Market Overview

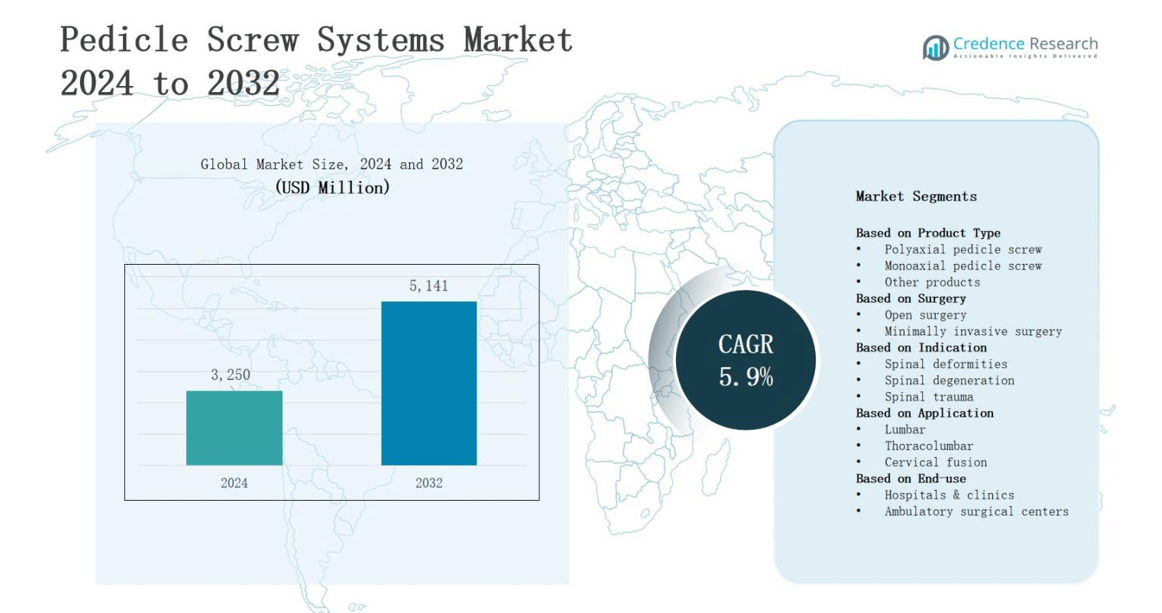

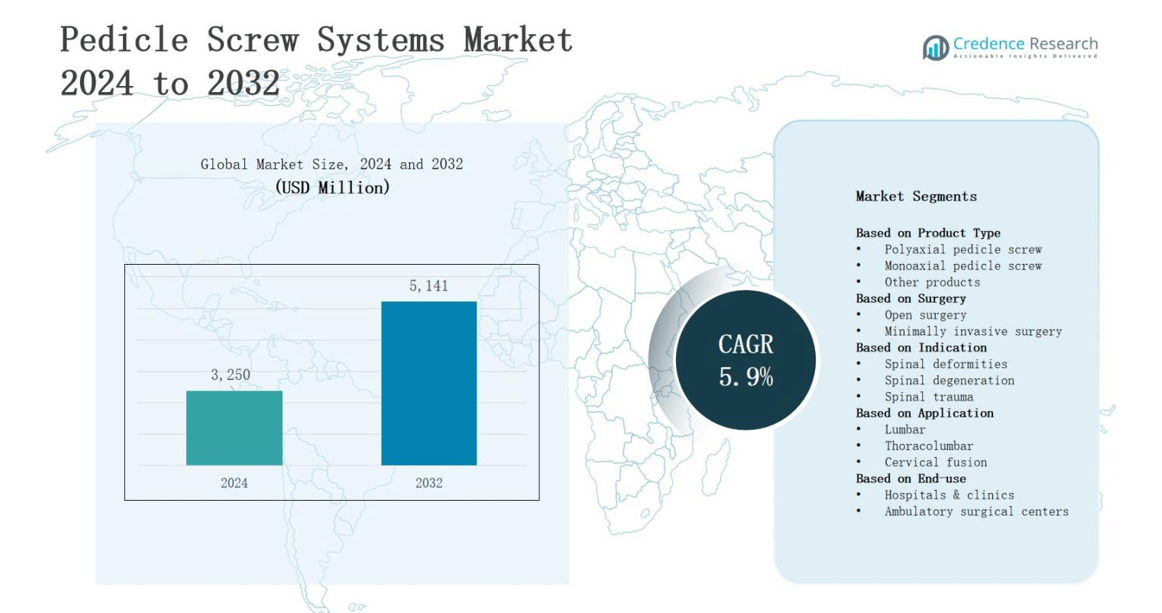

The pedicle screw systems market is projected to grow from USD 3,250 million in 2024 to USD 5,141 million by 2032, registering a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pedicle Screw Systems Market Size 2024 |

USD 3,250 million |

| Pedicle Screw Systems Market, CAGR |

5.9% |

| Pedicle Screw Systems Market Size 2032 |

USD 5,141 million |

The pedicle screw systems market is driven by the rising prevalence of spinal disorders, increasing demand for minimally invasive surgeries, and the growing elderly population prone to degenerative spine conditions. Advancements in biomaterials, image-guided navigation, and robotic-assisted surgeries enhance surgical precision, driving wider adoption. Favorable reimbursement policies and the rising number of trauma and accident cases further strengthen demand. Key trends include the shift toward customized implants, the integration of 3D printing for complex spinal reconstructions, and the adoption of hybrid fixation techniques, all contributing to improved clinical outcomes and expanded application across diverse patient groups.

The pedicle screw systems market demonstrates strong geographical diversity, with North America holding the largest share, followed by Europe and Asia Pacific as major growth hubs. Latin America and the Middle East & Africa also contribute steadily, supported by improving healthcare access and rising trauma cases. Key players shaping the market include Medtronic, Inc., Johnson & Johnson, Globus Medical, Inc., B. Braun, Alphatec Spine, Inc., Orthofix Medical Inc., Precision Spine, Inc., CTL Medical Corporation, Genesys Spine, LLC, RTI Surgical Holdings, Inc., and Medacta International SA.

Market Insights

- The pedicle screw systems market will grow from USD 3,250 million in 2024 to USD 5,141 million by 2032, recording a CAGR of 5.9% driven by rising spinal disorder prevalence.

- Polyaxial pedicle screws dominate with 55% share in 2024 due to flexibility and multi-directional angulation, followed by monoaxial at 30% and other products, including hybrid and expandable screws, at 15%.

- Open surgery leads with 60% share in 2024, supported by availability of trained surgeons, while minimally invasive surgery holds 40% share, boosted by navigation, robotics, and demand for quicker recovery.

- By indication, spinal degeneration dominates with 50% share, followed by spinal deformities at 30% and spinal trauma at 20%, fueled by aging populations, scoliosis treatments, and rising accident cases globally.

- Regionally, North America leads with 38% share, Europe follows at 27%, Asia Pacific holds 22%, Latin America accounts for 7%, and Middle East & Africa contribute 6% of global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Incidence of Spinal Disorders

The pedicle screw systems market benefits from the global increase in spinal disorders, including scoliosis, spinal stenosis, and degenerative disc diseases. It addresses growing demand for effective fixation systems that improve patient recovery and surgical outcomes. Surgeons rely on these systems to stabilize vertebrae and restore spinal alignment in complex conditions. The market expansion is also supported by higher awareness of early diagnosis. It positions these devices as vital tools in advanced spine surgeries.

Growing Demand for Minimally Invasive Surgeries

The pedicle screw systems market is supported by strong demand for minimally invasive procedures that reduce blood loss, infection risk, and recovery time. Patients prefer techniques that ensure faster rehabilitation and lower hospitalization costs. Hospitals increasingly invest in advanced fixation systems compatible with navigation and robotic tools. It strengthens the adoption rate across developed and emerging regions. Surgeons also embrace these systems to achieve higher accuracy, efficiency, and safety during spinal procedures.

- For instance, DePuy Synthes’ Viper Prime System, known for its minimally invasive design, has been documented to streamline spinal fixation procedures by reducing instrument passes and operative duration.

Technological Advancements and Product Innovation

The pedicle screw systems market experiences steady growth due to innovations in design, biomaterials, and surgical navigation technologies. Manufacturers develop polyaxial screws, expandable implants, and hybrid fixation systems to enhance stability. It drives adoption by providing surgeons with flexible and durable solutions. Integration of 3D printing enables customized implants for complex deformities. Robotic-assisted systems ensure precision and consistency. These advancements establish new benchmarks for safety, efficiency, and improved patient-centric surgical care globally.

- For instance, Eminent Spine received FDA clearance in 2025 for its 3D-printed titanium pedicle screw system, enabling customized implants tailored to complex spinal deformities, which enhances fixation stability.

Expanding Geriatric Population and Trauma Cases

The pedicle screw systems market gains momentum from an aging population prone to osteoporosis and spinal degeneration. Elderly patients require advanced fixation systems that ensure durability and safety. It also benefits from rising spinal injuries due to road accidents, workplace trauma, and sports activities. Hospitals invest in modern spinal care facilities to address this demand. Growing healthcare infrastructure supports market penetration. This combination of aging demographics and trauma cases sustains long-term adoption globally.

Market Trends

Adoption of Minimally Invasive and Robotic-Assisted Techniques

The pedicle screw systems market is witnessing strong momentum with the rising shift toward minimally invasive and robotic-assisted procedures. Hospitals and surgical centers invest heavily in advanced systems that reduce incision size, lower infection risk, and shorten recovery. It supports surgeons by providing better visibility and navigation in complex spine surgeries. Robotic guidance further ensures improved screw placement accuracy. This trend enhances clinical outcomes, lowers complications, and strengthens patient confidence in modern spinal procedures.

- For instance, the ExcelsiusGPS robotic system by Globus Medical demonstrated a 97.7% accuracy rate in pedicle screw placements during its first 56 clinical cases, significantly lowering malposition rates and improving patient safety through real-time imaging and robotic guidance.

Integration of Advanced Imaging and Navigation Technologies

The pedicle screw systems market benefits from integration with advanced imaging modalities such as intraoperative CT scans, fluoroscopy, and real-time navigation tools. These technologies provide surgeons with enhanced accuracy and reduced radiation exposure. It allows better preoperative planning and precise intraoperative guidance. Enhanced visualization supports complex spinal reconstructions with greater safety. Hospitals increasingly prefer such advanced systems to lower revision rates. This trend drives demand for next-generation implants aligned with precision-driven spine care.

- For instance, Medtronic’s StealthStation™ Navigation system, when integrated with the O-arm™ intraoperative imaging, enables 3D guidance during spinal screw placement, reducing the risk of malposition.

Growing Role of Customized and 3D-Printed Implants

The pedicle screw systems market is evolving with the rapid adoption of patient-specific and 3D-printed implants. Manufacturers focus on developing customized solutions tailored to anatomical variations and deformities. It supports higher surgical success rates, particularly in complex or revision cases. 3D printing enables cost efficiency, design flexibility, and reduced implant inventory. Hospitals recognize the value of personalized care in spine surgery. This trend accelerates partnerships between medtech companies and healthcare providers for tailored solutions.

Increasing Preference for Hybrid Fixation Systems

The pedicle screw systems market expands with the growing preference for hybrid fixation systems that combine traditional pedicle screws with hooks, rods, and expandable devices. Surgeons adopt these systems to provide enhanced spinal stability and adaptability in multi-level procedures. It ensures better correction of deformities and sustained fusion outcomes. Hybrid solutions also address challenges in osteoporotic or revision cases. Manufacturers innovate to develop versatile implants. This trend highlights a significant move toward comprehensive and adaptable spinal fixation strategies.

Market Challenges Analysis

High Costs and Limited Accessibility in Emerging Regions

The pedicle screw systems market faces a significant challenge due to the high cost of implants and related surgical procedures. Advanced fixation systems, robotic assistance, and navigation technologies demand substantial investment, limiting adoption in price-sensitive markets. It creates barriers for patients in developing regions where healthcare reimbursement is limited or absent. Hospitals struggle to balance affordability with quality care, slowing penetration in rural areas. This challenge restricts access for large patient populations requiring spinal interventions.

Surgical Risks and Regulatory Barriers

The pedicle screw systems market encounters hurdles from surgical risks and strict regulatory requirements. Potential complications, including nerve damage, implant failure, and infection, raise concerns among patients and surgeons. It also faces lengthy approval processes that delay product launches and innovation. Complex clinical validation standards increase development costs for manufacturers. Healthcare providers remain cautious in adopting new systems until long-term safety data is available. These factors collectively hinder faster expansion and adoption across global healthcare markets.

Market Opportunities

Rising Demand in Emerging Economies and Expanding Healthcare Infrastructure

The pedicle screw systems market holds strong opportunities in emerging economies where healthcare infrastructure is rapidly improving. Governments and private investors continue to expand specialized spine care facilities, creating demand for advanced fixation systems. It benefits from rising disposable incomes and growing insurance penetration that improve patient affordability. Medical tourism also supports growth, with countries offering cost-effective yet advanced spinal surgeries. Expanding access to skilled surgeons and modern hospitals positions these regions as promising growth avenues.

Innovation in Biomaterials and Personalized Implant Solutions

The pedicle screw systems market is poised for growth through innovation in biomaterials and personalized implants. Companies invest in titanium alloys, bioresorbable materials, and surface coatings that enhance durability, biocompatibility, and fusion rates. It gains momentum from 3D printing and digital modeling that support customized solutions tailored to patient anatomy. Hybrid and expandable systems further expand clinical applications. Growing collaboration between medtech firms and healthcare providers enables faster adoption of advanced designs, creating significant opportunities for long-term market expansion.

Market Segmentation Analysis:

By Product Type

In the pedicle screw systems market, polyaxial pedicle screws dominate with nearly 55% share in 2024 due to their flexibility and wide use in correcting complex spinal deformities. Surgeons prefer them for multi-directional angulation and ease of rod placement, which improve surgical outcomes. Monoaxial pedicle screws account for about 30% share, mainly used in cases requiring rigid fixation. Other products, including hybrid and expandable screws, hold the remaining 15% share, supported by growing adoption in specialized procedures.

- For instance, Medtronic’s CD Horizon Solera™ Spinal System, incorporating polyaxial screws, has been widely adopted in scoliosis and degenerative spine procedures due to its adaptability and streamlined rod insertion.

By Surgery

Open surgery remains the leading segment, holding about 60% share of the pedicle screw systems market in 2024. It continues to dominate due to its established adoption, availability of trained surgeons, and suitability for severe or multi-level conditions. Minimally invasive surgery, with a 40% share, is rapidly gaining ground driven by patient demand for reduced recovery time, lower infection risk, and smaller incisions. Increasing use of navigation and robotic guidance accelerates the adoption of minimally invasive techniques.

- For instance, Globus Medical’s ExcelsiusGPS system, a robotic navigation platform, demonstrated in peer-reviewed case series that it reduces intraoperative radiation exposure for both surgical teams and patients.

By Indication

Spinal degeneration leads this segment with about 50% share of the pedicle screw systems market, driven by the rising aging population and increasing cases of degenerative disc disease. Spinal deformities account for nearly 30% share, supported by growing corrective procedures for scoliosis and kyphosis. Spinal trauma contributes around 20% share, fueled by higher accident and sports injury rates. It is expected to expand further with increasing emergency care facilities and rising awareness of advanced spinal fixation systems.

Segments:

Based on Product Type

- Polyaxial pedicle screw

- Monoaxial pedicle screw

- Other products

Based on Surgery

- Open surgery

- Minimally invasive surgery

Based on Indication

- Spinal deformities

- Spinal degeneration

- Spinal trauma

Based on Application

- Lumbar

- Thoracolumbar

- Cervical fusion

Based on End-use

- Hospitals & clinics

- Ambulatory surgical centers

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the pedicle screw systems market with 38% share in 2024. The region benefits from advanced healthcare infrastructure, high adoption of minimally invasive techniques, and strong presence of leading medical device companies. It is supported by favorable reimbursement policies that encourage spinal surgeries. Rising cases of spinal degeneration among the elderly population further strengthen demand. Research investments and rapid integration of robotics also drive growth. Hospitals and specialized centers continue to expand their spinal care offerings.

Europe

Europe holds 27% share of the pedicle screw systems market in 2024. The region is driven by rising cases of spinal deformities and degenerative conditions across Germany, France, and the United Kingdom. Surgeons adopt advanced fixation systems to improve accuracy and patient outcomes. It benefits from supportive government healthcare policies and increased focus on minimally invasive procedures. Strong manufacturing capabilities also enable faster adoption of new technologies. Aging demographics continue to expand demand for advanced spinal implants.

Asia Pacific

Asia Pacific accounts for 22% share of the pedicle screw systems market in 2024. Growing healthcare infrastructure, rising disposable incomes, and increasing awareness of spinal health drive market expansion. It is supported by large patient populations in China and India requiring treatment for spinal trauma and degeneration. Medical tourism across countries like Thailand and India further enhances growth. Government initiatives to modernize healthcare create opportunities for advanced surgical procedures. Regional adoption of robotics and 3D printing is steadily rising.

Latin America

Latin America represents 7% share of the pedicle screw systems market in 2024. The region benefits from expanding hospital networks and gradual improvement in healthcare access. It is supported by growing medical tourism in Brazil and Mexico that offers advanced yet cost-effective spinal procedures. Rising accident and trauma cases fuel demand for spinal fixation systems. However, limited reimbursement and uneven healthcare quality restrict faster adoption. Continuous investments in specialized orthopedic and neurosurgical care improve growth prospects.

Middle East & Africa

The Middle East & Africa holds 6% share of the pedicle screw systems market in 2024. Demand is driven by rising trauma cases and growing awareness of advanced spinal treatment options. It is supported by government investments in healthcare infrastructure across Gulf countries. Increasing collaborations with global medical device companies enhance market availability. Limited specialist surgeons and uneven access to advanced care restrict growth in parts of Africa. Expanding private healthcare systems create opportunities for future adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genesys Spine, LLC

- Medtronic, Inc.

- Orthofix Medical Inc.

- Precision Spine, Inc.

- Braun

- Alphatec Spine, Inc.

- Johnson & Johnson

- Globus Medical, Inc.

- CTL Medical Corporation

- RTI Surgical Holdings, Inc.

- Medacta International SA

Competitive Analysis

The pedicle screw systems market is highly competitive with global players focusing on innovation, advanced technologies, and strategic partnerships to strengthen their positions. It is shaped by companies such as Medtronic, Inc., Johnson & Johnson, Globus Medical, Inc., and B. Braun, which lead with strong product portfolios and global distribution networks. Alphatec Spine, Inc., Orthofix Medical Inc., and Precision Spine, Inc. expand their presence by introducing innovative fixation systems tailored to complex spinal conditions. CTL Medical Corporation, Genesys Spine, LLC, and RTI Surgical Holdings, Inc. invest in developing hybrid and minimally invasive solutions to capture niche demand. Medacta International SA emphasizes personalized spinal implants supported by digital planning platforms. Competition intensifies through continuous product launches, integration of navigation and robotic-assisted technologies, and expansion into emerging economies with rising healthcare infrastructure. Companies also strengthen collaborations with hospitals and surgical centers to enhance adoption rates and secure long-term partnerships. The market remains innovation-driven, with strong emphasis on clinical outcomes, safety, and patient-centric solutions.

Recent Developments

- In April 2025, SpineGuard and Omnia Medical entered a binding agreement for the transfer of SpineGuard Inc., highlighting a strategic expansion in spine technology capabilities.

- In October 2023, Johnson & Johnson gained FDA approval for its TriALTIS spine system and navigation-enabled instruments, introducing advanced pedicle screw solutions for thoracolumbar surgical applications.

- In January 2023, Orthofix Medical Inc. introduced the Mariner Deformity Pedicle Screw System, featuring specialized reduction and correction tools designed for complex spinal deformity procedures.

- In April 2025, IMPLANET rolled out its Jazz Spinal System in the U.S., offering a comprehensive pedicle screw platform aimed at broadening its global spine market presence.

Market Concentration & Characteristics

The pedicle screw systems market is moderately concentrated, with a few multinational companies holding significant influence through strong product portfolios and extensive distribution networks. It is characterized by high entry barriers due to strict regulatory approvals, significant R&D investments, and the need for clinical validation. Leading players such as Medtronic, Inc., Johnson & Johnson, Globus Medical, Inc., and B. Braun dominate with advanced technologies and global reach, while smaller firms focus on niche innovations and regional presence. The market shows high reliance on technological advancements, including robotic-assisted systems, 3D printing, and hybrid fixation solutions, which create differentiation among competitors. It also reflects strong demand from aging populations, rising trauma cases, and increasing preference for minimally invasive procedures. Competitive intensity is reinforced by frequent product launches, partnerships with healthcare providers, and expansion into emerging economies where healthcare infrastructure is rapidly advancing and supporting wider adoption of advanced spinal fixation systems.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Surgery, Indication, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global demand for minimally invasive spinal surgeries will increase, driven by faster recovery and reduced risks.

- Hospitals will expand adoption of robotic-assisted systems, ensuring higher accuracy and improved surgical precision.

- Polyaxial pedicle screws will maintain dominance, offering flexibility and superior adaptability for complex spinal corrections.

- Rising elderly populations worldwide will fuel demand for treatments addressing spinal degeneration and related conditions.

- 3D-printed and personalized implants will expand adoption, improving patient outcomes in complex or revision spinal cases.

- Hybrid fixation systems will gain traction, offering enhanced stability and adaptability for multi-level spinal procedures.

- Emerging economies will create growth opportunities with expanding healthcare infrastructure and increasing access to advanced treatments.

- Rising accident and trauma cases worldwide will push adoption of advanced fixation devices for effective recovery.

- Collaborations between device manufacturers and hospitals will intensify, strengthening distribution and adoption across diverse regions.

- Innovation in biomaterials will continue advancing implant safety, biocompatibility, and durability in spinal fixation procedures.