Market Overview

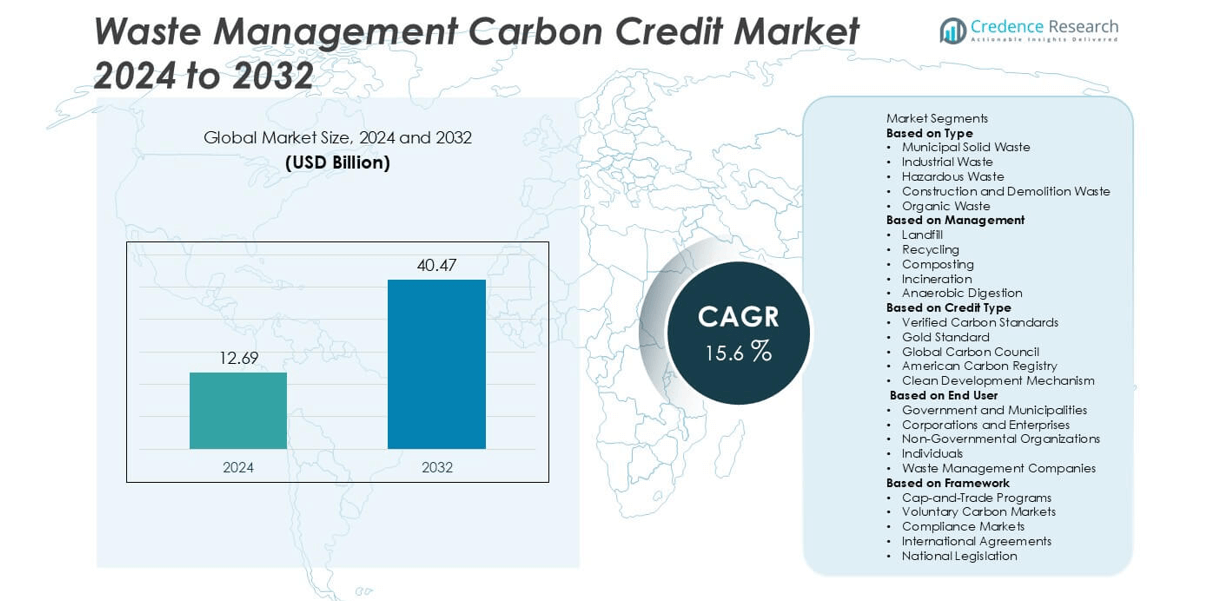

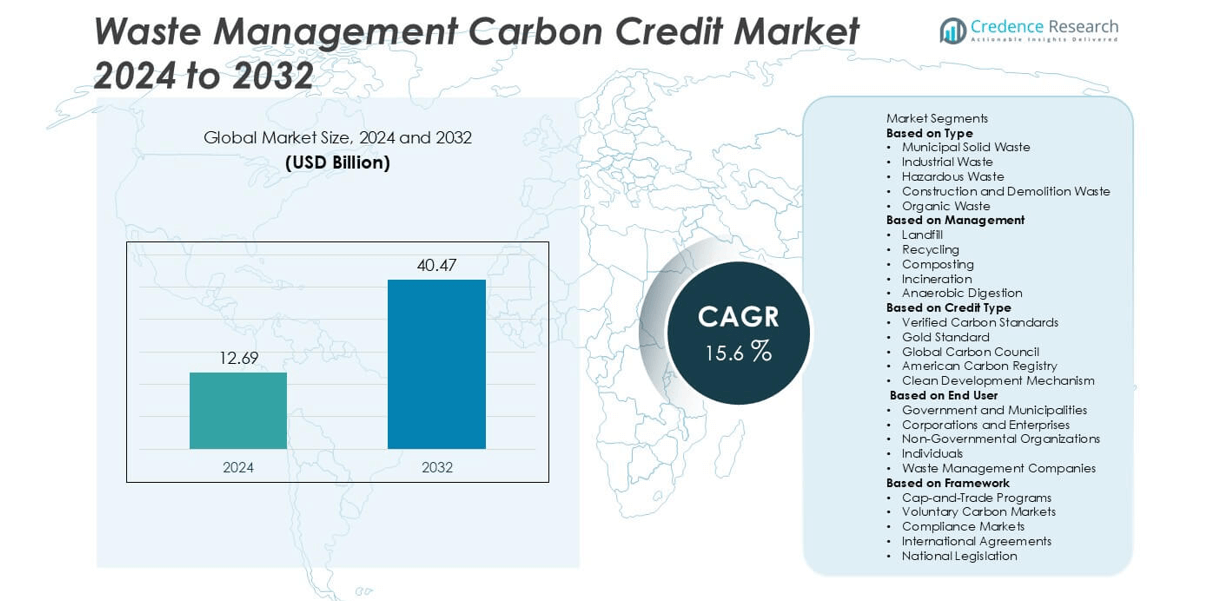

The global Waste Management Carbon Credit market was valued at USD 12.69 billion in 2024 and is projected to reach USD 40.47 billion by 2032, growing at a CAGR of 15.6% during the forecast period,

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waste Management Carbon Credit Market Size 2024 |

USD 12.69 billion |

| Waste Management Carbon Credit Market, CAGR |

15.6% |

| Waste Management Carbon Credit Market Size 2032 |

USD 40.47 billion |

The Waste Management Carbon Credit Market is driven by stringent government regulations, rising corporate commitments to net-zero goals, and advancements in waste-to-energy, recycling, and methane capture technologies. Strong policy support and growing ESG priorities are motivating organizations to adopt sustainable waste management practices that generate verifiable credits.

Geographically, the Waste Management Carbon Credit Market demonstrates strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing through distinct policy frameworks, infrastructure development, and sustainability initiatives. North America leads with advanced recycling programs and widespread adoption of landfill gas capture, while Europe emphasizes strict climate policies and circular economy practices. Asia-Pacific shows rapid expansion due to rising waste volumes and increasing investments in waste-to-energy projects, supported by government commitments to emission reduction. Latin America and the Middle East & Africa are gradually advancing through pilot projects and international collaborations. Key players shaping the market landscape include Veolia Environnement, Covanta Holding Corporation, Republic Services, and SUEZ, all of which leverage technological innovation, diversified waste management solutions, and strong sustainability strategies. Their focus on compliance with environmental regulations and expansion into voluntary carbon credit projects positions them competitively in global markets.

Market Insights

- The Waste Management Carbon Credit Market was valued at USD 12.69 billion in 2024 and is projected to reach USD 40.47 billion by 2032, growing at a CAGR of 15.6% during the forecast period.

- Government regulations, carbon pricing mechanisms, and corporate net-zero commitments are the primary drivers encouraging adoption of carbon credit projects across waste-to-energy, recycling, and landfill gas capture sectors.

- Key market trends include the growing role of digital platforms and blockchain in credit verification, rising demand in voluntary markets, and increased adoption of circular economy models to maximize resource recovery.

- The competitive landscape is shaped by major players such as Veolia Environnement, Covanta Holding Corporation, Republic Services, and SUEZ, which compete through technological innovation, sustainability strategies, and strategic partnerships.

- High capital requirements, limited infrastructure in emerging economies, and complex regulatory frameworks remain critical restraints, often slowing large-scale project development and reducing participation by smaller operators.

- Regional dynamics show North America leading with advanced waste management infrastructure, Europe driving growth through strict climate policies, Asia-Pacific expanding rapidly due to urbanization and waste volumes, and Latin America and the Middle East & Africa advancing through pilot projects and international funding support.

- The market outlook remains positive, with increasing investments from green finance institutions, growing awareness of climate change, and stronger corporate participation reinforcing the role of waste management carbon credits in global emission reduction strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Government Regulations and Policy Support Driving Carbon Credit Adoption

Governments across the globe are enforcing stricter environmental regulations to limit greenhouse gas emissions. Policy frameworks such as carbon pricing mechanisms and emission trading schemes are strengthening the role of waste management in carbon offset programs. The Waste Management Carbon Credit Market benefits from mandatory compliance requirements that encourage organizations to invest in carbon reduction initiatives. Public sector incentives, including tax benefits and subsidies, are motivating industries to adopt sustainable waste treatment practices. Strong regulatory backing not only creates accountability but also provides structure for transparent credit allocation. It fosters a reliable pathway for businesses to achieve emission reduction targets.

- For instance, Veolia captures methane from landfills globally, converting it into renewable energy like electricity or biomethane. This process significantly reduces greenhouse gas emissions, as methane is a far more potent warming agent than CO2.

Growing Corporate Commitments to Sustainability and Net-Zero Goals

Corporations are integrating sustainability into their long-term growth strategies, creating significant demand for carbon credits. Many global companies have pledged to achieve net-zero emissions, and waste management projects are a practical channel to meet these commitments. The Waste Management Carbon Credit Market gains traction as businesses turn to carbon credits to offset hard-to-abate emissions. It supports corporate branding, investor relations, and customer trust by demonstrating measurable environmental impact. Rising environmental, social, and governance (ESG) standards are accelerating this trend. The market aligns with corporate responsibility goals while delivering measurable financial value through credit trading.

- For instance, Republic Services operates an anaerobic digestion facility in California, not Arizona, that recycles food and organic waste into renewable energy. A 2023 report stated that by diverting this material from landfills, the company created a climate benefit equivalent to removing the emissions of 16,000 passenger vehicles.

Technological Advancements in Waste-to-Energy and Recycling Solutions

Innovation in waste-to-energy systems, recycling technologies, and methane capture solutions is expanding the efficiency of carbon credit generation. Advanced infrastructure ensures higher recovery rates and lower emissions, strengthening the financial viability of projects. The Waste Management Carbon Credit Market experiences growth as technology lowers operating costs and increases transparency in credit verification. It promotes scalable solutions that can be adopted in both developed and emerging economies. Digital tools for tracking and verifying emissions further enhance market credibility. Cutting-edge solutions encourage investors to support waste management projects with strong returns and sustainability benefits.

Rising Global Awareness of Climate Change and Circular Economy Models

The growing urgency to address climate change is fostering demand for sustainable waste management practices. Communities, governments, and industries are recognizing the value of integrating circular economy principles to reduce waste and generate renewable resources. The Waste Management Carbon Credit Market expands as awareness campaigns, educational programs, and climate action initiatives highlight the benefits of carbon offset projects. It positions waste as a resource, promoting energy recovery, material reuse, and lower landfill dependency. Greater awareness drives participation from diverse stakeholders, strengthening both voluntary and compliance markets. Public pressure continues to amplify the need for transparent and impactful carbon credit solutions.

Market Trends

Increasing Integration of Digital Platforms and Blockchain for Transparency

Technology adoption is shaping the carbon credit landscape with digital platforms and blockchain applications. Companies are using these tools to ensure accurate tracking, verification, and reporting of credits generated from waste management projects. The Waste Management Carbon Credit Market is benefiting from secure and transparent systems that reduce fraud and improve credibility. It enables stakeholders to monitor emission reductions in real time, enhancing investor and corporate confidence. Smart contracts are also being implemented to streamline transactions, reducing administrative costs. The adoption of digital ecosystems is expected to continue strengthening accountability and efficiency.

- For instance, SUEZ in France uses its CircularChain blockchain platform to improve the traceability of waste, like sewage sludge used for agricultural recovery. SUEZ does report broader CO2 savings, including millions of tonnes avoided in 2023 across all recovery efforts.

Expansion of Voluntary Carbon Credit Market Through Corporate Demand

Voluntary markets are gaining momentum as corporations seek flexible pathways to offset emissions beyond compliance requirements. Many organizations prefer voluntary participation to demonstrate leadership in sustainability and climate action. The Waste Management Carbon Credit Market is witnessing higher activity in voluntary trading, with businesses purchasing credits to align with net-zero targets. It creates opportunities for new waste-to-energy and recycling projects to secure funding through credit sales. Consumer expectations are also influencing corporate behavior, reinforcing the appeal of voluntary credits. This trend is expected to accelerate as global ESG standards evolve.

Growing Focus on Circular Economy and Resource Recovery Models

A shift toward circular economy practices is reshaping waste management strategies worldwide. Companies are prioritizing solutions that convert waste into valuable resources while reducing emissions. The Waste Management Carbon Credit Market reflects this trend through projects centered on material recovery, renewable energy generation, and landfill diversion. It emphasizes long-term sustainability by reducing dependency on linear waste disposal models. Governments and industries are aligning strategies to maximize resource efficiency and minimize environmental footprints. This approach is expected to drive continued innovation in waste processing and credit generation.

- For instance, in 2023, SUEZ in Asia alone produced 315 gigawatt-hours (315 million kWh) of sustainable energy, and the company has broader goals for renewable energy generation and electricity self-sufficiency. The company is transparent about its waste-to-energy activities.

Rising Investments from Private Equity and Green Financing Institutions

Financial institutions are increasingly directing capital toward carbon credit projects tied to waste management. Green bonds, sustainability-linked loans, and private equity funding are supporting large-scale initiatives across global markets. The Waste Management Carbon Credit Market is attracting investors seeking stable returns combined with measurable environmental impact. It benefits from the alignment of financial performance with climate goals, which appeals to both institutional and impact investors. Capital inflows are enabling advanced project development, including methane capture and waste-to-energy infrastructure. The trend points toward stronger integration between financial markets and sustainability-driven waste solutions.

Market Challenges Analysis

Complex Regulatory Frameworks and Verification Barriers

Diverse regulatory structures across regions present a significant challenge for consistent growth of the carbon credit industry. Different methodologies, crediting standards, and compliance rules often create confusion for project developers and investors. The Waste Management Carbon Credit Market faces obstacles when verifying and certifying credits, as processes can be lengthy, costly, and fragmented. It requires standardized frameworks to ensure fair pricing and reliable trading across global markets. Disparities between voluntary and compliance systems further complicate participation, especially for smaller waste management operators. Limited harmonization reduces efficiency and slows the expansion of large-scale credit projects.

High Costs, Limited Infrastructure, and Investor Uncertainty

Developing waste-to-energy plants, methane capture systems, or advanced recycling facilities demands substantial capital investment. Many regions lack adequate infrastructure to scale these projects effectively, restricting the potential to generate carbon credits. The Waste Management Carbon Credit Market struggles when financial risks outweigh the expected returns, discouraging new entrants and investors. It also faces uncertainty due to fluctuating carbon credit prices, which can undermine project profitability. Smaller firms encounter difficulty securing funding, while larger organizations hesitate without stable long-term policy support. These barriers limit the speed and scope of market development, despite rising global demand for carbon offsets.

Market Opportunities

Expansion of Circular Economy and Waste-to-Energy Initiatives

Growing emphasis on resource efficiency and sustainable waste practices is creating strong opportunities for carbon credit generation. Governments and industries are promoting waste-to-energy plants, landfill gas capture, and advanced recycling facilities to minimize emissions and recover valuable resources. The Waste Management Carbon Credit Market stands to benefit as these projects align directly with emission reduction and offset mechanisms. It enables stakeholders to monetize environmental benefits while contributing to broader climate goals. Corporate demand for credits that demonstrate tangible sustainability outcomes supports this momentum. This shift opens pathways for innovative solutions that turn waste streams into profitable and eco-friendly assets.

Rising Participation of Emerging Economies and Green Finance Support

Emerging economies are expanding their role in global carbon markets by investing in modern waste management systems. These regions often face high waste volumes and limited infrastructure, creating scope for impactful projects with measurable emission reductions. The Waste Management Carbon Credit Market can capture this growth by attracting green finance, international partnerships, and technology transfer. It benefits from strong interest by financial institutions seeking to fund projects with both economic and environmental returns. Multilateral organizations and climate funds are also increasing support for waste-focused initiatives. This environment creates opportunities for inclusive growth while accelerating the transition to low-carbon economies.

Market Segmentation Analysis:

By Type

The market is segmented by type into recycling, landfill gas capture, waste-to-energy, and composting projects. Recycling initiatives contribute significantly, as they reduce emissions from raw material production and support resource efficiency. Waste-to-energy projects are gaining attention due to their dual role in generating renewable energy and offsetting methane emissions. The Waste Management Carbon Credit Market benefits from landfill gas capture, which prevents methane release and creates tradable credits. Composting is emerging as a viable segment, particularly in regions with strong agricultural activity and organic waste volumes. It supports sustainable soil practices while contributing to emission reduction efforts. Each type offers distinct pathways for organizations to monetize sustainable waste solutions.

- For instance, Covanta’s facilities process approximately 21 million tons of waste annually, which generates about 10 million megawatt-hours of electricity. This amount of power is enough to supply renewable energy to approximately one million homes. The company also recycles hundreds of thousands of tons of metal each year.

By Management

Segmentation by management highlights municipal, industrial, and commercial waste streams as major categories. Municipal waste management dominates due to rapid urbanization and rising household waste volumes. Industrial waste contributes strongly, as large manufacturers seek credits to offset emissions from production processes. The Waste Management Carbon Credit Market leverages commercial waste management, with retail, hospitality, and service industries investing in carbon reduction initiatives. It demonstrates that both public and private sectors have active roles in developing projects. Growing policy pressure on local governments and corporations is strengthening demand across all management categories. Effective waste stream management directly translates into higher credit generation potential.

- For instance, SABIC sold 18,000 metric tons of products using recycled feedstock in 2023 and set a long-term goal to process one million tons annually by 2030.

By Credit Type

The market is also segmented by credit type into compliance credits and voluntary credits. Compliance credits remain essential for organizations required to meet regulatory emission targets. These credits ensure adherence to government-mandated frameworks and drive large-scale waste management projects. The Waste Management Carbon Credit Market benefits from the expansion of voluntary credits, supported by corporations aiming to meet net-zero commitments. It creates flexible opportunities for businesses seeking to enhance ESG performance and corporate reputation. Voluntary credits are increasingly attractive due to their adaptability and strong alignment with consumer expectations. The balance between compliance and voluntary credits is expected to shape market dynamics over the forecast period.

Segments:

Based on Type

- Municipal Solid Waste

- Industrial Waste

- Hazardous Waste

- Construction and Demolition Waste

- Organic Waste

Based on Management

- Landfill

- Recycling

- Composting

- Incineration

- Anaerobic Digestion

Based on Credit Type

- Verified Carbon Standards

- Gold Standard

- Global Carbon Council

- American Carbon Registry

- Clean Development Mechanism

Based on End User

- Government and Municipalities

- Corporations and Enterprises

- Non-Governmental Organizations

- Individuals

- Waste Management Companies

Based on Framework

- Cap-and-Trade Programs

- Voluntary Carbon Markets

- Compliance Markets

- International Agreements

- National Legislation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for the largest share of the Waste Management Carbon Credit Market, representing around 38% in 2024. The region benefits from mature waste management infrastructure, advanced recycling programs, and strong policy frameworks that support carbon trading. The United States leads with federal and state-level initiatives that encourage landfill gas capture, renewable energy from waste, and municipal recycling projects. Canada follows with its commitment to climate targets under the Paris Agreement, fostering demand for compliance and voluntary carbon credits. The market in North America is further strengthened by growing corporate participation, with companies prioritizing net-zero strategies and purchasing voluntary credits to offset hard-to-abate emissions. It benefits from well-established verification mechanisms, which create trust and transparency in credit generation. With increasing investment in circular economy initiatives, North America is positioned to sustain its leadership during the forecast period.

Europe

Europe captured approximately 29% of the market share in 2024, supported by ambitious climate policies and a strong emphasis on sustainability. The European Union Emissions Trading System (EU ETS) plays a central role in driving demand for compliance credits across waste management projects. Countries such as Germany, France, and the United Kingdom have prioritized landfill diversion, recycling, and waste-to-energy solutions, creating a robust base for credit generation. The Waste Management Carbon Credit Market in Europe thrives on policy alignment, as governments push for carbon neutrality by 2050. It benefits from technological leadership in advanced recycling methods and efficient energy recovery from waste. Corporate demand also remains strong, with businesses integrating voluntary credits into their ESG frameworks. Europe’s focus on reducing dependency on landfill disposal and transitioning toward circular economy models ensures steady market expansion in the coming years.

Asia-Pacific

Asia-Pacific held a market share of around 22% in 2024, with rapid growth potential driven by urbanization, population increase, and industrial expansion. Countries such as China, India, and Japan are witnessing rising waste volumes, creating opportunities for large-scale carbon credit projects. The Waste Management Carbon Credit Market in Asia-Pacific benefits from government initiatives promoting methane capture, composting, and waste-to-energy investments. It is supported by international funding and technology transfer programs that help emerging economies strengthen their waste management infrastructure. Corporate participation is increasing, with multinational and domestic firms investing in voluntary credits to showcase sustainability efforts. Regional disparities exist, with advanced markets like Japan and South Korea demonstrating higher compliance adoption, while Southeast Asian countries are focusing on voluntary projects. The region is expected to record the fastest growth rate over the forecast period, supported by climate commitments and financial incentives.

Latin America

Latin America accounted for about 7% of the market share in 2024, with potential for significant development in carbon credit projects. Countries such as Brazil, Mexico, and Chile are focusing on reducing emissions through waste-to-energy plants and methane capture initiatives. The Waste Management Carbon Credit Market in Latin America benefits from abundant organic waste streams that support composting and recycling projects. It is gradually attracting foreign investment and international climate funds, which strengthen infrastructure development. Local governments are also adopting regulatory frameworks to align with global climate goals, creating opportunities for compliance and voluntary markets. Despite challenges related to infrastructure gaps and financial limitations, Latin America shows strong potential to increase its contribution to global carbon credit supply.

Middle East and Africa

The Middle East and Africa together represented around 4% of the market share in 2024, with growth primarily driven by early-stage projects. The region is focusing on modernizing waste management practices to reduce landfill dependency and improve recycling. The Waste Management Carbon Credit Market here is supported by pilot projects in countries like the United Arab Emirates, Saudi Arabia, and South Africa, which are investing in sustainable urban development. It relies heavily on international collaboration and funding to scale projects, given infrastructure and financial constraints. Rising awareness of climate risks and government commitments to diversify economies beyond fossil fuels are fostering interest in carbon credit initiatives. With increasing focus on circular economy models, the region is expected to record steady growth, though it will remain a smaller contributor compared to other regions during the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Waste Management Carbon Credit Market features leading players such as Covanta Holding Corporation, Republic Services, Veolia Environnement, FCC Environment, Stericycle, Biffa, SUEZ, Tervita Corporation, Clean Harbors, and GFL Environmental Inc. These companies compete by leveraging advanced waste-to-energy facilities, recycling infrastructure, and landfill gas capture systems to generate verifiable carbon credits. They focus on integrating sustainability strategies with operational efficiency, which allows them to attract corporate clients seeking reliable emission reduction solutions. Strong investment in digital platforms, monitoring systems, and compliance frameworks enhances their credibility in both voluntary and regulatory markets. Strategic mergers, acquisitions, and partnerships are also common, enabling companies to expand geographic reach and diversify service offerings. Competition is intensifying as demand for voluntary credits grows, with firms positioning themselves as leaders in providing scalable and transparent carbon reduction projects. Innovation, financial strength, and strong adherence to environmental standards remain critical factors shaping the market position of these players

Recent Developments

- In July 2025, Republic Services announced it exceeded its 2025 emission reduction target a year early, achieving a 20% reduction in GHG emissions since 2017, driven by investments in circularity and decarbonization, further aligning with customer climate goals.

- In Mar-2023, Republic Services launched a landfill gas-to-energy project in California, generating carbon credits equivalent to 120,000 metric tons of CO₂ and supporting renewable energy certificates.

- In Jan-2023, Covanta Holding Corporation announced the expansion of its carbon offset program through enhanced energy-from-waste operations, capturing an additional 95,000 metric tons of CO₂-equivalent annually.

Report Coverage

The research report offers an in-depth analysis based on Type, Management, Credit Type, End User, Framework and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with stronger policy frameworks supporting emission reduction goals.

- Corporate net-zero commitments will continue to drive demand for voluntary carbon credits.

- Advancements in waste-to-energy and recycling technologies will increase credit generation efficiency.

- Digital platforms and blockchain adoption will enhance transparency and trust in credit verification.

- Green financing and sustainability-linked investments will accelerate large-scale project development.

- Emerging economies will gain importance as they scale modern waste management infrastructure.

- Circular economy practices will strengthen the role of resource recovery in credit markets.

- Competitive intensity will rise as leading players expand geographic reach and service portfolios.

- Public awareness of climate change will reinforce participation in both compliance and voluntary markets.

- Long-term growth will align with global climate targets, making waste management carbon credits a core sustainability tool.