Market Overview:

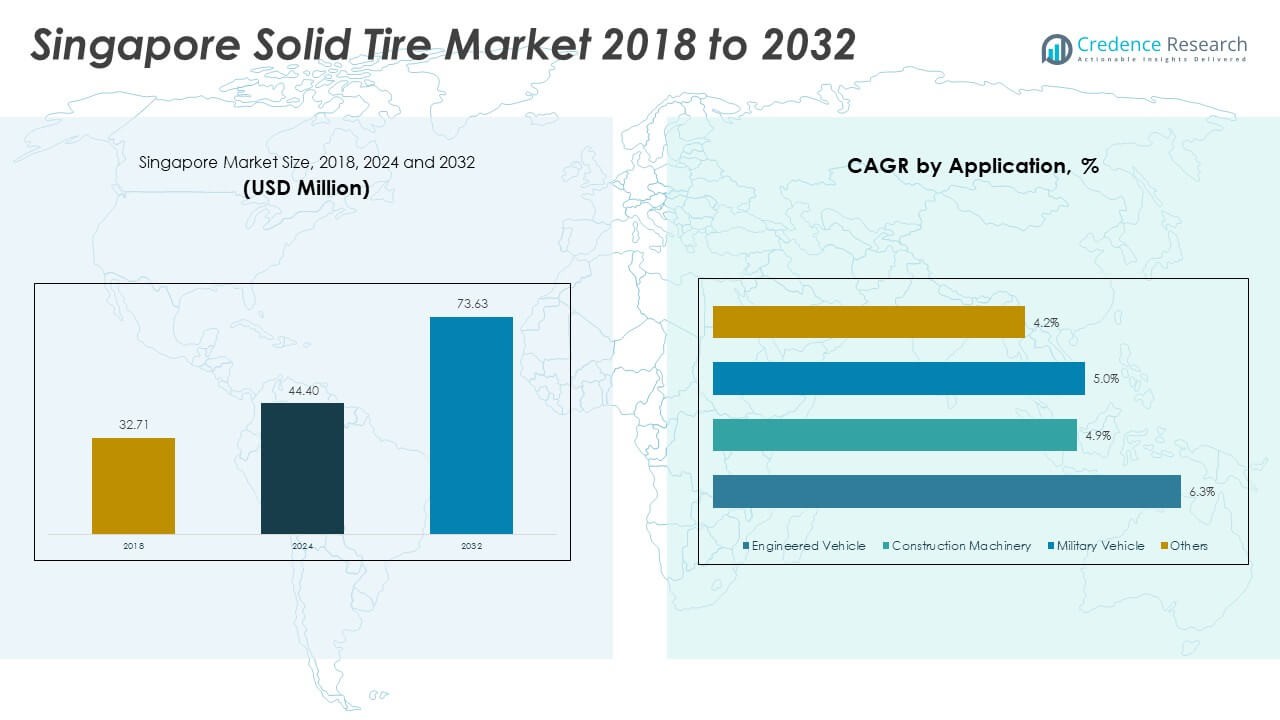

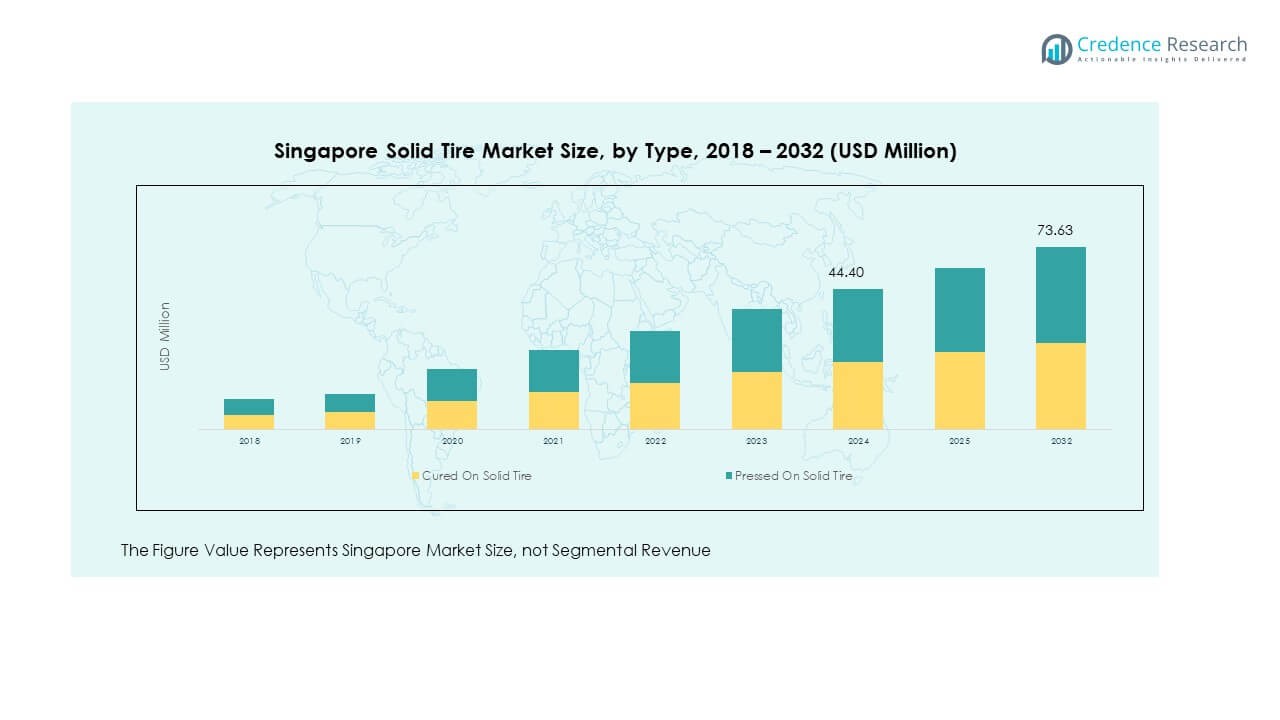

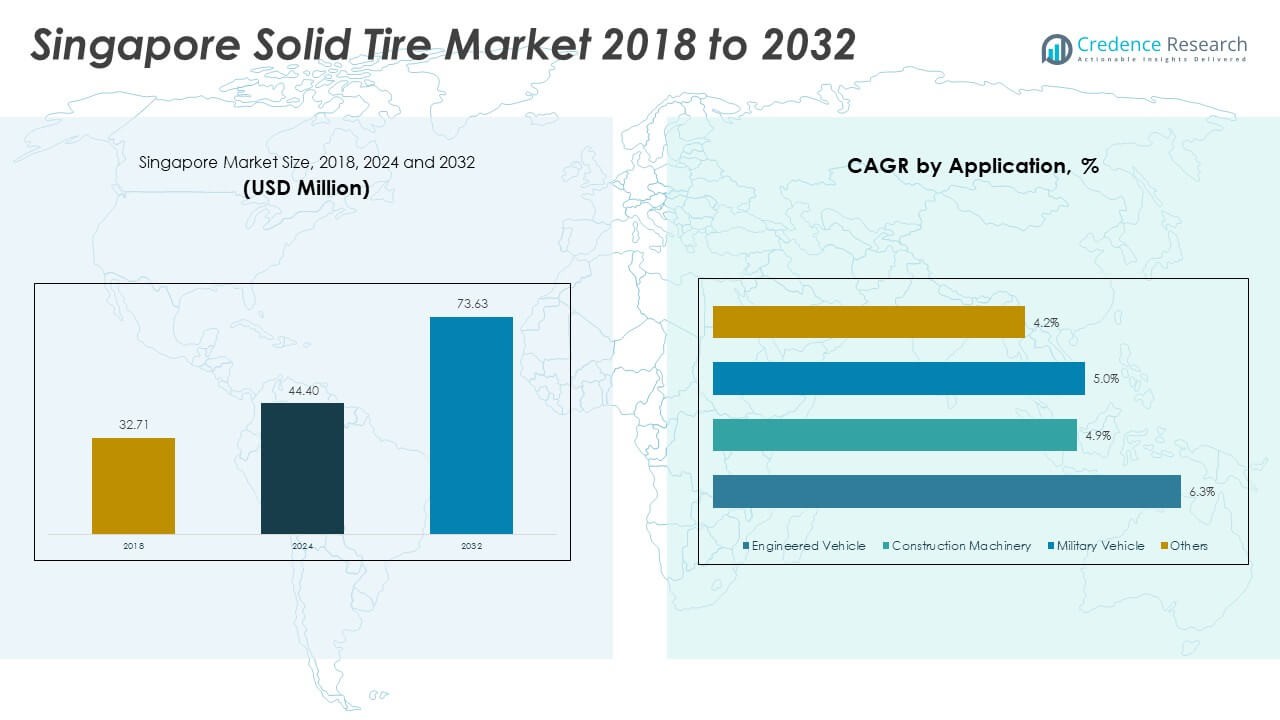

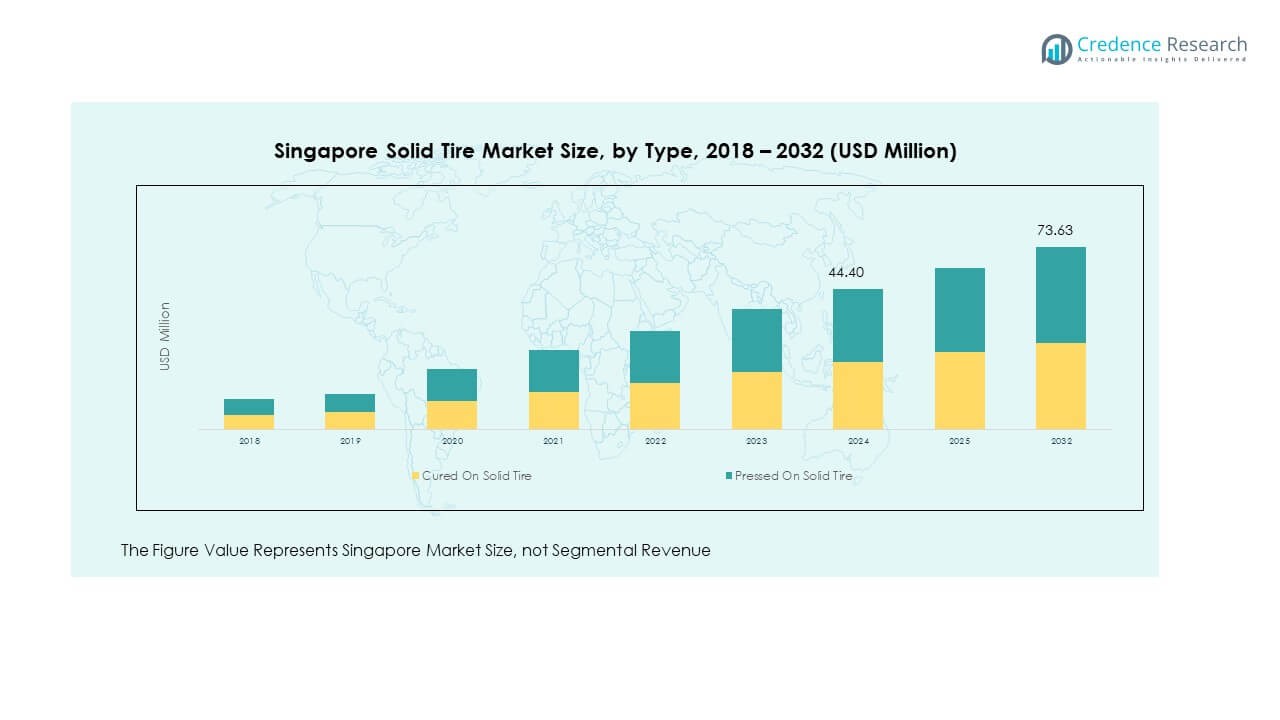

The Singapore Solid Tire Market size was valued at USD 32.71 million in 2018 to USD 44.40 million in 2024 and is anticipated to reach USD 73.63 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Singapore Solid Tire Market Size 2024 |

USD 44.40 Million |

| Singapore Solid Tire Market, CAGR |

6.53% |

| Singapore Solid Tire Market Size 2032 |

USD 73.63 Million |

Growing demand for durable and low-maintenance tires across industrial vehicles drives the Singapore Solid Tire Market. Increasing adoption in forklifts, port handling equipment, and construction machinery highlights strong demand from logistics and infrastructure sectors. Rising focus on operational safety, fuel efficiency, and reduced downtime further supports the market. Manufacturers are also advancing product designs with better load-carrying capacity and heat resistance, enabling adoption across diverse industries.

The market in Singapore is strongly influenced by its strategic geographic location and advanced infrastructure. The country’s role as a regional logistics hub supports widespread demand for solid tires across warehouses, shipping ports, and industrial facilities. While Singapore remains the primary focus, regional spillover effects extend to neighboring Southeast Asian countries, where industrialization is growing. Emerging economies in the region are expected to adopt solid tires more actively, while Singapore continues leading with its strong infrastructure base and industrial demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Singapore Solid Tire Market size was USD 32.71 million in 2018, reached USD 44.40 million in 2024, and is projected to hit USD 73.63 million by 2032, growing at a CAGR of 6.53%.

- Asia-Pacific (38%), North America (27%), and Europe (22%) dominate due to advanced industrial infrastructure, high logistics activity, and strong construction demand.

- The Asia-Pacific region is also the fastest-growing, supported by rapid industrialization, expansion of e-commerce, and rising infrastructure investments.

- Pressed On Solid Tires hold the larger share at 61%, driven by their wide use in port handling and industrial vehicles.

- Cured On Solid Tires account for 39%, favored for their cost efficiency and applications in light-duty industrial equipment.

Market Drivers:

Rising Industrial Applications in Logistics, Construction, and Warehousing Sectors:

The Singapore Solid Tire Market benefits from high demand in logistics, construction, and warehousing operations. Solid tires offer durability, stability, and resistance to punctures, making them ideal for forklifts, port equipment, and material-handling machinery. Rapid growth of Singapore’s logistics hub activities has fueled continuous adoption. The expansion of smart warehouses and e-commerce facilities increases reliance on tire solutions that reduce downtime. Construction projects supported by government infrastructure initiatives also generate steady requirements. The adoption of automation in warehouses further elevates the need for reliable tire performance. Companies prioritize operational efficiency and safety by investing in long-lasting tire solutions. It positions solid tires as a dependable choice across demanding industrial settings.

- For instance, Michelin’s Uptis airless tire technology eliminates puncture risks, providing fleets with near-zero maintenance and potentially reducing premature tire scrapping by up to 20%, which supports sustainability initiatives through material and waste savings. This positions Uptis and other airless technologies as a dependable choice for specific fleet and passenger vehicles operating in demanding settings.

Growth in Port Handling Equipment and Strategic Regional Connectivity:

Singapore’s role as a global shipping and logistics hub drives demand for solid tires across port handling equipment. The Singapore Solid Tire Market records rising adoption in cranes, loaders, and container-moving machines that operate continuously in challenging environments. It reduces risks of operational delays by providing stable, maintenance-free solutions. The country’s connectivity to regional trade routes increases equipment utilization rates, strengthening demand for resilient tires. Government focus on port upgrades to handle higher trade volumes supports future growth. Heavy-duty tire designs with enhanced heat and load resistance further meet these evolving needs. Operators view solid tires as essential to improving safety and minimizing disruptions. Their growing use in ports underlines their critical role in Singapore’s industrial development.

- For instance, Bridgestone’s VCLG port tire series offers improved load capacity with heat resistance compound technology that extends tire life and operational hours, supporting continuous port equipment use under heavy loads. Operators view solid tires as essential to improving safety and minimizing disruptions.

Advancements in Tire Technology and Focus on Sustainable Operations:

The market experiences growth through innovations in tire design that enhance performance and sustainability. The Singapore Solid Tire Market benefits from advancements such as improved tread compounds, heat dissipation features, and longer service life. It allows industries to reduce replacement cycles and lower operating costs. Increasing awareness of environmental responsibility is pushing companies to choose tires with recyclable materials and energy-efficient performance. Demand rises for products that balance durability with sustainability. Manufacturers actively invest in new technologies that align with global standards of eco-friendly solutions. The introduction of premium-quality solid tires further accelerates adoption among high-performance sectors. This technology-driven shift ensures the market aligns with industrial and sustainability priorities.

Expanding Adoption in E-Commerce, Cold Storage, and High-Performance Segments:

The growth of e-commerce and cold storage operations drives steady adoption of solid tires across specialized facilities. The Singapore Solid Tire Market gains traction as businesses invest in handling equipment for perishable goods and high-frequency logistics. It ensures efficient operations by delivering high load capacity and consistent performance in controlled environments. Cold storage and food handling operations rely heavily on reliable tire solutions. Rising investments in automation within these sectors amplify the importance of durable, low-maintenance tires. Companies in retail and distribution networks continue to prioritize efficiency through dependable material-handling systems. Tire manufacturers cater to these needs with specialized solutions that fit industry requirements. This expansion highlights growing diversification of demand across new verticals.

Market Trends:

Rising Adoption of Smart Tire Monitoring and Connected Solutions:

A major trend shaping the Singapore Solid Tire Market is the integration of smart tire monitoring systems. Advanced sensors and IoT technologies track pressure, temperature, and performance in real time. It enhances safety and reduces unplanned downtime in logistics and construction operations. Operators gain valuable data insights to optimize replacement cycles and reduce costs. Singapore’s advanced digital infrastructure supports rapid adoption of such technologies. Growing demand for predictive maintenance aligns with these smart solutions. Companies benefit by reducing risks linked to equipment failure. This trend strengthens the market by aligning tire usage with digital transformation goals.

- For instance, Continental’s ContiConnect digital tire management platform has demonstrated the ability to reduce tire punctures by up to 30% and increase tire lifespan by 10-20% for certain commercial fleets. While fuel savings can vary, some sources point to an average 1% increase in fuel efficiency by monitoring tire pressure and temperature in real-time. Case studies with transport companies confirm these benefits, showing improvements in reliability, reductions in roadside service calls, and lowered overall operating costs.

Increasing Preference for Customized and Application-Specific Tire Designs:

The demand for customized tire solutions tailored to industrial needs is steadily rising. The Singapore Solid Tire Market shows increased adoption of tires designed for specific applications such as heavy lifting, port handling, and automated warehousing. It creates opportunities for manufacturers to supply industry-focused product lines. Customized tread designs and compounds improve traction, performance, and durability. End users seek differentiated products to address unique operational conditions. Singapore’s diverse industrial base ensures consistent growth for this trend. Manufacturers compete by offering specialized designs that optimize safety and operational efficiency. This trend strengthens the value proposition of solid tires across different sectors.

- For instance, Hankook Tire’s SmartFlex AH51 and DH51 tires, introduced for European markets, exhibit an improvement of 15% and 20% in mileage, respectively, over their predecessors. This is achieved through features like 3D sipes and “hidden grooves” that regenerate with wear, maintaining consistent traction and durability throughout the tire’s lifespan. End users seek these differentiated products to address specific operational conditions, contributing to a global trend toward advanced tire technology.

Expanding Role of Automation and Robotics in Warehousing and Logistics:

Automation in warehouses and logistics networks is reshaping tire requirements. The Singapore Solid Tire Market benefits from growing reliance on robotics and automated guided vehicles. It fuels demand for compact, durable, and precision-designed tire systems. Automated systems require consistent performance, and solid tires meet these expectations effectively. Investments in smart logistics parks across Singapore amplify this trend. The shift toward robotics intensifies the need for specialized tires. Tire makers invest in solutions that deliver smooth, noise-free, and reliable operation. This alignment with automation underscores a long-term transformation in industrial tire usage.

Rising Focus on Green Manufacturing and Eco-Friendly Tire Production:

The emphasis on eco-friendly products is influencing tire manufacturing approaches. The Singapore Solid Tire Market responds with innovations in green materials and sustainable processes. It reduces carbon footprints while addressing industrial performance needs. Recyclable compounds and reduced energy consumption during production strengthen market positioning. Companies prioritize suppliers that meet sustainability standards in their supply chains. Demand from multinational corporations in Singapore drives this trend further. Manufacturers expand research into green technology integration for long-term growth. Eco-conscious buyers increasingly view sustainable tire production as an essential market requirement.

Market Challenges Analysis:

High Cost Pressures and Limited Awareness in Smaller Enterprises:

The Singapore Solid Tire Market faces challenges linked to the high initial cost of premium tire solutions. It creates barriers for smaller enterprises with restricted budgets. Many businesses in small-scale logistics hesitate to adopt advanced tire options due to financial constraints. Limited awareness of long-term savings also hinders adoption. Operators often underestimate the benefits of reduced downtime and lower maintenance costs. Competing with low-cost pneumatic alternatives adds another challenge for suppliers. The perception of solid tires as costly investments reduces penetration among cost-sensitive buyers. Addressing cost perception and awareness remains a critical challenge for the industry.

Supply Chain Disruptions and Dependence on Imports for Raw Materials:

The market also faces supply chain risks linked to import dependency for raw materials. The Singapore Solid Tire Market relies heavily on global supply routes for rubber and key inputs. It makes the sector vulnerable to price fluctuations and shipping delays. Geopolitical tensions and transport bottlenecks add further risks. These factors can disrupt consistent supply and impact production timelines. Market players face difficulty balancing demand with fluctuating material availability. Regional dependence on external suppliers intensifies exposure to external shocks. Companies must diversify sourcing strategies to reduce vulnerability. This challenge remains critical in sustaining consistent market growth.

Market Opportunities:

Expansion Across Regional Trade Networks and Neighboring Southeast Asian Economies:

Significant opportunities exist in extending market reach beyond Singapore into regional economies. The Singapore Solid Tire Market is positioned as a hub that can supply nearby Southeast Asian countries experiencing industrial growth. It creates potential for manufacturers to leverage Singapore’s logistics connectivity. Demand from emerging economies in the region drives cross-border expansion opportunities. Manufacturers can capture new markets by offering specialized, durable products. Regional partnerships also enhance supply chain resilience. Singapore’s strategic position provides a base for developing broader regional market share. This expansion supports growth beyond domestic boundaries.

Rising Investments in Innovation and Premium Product Development:

Product innovation presents strong opportunities for advancing market penetration. The Singapore Solid Tire Market benefits from rising investments in high-performance tires designed for automation, robotics, and sustainability. It enables manufacturers to differentiate in a competitive environment. Businesses increasingly prefer premium solutions with longer lifespan and eco-friendly properties. Continuous research ensures steady innovation pipelines. Tire makers that align with advanced industrial needs can secure a leading position. Singapore’s industrial ecosystem supports demand for innovative and sustainable products. This creates a favorable platform for companies to expand offerings and capture long-term value.

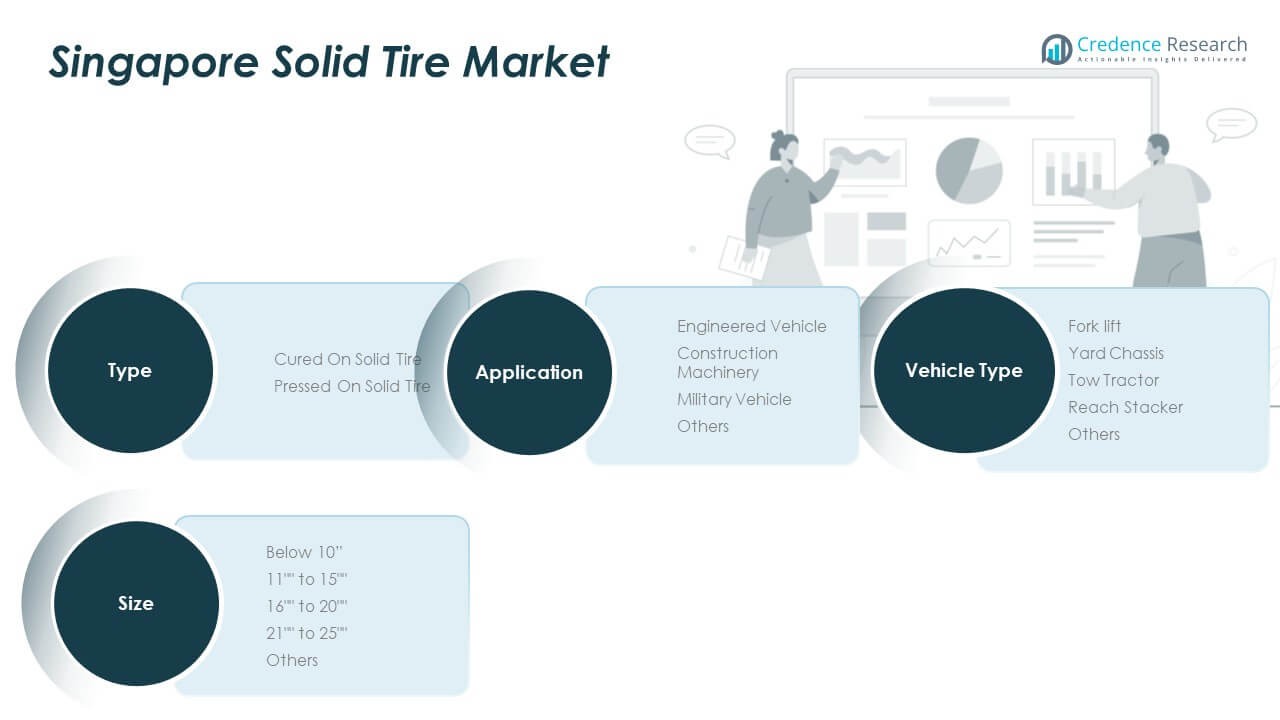

Market Segmentation Analysis:

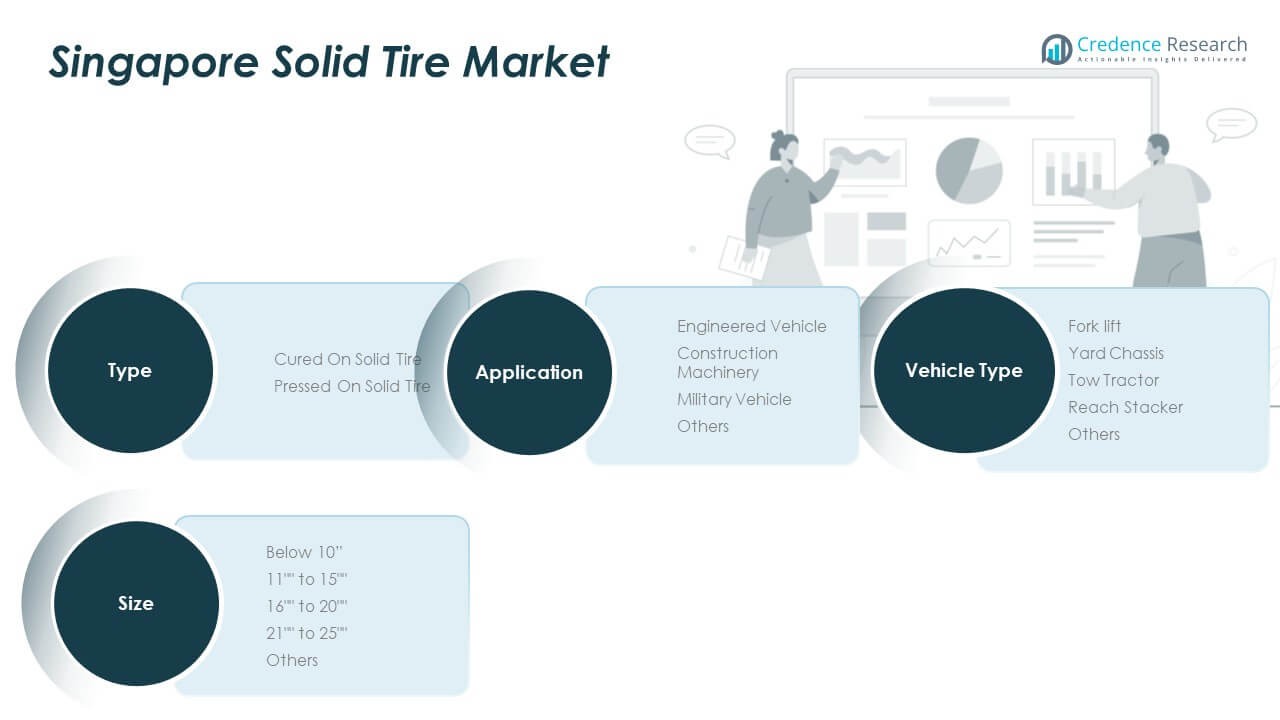

By Type

The Singapore Solid Tire Market is segmented into cured on solid tires and pressed on solid tires. Pressed on solid tires hold the larger share due to their strength, durability, and use in heavy-duty industrial applications. Cured on solid tires continue to serve light and medium-duty vehicles, offering cost efficiency and simple replacement options. Both categories sustain demand across logistics, construction, and warehousing sectors.

- For instance, Michelin has developed advanced rubber compound technologies, such as their Carbion, Silicon, and Forcion innovations, to enhance durability and improve performance for commercial and industrial vehicles. Similarly, Goodyear utilizes proprietary tread designs and compounds, like those in its FUELMAX and Assurance lines, to optimize rolling resistance and provide longer-lasting tread life.

By Application

The market is divided into engineered vehicles, construction machinery, military vehicles, and others. Construction machinery dominates the segment, supported by Singapore’s steady infrastructure investments. Engineered vehicles follow with strong usage in material handling and industrial processes. Military vehicles, while smaller in demand, require high-performance tires suitable for extreme conditions. The “others” category includes smaller specialized applications that extend market reach.

- For instance, Bridgestone supplies tires specifically engineered for heavy earthmoving equipment featuring heat-resistant compounds, which reduce tire temperature during prolonged operations, significantly extending tire durability and performance under harsh conditions.

By Size

Size segmentation includes below 10”, 11″ to 15″, 16″ to 20″, 21″ to 25″, and others. The 16″ to 20″ category leads due to its wide use in forklifts and medium industrial vehicles. The 11″ to 15″ size also captures notable demand, especially in compact equipment and yard vehicles. Larger sizes serve port handling and construction equipment, while smaller options target niche applications.

By Vehicle Type

The market is segmented into forklifts, yard chassis, tow tractors, reach stackers, and others. Forklifts account for the largest share, driven by strong demand from warehouses and logistics hubs. Yard chassis and tow tractors support continuous port operations, ensuring efficient cargo handling. Reach stackers cater to container management, strengthening the role of solid tires in Singapore’s logistics ecosystem.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11″ to 15″

- 16″ to 20″

- 21″ to 25″

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Central Role of Port and Maritime Zones – 45% Share

The Singapore Solid Tire Market is heavily concentrated around the country’s maritime and port operations, reflecting its role as a global trade hub. Demand is strongest in regions linked to container terminals and port handling facilities, where heavy equipment such as yard chassis, reach stackers, and forklifts require durable tire solutions. It benefits from continuous port expansion and modernization projects that prioritize efficiency and safety. Industrial estates near these maritime zones further contribute to adoption. Strong trade activity ensures steady demand for heavy-duty solid tires across key port locations, giving this segment the largest regional share.

Industrial and Warehousing Clusters Driving Growth – 35% Share

Major industrial and logistics clusters across western and northern Singapore account for significant market share. These areas host extensive warehousing, distribution centers, and advanced manufacturing facilities that depend on forklifts and tow tractors. The Singapore Solid Tire Market gains momentum here due to growing e-commerce and retail distribution, which drive warehouse automation. It supports demand for pressed on solid tires, valued for their resilience and ability to handle high-frequency usage. Expansion of logistics parks and cold storage facilities continues to strengthen growth in these regional clusters, making them a dominant contributor.

Construction and Urban Development Hotspots – 20% Share

Construction-driven demand originates from urban development zones and large infrastructure projects spread across Singapore. The Singapore Solid Tire Market benefits from sustained use in construction machinery operating in both commercial and residential development sites. It is also driven by government-backed urban renewal and transportation projects, which keep construction activity steady. These zones create consistent requirements for cured on solid tires, preferred for their cost effectiveness in mid-duty machinery. Demand extends into supporting industries around construction supply chains, further boosting adoption. Together, these construction-focused areas hold a smaller but steady share of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Michelin Asia-Pacific Pte Ltd

- Goodyear Singapore Pte Ltd

- Bridgestone Asia Pacific Pte Ltd

- Continental Automotive Singapore Pte Ltd

- Dunlopillo Holdings Pte Ltd

- Hankook Tire Singapore Pte Ltd

- Kumho Tire Singapore Pte Ltd

- Pirelli Asia Pte Ltd

- Toyo Tire Asia Co Ltd

- Yokohama Tire (Singapore) Pte Ltd

- Omni United Pte Ltd

- YHI Corporation Singapore Pte Ltd

- Union Forklift Pte Ltd

Competitive Analysis:

The Singapore Solid Tire Market features intense competition driven by global and regional players operating in logistics, construction, and port equipment segments. Leading manufacturers such as Michelin, Goodyear, Bridgestone, and Yokohama maintain strong presence through premium product portfolios and strategic distribution networks. Local companies like Omni United and Union Forklift strengthen market accessibility by providing cost-efficient solutions tailored to Singapore’s industrial needs. It is shaped by innovation in tire durability, sustainability, and load-handling capacity, which remain critical differentiators. Partnerships with logistics operators and port authorities enhance visibility and adoption. Competitive dynamics also reflect the growing role of product customization, advanced compounds, and technology integration to meet evolving demands.

Recent Developments:

- In July 2025, Michelin Asia-Pacific Pte Ltd appointed Florentin Odenwald as the new Managing Director for Malaysia, Singapore, and Brunei, emphasizing the company’s strategic focus on sustainable mobility and strengthening its premium brand positioning in the Southeast Asian region. Odenwald brings extensive global automotive experience and will lead Michelin’s regional growth and innovation efforts.

- Pirelli Asia Pte Ltd entered a long-term strategic partnership in April 2025 with CTS, a Northern European tire service provider, to enhance market presence with integrated tire services, wheel alignment, and sustainable tire solutions, especially targeting markets with high electric vehicle penetration.

- Bridgestone Asia Pacific Pte Ltd announced in February 2025 that its Taiwan and Vietnam tire manufacturing plants achieved the ISCC PLUS certification, marking significant progress toward using 100% sustainable materials by 2050. This certification supports Bridgestone’s circular economy initiatives and sustainability commitments across its supply chain.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Strong demand from logistics hubs and port operations will sustain tire adoption.

- Warehousing expansion with automation will strengthen demand for pressed on solid tires.

- Construction machinery use will remain steady with infrastructure upgrades across Singapore.

- Cold storage and e-commerce operations will drive segment diversification.

- Tire makers will focus on sustainability through eco-friendly materials and green processes.

- Advanced tread and heat-resistant designs will improve performance in heavy-duty operations.

- Forklifts will continue to lead vehicle-based demand across industrial clusters.

- Partnerships with logistics operators will enhance supply chain integration.

- Digital solutions such as smart tire monitoring will gain traction in industrial fleets.

- Regional spillover opportunities into Southeast Asia will expand market reach.