Market Overview

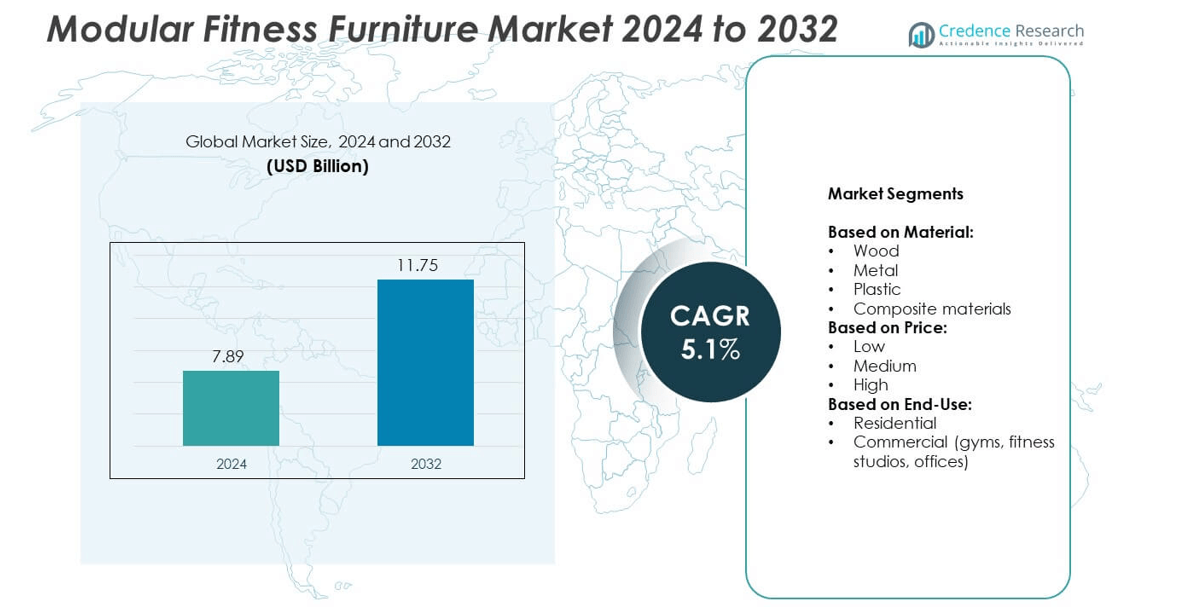

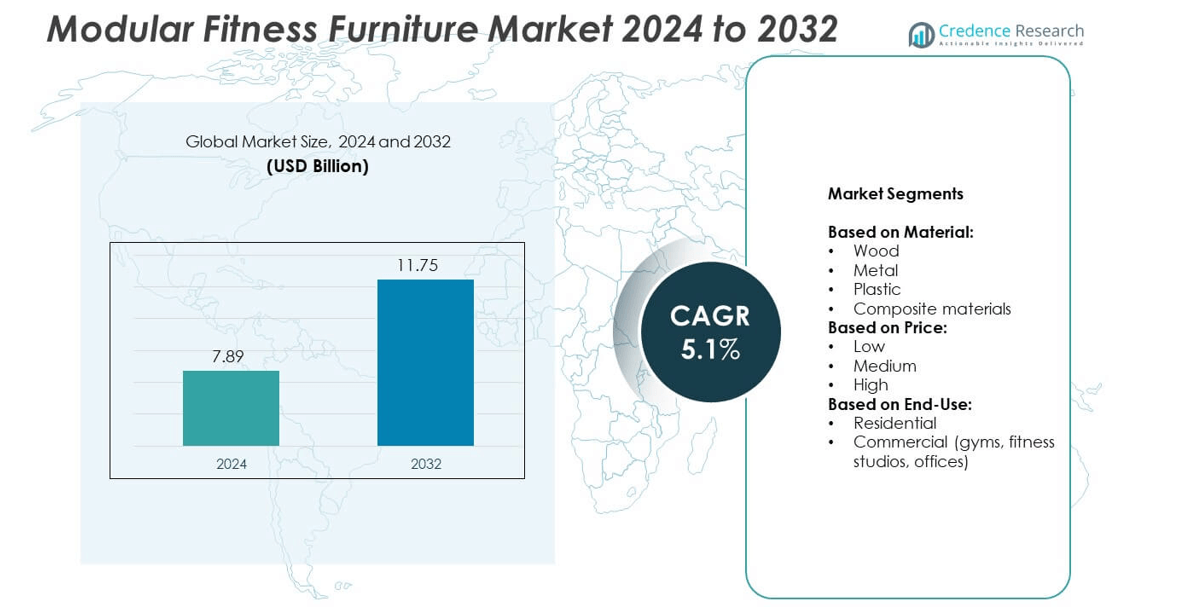

Modular Fitness Furniture Market size was valued at USD 7.89 billion in 2024 and is anticipated to reach USD 11.75 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Fitness Furniture Market Size 2024 |

USD 7.89 billion |

| Modular Fitness Furniture Market, CAGR |

5.1% |

| Modular Fitness Furniture Market Size 2032 |

USD 11.75 billion |

Rising health awareness and urbanization drive demand for space-efficient and versatile fitness solutions. Consumers increasingly adopt home-based workouts, creating growth opportunities for compact modular units. Smart-enabled furniture with app connectivity and performance tracking enhances user experience. Multi-functional designs allow both residential and commercial users to perform diverse exercises in limited spaces. Manufacturers focus on durable, ergonomic, and eco-friendly materials to meet evolving preferences. Technological integration and customization options further support adoption and strengthen market expansion.

North America and Europe lead the adoption of Modular Fitness Furniture due to urbanization, health-conscious consumers, and advanced fitness infrastructure. Asia-Pacific shows rapid growth driven by rising disposable income and home fitness trends. Manufacturers focus on expanding distribution and e-commerce channels to reach residential and commercial users. Key players such as Technogym, Life Fitness, Core Health & Fitness, and Peloton drive innovation with multi-functional, smart-enabled, and durable modular solutions, catering to diverse consumer needs across these regions.

Market Insights

- Modular Fitness Furniture market size was valued at USD 7.89 billion in 2024 and is anticipated to reach USD 11.75 billion by 2032, at a CAGR of 5.1%.

- Rising urbanization and increasing health awareness drive demand for space-efficient and versatile fitness solutions.

- Smart-enabled furniture with app connectivity, performance tracking, and multi-functional designs enhances user experience and adoption.

- Leading players including BodyCraft, Technogym, Life Fitness, Core Health & Fitness, Peloton, and Escape Fitness focus on innovation, customization, and durable materials to maintain competitiveness.

- High production costs, complex assembly requirements, and limited consumer awareness restrict faster adoption in residential and commercial segments.

- North America and Europe dominate due to advanced fitness infrastructure, while Asia-Pacific shows rapid growth from rising disposable income and home fitness trends.

- Manufacturers leverage e-commerce, strategic partnerships, and local distribution networks to expand market reach and target both residential and commercial customers effectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Health and Wellness Awareness Among Consumers Driving Demand for Modular Fitness Furniture

Growing awareness of health and fitness fuels demand for convenient workout solutions. Consumers prefer home gyms and flexible fitness spaces to maintain active lifestyles. It supports integration of multiple exercise modules within limited spaces. Manufacturers develop adaptable furniture that combines functionality with ergonomic design. Rising interest in personalized fitness experiences boosts adoption in residential settings. Gyms and wellness centers also upgrade facilities using modular solutions to attract and retain members. This trend enhances the overall market growth through continuous product innovation and consumer engagement.

- For instance, the Cybex Ion Adjustable Bench supports a maximum training weight of 500 lbs (227 kg).

Technological Advancements in Material and Design Enhancing Product Appeal

Innovation in materials and design improves durability and aesthetics of fitness furniture. Lightweight yet strong components allow easy rearrangement and storage. Modular Fitness Furniture incorporates multi-functional units that serve different workout routines. Companies invest in high-quality coatings, anti-slip surfaces, and space-efficient structures. It enables fitness centers to optimize space without compromising safety or performance. Product versatility and ease of assembly increase consumer confidence and purchase intent. Continuous improvement in design ensures long-term market competitiveness.

- For instance, Escape Fitness offers configurable modular rack systems, such as those in its Octagon range, that allow gyms to tailor spaces for different user groups. The system includes options like the RACK5, a functional training rack with dimensions of 190 cm (Height) x 60 cm (Width)x 70 cm (Depth), supporting a variety of functional training equipment.

Expansion of Commercial Fitness Centers and Corporate Wellness Programs Supporting Market Growth

Corporate wellness initiatives encourage installation of flexible fitness solutions in offices. Hotels, resorts, and commercial gyms adopt modular furniture to maximize utility of limited areas. It allows seamless reconfiguration of workout zones according to member demand. Facility managers prefer modular systems due to low maintenance and scalability. Growing fitness infrastructure in urban areas contributes to rising adoption. Increased corporate and hospitality sector investments enhance market penetration. This commercial demand sustains steady revenue growth for manufacturers.

Influence of Urbanization and Space-Constrained Living on Modular Furniture Adoption

Urban population growth creates demand for compact, efficient fitness solutions. Small apartments and shared spaces require furniture that combines multiple functions. Modular Fitness Furniture allows residents to maintain active routines without occupying excessive space. It supports flexible setups that adapt to changing living arrangements. Designers focus on ergonomic layouts to meet urban lifestyle needs. Consumer preference for multifunctional and space-saving furniture accelerates market expansion. This urban-driven trend ensures sustained product relevance and adoption.

Market Trends

Rising Integration of Smart Technology and Connected Fitness Solutions Shaping Modular Fitness Furniture Market

The integration of smart technology enhances user experience and performance tracking. Connected devices allow users to monitor workouts, set goals, and adjust resistance levels. Modular Fitness Furniture incorporates sensors, digital displays, and app connectivity for seamless interaction. It enables personalized fitness routines based on real-time data. Manufacturers focus on combining technology with ergonomic design to attract tech-savvy consumers. Gyms and home users benefit from efficient space utilization while leveraging digital features. This trend strengthens the appeal of modern, intelligent fitness solutions.

- For instance, Core Health & Fitness offers a range of durable, commercial-grade benches, such as those in its Star Trac and Nautilus lines. These benches are constructed from heavy-gauge steel to ensure stability, with some models weighing between 52 kg and 122 kg to withstand high-traffic environments.

Shift Toward Compact, Multi-Functional Designs to Meet Space Constraints

Urban living drives demand for compact and versatile fitness solutions. Modular furniture combines multiple exercise functions in a single unit. It allows users to perform strength, cardio, and flexibility routines within limited spaces. Manufacturers focus on lightweight, foldable, and easy-to-store designs for convenience. Consumers increasingly prefer products that adapt to evolving fitness needs. Multi-functional designs reduce clutter while maintaining effectiveness. This trend encourages broader adoption in both residential and commercial setups.

- For instance, Peloton offers a range of accessories for strength training, including dumbbells weighing up to 30 lbs and resistance bands.

Growing Emphasis on Sustainability and Eco-Friendly Materials in Modular Fitness Furniture Market

Eco-conscious consumers influence demand for sustainable products. Manufacturers use recycled, durable, and non-toxic materials for furniture construction. It reduces environmental impact while maintaining product performance and safety. Brands highlight sustainability to differentiate themselves in competitive markets. Energy-efficient production techniques and recyclable components gain attention. Users appreciate products that combine functionality with environmental responsibility. This trend supports long-term market positioning and brand loyalty.

Rising Popularity of Home-Based Fitness Solutions Driving Modular Furniture Innovation

Home workouts gain momentum due to flexible lifestyles and remote work trends. Consumers seek convenient and adaptable furniture for personal exercise routines. Modular Fitness Furniture allows easy rearrangement and customization for various exercises. It provides cost-effective alternatives to gym memberships while supporting daily fitness goals. Designers focus on aesthetic appeal alongside functionality to fit home interiors. Growing demand encourages manufacturers to expand product portfolios and innovation. This trend reinforces the relevance of modular solutions in modern fitness culture.

Market Challenges Analysis

High Production Costs and Material Limitations Restricting Modular Fitness Furniture Market Expansion

Manufacturers face challenges due to the high cost of premium materials and advanced components. Durable metals, high-grade plastics, and smart sensors increase production expenses. Modular Fitness Furniture requires precision engineering to ensure safety and functionality. It limits the ability of smaller players to compete with established brands. Consumers may hesitate to invest in expensive units despite the benefits of versatility. Supply chain constraints and fluctuating raw material prices further complicate cost management. This challenge slows adoption in price-sensitive residential and commercial segments.

Complex Assembly Requirements and Limited Consumer Awareness Hindering Market Growth

Complex design and assembly procedures create barriers for first-time buyers. Consumers may struggle to configure modules correctly without guidance. It affects satisfaction and can result in negative perceptions of modular solutions. Limited awareness about product benefits reduces interest in modular setups compared to traditional fitness equipment. Retailers and brands must invest in education, tutorials, and customer support. Space and compatibility concerns in small homes or offices further restrict usage. These challenges collectively impede faster growth of the Modular Fitness Furniture market.

Market Opportunities

Expansion into Emerging Markets and Urban Residential Segments Creating Growth Opportunities

Rising urbanization and disposable income in emerging regions create significant market potential. Consumers seek space-efficient and versatile fitness solutions for apartments and small homes. Modular Fitness Furniture offers compact designs that meet these evolving lifestyle needs. It allows manufacturers to target both residential and small commercial segments with tailored solutions. Strategic partnerships with local distributors can enhance market reach. Marketing campaigns focused on convenience and multifunctionality can attract first-time buyers. This geographic expansion provides avenues for sustained revenue growth and brand recognition.

Innovation in Customization and Smart-Enabled Fitness Solutions Driving Market Prospects

Demand for personalized and technology-driven fitness experiences creates new opportunities. Consumers prefer modular units that adapt to specific exercise routines and space requirements. Modular Fitness Furniture integrates smart features such as app connectivity, performance tracking, and adjustable configurations. It encourages repeat purchases and brand loyalty by offering flexible solutions for changing fitness goals. Collaboration with tech companies can accelerate product innovation. Focused research on ergonomic and aesthetic design increases consumer appeal. This trend positions manufacturers to capitalize on the growing intersection of fitness and technology.

Market Segmentation Analysis:

By Material:

The Modular Fitness Furniture market offers diverse material options to meet durability and design requirements. Wood provides a classic aesthetic and sturdy support for residential and light commercial applications. It appeals to consumers who prefer natural materials and elegant finishes. Metal ensures strength and longevity, making it suitable for high-traffic gyms and commercial facilities. Plastic delivers lightweight, cost-effective solutions for compact spaces and flexible setups. Composite materials combine multiple properties, offering resilience, versatility, and design flexibility. Manufacturers focus on material innovation to balance strength, safety, and aesthetic appeal.

- For instance, Matrix Fitness is a major manufacturer of commercial-grade fitness equipment, including modular systems for functional and group training, such as the Magnum series racks and the Connexus Functional Training line. These systems are constructed with heavy-duty steel frames, with models like the Magnum Power Rack rated for a maximum training weight of 408.5 kg / 900 lbs, and are engineered for high-traffic environments.

By Price:

Price-based segmentation addresses varying consumer affordability and quality preferences. Low-priced furniture targets budget-conscious residential buyers and small fitness setups. It provides essential modular functions without advanced features. Medium-priced offerings combine durability, ergonomic design, and partial smart features. It attracts both home users and commercial clients seeking a balance between cost and functionality. High-priced units integrate premium materials, advanced customization, and technology-driven solutions. It appeals to fitness studios, high-end gyms, and affluent residential buyers. This segmentation enables brands to capture a wide market spectrum.

- For instance, Life Fitness, including its Hammer Strength brand, offers commercial-grade modular multi-station rigs constructed with heavy-gauge steel frames, designed for continuous use in fitness centers. These systems are engineered for high performance and durability, with larger units, such as the FIT 3 Multi-Gym, weighing up to 570 kg.

By End-Use:

End-use segmentation distinguishes between residential and commercial demand. Residential users prefer space-saving, multi-functional units that suit apartments and homes. It offers flexibility for diverse workout routines in limited spaces. Commercial clients, including gyms, fitness studios, and corporate offices, require robust, scalable, and durable furniture. It supports high-frequency usage and allows easy reconfiguration to accommodate varying user volumes. Modular solutions enable commercial facilities to optimize floor space and provide enhanced user experience. This segmentation drives targeted product development and marketing strategies across different end-user categories.

Segments:

Based on Material:

- Wood

- Metal

- Plastic

- Composite materials

Based on Price:

Based on End-Use:

- Residential

- Commercial (gyms, fitness studios, offices)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 32% share of the Modular Fitness Furniture market, driven by strong consumer interest in home fitness and wellness. Urbanization and rising disposable income support adoption of space-efficient and multifunctional fitness solutions. It allows manufacturers to introduce high-quality modular units with advanced features for both residential and commercial users. Gyms and corporate offices increasingly implement modular systems to optimize floor space and enhance member experience. Consumer preference for smart-enabled furniture encourages integration of sensors and digital connectivity. Leading brands focus on product innovation and strategic distribution channels to maintain market dominance. This region remains a key revenue generator due to continuous investments in fitness infrastructure.

Europe

Europe accounts for a 28% share of the market, propelled by growing awareness of health and wellness and increasing fitness center memberships. Consumers and businesses prefer modular solutions that combine functionality with design aesthetics suitable for modern interiors. It supports flexible arrangements in small homes, apartments, and office spaces. Regulations promoting safety and sustainability drive manufacturers to adopt eco-friendly and durable materials. Commercial adoption in gyms, wellness studios, and hotels contributes significantly to revenue growth. Brands emphasize product customization to meet regional preferences and ergonomic standards. Europe’s focus on lifestyle-driven fitness trends sustains steady market expansion.

Asia-Pacific

Asia-Pacific holds a 25% share of the Modular Fitness Furniture market, reflecting rapid urbanization, rising disposable income, and increasing awareness of health and fitness. Growing home fitness adoption fuels demand for compact and multifunctional solutions. It allows manufacturers to cater to both residential and commercial segments, including gyms, fitness studios, and corporate offices. Rising e-commerce penetration supports direct-to-consumer sales of modular units. Local production hubs in China, India, and Japan reduce costs and improve accessibility. Manufacturers focus on innovative designs that adapt to space constraints in urban apartments. This region offers substantial growth potential due to increasing fitness consciousness and expanding middle-class populations.

Latin America

Latin America contributes a 9% share, driven by urban population growth and increased interest in home-based fitness solutions. Consumers favor affordable and versatile modular furniture to maintain exercise routines in limited spaces. It enables fitness centers and corporate offices to enhance member engagement through flexible setups. Manufacturers focus on localized production and distribution networks to reduce costs and improve market reach. Rising awareness of health and wellness encourages adoption across both residential and commercial segments. Partnerships with gyms and online platforms support market expansion in major countries such as Brazil and Mexico.

Middle East & Africa

Middle East & Africa holds a 6% market share, influenced by growing urbanization and the establishment of fitness centers in metropolitan areas. Consumers increasingly adopt modular furniture for home gyms and corporate wellness programs. It provides scalable, space-efficient solutions that suit diverse living and working environments. Manufacturers emphasize durability and premium design to meet local preferences and climate conditions. The rising number of luxury residential projects and wellness-focused commercial spaces drives growth. Regional distribution networks and strategic marketing campaigns strengthen market penetration. This region shows gradual but steady adoption, offering long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Technogym

- Core Health & Fitness

- Peloton

- Escape Fitness

- Nautilus

- YR Fitness

- Precor

- Ecore Athletic

- Life Fitness

- Hammer Strength

- BodyCraft

- Kimball International

- Eleiko

- Rogue Fitness

- Matrix Fitness

- Power Lift

- Herman Miller

Competitive Analysis

Key players in the Modular Fitness Furniture market include BodyCraft, Core Health & Fitness, Ecore Athletic, Eleiko, Escape Fitness, Hammer Strength, Herman Miller, Kimball International, Life Fitness, Matrix Fitness, Nautilus, Peloton, Power Lift, Precor, Rogue Fitness, Technogym, and YR Fitness. These companies focus on delivering high-quality, durable, and versatile modular solutions for residential and commercial users. They invest in research and development to integrate smart technology, ergonomic designs, and multi-functional features into their product portfolios. Strong brand recognition and established distribution networks allow these players to capture significant market share. They continuously innovate to meet evolving consumer demands, such as compact units for urban homes and scalable solutions for gyms and corporate wellness programs. Partnerships with fitness centers, technology providers, and e-commerce platforms strengthen their market presence. Companies emphasize customization and premium materials to differentiate their offerings. They leverage marketing campaigns highlighting convenience, safety, and performance benefits to attract consumers. Strategic expansions into emerging markets and urban regions enhance growth potential. Focus on sustainability and eco-friendly materials also positions them favorably in health-conscious and environmentally aware markets. Overall, these leading players maintain competitiveness through innovation, product diversification, and targeted customer engagement, driving steady adoption of modular fitness furniture worldwide.

Recent Developments

- In May 2025, Kimball International introduced new products expanding their lounge furniture selections. New additions include the Fringe 3.0 lounge solution with a smaller footprint design, enhanced Kolo Pods offering new furniture options and accessories, and the Thesis power station wireless charging solution.

- In February 2025, Technogym launched its “Healthness” vision, a new concept that uses AI and data to promote preventive health and hyper-personalized fitness.

- In 2023, Escape Fitness rolled out a lightweight modular unit designed for small gyms and boutique studios.

Report Coverage

The research report offers an in-depth analysis based on Material, Price, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for space-efficient fitness solutions will continue to grow in urban areas.

- Smart-enabled and connected modular units will gain higher adoption among tech-savvy consumers.

- Manufacturers will focus on multi-functional designs that combine strength, cardio, and flexibility features.

- Residential adoption will expand due to rising home fitness awareness and remote work trends.

- Commercial gyms and corporate wellness programs will increasingly implement modular furniture for scalability.

- Eco-friendly and sustainable materials will become a key differentiator for market players.

- Customization options will drive repeat purchases and enhance consumer loyalty.

- E-commerce and direct-to-consumer sales channels will strengthen market reach and accessibility.

- Emerging markets in Asia-Pacific and Latin America will offer significant growth opportunities.

- Continuous innovation in design, ergonomics, and technology integration will maintain market competitiveness.