Market Overview

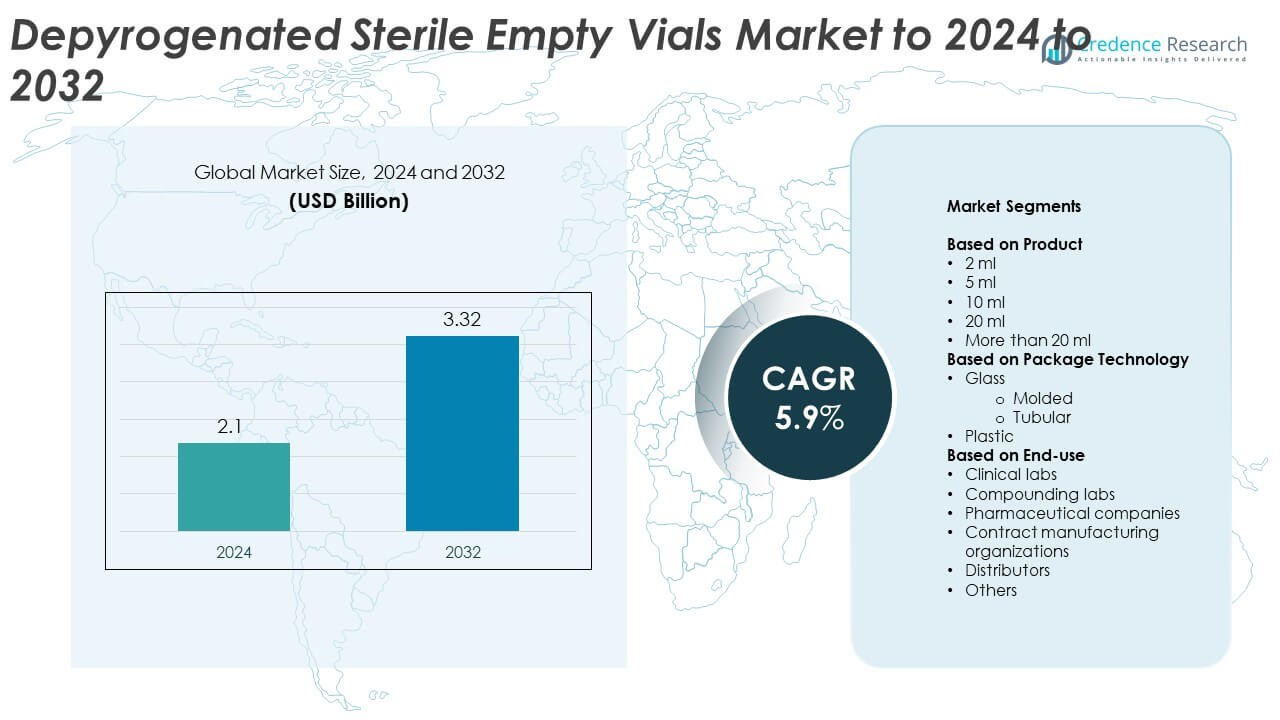

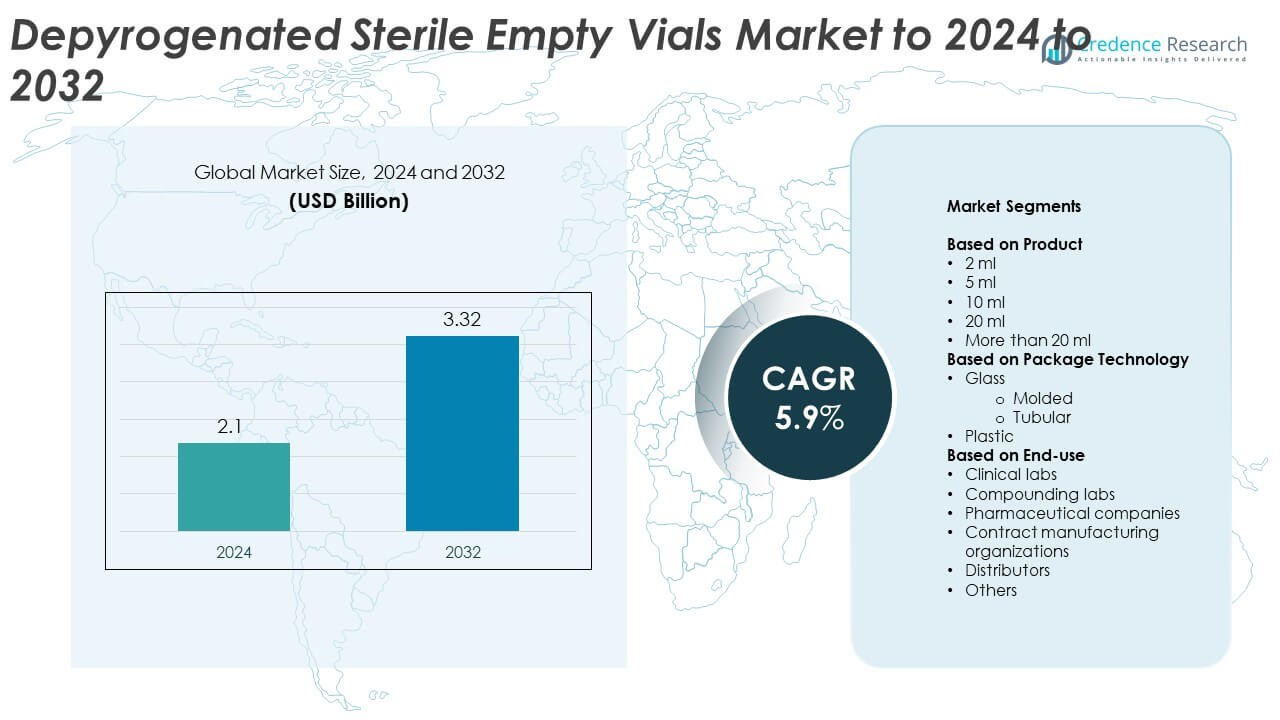

Depyrogenated Sterile Empty Vials Market size was valued at USD 2.1 billion in 2024 and is anticipated to reach USD 3.32 billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Depyrogenated Sterile Empty Vials Market Size 2024 |

USD 2.1 Billion |

| Depyrogenated Sterile Empty Vials Market, CAGR |

5.9% |

| Depyrogenated Sterile Empty Vials Market Size 2032 |

USD 3.32 Billion |

The Depyrogenated Sterile Empty Vials Market is characterized by strong competition among major players such as Gerresheimer, Thermo Fisher Scientific, SGD Pharma, Stevanato, Corning, Nipro PharmaPackaging, DWK Life Sciences, Datwyler, SCHOTT, and APG Pharma. These companies focus on expanding sterile vial production capacities, improving automation, and adopting advanced depyrogenation technologies to meet rising regulatory and quality demands. North America dominated the global market in 2024 with a 38% share, driven by a robust pharmaceutical manufacturing base, advanced biologics production, and stringent sterility standards. Europe followed with 29%, supported by expanding vaccine and biosimilar manufacturing facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Depyrogenated Sterile Empty Vials Market was valued at USD 2.1 billion in 2024 and is projected to reach USD 3.32 billion by 2032, growing at a CAGR of 5.9%.

- Growing biologics, vaccines, and injectable drug production are key drivers boosting the demand for sterile and depyrogenated vials.

- The market is witnessing trends toward automation, ready-to-use vial formats, and eco-friendly packaging innovations enhancing sterility assurance.

- Competition remains strong among leading manufacturers focusing on quality, capacity expansion, and technological advancements to meet global pharmaceutical standards.

- North America dominated with a 38% share in 2024, followed by Europe with 29%, while Asia Pacific held 23%; the 10 ml vial segment led overall product demand due to its high suitability for injectables and biologics.

Market Segmentation Analysis:

By Product

The 10 ml vials segment dominated the Depyrogenated Sterile Empty Vials Market in 2024, accounting for around 34% of total revenue. These vials are widely used in injectable formulations and vaccines due to their optimal fill volume and compatibility with automated filling systems. The growing production of biologics and COVID-19 booster doses increased demand for this size. Smaller vials such as 2 ml and 5 ml are gaining traction for clinical samples, while 20 ml and larger options serve bulk drug packaging needs in contract manufacturing and hospital compounding applications.

- For instance, AstraZeneca supplies Vaxzevria in 5 mL multidose vials.

By Package Technology

Glass vials remained the dominant category, capturing approximately 78% of the market share in 2024. Within glass packaging, tubular glass vials outperformed molded variants due to their superior clarity, dimensional consistency, and resistance to thermal stress during depyrogenation. Pharmaceutical manufacturers prefer tubular vials for sterile injectable drugs and biologics requiring high purity. Plastic vials are expanding gradually, driven by their lightweight and shatter-resistant benefits. However, concerns regarding extractables and leachables limit plastic adoption in sensitive drug formulations.

- For instance, Corning and a partner launched a tubing plant sized for 13,000 tonnes a year, enough for about 2.2 billion vials annually by 2025/26.

By End-use

Pharmaceutical companies held the largest share of about 41% in the Depyrogenated Sterile Empty Vials Market in 2024. This dominance stems from large-scale vaccine production, biologics development, and stringent regulatory needs for sterile packaging. Contract manufacturing organizations (CMOs) also form a growing segment as pharma firms increasingly outsource sterile filling operations. Clinical and compounding labs contribute steadily, driven by diagnostic testing and personalized medication compounding. Distributors and other medical facilities maintain moderate demand for ready-to-fill depyrogenated vials to streamline supply chains and reduce contamination risks.

Key Growth Drivers

Rising Demand for Biologics and Vaccines

The rapid expansion of biologics, biosimilars, and vaccines has significantly boosted the need for depyrogenated sterile empty vials. These vials ensure product safety by eliminating endotoxins, which is vital for injectable formulations. Global immunization campaigns and advancements in mRNA-based therapies have further increased production volumes, particularly in developed pharmaceutical markets. Manufacturers are expanding vial sterilization capacities to meet the surge in biopharmaceutical demand, making this one of the most influential growth drivers for the market.

- For instance, Serum Institute of India reports over 1.75 billion Covishield doses administered, underscoring sustained vial demand.

Stringent Regulatory Standards for Sterility Assurance

Growing emphasis on product sterility by regulatory authorities such as the FDA and EMA has strengthened demand for depyrogenated packaging. Pharmaceutical companies are required to comply with strict endotoxin and microbial contamination limits for parenteral products. This drives investments in validated depyrogenation equipment and sterile vial production facilities. Companies prioritize validated, ready-to-use vials to reduce contamination risks and meet regulatory expectations, positioning sterility compliance as a primary growth catalyst in this market.

- For instance, SCHOTT Pharma supplies adaptiQ® RTU vials packaged to ISO 21882, the standard for sterile packaged ready-for-filling glass vials. The dimensions of this packaging are harmonized with ISO 11040-7, the standard for prefilled syringe packaging, which allows for enhanced compatibility on sterile filling lines.

Expansion of Contract Manufacturing Services

The growing outsourcing trend in pharmaceutical and biotechnology sectors supports market expansion. Contract manufacturing organizations (CMOs) increasingly adopt depyrogenated sterile vials to handle multiple client products safely and efficiently. Rising small and mid-sized biotech firms, lacking in-house sterile filling infrastructure, prefer CMOs for cost-effective and compliant production. This shift strengthens vial demand across global facilities, driving sustained market growth. The rising volume of biologics and specialty injectables magnifies this driver’s impact across regions.

Key Trends & Opportunities

Shift Toward Ready-to-Use and Pre-Sterilized Vials

Pharmaceutical firms are transitioning toward ready-to-use (RTU) depyrogenated vials to minimize contamination and reduce production time. RTU vials eliminate the need for on-site washing, depyrogenation, and sterilization processes. This approach aligns with lean manufacturing trends and improves operational efficiency. The rising adoption of isolator-based filling systems further supports this shift, as companies prioritize flexible and contamination-free vial handling solutions.

- For instance, West Pharmaceutical Services lists SCHOTT adaptiQ 10 mL RTU vials at 48 vials per nest and six tubs per carton for fast, clean changeovers.

Growing Adoption of Automation and Smart Packaging Lines

Automation in sterile packaging lines is reshaping vial production. Integration of robotic systems, automated inspection, and traceability technologies ensures quality consistency and regulatory compliance. Manufacturers are adopting digital monitoring tools to control depyrogenation and sterilization cycles more precisely. This trend improves output quality while reducing labor costs and human error, creating new opportunities for advanced vial production facilities globally.

- For instance, the Antares Vision Group’s VRI-VI series of automatic visual inspection systems for small volume parenterals, including vials, can inspect various product contents, including liquids, suspensions, emulsions, and freeze-dried products. The machine is designed for 100% quality checks.

Key Challenges

High Capital Costs for Sterile Production Facilities

Establishing depyrogenated sterile vial production requires significant investment in cleanroom infrastructure, validated depyrogenation tunnels, and inspection systems. High setup and maintenance costs create barriers for small and mid-sized manufacturers. Moreover, stringent validation requirements and periodic audits increase operational expenses. These financial challenges limit new entrants and slow capacity expansion, especially in emerging markets with limited access to advanced sterilization technologies.

Supply Chain and Material Constraints

The market faces challenges due to fluctuations in high-quality borosilicate glass and pharmaceutical-grade polymer supply. Limited raw material availability, coupled with growing demand from vaccine and biologics production, causes procurement delays. Additionally, transportation restrictions and energy costs affect global vial supply consistency. Such material constraints can disrupt manufacturing schedules and hinder timely delivery to pharmaceutical clients, posing a persistent challenge for vial producers.

Regional Analysis

North America

North America held the largest share of around 38% in the Depyrogenated Sterile Empty Vials Market in 2024. The region’s strong pharmaceutical manufacturing base and high adoption of injectable biologics drive market demand. The United States leads due to its advanced sterile packaging standards, well-established regulatory framework, and expanding biologics pipeline. Major pharmaceutical and biotech companies are investing in advanced sterilization and filling technologies to ensure contamination-free drug packaging. Canada contributes steadily, supported by government funding in vaccine production and increasing adoption of pre-sterilized packaging formats in pharmaceutical operations.

Europe

Europe accounted for about 29% of the global Depyrogenated Sterile Empty Vials Market in 2024. The market benefits from growing investments in biologics, generics, and vaccine development. Germany, France, and the United Kingdom are the key contributors, supported by strong pharmaceutical R&D infrastructure and stringent quality regulations. The rising focus on sterile injectable formulations and expansion of aseptic filling lines drive regional growth. European vial manufacturers are also adopting automation and eco-friendly packaging technologies, ensuring compliance with European Medicines Agency (EMA) sterilization standards and sustainability initiatives in pharmaceutical packaging.

Asia Pacific

Asia Pacific captured nearly 23% of the Depyrogenated Sterile Empty Vials Market in 2024, driven by rapid expansion in biopharmaceutical production and clinical research. China, India, and Japan lead regional growth due to increasing vaccine output and government support for local drug manufacturing. Contract manufacturing organizations are strengthening their vial sterilization capacities to serve multinational pharmaceutical clients. Rising healthcare investments and the availability of low-cost manufacturing facilities also make the region a key outsourcing hub for sterile vial production. Demand is expected to grow further with the rising export of injectable drugs.

Latin America

Latin America represented approximately 6% of the Depyrogenated Sterile Empty Vials Market in 2024. The region is experiencing steady growth supported by improving pharmaceutical production capacities in Brazil and Mexico. Rising vaccination campaigns, expanding generic drug markets, and increasing imports of pre-sterilized vials from North America contribute to demand. Domestic manufacturers are gradually upgrading their filling and depyrogenation processes to comply with global safety standards. Despite infrastructure limitations, government-backed healthcare programs and foreign collaborations are boosting sterile packaging adoption in regional pharmaceutical and diagnostic industries.

Middle East & Africa

The Middle East & Africa accounted for about 4% of the global Depyrogenated Sterile Empty Vials Market in 2024. The market is growing as healthcare infrastructure and local pharmaceutical production improve across the Gulf countries and South Africa. Rising imports of sterile vials and vaccines, coupled with government investments in healthcare manufacturing, support steady expansion. The United Arab Emirates and Saudi Arabia are emerging as key distribution hubs. However, limited local manufacturing and high dependency on imported raw materials continue to constrain large-scale production within the region.

Market Segmentations:

By Product

- 2 ml

- 5 ml

- 10 ml

- 20 ml

- More than 20 ml

By Package Technology

By End-use

- Clinical labs

- Compounding labs

- Pharmaceutical companies

- Contract manufacturing organizations

- Distributors

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Depyrogenated Sterile Empty Vials Market is highly competitive, with major players such as Gerresheimer, Thermo Fisher Scientific, SGD Pharma, Stevanato, Corning, Nipro PharmaPackaging, DWK Life Sciences, Datwyler, SCHOTT, and APG Pharma leading the landscape. These companies focus on expanding sterile vial manufacturing capacities, enhancing automation, and integrating advanced depyrogenation technologies to meet rising pharmaceutical standards. Strategic collaborations with biotech and pharmaceutical firms help strengthen global supply chains and ensure compliance with stringent regulatory norms. Manufacturers are also investing in research to improve vial durability, thermal stability, and contamination resistance. Growing demand for ready-to-use and pre-sterilized vials has encouraged the development of innovative packaging solutions with traceability features. Regional players are entering partnerships and adopting flexible manufacturing models to serve evolving market needs efficiently. Overall, competition centers on quality assurance, technological advancement, and large-scale production capabilities to meet the increasing demand for sterile packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gerresheimer

- Thermo Fisher Scientific

- SGD Pharma

- Stevanato

- Corning

- Nipro PharmaPackaging

- DWK Life Sciences

- Datwyler

- SCHOTT

- APG Pharma

Recent Developments

- In 2025, Stevanato Group introduced a new line of depyrogenated nested vials that are compatible with robotic aseptic filling systems.

- In 2024, Gerresheimer introduced a new line of eco-friendly, depyrogenated vials to enhance sustainability efforts in the pharmaceutical supply chain

- In 2023, Datwyler introduced Ready-for-Sterilization (RFS) Combiseals, which are compatible with RTU filling operations.

Report Coverage

The research report offers an in-depth analysis based on Product, Package Technology, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ready-to-use depyrogenated vials will rise due to sterile filling efficiency.

- Biologic and vaccine expansion will continue driving large-scale sterile vial production.

- Automation in depyrogenation and inspection systems will enhance process reliability.

- Contract manufacturing organizations will strengthen their sterile packaging capacities.

- Use of eco-friendly and lightweight vial materials will gain industry attention.

- Advanced glass formulations will improve durability and contamination resistance.

- Pharmaceutical firms will adopt digital tracking for vial sterilization validation.

- Regional manufacturers in Asia Pacific will expand exports to global clients.

- Collaborations between vial makers and pharma companies will increase supply resilience.

- Innovation in pre-sterilized vial packaging formats will boost market competitiveness.