Market Overview:

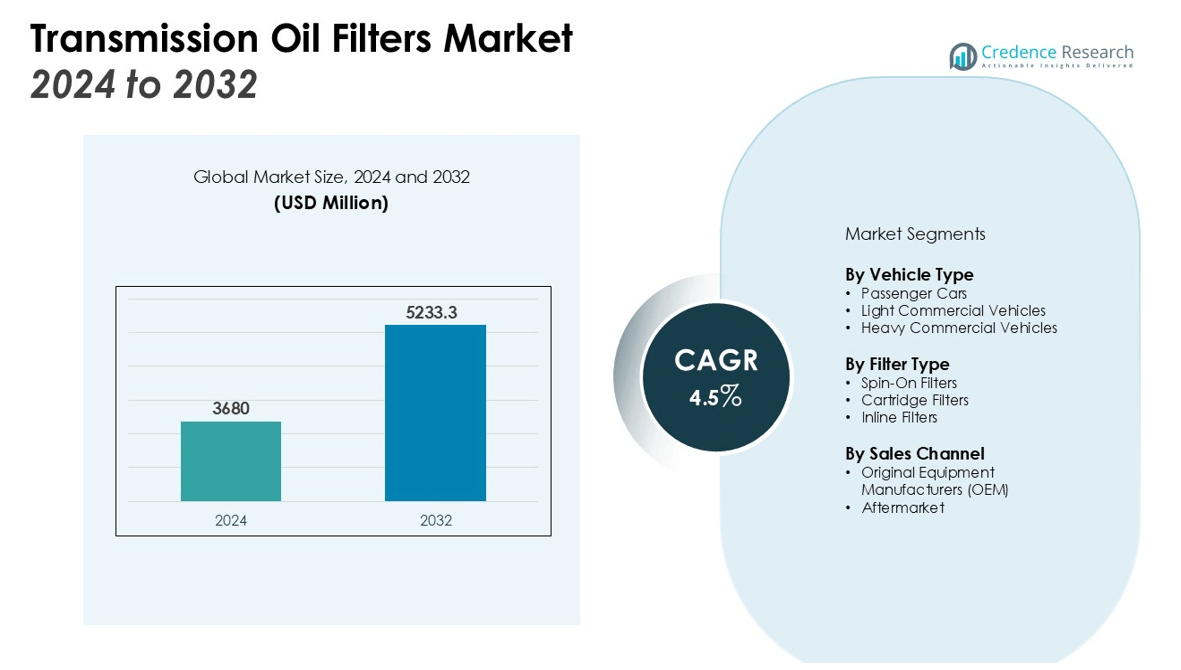

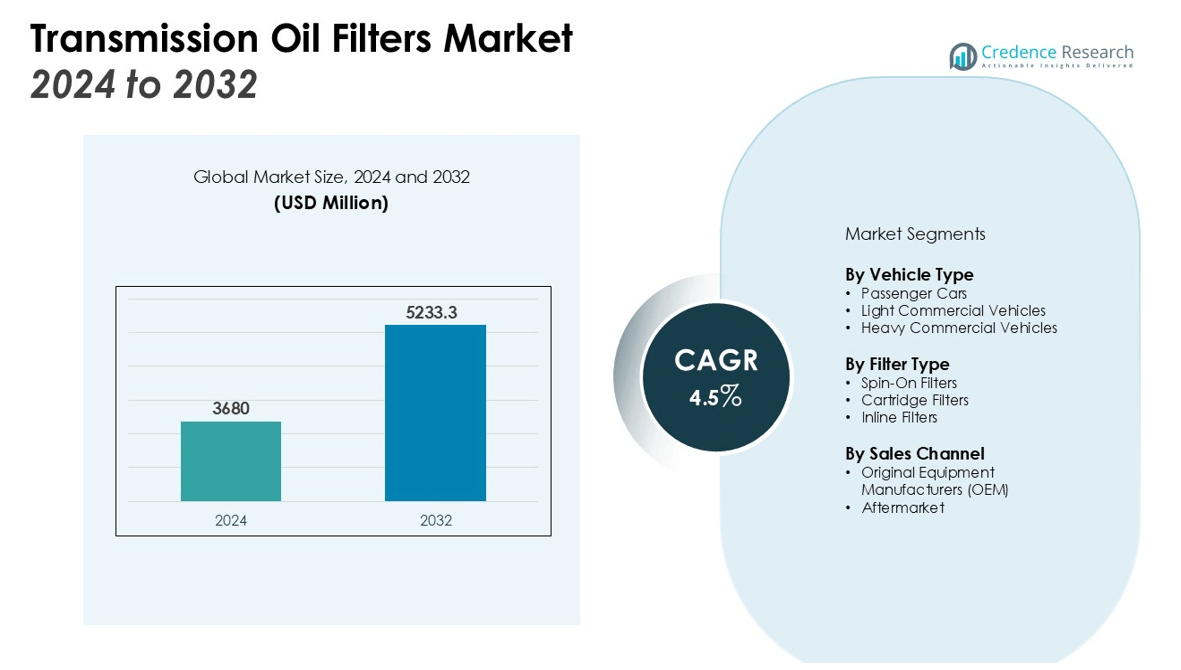

The Transmission Oil Filters Market size was valued at USD 3680 million in 2024 and is anticipated to reach USD 5233.3 million by 2032, at a CAGR of 4.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transmission Oil Filters Market Size 2024 |

USD 3680 million |

| Transmission Oil Filters Market, CAGR |

4.5% |

| Transmission Oil Filters Market Size 2032 |

USD 5233.3 million |

Key drivers shaping the market include stricter emission standards and the need for improved fuel efficiency. Advances in filter materials and designs are enhancing durability, helping manufacturers meet regulatory expectations while offering better protection for transmission systems. The trend of extended vehicle lifespans further supports recurring filter replacements, strengthening aftermarket opportunities. Growing electrification of vehicles is also influencing filter design, ensuring compatibility with evolving drivetrain technologies.

Regionally, Asia Pacific holds a strong position due to rapid automotive manufacturing growth and expanding vehicle ownership. North America maintains stable demand driven by established automotive networks and aftermarket service providers. Europe shows steady development, supported by environmental regulations and a strong base of premium vehicle manufacturers. These factors together ensure the transmission oil filters market maintains its upward trajectory across major global regions.

Market Insights:

- The Transmission Oil Filters Market was valued at USD 3680 million in 2024 and is projected to reach USD 5233.3 million by 2032.

- Stricter emission regulations and rising demand for fuel-efficient vehicles continue to drive the adoption of advanced filtration systems.

- Technological improvements in filter media and designs enhance durability, extend service intervals, and reduce operating costs.

- Extended vehicle lifespans strengthen recurring replacement cycles, creating steady growth opportunities in the aftermarket sector.

- Volatile raw material costs and supply chain disruptions challenge manufacturers to maintain product quality and affordability.

- Asia Pacific leads with 45% share of global revenue, supported by strong manufacturing and expanding vehicle ownership.

- North America and Europe maintain stable demand, supported by aftermarket strength, regulatory enforcement, and premium vehicle adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Norms and Regulatory Compliance Driving Demand

The Transmission Oil Filters Market is strongly influenced by tightening emission regulations across global regions. Governments mandate improved vehicle efficiency and reduced emissions, which increases the need for effective filtration. It ensures cleaner transmission operations by reducing particulate contamination and supporting compliance with regulatory requirements. Rising pressure from environmental standards compels manufacturers to adopt advanced filtration systems that meet durability and performance benchmarks.

- For instance, MANN+HUMMEL’s pressure-side transmission oil filters for passenger cars are engineered to achieve a separation efficiency Beta ratio greater than 200 for 5-micrometer particles, ensuring exceptional oil cleanliness to protect sensitive transmission components.

Growing Focus on Fuel Efficiency and Engine Performance

The Transmission Oil Filters Market benefits from a strong focus on improving fuel efficiency. Transmission systems require high-quality filters to minimize wear and optimize fluid performance. It helps extend transmission life, reduce maintenance costs, and improve overall vehicle reliability. With rising fuel prices and customer demand for efficient vehicles, manufacturers prioritize advanced filters that deliver consistent results under demanding conditions.

- For instance, Allison Transmission provides a main filter change interval of up to 75,000 miles for its 3000 and 4000 series transmissions when using its approved High Capacity Filters under a general duty cycle.

Technological Advancements in Filter Design and Materials

The Transmission Oil Filters Market is expanding through innovation in filter media and structural designs. Manufacturers introduce filters with enhanced dirt-holding capacity, longer service intervals, and improved sealing technology. It enables transmission systems to operate smoothly while supporting cost efficiency for end users. Advanced synthetic materials and multi-layer filtration designs are now widely adopted to ensure greater protection and durability.

Extended Vehicle Lifespans and Aftermarket Growth Opportunities

The Transmission Oil Filters Market benefits from increasing vehicle lifespans, which strengthen recurring demand in the aftermarket sector. Older vehicles require more frequent replacements, creating steady sales beyond the original equipment phase. It supports long-term revenue streams for suppliers while expanding service opportunities for workshops and retailers. With consumers keeping vehicles longer, recurring replacement cycles secure the market’s consistent upward trend.

Market Trends:

Integration of Advanced Filtration Technologies and Sustainable Materials

The Transmission Oil Filters Market is witnessing a notable trend toward advanced filter technologies and sustainable materials. Manufacturers are introducing multi-layer synthetic filter media that extend service intervals while enhancing fluid purity. It improves transmission reliability and helps vehicle owners reduce maintenance costs. Increasing interest in eco-friendly solutions drives the adoption of recyclable and bio-based materials in filter production. The market also reflects demand for lightweight and compact designs that align with modern vehicle architecture. Integration of digital monitoring systems within filters is gaining attention, allowing predictive maintenance and real-time performance tracking.

- For instance, MANN+HUMMEL manufactures a pressure-side transmission oil filter that achieves a separation efficiency rating of Beta 200 for particles as small as 5 micrometers.

Rising Adoption in Automatic and Hybrid Vehicle Segments Globally

The Transmission Oil Filters Market is influenced by the rapid adoption of automatic and hybrid vehicles across regions. Growing consumer preference for smoother driving experiences and fuel-efficient mobility strengthens demand for high-performance filters. It creates opportunities for suppliers to develop products compatible with advanced drivetrains, including hybrid and electric platforms with auxiliary transmission systems. Vehicle electrification encourages design modifications in filters to manage new operating conditions. Expanding aftermarket channels support wider accessibility and increase replacement rates, especially in regions with growing vehicle fleets. The combination of technology adoption, evolving mobility needs, and aftermarket expansion defines the market’s long-term growth direction.

- For instance, MAHLE produces spin-on oil filters with a high-pressure-resistant housing designed to compensate for load peaks of up to 20 bar, ensuring reliable performance in demanding applications.

Market Challenges Analysis:

Volatility in Raw Material Prices and Manufacturing Costs

The Transmission Oil Filters Market faces challenges from fluctuating raw material prices and rising manufacturing expenses. Steel, synthetic fibers, and specialty polymers form the core of filter production, and their cost variations impact overall profitability. It pressures manufacturers to balance quality with affordability while meeting regulatory standards. Supply chain disruptions also add uncertainty, causing delays in delivery and production planning. High energy costs further contribute to operational strain for manufacturers, creating barriers for smaller suppliers. The need to sustain competitive pricing without compromising durability remains a persistent challenge.

Shift Toward Electric Vehicles and Reduced Maintenance Needs

The Transmission Oil Filters Market is affected by the gradual transition toward electric vehicles, which reduces demand for traditional transmission systems. EVs typically require fewer mechanical components, lowering the need for oil-based filtration. It compels manufacturers to diversify portfolios and develop products compatible with hybrid platforms. Slow adoption of advanced filter technologies in cost-sensitive markets adds to the difficulty. Counterfeit and low-quality filters in emerging economies also hinder brand growth and create safety risks. Market participants must adapt strategies to address these evolving challenges while sustaining long-term relevance.

Market Opportunities:

Expansion of Aftermarket Services and Replacement Demand

The Transmission Oil Filters Market presents strong opportunities in the aftermarket segment, supported by rising vehicle lifespans and increasing maintenance awareness. Consumers are keeping vehicles longer, which expands recurring replacement cycles for transmission filters. It allows service providers and retailers to strengthen distribution networks and capture steady revenue streams. Growing preference for cost-effective maintenance solutions further increases aftermarket demand in both developed and emerging economies. Manufacturers offering extended service life filters gain a competitive advantage in capturing this recurring business. The aftermarket remains a critical growth driver for sustained long-term opportunities.

Adoption of Smart Filtration and Emerging Vehicle Technologies

The Transmission Oil Filters Market is creating opportunities through the integration of smart filtration systems and compatibility with evolving drivetrains. Filters equipped with sensors and monitoring features enable predictive maintenance and performance tracking. It enhances reliability for fleet operators and supports advanced mobility solutions. Growth of automatic, hybrid, and plug-in hybrid vehicles strengthens demand for specialized filter designs. Suppliers that innovate for these applications secure an advantage in capturing new revenue streams. Rising investments in eco-friendly materials and recyclable filter components also provide opportunities to align with sustainability goals across global markets.

Market Segmentation Analysis:

By Vehicle Type

The Transmission Oil Filters Market by vehicle type is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. Passenger cars dominate demand due to rising global ownership rates and higher adoption of automatic transmissions. It gains further strength from growing awareness of preventive maintenance in urban regions. Light and heavy commercial vehicles also represent significant growth potential, supported by fleet expansion and logistics sector development.

- For instance, the MANN-FILTER W 7071 transmission oil filter, developed for the Mercedes-Benz eActros electric truck, is a technological achievement that uses a fully synthetic medium to separate particles as small as 50 micrometers.

By Filter Type

By filter type, the Transmission Oil Filters Market includes spin-on filters, cartridge filters, and inline filters. Spin-on filters remain widely used for their ease of installation and cost efficiency. Cartridge filters are gaining traction due to their recyclability and alignment with environmental standards. It allows manufacturers to meet regulatory expectations while offering durable and efficient solutions. Inline filters cater to specialized applications where extended service intervals are critical.

- For instance, Parker Hannifin’s Moduflow™ Plus Series of low-pressure inline filters demonstrates robust construction with a maximum allowable operating pressure of 13.8 bar.

By Sales Channel

By sales channel, the Transmission Oil Filters Market is divided into original equipment manufacturers (OEM) and aftermarket. OEM supply remains vital due to strong relationships with automotive producers and demand for factory-fitted components. The aftermarket segment continues to expand, driven by recurring replacement needs and longer vehicle lifespans. It provides opportunities for suppliers to capture sustained demand through service networks and independent workshops. Together, these segments support balanced growth across both production and service phases.

Segmentations:

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Filter Type

- Spin-On Filters

- Cartridge Filters

- Inline Filters

By Sales Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia Pacific Leads with Strong Manufacturing and Vehicle Demand

The Transmission Oil Filters Market in Asia Pacific holds 45% share of global revenue, making it the largest regional contributor. China, India, Japan, and South Korea remain central hubs for vehicle production and filter consumption. It benefits from cost-effective manufacturing, strong aftermarket presence, and rising vehicle ownership. Urban growth and industrial expansion continue to drive passenger and commercial vehicle sales, boosting demand for advanced filters. Strategic investments from global manufacturers reinforce Asia Pacific’s dominance in this market.

North America Maintains Growth with Aftermarket Strength

The Transmission Oil Filters Market in North America accounts for 28% share, supported by a strong automotive base and mature aftermarket networks. The United States leads regional demand with large commercial fleets and high consumer maintenance awareness. It gains further strength from recurring replacement cycles and steady new vehicle sales. The presence of well-established OEMs and widespread service channels secures long-term market stability. North America’s structured distribution networks also ensure consistent availability of high-quality filtration products.

Europe Supported by Regulations and Premium Vehicle Expansion

The Transmission Oil Filters Market in Europe represents 20% share, reflecting its position as a mature and regulated region. Germany, France, and the United Kingdom remain key contributors, driven by premium and hybrid vehicle adoption. It benefits from strict emission regulations that encourage advanced filter technologies with longer service intervals. The growing demand for luxury and fuel-efficient cars further supports regional filter adoption. Strong OEM-supplier collaborations enhance technological development and align with Europe’s sustainability initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ACDelco

- Mann+Hummel

- Parker Hannifin Corporation

- Cummins Filtration

- Mahle GmbH

- Denso Corporation

- Ahlstrom-Munksjö

- Champion Laboratories, Inc.

- Donaldson Company, Inc.

- Bosch Auto Parts

- Hengst SE

Competitive Analysis:

The Transmission Oil Filters Market is defined by strong competition among global and regional manufacturers focusing on quality, durability, and compliance with emission standards. Leading players emphasize advanced filtration technologies, longer service intervals, and eco-friendly materials to strengthen market presence. It remains highly fragmented, with established brands competing against emerging suppliers offering cost-effective solutions. Strategic partnerships with automotive OEMs secure consistent demand, while aftermarket networks expand recurring sales opportunities. Companies invest in research and development to enhance filter media performance and adapt to evolving drivetrain technologies, including hybrid and electric platforms. Competitive differentiation often centers on product reliability, pricing strategies, and supply chain efficiency. The growing importance of counterfeit prevention and sustainability goals further shapes competitive positioning. Continuous innovation and strong distribution channels enable leading manufacturers to maintain customer trust and secure long-term growth in this market.

Recent Developments:

- In August 2025, ACDelco and the OTE Group held a partnership meeting in Oman, where OTE Group was announced as the exclusive distributor for ACDelco lubricants in the country.

- In June 2025, Parker Hannifin Corporation announced its agreement to acquire Curtis Instruments, Inc., a manufacturer of motor speed controllers and other electronics for electric vehicles, for approximately $1 billion in cash.

- In February 2025, Cummins Inc. announced the acquisition of assets from First Mode, a company specializing in retrofit hybrid solutions for mining and rail operations.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle Type, Filter Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Transmission Oil Filters Market will continue to expand due to rising global vehicle ownership.

- It will see stronger demand from automatic and hybrid vehicles requiring advanced filtration systems.

- Manufacturers will invest in eco-friendly materials to align with sustainability targets and regulations.

- Growth in aftermarket sales will accelerate, supported by extended vehicle lifespans and replacement needs.

- It will benefit from digital monitoring integration, allowing predictive maintenance and improved service efficiency.

- Regional growth in Asia Pacific will remain dominant, driven by robust automotive manufacturing bases.

- North America will sustain demand through established service networks and fleet maintenance requirements.

- Europe will emphasize innovation in premium and hybrid vehicle segments under strict emission standards.

- Market competition will intensify, with companies focusing on cost efficiency and global distribution reach.

- It will evolve with continuous product innovations ensuring compatibility with electric and hybrid drivetrains.