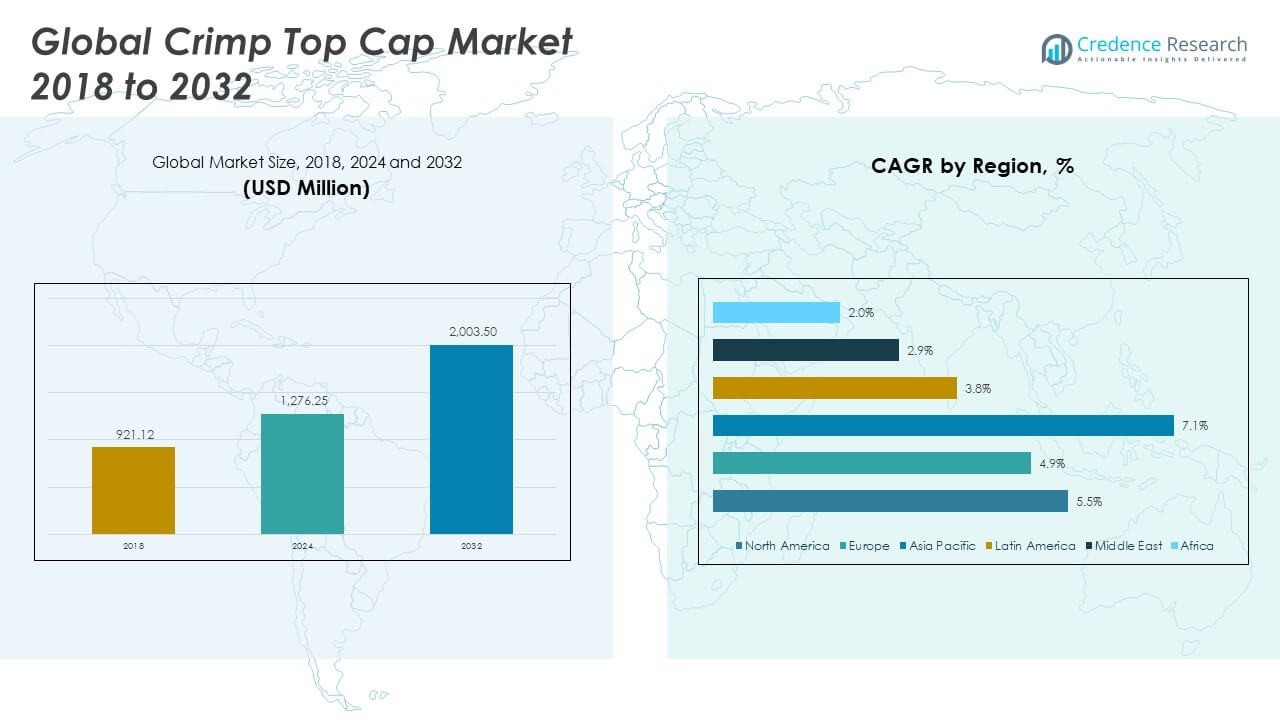

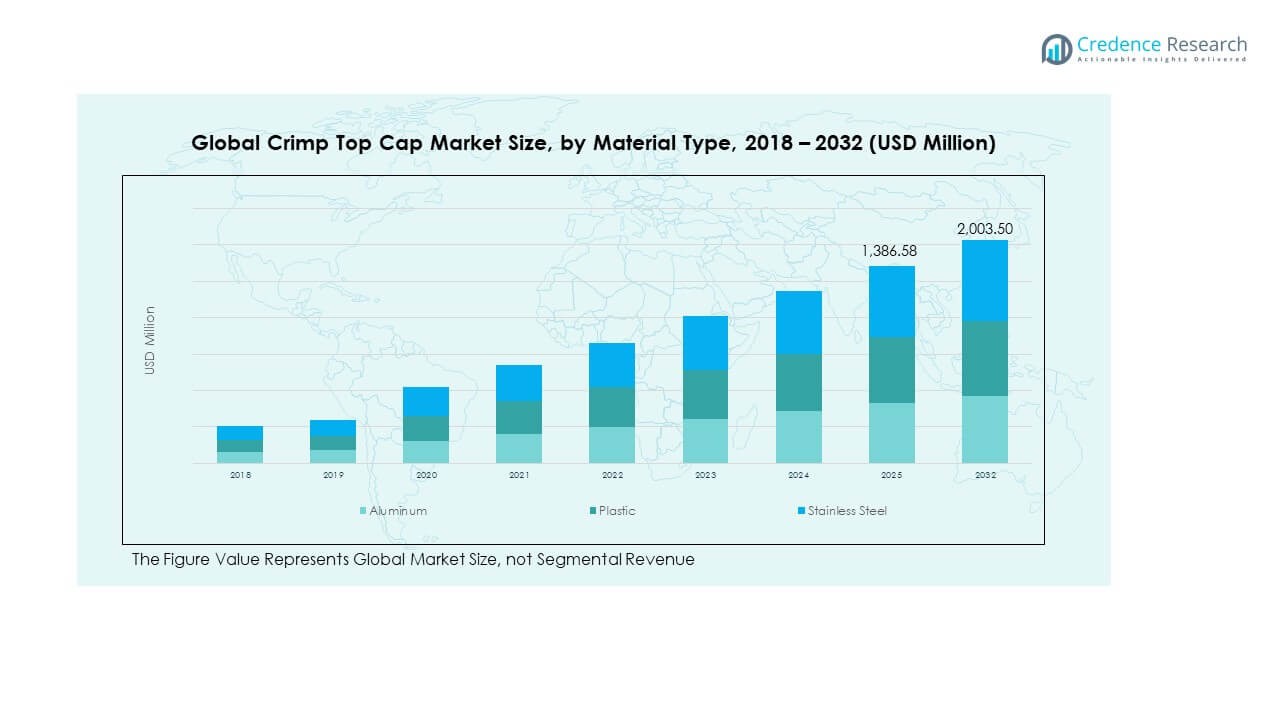

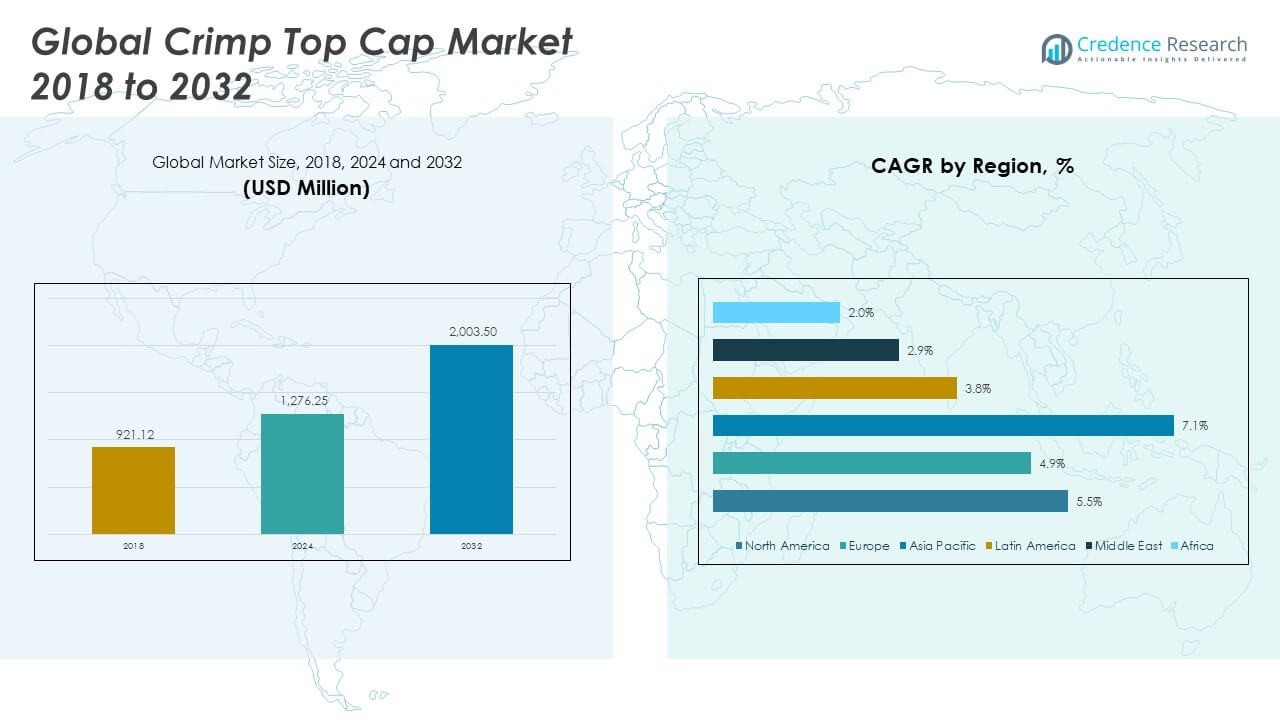

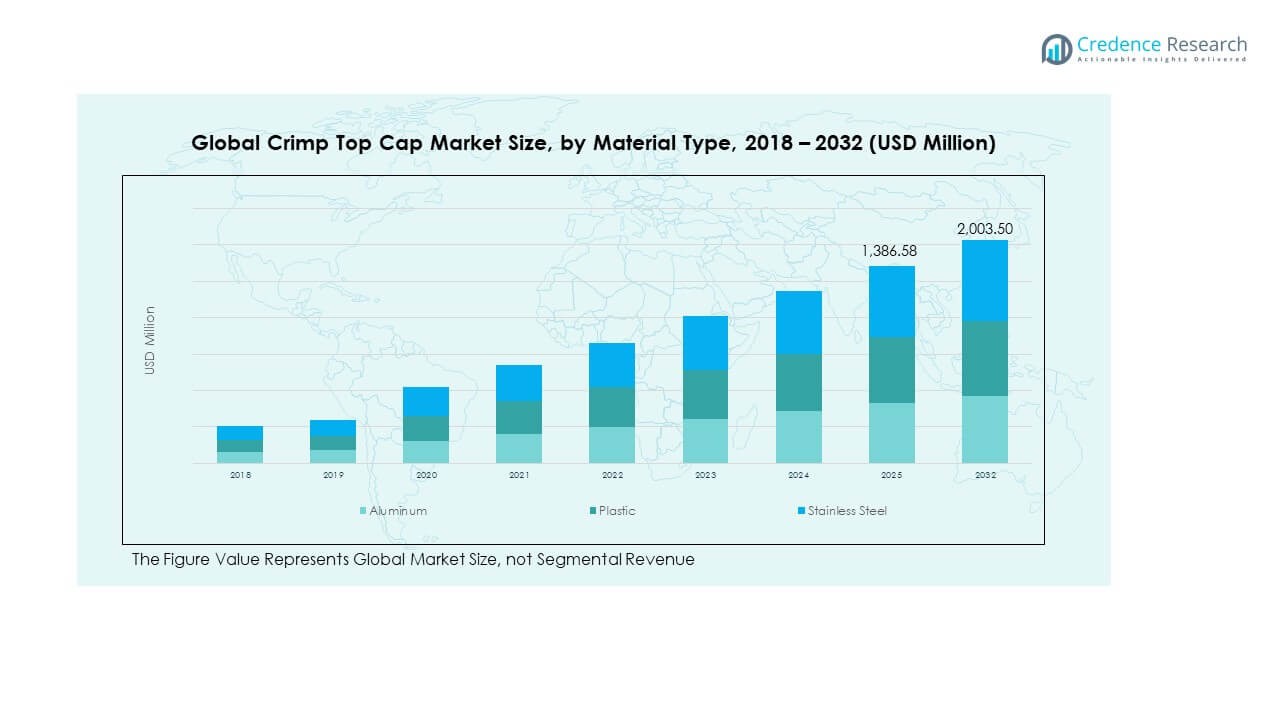

The Global Crimp Top Cap Market size was valued at USD 921.12 million in 2018 to USD 1,276.25 million in 2024 and is anticipated to reach USD 2,003.50 million by 2032, at a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crimp Top Cap Market Size 2024 |

USD 1,276.25Million |

| Crimp Top Cap Market, CAGR |

5.40% |

| Crimp Top Cap Market Size 2032 |

USD 2,003.50 Million |

The market growth is driven by rising demand in pharmaceutical packaging, where crimp top caps ensure secure sealing and contamination prevention. Increasing adoption in laboratory applications further strengthens market demand, as precision and safety standards become more stringent. Manufacturers are also introducing advanced crimping solutions with improved material strength, enhancing cap integrity and compliance with global quality regulations. Growing emphasis on sterile drug delivery systems and the expansion of injectable drugs pipeline significantly propel the market forward.

Regionally, North America leads due to strong pharmaceutical manufacturing, regulatory compliance, and advanced research infrastructure. Europe follows with high adoption in drug packaging and medical research, driven by strict safety standards. Asia Pacific is emerging as a high-growth region, fueled by expanding healthcare infrastructure, rising clinical trials, and increasing investments in generics. Countries like China and India are becoming key contributors, while Latin America and the Middle East show gradual adoption supported by improving pharmaceutical supply chains and healthcare advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Crimp Top Cap Market was valued at USD 921.12 million in 2018, reached USD 1,276.25 million in 2024, and is projected to achieve USD 2,003.50 million by 2032, growing at a CAGR of 5.40%.

- Europe held the largest share in 2024 at 42.7%, followed by North America at 28.8% and Asia Pacific at 20.1%, driven by strong pharmaceutical hubs, advanced healthcare infrastructure, and research investments.

- Asia Pacific is the fastest-growing region with a 7.1% CAGR and 20.1% share in 2024, supported by expanding pharmaceutical production, vaccine programs, and cost-efficient manufacturing.

- Aluminum dominated material share in 2024 with more than 55%, supported by its lightweight nature, durability, and suitability for sterile applications across pharmaceutical and laboratory use.

- Plastic accounted for roughly 30% of segment share in 2024, driven by demand in cost-sensitive food and beverage packaging, while stainless steel retained a smaller share in specialized industrial and chemical applications.

Market Drivers:

Growing Adoption of Sterile Packaging Solutions in Pharmaceutical and Biotech Applications

The Global Crimp Top Cap Market is driven by the need for secure and sterile packaging in pharmaceutical and biotech industries. Crimp top caps play a critical role in safeguarding injectable drugs from contamination and maintaining product integrity. Rising approvals of injectable formulations have strengthened the reliance on these closures. It ensures tamper-evidence, precise sealing, and compatibility with advanced drug delivery systems. Demand growth is fueled by stringent regulatory guidelines supporting safe packaging. Global research expansion further amplifies adoption. Investment in sterile facilities also supports market advancement.

- For example, Gerresheimer expanded its sterile packaging operations in Peachtree City, U.S., with over 130,000 square feet of ISO Class 8 and 9 cleanrooms to boost production of inhalers and auto-injectors. This investment strengthens its role as a key supplier of pharmaceutical packaging and drug delivery solutions in global healthcare markets.

Expansion of Clinical Research Activities and Rising Volume of Injectable Drugs

A surge in clinical trials and injectable therapies has fueled significant demand for crimp top caps worldwide. The Global Crimp Top Cap Market benefits from the increase in biologics and biosimilars requiring advanced packaging. Crimp tops provide secure containment, which reduces risk during transportation and storage. It supports the safe use of vaccines, oncology drugs, and chronic disease treatments. Pharmaceutical companies prefer these closures due to their reliability and performance under regulatory pressure. Growing drug pipelines highlight their importance in research applications. Hospitals and laboratories continue to integrate them extensively. Industrial players invest in scaling production to meet this requirement.

Advancements in Material Quality and Manufacturing Techniques Supporting Higher Standards

Manufacturers are introducing advanced crimp top caps with improved durability and material purity. The Global Crimp Top Cap Market has experienced steady support from innovations in aluminum alloys and coatings. It enhances barrier properties and prevents chemical interaction with drug formulations. These improvements align with evolving international safety regulations. Rising automation in cap production boosts supply efficiency and standardization. Enhanced inspection systems ensure consistent quality levels in high-volume manufacturing. It allows companies to meet growing global demand without compromising compliance. Such developments strengthen customer confidence in pharmaceutical packaging.

- For example, Stevanato Group has integrated laser-based visual inspection systems into its crimp cap production lines, enabling full inspection capability of up to 36,000 caps per hour. This advancement ensures precise dimensional accuracy and a defect-free supply of closures, strengthening quality assurance for pharmaceutical clients.

Rising Global Healthcare Spending and Expansion of Drug Distribution Channels

The increase in healthcare spending across developed and emerging economies supports higher demand for crimp top caps. The Global Crimp Top Cap Market gains momentum from expanded drug distribution networks and broader access to treatments. It benefits from government initiatives promoting reliable healthcare packaging systems. Pharmaceutical exports from Asia Pacific and Europe create opportunities for crimp cap suppliers. Growing hospital networks and vaccination programs contribute to stable adoption. Rising emphasis on public health and safe drug delivery reinforces market reliance. It is further strengthened by the need to standardize packaging across international markets. These drivers keep the market firmly positioned for growth.

Market Trends

Integration of Automated Crimping Systems and Smart Manufacturing Practices

The Global Crimp Top Cap Market is witnessing a shift toward automation in production and application. Automated crimping systems ensure precision and reduce human error during sealing processes. It improves operational efficiency and reduces costs in pharmaceutical facilities. Manufacturers adopt digital quality control tools to monitor sealing integrity. Advanced machinery allows rapid scale-up to meet fluctuating demand. Adoption of robotics enhances consistency across global supply chains. The move toward Industry 4.0 practices reinforces digital integration. It drives adoption of intelligent solutions in cap manufacturing and application.

Increased Customization in Cap Designs and Focus on Aesthetic Packaging Innovation

The demand for customized packaging has influenced manufacturers to develop versatile crimp top cap designs. The Global Crimp Top Cap Market adapts to pharmaceutical and laboratory needs by offering variations in colors, materials, and finishes. It enhances brand identity while maintaining safety. Research facilities require distinctive features for precise identification of samples. Manufacturers focus on ergonomic designs to improve usability in high-volume settings. Growing awareness of branding in healthcare creates opportunities for tailored solutions. It encourages players to combine function with visual differentiation. This trend reflects the merging of utility and marketing potential.

Growing Emphasis on Eco-Friendly Manufacturing and Recycling Initiatives

Sustainability has become a strong trend across the healthcare packaging sector. The Global Crimp Top Cap Market is moving toward eco-friendly production processes and recyclable materials. It aligns with regulatory goals targeting reduced environmental impact. Manufacturers explore lightweight aluminum options to cut material waste. Demand for sustainable supply chains drives sourcing strategies. Industry leaders invest in renewable energy within production facilities. It reduces the carbon footprint while maintaining compliance. The transition to greener practices is expected to reshape industry standards. It positions manufacturers to capture eco-conscious customers.

- · For instance, Schott AG’s Jambusar facility in Gujarat operates on renewable energy through a 5.5 MW wind–solar hybrid plant, reducing nearly 16,000 tons of CO₂ annually. Since the site manufactures pharmaceutical glass vials that rely on crimp top caps for sealing,

Rising Adoption of Advanced Analytical Tools in Packaging Validation Processes

Technological progress has brought advanced testing methods to verify the performance of crimp top caps. The Global Crimp Top Cap Market integrates inspection systems that monitor sealing precision and detect micro-defects. It ensures higher compliance with international packaging regulations. Pharmaceutical companies deploy high-resolution imaging tools for quality assurance. Automated leak detection enhances confidence in sterile applications. Industry adoption of predictive analytics supports proactive issue resolution. It reduces wastage and boosts production yield. Growing demand for error-free packaging is strengthening this trend. It ensures consistent safety for sensitive drug products.

- For example, Stevanato Group has introduced its Vision Robot Unit (VRU), a modular robotic inspection platform designed for 100% visual inspection of parenteral containers, including vials and closures. The system leverages advanced imaging and automation to ensure precise defect detection and compliance with sterile packaging requirements for injectable drug delivery.

Market Challenges Analysis

Rising Regulatory Pressures and High Compliance Costs Across Global Packaging Standards

The Global Crimp Top Cap Market faces increasing regulatory scrutiny across multiple jurisdictions. It requires manufacturers to comply with diverse standards on safety, material quality, and performance validation. The costs of meeting these requirements place pressure on profit margins. Companies must invest heavily in advanced inspection and documentation processes. Regulatory audits add complexity and require consistent alignment across production sites. It challenges smaller players that lack sufficient resources to manage compliance. The need for third-party certifications further increases operational costs. This challenge can slow expansion into highly regulated markets.

Supply Chain Disruptions and Cost Fluctuations of Raw Materials for Manufacturing Caps

Supply chain instability has emerged as a significant barrier for manufacturers of crimp top caps. The Global Crimp Top Cap Market depends heavily on metals such as aluminum, whose price fluctuations impact cost structures. It exposes companies to profitability risks during volatile market conditions. Logistics disruptions have slowed distribution and affected on-time deliveries. Pharmaceutical clients demand consistent availability, which raises pressure on suppliers. Rising energy costs also influence production expenses. It requires manufacturers to adopt flexible sourcing strategies to ensure stability. Continued instability in global trade could restrain growth in sensitive markets.

Market Opportunities

Growing Penetration of Injectable Therapies in Emerging Healthcare Markets Creating Expansion Scope

The Global Crimp Top Cap Market has promising opportunities in emerging economies with expanding healthcare access. It benefits from the rising adoption of injectable therapies for chronic and infectious diseases. Governments are increasing investment in medical infrastructure, opening growth potential for packaging suppliers. Demand for cost-effective solutions drives interest in locally produced crimp caps. Pharmaceutical outsourcing in regions like Asia Pacific strengthens long-term opportunities. It provides scalability and low-cost manufacturing advantages. Growing partnerships between multinational drugmakers and regional suppliers also support market penetration.

Rising Investments in Biologics and Biosimilars Generating Long-Term Demand for High-Quality Closures

The expansion of biologics and biosimilars markets has created attractive growth opportunities for crimp top cap manufacturers. The Global Crimp Top Cap Marketis positioned to benefit from the need for sterile and secure closures in advanced therapies. It leverages advancements in cap materials to meet stringent storage and delivery requirements. Increasing R&D activity in biopharmaceuticals expands demand pipelines. Market participants are diversifying portfolios to serve multiple therapeutic areas. It also provides opportunities for premium, specialized cap designs. Long-term growth potential is sustained by continued innovation and adoption of injectable drug formats.

Market Segmentation Analysis:

The Global Crimp Top Cap Market is segmented

By material type

Into aluminum, plastic, and stainless steel. Aluminum dominates due to its superior barrier properties, lightweight nature, and suitability for pharmaceutical and laboratory applications. Plastic caps hold strong relevance in cost-sensitive industries such as food and beverage, where flexibility and affordability are key. Stainless steel remains a niche segment, primarily utilized in specialized chemical and high-durability environments where resistance to corrosion and strength are critical. It supports applications requiring longer lifecycle and structural stability.

- For example, DWK Life Sciences produces polypropylene Push-On caps for its Duran® bottles, engineered for use in food and beverage laboratories. These caps withstand temperatures from -40°C to 121°C, making them suitable for routine laboratory processing and reliable sample handling.

By application

The market spans food and beverage, pharmaceutical, cosmetics, chemicals, and others. Pharmaceutical applications command the largest share, driven by stringent requirements for sterile drug packaging and injectable formulations. Food and beverage sectors also contribute significantly, with crimp top caps ensuring product freshness and secure sealing. Cosmetics employ them for premium packaging solutions, while chemicals leverage their safety features for controlled storage. Other uses include laboratory research and industrial product containment. It continues to align with demand across varied applications.

By end user industries

The segmentation includes packaging, manufacturing, healthcare, food processing, and others. Packaging leads with consistent demand from pharmaceuticals, supported by global distribution and compliance needs. Healthcare remains a core end user due to the expansion of drug pipelines and biologics. Manufacturing integrates crimp caps in specialized processes requiring secure closures, while food processing relies on them for preservation. Other industries adopt crimp top caps for laboratory and research purposes. It highlights the versatility and adaptability of these closures across critical sectors.

- For example, Aptar Pharma reported supplying crimp closures for vaccines and biologic drugs in 2024, highlighting its role in meeting healthcare safety protocols outlined in its annual compliance reports.

Segmentation:

By Material Type

- Aluminum

- Plastic

- Stainless Steel

By Application

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Chemicals

- Others

By End User Industries

- Packaging

- Manufacturing

- Healthcare

- Food Processing

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Crimp Top Cap Market size was valued at USD 269.39 million in 2018 to USD 367.46 million in 2024 and is anticipated to reach USD 579.25 million by 2032, at a CAGR of 5.5% during the forecast period. North America holds a market share of 28.8% in 2024, supported by its strong pharmaceutical sector and advanced healthcare infrastructure. The United States leads with high demand for sterile injectable packaging and strict compliance with FDA regulations. It benefits from a well-established research ecosystem, driving continuous innovation in closures. Canada and Mexico contribute with growing drug exports and manufacturing bases. Healthcare expenditure expansion sustains cap adoption across multiple applications. Investments in biologics and injectable drugs reinforce the need for reliable crimp top solutions. It remains a mature market with consistent long-term opportunities.

Europe

The Europe Global Crimp Top Cap Market size was valued at USD 402.85 million in 2018 to USD 545.11 million in 2024 and is anticipated to reach USD 823.67 million by 2032, at a CAGR of 4.9% during the forecast period. Europe accounts for 42.7% market share in 2024, making it the largest regional contributor. Pharmaceutical hubs in Germany, France, and the UK drive adoption, backed by stringent EU regulatory standards. It benefits from strong investments in R&D and expanding biologics pipelines. Eastern Europe also shows rising adoption due to growing generics production. Food and beverage industries utilize crimp caps for secure packaging, while cosmetics contribute to niche demand. Sustainability initiatives encourage recyclable and eco-friendly closures. It remains a dominant player with high regulatory emphasis and innovation focus.

Asia Pacific

The Asia Pacific Global Crimp Top Cap Market size was valued at USD 170.62 million in 2018 to USD 257.00 million in 2024 and is anticipated to reach USD 458.82 million by 2032, at a CAGR of 7.1% during the forecast period. Asia Pacific holds a 20.1% market share in 2024, with the fastest growth among all regions. China and India are central to expansion, driven by rising pharmaceutical production, vaccine programs, and cost-efficient manufacturing. Japan and South Korea maintain strong positions through advanced healthcare technologies and research activities. It benefits from increasing outsourcing in drug production and clinical trials. Food and beverage applications strengthen regional demand, supported by large consumer bases. Rapid urbanization also drives packaging innovation. It emerges as a high-potential hub for both local and global players.

Latin America

The Latin America Global Crimp Top Cap Market size was valued at USD 42.59 million in 2018 to USD 58.26 million in 2024 and is anticipated to reach USD 80.71 million by 2032, at a CAGR of 3.8% during the forecast period. Latin America represents 4.6% of the market share in 2024, with Brazil leading adoption. Growth is supported by expanding pharmaceutical exports, government vaccination programs, and rising healthcare investments. It is influenced by food and beverage packaging needs, particularly in Brazil and Mexico. Demand from cosmetics also adds to regional consumption. Challenges exist due to uneven regulatory environments across countries. Opportunities are emerging with foreign investments in healthcare and drug manufacturing. It is gradually moving toward greater adoption of standardized closures.

Middle East

The Middle East Global Crimp Top Cap Market size was valued at USD 23.24 million in 2018 to USD 29.13 million in 2024 and is anticipated to reach USD 37.72 million by 2032, at a CAGR of 2.9% during the forecast period. The region accounts for 2.3% of the global share in 2024, reflecting modest but stable demand. GCC countries dominate with investments in healthcare infrastructure and drug imports. Israel shows strong innovation in research facilities that integrate crimp closure applications. It faces challenges due to dependence on imports and limited local production. Pharmaceutical sector expansion supports demand for sterile packaging. Cosmetics and personal care industries add secondary contributions. It maintains relevance through regional modernization of healthcare systems.

Africa

The Africa Global Crimp Top Cap Market size was valued at USD 12.43 million in 2018 to USD 19.29 million in 2024 and is anticipated to reach USD 23.32 million by 2032, at a CAGR of 2.0% during the forecast period. Africa contributes 1.5% of the global market share in 2024, making it the smallest regional participant. South Africa leads adoption with stronger healthcare infrastructure and pharmaceutical imports. Egypt follows with demand supported by government-led healthcare programs. It is limited by supply chain gaps and weak local manufacturing bases. Rising vaccination campaigns expand opportunities in sterile drug packaging. Food and beverage sectors slowly drive consumption in emerging economies. Global players see long-term prospects as infrastructure improves. It reflects gradual progress in a challenging market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Konecranes Plc

- Silgan Holdings Inc.

- Manitowoc Cranes (Terex Corporation)

- Closure Systems International Inc.

- Crown Holdings, Inc.

- Nandini Marketing Company

- Renaud Bio Pvt Ltd

- Bellcross Industries Pvt. Ltd.

- Skylark

- Unichrome Associates

Competitive Analysis:

The Global Crimp Top Cap Market features a mix of multinational corporations and regional players competing on product quality, material innovation, and compliance strength. Key companies such as Silgan Holdings Inc., Crown Holdings, Closure Systems International, and Konecranes Plc dominate through large-scale production and established distribution networks. It is shaped by continuous investment in lightweight materials, improved sealing integrity, and eco-friendly designs. Regional players such as Bellcross Industries and Renaud Bio Pvt Ltd strengthen competition with cost-effective solutions tailored to local demand. Strategic moves include mergers, product launches, and capacity expansion, reflecting the industry’s push for wider presence. Companies are also investing in automation and digital quality systems to ensure consistency. It demonstrates strong competition where global players leverage scale while smaller firms focus on niche markets and regional adaptability.

Recent Developments:

- In August 2025, Konecranes Plc delivered a state-of-the-art portal crane to Royal Selangor in Malaysia, supporting precision craftsmanship and expanding its reach in Southeast Asia. This initiative illustrates Konecranes’ commitment to specialty applications, and the Royal Selangor project was completed with advanced digital crane control features.

- In July 2025, Closure Sys tems International Inc. launched the Defender-Lok™ child-resistant closure (CRC) platform aimed at over-the-counter and nutraceutical markets. This innovative product offers certified safety and line efficiency, integrating seamlessly into existing capping lines and supporting regulatory compliance.

- In May 2025, Crown Holdings, Inc. announced the addition of a third high-speed production line to its beverage can facility in Ponta Grossa, Brazil. Once completed, the plant’s annual output will increase to 3.6 billion cans, making it Crown’s largest facility in Brazil and supporting both alcoholic and non-alcoholic beverage sectors.

- In February 2025, Manitowoc Cranes (Terex Corporation), through its subsidiary MGX Equipment Services, acquired key crane assets from Ring Power Corporation, strengthening its direct-to-customer footprint in Georgia, North Carolina, and South Carolina. This transaction expands Manitowoc’s crane sales, aftermarket parts, and service capabilities in those territories.

Market Concentration & Characteristics:

The Global Crimp Top Cap Market shows moderate concentration with a few large companies holding significant revenue shares, while regional manufacturers contribute to localized supply. It reflects characteristics of a regulated industry where compliance, sterile integrity, and material quality drive competitiveness. It remains innovation-oriented, with rising focus on recyclable materials and automation in production. Pricing structures vary by material type, with aluminum caps leading demand. Competition is balanced between global leaders leveraging economies of scale and smaller firms responding to specific regional needs. It presents stable growth opportunities supported by strong adoption in healthcare and pharmaceutical packaging.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Application and End User Industries. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Crimp Top Cap Market will expand with rising demand for sterile packaging in injectable drugs and biologics.

- Growth in clinical trials and vaccine programs will strengthen adoption across pharmaceutical applications.

- Increasing focus on eco-friendly and recyclable materials will influence future product development.

- Automation and digital inspection systems will improve sealing precision and production efficiency.

- Emerging economies will create opportunities through healthcare infrastructure development and drug manufacturing.

- Food and beverage industries will sustain demand by emphasizing product safety and extended shelf life.

- Cosmetics and personal care sectors will drive niche growth through premium packaging preferences.

- Global players will pursue mergers, acquisitions, and partnerships to enhance regional footprints.

- Regulatory alignment across regions will encourage standardization of material quality and safety practices.

- Innovation in lightweight designs and advanced coatings will shape long-term competitive strategies.