Market Overview

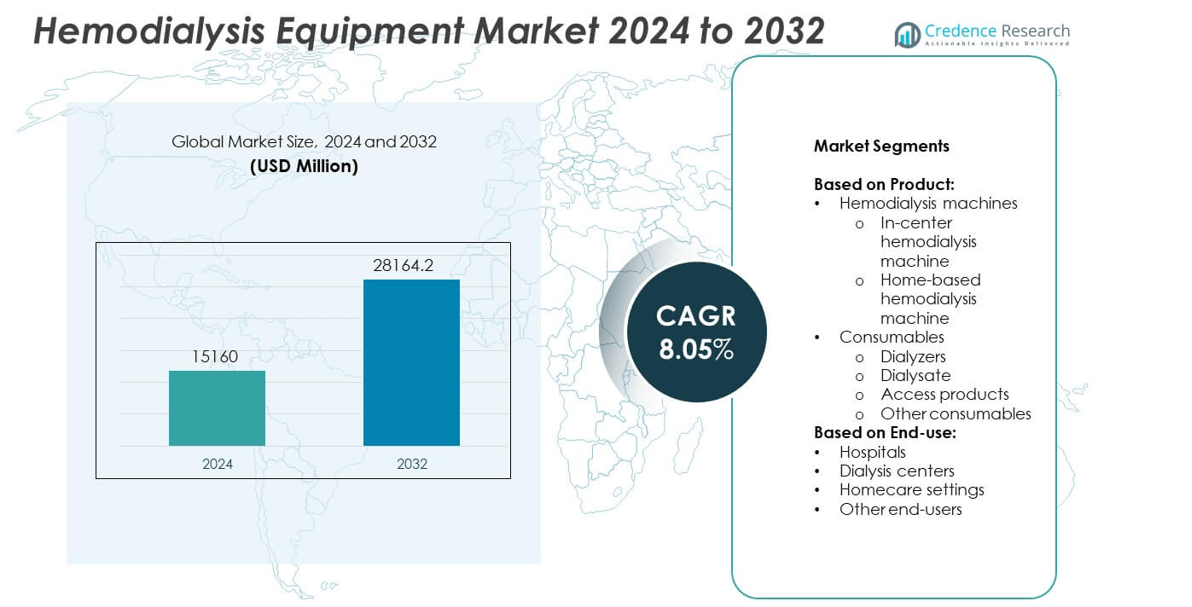

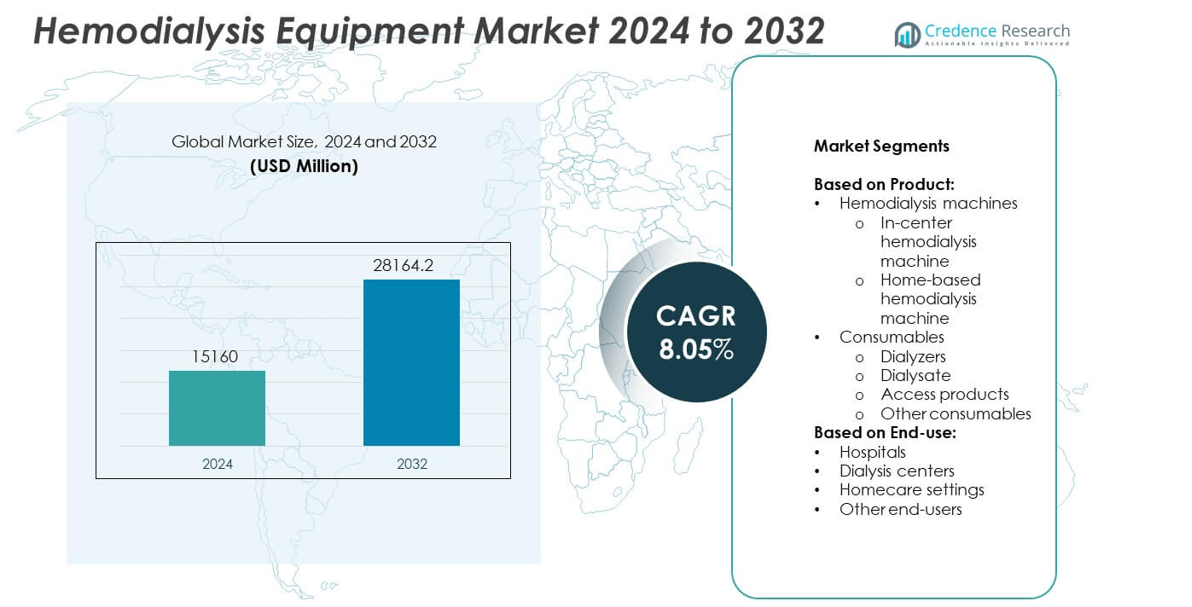

The Hemodialysis Equipment Market size was valued at USD 15,160 million in 2024 and is anticipated to reach USD 28,164.2 million by 2032, at a CAGR of 8.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemodialysis Equipment Market Size 2024 |

USD 15,160 million |

| Hemodialysis Equipment Market, CAGR |

8.05% |

| Hemodialysis Equipment Market Size 2032 |

USD 28,164.2 million |

The Hemodialysis Equipment market grows through rising chronic kidney disease cases, aging populations, and increasing diabetes prevalence. Demand strengthens as hospitals and dialysis centers expand treatment capacity to meet patient needs. Technological advances in smart machines, portable systems, and biocompatible consumables enhance safety, efficiency, and comfort. The market also benefits from supportive reimbursement policies and government healthcare investments. Growing adoption of home-based dialysis and integration of digital monitoring tools highlight key trends shaping future demand and patient-centric care models.

The Hemodialysis Equipment market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, driven by rising kidney disease prevalence and expanding healthcare infrastructure. North America and Europe lead adoption through advanced facilities and supportive policies, while Asia-Pacific experiences rapid growth with large patient populations and healthcare investments. Key players such as Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., B. Braun Melsungen AG, and Nipro Corporation shape competitiveness with innovation and global reach.

Market Insights

- The Hemodialysis Equipment market was valued at USD 15,160 million in 2024 and is projected to reach USD 28,164.2 million by 2032, growing at a CAGR of 8.05%.

- Rising prevalence of chronic kidney disease, aging population, and increasing diabetes cases drive demand for dialysis equipment globally.

- Technological innovation, including portable machines, biocompatible consumables, and integration of digital monitoring, shapes market trends and improves treatment outcomes.

- Competition remains intense, with global players focusing on product innovation, partnerships, and expansion into emerging regions to maintain leadership.

- High treatment costs, need for skilled professionals, and limited access in low-income countries restrain widespread adoption of advanced systems.

- North America and Europe lead in adoption due to strong infrastructure and supportive healthcare policies, while Asia-Pacific shows fastest growth with expanding healthcare investments.

- The market outlook remains positive as key manufacturers enhance patient-centric solutions and governments strengthen support for dialysis services worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Chronic Kidney Disease and Growing Patient Population

The Hemodialysis Equipment market benefits from the increasing incidence of chronic kidney disease worldwide. Aging populations and rising cases of hypertension and diabetes fuel demand for dialysis solutions. Healthcare systems continue to face mounting pressure to provide advanced treatment for end-stage renal disease. This growing patient base supports sustained adoption of dialysis machines, filters, and consumables. Hospitals and clinics expand their dialysis capacity to meet demand. It drives consistent sales of equipment across developed and developing economies. Strong prevalence rates ensure reliable market momentum.

- For instance, Fresenius Medical Care’s NxStage home hemodialysis system serves more than 14 000 U.S. patients as of late 2024.

Technological Advancements in Hemodialysis Systems and Treatment Solutions

The Hemodialysis Equipment market grows through innovation in machine design, treatment accuracy, and patient comfort. New systems integrate automated monitoring, digital interfaces, and precision fluid management. These advancements reduce complications and enhance treatment efficiency. Portable and home-based dialysis units expand access and convenience for patients. Integration of smart features improves clinical decision-making and reduces workload for healthcare professionals. It enhances long-term patient outcomes and fosters trust in advanced dialysis solutions. Continuous technological upgrades remain critical for industry competitiveness.

- For instance, Historically, before its acquisition by Baxter in 2013, Gambro’s dialysis products were reported to serve approximately 350,000 chronic kidney disease patients annually. The global dialysis patient population has since grown significantly, and Gambro’s technologies are now integrated into the product portfolios of other companies

Rising Government Healthcare Spending and Favorable Reimbursement Policies

The Hemodialysis Equipment market gains support from expanding government investment in healthcare infrastructure. Authorities allocate higher budgets to tackle chronic diseases and improve patient survival rates. Favorable reimbursement policies in many regions reduce the financial burden on patients. This strengthens acceptance of regular dialysis and creates wider access to equipment. Hospitals and clinics benefit from improved funding channels that ease procurement of modern systems. It encourages providers to replace outdated machines with advanced alternatives. Strong policy frameworks contribute to stable growth.

Expansion of Dialysis Centers and Increased Focus on Home-Based Care

The Hemodialysis Equipment market is supported by the rising establishment of dialysis centers across urban and rural areas. Healthcare providers extend outreach to underserved populations by expanding facility networks. Home-based dialysis adoption grows with demand for personalized and flexible treatment. Patients prefer solutions that reduce travel time and hospital dependency. This trend improves patient quality of life and boosts recurring demand for portable equipment. It aligns with the industry’s focus on patient-centric models of care. The combined growth of institutional and home settings accelerates market adoption.

Market Trends

Adoption of Portable and Home-Based Hemodialysis Solutions

The Hemodialysis Equipment market witnesses strong demand for compact and user-friendly devices. Patients prefer home-based systems that reduce hospital visits and provide greater flexibility. Companies design portable machines with simplified controls to support self-care. This shift aligns with healthcare strategies focused on patient convenience and independence. It encourages growth in recurring sales of consumables used in home sessions. Expanding training programs help patients and caregivers manage equipment effectively. The trend strengthens adoption in both developed and emerging economies.

- For instance, Fresenius Medical Care developed the “Apollo” AI database from six continents, compiling data on over 540 000 dialysis patients, more than 140 million treatments, and over 34 million lab assessments

Integration of Digital Technologies and Smart Monitoring Features

The Hemodialysis Equipment market advances with the integration of digital health technologies. Smart machines now feature sensors, automated alerts, and real-time data tracking. These tools support clinicians in monitoring patient conditions more precisely. Remote connectivity allows providers to track outcomes and adjust treatments effectively. It ensures higher treatment accuracy and reduces the risk of complications. The integration of AI-based decision support further optimizes care delivery. Healthcare facilities adopt such innovations to improve efficiency and safety.

- For instance, Outset Medical’s Tablo system sends over 70 distinct treatment data fields in real time to connected EMRs, including event-based alerts and remote status tracking during treatments.

Rising Focus on Biocompatible and Advanced Dialyzer Materials

The Hemodialysis Equipment market evolves with innovations in dialyzer membranes and materials. Manufacturers develop biocompatible filters that minimize side effects and improve tolerance. Advanced materials enhance toxin removal and extend product lifespan. Patients benefit from improved comfort and reduced immune responses. It drives preference for premium solutions that enhance treatment quality. Regulatory bodies support the use of safer components, strengthening industry standards. This trend builds long-term trust in advanced dialysis consumables.

Growing Partnerships and Strategic Collaborations Among Industry Players

The Hemodialysis Equipment market expands through active collaborations between manufacturers, hospitals, and research institutions. Companies form alliances to accelerate innovation and increase distribution networks. Partnerships focus on developing new technologies, improving affordability, and expanding global reach. It helps players address rising demand in diverse healthcare settings. Co-development initiatives also promote localized production to reduce supply gaps. These collaborations enhance competitive strength and widen product accessibility. The trend supports sustainable industry growth and technological advancement.

Market Challenges Analysis

High Treatment Costs and Limited Accessibility Across Regions

The Hemodialysis Equipment market faces challenges due to high treatment expenses and limited access in developing regions. Advanced dialysis machines, consumables, and maintenance costs create financial barriers for patients. In many low- and middle-income countries, healthcare infrastructure remains underdeveloped and cannot support widespread availability. Unequal reimbursement policies further restrict adoption among underprivileged populations. It limits consistent patient access to life-saving dialysis procedures. Economic disparities across regions hinder global market penetration. Addressing affordability remains a key priority for industry stakeholders.

Technical Complications and Dependence on Skilled Workforce

The Hemodialysis Equipment market also encounters obstacles from technical issues and operational complexity. Dialysis machines require regular calibration, skilled handling, and strict maintenance to ensure safe operation. A shortage of trained healthcare professionals restricts the use of advanced systems in several areas. Patients face risks from machine-related complications, infections, and treatment errors. It places significant pressure on providers to maintain high clinical standards. Dependence on specialized staff slows adoption in regions with workforce shortages. These barriers affect efficiency and consistent delivery of dialysis care worldwide.

Market Opportunities

Expansion of Home Dialysis and Patient-Centric Care Models

The Hemodialysis Equipment market holds strong opportunity in the growing shift toward home dialysis. Patients increasingly seek solutions that provide flexibility and reduce hospital dependency. Companies design compact machines with intuitive controls to support self-use safely. Healthcare systems encourage adoption by offering training programs for patients and caregivers. It supports a care model that emphasizes independence and long-term treatment adherence. Rising preference for personalized treatment creates demand for portable and user-friendly systems. This trend positions home-based care as a major growth driver.

Emerging Markets and Adoption of Advanced Technologies

The Hemodialysis Equipment market benefits from rising healthcare investments in Asia-Pacific, Latin America, and the Middle East. Expanding hospital networks and government support improve access to advanced dialysis equipment. Growing awareness of chronic kidney disease detection further accelerates adoption. It creates opportunities for manufacturers to expand their reach with cost-effective and innovative solutions. Integration of AI, remote monitoring, and biocompatible materials strengthens treatment outcomes and builds trust. Partnerships with local providers open pathways for regional expansion. These opportunities support sustainable market growth and broader patient access.

Market Segmentation Analysis:

By Product:

Machines and consumables. Hemodialysis machines remain a core revenue generator with strong demand in both in-center and home-based treatments. In-center machines dominate due to the high number of patients relying on hospital and clinic-based dialysis. Home-based machines gain traction with rising preference for convenience and independence, supported by technological advances that improve safety and ease of use. It creates consistent opportunities for manufacturers focusing on compact and portable designs. Growth in this segment reflects patient needs for reliability and accessibility. Consumables represent another significant share within the Hemodialysis Equipment market. Dialyzers hold a leading position as they are critical for toxin removal and require frequent replacement. Dialysate products maintain steady demand, ensuring accurate filtration and treatment performance. Access products, such as catheters and fistulas, contribute to continuous market demand due to their essential role in every treatment session. Other consumables, including bloodlines and tubing, strengthen recurring revenue streams for suppliers. It drives a cycle of repeat purchases that sustains long-term market expansion. Consumables remain integral in ensuring consistent and safe dialysis delivery.

- For instance, Baxter’s Polyflux series has delivered over 300 million dialyzers worldwide since 1988.

By End-Use:

Hospitals capture a large share of the Hemodialysis Equipment market. Their dominance stems from strong infrastructure, skilled staff, and ability to manage high patient volumes. Dialysis centers also show robust adoption as they specialize in providing regular treatment sessions at scale. Homecare settings witness fast growth, driven by rising adoption of portable machines and supportive patient training programs. It positions homecare as an emerging segment with increasing acceptance worldwide. Other end-users, such as research institutions and community clinics, contribute moderately but add diversity to the market landscape. Together, these segments reflect a balance between institutional reliance and expanding patient-centric care models.

- For instance, Tablo training programs enable home dialysis adoption in about 2 weeks, versus 4–6 weeks with other devices

Segments:

Based on Product:

- Hemodialysis machines

- In-center hemodialysis machine

- Home-based hemodialysis machine

- Consumables

- Dialyzers

- Dialysate

- Access products

- Other consumables

Based on End-use:

- Hospitals

- Dialysis centers

- Homecare settings

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for a significant portion of the Hemodialysis Equipment market with a market share of 34%. The region benefits from advanced healthcare infrastructure, high healthcare spending, and strong adoption of innovative dialysis technologies. Widespread prevalence of chronic kidney disease and diabetes creates consistent demand for dialysis services. Hospitals and dialysis centers in the United States and Canada invest heavily in modern machines and consumables to improve patient outcomes. Favorable reimbursement policies and government support further strengthen access to advanced equipment. It also benefits from a large base of key industry players who introduce upgraded systems and consumables at regular intervals. The presence of specialized dialysis centers ensures consistent equipment utilization and supports recurring sales.

Europe

Europe holds a market share of 27% in the Hemodialysis Equipment market, supported by well-established healthcare systems and strict clinical standards. Countries such as Germany, France, Italy, and the United Kingdom lead adoption due to high prevalence of end-stage renal disease. Strong reimbursement frameworks encourage hospitals and clinics to expand their dialysis capabilities with advanced equipment. The region witnesses rising preference for home-based dialysis solutions as healthcare providers promote patient independence. It benefits from technological innovation and collaborative projects among research institutions and manufacturers. Expansion of dialysis networks across Central and Eastern Europe further strengthens equipment demand. Regulatory policies that focus on safety and patient welfare drive adoption of biocompatible consumables and advanced machines.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional segment with a market share of 25%. Rapid industrialization, urbanization, and rising chronic disease burden in China, India, and Japan fuel demand for dialysis services. The region invests heavily in healthcare infrastructure to address growing patient volumes. Hospitals and dialysis centers expand capacity, while home-based care adoption begins to accelerate in urban areas. It also benefits from rising government initiatives to improve access to affordable treatment solutions. Strong local manufacturing presence and partnerships with international players boost equipment availability and reduce costs. Increasing awareness of chronic kidney disease detection contributes to higher treatment adoption. Asia-Pacific remains a key growth hub due to its large patient population and rising healthcare investments.

Latin America

Latin America accounts for 8% of the Hemodialysis Equipment market, supported by rising healthcare investments and improving awareness of chronic kidney disease. Countries such as Brazil and Mexico lead the regional market due to expanding dialysis networks and government-backed healthcare programs. Limited reimbursement frameworks and uneven distribution of facilities restrict adoption in rural areas. It creates opportunities for private providers to expand dialysis services and equipment availability. Patients in urban centers gain better access to advanced machines and consumables, driving steady adoption. Partnerships with international players improve the introduction of new technologies across key markets. Despite infrastructure challenges, the region demonstrates stable growth potential supported by expanding healthcare coverage.

Middle East and Africa

The Middle East and Africa together contribute 6% of the Hemodialysis Equipment market. The region faces a growing burden of chronic kidney disease due to lifestyle changes and limited early detection practices. Wealthier Gulf countries, including Saudi Arabia and the United Arab Emirates, invest heavily in modern dialysis infrastructure and advanced equipment. It results in high per capita adoption in these markets compared to the African subcontinent. Africa experiences slower growth due to weaker healthcare infrastructure and limited reimbursement support. However, international aid programs and government investment gradually improve access to dialysis equipment in several countries. Rising awareness campaigns and the development of regional dialysis centers provide growth opportunities for manufacturers. The region remains a developing market with scope for significant expansion in the long term.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Hemodialysis Equipment market features leading players such as Asahi Kasei Corporation, Baxter International Inc., B. Braun Melsungen AG, Diaverum Holding AB, DaVita Inc., Fresenius Medical Care AG & Co. KGaA, Nipro Corporation, Nikkiso Co., Ltd, Rockwell Medical Technologies Inc., and Toray Industries, Inc. These companies hold strong market positions by leveraging product innovation, global distribution networks, and advanced treatment solutions. They focus on integrating digital features, improving biocompatible consumables, and expanding home-based dialysis options to address evolving patient needs. Strong investment in research and development supports the launch of next-generation machines with higher efficiency and safety. Many players emphasize strategic partnerships with healthcare providers to expand service offerings and maintain consistent equipment demand. Geographic expansion into emerging markets further strengthens competitiveness, supported by tailored solutions for affordability and accessibility. Intense competition pushes firms to differentiate through product quality, patient outcomes, and cost efficiency. The market remains highly consolidated, with dominant players maintaining influence through innovation pipelines and established clinical trust. Smaller and regional players compete by offering cost-effective alternatives and localized services, creating a balanced competitive environment. Together, these dynamics shape a market driven by innovation, patient-centric solutions, and global expansion strategies.

Recent Developments

- In 2025, Asahi Kasei Corporation, The company spun off its medical and blood purification businesses, including hemodialysis operations, into the newly formed Asahi Kasei Medical Co., Ltd., refocusing it on medical devices.

- In 2024, Fresenius Medical Care, The company received FDA 510(k) clearance for its new 5008X Hemodialysis System, capable of Hemodiafiltration and High‑Volume HDF. This approval paves the way for its gradual rollout in the United States

- In 2023, Baxter International Inc. ,The company announced “Vantive” as the name for its proposed spin‑off entity consisting of its Renal Care and Acute Therapies businesses. The spin‑off was expected to launch by July 2024 or earlier.

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising cases of chronic kidney disease worldwide.

- Home-based dialysis adoption will grow with demand for patient convenience and flexibility.

- Technological advances will improve machine efficiency, safety, and treatment accuracy.

- Digital integration and remote monitoring will support better patient management.

- Emerging economies will drive growth through expanding healthcare infrastructure.

- Biocompatible consumables will gain preference due to improved safety and tolerance.

- Government initiatives and reimbursement support will enhance access to dialysis care.

- Strategic collaborations among manufacturers will accelerate innovation and distribution.

- Portable and compact machines will strengthen adoption in homecare settings.

- Increased awareness of kidney disease detection will boost long-term equipment demand.