Market Overview

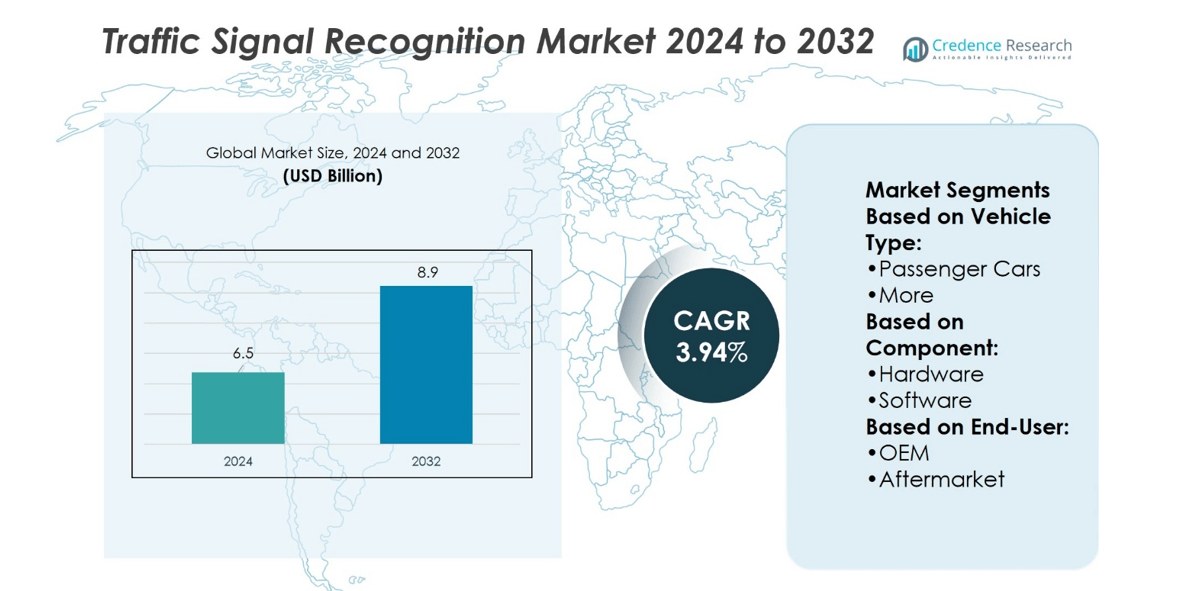

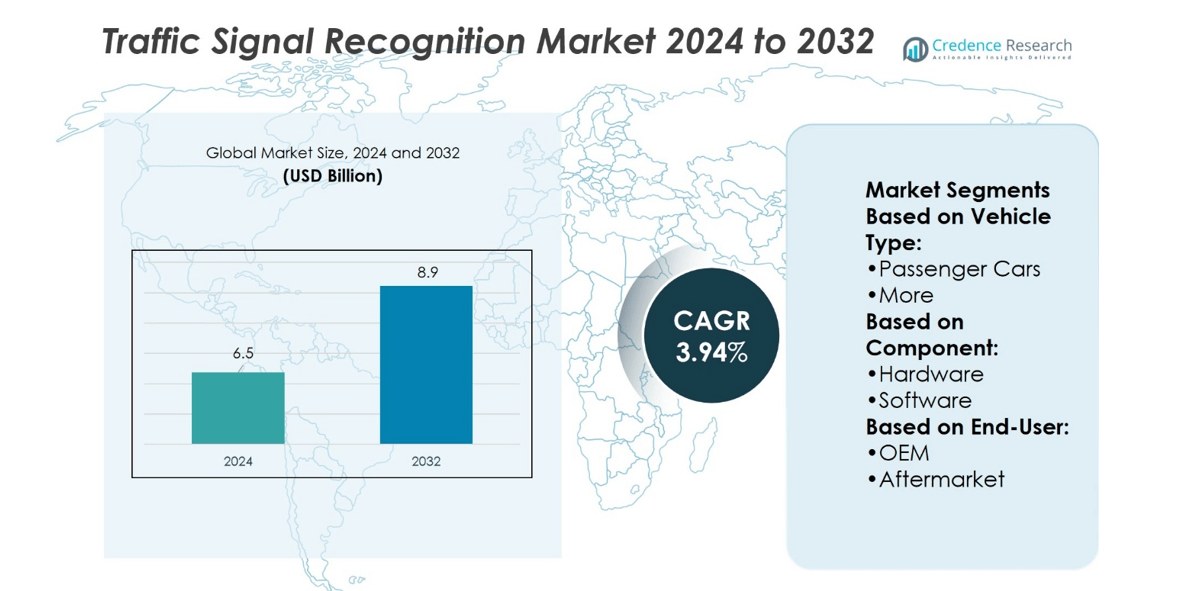

Traffic Signal Recognition Market size was valued at USD 6.5 billion in 2024 and is anticipated to reach USD 8.9 billion by 2032, at a CAGR of 3.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Traffic Signal Recognition Market Size 2024 |

USD 6.5 billion |

| Traffic Signal Recognition Market, CAGR |

3.94% |

| Traffic Signal Recognition Market Size 2032 |

USD 8.9 billion |

The Traffic Signal Recognition Market grows through rising demand for advanced driver-assistance systems, strict safety regulations, and increasing focus on road safety across urban environments. Automakers embed recognition systems in both premium and mid-range vehicles to meet compliance standards and consumer expectations. It benefits from advances in AI, machine learning, and sensor fusion, which improve accuracy in complex traffic and weather conditions. Growing smart city initiatives and vehicle-to-infrastructure connectivity further accelerate adoption. Strong collaboration between technology firms and automotive manufacturers ensures continuous innovation, positioning traffic signal recognition as a vital component of intelligent mobility and safer driving ecosystems worldwide.

The Traffic Signal Recognition Market records strong geographical presence led by Asia-Pacific with the largest share, followed by North America and Europe with significant adoption supported by strict safety regulations and advanced automotive infrastructure. Latin America and the Middle East & Africa contribute smaller but emerging shares driven by urban mobility projects. Key players actively shaping the market include Hyundai, Hitachi Automotive Systems, Continental, Ford, Bosch, Hella, General Motors, HERE Technologies, Denso, and Audi, all competing through innovation and strategic partnerships.

Market Insights

- Traffic Signal Recognition Market size was valued at USD 6.5 billion in 2024 and is projected to reach USD 8.9 billion by 2032, at a CAGR of 3.94%.

- Rising demand for advanced driver-assistance systems and strict safety regulations drive steady growth.

- Technological progress in AI, machine learning, and sensor fusion strengthens system accuracy.

- Competition intensifies as leading automakers and technology firms invest in innovation and partnerships.

- High development costs and regional regulatory differences restrain faster global deployment.

- Asia-Pacific leads in market share, followed by North America and Europe with strong adoption.

- Latin America and the Middle East & Africa show gradual growth supported by smart city and urban mobility projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Road Safety and Efficient Traffic Management

The Traffic Signal Recognition Market grows strongly due to the rising need for safer transportation networks. Governments implement stricter road safety rules, which increases adoption of advanced driver-assistance systems. Traffic signal recognition supports accident prevention by alerting drivers and autonomous systems to signals. It ensures consistent compliance with speed and stop requirements, reducing human error on busy roads. Increasing vehicle density in cities reinforces the role of recognition systems. Automakers integrate such features in mid and high-range models to strengthen safety compliance.

- For instance, Hitachi’s stereo-camera system detects pedestrians and vehicles using parallax analysis from dual lenses and feeds that into fusion processing that outputs 3D object position and speed with single-unit reliability.

Rising Integration of Advanced Driver Assistance Systems (ADAS) in Vehicles

The Traffic Signal Recognition Market benefits from the wider adoption of ADAS features across global automotive production. Automakers focus on embedding vision-based systems that improve navigation and reduce risks. It helps cars detect red lights, speed restrictions, and pedestrian crossings with precision. The growing adoption of Level 2 and higher automation strengthens reliance on recognition technology. Consumer preference for intelligent vehicles drives investment in reliable signal recognition systems. Strong regulatory encouragement for ADAS inclusion accelerates the expansion of these technologies.

- Ford’s BlueCruise hands-free driving system has been installed in more than 420,000 vehicles, which have collectively covered over 213 million hands-free miles globally. This large-scale deployment demonstrates the reliability of Ford’s ADAS features in real-world conditions, with consistent performance across diverse terrains and traffic environments.

Technological Advances in Imaging, AI, and Machine Learning Models

The Traffic Signal Recognition Market advances through innovation in imaging sensors and deep learning algorithms. High-resolution cameras and LiDAR improve accuracy under varied weather and lighting. It enables reliable detection of worn or partially blocked signals. Machine learning models train with vast datasets to ensure predictive accuracy in diverse traffic conditions. Integration with cloud platforms further supports real-time updates and analytics. Automotive companies invest heavily in R&D to refine system efficiency and reduce false alerts.

Supportive Government Regulations and Infrastructure Modernization Initiatives

The Traffic Signal Recognition Market gains momentum through policies promoting connected mobility and autonomous driving. Governments invest in smart city projects that integrate intelligent road infrastructure. It aligns with national strategies targeting reduced accidents and improved traffic efficiency. Subsidies and mandates for ADAS adoption create consistent opportunities for manufacturers. Partnerships between automakers and technology firms support pilot programs across urban corridors. Rapid digital transformation in mobility infrastructure sustains long-term demand for advanced recognition systems.

Market Trends

Growing Adoption of Autonomous and Semi-Autonomous Driving Technologies

The Traffic Signal Recognition Market shows strong alignment with the rise of autonomous and semi-autonomous vehicles. Automakers integrate recognition systems into advanced driving platforms to support compliance and navigation. It ensures vehicles interpret real-time traffic signals, reducing risks in urban environments. Semi-autonomous features such as adaptive cruise control increasingly rely on signal recognition to optimize performance. Consumer demand for safer and smarter driving experiences pushes manufacturers to expand system adoption. The trend highlights the role of recognition as a core enabler of next-generation mobility.

- For instance, Bosch’s ADAS platform processes full-surround perception using up to 1,000 TOPS compute, outputting a precise 360° model even at high speeds. Combined with radar SoCs that integrate major components onto a single chip, these innovations power semi-autonomous features like adaptive cruise control and signal recognition with exceptional processing density and compactness.

Expansion of AI-Powered Vision and Sensor Fusion Technologies

The Traffic Signal Recognition Market benefits from advances in AI, computer vision, and sensor fusion. Machine learning models analyze complex signal patterns with higher accuracy. It improves recognition in low-visibility conditions such as fog, rain, or glare. Fusion of cameras, LiDAR, and radar delivers redundancy that strengthens system reliability. Automakers collaborate with technology firms to scale AI-powered modules across production lines. Continuous refinement of deep learning algorithms positions recognition as a central trend in connected driving systems.

- For instance, Hella’s 24 GHz radar sensor—used across 120+ series projects—exceeds 50 million units sold. It supports function-rich ADAS features through narrow-band and MMIC tech, operating seamlessly within multi-sensor fusion systems to ensure accurate signal and obstacle detection in poor visibility.

Growing Emphasis on Smart City and Connected Infrastructure Projects

The Traffic Signal Recognition Market expands through global investments in smart city infrastructure. Governments deploy intelligent traffic lights and connected intersections that complement in-vehicle recognition systems. It enhances interoperability between vehicles and road infrastructure, creating smoother traffic flows. Integration of vehicle-to-infrastructure communication supports broader adoption of recognition technology. Urbanization and congestion management goals drive consistent demand for such systems. This trend strengthens the partnership between public authorities and mobility technology developers.

Shift Toward Standardization and Regulatory Compliance Across Regions

The Traffic Signal Recognition Market evolves with rising regulatory requirements for ADAS features in vehicles. Authorities in Europe and Asia mandate inclusion of recognition systems in certain models. It supports driver awareness, compliance, and accident reduction initiatives. Automakers adopt standardized testing protocols to meet certification requirements. Regional variations in traffic signs accelerate the need for harmonized algorithms. The trend emphasizes the growing role of policy alignment in shaping global market adoption.

Market Challenges Analysis

High Complexity in Signal Detection Across Diverse Road and Environmental Conditions

The Traffic Signal Recognition Market faces challenges due to the diversity of traffic lights across regions. Variations in size, shape, and placement of signals complicate detection for recognition systems. It struggles under poor weather conditions such as heavy rain, fog, and snow that obstruct visibility. Low-light or glare from sunlight further reduces accuracy, raising concerns for driver safety. Aging infrastructure in many cities includes faded or obstructed signals that limit recognition performance. These challenges demand continuous advancements in imaging sensors and algorithm design.

High Development Costs and Regulatory Compliance Barriers for Automakers

The Traffic Signal Recognition Market encounters barriers linked to the high cost of R&D and system integration. Automakers invest heavily in testing, calibration, and validation across multiple traffic environments. It requires significant collaboration with governments to align with evolving ADAS regulations. Regional differences in standards increase the cost of producing universal systems. Small manufacturers face difficulty in balancing cost control with technological reliability. Strict compliance and certification processes create longer development timelines, restraining faster deployment across fleets.

Market Opportunities

Rising Adoption of Connected and Intelligent Mobility Solutions Across Urban Environments

The Traffic Signal Recognition Market presents opportunities through integration with connected and intelligent mobility platforms. Governments invest in smart city projects that align with real-time traffic management goals. It creates strong demand for recognition systems capable of interacting with connected intersections and adaptive lights. Vehicle-to-infrastructure communication supports smoother traffic flow and enhances road safety. Automakers that embed recognition within broader ADAS packages strengthen value for consumers. Expanding deployment of connected vehicles across major cities drives consistent opportunities for technology suppliers.

Growing Demand for Advanced Driver Assistance in Emerging Automotive Markets

The Traffic Signal Recognition Market benefits from rising consumer preference for safety-focused vehicles in emerging regions. Urbanization in Asia-Pacific, Latin America, and the Middle East fuels adoption of ADAS features. It enables automakers to introduce recognition systems in both mid-range and premium models. Supportive regulations and safety awareness campaigns further expand the customer base. Continuous innovation in AI and sensor technologies allows scalable deployment at competitive costs. These opportunities create pathways for wider adoption of recognition systems across global automotive production.

Market Segmentation Analysis:

By Vehicle Type

The Traffic Signal Recognition Market demonstrates strong adoption across passenger cars, which dominate demand due to rising integration of ADAS features in mainstream models. Automakers equip compact and mid-sized cars with recognition systems to meet regulatory requirements and enhance safety ratings. It supports drivers in both urban and highway conditions, reducing accident risks tied to missed signals. Luxury and premium vehicles lead in embedding advanced recognition technologies, offering higher precision through multi-sensor fusion. Commercial vehicles also present opportunities, with logistics fleets focusing on safety and compliance. Broader adoption across all vehicle types reinforces recognition as a key safety and navigation enabler.

- For instance, GM’s Super Cruise uses high-precision maps built from LiDAR data to enable hands-free driving on over 750,000 miles of mapped roads in North America. Additionally, older Opel Eye camera systems could detect traffic signs up to 100 meters ahead, with functions limited primarily to highway use.

By Component

The Traffic Signal Recognition Market is driven by hardware and software working together to ensure accurate performance. Hardware includes cameras, sensors, and processing units that capture and interpret traffic signals in real time. It requires consistent upgrades to address environmental challenges such as low-light visibility and weather disruptions. Software forms the analytical core, using AI and machine learning to improve accuracy and adapt to varied signal types. Automakers rely on continuous software updates to maintain compliance with regional standards. Integration of both hardware and software creates a balanced ecosystem that supports reliable and scalable deployments.

- For instance, Denso’s Global Safety Package 3 uses a radar and camera fusion system that delivers greater detection range and angle, while reducing parts count to less than half compared to its previous generation.

By End-User

The Traffic Signal Recognition Market records strong traction from original equipment manufacturers (OEMs), who lead in embedding recognition systems directly into new vehicles. Safety regulations and consumer demand encourage OEMs to prioritize advanced driver assistance features. It ensures higher market penetration and strengthens the value proposition of new models. The aftermarket segment grows as consumers retrofit older vehicles with recognition solutions to improve safety. Technology providers expand partnerships with dealers and service networks to meet this demand. Both OEM and aftermarket adoption create diverse pathways for growth, ensuring recognition systems serve both new and existing vehicles globally.

Segments:

Based on Vehicle Type:

Based on Component:

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 34% of the Traffic Signal Recognition Market, supported by strict road safety regulations and advanced automotive technologies. The United States leads regional adoption, driven by high integration of ADAS features in new vehicles. It benefits from the presence of major automakers and technology providers who invest heavily in R&D. Recognition systems are widely deployed in premium vehicles and are gradually moving into mid-range passenger cars. The region also shows strong demand from the aftermarket segment, where consumers retrofit older cars with recognition solutions to enhance safety and compliance. Canada contributes steadily through regulatory programs and growing awareness of intelligent mobility systems. North America remains one of the most mature and regulation-driven markets worldwide.

Europe

Europe accounts for 29% of the market, with growth strongly linked to the European Union’s General Safety Regulation, which mandates advanced driver-assistance features including traffic signal recognition. Germany, France, and the United Kingdom dominate adoption due to their strong automotive production bases and consumer demand for premium vehicles. It benefits from a well-developed road infrastructure that supports high system reliability and accuracy. Major European suppliers such as Bosch, Continental, and Valeo continue to refine both hardware and AI-based algorithms for improved performance. Regulatory pressure has accelerated adoption, making recognition systems a standard in new vehicles. Europe remains a technology-driven market where regulatory compliance and innovation work closely together.

Asia-Pacific

Asia-Pacific dominates with 38.75% share, making it the largest regional market. China is the top contributor, supported by high automotive production volumes, government safety initiatives, and rapid adoption of ADAS technologies. Japan shows strong penetration due to advanced automotive technologies and demand for high-performance vehicles. India demonstrates increasing adoption through urban mobility programs and road safety campaigns. It benefits from rising consumer preference for safety-oriented vehicles and smart city projects that emphasize intelligent traffic management. Automakers in the region integrate recognition systems not only into luxury vehicles but also into mid-range models to appeal to a wider customer base. Asia-Pacific stands out as the fastest-growing region, with long-term expansion supported by infrastructure modernization and mass-market affordability.

Latin America

Latin America holds less than 5% of the market, with Brazil and Mexico leading adoption. These countries focus on improving urban traffic management and modernizing transport systems. It remains a cost-sensitive market, which restricts large-scale integration of recognition systems in entry-level vehicles. However, demand grows steadily in premium and commercial fleets where safety compliance is a priority. Local governments are gradually adopting smart mobility programs that may strengthen future adoption. Partnerships between global automakers and regional distributors further expand availability of recognition systems. While growth is slower compared to North America and Asia, Latin America presents untapped opportunities in urban centers.

Middle East & Africa

The Middle East & Africa represents less than 5% of the market but shows rising potential. Gulf countries such as the UAE and Saudi Arabia invest heavily in smart city infrastructure, supporting intelligent traffic management systems. It benefits from demand for premium vehicles equipped with advanced safety features, which often include recognition systems. South Africa demonstrates growing adoption through pilot projects in intelligent transportation. Broader market growth is limited by the absence of strict regulatory mandates and the high cost of advanced automotive systems. However, urbanization and investments in road modernization create long-term opportunities. Recognition adoption in the region is expected to increase gradually as infrastructure development continues.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hyundai

- Hitachi Automotive Systems

- Continental

- Ford

- Bosch

- Hella

- General Motors

- HERE Technologies

- Denso

- Audi

Competitive Analysis

The Traffic Signal Recognition Market players such as Hyundai, Hitachi Automotive Systems, Continental, Ford, Bosch, Hella, General Motors, HERE Technologies, Denso, and Audi. The Traffic Signal Recognition Market is highly competitive, shaped by rapid technological innovation and evolving safety regulations. Companies invest in advanced sensors, AI-based software, and vehicle-to-infrastructure connectivity to improve accuracy and reliability. It demands strong collaboration across automotive manufacturers, technology providers, and mapping platforms to deliver integrated solutions. Rising consumer demand for ADAS features in both premium and mid-range vehicles drives steady market expansion. Competition also intensifies through continuous R&D spending, regional partnerships, and compliance with strict safety standards. This dynamic environment pushes firms to differentiate through performance, cost efficiency, and adaptability to diverse traffic conditions.

Recent Developments

- In March 2025, Volkswagen expanded collaboration with Valeo and Mobileye to bring Level-2 Plus automation to future MQB models, adding 360° camera and radar arrays for hands-free driving and smart parking.

- In January 2025, Aurora, Continental, and NVIDIA formed a strategic alliance to commercialize driverless trucks on the NVIDIA DRIVE Thor SoC, with series production targeted for 2027.

- In October 2023, Kimley-Horn announced the new development of Traction Priority, a cloud-based signal control software designed for comprehensive data integration. This new innovation employs GPS data from several units like buses, trucks, and even emergency response equipment so that priority signaling can be conducted in a ‘first come, first served’ manner.

- In July 2023, Mobileye integrated its Vision-Only Intelligent Speed Assist (ISA) system as a new product that enables compliance with new EU laws that came into effect mandating that all new IC engine automobiles must come equipped with speed limiters. This application uses high-level cameras to assess speed limitations and assist drivers to within real-time.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with higher adoption of advanced driver-assistance systems in vehicles.

- Demand will rise as governments enforce stricter safety regulations worldwide.

- Automakers will integrate recognition systems into mid-range vehicles for broader accessibility.

- AI and machine learning will improve accuracy in complex traffic environments.

- Cloud-based updates will support real-time adaptability of recognition systems.

- Growth will strengthen with smart city projects and connected infrastructure deployment.

- Aftermarket solutions will gain traction for retrofitting older vehicles.

- Regional adoption will vary, with Asia-Pacific leading long-term expansion.

- Partnerships between automakers and technology firms will drive faster innovation.

- Continuous focus on safety and automation will keep recognition systems a core automotive feature.