Market Overview

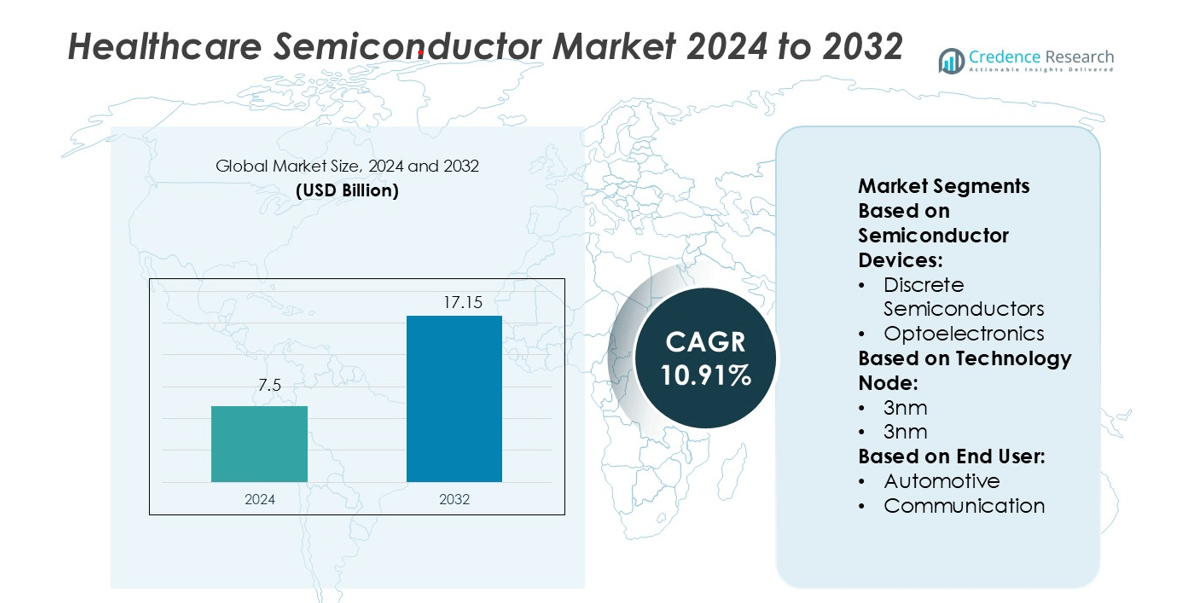

Healthcare Semiconductor Market size was valued USD 7.5 billion in 2024 and is anticipated to reach USD 17.15 billion by 2032, at a CAGR of 10.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Semiconductor Market Size 2024 |

USD 7.5 billion |

| Healthcare Semiconductor Market, CAGR |

10.91% |

| Healthcare Semiconductor Market Size 2032 |

USD 17.15 billion |

The healthcare semiconductor market is characterized by the presence of established global players driving continuous innovation in chip design, manufacturing, and application integration. Companies are focusing on AI-enabled chips, low-power processors, and advanced sensing technologies to support next-generation medical devices and connected healthcare ecosystems. North America leads the global market with a 36% share in 2024, supported by strong infrastructure, advanced R&D capabilities, and early technology adoption in medical applications. This leadership is reinforced by active investments in telemedicine, wearable health technologies, and AI-driven diagnostics. The region’s strong regulatory framework and growing demand for connected care further strengthen its competitive edge.

Market Insights

- The Healthcare Semiconductor Market size was valued at USD 7.5 billion in 2024 and is projected to reach USD 17.15 billion by 2032, growing at a CAGR of 10.91%.

- Rising adoption of AI-enabled chips, advanced sensors, and low-power processors is driving innovation in connected medical devices and diagnostic systems.

- Miniaturization, 5G integration, and real-time data processing trends are boosting semiconductor usage in telemedicine and wearable healthcare technologies.

- North America holds a 36% share of the market in 2024, while discrete semiconductors lead the device segment with a 42% share, strengthening their position in critical applications.

- High manufacturing costs and complex regulatory processes act as key restraints, while growing investment in R&D, healthcare infrastructure, and sustainable chip production supports future market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Semiconductor Devices

Discrete semiconductors dominate the healthcare semiconductor market with a 42% share in 2024. These components are widely used in power management, medical imaging, and diagnostic equipment, ensuring stable and efficient performance. Their reliability in critical systems such as patient monitoring devices and imaging scanners drives adoption. Growing demand for energy-efficient components and miniaturized medical devices further supports their lead. Optoelectronics and other advanced devices are also expanding as healthcare shifts toward real-time data acquisition and sensor-based monitoring, boosting innovation in connected medical equipment.

- For instance, Hamamatsu Photonics offers a variety of light sources for biomedical and industrial applications, which includes both lamps and lasers LC8 is a UV spot light source that uses a mercury-xenon lamp and is suitable for tasks like UV curing or microscope illumination.

By Technology Node

The 28nm technology node holds the largest market share at 34% in 2024. This node offers a balance between power efficiency, performance, and cost, making it ideal for medical imaging systems, wearables, and implantable devices. Its maturity and production scalability ensure stable supply for healthcare OEMs. While 7nm and 5nm nodes are gaining traction for AI-enabled diagnostics and edge computing in healthcare applications, their higher cost limits large-scale deployment. However, ongoing innovation in advanced process nodes indicates future growth in data-driven and AI-integrated medical technologies.

- For instance, ROHM Semiconductor develops red laser diodes, such as the RLD63NPCx series, which operate at a typical wavelength of 635 nm. These high-precision laser diodes are suitable for applications such as optical disk pickups and sensors.

By End-User

The communication segment leads the market with a 41% share in 2024, driven by both wired and wireless technologies. Strong adoption of telemedicine, remote monitoring, and cloud-connected healthcare platforms fuels demand for semiconductors supporting fast, secure data transfer. Wireless solutions enable real-time patient tracking, while wired systems ensure stable connectivity for hospital networks and imaging infrastructure. Automotive applications are growing steadily with the integration of health monitoring systems in vehicles, supporting long-term market expansion. Semiconductor adoption in communication remains crucial for enabling connected and intelligent healthcare ecosystems.

Key Growth Drivers

Rising Demand for Connected Healthcare Devices

The growing use of connected medical devices is a major growth driver for the healthcare semiconductor market. Wearables, implantable sensors, and remote monitoring systems rely on high-performance chips for efficient data collection and transfer. Advancements in semiconductor miniaturization enable compact devices with improved battery life and processing power. Increasing adoption of telemedicine and home-based healthcare accelerates demand. Hospitals and healthcare providers are integrating these devices into patient care to support real-time monitoring, early diagnosis, and better treatment outcomes, driving semiconductor usage across multiple applications.

- For instance, Nichia’s NDB7K75 laser diode is a high-power blue laser diode with a dominant wavelength of 450 nm, delivering 3.5 W output power for applications such as high-intensity lighting and industrial processing.

Integration of AI and Advanced Analytics in Healthcare

The adoption of AI-driven diagnostic tools and predictive analytics is fueling semiconductor demand. Advanced processors and memory chips enable faster data processing in medical imaging, genomic sequencing, and diagnostic platforms. AI integration improves accuracy, reduces diagnostic errors, and supports automated clinical workflows. Companies are investing in edge AI chips for real-time data analysis without relying solely on cloud computing. These developments enhance the performance and responsiveness of critical healthcare systems, supporting precision medicine and accelerating innovation in next-generation healthcare technologies.

- For instance, IPG Photonics offers high-power single-mode fiber lasers in its YLR-SM series. These lasers can provide up to 3,000 W of continuous-wave output, typically with a wavelength of ~1,070 nm.

Growing Investments in Healthcare Infrastructure

Rising public and private investments in healthcare infrastructure are driving semiconductor adoption. Hospitals and research centers are deploying advanced diagnostic and monitoring equipment, requiring powerful semiconductor components for data processing and connectivity. Expansion of digital health systems, including electronic health records and smart hospital networks, further fuels demand. Governments and private investors are funding upgrades in healthcare facilities and IT infrastructure, creating strong opportunities for semiconductor suppliers. This investment wave strengthens supply chains and encourages technology integration across all levels of patient care.

Key Trends & Opportunities

Advancement in Miniaturized and Low-Power Chips

The development of miniaturized, energy-efficient semiconductor chips is a key market trend. These chips support portable medical devices, wearables, and implantable sensors. Manufacturers are focusing on optimizing power consumption while improving performance and connectivity. Smaller chips enable longer battery life and better patient comfort, which is essential for continuous monitoring applications. This trend also supports personalized and preventive healthcare models, opening new opportunities for semiconductor suppliers to collaborate with medical device manufacturers.

- For instance, Coherent’s Monaco 1035 femtosecond laser is available in different models, with options delivering up to 150 W of output power at a precise wavelength of 1035 nm.

Adoption of 5G and Edge Computing in Healthcare

5G and edge computing are transforming healthcare infrastructure. High-speed, low-latency networks enhance real-time monitoring, remote surgery, and AI-assisted diagnostics. Semiconductors designed for 5G enable faster data transfer between medical devices and hospital systems. Edge computing reduces dependence on centralized data centers, allowing on-site processing of critical health data. This integration supports new applications such as smart ambulances, mobile diagnostics, and virtual care platforms. The trend creates significant opportunities for chipmakers to design specialized solutions for healthcare connectivity.

- For instance, Sharp develops various blue-violet laser diodes, such as the GH04W10A2GC, which delivers up to 350 mW of continuous-wave output at 405 nm.

Focus on Sustainable Semiconductor Manufacturing

Sustainability is gaining attention in semiconductor production for healthcare applications. Manufacturers are adopting energy-efficient fabrication methods and recyclable materials. Green manufacturing lowers environmental impact and aligns with stricter healthcare industry regulations. This shift creates competitive advantages for companies with eco-friendly operations and boosts their appeal to healthcare organizations focused on ESG goals. Sustainable practices also reduce operational costs and enhance long-term supply chain resilience.

Key Challenges

High Manufacturing and Integration Costs

Rising costs in semiconductor manufacturing pose a major challenge for market growth. Advanced chip fabrication requires expensive equipment, skilled labor, and cleanroom environments. Integrating these components into complex medical devices adds further cost pressure. Smaller medical device manufacturers often struggle to match these expenses, slowing market penetration. The high investment needed for R&D and regulatory compliance also impacts profit margins, especially for startups and mid-sized firms in the healthcare technology sector.

Regulatory and Data Security Concerns

Strict regulatory standards and data security requirements create significant barriers. Medical devices using semiconductors must comply with complex approval processes, which delay product launches. Data security is a critical concern due to sensitive patient information processed through connected devices. Breaches can lead to legal liabilities and loss of trust. Chipmakers and device manufacturers must invest in secure designs and encryption technologies to meet healthcare regulations. These requirements increase costs and extend development timelines, challenging rapid market expansion.

Regional Analysis

North America

North America leads the healthcare semiconductor market with a 36% share in 2024. Strong healthcare infrastructure, early technology adoption, and high investment in medical devices drive regional growth. The U.S. dominates due to its advanced telemedicine ecosystem and strong semiconductor manufacturing base. Widespread use of AI-enabled diagnostic tools and connected monitoring systems further boosts demand. Key market players collaborate with hospitals and device manufacturers to support innovation. Favorable regulatory frameworks and growing focus on personalized healthcare strengthen the region’s leadership in integrating advanced chips into clinical and remote care applications.

Europe

Europe holds a 28% share of the global healthcare semiconductor market in 2024. The region benefits from strong government support for digital health initiatives and medical device innovation. Countries like Germany, France, and the UK are investing heavily in AI-driven healthcare solutions and connected patient monitoring. A well-established regulatory framework supports safe semiconductor integration in critical applications. Rising demand for energy-efficient chips in diagnostic equipment also fuels market expansion. Europe’s commitment to sustainable semiconductor manufacturing further enhances its competitiveness and aligns with the healthcare sector’s ESG goals.

Asia Pacific

Asia Pacific accounts for a 25% share of the healthcare semiconductor market in 2024. Rapid growth in healthcare infrastructure and increased government spending on digital health technologies drive strong demand. China, Japan, South Korea, and India lead the region with large-scale deployments of connected healthcare systems. The rise of local semiconductor fabrication capabilities supports cost-effective chip production. High patient volumes and expanding telemedicine platforms accelerate adoption of AI-powered diagnostic tools and monitoring devices. This strong ecosystem positions Asia Pacific as a key growth hub for the healthcare semiconductor industry.

Latin America

Latin America represents a 7% share of the healthcare semiconductor market in 2024. Countries like Brazil and Mexico are increasing investments in digital health and hospital infrastructure. The growing use of connected devices and telemedicine platforms drives demand for cost-efficient chips. However, limited semiconductor manufacturing capacity and slower technology adoption create challenges. Partnerships with international chipmakers and government-led digitalization programs are helping bridge this gap. Expanding access to affordable medical technologies is expected to support steady market growth across the region over the forecast period.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the global healthcare semiconductor market in 2024. Investments in smart healthcare infrastructure, particularly in the UAE and Saudi Arabia, are fueling demand for advanced chips. Hospitals are adopting connected monitoring systems and AI-driven diagnostic tools to modernize healthcare delivery. Limited local semiconductor production remains a challenge, increasing reliance on imports. However, strategic partnerships with global technology providers and government digital health strategies support gradual market expansion. Ongoing investments in telemedicine and digital hospitals will strengthen future growth in the region.

Market Segmentations:

By Semiconductor Devices:

- Discrete Semiconductors

- Optoelectronics

By Technology Node:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The healthcare semiconductor market features prominent players such as Amedisys, Inc., Abbott, Baxter International Inc., 3M Healthcare, Cardinal Health Inc., F. Hoffmann-La Roche AG, B. Braun Melsungen AG, Sunrise Medical, Medtronic PLC, and Air Liquide. The healthcare semiconductor market is shaped by strong innovation, strategic partnerships, and rapid technological integration. Leading companies focus on developing AI-enabled chips, low-power processors, and advanced sensors to enhance diagnostic accuracy and patient monitoring. R&D investments and collaborations with semiconductor manufacturers play a key role in driving product innovation and market differentiation. Many players are expanding their digital infrastructure to support real-time data processing and seamless device connectivity. Sustainability, regulatory compliance, and supply chain resilience have also become central to competitive strategies. This focus strengthens their market position and supports long-term growth in connected healthcare solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Samsung Electronics Co., Ltd. announced that it has signed an agreement to acquire Xealth, a unique healthcare integration platform. Samsung Electronics agreed to acquire Xealth, aiming to embed secure AI accelerators and sensor interfaces across telemedicine platforms.

- In July 2025, Medtronic and Philips, two global leaders in healthcare technology, announced a significant step forward in their strategic collaboration in patient monitoring. Medtronic and Philips launched a strategic collaboration to merge Nellcor pulse-oximetry and Microstream capnography chips into Philips patient monitors.

- In March 2025, Canada’s Semiconductor Council admitted Hepzibah AI, a pioneering venture focused on next-generation, energy-efficient AI inference technology, has joined as its latest industry member.

- In November 2024, LG Electronics deepened its partnership with Tenstorrent, planning RISC-V AI SoCs scalable from milliwatts to megawatts for potential medical instrumentation.LG aims to enhance its design and development capabilities for AI chips tailored to its products and services

Report Coverage

The research report offers an in-depth analysis based on Semiconductor Devices, Technology Node, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered chips will increase to support advanced diagnostic and monitoring applications.

- Miniaturized and energy-efficient semiconductors will drive growth in wearable healthcare devices.

- Integration of 5G and edge computing will enhance connectivity in telemedicine and hospital networks.

- Demand for secure and high-performance chips will rise with expanding digital health ecosystems.

- Semiconductor innovation will enable faster data processing in personalized and precision medicine.

- Sustainability and green manufacturing will become a major focus for semiconductor production.

- Strategic partnerships between chipmakers and medical device firms will accelerate technology deployment.

- Regulatory compliance and cybersecurity will shape product development strategies.

- Expanding healthcare infrastructure in emerging regions will create new semiconductor demand.

- Increased investment in R&D will strengthen innovation and market competitiveness.