Market Overview:

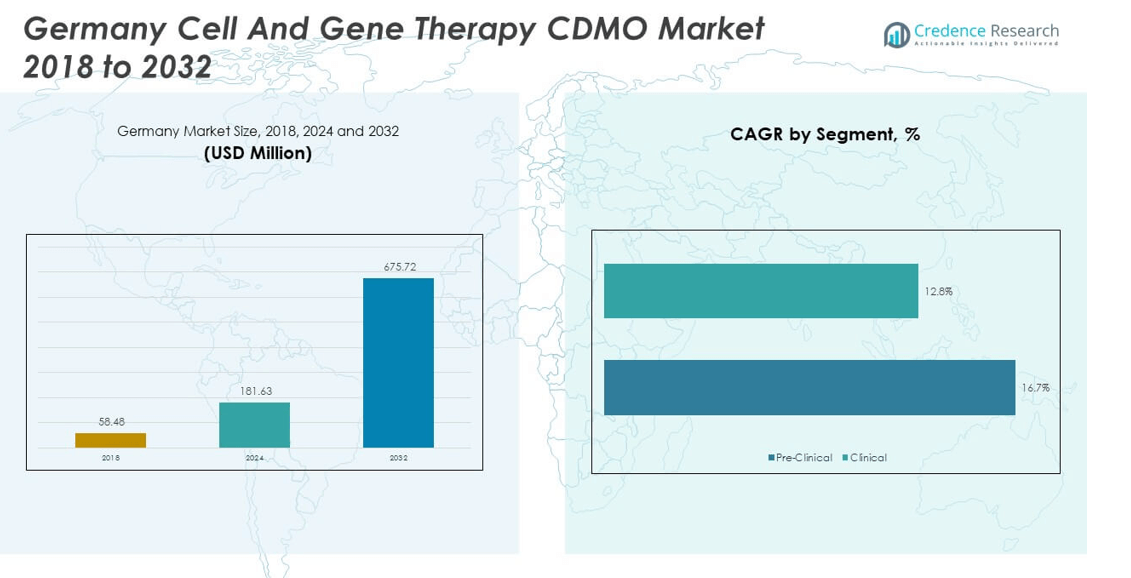

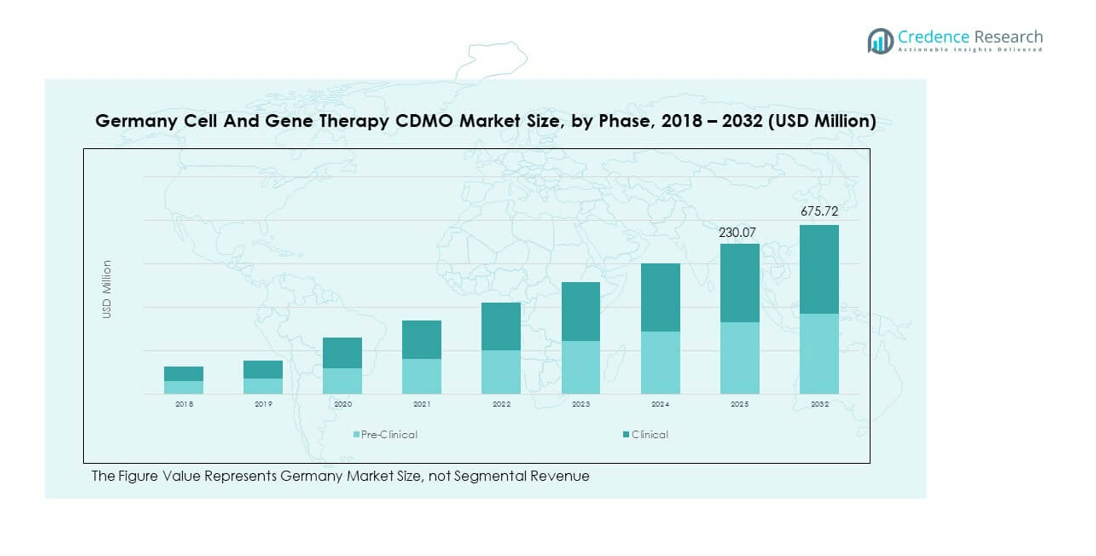

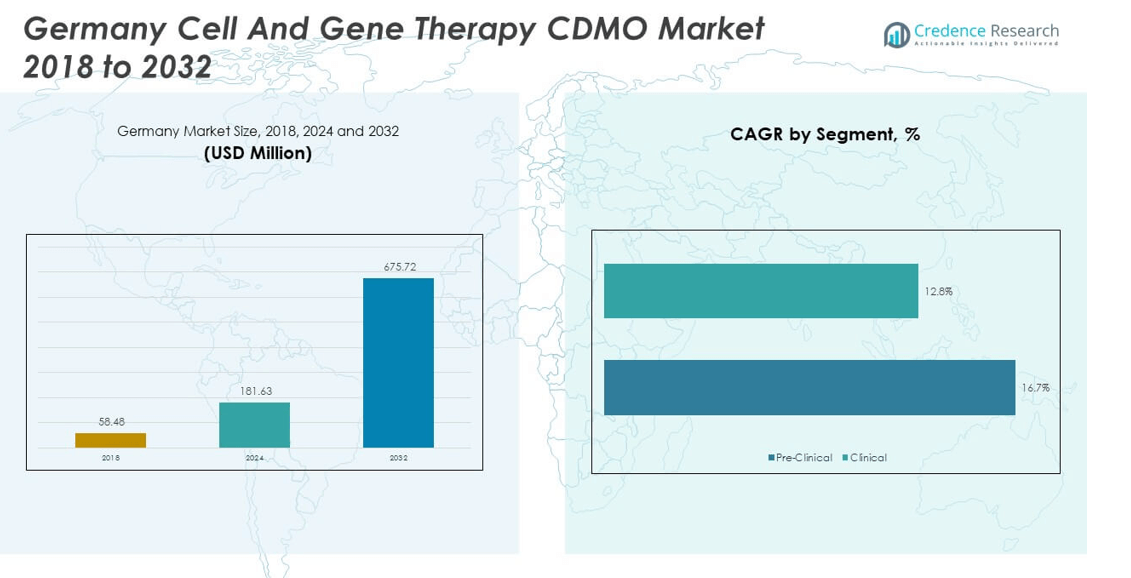

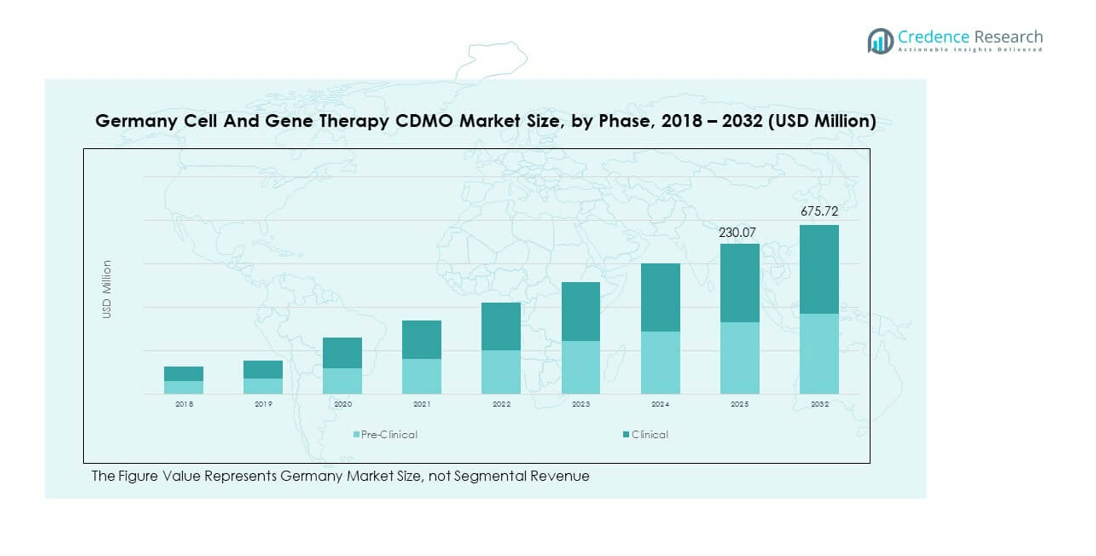

The Germany Cell and Gene Therapy CDMO Market size was valued at USD 58.48 million in 2018 to USD 181.63 million in 2024 and is anticipated to reach USD 675.72 million by 2032, at a CAGR of 16.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Cell and Gene Therapy CDMO Market Size 2024 |

USD 181.63 million |

| Germany Cell and Gene Therapy CDMO Market, CAGR |

16.64% |

| Germany Cell and Gene Therapy CDMO Market Size 2032 |

USD 675.72 million |

The growth of the market is supported by rising government initiatives and favorable regulatory frameworks that encourage advanced therapy development. Pharmaceutical companies and biotech firms are increasingly outsourcing manufacturing to CDMOs to reduce operational complexities and accelerate commercialization timelines. The need for specialized expertise, scalability, and cost efficiency further drives demand. In addition, increasing prevalence of genetic disorders, along with a growing pipeline of cell and gene therapies, positions CDMOs as vital enablers in bridging research to clinical and commercial-scale production.

Regionally, Germany holds a strong position within Europe due to its advanced healthcare infrastructure, established pharmaceutical industry, and supportive innovation ecosystem. Countries like the United Kingdom, Switzerland, and France also contribute significantly, benefiting from research excellence and regulatory support. Emerging Eastern European nations are gaining traction with expanding clinical trial activity and rising investments in biotech facilities. This geographic spread underscores Europe’s role as both a leading and diversifying hub for cell and gene therapy development, where mature markets drive innovation while emerging ones offer expansion opportunities.

Market Insights:

- The Germany Cell and Gene Therapy CDMO Market was valued at USD 58.48 million in 2018, reached USD 181.63 million in 2024, and is projected to hit USD 675.72 million by 2032, growing at a CAGR of 16.64%.

- Western Germany led with 42% share in 2024 due to strong pharmaceutical clusters, followed by Southern Germany at 31% with robust biotech ecosystems, and Northern Germany at 15% leveraging logistics and port access.

- Eastern Germany, holding 12% share, is the fastest-growing region, supported by academic collaborations, government-backed funding, and increasing small-to-mid CDMO participation.

- In 2024, the clinical phase segment dominated the market, accounting for nearly 72% of the total share, reflecting growing trial activity and commercial-scale production.

- The pre-clinical phase contributed the remaining 28%, providing essential early-stage research and development support for therapy pipelines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expanding Adoption of Advanced Therapies and Outsourcing Strategies

The Germany Cell and Gene Therapy CDMO Market benefits from the strong adoption of novel therapies targeting rare and chronic diseases. It is supported by increasing pharmaceutical and biotechnology investments directed toward specialized therapies. Rising demand for outsourcing services drives CDMOs to offer scalable and cost-effective solutions for clinical and commercial needs. Government initiatives and favorable reimbursement policies encourage therapy adoption, fostering CDMO reliance. Companies face fewer risks when shifting production responsibilities to CDMOs, accelerating product launch timelines. The expertise provided by CDMOs enhances compliance with complex regulatory requirements. This capability allows small and mid-sized firms to compete effectively in advanced therapies. The combination of innovation, supportive policies, and outsourcing demand strengthens the long-term outlook.

- For example, Rentschler Biopharma announced in 2024 an investment to expand its Laupheim, Germany site with a new four-story, 3,400 m² buffer media station. The facility will include advanced buffer and media tanks to enhance drug substance production, logistics, and scaling for complex biologics and advanced therapies.

Expanding Pipeline of Clinical Trials and Specialized Infrastructure Growth

The market growth is influenced by a rising number of clinical trials targeting genetic and cell-based treatments. It creates opportunities for CDMOs to manage manufacturing for diverse therapy stages. Investment in specialized facilities supports large-scale, regulatory-compliant production capabilities. The Germany Cell and Gene Therapy CDMO Market benefits from a robust clinical trial ecosystem backed by strong academic research. It provides access to early-stage therapies that later transition to commercial production. Increasing collaborations between research institutes and CDMOs enhance technical expertise and operational capacity. These partnerships enable faster scalability and improved efficiency for complex therapies. Continuous expansion of infrastructure positions CDMOs as critical players in bridging research with market-ready therapies.

Favorable Regulatory Environment and Quality Standards Development

Germany has developed strict but supportive regulatory guidelines for advanced therapies, driving CDMO involvement. It benefits companies by providing clear compliance pathways and ensuring product quality. CDMOs offer specialized knowledge in meeting regulatory requirements, reducing risks for clients. The Germany Cell and Gene Therapy CDMO Market reflects strong alignment between government oversight and industry innovation. It creates a framework where therapies can achieve approval with confidence in safety and efficacy. Rising emphasis on Good Manufacturing Practices (GMP) enhances the reliability of outsourced production. Strong national quality standards attract international clients seeking compliant manufacturing. This supportive framework strengthens CDMO credibility and expands their competitive positioning.

Rising Demand for Personalized Medicine and Targeted Treatment Solutions

Growing patient preference for therapies addressing unmet medical needs creates demand for CDMO expertise. It highlights the shift toward personalized medicine where therapies are tailored to genetic profiles. The Germany Cell and Gene Therapy CDMO Market benefits from this demand by offering adaptable solutions. It ensures scalable manufacturing capacity for therapies with specific patient populations. The demand for targeted therapies requires CDMOs to integrate advanced technologies. Clients rely on them to manage complex processes while ensuring cost efficiency. Growing precision in treatment delivery raises expectations for CDMO capabilities. This alignment between patient needs and technical expertise reinforces the expanding role of CDMOs.

- For example, BioNTech manufactures individualized mRNA cancer vaccine batches in Germany for its ongoing clinical trials, using patient-specific sequencing data to guide production. The company is advancing personalized medicine approaches that integrate next-generation sequencing with rapid vaccine manufacturing for oncology programs.

Market Trends:

Increasing Focus on Automation and Digital Manufacturing Platforms

Automation technologies are being integrated across production lines to enhance efficiency and quality. It reduces human error and ensures consistent outcomes across therapy batches. The Germany Cell and Gene Therapy CDMO Market reflects this transition with rapid adoption of digital platforms. It supports real-time monitoring, predictive analytics, and data-driven decision-making. Advanced automation allows scalability without compromising regulatory compliance. These technologies lower costs while improving turnaround times. Pharmaceutical clients favor CDMOs with integrated digital systems for complex manufacturing needs. This trend ensures a competitive edge for providers embracing Industry 4.0 solutions.

- For example, Ori Biotech and Fresenius Kabi announced on December 10, 2024, a collaboration in Germany to integrate Ori’s IRO® platform with Fresenius Kabi’s Cue® and Lovo® cell processing systems. This integration delivers a closed, end-to-end workflow that reduces manual handling, enhances efficiency, and supports scalable, modular cell and gene therapy manufacturing.

Growing Collaboration Between CDMOs and Research Institutes

Collaboration between academic research centers and CDMOs creates synergies in therapy development. It combines scientific innovation with scalable production expertise for clinical and commercial needs. The Germany Cell and Gene Therapy CDMO Market shows increasing reliance on such partnerships. It ensures that research outcomes transition effectively into market-ready therapies. Collaborative models reduce time-to-market and enhance resource utilization. Research institutions provide early-stage breakthroughs, while CDMOs supply industrial execution. These alliances create a sustainable pipeline for advanced therapies. The trend underlines the importance of knowledge sharing and joint development initiatives.

- For example, a consortium led by Charité – Universitätsmedizin Berlin and Bayer AG officially announced the Berlin Center for Gene and Cell Therapies (BC-GCT) in June 2024. The center will feature a start-up incubator with fully equipped laboratory spaces and a GMP-certified production facility to support the translation of research into clinical manufacturing in Germany.

Expansion of Global Client Base and International Service Demand

German CDMOs are gaining recognition beyond domestic markets, attracting global pharmaceutical firms. It reflects growing demand for reliable, high-quality, and compliant manufacturing services. The Germany Cell and Gene Therapy CDMO Market strengthens its position as a European hub. It supports multinational companies seeking production facilities with advanced capabilities. International clients value Germany’s strong regulatory alignment with global standards. This trend creates opportunities for CDMOs to expand their portfolio internationally. Cross-border partnerships foster knowledge transfer and innovation growth. The expansion of the client base enhances global competitiveness of local CDMOs.

Integration of Novel Technologies to Enhance Therapy Scalability

Emerging technologies such as single-use bioreactors and advanced cell processing systems shape the sector. It increases flexibility in manufacturing and reduces operational complexity. The Germany Cell and Gene Therapy CDMO Market demonstrates significant adoption of these innovative tools. It helps optimize production cycles for both small and large batches. Technology integration supports therapy scalability, addressing growing patient demand. Advanced systems improve process control, enhancing therapy consistency. Clients expect CDMOs to integrate novel tools to maintain competitiveness. This focus on innovation drives efficiency and supports future industry expansion.

Market Challenges Analysis:

Regulatory Complexity and Cost Pressures on Development

The Germany Cell and Gene Therapy CDMO Market faces challenges linked to regulatory complexity and rising compliance costs. It requires CDMOs to maintain stringent quality standards and adapt to evolving global guidelines. Meeting these requirements often increases operational expenses, reducing profit margins. Companies struggle to balance compliance with efficiency while keeping therapy prices competitive. Small and mid-sized firms face particular difficulty accessing high-quality CDMO services under strict cost structures. It increases reliance on larger players with established resources. High operational costs also limit market entry for emerging CDMOs. Regulatory pressures remain one of the most significant challenges shaping the industry.

Limited Skilled Workforce and Technological Adaptation Barriers

Another challenge is the shortage of skilled professionals capable of handling complex cell and gene therapy processes. The Germany Cell and Gene Therapy CDMO Market depends on advanced scientific expertise, which is limited in supply. It forces CDMOs to invest heavily in training and talent acquisition. Workforce shortages create bottlenecks in scaling production to meet market demand. Technological adaptation also remains difficult, requiring continuous investment in innovation. Smaller CDMOs often lack capital to adopt cutting-edge platforms. This gap slows competitive growth and widens the divide between established and emerging providers. Addressing talent and technology barriers will be critical for sustained industry growth.

Market Opportunities:

Expansion into Emerging Therapeutic Areas and Novel Applications

The Germany Cell and Gene Therapy CDMO Market has opportunities linked to emerging therapeutic areas, including oncology, neurology, and rare diseases. It offers CDMOs the chance to expand their service portfolios and attract diverse clients. The growing prevalence of genetic disorders creates consistent demand for advanced therapy solutions. CDMOs can establish partnerships with biotech firms exploring innovative applications. It strengthens their market position while diversifying revenue streams. Emerging fields such as regenerative medicine further widen the potential. Access to new therapeutic domains ensures long-term relevance. Strategic positioning in these areas drives innovation and growth.

Strategic Partnerships and Global Expansion of Service Models

Opportunities also lie in forming strategic partnerships with pharmaceutical companies and research organizations. The Germany Cell and Gene Therapy CDMO Market can leverage alliances to expand capacity and expertise. It enables CDMOs to secure long-term contracts and ensure consistent demand. Global expansion provides further opportunities, with rising demand across developed and emerging regions. CDMOs can extend service models internationally while benefiting from strong German credibility. These opportunities strengthen competitive advantage through collaborative growth. It fosters innovation through knowledge sharing and joint product development. Expansion and partnerships create a sustainable growth pathway for the industry.

Market Segmentation Analysis:

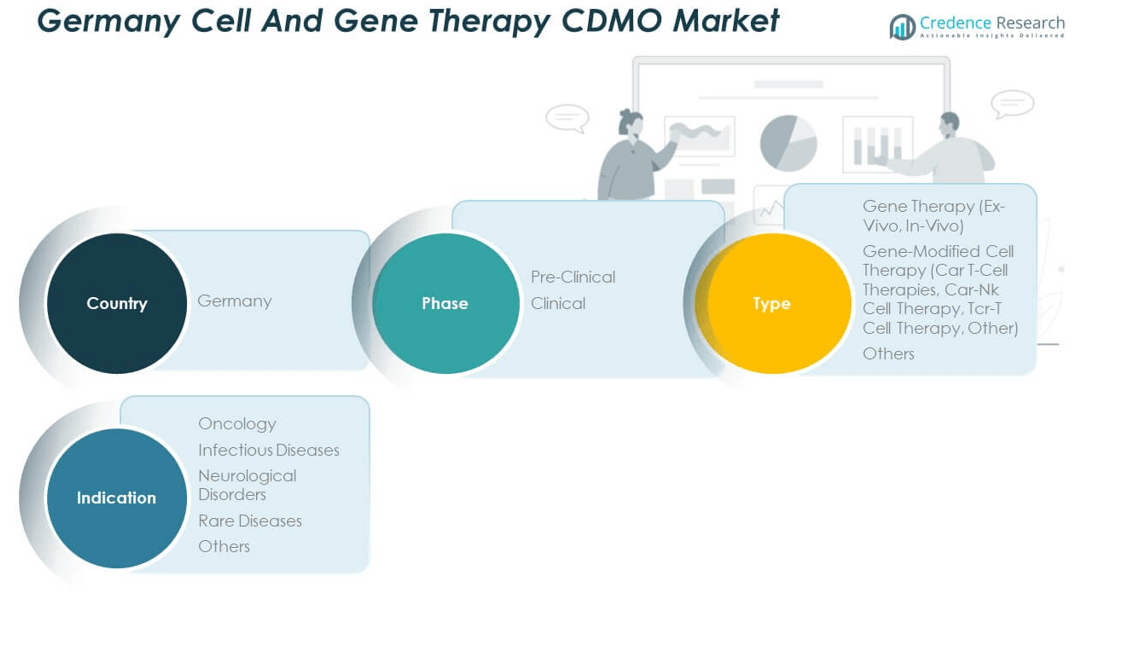

By phases, the Germany Cell and Gene Therapy CDMO Market demonstrates strong growth across different phases, with clinical services holding the dominant share. It benefits from rising numbers of clinical trials and increasing demand for scalable, compliant production facilities. Pre-clinical services also remain essential, offering early-stage support and specialized expertise for novel therapies entering pipelines. This phase enables companies to transition smoothly toward regulatory approval and commercial-scale production.

- For example, Pluri Inc. launched its PluriCDMO™ division in January 2024, operating a 47,000 square-foot GMP-certified cell therapy facility in Haifa, Israel. It offers pre-clinical through late-stage clinical cell therapy manufacturing using a proprietary 3D bioreactor system.

By type, gene therapy represents a critical segment, with both ex-vivo and in-vivo approaches gaining attention. Ex-vivo therapies are driven by their precision in modifying patient-derived cells, while in-vivo approaches expand adoption through direct genetic delivery methods. Gene-modified cell therapies remain highly significant, particularly CAR T-cell therapies, which lead adoption in oncology. CAR-NK and TCR-T therapies are emerging areas with growing investment. Other therapy types also provide opportunities for niche treatment solutions.

- For instance, in June 2024, researchers at Hannover Medical School (MHH), Germany, performed successful ex vivo genetic engineering of donor hearts using lentiviral vectors during normothermic perfusion. This method achieved sustained genetic modification with class I and II antigen expression reduced by 66% and 76% respectively in vascular endothelium without tissue injury.

By indication, oncology dominates due to the high prevalence of cancer and strong therapeutic pipeline demand. It continues to drive investment in manufacturing solutions that ensure speed, safety, and scalability. Infectious diseases represent a notable segment as companies explore gene therapies for conditions with limited treatments. Neurological disorders and rare diseases also contribute strongly, reflecting unmet medical needs and high patient expectations. Other indications provide opportunities for innovative applications, expanding CDMO service relevance. Together, these segments highlight the market’s diversified growth potential and reinforce its critical role in advancing advanced therapy development.

Segmentation:

By Phase

By Type

- Gene Therapy

- Gene-Modified Cell Therapy

- CAR T-Cell Therapies

- CAR-NK Cell Therapy

- TCR-T Cell Therapy

- Others

- Others

By Indication

- Oncology

- Infectious Diseases

- Neurological Disorders

- Rare Diseases

- Others

Regional Analysis:

Western Germany holds the leading position in the Germany Cell and Gene Therapy CDMO Market with a market share of 42%. The region benefits from advanced healthcare infrastructure, strong pharmaceutical clusters, and a concentration of CDMO facilities. It attracts both domestic and international companies seeking access to established supply chains and research expertise. The presence of large multinational firms strengthens collaboration and supports clinical-to-commercial scale manufacturing. It provides consistent demand through academic partnerships and hospital networks. The western region sets the benchmark for quality, compliance, and innovation in advanced therapy production.

Southern Germany accounts for 31% of the market share, reflecting strong biotech ecosystems and specialized research institutions. The region has invested in high-capacity manufacturing and GMP-compliant facilities. It offers robust support for both clinical and commercial projects in gene and cell therapy. Companies rely on southern Germany for technical know-how and skilled workforce availability. It also benefits from government-backed innovation initiatives aimed at fostering life sciences growth. The concentration of mid-sized CDMOs creates a competitive and diverse environment, supporting global partnerships. This makes the region a strong hub for specialized therapy development and contract manufacturing.

Northern and Eastern Germany collectively represent 27% of the Germany Cell and Gene Therapy CDMO Market, with northern Germany holding 15% and eastern Germany 12%. Northern Germany leverages port access and logistics capabilities to support international trade in advanced therapies. It is developing as an emerging hub for CDMO services through rising investments and expanding biotech clusters. Eastern Germany contributes through academic collaborations and government funding programs that promote biotechnology growth. It shows potential for expansion with increasing interest from small and mid-sized CDMOs. Both subregions complement the dominance of western and southern hubs, ensuring balanced national growth. Together, they play a vital role in expanding Germany’s overall competitiveness in advanced therapy manufacturing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Germany Cell and Gene Therapy CDMO Market is shaped by a mix of global leaders and specialized domestic firms. Key players such as AGC Biologics, WuXi Advanced Therapies, Oxford Biomedica, and Recipharm strengthen their positions through large-scale capacity, advanced technology, and international networks. It benefits from the presence of German-based firms like CEVEC Pharmaceuticals and Bayer AG, which focus on innovation, regulatory compliance, and regional expertise. These companies invest heavily in viral vector manufacturing, GMP-certified facilities, and advanced cell processing platforms to support complex therapy development. The market reflects intense competition where partnerships, mergers, and geographic expansion define strategic growth. It encourages CDMOs to diversify service offerings, ranging from pre-clinical support to full commercial-scale manufacturing. Companies differentiate through flexibility, speed to market, and integration of digital manufacturing solutions. Mid-sized and niche CDMOs gain relevance by providing specialized services, particularly in CAR-T and rare disease therapies. Competitive pressures push firms to expand infrastructure and secure long-term contracts with biotech and pharmaceutical clients. The balance between large multinational CDMOs and focused regional providers strengthens Germany’s role as a key hub for advanced therapy manufacturing, ensuring the sector remains dynamic and innovation-driven.

Recent Developments:

- In May 2025, WuXi Advanced Therapies underwent a strategic merger where its U.S. and U.K. operations were combined with Minaris Regenerative Medicine to form Minaris Advanced Therapies. This newly formed organization now delivers cell therapy manufacturing and testing across North America, Europe (including Munich), and Asia-Pacific, producing clinical-stage and commercial products globally and serving over 27 commercial products with expertise in viral vectors and cell therapies.

- In April 2025, AGC Biologics announced the launch of its new Cell and Gene Technologies Division, designed to elevate existing capabilities and expand support for advanced therapy developers globally. The division, headquartered at the Milan Cell and Gene Center of Excellence, offers integrated end-to-end services, including proprietary cell therapy and viral vector platforms, commercial-scale manufacturing, and a dedicated R&D team.

- In February 2025, Swarm Oncology Ltd. entered into a strategic partnership with Cellex Cell Professionals GmbH, a leading cell and gene therapy CDMO based in Cologne, Germany. The partnership aims to accelerate the clinical development and manufacturing of Swarm’s innovative T cell therapies for solid cancers.

Report Coverage:

The research report offers an in-depth analysis based on Phase, Type and Indication. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Cell and Gene Therapy CDMO Market will see strong expansion driven by increasing clinical trial activity.

- Demand for personalized medicine will strengthen CDMO relevance across diverse therapeutic areas.

- Advanced automation and digital platforms will enhance scalability and regulatory compliance.

- Oncology will remain the dominant indication, supported by a robust therapy pipeline.

- Rare and neurological disease therapies will gain traction, creating new growth avenues.

- Strategic alliances between biotech firms and CDMOs will accelerate innovation and capacity building.

- Western Germany will continue to lead, supported by established infrastructure and global partnerships.

- Smaller CDMOs focusing on niche services will emerge as key contributors to market diversity.

- Investment in GMP-certified facilities and skilled workforce will remain central to competitiveness.

- International demand for German CDMO services will expand, strengthening the country’s position as a European hub.