Market Overview

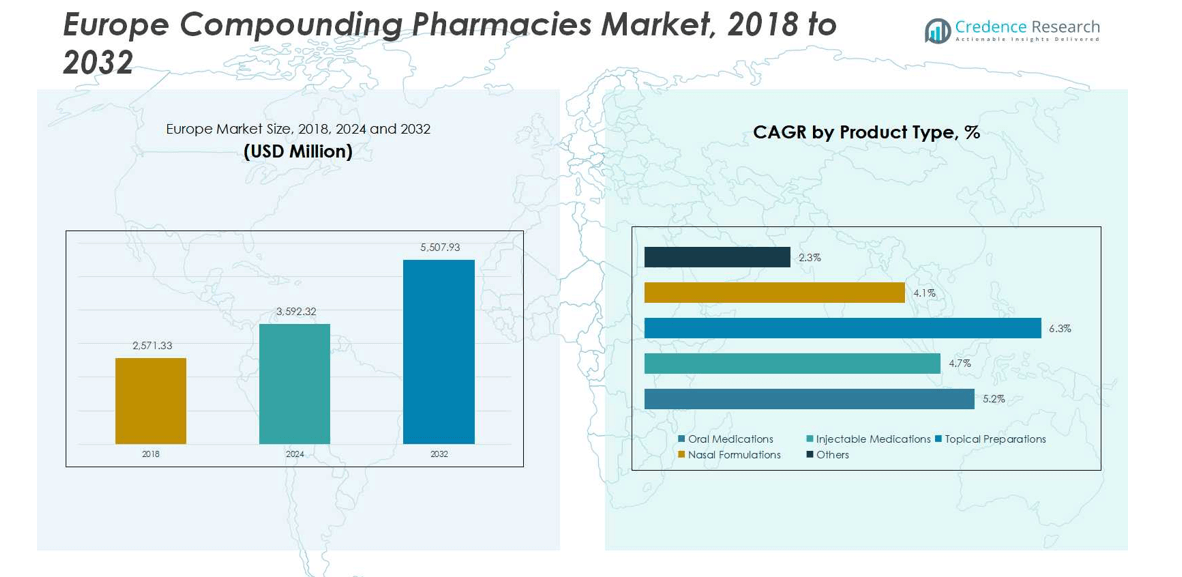

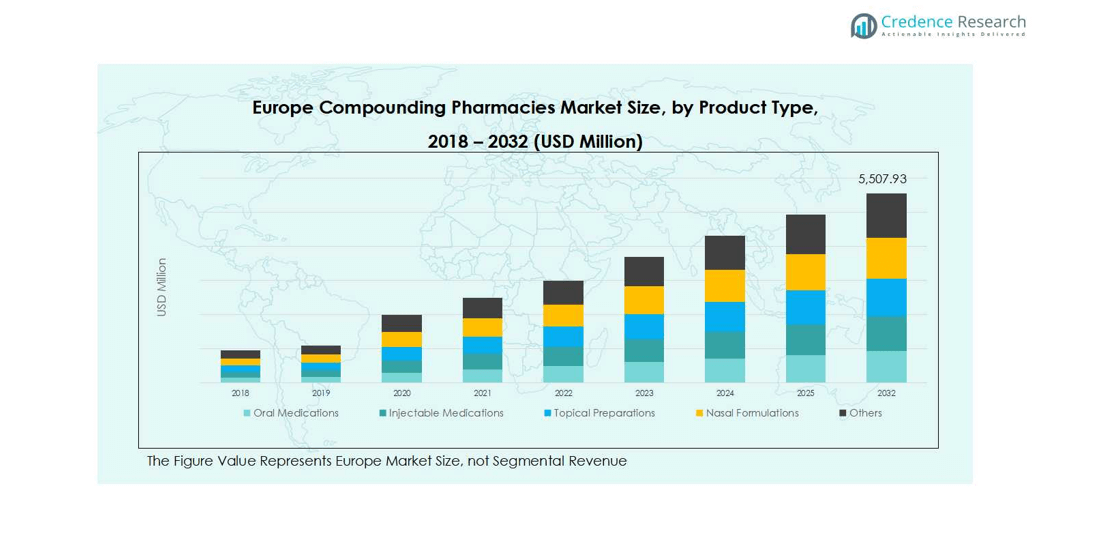

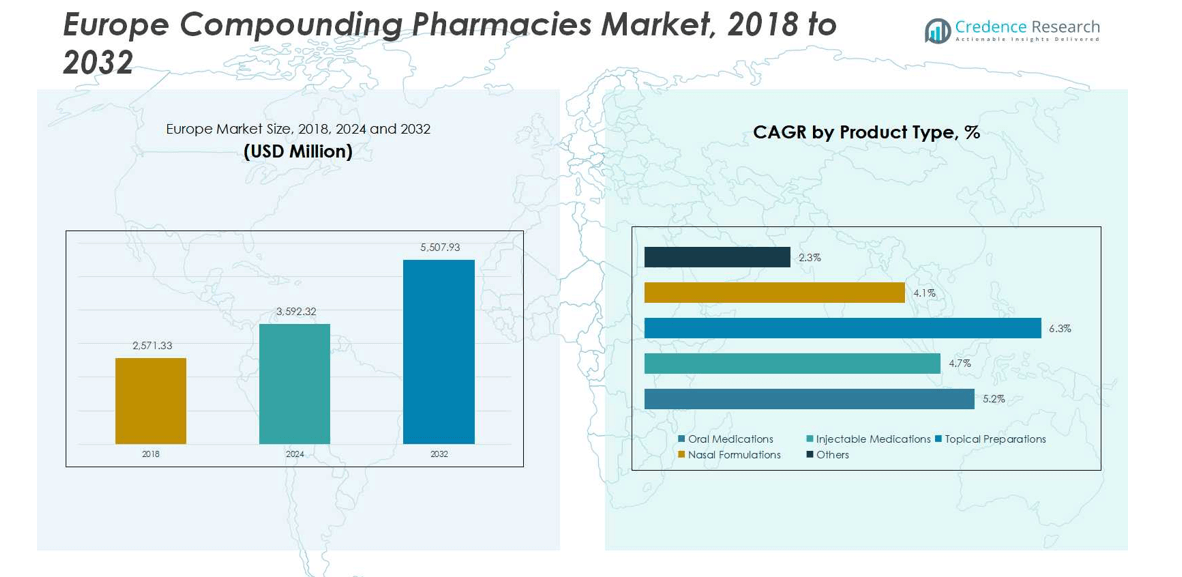

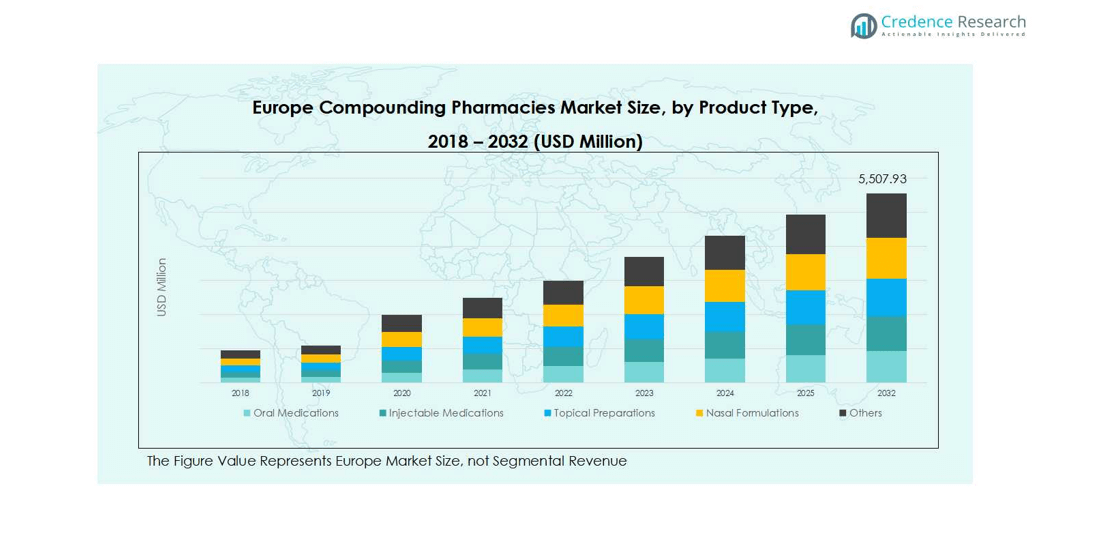

Europe Compounding Pharmacies market size was valued at USD 2,571.33 Million in 2018 and grew to USD 3,592.32 Million in 2024. It is anticipated to reach USD 5,507.93 Million by 2032, growing at a CAGR of 5.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Compounding Pharmacies Market Size 2024 |

USD 3,592.32 Million |

| Europe Compounding Pharmacies Market, CAGR |

5.05% |

| Europe Compounding Pharmacies Market Size 2032 |

USD 5,507.93 Million |

The Europe Compounding Pharmacies market is led by key players including Fagron N.V., Elixir Compounding Pharmacy, Fresenius Kabi AG, Belle Santé Diagnostic & Therapeutic Institute Pvt. Ltd, Triangle Compounding Pharmacy, Vertisis Custom Pharmacy, Avella Specialty Pharmacy, B. Braun Melsungen AG, PharMEDium Healthcare Holdings, Inc., and US Compounding Inc. These companies drive growth through innovative personalized formulations, expansion of sterile and non-sterile compounding services, and strategic partnerships with hospitals and specialty clinics. Germany emerges as the leading region with a 20% market share, followed by the United Kingdom at 18% and France at 15%, reflecting strong demand for patient-specific oral, injectable, and topical medications. Growth is further supported by an aging population, rising prevalence of chronic diseases, and increasing adoption of advanced compounding technologies across Europe, positioning these players for sustained market leadership.

Market Insights

- Europe Compounding Pharmacies market was valued at USD 3,592.32 Million in 2024 and is projected to reach USD 5,507.93 Million by 2032, growing at a CAGR of 5.05%.

- Rising demand for personalized medications, including oral, injectable, and topical formulations, is driving market growth, supported by an aging population and increasing chronic disease prevalence.

- Technological advancements in sterile and non-sterile compounding, automation, and formulation accuracy are key trends enhancing efficiency, reducing errors, and expanding product offerings across hospitals and specialty pharmacies.

- The market is highly competitive, led by Fagron N.V., Fresenius Kabi AG, Elixir Compounding Pharmacy, B. Braun Melsungen AG, and other regional players focusing on partnerships, product innovation, and expansion of 503A and 503B pharmacy services.

- Germany leads the regional market with a 20% share, followed by the UK at 18% and France at 15%; oral medications dominate product type share at 42%, while non-sterile compounding holds 58% of the sterility segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

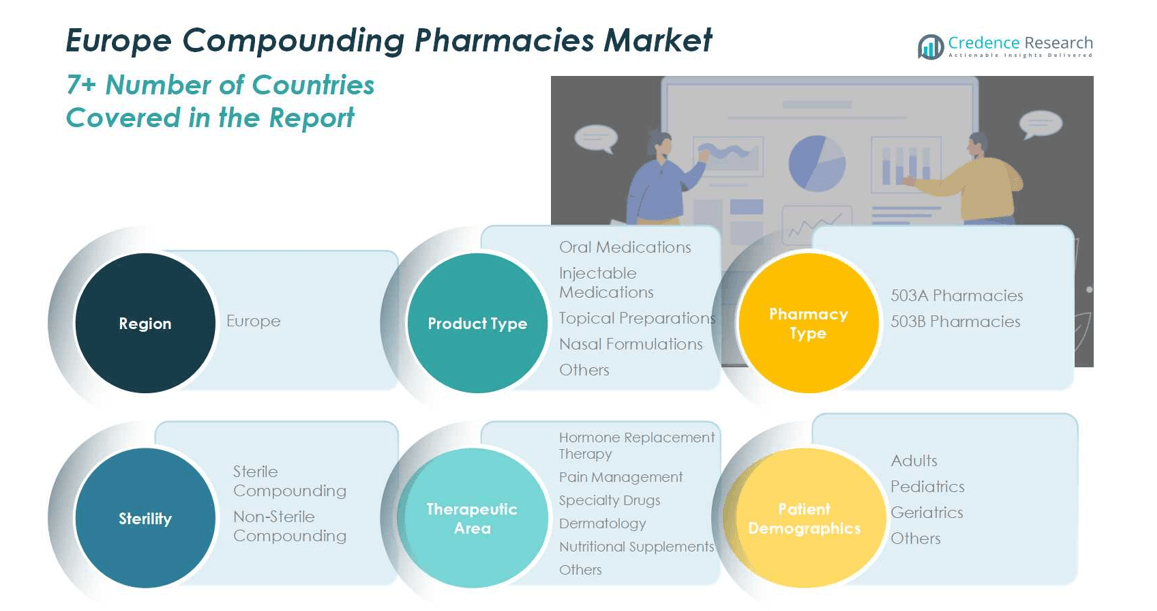

Market Segmentation Analysis:

By Product Type:

The Europe Compounding Pharmacies market by product type is primarily driven by the rising demand for personalized medications. Oral medications dominate the segment, accounting for 42% of the market share in 2024, owing to their extensive use in hormone replacement therapy, pain management, and chronic disease management. Injectable medications follow closely, benefiting from advancements in sterile compounding and increasing hospital adoption. The segment’s growth is propelled by patient-specific dosing requirements, regulatory support for tailored therapies, and an expanding geriatric population seeking customized treatments.

- For instance, oral estrogen-progestogen drugs, such as those prescribed in menopause management, are tailored in doses ranging from 0.5 mg to 2 mg based on patient needs, supporting treatment effectiveness and minimizing risks.

By Pharmacy Type:

Within pharmacy types, 503A pharmacies lead the Europe market, holding 65% of the segment share. These pharmacies cater to patient-specific prescriptions, providing customized formulations on-demand, which aligns with the rising preference for personalized medicine. The 503B pharmacies segment is witnessing gradual growth, supported by large-scale sterile compounding and outsourcing trends among hospitals and clinics. The dominance of 503A pharmacies is driven by regulatory frameworks favoring patient-centric compounding, cost-effectiveness for individual prescriptions, and the increasing prevalence of chronic diseases requiring personalized therapeutic solutions.

- For instance, Cundell notes that 503B facilities focus heavily on good manufacturing practice (GMP) compliance to support sterile compounding for healthcare institutions and are adopting robotic compounding technologies for improved efficiency.

By Sterility:

In terms of sterility, non-sterile compounding represents the dominant sub-segment with 58% of market share, primarily due to its widespread application in oral, topical, and nutritional formulations. Sterile compounding, while smaller, is rapidly expanding driven by the growing demand for injectable medications and stringent quality regulations. Non-sterile compounding growth is fueled by the need for patient-specific dosing, rising dermatology treatments, and an expanding home-care therapy market. Increasing awareness of personalized therapies and advancements in compounding technology further support the segment’s expansion across Europe.

Key Growth Drivers

Rising Demand for Personalized Medicine

The growing preference for patient-specific therapies is a major driver of the Europe Compounding Pharmacies market. Personalized medicine allows physicians to tailor formulations based on individual patient needs, including dosage, delivery method, and combination therapies. This demand is particularly high among patients with chronic diseases, hormonal imbalances, and rare conditions. Advances in compounding technology, coupled with regulatory support for customized treatments, have further strengthened the adoption of personalized medications across Europe, boosting market growth significantly.

Increasing Geriatric Population

Europe’s rapidly aging population is driving demand for compounding pharmacies. Older adults often require multiple medications and customized dosing to manage chronic illnesses such as cardiovascular disorders, diabetes, and arthritis. Compounded medications allow for flexible formulations, easier administration, and improved patient adherence, enhancing treatment outcomes. The growing geriatric demographic, combined with rising life expectancy, is fueling continuous demand for tailored pharmaceutical solutions, positioning compounding pharmacies as a vital segment in Europe’s healthcare ecosystem.

- For instance, Pfizer has developed PAXLOVID™, an oral antiviral treatment for elderly COVID-19 patients, which significantly reduces hospitalization and death risk, demonstrating the importance of customized medication in older populations.

Expansion of Sterile and Injectable Medications

The rising adoption of sterile and injectable medications is another significant growth driver. Hospitals, clinics, and specialty treatment centers increasingly rely on compounding pharmacies for patient-specific injectables, vaccines, and biologics. Regulatory initiatives emphasizing quality, safety, and sterile preparation standards encourage pharmacies to expand their sterile compounding capabilities. This trend not only addresses hospital outsourcing needs but also supports home healthcare treatments requiring injectables, thereby driving both revenue growth and technological advancements in the European compounding pharmacies market.

- For instance, Japan’s Ministry of Health approved ADZYNMA, the first recombinant enzyme replacement therapy for a rare clotting disorder, demonstrating advancements in sterile injectable therapies.

Key Trends & Opportunities

Technological Advancements in Compounding

Innovation in compounding techniques, automation, and formulation software is transforming the Europe market. Advanced mixing, measuring, and sterile preparation technologies improve accuracy, reduce contamination risks, and enhance production efficiency. Pharmacies adopting these innovations can offer more complex formulations and higher-quality personalized medicines. These technological trends also create opportunities for new product launches, expansion of injectable and topical therapies, and increased partnerships between compounding pharmacies and hospitals or clinics, positioning companies for long-term growth in a competitive landscape.

- For instance, Fagron NV is a global leader known for its innovative formulations and comprehensive product portfolio, integrating robotic dispensing units to enhance precision and reduce contamination risks.

Rising Focus on Specialty Therapeutics

The Europe compounding pharmacies market is increasingly exploring specialty therapeutics, such as hormone replacement, pain management, and dermatology treatments. Rising awareness among patients and healthcare providers, coupled with unmet medical needs, creates opportunities for custom formulations tailored to niche therapeutic areas. Specialty therapies often require precise dosing, unique delivery systems, and patient-specific adjustments, driving demand for specialized compounding services. This focus enables pharmacies to differentiate themselves, expand market share, and capitalize on premium pricing opportunities in high-value therapeutic segments.

- For instance, for dermatology, compounding pharmacies like Thera Peak Pharmacy offer personalized topical solutions designed to address skin conditions with optimized delivery and formulations, improving therapeutic outcomes and patient satisfaction.

Key Challenges

Regulatory Compliance and Variability

Navigating complex and evolving regulations across European countries is a key challenge for compounding pharmacies. Compliance with quality standards, safety protocols, and documentation requirements can be resource-intensive, particularly for pharmacies operating in multiple regions. Variability in national regulations may limit cross-border operations and increase operational costs. Additionally, stringent inspections and potential penalties for non-compliance can impact market growth. Companies must continuously invest in training, quality control systems, and regulatory expertise to mitigate risks while maintaining service quality and patient safety.

Risk of Medication Errors and Quality Control

Ensuring precise formulations and preventing errors is a major challenge in compounding pharmacies. Custom preparations inherently carry risks of dosing mistakes, contamination, or stability issues, especially in sterile injectables. Medication errors can lead to adverse patient outcomes, legal liabilities, and reputational damage. Maintaining strict quality control, standardized procedures, and skilled personnel is critical but resource-intensive. Balancing high-quality personalized services with operational efficiency remains a persistent challenge, requiring ongoing investment in technology, staff training, and quality assurance systems.

Regional Analysis

United Kingdom

The United Kingdom holds a significant position in the Europe Compounding Pharmacies market, capturing a market share of 18% in 2024. Growth is driven by increasing demand for personalized medications, particularly in hormone replacement therapy, pain management, and dermatology. The presence of well-established compounding pharmacies, supportive healthcare regulations, and high patient awareness further boost market expansion. Both 503A and 503B pharmacies contribute to growth, with a rising trend in sterile compounding for injectable medications. Continuous investments in advanced compounding technologies and growing adoption of patient-specific formulations are expected to sustain the UK’s market growth throughout the forecast period.

France

France commands a market share of 15% in the Europe Compounding Pharmacies market, underpinned by a strong healthcare infrastructure and increasing adoption of tailored therapies. The country’s growth is fueled by a growing geriatric population, rising prevalence of chronic diseases, and demand for oral and topical compounded medications. Sterile compounding for injectable therapies is gaining traction in hospitals and specialty clinics, further enhancing market potential. Regulatory frameworks promoting patient-specific formulations, coupled with expanding pharmacy networks, enable pharmacies to meet increasing healthcare demands. Ongoing technological advancements in formulation and compounding services support France’s steady market growth.

Germany

Germany represents a key market with a market share of 20%, driven by its robust pharmaceutical industry and high patient demand for personalized medications. Injectable and oral formulations dominate, supported by extensive hospital adoption of sterile compounding services. The country benefits from stringent quality standards and regulatory support that ensure safety and efficacy in customized therapies. Growth is further propelled by rising chronic disease prevalence, geriatric care needs, and technological advancements in automated compounding systems. Germany’s leading position is reinforced by a combination of patient-specific solutions, strong pharmacy networks, and continuous innovation in sterile and non-sterile formulations.

Italy

Italy holds a market share of 12% in the Europe Compounding Pharmacies market, driven by increasing demand for oral and topical formulations across dermatology, hormone therapy, and nutritional supplements. 503A pharmacies dominate the market, offering patient-specific compounded medications tailored to individual needs. Growth is further supported by the rising elderly population, expanding awareness of personalized medicine, and hospital demand for sterile injectable preparations. Italian pharmacies are increasingly adopting advanced compounding technologies to improve quality, reduce errors, and meet regulatory standards. These factors collectively enhance the country’s market presence and position Italy for steady growth through 2032.

Spain

Spain captures a market share of 8%, led by rising patient demand for personalized medications, particularly in hormone replacement and pain management therapies. Non-sterile compounded formulations such as oral and topical medications dominate, while sterile compounding for injectables is gradually expanding in hospitals. Growth is driven by increased awareness of tailored therapies, regulatory support for compounding practices, and the presence of established pharmacy networks. Technological improvements in formulation and quality control further bolster market potential. Spain’s focus on patient-centric care and adoption of innovative compounding solutions ensures steady market expansion throughout the forecast period.

Russia

Russia holds a market share of 10% in the Europe Compounding Pharmacies market, fueled by rising healthcare expenditure, increasing prevalence of chronic and rare diseases, and expanding adoption of personalized therapies. Oral and injectable medications lead the segment, with sterile compounding gaining importance in hospitals and specialized treatment centers. The growth is also supported by the government’s initiatives to improve healthcare accessibility and quality. Emerging compounding pharmacies are investing in advanced formulation technologies to enhance accuracy and patient safety. Increasing patient awareness and demand for tailored therapies position Russia as a growing market in the European compounding pharmacy landscape.

Rest of Europe

The rest of Europe collectively accounts for a market share of 17%, encompassing countries such as Belgium, Netherlands, Switzerland, and the Nordics. Growth in these regions is driven by rising demand for personalized medications, technological adoption in compounding, and expanding sterile and non-sterile pharmacy services. Oral and topical formulations dominate, while injectable therapies are gaining traction in hospitals. Supportive regulatory frameworks, increasing chronic disease prevalence, and an aging population are key growth enablers. Investments in advanced compounding solutions, quality control, and patient-specific formulations continue to expand market reach across these diverse European countries.

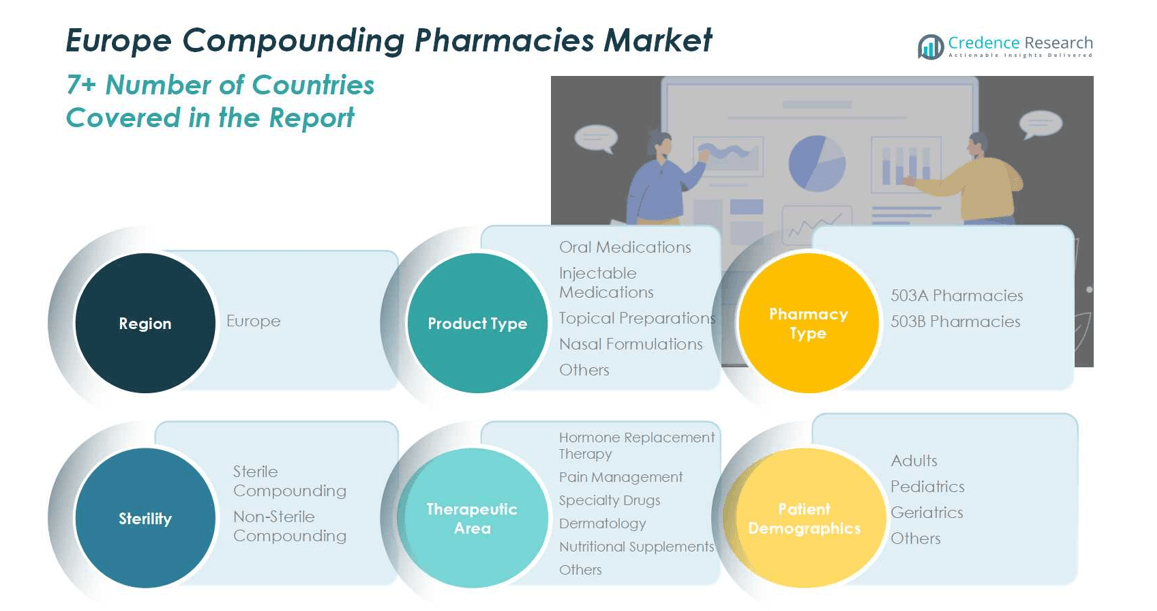

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulation

- Others

By Pharmacy Type:

- 503A Pharmacies

- 503B Pharmacies

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area:

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics:

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe Compounding Pharmacies market is characterized by key players such as Fagron N.V., Elixir Compounding Pharmacy, Fresenius Kabi AG, Belle Santé Diagnostic & Therapeutic Institute Pvt. Ltd, Triangle Compounding Pharmacy, Vertisis Custom Pharmacy, Avella Specialty Pharmacy, B. Braun Melsungen AG, PharMEDium Healthcare Holdings, Inc., and US Compounding Inc. These companies focus on expanding their product portfolios, enhancing technological capabilities, and entering strategic partnerships to strengthen their market presence. The market remains highly fragmented, with both large multinational corporations and regional pharmacies competing to provide personalized, patient-specific formulations. Innovation in sterile and non-sterile compounding, investment in advanced automation systems, and compliance with stringent regulatory standards are key differentiators. Rising demand for injectable, topical, and oral medications, coupled with growing awareness of personalized therapies, fuels competition and drives continuous improvement across the European market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fagron N.V.

- Elixir Compounding Pharmacy

- Fresenius Kabi AG

- Belle Santé Diagnostic & Therapeutic Institute Pvt. Ltd

- Triangle Compounding Pharmacy

- Vertisis Custom Pharmacy

- Avella Specialty Pharmacy

- Braun Melsungen AG

- PharMEDium Healthcare Holdings, Inc.

- US Compounding Inc.

Recent Developments

- In October 2025, Roquette expanded its Health & Pharma Solutions portfolio at CPhI Worldwide, following its acquisition of IFF Pharma Solutions, and launched KLEPTOSE® Crysmeb Methyl-Beta-Cyclodextrin for oral and parenteral formulations.

- In June 2025, Hims & Hers Health acquired Zava, a European telehealth company operating in the UK, Germany, France, and Ireland, to strengthen its presence in Europe and provide personalized weight-loss medications.

- In June 2025, H.I.G. Capital, a global investment firm, acquired ITH Group Limited, a leading UK provider of aseptic pharmaceutical compounding services, in partnership with the company’s founders

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising demand for personalized medications.

- Increasing adoption of sterile and injectable formulations will support expansion in hospitals and specialty clinics.

- Growth in the geriatric population will enhance demand for patient-specific therapies and customized dosing.

- Advancements in compounding technology and automation will improve accuracy, efficiency, and safety.

- Non-sterile compounding for oral and topical medications will continue to dominate the market.

- Expansion of 503A and 503B pharmacies will create broader service coverage across Europe.

- Rising awareness of specialty therapeutics, including hormone replacement and dermatology treatments, will fuel growth.

- Regulatory support for patient-specific formulations will encourage market participation and innovation.

- Emerging markets within Europe will offer new opportunities for regional expansion.

- Strategic partnerships, acquisitions, and collaborations among key players will strengthen market competitiveness.