Market Overview:

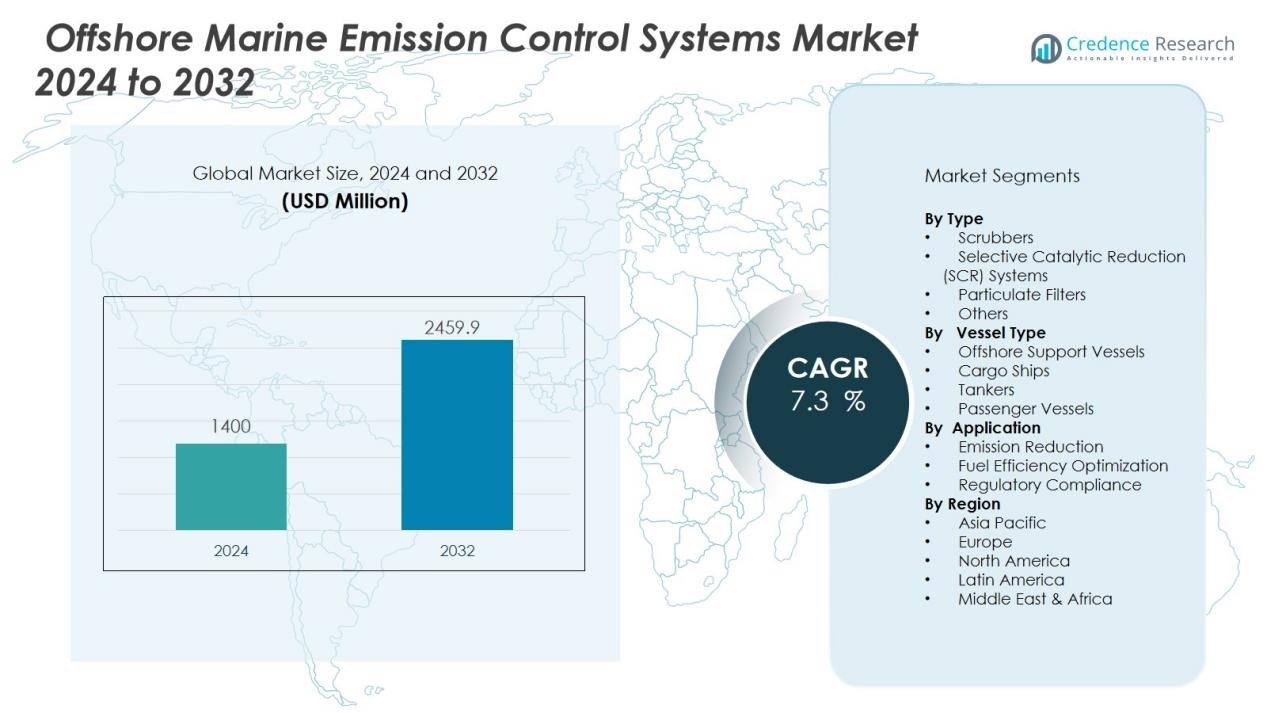

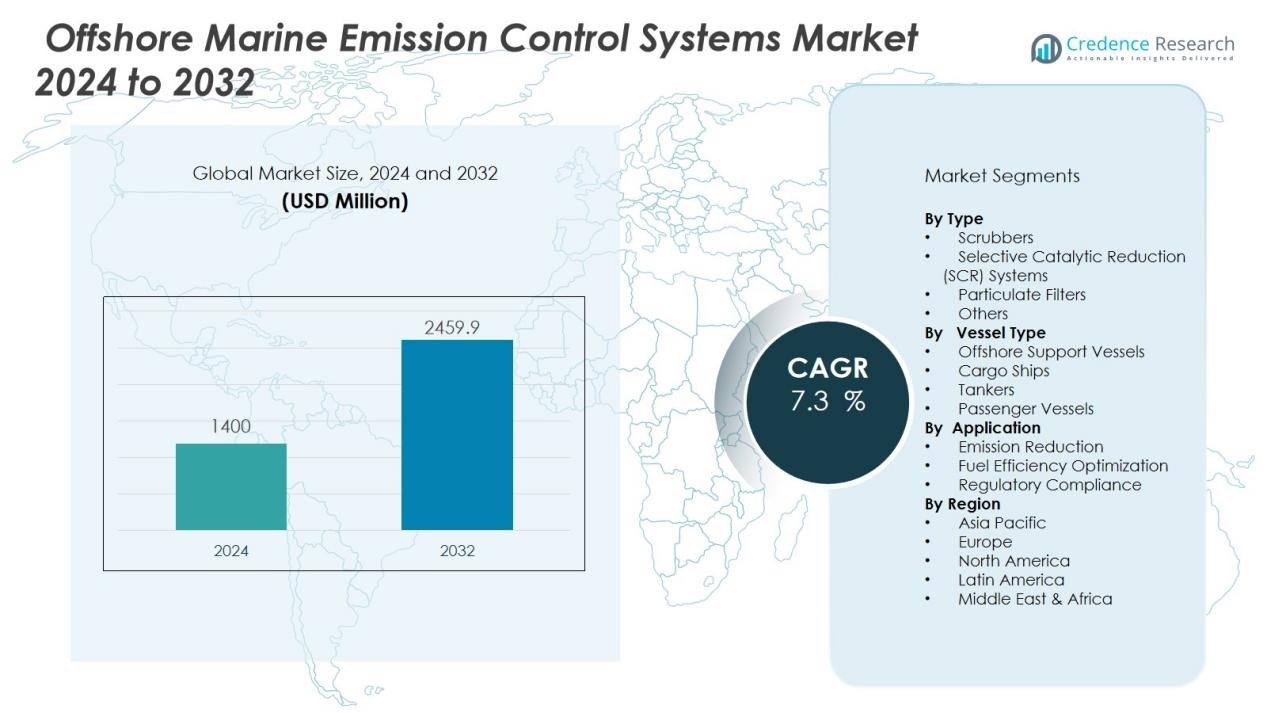

The Offshore marine emission control systems market size was valued at USD 1400 million in 2024 and is anticipated to reach USD 2459.9 million by 2032, at a CAGR of 7.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Marine Emission Control Systems Market Size 2024 |

USD 1400 Million |

| Offshore Marine Emission Control Systems Market, CAGR |

7.3 % |

| Offshore Marine Emission Control Systems Market Size 2032 |

USD 2459.9 Million |

xKey drivers include stricter International Maritime Organization (IMO) standards limiting sulfur and nitrogen oxide emissions, as well as rising environmental concerns regarding air quality in coastal and offshore regions. Offshore oil and gas operations, along with cargo and passenger shipping activities, are investing heavily in advanced scrubbers, selective catalytic reduction systems, and hybrid solutions to ensure compliance. Increasing demand for LNG-fueled vessels and renewable offshore projects is further accelerating system adoption.

Regionally, Europe and North America dominate the offshore marine emission control systems market due to strong enforcement of environmental regulations and early adoption of clean technologies. Asia-Pacific is witnessing the fastest growth, supported by expanding shipbuilding industries in China, South Korea, and Japan, coupled with growing offshore energy exploration. The Middle East and Latin America are also emerging markets, driven by offshore oil and gas activities and rising environmental mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Offshore marine emission control systems market was valued at USD 1400 million in 2024 and is expected to reach USD 2459.9 million by 2032, growing at a CAGR of 7.3%.

- Strict IMO regulations on sulfur and nitrogen oxide emissions drive strong adoption of scrubbers, catalytic reduction units, and hybrid systems.

- Growing focus on environmental sustainability and coastal air quality pushes operators to invest in eco-friendly solutions.

- Expanding offshore oil, gas, and renewable projects fuel continuous demand for emission reduction technologies across support vessels and rigs.

- Rising adoption of LNG-fueled and hybrid propulsion vessels creates opportunities for integrated emission control solutions.

- High installation, retrofitting, and maintenance costs remain key challenges, particularly for small and mid-sized operators.

- North America led with 32% share in 2024, followed by Europe at 29%, while Asia-Pacific with 27% is forecast to grow fastest due to strong shipbuilding and tightening regional emission mandates.

Market Drivers:

Rising Stringency of International Maritime Organization (IMO) Regulations:

The Offshore marine emission control systems market is primarily driven by strict IMO rules targeting sulfur oxides and nitrogen oxides. These mandates require vessels to install scrubbers, catalytic reduction units, or adopt alternative fuels to meet emission limits. Compliance pressure compels shipping operators and offshore oil and gas companies to invest in advanced control technologies. It strengthens demand across both newbuild vessels and retrofitted fleets.

- For instance, Wärtsilä supplied 350 marine scrubber systems globally by mid-2020, enabling ships to meet IMO 2020 sulfur limits while continuing to use high-sulfur fuel oil.

Growing Focus on Environmental Sustainability and Air Quality:

Heightened awareness of marine pollution and its impact on coastal communities is fueling adoption. Governments and environmental agencies are enforcing stricter coastal air quality standards, making emission control technologies critical. It pushes shipping companies to adopt eco-friendly systems that reduce greenhouse gas output. The emphasis on sustainable maritime operations further reinforces this growth trend.

- For instance, Wärtsilä’s Moss, Norway research facility captures 10 tonnes of CO₂ per day from a marine engine using its full-scale carbon capture solution.

Expanding Offshore Oil, Gas, and Renewable Energy Activities:

The expansion of offshore exploration, production, and renewable energy projects significantly increases vessel movements. Offshore support vessels, rigs, and service fleets must comply with emission control norms to operate in regulated waters. It drives continuous demand for emission reduction systems to maintain operational approval. The growing offshore wind sector also contributes to adoption as environmental standards extend to renewable operations.

Rising Demand for LNG-Fueled and Hybrid Propulsion Vessels:

The shift toward LNG-fueled vessels and hybrid propulsion technologies enhances the role of emission control systems. LNG lowers carbon and sulfur emissions but still requires complementary systems for full compliance. It creates opportunities for integrated solutions combining scrubbers and catalytic converters. The adoption of hybrid technologies in offshore operations accelerates the need for advanced emission control systems worldwide.

Market Trends:

Integration of Advanced Hybrid and LNG-Based Emission Control Solutions:

The Offshore marine emission control systems market is witnessing a clear trend toward hybrid and LNG-based technologies that enhance efficiency and compliance. Ship operators are adopting LNG propulsion to lower sulfur and carbon emissions, supported by emission control systems for complete regulatory alignment. Hybrid solutions combining scrubbers, selective catalytic reduction systems, and particulate filters are gaining traction due to their ability to address multiple pollutants simultaneously. It supports fleet operators in meeting global and regional emission limits without compromising operational flexibility. Growing investments in LNG infrastructure at ports and offshore facilities further encourage adoption of dual solutions. The integration of digital monitoring technologies also plays a key role, ensuring continuous performance and compliance tracking.

- For instance, MAN Energy Solutions equipped the Viking Grace ferry with an LNG engine and selective catalytic reduction (SCR) system, achieving nitrogen oxide (NOx) emissions below 0.4 g/kWh, demonstrating significant efficiency in emission reduction.

Rising Emphasis on Retrofitting and Digital Monitoring for Compliance:

Retrofitting existing offshore fleets with advanced emission control systems is becoming a dominant trend in regulated regions. With thousands of offshore support and cargo vessels already in operation, operators are focusing on upgrading equipment to extend service life while meeting IMO standards. It highlights a shift from reliance on newbuild vessels to extending compliance across older fleets. Demand for digital monitoring tools that provide real-time emission data is also increasing, driven by stricter enforcement and port inspections. Predictive maintenance powered by data analytics is emerging as a key enabler, reducing downtime while improving system efficiency. The market is also seeing partnerships between system providers and digital solution companies to deliver integrated compliance packages.

- For example, Kongsberg Digital’s Vessel Insight platform connects more than 600 vessels worldwide and delivers continuous emission and performance data, enabling proactive regulatory compliance and operational efficiency.

Market Challenges Analysis:

High Installation and Maintenance Costs of Emission Control Systems:

The Offshore marine emission control systems market faces a significant challenge due to the high capital and operational expenses involved. Installing scrubbers, catalytic converters, and filtration units requires major investments, which many small and mid-sized operators struggle to afford. It increases the financial burden on companies already managing volatile fuel prices and tight margins. Ongoing maintenance, spare parts, and specialized crew training further add to operational costs. Limited access to financing options in emerging economies also restricts large-scale adoption. These cost barriers can delay compliance and slow down market expansion in cost-sensitive regions.

Technical Complexity and Infrastructure Limitations for Compliance:

Another challenge is the technical complexity of integrating emission control systems with existing offshore vessels. Retrofitting older fleets requires significant modifications, which may not always be technically feasible or cost-effective. It also demands downtime, reducing fleet availability for critical offshore operations. Limited infrastructure for alternative fuels like LNG further constrains adoption in several regions. Operators face difficulties in accessing skilled technicians capable of maintaining advanced systems, leading to potential compliance risks. The lack of uniform global enforcement also creates uncertainty, making some companies hesitant to invest heavily in advanced solutions.

Market Opportunities:

Growing Adoption of Green Shipping and Renewable Offshore Projects:

The Offshore marine emission control systems market presents strong opportunities through the global shift toward green shipping practices. Rising investment in offshore wind and renewable energy projects increases the number of vessels requiring compliance with emission regulations. It creates demand for advanced systems that reduce greenhouse gases and particulate matter. Governments are offering incentives and subsidies to promote clean maritime technologies, making adoption financially attractive. Shipowners are also gaining reputational benefits by meeting sustainability targets, which strengthens long-term demand. The expansion of eco-friendly offshore infrastructure further boosts opportunities for integrated emission control solutions.

Expanding Retrofitting Market and Digital Integration for Compliance:

Retrofitting existing offshore fleets opens a large growth avenue, especially in regions with aging vessels. Operators seek cost-effective ways to extend fleet life while aligning with IMO standards. It accelerates demand for modular and compact emission control systems designed for retrofit applications. The growing role of digital monitoring and predictive maintenance technologies also creates opportunities for providers offering combined hardware and software solutions. Integrated compliance platforms help operators optimize fuel efficiency while maintaining emission limits. Strong growth in Asia-Pacific, driven by active shipbuilding and expanding offshore industries, highlights a lucrative opportunity for global and regional suppliers.

Market Segmentation Analysis:

By Type:

The Offshore marine emission control systems market by type is categorized into scrubbers, selective catalytic reduction systems, particulate filters, and others. Scrubbers hold the largest share due to their effectiveness in removing sulfur oxides and alignment with IMO sulfur limits. Selective catalytic reduction systems are expanding rapidly, driven by stricter nitrogen oxide emission standards in controlled zones. It benefits from growing preference for hybrid systems that combine multiple technologies for comprehensive compliance. Particulate filters are also gaining momentum as operators focus on reducing fine particle emissions to meet coastal air quality regulations.

- For instance, the Alfa Laval PureNOx LS water treatment system installed on a two-stroke MAN 5G70ME-C10.5-G engine cleans EGR bleed-off water down to 15 ppm oil content before overboard discharge .

By Vessel Type:

By vessel type, the market is segmented into offshore support vessels, cargo ships, tankers, and passenger vessels. Offshore support vessels dominate demand due to their extensive operations in oil, gas, and renewable projects. Cargo ships also contribute significantly as international trade requires vessels to comply with global emission standards. It is reinforced by the need to retrofit older fleets engaged in cross-border operations. Passenger vessels, including ferries and cruise ships, are adopting advanced systems to meet strict port and coastal air quality mandates.

- For instance, Maersk Tankers committed to install scrubber systems on four LR2 product tanker vessels to meet the IMO 2020 sulphur cap.

By Application:

By application, the market is divided into emission reduction, fuel efficiency optimization, and regulatory compliance. Emission reduction holds the largest share, supported by strict environmental standards. Fuel efficiency optimization is gaining traction as operators seek to balance cost savings with compliance. It strengthens demand for integrated solutions that improve efficiency while meeting emission norms. Regulatory compliance continues to be the backbone of system adoption across all offshore operations.

Segmentations:

By Type:

- Scrubbers

- Selective Catalytic Reduction (SCR) Systems

- Particulate Filters

- Others

By Vessel Type:

- Offshore Support Vessels

- Cargo Ships

- Tankers

- Passenger Vessels

By Application:

- Emission Reduction

- Fuel Efficiency Optimization

- Regulatory Compliance

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America held 32% market share in 2024 and is projected to maintain steady growth through 2032. The Offshore marine emission control systems market benefits from strict enforcement of IMO and EPA regulations across U.S. and Canadian waters. Operators are investing heavily in scrubbers, selective catalytic reduction systems, and hybrid technologies to meet environmental mandates. Strong presence of offshore oil and gas activities further drives system adoption across support vessels and rigs. It is reinforced by government-backed initiatives promoting LNG-fueled shipping and cleaner offshore operations. The availability of advanced retrofitting technologies and strong service networks also supports market expansion.

Europe:

Europe accounted for 29% market share in 2024, driven by early adoption of emission control technologies and strict EU directives. The region enforces some of the most stringent environmental standards, including Emission Control Areas (ECAs) in the North Sea and Baltic Sea. Shipowners prioritize compliance by integrating advanced scrubbers and catalytic converters into both existing and newbuild vessels. It creates strong demand across offshore oil, gas, and renewable support fleets. Investments in offshore wind energy projects further stimulate adoption of emission reduction solutions. The presence of leading marine technology providers in countries like Norway and Germany strengthens regional growth.

Asia-Pacific:

Asia-Pacific secured 27% market share in 2024 and is forecast to record the fastest growth during the assessment period. The Offshore marine emission control systems market benefits from the dominance of shipbuilding hubs in China, South Korea, and Japan. Governments are tightening emission norms in coastal areas, driving rapid adoption of clean marine technologies. Expanding offshore exploration, energy production, and port infrastructure projects add further momentum. It is supported by rising LNG trade and the deployment of LNG-fueled vessels across regional shipping routes. Growing demand for retrofitting solutions in aging fleets also enhances adoption prospects across emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alfa Laval

- Yara

- Wartsila

- Shanghai Bluesoul

- DowDuPont

- Niigata Power System

- Clean Marine

- DEC Maritime

- Johnson Matthey

- Mitsubishi

- Kwangsung

Competitive Analysis:

The Offshore marine emission control systems market is highly competitive with global and regional players focusing on innovation and compliance-driven solutions. Key companies include Alfa Laval, Yara, Wartsila, Shanghai Bluesoul, DowDuPont, Niigata Power System, and Clean Marine. These companies prioritize advanced technologies such as hybrid scrubbers, selective catalytic reduction systems, and integrated monitoring platforms to meet stringent IMO regulations. It is characterized by continuous investments in research, partnerships with shipbuilders, and expansion of retrofitting services. Market leaders leverage strong distribution networks and aftersales support to strengthen customer loyalty. Rising demand for cost-efficient, modular, and compact systems pushes companies to expand their portfolios. Competitive intensity remains strong as emerging regional firms introduce specialized solutions tailored to local emission norms and offshore requirements.

Report Coverage:

The research report offers an in-depth analysis based on Type, Vessel Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Offshore marine emission control systems market will expand with continued enforcement of global emission regulations.

- Adoption of hybrid solutions combining scrubbers, catalytic converters, and filters will accelerate to ensure compliance.

- LNG-fueled and alternative fuel vessels will create steady demand for complementary emission control systems.

- Digital monitoring platforms with real-time emission tracking will become standard across offshore fleets.

- Retrofitting older vessels will emerge as a primary growth driver, especially in regulated regions.

- Offshore oil, gas, and renewable energy projects will sustain strong demand for advanced systems.

- Partnerships between technology providers and digital solution companies will deliver integrated compliance solutions.

- Investments in port infrastructure for LNG and green shipping fuels will boost system adoption.

- Asia-Pacific will lead growth, supported by shipbuilding dominance and stricter regional emission mandates.

- Continuous innovation in compact, modular, and cost-efficient systems will enhance adoption across diverse vessel types.