Market Overview:

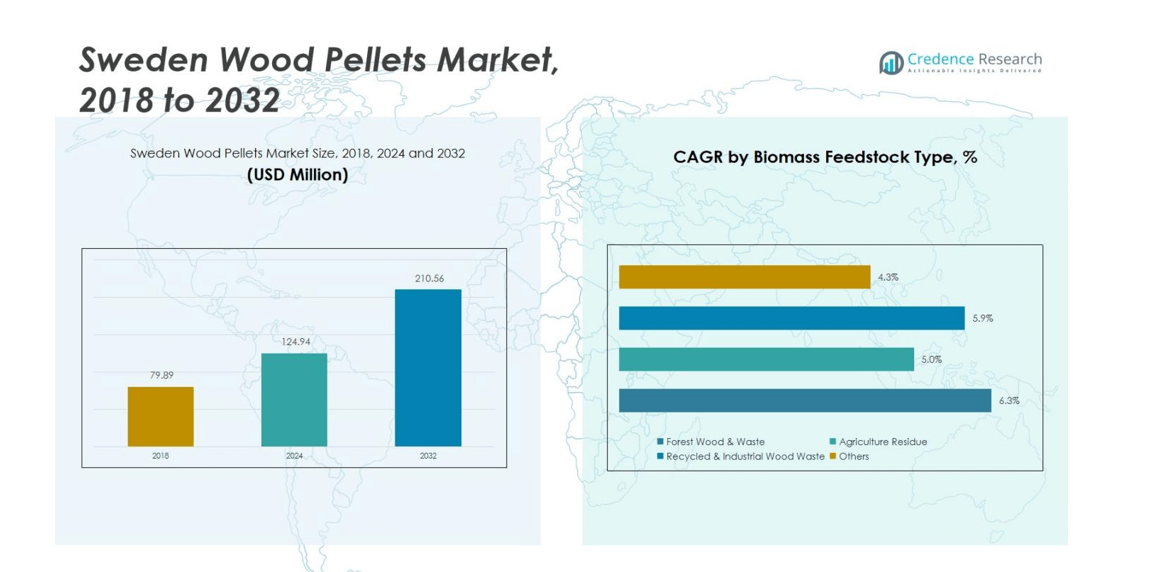

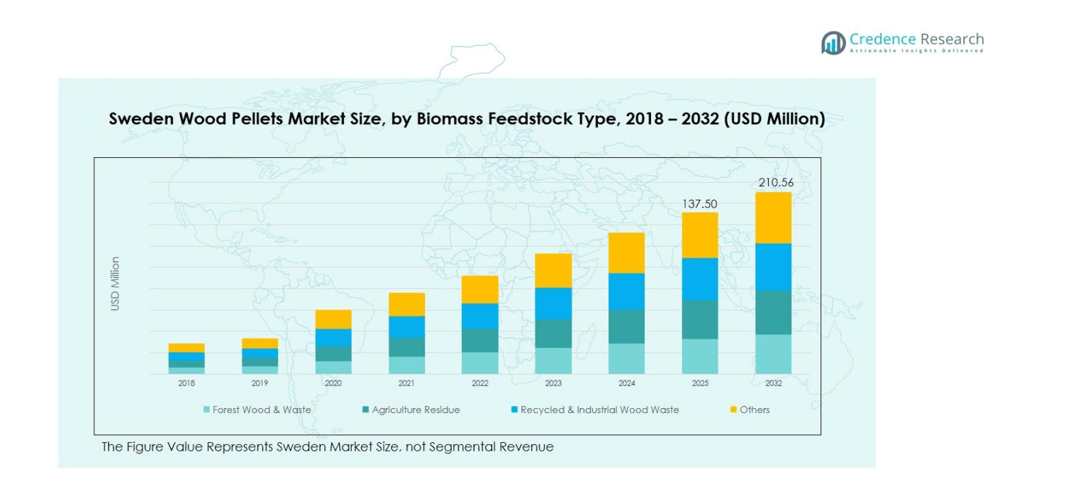

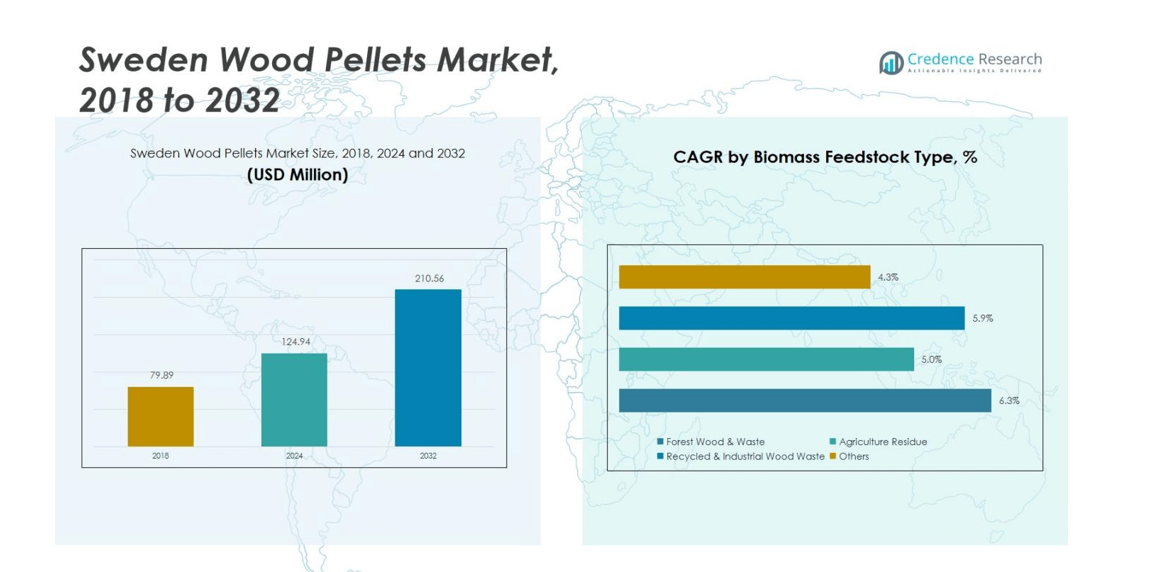

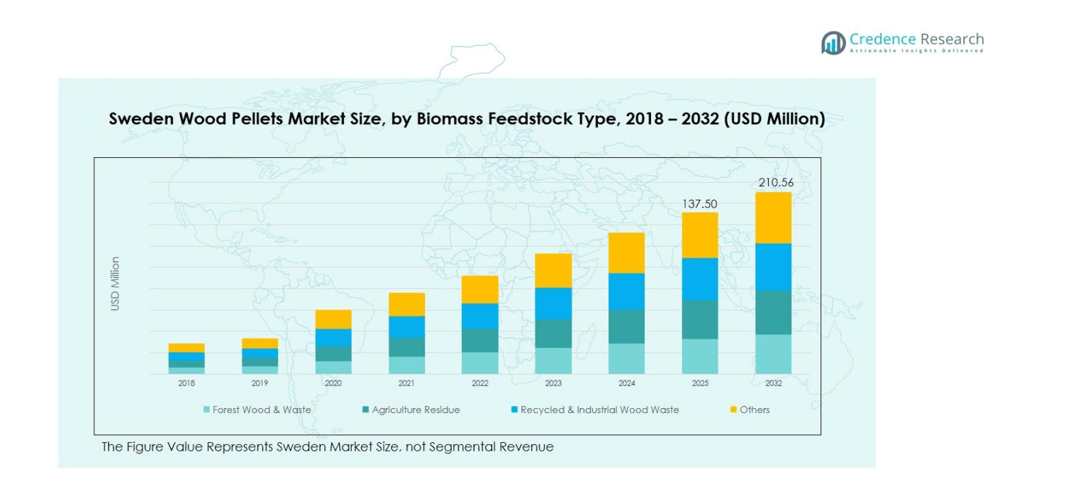

Sweden Wood Pellets Market size was valued at USD 79.89 million in 2018, grew to USD 124.94 million in 2024, and is anticipated to reach USD 210.56 million by 2032, at a CAGR of 6.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sweden Wood Pellets Market Size 2024 |

USD 124.94 million |

| Sweden Wood Pellets Market, CAGR |

6.28% |

| Sweden Wood Pellets Market Size 2032 |

USD 210.56 million |

The Sweden Wood Pellets Market is highly competitive, led by key players including Scandinavian Enviro Systems, Swedenergy AB, E.On Sverige AB, Sveaskog, Vallvik Wood Pellets, Svenska Cellulosa AB (SCA), and Setra Group. These companies strengthen their market positions through capacity expansion, product diversification, and technological advancements in pellet production, while ensuring sustainable forest management practices. Industrial, residential, and commercial applications drive consistent demand, supported by government incentives and renewable energy policies. Northern Sweden emerges as the leading region, holding a 35% market share, attributed to its extensive forest resources, established production facilities, and advanced logistics networks. The combination of strategic initiatives by top players and the dominant role of Northern Sweden reinforces Sweden’s position as a major contributor to the global wood pellets market.

Market Insights

- The Sweden Wood Pellets Market was valued at USD 124.94 Million in 2024 and is projected to reach USD 210.56 Million by 2032, growing at a CAGR of 6.28%.

- Growth is driven by strong government support for renewable energy, rising demand for sustainable heating solutions, and abundant availability of forest wood and industrial biomass.

- Key trends include increasing adoption of industrial co-firing in power plants and rising export opportunities, particularly to Europe and Asia, supported by sustainability certifications and efficient logistics.

- The market is competitive, led by Scandinavian Enviro Systems, Swedenergy AB, E.On Sverige AB, Sveaskog, Vallvik Wood Pellets, Svenska Cellulosa AB (SCA), and Setra Group, focusing on technological advancements, product diversification, and strategic collaborations.

- Northern Sweden dominates with a 35% market share due to extensive forest resources and established production facilities, followed by Central Sweden (30%), Southern Sweden (25%), and Eastern Sweden (10%). Forest Wood & Waste leads the feedstock segment with 55% share, while Industrial Pellet for CHP/District Heating leads applications at 50%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Biomass Feedstock Type:

The Forest Wood & Waste sub-segment dominates the Sweden Wood Pellets Market, accounting for 55% of the total biomass feedstock share in 2024. Its prominence is driven by the abundant availability of sustainable forest residues and low-cost raw materials. This segment benefits from strong government support for renewable energy and efficient pellet production technologies. Agriculture Residue and Recycled & Industrial Wood Waste follow, contributing 20% and 15% respectively, while the Others category holds the remaining 10%, primarily from mixed biomass sources. Rising adoption of eco-friendly energy solutions continues to fuel growth across all feedstock types.

- For instance, Swedish company Meva Energy completed a commercial plant producing 4.5 MW of producer gas from wood waste, replacing fossil gas in industrial use, showcasing efficient utilization of forest wood residues.

By Application:

Industrial Pellet for CHP/District Heating leads the application segment with a 50% share of the Sweden Wood Pellets Market in 2024. Growth is supported by increasing district heating networks and policies promoting renewable energy in industrial and municipal sectors. Industrial Pellet for Co-Firing captures a 25% share, driven by co-firing mandates in power generation, while Residential & Commercial Heating holds a 20% share due to rising demand for sustainable home heating solutions. The Others category accounts for 5%, including niche uses such as biomass boilers in commercial establishments. Government incentives and environmental regulations continue to drive adoption across applications.

- For instance, Valmet is delivering a 50 MW pellet-fired heating plant to Göteborg Energi AB, designed to increase renewable district heating capacity and optimize heat production in the Gothenburg region, slated for start-up in late 2026.

Key Growth Drivers

Strong Government Support for Renewable Energy

Sweden’s Wood Pellets Market benefits from robust government policies promoting renewable energy and carbon neutrality. Subsidies, tax incentives, and favorable regulatory frameworks encourage the adoption of wood pellets across industrial, residential, and district heating sectors. Initiatives such as energy efficiency programs and sustainable forest management drive consistent demand, making wood pellets a preferred renewable energy source. Government backing ensures stable market conditions and strengthens Sweden’s position as a leader in sustainable biomass energy.

- For instance, Sweden’s Wood Pellets Market benefits from robust government policies promoting renewable energy and carbon neutrality. Subsidies, tax incentives, and favorable regulatory frameworks encourage the adoption of wood pellets across industrial, residential, and district heating sectors.

Rising Demand for Sustainable Heating Solutions

Increasing environmental awareness and the push to reduce fossil fuel consumption have amplified demand for residential and industrial heating using wood pellets. District heating systems and industrial co-firing applications are witnessing accelerated adoption, driven by energy efficiency and lower greenhouse gas emissions. Consumers and businesses increasingly prioritize eco-friendly alternatives, positioning wood pellets as a cost-effective and sustainable energy solution. This growing preference fuels market expansion while promoting innovation in pellet quality, storage solutions, and supply chain efficiency.

- For instance, the RWE Amer 9 power station in the Netherlands successfully co-fired 2,300 tons of torrefied wood pellets at up to 25% blend without operational issues, proving wood pellet co-firing’s viability at commercial scale.

Abundant Biomass Availability

Sweden’s vast forest resources provide a consistent and cost-effective supply of raw materials for wood pellet production. Forest residues, industrial wood waste, and agricultural by-products ensure that feedstock availability remains stable, supporting both domestic consumption and exports. This abundance reduces dependency on imports, stabilizes prices, and allows manufacturers to scale production efficiently. Ample biomass availability underpins market growth, enabling Sweden to meet increasing energy demands while promoting sustainable forest management practices.

Key Trends and Opportunities

Industrial Co-Firing Adoption

Industrial co-firing of wood pellets with coal in power plants is gaining traction in Sweden. Companies increasingly integrate biomass into energy generation to meet renewable energy targets and reduce carbon footprints. This trend is supported by regulatory mandates and financial incentives for renewable energy integration. Co-firing enhances operational efficiency while reducing dependency on fossil fuels, creating a lucrative market segment for industrial pellets. The trend opens opportunities for pellet producers to supply large-scale power plants.

- For instance, BK Tech Pellets AB, a major Swedish wood pellet producer, has consolidated its pellet production facilities to better meet the growing demand for wood pellets, supporting fossil-free steam supply for industrial processes both domestically and internationally.

Expansion in Export Markets

Sweden’s high-quality wood pellets are increasingly sought after in international markets, particularly across Europe and Asia. Rising global demand for renewable energy sources presents export opportunities for manufacturers, helping them diversify revenue streams. Strategic partnerships, improved logistics, and sustainability certifications enhance market credibility abroad. Export growth allows Swedish producers to leverage excess production capacity, optimize economies of scale, and expand their market footprint. This positions Sweden as a key player in the global wood pellets supply chain.

- For instance, the Kährs Group, a leading Swedish wood flooring manufacturer, completed Sustainable Biomass Program (SBP) certification for its wood pellet production, ensuring the pellets come from well-managed and sustainable forestry sources.

Key Challenges

Feedstock Price Volatility

Fluctuating prices of forest wood, agricultural residues, and industrial wood waste can impact production costs and market stability. Seasonal availability, transportation costs, and competition for raw materials contribute to price volatility. Producers face challenges in maintaining consistent pellet quality and competitive pricing amid these fluctuations. Effective feedstock management, long-term sourcing agreements, and technological improvements in production efficiency are essential strategies to mitigate the impact of price volatility on market growth.

Storage and Transportation Constraints

Wood pellets are sensitive to moisture and require careful handling, storage, and transportation. Inadequate storage facilities can lead to pellet degradation, reducing calorific value and marketability. Logistical challenges, including long-distance transportation and infrastructure limitations, increase operational costs and disrupt supply chains. Smaller distributors and end-users often face difficulties in maintaining optimal storage conditions, impacting reliability. Investment in advanced storage solutions, moisture-resistant packaging, and efficient logistics networks is critical to ensure consistent supply and support market expansion.

Regional Analysis

Northern Sweden

Northern Sweden holds a significant share of 35% in the country’s wood pellets market, driven by the region’s extensive forest resources and well-established pellet production facilities. The area benefits from sustainable forest management practices and advanced pelletizing technologies, ensuring a steady supply of high-quality biomass. Demand is primarily fueled by industrial applications, including district heating and co-firing, supported by government incentives for renewable energy. Northern Sweden’s cold climate also encourages residential adoption of wood pellets for heating, reinforcing market growth. Strategic investments in logistics and infrastructure further enhance accessibility and market penetration across the region.

Central Sweden

Central Sweden accounts for 30% of the wood pellets market, benefiting from a balanced combination of industrial, residential, and commercial consumption. The region’s moderate climate and dense urban centers drive consistent demand for residential heating applications. Industrial co-firing and district heating projects contribute substantially to the market share. Proximity to major transportation routes and pellet processing plants ensures efficient supply chains and reduced distribution costs. Continuous government support, including subsidies and carbon emission reduction policies, strengthens market adoption. Central Sweden’s strategic location and diversified demand base make it a key contributor to the overall growth of the country’s wood pellets market.

Southern Sweden

Southern Sweden contributes 25% to the national wood pellets market, supported by high population density and active industrial hubs. Residential and commercial heating applications dominate demand in this region, alongside industrial co-firing initiatives. The region’s access to agricultural residues supplements forest wood supply, enhancing feedstock diversity. Favorable government policies and incentives for renewable energy adoption, coupled with efficient logistics networks, support market expansion. Southern Sweden’s proximity to export ports also provides opportunities for pellet exports. Rising consumer awareness regarding sustainable heating solutions drives household adoption, further consolidating the region’s role as a significant contributor to the Sweden wood pellets market.

Eastern Sweden

Eastern Sweden represents 10% of the national wood pellets market, primarily driven by niche industrial applications and smaller-scale district heating systems. Limited forest coverage compared to the northern regions restricts biomass availability, but the presence of manufacturing facilities and access to transportation networks partially offsets this constraint. Residential and commercial heating adoption is gradually increasing due to rising environmental awareness and supportive regional energy policies. Local government incentives and initiatives to promote renewable energy sources foster steady market growth. Despite its smaller share, Eastern Sweden offers potential for expansion, particularly in industrial co-firing and localized residential heating projects.

Market Segmentations:

By Biomass Feedstock Type

- Forest Wood & Waste

- Agriculture Residue

- Recycled & Industrial Wood Waste

- Others

By Application:

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Residential & Commercial Heating

- Others

By Region

- Northern Sweden

- Central Sweden

- Southern Sweden

- Eastern Sweden

Competitive Landscape

The Sweden Wood Pellets Market is highly competitive, with key players including Scandinavian Enviro Systems, Swedenergy AB, E.On Sverige AB, Sveaskog, Vallvik Wood Pellets, Svenska Cellulosa AB (SCA), and Setra Group leading the industry. These companies focus on strategic initiatives such as capacity expansion, product diversification, and technological advancements in pellet production to strengthen their market positions. Investments in sustainable forest management and advanced pelletizing technologies enable them to maintain consistent product quality and meet growing domestic and export demand. Collaborations with industrial, commercial, and residential clients further enhance market reach. Competitive pricing, adherence to environmental regulations, and certification standards are crucial for differentiation. Additionally, companies actively explore export opportunities and innovative biomass solutions to capture emerging market segments, positioning Sweden as a major player in the global wood pellets industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- On July 23, 2025, Swedish wood products company Vida AB announced the acquisition of three sawmills in Central Sweden for €102 million. This strategic move aims to bolster its position in Europe’s forest-based bioeconomy and enhance its capacity to produce wood pellets, animal bedding, and construction wood.

- On September 17, 2025, Vida AB, a subsidiary of Canfor Corporation, completed the acquisition of AB Karl Hedin Sågverk for approximately €164 million.

- In October 2024, Scandbio, Sweden’s largest producer of solid refined wood fuels, was acquired by the German energy company LEAG Group. Scandbio specializes in producing 100% renewable energy in the form of wood pellets, utilizing by-products from sawmills and forests.

Report Coverage

The research report offers an in-depth analysis based on Biomass Feedstock Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing demand for renewable energy.

- Adoption of wood pellets in industrial co-firing applications will expand further.

- Residential and commercial heating demand will continue to rise due to environmental awareness.

- Government policies and incentives will support market expansion across all regions.

- Technological advancements in pellet production will improve efficiency and quality.

- Export opportunities will grow, strengthening Sweden’s position in the global wood pellets market.

- Increased utilization of agricultural residues and industrial wood waste will diversify feedstock sources.

- Investment in logistics and storage infrastructure will enhance supply chain efficiency.

- Strategic partnerships and collaborations will drive innovation and market penetration.

- Sustainability initiatives and carbon reduction goals will continue to fuel long-term market demand.