Market Overview:

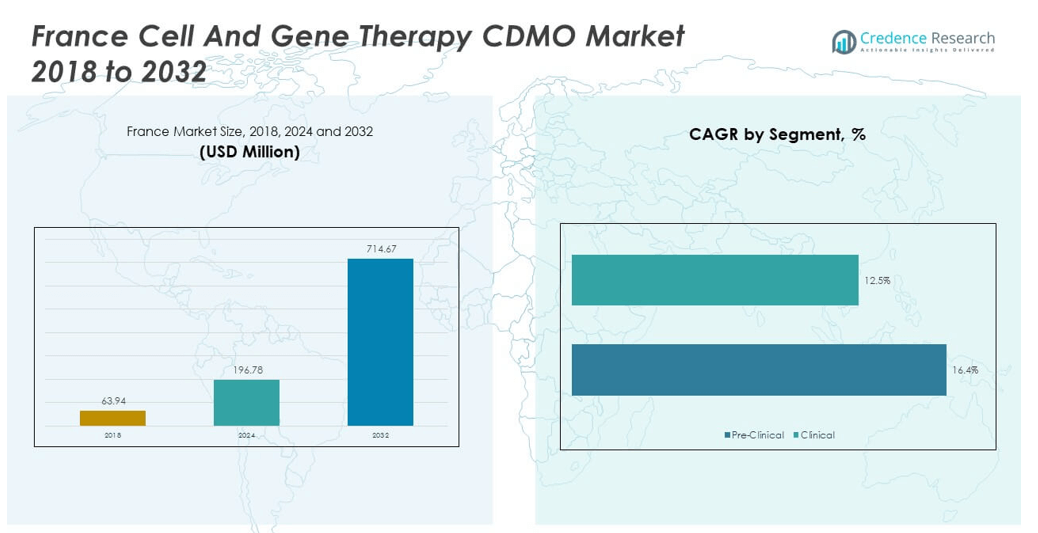

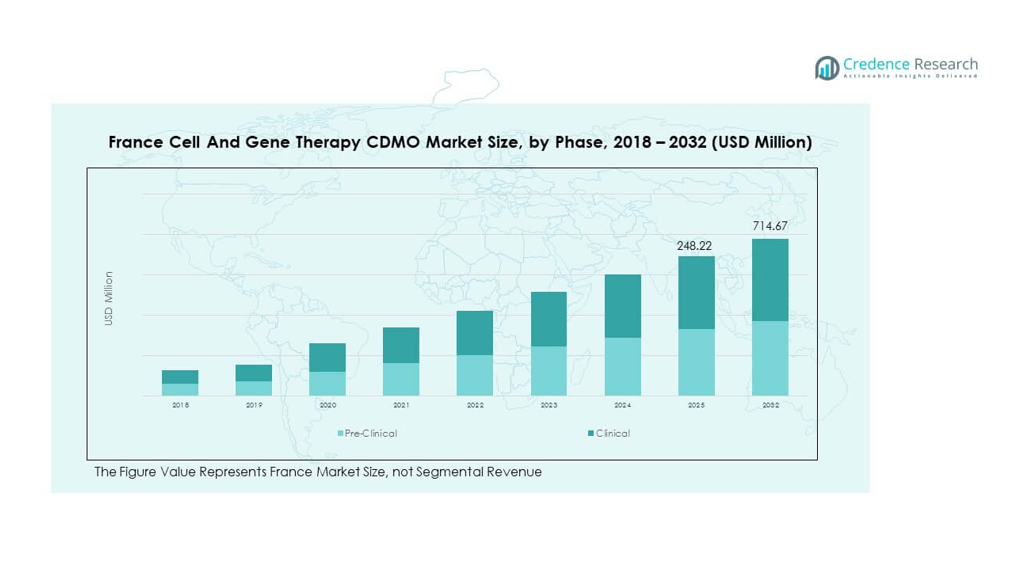

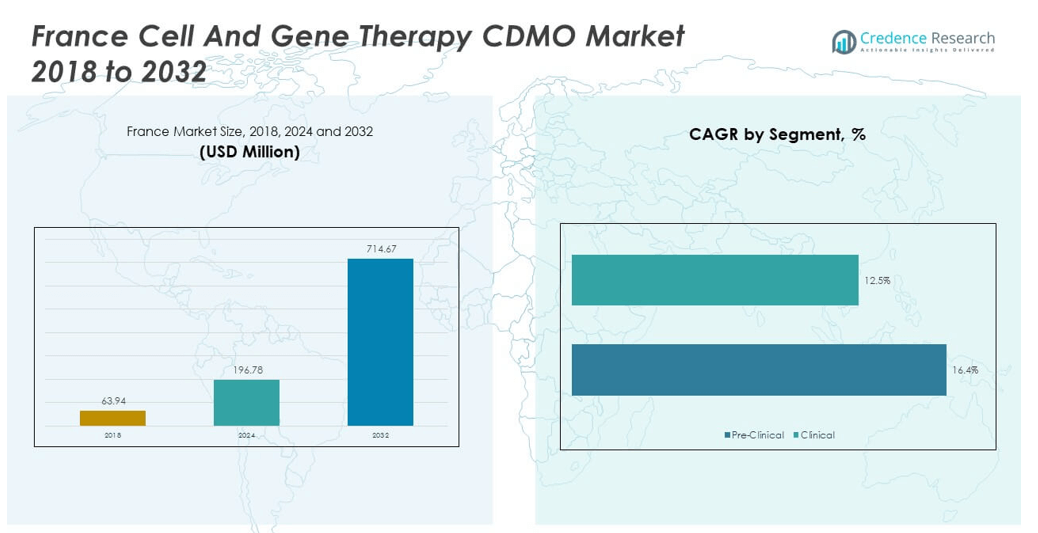

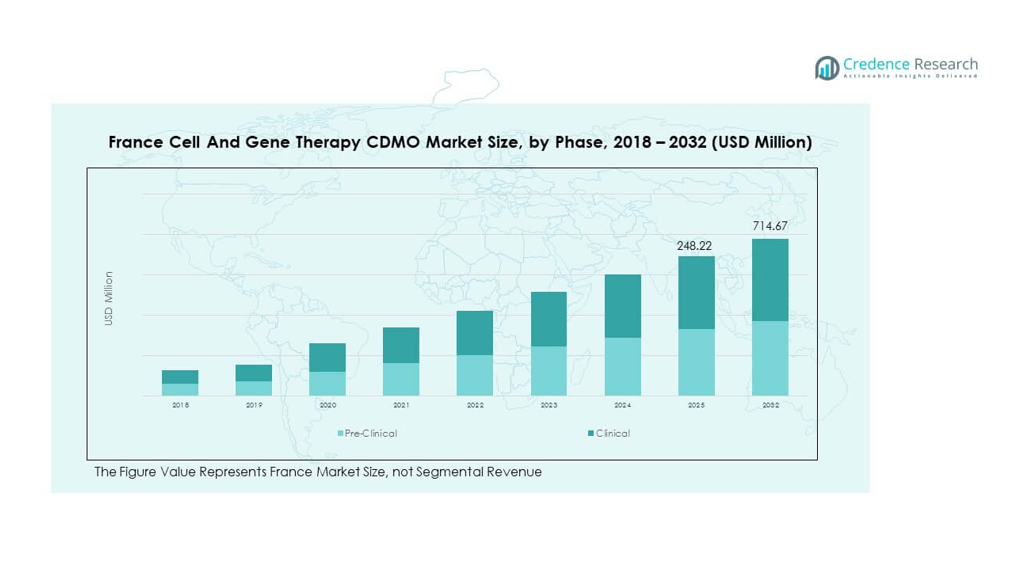

The France Cell and Gene Therapy CDMO Market size was valued at USD 63.94 million in 2018 to USD 196.78 million in 2024 and is anticipated to reach USD 714.67 million by 2032, at a CAGR of 16.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Cell and Gene Therapy CDMO Market Size 2024 |

USD 196.78 million |

| France Cell and Gene Therapy CDMO Market, CAGR |

16.31% |

| France Cell and Gene Therapy CDMO Market Size 2032 |

USD 714.67 million |

The market is expanding rapidly, driven by rising demand for advanced therapies targeting rare and chronic diseases. Increased investments in R&D, coupled with favorable government support for regenerative medicine, are accelerating development. Pharmaceutical and biotech companies are outsourcing to CDMOs to reduce costs, improve efficiency, and access specialized expertise in viral vector manufacturing and gene-editing technologies. The growing clinical pipeline of cell and gene therapies in France further boosts outsourcing demand, positioning CDMOs as strategic partners in advancing innovation and commercialization.

Geographically, France remains a strong hub within Europe, supported by its advanced healthcare infrastructure and skilled workforce. Neighboring countries like Germany and the UK also lead in research and manufacturing, strengthening the regional ecosystem. Emerging markets in Eastern Europe are beginning to attract attention due to lower operating costs and supportive policies, although they lack the established expertise of Western Europe. France’s position is further enhanced by collaborations with global biotech firms and strategic partnerships with academic institutions, solidifying its role as a key player in the European cell and gene therapy landscape.

Market Insights:

- The France Cell and Gene Therapy CDMO Market grew from USD 63.94 million in 2018 to USD 196.78 million in 2024 and is projected to reach USD 714.67 million by 2032, reflecting a CAGR of 16.31%.

- Western France led with 42% share in 2024, supported by strong biopharma clusters; Northern France followed with 35%, driven by advanced facilities; Southern and Central France held 23%, benefiting from targeted research investments.

- Northern France is the fastest-growing subregion, supported by government incentives, viral vector production capacity, and expanding clinical trial activity, strengthening its strategic role in Europe.

- Clinical phase held 78% share in 2024, reflecting strong outsourcing demand for late-stage trials and commercial readiness.

- Pre-clinical phase contributed 22% in 2024, underpinned by early-stage research projects and proof-of-concept studies requiring specialized CDMO expertise.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Advanced Therapeutics in Rare and Chronic Disease Segments

The France Cell and Gene Therapy CDMO Market is growing because of the increasing demand for treatments addressing rare and chronic conditions. Pharmaceutical and biotech firms are outsourcing complex projects to CDMOs to accelerate product development and secure faster regulatory approvals. The rising number of patients with genetic disorders is creating demand for scalable cell and gene therapies. Government initiatives supporting advanced therapies are fueling investment into specialized facilities. CDMOs provide expertise in viral vectors, gene editing, and clinical-grade manufacturing that large pharma depends upon. Collaborations with academic institutions are further pushing innovation across therapeutic applications. Hospitals and research centers are driving clinical studies, which increases outsourcing needs. The market benefits from a growing therapeutic pipeline seeking commercial readiness.

Strong Government and Institutional Support for Biomanufacturing Infrastructure

The government is playing a central role in shaping the CDMO ecosystem through supportive frameworks and funding schemes. Public-private partnerships are creating an innovation-friendly environment for scaling advanced therapies. Regulatory bodies in France have provided streamlined approval pathways, improving development timelines. Investments in biomanufacturing parks are strengthening infrastructure capacity across multiple therapy areas. The France Cell and Gene Therapy CDMO Market is benefiting from research-focused initiatives across oncology, rare diseases, and regenerative medicine. Academic collaborations with international partners are bringing expertise that strengthens domestic capabilities. Institutional support ensures that companies can access grants and research funding to expand. It allows emerging CDMOs to compete on quality, compliance, and scalability.

- For example, in 2023, the French government advanced its France 2030 strategy by committing €800 million to biotherapies and biomanufacturing. By mid-2024, €338 million had been allocated to 86 projects aimed at strengthening health-related bioproduction capacity. This initiative is supported by programs such as France Biolead, which coordinates public and private stakeholders to expand infrastructure, accelerate innovation, and boost the country’s competitiveness in advanced therapy manufacturing.

Expanding Outsourcing to Meet Rising Complexity in Manufacturing Processes

Pharma and biotech companies are facing significant challenges in manufacturing complex therapies, leading to higher outsourcing levels. It enables firms to leverage CDMOs for specialized viral vector production and complex supply chain management. France’s CDMOs are gaining attention for their expertise in scaling laboratory results into commercial-grade manufacturing. The France Cell and Gene Therapy CDMO Market benefits from this shift as developers prefer strategic partnerships over in-house expansions. This trend reduces costs and shortens timelines for clinical projects, creating stronger reliance on CDMOs. Increasingly complex therapies require process optimization and regulatory alignment, which CDMOs deliver effectively. Global players are also forming joint ventures with French firms to enhance operational reach. This outsourcing model strengthens domestic and international competitiveness.

Integration of Advanced Technology Platforms Across Therapeutic Development

The market is experiencing rapid integration of advanced technologies across production and analytics stages. Digital platforms improve consistency in cell expansion, viral transduction, and quality assurance. Artificial intelligence is driving predictive modeling to reduce trial failures and optimize processes. It is enabling CDMOs to provide tailored solutions that align with strict regulatory frameworks. The France Cell and Gene Therapy CDMO Market benefits from these technological upgrades by attracting global partners seeking innovation. Automation systems are reducing manual handling, lowering contamination risks, and improving scalability. Advanced analytics support real-time monitoring and faster batch releases. These upgrades enhance cost efficiency, compliance, and therapeutic performance across the entire development pipeline.

- For example, LFB Biomanufacturing’s industrial site in Alès, France, has maintained U.S. FDA approval since 2020 and successfully passed its most recent inspection in 2022, affirming its compliance with international GMP standards. The facility employs state-of-the-art single-use technologies and flexible equipment, and it holds approvals from ANSM, EMA, and the FDA, supporting clinical and commercial bioproduction of monoclonal antibodies and therapeutic proteins.

Market Trends

Increasing Adoption of Modular and Flexible Manufacturing Facilities

The market is shifting towards modular and flexible infrastructure to meet dynamic production demands. It supports small and large batch runs, accommodating varied clinical trial requirements. Modular cleanroom facilities allow faster adjustments to regulatory needs and therapy-specific processes. The France Cell and Gene Therapy CDMO Market is evolving with facilities designed for adaptability and shorter timelines. This trend reflects the growing importance of personalized medicine and rapid clinical development cycles. CDMOs are focusing on plug-and-play infrastructure for viral vector and CAR-T therapy production. Flexible systems also reduce investment risks and improve scalability for diverse therapeutic portfolios. These developments enhance competitiveness in both domestic and international markets.

- For instance, Yposkesi, an SK Pharmteco company, inaugurated a 10,000 m² viral vector manufacturing facility in Corbeil-Essonnes, France. The site includes six upstream and two downstream cleanrooms, tripling bioreactor capacity from 2,000 L to 7,000 L. It can produce up to 12,000 vials annually across 75 batches, making it the largest viral vector CDMO operation in France.

Growing Strategic Collaborations with Global and Regional Biopharma Leaders

Collaborations between French CDMOs and international biopharma firms are strengthening the market’s ecosystem. Strategic alliances are enhancing knowledge transfer, funding access, and global visibility. The France Cell and Gene Therapy CDMO Market is gaining recognition as a partner in large-scale projects across oncology and rare disease therapies. Such collaborations expand expertise in areas like immunotherapy and advanced gene editing. Global partnerships are also opening opportunities for French CDMOs in North American and Asian markets. It provides access to broader patient pools and advanced clinical trial networks. Academic alliances continue to drive technology transfers and collaborative research output. These partnerships ensure CDMOs remain at the forefront of innovation.

Rising Emphasis on Personalized and Precision Medicine Approaches

The market is increasingly influenced by the shift towards personalized and precision medicine solutions. It drives demand for customized manufacturing processes that can adapt to unique patient needs. Personalized therapies require flexible viral vector platforms and highly controlled environments. The France Cell and Gene Therapy CDMO Market is aligning with this trend by investing in adaptable technology. CDMOs are prioritizing patient-specific solutions for oncology and regenerative therapies. Smaller batch sizes are becoming common, requiring more efficient process controls. Personalized medicine encourages stronger collaboration between hospitals, researchers, and CDMOs. This focus is reshaping production frameworks to serve highly targeted therapies.

- For example, in November 2023, Cell-Easy and Toulouse University Hospital received approval for a first-in-human trial using allogeneic adipose-derived mesenchymal stem cells (ASCs) to treat systemic sclerosis. The company’s GMP-compliant process can generate over 5,000 clinical doses from a single donor and lowers manufacturing costs by twenty-fold. This scalable approach supports advanced therapies for rare and severe conditions.

Increased Focus on Quality, Compliance, and Regulatory Standardization

The regulatory landscape is placing greater emphasis on harmonized compliance standards across Europe. The France Cell and Gene Therapy CDMO Market is responding by strengthening quality assurance frameworks. It involves advanced validation, GMP certification, and real-time monitoring systems. The demand for transparent supply chains and traceability in biologics manufacturing is rising. CDMOs are adopting global quality benchmarks to attract multinational partnerships. Enhanced compliance frameworks improve investor confidence and market credibility. Process monitoring technologies ensure higher levels of consistency and safety. This trend reinforces France’s position as a trusted hub for clinical and commercial manufacturing.

Market Challenges Analysis

High Manufacturing Costs and Limited Availability of Specialized Resources

The France Cell and Gene Therapy CDMO Market faces a key challenge with high production costs. It requires specialized bioreactors, viral vector platforms, and cleanroom facilities that demand heavy investment. Many smaller CDMOs struggle to secure capital for scaling operations. The availability of skilled professionals in cell biology, immunology, and gene editing is also limited. Training costs further add to financial burdens, delaying development schedules. Cost-intensive supply chains make large-scale projects harder to sustain without long-term contracts. The financial gap between early-stage firms and global CDMOs remains a barrier. This challenge slows growth for emerging players in the French ecosystem.

Complex Regulatory Landscape and Operational Risks Impacting Scalability

Regulatory frameworks are strict, and compliance failures can lead to costly delays. It complicates timelines for clinical and commercial development, particularly in advanced therapies. Global clients often demand harmonized compliance, creating pressure on French CDMOs to adapt. The France Cell and Gene Therapy CDMO Market faces risk from evolving EU regulations and GMP requirements. Operational risks such as contamination or process deviations add further challenges. Infrastructure upgrades are mandatory to maintain global competitiveness. Smaller firms often lack the resources to keep pace with technological and regulatory changes. These barriers create long-term scalability issues that need systematic resolution.

Market Opportunities

Expansion of Clinical Trials and Growing Demand for Commercial-Scale Outsourcing

The rising number of clinical trials across oncology, rare diseases, and regenerative therapies is creating opportunities for CDMOs. The France Cell and Gene Therapy CDMO Market benefits from companies seeking commercial-scale production for late-stage products. It allows CDMOs to position themselves as strategic partners in regulatory submissions and product launches. Growing interest in outsourcing supports CDMOs in achieving steady long-term contracts. Clinical partnerships with hospitals and universities also drive collaborative growth. Outsourcing models reduce costs while ensuring advanced expertise in regulatory alignment. This creates significant opportunities for expanding services and strengthening global partnerships.

Adoption of Emerging Technologies and Investment in Next-Generation Platforms

Opportunities are expanding with the adoption of automation, AI-driven process monitoring, and digital twins in manufacturing. The France Cell and Gene Therapy CDMO Market can leverage these platforms to attract global partners and investors. It enables companies to deliver greater precision, efficiency, and compliance. Next-generation viral vectors and gene-editing technologies offer expansion avenues across therapeutic segments. CDMOs adopting these solutions position themselves as leaders in innovation. Investors are actively supporting firms that demonstrate strong technological integration. These opportunities provide a pathway for long-term competitiveness in global biomanufacturing networks.

Market Segmentation Analysis:

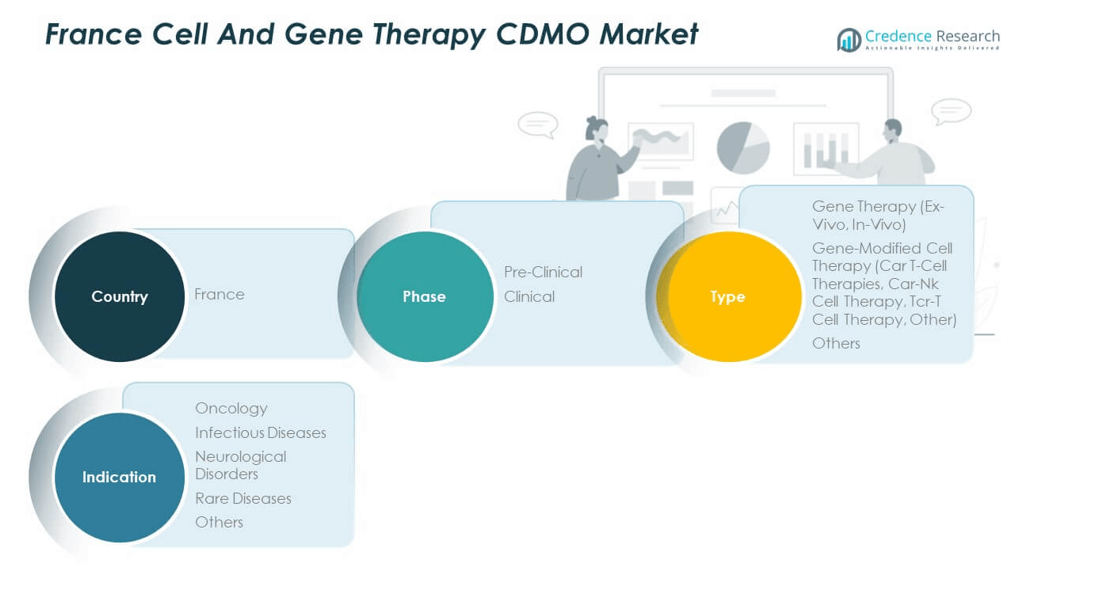

The France Cell and Gene Therapy CDMO Market is segmented

By phase into pre-clinical and clinical. The pre-clinical segment focuses on early-stage research and proof-of-concept studies, requiring specialized small-scale manufacturing and regulatory guidance. Clinical phase demand is higher, with CDMOs supporting large-scale production, process optimization, and compliance for late-stage trials. The clinical segment holds a dominant share due to strong outsourcing needs from biopharma companies preparing therapies for commercialization.

- For example, CellProthera selected CELLforCURE by SEQENS in May 2025 as its CDMO partner for the Phase III GMP manufacturing of ProtheraCytes®, an autologous expanded CD34⁺ stem cell therapy targeting improved heart failure outcomes. The company will transfer its bioproduction technology to the specialized ANSM-approved facility this year, aiming to produce clinical batches starting in 2026. This partnership strengthens capacity for late-stage, regulatory-grade cell therapy production.

By type, the market includes gene therapy and gene-modified cell therapy. Gene therapy is divided into ex-vivo and in-vivo approaches, each requiring distinct manufacturing capabilities. Ex-vivo methods involve genetic modification outside the body, often applied in rare disease treatment, while in-vivo techniques deliver genetic material directly into patients. Gene-modified cell therapy remains a fast-growing segment, driven by CAR T-cell therapies, CAR-NK cell therapy, TCR-T cell therapy, and others. It is gaining momentum due to rising oncology applications and growing adoption of immunotherapies. Other therapies contribute to niche areas but remain secondary in revenue generation.

By indication, the market is segmented into oncology, infectious diseases, neurological disorders, rare diseases, and others. Oncology holds the largest share, driven by strong demand for CAR-T therapies targeting hematologic cancers. Infectious diseases are expanding due to advancements in viral vector platforms. Neurological disorders are emerging as a promising segment with ongoing research in gene-based treatments. Rare diseases are a critical focus, with CDMOs supporting therapies addressing unmet medical needs. Other indications contribute to incremental demand but remain less dominant in the overall market landscape.

- For example, Genethon leads multiple rare disease gene therapy programs; as of 2024, it has 12 products in clinical trials and one on the market, with many therapies focused on unmet pediatric and ultra-rare disorders.

Segmentation:

By Phase

By Type

- Gene Therapy

- Gene-Modified Cell Therapy

- CAR T-Cell Therapies

- CAR-NK Cell Therapy

- TCR-T Cell Therapy

- Others

- Others

By Indication

- Oncology

- Infectious Diseases

- Neurological Disorders

- Rare Diseases

- Others

Regional Analysis:

Western France – Leading Biopharma and Research Hub

Western France accounts for 42% of the France Cell and Gene Therapy CDMO Market, supported by strong biopharmaceutical clusters and advanced research institutions. It benefits from the presence of major CDMOs and universities that collaborate on cell and gene therapy development. Manufacturing infrastructure in this subregion is well-established, enabling large-scale clinical and commercial production. It attracts international partnerships due to its robust compliance standards and skilled workforce. Government-backed innovation zones further strengthen its role in advanced therapy research. Western France continues to expand capacity to meet rising demand for oncology and rare disease therapies. Its leadership position is reinforced by long-term collaborations with multinational biopharma companies.

Northern France – Expanding Manufacturing and Clinical Trial Activity

Northern France represents 35% of the market share, driven by increasing investments in biomanufacturing facilities and clinical trial centers. It serves as a key hub for viral vector production and advanced therapy logistics. The France Cell and Gene Therapy CDMO Market in this subregion benefits from government incentives that support expansion projects. It has become attractive to international CDMOs seeking access to European patient populations and trial networks. Northern France is also developing academic-industry alliances to accelerate innovation in gene-modified cell therapies. It maintains competitive advantages through specialized infrastructure and cost-efficient production environments. Its role is strengthening as companies prioritize regional diversification of supply chains.

Southern and Central France – Emerging Growth Subregions with Targeted Investments

Southern and Central France collectively account for 23% of the market, showing steady growth supported by targeted investments in specialized facilities. These subregions are developing expertise in neurological and infectious disease therapy research. The France Cell and Gene Therapy CDMO Market in this area is smaller but demonstrates strong potential for expansion. It benefits from growing collaborations between regional hospitals and biotech firms working on rare disease therapies. Emerging CDMOs are focusing on niche therapeutic applications and early-stage projects. It positions these subregions as future contributors to the national cell and gene therapy ecosystem. Long-term prospects are positive, with expanding research programs and supportive policy frameworks fostering sustainable growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AGC Biologics

- WuXi Advanced Therapies

- Oxford Biomedica

- Novasep

- Recipharm

- CEVEC Pharmaceuticals

- Bayer AG

- Cell and Gene Therapy Catapult

- BioElpida

- Cell Medica

Competitive Analysis:

The France Cell and Gene Therapy CDMO Market is characterized by a competitive landscape with global leaders and domestic specialists shaping its direction. Major players such as AGC Biologics, WuXi Advanced Therapies, Oxford Biomedica, and Novasep hold significant positions through strong manufacturing capabilities and diversified service portfolios. These companies provide end-to-end solutions covering pre-clinical support, clinical manufacturing, and commercial-scale production, making them preferred partners for biopharma clients. It benefits from their expertise in viral vector platforms, CAR-T therapies, and regulatory alignment. Strategic mergers, acquisitions, and facility expansions are frequent as companies aim to strengthen European footprints. Domestic players including BioElpida and Recipharm contribute to market competitiveness by focusing on specialized capabilities and tailored services. They compete by offering flexibility in project management and advanced technologies for early-stage programs. The France Cell and Gene Therapy CDMO Market is witnessing rising collaborations between CDMOs, academic institutions, and research centers, which foster innovation and accelerate therapy development. It is also defined by increasing competition on quality, compliance, and scalability, as clients prioritize reliable partners for advanced therapy projects.

Recent Developments:

- In June 2025, CELLforCURE by SEQENS entered into a strategic partnership with Galapagos NV to manufacture the CD19 CAR T-cell therapy candidate GLPG5101 at its Les Ulis site in France. This collaboration is intended to support decentralized manufacturing for upcoming clinical trials targeting relapsed/refractory non-Hodgkin lymphoma. The deal may expand to additional cell therapy candidates in the Galapagos pipeline.

- In June 2025, eXmoor Pharma, a UK-based integrated cell and gene therapy CDMO, teamed up with Signadori Bio, a French oncology biotechnology company, to accelerate the development of a gene-modified monocyte-derived macrophage cell therapy for solid tumors. The partnership covers technology translation, process development, and GMP manufacturing support to advance Signadori Bio’s candidate toward first-in-human trials, leveraging both firms’ complementary strengths.

- In May 2025, CellProthera, a regenerative cell therapy developer based in Mulhouse, France, announced a strategic partnership with CELLforCURE by SEQENS to serve as its contract development and manufacturing organization (CDMO) partner for the Phase 3 clinical trial of its ProtheraCytes® autologous stem cell therapy.

- In January 2025, AGC Biologics entered into an alliance with Genenta to introduce an exclusive GMP suite at its Cell and Gene Center of Excellence in Milan, strengthening its offering for gene therapy manufacturing in Europe, directly impacting services available for French clients and the broader region.

Report Coverage:

The research report offers an in-depth analysis based on Phase, Type and Indication. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Cell and Gene Therapy CDMO Market will expand with rising adoption of advanced therapies targeting oncology and rare diseases.

- Outsourcing demand will strengthen as biopharma companies rely on CDMOs for complex clinical and commercial production.

- Increasing integration of automation and AI-driven systems will enhance efficiency, scalability, and compliance across manufacturing processes.

- Strong government and institutional support will encourage investment in biomanufacturing infrastructure and academic-industry collaborations.

- Global partnerships will continue to shape competitive dynamics, allowing French CDMOs to access wider markets and patient networks.

- Expansion of personalized and precision medicine will drive specialized manufacturing processes tailored to patient-specific therapies.

- Skilled workforce development and training programs will remain critical to meet technical and regulatory requirements.

- Modular and flexible facility design will support the rapid scaling of diverse therapies and clinical trial volumes.

- Rising focus on quality assurance and regulatory harmonization will enhance credibility and attract international clients.

- France’s strategic positioning in Europe will solidify its role as a hub for innovation, clinical research, and advanced manufacturing.