Market Overview

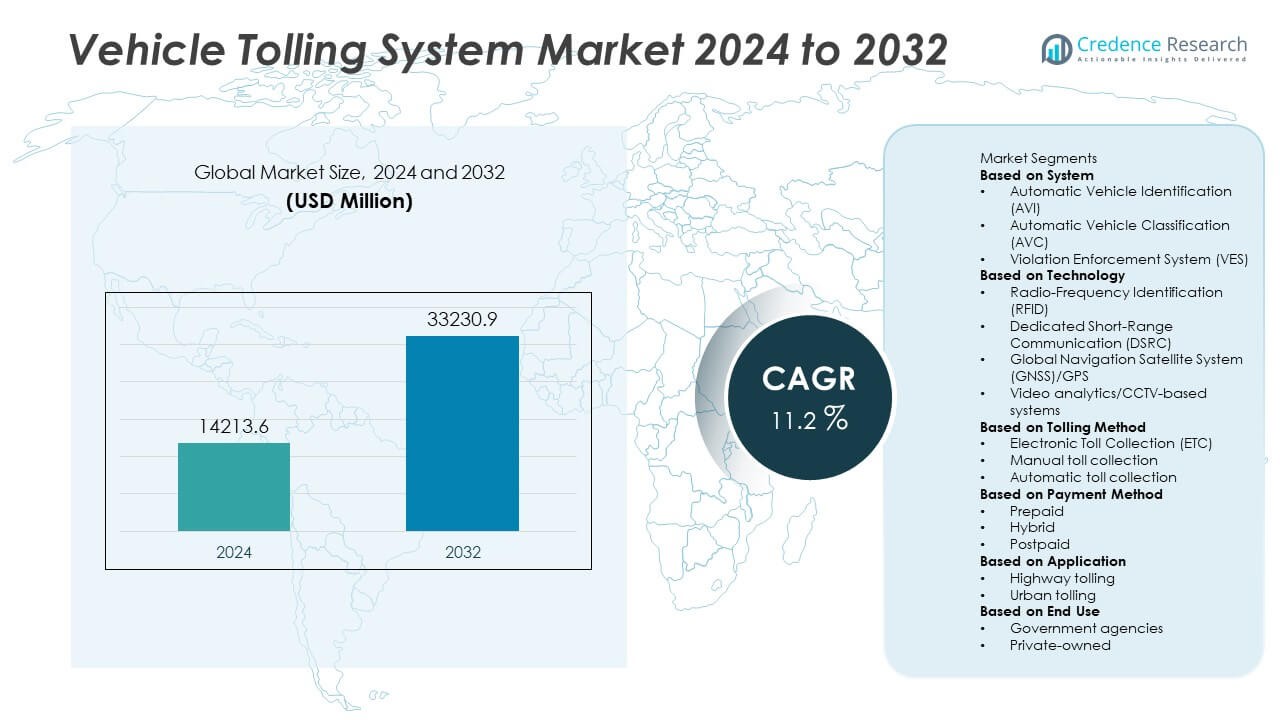

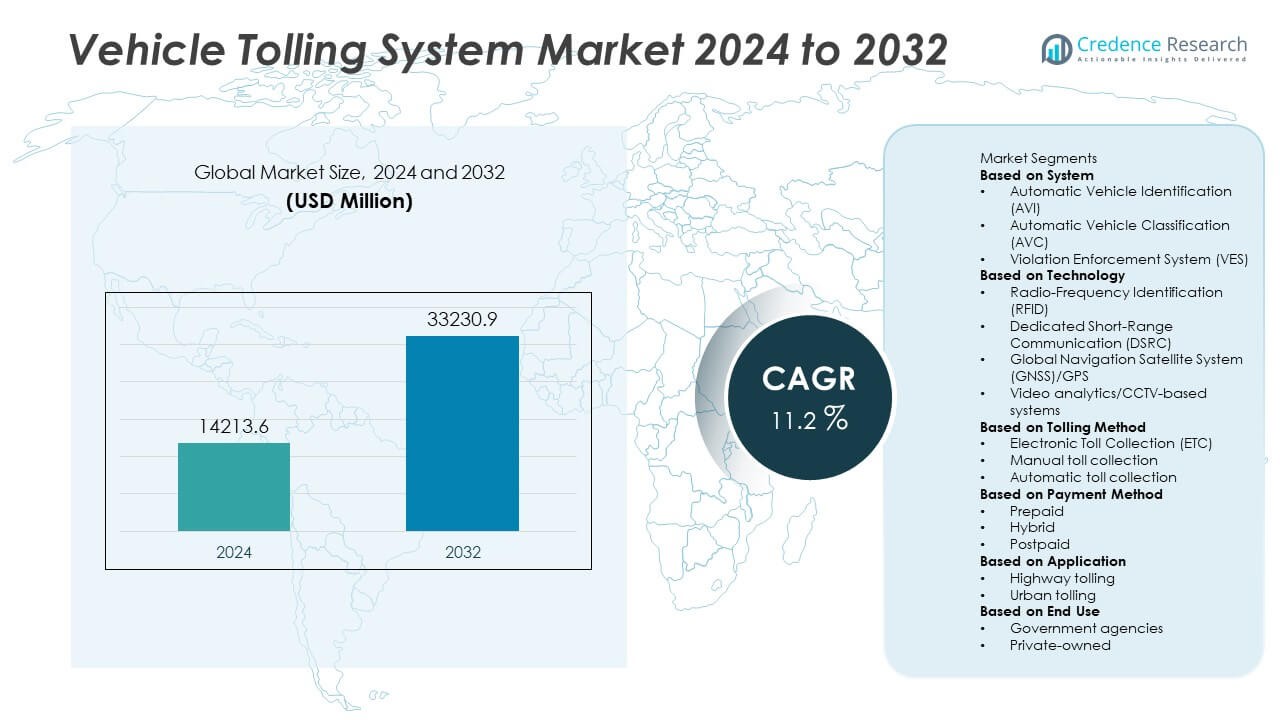

The Vehicle Tolling System Market was valued at USD 14,213.6 million in 2024 and is projected to reach USD 33,230.9 million by 2032, expanding at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Tolling System Market Size 2024 |

USD 14,213.6 Million |

| Vehicle Tolling System Market, CAGR |

11.2% |

| Vehicle Tolling System Market Size 2032 |

USD 33,230.9 Million |

The Vehicle Tolling System Market advances with rising demand for congestion reduction, smart mobility, and efficient road infrastructure funding. Governments invest in electronic toll collection, RFID, and GNSS technologies to improve traffic flow and revenue accuracy.

The Vehicle Tolling System Market demonstrates wide geographical adoption, with North America focusing on electronic toll collection networks such as transponder-based systems that reduce congestion on highways, while Europe emphasizes GNSS-based distance tolling and congestion pricing to align with sustainable transport policies. Asia-Pacific expands rapidly with large-scale programs in China and India, where governments deploy nationwide RFID and digital tolling initiatives to handle increasing vehicle volumes. Latin America modernizes its road infrastructure with public-private partnerships supporting RFID and ANPR-based tolling, whereas the Middle East & Africa gradually invest in cashless tolling linked to smart city development. Key players shaping the competitive landscape include Thales Group, known for advanced traffic management solutions; Siemens AG, a leader in integrated tolling and smart mobility systems; Kapsch TrafficCom AG, specializing in multi-lane free-flow and GNSS-based tolling; and TransCore, recognized for electronic toll collection and intelligent transportation networks in North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vehicle Tolling System Market was valued at USD 14,213.6 million in 2024 and is projected to reach USD 33,230.9 million by 2032, growing at a CAGR of 11.2% during the forecast period.

- The market grows with rising demand for congestion reduction, sustainable road funding, and improved traffic efficiency supported by government-led tolling modernization programs.

- Key trends include expansion of electronic toll collection networks, adoption of multi-lane free-flow systems, and integration of AI and data analytics for traffic monitoring and predictive maintenance.

- Leading companies such as Siemens AG, Kapsch TrafficCom AG, Thales Group, TransCore, and Honeywell International Inc. compete by focusing on advanced technologies, cross-border interoperability, and smart city integration.

- High infrastructure costs, lengthy implementation timelines, and data privacy concerns act as restraints that limit large-scale adoption in certain regions.

- North America emphasizes electronic toll collection networks, Europe advances distance-based and congestion tolling, Asia-Pacific grows rapidly through large-scale RFID and GNSS deployment, Latin America expands tolling through public-private partnerships, while the Middle East & Africa invest gradually in cashless and smart tolling systems.

- Long-term opportunities are driven by integration with smart mobility platforms, expansion of electric vehicle corridors, and increasing government focus on digitalized and environmentally sustainable transport systems.

Market Drivers

Rising Focus on Traffic Congestion Reduction and Road Efficiency

The Vehicle Tolling System Market grows strongly with increasing emphasis on reducing traffic congestion in urban areas and highways. Governments and transport authorities implement electronic tolling to minimize delays at toll plazas and improve road efficiency. Automated systems ensure faster vehicle movement, which reduces fuel consumption and lowers emissions. It allows transportation authorities to manage traffic flow more effectively by integrating real-time data into planning and operations. Tolling also provides a sustainable revenue stream for maintaining and upgrading road infrastructure. The push for smoother mobility continues to accelerate adoption worldwide.

- For instance, TransCore deployed its Infinity Digital Lane System across the Delaware River Joint Toll Bridge Commission network, significantly reducing average wait times during peak hours. Specifically, the system has led to a reduction of over 20 minutes in average wait times during peak hours according to TransCore.

Increasing Government Investments in Smart Infrastructure

National and regional governments prioritize investments in smart infrastructure to meet rising mobility demands. Large-scale funding programs encourage the deployment of advanced toll collection technologies across highways and expressways. The Vehicle Tolling System Market benefits from such initiatives, as electronic tolling aligns with smart city development and digital transformation strategies. It reduces manual intervention, improves revenue collection accuracy, and supports transparent operations. Countries in Asia-Pacific and Europe lead with extensive toll road networks supported by modernized tolling technologies. Public-private partnerships further strengthen implementation across both developed and emerging economies.

- For instance, The National Highways Authority of India (NHAI) FASTag program, which facilitates electronic toll collection, has seen a significant increase in daily electronic transactions. The Indian government recently reported that the program recorded 1.16 crore transactions in a single day, with a total of ₹193.15 crore collected.

Growing Adoption of Cashless and Contactless Payment Solutions

The rapid shift toward digital payment solutions enhances tolling efficiency and user convenience. Electronic toll collection systems allow cashless transactions through RFID tags, ANPR cameras, and mobile applications. The Vehicle Tolling System Market adapts quickly to this demand, offering integrated solutions that support multiple payment platforms. It ensures faster processing, reduces cash-handling risks, and lowers administrative costs. Widespread adoption of mobile wallets and banking applications further accelerates this transition. Consumers increasingly prefer seamless, contactless toll payments that align with global digital finance trends.

Rising Demand for Sustainable Transportation Solutions

Sustainability goals drive governments and operators to adopt tolling systems that encourage efficient vehicle use and reduce environmental impact. The Vehicle Tolling System Market plays a crucial role in promoting eco-friendly transportation by discouraging excessive fuel consumption through congestion pricing and distance-based tolling. It enables authorities to incentivize carpooling and the use of low-emission vehicles. Smart tolling contributes to reducing traffic-related carbon footprints, aligning with climate targets set by many countries. The integration of tolling with electric vehicle infrastructure enhances its relevance in the evolving mobility landscape. Sustainable policies ensure long-term adoption of advanced tolling systems across global road networks.

Market Trends

Expansion of Electronic Toll Collection (ETC) Networks

The Vehicle Tolling System Market shows strong alignment with the expansion of electronic toll collection networks across highways and urban corridors. Governments invest in RFID, Dedicated Short-Range Communication (DSRC), and satellite-based tolling to eliminate delays at toll booths. It improves operational efficiency by reducing human error and manual cash handling. Toll operators deploy multi-lane free-flow systems that allow uninterrupted traffic movement. The expansion of ETC networks not only enhances driver convenience but also improves revenue assurance for infrastructure projects. This trend continues to define large-scale modernization programs in both developed and emerging markets.

- For instance, Kapsch TrafficCom implemented its multi-lane free-flow (MLFF) system on Austria’s A9 Pyhrn Autobahn in 2024, where the system processed more than 1.1 million vehicles monthly, ensuring 99.95% transaction accuracy across all lanes.

Integration of Advanced Data Analytics and AI Technologies

The adoption of artificial intelligence and advanced analytics is reshaping toll management. Operators use predictive models to analyze traffic flows, forecast toll revenues, and optimize lane allocation. The Vehicle Tolling System Market benefits from AI-enabled license plate recognition and anomaly detection that reduce fraud and improve compliance. It provides authorities with real-time insights to manage congestion more effectively. Predictive analytics also enhances system maintenance by identifying faults before disruptions occur. AI-driven tolling solutions create smarter, safer, and more reliable networks.

- For instance, Kapsch TrafficCom launched a barrier-free tolling system on Norway’s National Road 4 in July 2025—deploying charging point equipment that integrates OBE communication and license plate recognition, in operation across multiple counties and ensuring reliable detection in all weather conditions.

Growing Role of Mobility-as-a-Service (MaaS) Platforms

The tolling industry adapts to new mobility patterns shaped by shared mobility and subscription-based transport models. Integration of tolling systems with MaaS platforms allows seamless travel experiences across multiple transport modes. The Vehicle Tolling System Market leverages this trend by enabling interoperability between road tolls, parking, and public transport payments. It ensures drivers and commuters access unified accounts for simplified transactions. This integration supports broader mobility ecosystems where tolling is no longer an isolated service. The trend strengthens the role of tolling systems in future mobility infrastructure.

Increasing Implementation of Distance-Based and Dynamic Pricing Models

Dynamic tolling and distance-based fee models gain traction to optimize traffic management and revenue generation. Authorities implement congestion pricing in cities to discourage excessive vehicle use during peak hours. The Vehicle Tolling System Market adapts to this demand by integrating software capable of real-time fare adjustments. It enables flexible pricing strategies that promote carpooling, public transport use, and reduced emissions. Distance-based tolling ensures fair cost distribution, reflecting actual road usage rather than fixed rates. The rise of smart pricing models highlights the market’s transition toward intelligent, adaptive tolling solutions.

Market Challenges Analysis

High Infrastructure Costs and Implementation Barriers

The Vehicle Tolling System Market faces challenges from the high capital investment required for toll infrastructure development. Building electronic toll collection systems involves deployment of RFID readers, sensors, cameras, and communication networks across large corridors. It raises costs for governments and operators, particularly in emerging economies with limited budgets. Integration of advanced tolling technologies also demands strong IT systems and cybersecurity measures, which further increase expenditure. Lengthy approval processes and land acquisition delays slow down large-scale projects. These factors limit the pace of adoption, keeping toll modernization uneven across regions.

Technical Complexities and Data Privacy Concerns

Operational challenges arise from the technical complexity of integrating toll systems with existing transportation infrastructure. The Vehicle Tolling System Market requires advanced interoperability between multiple payment platforms, traffic monitoring systems, and national transport databases. It increases the risk of technical glitches, system downtime, and revenue leakages. Data privacy concerns also emerge, as tolling systems rely heavily on vehicle tracking, license plate recognition, and user payment records. Weak security frameworks expose operators to cyberattacks and data misuse. The shortage of skilled workforce capable of managing large-scale digital toll operations compounds these challenges, restricting seamless implementation across networks.

Market Opportunities

Expansion of Smart Mobility and Connected Infrastructure

The Vehicle Tolling System Market benefits from the rapid expansion of smart mobility initiatives and connected transport infrastructure. Governments and private operators are integrating tolling with intelligent transportation systems that support real-time traffic monitoring and automated fare collection. It creates opportunities to link tolling platforms with parking, urban transit, and mobility-as-a-service applications, enabling unified payment ecosystems. Growing investments in 5G connectivity further enhance tolling performance by ensuring low-latency communication between vehicles and tolling infrastructure. Countries with large urban populations are prioritizing smart corridors where tolling plays a central role in traffic management. These developments open new revenue models and improve user convenience.

Growing Demand for Electric Vehicle Integration and Green Corridors

Rising adoption of electric vehicles creates opportunities to design tolling systems aligned with sustainable mobility goals. The Vehicle Tolling System Market adapts to this trend by integrating tolling with EV charging stations and offering incentives for low-emission vehicles. It allows authorities to implement differential pricing that promotes eco-friendly transportation choices. Governments worldwide are investing in green highway projects where tolling revenue supports EV infrastructure development. Tolling operators can also leverage carbon credit mechanisms linked to reduced traffic emissions. This alignment with clean energy policies positions modern tolling systems as critical enablers of the global sustainability agenda.

Market Segmentation Analysis:

By System

The Vehicle Tolling System Market segments by system into transponder-based, video analytics-based, and global navigation satellite system (GNSS)-based solutions. Transponder-based systems dominate long-standing tolling networks, offering reliable identification of vehicles through RFID tags and dedicated short-range communication. It remains a preferred choice for highways with high traffic density, where speed and accuracy are essential. Video analytics-based tolling grows steadily due to advancements in automatic number plate recognition (ANPR) cameras, enabling cashless tolling without physical devices. GNSS-based systems emerge as a flexible alternative, allowing distance-based charging and satellite-enabled monitoring across large road networks. The expansion of GNSS projects in Europe and Asia strengthens this segment as authorities explore scalable solutions for national corridors.

- For instance, Toll Collect launched the world’s first national GNSS road‑pricing system in Germany, covering over 12,000 kilometers of motorways and tracking trucks with onboard GNSS units and DSRC for enforcement.

By Technology

Technological segmentation includes RFID, DSRC, ANPR, and GPS/GNSS. RFID-based tolling leads adoption, driven by its low operational cost and high transaction accuracy. The Vehicle Tolling System Market also reflects strong adoption of DSRC, widely deployed in North America and Europe for real-time, short-range communication. ANPR technology gains ground in urban regions where license plate detection eliminates the need for physical tags. It supports seamless tolling across mixed vehicle classes, improving compliance and reducing manual enforcement. GPS/GNSS tolling, though newer, expands rapidly in regions experimenting with satellite-enabled distance-based charging models. Each technology contributes uniquely, creating a diverse landscape of tolling innovations.

- For instance, In the UK, approximately 11,000 Automatic Number Plate Recognition (ANPR) cameras capture around 50 million reads daily. These cameras are used by law enforcement to track vehicle movements, detect crime, and monitor for uninsured vehicles.

By Tolling Method

The market divides by tolling method into open road tolling, distance-based tolling, and congestion pricing. Open road tolling, also called multi-lane free flow, dominates due to its ability to eliminate physical toll plazas and enable uninterrupted traffic flow. It enhances user experience by reducing waiting times and fuel wastage. Distance-based tolling expands steadily in regions prioritizing fair cost distribution by charging vehicles based on actual kilometers traveled. The Vehicle Tolling System Market also sees rapid growth in congestion pricing models, particularly in metropolitan areas where traffic management and environmental concerns are critical. It empowers authorities to regulate peak-hour demand while incentivizing sustainable travel. The balance of these tolling methods reflects a shift toward intelligent, adaptive, and environmentally conscious mobility solutions.

Segments:

Based on System

- Automatic Vehicle Identification (AVI)

- Automatic Vehicle Classification (AVC)

- Violation Enforcement System (VES)

Based on Technology

- Radio-Frequency Identification (RFID)

- Dedicated Short-Range Communication (DSRC)

- Global Navigation Satellite System (GNSS)/GPS

- Video analytics/CCTV-based systems

Based on Tolling Method

- Electronic Toll Collection (ETC)

- Manual toll collection

- Automatic toll collection

Based on Payment Method

Based on Application

- Highway tolling

- Urban tolling

Based on End Use

- Government agencies

- Private-owned

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 29% of the Vehicle Tolling System Market, supported by strong adoption of electronic toll collection and cashless payment solutions. The United States leads the region with widespread deployment of transponder-based tolling networks such as E-ZPass, which serves over 35 million active accounts across multiple states. Canada invests in modernized toll roads and bridges, while Mexico expands electronic tolling to improve efficiency on busy highways. It benefits from well-established infrastructure, advanced digital payment penetration, and regulatory support for congestion pricing initiatives in urban areas. Ongoing integration of RFID, ANPR, and GPS technologies enhances system reliability and user convenience. The growing focus on smart city development further accelerates regional adoption.

Europe

Europe represents 31% of the Vehicle Tolling System Market, making it the largest regional share. Countries such as Germany, France, and the United Kingdom invest in advanced distance-based tolling systems supported by GNSS technology. It reflects Europe’s emphasis on sustainable transportation policies and cross-border interoperability. The European Union promotes unified tolling systems under the European Electronic Toll Service (EETS), enabling seamless travel across member states with a single on-board unit. Investments in congestion pricing projects in cities like London, Stockholm, and Milan highlight the region’s leadership in environmentally driven tolling. Europe’s integration of tolling with smart mobility and low-emission zones secures its strong position in the market.

Asia-Pacific

Asia-Pacific holds 27% of the Vehicle Tolling System Market, driven by rapid infrastructure development and increasing traffic volumes. China leads with nationwide implementation of electronic tolling that connects more than 30 provinces, supporting efficient long-distance transport. India expands toll plazas under the FASTag program, which surpassed 60 million active users in 2024 and processes over 7 million transactions daily. Japan and South Korea deploy DSRC and GNSS-based tolling across expressways, ensuring accuracy and efficiency in dense urban traffic. It benefits from strong government support for digitalization and smart mobility solutions. The region’s fast-growing population and rising vehicle ownership sustain high demand for tolling modernization.

Latin America

Latin America contributes 7% of the Vehicle Tolling System Market, supported by highway concessions and public-private partnerships. Brazil dominates with extensive toll road networks that incorporate RFID and ANPR-based solutions. Chile and Argentina invest in electronic tolling projects to improve efficiency in urban corridors and intercity highways. It reflects a growing emphasis on reducing congestion and generating stable revenue for road maintenance. International partnerships with European and U.S. tolling technology providers strengthen system deployment in the region. Latin America continues to expand its tolling footprint, although adoption varies by country based on regulatory and economic factors.

Middle East & Africa

The Middle East & Africa accounts for 6% of the Vehicle Tolling System Market, with emerging interest in tolling modernization and smart transport systems. The United Arab Emirates leads with advanced electronic tolling, including the Salik system in Dubai, which operates entirely cashless and processes millions of transactions daily. Saudi Arabia invests in toll road projects as part of Vision 2030, emphasizing efficiency and private sector participation. In Africa, South Africa introduces electronic tolling on national highways to improve revenue collection and reduce congestion. It gains momentum from urbanization and rising vehicle density, though adoption remains gradual compared to other regions. The long-term potential is significant, supported by government-backed infrastructure programs and regional integration initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Sensys Gatso Group

- Honeywell International Inc.

- Transcore

- Continental AG

- Jenoptik AG

- Indra Sistemas

- Cubic Corporation

- Thales Group

- Kapsch TrafficCom AG

Competitive Analysis

The competitive landscape of the Vehicle Tolling System Market is shaped by global players that focus on technology leadership, large-scale project execution, and integration with smart mobility platforms. Siemens AG, Thales Group, Kapsch TrafficCom AG, TransCore, Cubic Corporation, Honeywell International Inc., Indra Sistemas, Continental AG, Sensys Gatso Group, and Jenoptik AG dominate the market with diverse portfolios covering electronic toll collection, GNSS-based tolling, ANPR solutions, and multi-lane free-flow systems. Siemens AG leverages its expertise in intelligent transportation and integrated digital platforms, while Thales Group emphasizes security-driven tolling solutions and advanced traffic management. Kapsch TrafficCom AG stands out with leadership in free-flow tolling and GNSS deployments across Europe and Asia. TransCore plays a critical role in North America with strong deployment of RFID and ETC technologies, while Cubic Corporation focuses on urban tolling integrated with public transport systems. Honeywell International Inc. and Continental AG strengthen their presence with hardware, sensors, and software-driven toll management platforms. Indra Sistemas contributes to large government-backed tolling projects, and Sensys Gatso Group specializes in enforcement technologies linked to toll compliance. Jenoptik AG enhances its position with advanced ANPR and traffic enforcement cameras. Collectively, these players compete through innovation, partnerships, and global expansion to capture rising demand for seamless tolling and smart road infrastructure.

Recent Developments

- In June 2025, TransCore deployed its next-generation Infinity Digital Lane System—including AI-powered VCATS™ and SmartPass® readers.

- In September 2024, SkyToll, in collaboration with its sister company TollNet, secured a major contract to develop and implement a state-of-the-art Electronic Toll System (ETS) across Croatia’s highways. This initiative aims to significantly improve tolling efficiency, reduce manual interventions, and provide a faster, more seamless experience for highway users. The ETS will also contribute to enhanced traffic management and reduced congestion on Croatian roadways.

- In April 2024, Ohio Turnpike implemented a toll collection system. The new system incorporates Open Road Tolling (ORT)which allows vehicles to pass through tolling points without stopping, promoting seamless traffic flow. The project includes the removal of all toll gates in E-ZPass lanes at both entry and exit points, drastically reducing congestion and enhancing overall driver convenience.

- In May 2024, Cubic Transportation Systems showcased its next-gen tolling solutions—including Umo Pass and Road User Charging platforms—at the ITE Joint International Conference, enhancing smart mobility frameworks.

Market Concentration & Characteristics

The Vehicle Tolling System Market demonstrates a moderately concentrated structure, with global leaders and specialized regional players driving adoption through advanced technologies and strategic partnerships. Leading companies such as Siemens AG, Kapsch TrafficCom AG, Thales Group, TransCore, and Honeywell International Inc. dominate large-scale projects by leveraging expertise in electronic toll collection, multi-lane free-flow solutions, and GNSS-based systems. It is characterized by high infrastructure costs, long implementation cycles, and strong reliance on government policies and concessions, which create entry barriers for smaller firms. The market reflects a mix of standardized transponder-based solutions in mature economies and innovative ANPR or satellite-enabled systems in emerging regions. Integration with digital payments, smart mobility platforms, and connected vehicle technologies shapes its evolution, while data privacy and interoperability remain defining challenges. Intense competition pushes players to focus on seamless user experience, operational efficiency, and sustainable tolling models that align with global smart city and green transport initiatives.

Report Coverage

The research report offers an in-depth analysis based on System, Technology, Tolling Method, Payment Method, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electronic toll collection will accelerate with wider adoption of RFID, DSRC, and GNSS systems.

- Multi-lane free-flow tolling will expand to eliminate traditional toll plazas and improve traffic efficiency.

- Artificial intelligence and data analytics will play a stronger role in revenue assurance and traffic management.

- Integration with smart mobility platforms will create unified payment ecosystems across transport modes.

- Governments will prioritize congestion pricing and dynamic tolling to regulate peak-hour traffic in cities.

- Adoption of cashless and contactless payment methods will enhance user convenience and system transparency.

- Asia-Pacific will emerge as a key growth hub with large-scale nationwide digital tolling programs.

- Europe will lead in sustainable tolling policies through distance-based and emission-linked pricing models.

- Collaboration between public agencies and private operators will drive investment in advanced tolling networks.

- Electric vehicle growth will encourage tolling systems integrated with charging infrastructure and green corridors.