Market Overview:

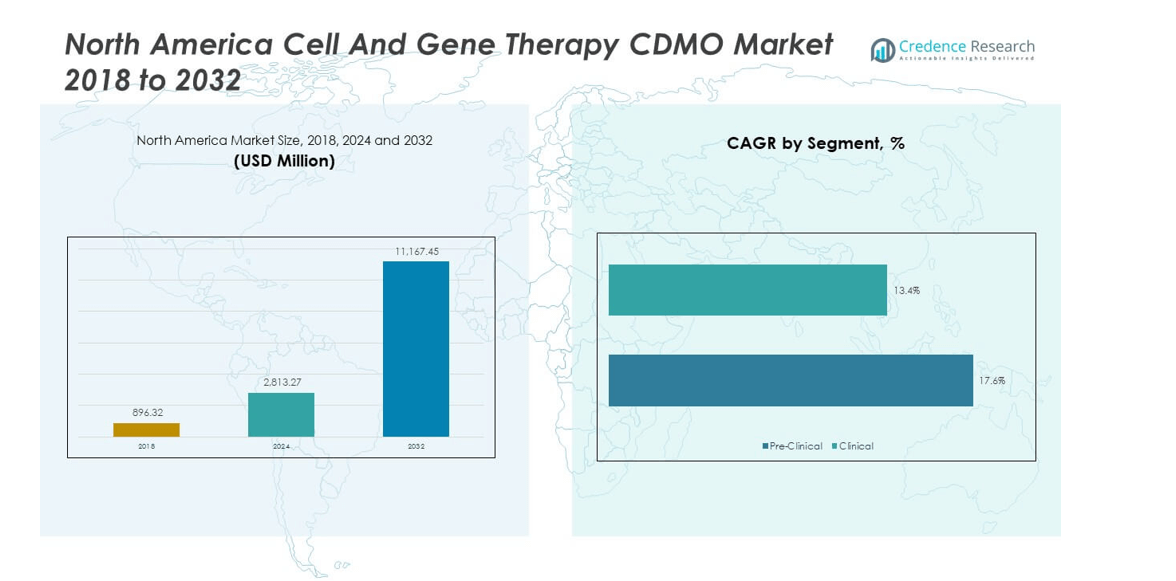

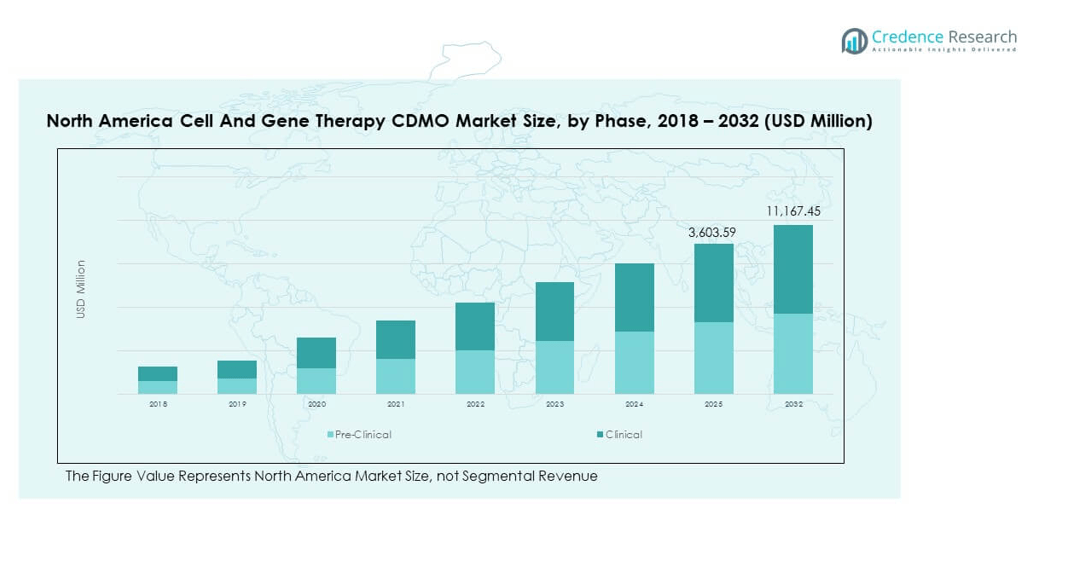

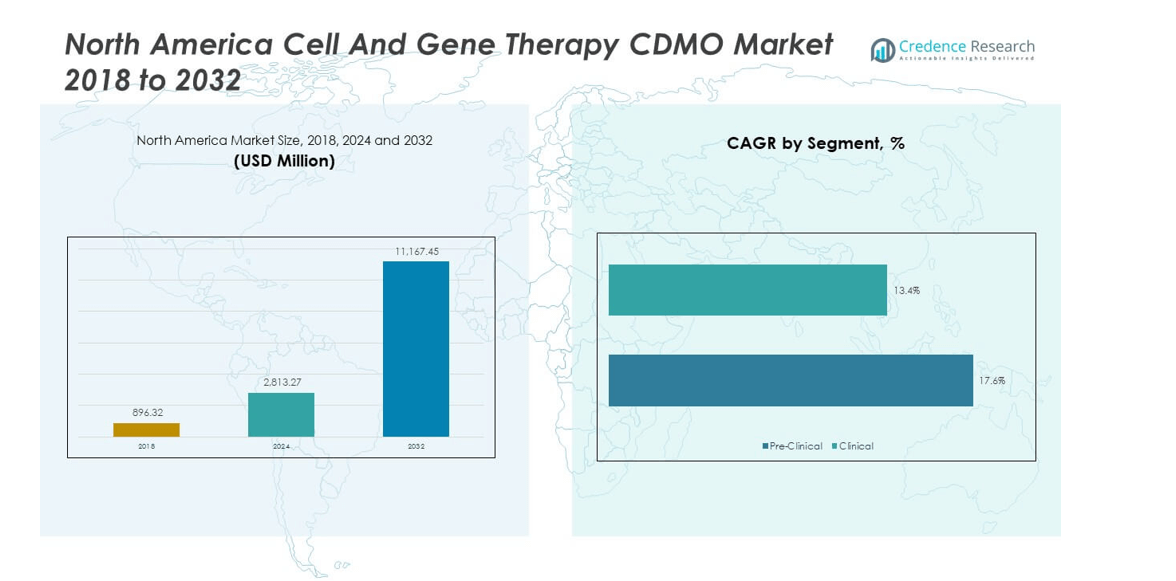

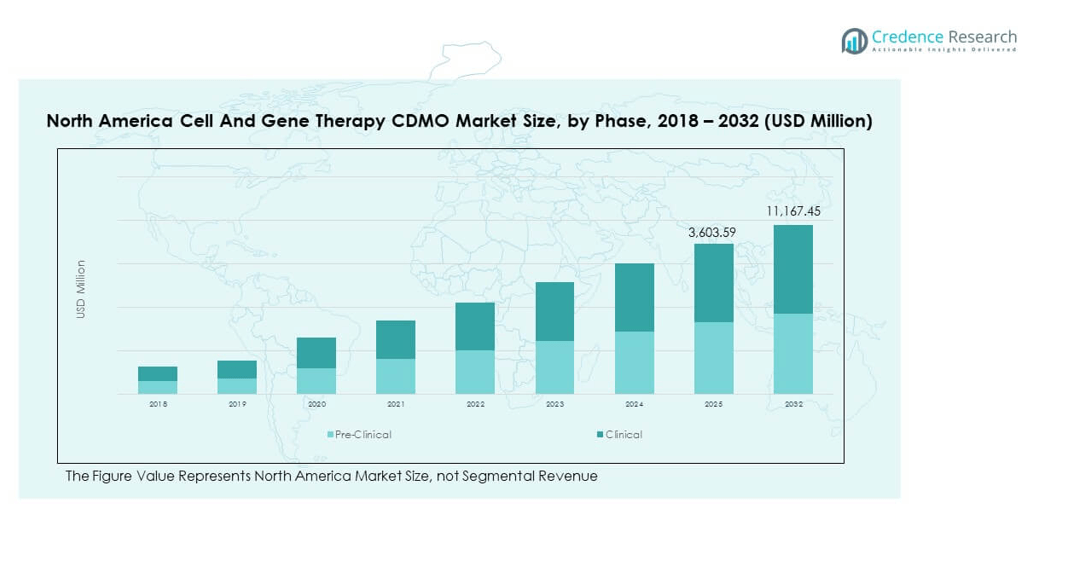

The North America Cell and Gene Therapy CDMO Market size was valued at USD 896.32 million in 2018 to USD 2,813.27 million in 2024 and is anticipated to reach USD 11,167.45 million by 2032, at a CAGR of 17.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Cell and Gene Therapy CDMO Market Size 2024 |

USD 2,813.27 million |

| North America Cell and Gene Therapy CDMO Market, CAGR |

17.54% |

| North America Cell and Gene Therapy CDMO Market Size 2032 |

USD 11,167.45 million |

The market is driven by the rising demand for advanced therapies addressing rare and chronic diseases, coupled with an increase in clinical trial activity. Growing investments from pharmaceutical and biotechnology companies in outsourcing development and manufacturing enhance efficiency and reduce costs. Expanding regulatory support, accelerated approvals for cell and gene therapies, and the growing focus on personalized medicine are further fueling growth. In addition, the need for scalable manufacturing solutions, driven by an increase in pipeline therapies, supports the growing reliance on CDMOs across the region.

The United States dominates the market, supported by its advanced healthcare infrastructure, strong research ecosystem, and presence of leading CDMOs. Canada shows steady progress, aided by supportive government policies and growing biotech clusters. Mexico emerges as an attractive region due to increasing collaborations and cost-effective manufacturing opportunities. The concentration of innovation, funding, and clinical research activity in the U.S. ensures its leadership, while Canada and Mexico continue to strengthen their positions by fostering investments and regional expansion in the cell and gene therapy landscape.

Market Insights:

- The North America Cell and Gene Therapy CDMO Market was valued at USD 896.32 million in 2018, reached USD 2,813.27 million in 2024, and is projected to hit USD 11,167.45 million by 2032, registering a CAGR of 17.54%.

- The United States (78%) dominates due to strong clinical trial activity, advanced healthcare infrastructure, and leading CDMO presence, followed by Canada (14%) with supportive policies and biotech clusters, and Mexico (8%) benefiting from cost-effective manufacturing.

- Mexico is the fastest-growing region, holding 8% share, driven by regulatory improvements, expanding infrastructure, and strategic collaborations with global companies.

- In 2024, the clinical phase segment held 65% of the market, supported by an increasing number of advanced therapies moving into late-stage trials.

- The pre-clinical phase accounted for 35%, driven by rising investments in discovery, early-stage development, and scaling needs for novel therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Advanced Therapies Across Healthcare Ecosystem

The North America Cell and Gene Therapy CDMO Market benefits from rising demand for innovative therapies targeting rare and chronic conditions. Pharmaceutical and biotechnology companies continue to outsource manufacturing to CDMOs to streamline operations and focus on core competencies. It supports companies by providing flexible, scalable platforms for cell and gene therapy production. The rapid increase in clinical trial activity across oncology and genetic disorders further enhances demand. Regulatory agencies in the region encourage accelerated approvals, strengthening growth momentum. Rising healthcare spending in the U.S. supports adoption of cutting-edge therapies. Strategic collaborations between academic research institutions and CDMOs expand service offerings. This synergy continues to fuel overall market advancement.

- For example, in August 2022, Thermo Fisher Scientific expanded its cell and gene therapy CDMO capabilities by opening a new 300,000-square-foot facility in Plainville, Massachusetts, designed for large-scale viral vector manufacturing to support clinical and commercial supply needs, particularly in oncology.

Expanding Regulatory Support and Accelerated Approval Pathways

Supportive regulatory frameworks enhance growth within the North America Cell and Gene Therapy CDMO Market. The U.S. FDA provides expedited approval pathways for cell and gene therapies addressing unmet needs. It encourages faster commercialization of therapies and boosts CDMO demand. Rising designations such as Breakthrough Therapy and Orphan Drug Status contribute to higher development activity. The regulatory environment provides clarity on compliance, improving investor confidence. CDMOs benefit from clearer quality standards and streamlined approval timelines. Strong oversight ensures safety and builds trust among healthcare providers. These factors create a robust foundation for expanding therapeutic development.

Increasing Investments and Capital Inflows into Biotech Development

Large-scale investments by global and regional stakeholders drive growth in the North America Cell And Gene Therapy CDMO Market. Investors support biotech firms and CDMOs to enhance manufacturing capacities. It enables construction of new facilities and expansion of advanced platforms. High-value funding rounds provide startups with resources to advance cell and gene therapy programs. The strong presence of venture capital firms in the U.S. accelerates innovation. Investments also foster technology adoption across single-use systems and automation. Funding encourages CDMOs to expand services covering process development to commercial-scale manufacturing. These capital inflows strengthen the entire ecosystem and improve competitiveness.

- In May 2023, ElevateBio closed a $401 million Series D funding round to advance its cell and gene therapy CDMO capabilities. The proceeds support expansion of its BaseCamp® end-to-end cGMP manufacturing and process-development business in Massachusetts, enhance its Life Edit gene-editing and iPSC platforms, and increase manufacturing capacity and geographic reach.

Rising Need for Scalable and Flexible Manufacturing Infrastructure

The North America Cell And Gene Therapy CDMO Market is shaped by the urgent requirement for scalable solutions. It addresses manufacturing bottlenecks faced by sponsors due to high complexity of therapies. CDMOs provide modular, flexible platforms that reduce cost and time to market. The market responds to rising pipelines of therapies needing efficient production. Companies prefer outsourcing due to limited in-house expertise and regulatory risks. CDMOs offer access to advanced platforms, ensuring quality and compliance. Expansion of multi-product facilities allows quicker adaptation to sponsor requirements. This capability drives reliance on CDMOs for consistent long-term growth.

Market Trends:

Integration of Advanced Automation and Digital Manufacturing Solutions

The North America Cell and Gene Therapy CDMO Market is witnessing strong adoption of digital technologies. Automation and AI-driven platforms are used to improve consistency across processes. It enhances efficiency and reduces variability in critical manufacturing steps. CDMOs apply advanced monitoring systems to track cell quality and viability. Data analytics platforms support predictive maintenance and reduce downtime. Smart manufacturing solutions enable scalable production while maintaining regulatory compliance. Continuous process monitoring strengthens trust among sponsors and regulators. The integration of these digital tools is reshaping the competitive landscape.

Growing Focus on Allogeneic Therapies and Platform Development

The North America Cell And Gene Therapy CDMO Market reflects a shift toward allogeneic therapies. It enables large-scale production for multiple patients from a single source. Companies invest in platform-based models that reduce development time. Allogeneic approaches support broader access and lower treatment costs. CDMOs strengthen capabilities in cryopreservation and storage solutions. The model helps manage logistics and distribution across borders effectively. Focus on scalable platforms attracts biopharma partnerships with CDMOs. This direction is redefining strategies for therapy commercialization.

Expansion of Strategic Collaborations Across Biopharma and CDMOs

Collaborations are emerging as a critical trend in the North America Cell And Gene Therapy CDMO Market. Large pharma companies partner with specialized CDMOs to address complex demands. It enhances innovation by combining clinical expertise with manufacturing capabilities. Strategic alliances support faster time-to-market for advanced therapies. Partnerships include technology transfers, co-development projects, and licensing agreements. Growing mergers and acquisitions consolidate expertise within the industry. These collaborations enhance value chains and reduce operational risks. This collaborative environment accelerates therapy availability across the region.

- For example, in April 2024, Bristol Myers Squibb and Cellares entered into a $380 million capacity reservation and supply agreement. The collaboration deploys Cellares’s fully automated Cell Shuttle platform across its smart factories in the U.S., EU, and Japan to support commercial-scale manufacturing of select CAR-T cell therapies.

Increasing Emphasis on Patient-Centric Therapy Development Models

The North America Cell and Gene Therapy CDMO Market adopts a stronger focus on patient-centered development. It addresses demand for personalized, targeted solutions aligned with patient-specific conditions. Advances in genomic profiling support tailored approaches. CDMOs adapt to these models by offering flexible manufacturing solutions. Patient-centric models improve therapy outcomes and strengthen healthcare adoption. Focus on individualized therapies pushes development of smaller, specialized batches. Companies integrate feedback loops to enhance therapy effectiveness. This emphasis ensures sustainable growth and deeper alignment with healthcare goals.

- For instance, in February 2024, WuXi Advanced Therapies established a rapid-turnaround cell therapy manufacturing service in Philadelphia, supporting patient-specific autologous therapies with an average vein-to-vein delivery of 9 days for rare leukemia indications.

Market Challenges Analysis:

High Manufacturing Costs and Limited Skilled Workforce

The North America Cell and Gene Therapy CDMO Market faces significant cost-related challenges. Developing and manufacturing these therapies requires specialized infrastructure with high capital expenditure. It leads to higher production costs, limiting access for smaller biotech firms. The scarcity of skilled professionals in cell culture, bioprocessing, and regulatory compliance further constrains expansion. CDMOs must invest heavily in training to meet industry needs. Limited scalability of current platforms also increases delays in commercialization. Sponsors depend heavily on CDMOs for efficiency, but capacity limitations persist. These barriers create uneven growth across the ecosystem.

Complex Regulatory Environment and Supply Chain Disruptions

The North America Cell and Gene Therapy CDMO Market faces challenges tied to complex compliance demands. Regulatory agencies impose strict requirements to ensure safety and efficacy. It requires CDMOs to maintain high standards of documentation and monitoring. Navigating multiple frameworks across regions increases operational risks. Supply chain disruptions involving critical raw materials and viral vectors intensify bottlenecks. Limited suppliers amplify vulnerability in production timelines. Companies struggle to secure consistent inputs for large-scale projects. These factors challenge growth momentum and demand long-term strategic solutions.

Market Opportunities:

Growing Expansion of Advanced Manufacturing Platforms and Capacity

The North America Cell And Gene Therapy CDMO Market presents opportunities through expansion of advanced facilities. It creates capacity to support large numbers of therapies entering clinical stages. CDMOs can strengthen modular and multi-product capabilities to address diverse sponsor needs. Investment in state-of-the-art platforms improves efficiency and compliance. Emerging biotechs benefit from affordable outsourcing solutions, boosting CDMO partnerships. Rapidly evolving therapies demand continuous infrastructure upgrades. These opportunities enhance the region’s leadership in the global landscape.

Increasing Partnerships and Diversification of Service Portfolios

The North America Cell And Gene Therapy CDMO Market is positioned to expand through stronger collaborations. It allows CDMOs to diversify service offerings across development and commercialization stages. Strategic alliances with biotech and academic organizations enhance innovation pipelines. Partnerships foster access to advanced technologies and shared expertise. Expansion of integrated services improves long-term value for sponsors. Growing opportunities lie in global collaborations targeting scalability and logistics. These partnerships ensure broader adoption and new revenue streams for CDMOs.

Market Segmentation Analysis:

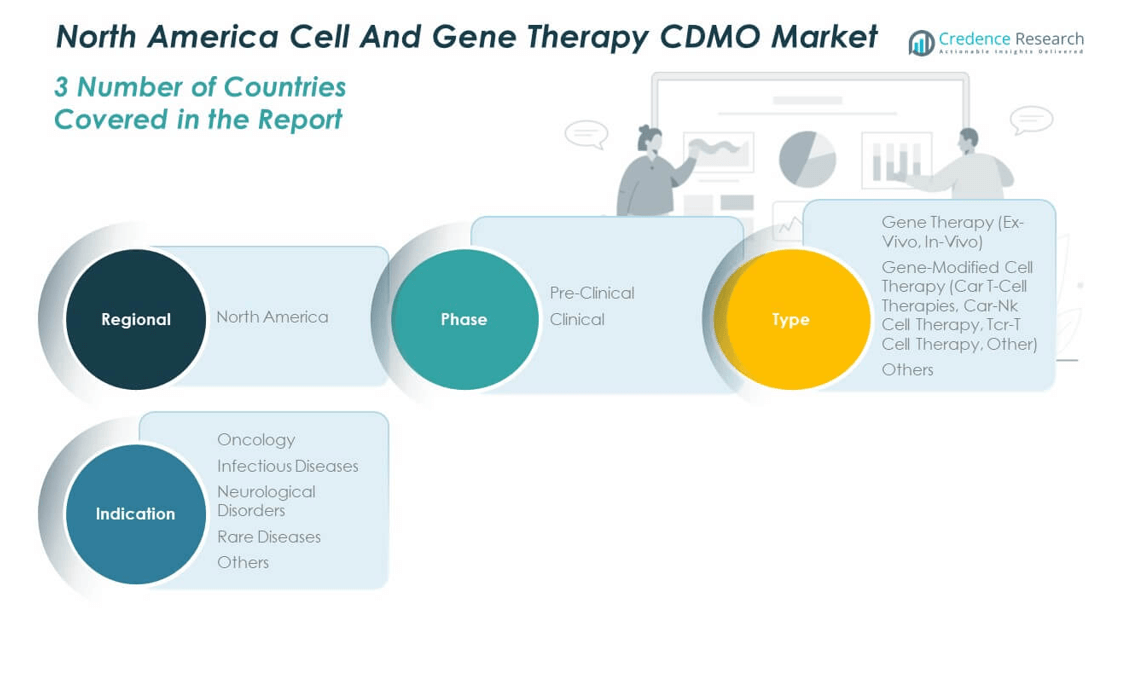

By phase segment, the North America Cell and Gene Therapy CDMO Market demonstrates strong growth across its phase segments, with clinical programs holding a dominant share. It reflects the rising number of advanced therapies entering human trials supported by robust regulatory pathways. Pre-clinical development continues to attract investments, with CDMOs providing specialized expertise for early discovery and scale-up processes. Demand in both segments is reinforced by the growing pipeline of innovative therapies addressing rare and complex conditions.

By type, gene therapy remains a key revenue contributor, with both ex-vivo and in-vivo approaches gaining traction. Ex-vivo therapies focus on modifying cells outside the body and then reintroducing them, while in-vivo approaches deliver therapeutic material directly to target tissues. Gene-modified cell therapies, including CAR T-cell, CAR-NK, and TCR-T therapies, are achieving rapid adoption due to clinical success in oncology. It creates strong opportunities for CDMOs specializing in complex manufacturing platforms. The “others” category represents emerging therapy models that diversify the service demand spectrum.

- For example, in October 2024, OmniaBio Inc. opened its 120,000 sq ft cell and gene therapy (CGT) manufacturing facility in Hamilton, Ontario. The facility functions as an AI and automation-enabled centre of excellence to support the production of various therapies, including cellular immunotherapies and iPSC-based therapies.

By indication, oncology dominates due to the effectiveness of cell and gene therapies in treating various cancers. Infectious diseases represent a growing area with ongoing interest in innovative therapies beyond traditional vaccines. Neurological disorders also gain attention as gene therapies offer new pathways to address degenerative conditions. Rare diseases hold significant potential given regulatory incentives and patient-specific requirements. The “others” segment highlights broader therapeutic applications that continue to expand the role of CDMOs across healthcare domains.

- For example, in February 2025, PHC Corporation signed a Master Collaboration Agreement with CCRM to develop enhanced primary T-cell expansion culture processes for cell and gene therapies by integrating PHC’s LiCellGrow™ system with CCRM’s regenerative medicine expertise.

Segmentation:

By Phase

By Type

- Gene Therapy

- Gene-Modified Cell Therapy

- CAR T-Cell Therapies

- CAR-NK Cell Therapy

- TCR-T Cell Therapy

- Other

- Others

By Indication

- Oncology

- Infectious Diseases

- Neurological Disorders

- Rare Diseases

- Others

By Region

- North America (Regional Breakdown)

Regional Analysis:

The United States leads the North America Cell and Gene Therapy CDMO Market with a market share of 78% in 2024. Its dominance is supported by a mature healthcare ecosystem, extensive clinical trial activity, and the presence of leading CDMOs with advanced infrastructure. Strong regulatory support from the U.S. FDA encourages faster approvals for novel therapies, boosting demand for outsourcing services. It benefits further from substantial venture capital investments and government-backed research initiatives. The concentration of biotech clusters in regions such as Boston and California strengthens innovation pipelines. This environment enables the U.S. to remain the core hub for cell and gene therapy development.

Canada holds a market share of 14% in the North America Cell and Gene Therapy CDMO Market. The country is building momentum through supportive policies and expanding biotech clusters in Toronto, Vancouver, and Montreal. It is developing collaborative partnerships with U.S. firms to expand capabilities and access funding. Government incentives for research and development improve confidence among local biotech startups. The presence of specialized academic institutions supports translational research into advanced therapies. Canada’s role continues to grow as CDMOs expand their footprint to serve regional demand effectively.

Mexico accounts for 8% of the North America Cell and Gene Therapy CDMO Market. It is emerging as a competitive location due to cost-effective manufacturing and favorable trade frameworks. Partnerships with multinational companies and regional CDMOs help strengthen capacity in specialized therapy production. The government promotes biomanufacturing growth through regulatory improvements and investments in healthcare infrastructure. Mexico benefits from its strategic proximity to the U.S., enabling efficient logistics and cross-border collaborations. It is positioning itself as a rising hub for contract development and manufacturing in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Cell And Gene Therapy CDMO Market is highly competitive, with established players and emerging specialists shaping the landscape. Lonza Group AG, Catalent, and Thermo Fisher Scientific dominate with extensive infrastructure, advanced platforms, and strong global networks. It enables them to secure large-scale projects and maintain long-term partnerships with leading biopharma firms. Charles River Laboratories and Cytiva strengthen their positions through integrated service offerings, covering early development to commercial-scale production. Their ability to provide end-to-end solutions supports customer retention and market leadership. Smaller players such as Cellares, Minaris Regenerative Medicine, and Lykan Bioscience are carving niches by focusing on innovation and flexible manufacturing models. It helps them address demand for personalized therapies, rapid scale-up, and cost-efficient solutions. Resilience and FUJIFILM Diosynth Biotechnologies are expanding regional presence through capacity investments and strategic collaborations. Competition is intensifying as CDMOs differentiate through technology adoption, regulatory compliance, and specialized expertise in viral vectors, cell expansion, and cryopreservation. Market dynamics favor companies that combine operational scale with innovation, positioning them to capture growing demand across diverse therapy pipelines.

Recent Developments:

- In June 2025, ProBio, a leading cell and gene therapy CDMO, announced the opening of its flagship U.S. plasmid and viral vector manufacturing facility in Hopewell, New Jersey. This launch significantly expands ProBio’s capabilities in the North American market, aiming to advance innovation and scalability in gene and cell therapy manufacturing.

- In May 2025, Minaris Advanced Therapies was launched as a leading cell therapy CDMO and contract testing provider. This new company was formed through strategic acquisitions by the investment firm Altaris, combining Minaris Regenerative Medicine and the U.S. and U.K. operations of WuXi Advanced Therapies.

- In April 2025, Artis BioSolutions marked its market entry as a North American cell and gene therapy CDMO by acquiring Landmark Bio. This strategic acquisition strengthens Artis BioSolutions’ CDMO capabilities for advanced therapy manufacturing and service delivery in the region.

- In February 2025, PHC Corporation partnered with CCRM to develop T-cell expansion culture processes for cell and gene therapy manufacturing. This collaboration is designed to bolster expertise and capacity for T-cell based therapies in North America, supporting the growing demand for innovative treatment solutions.

Report Coverage:

The research report offers an in-depth analysis based on Phase, Type and Indication. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Cell And Gene Therapy CDMO Market will see expanding reliance on outsourcing for complex therapies.

- Demand for scalable and flexible manufacturing infrastructure will intensify as pipelines mature.

- Regulatory clarity and expedited approvals will continue to accelerate clinical-to-commercial transitions.

- Investment in advanced automation and digital platforms will reshape operational efficiency.

- Partnerships between CDMOs and biotech firms will grow to address rising capacity needs.

- The market will experience diversification across therapy types, with broader adoption of gene-modified cell therapies.

- Oncology will remain the leading therapeutic area, while rare and neurological diseases gain momentum.

- S. dominance will persist, with Canada and Mexico strengthening their roles through supportive ecosystems.

- Consolidation through mergers and acquisitions will redefine competition and expand service portfolios.

- Long-term growth will be supported by innovation, capital inflows, and increasing regional collaborations.