Market Overview

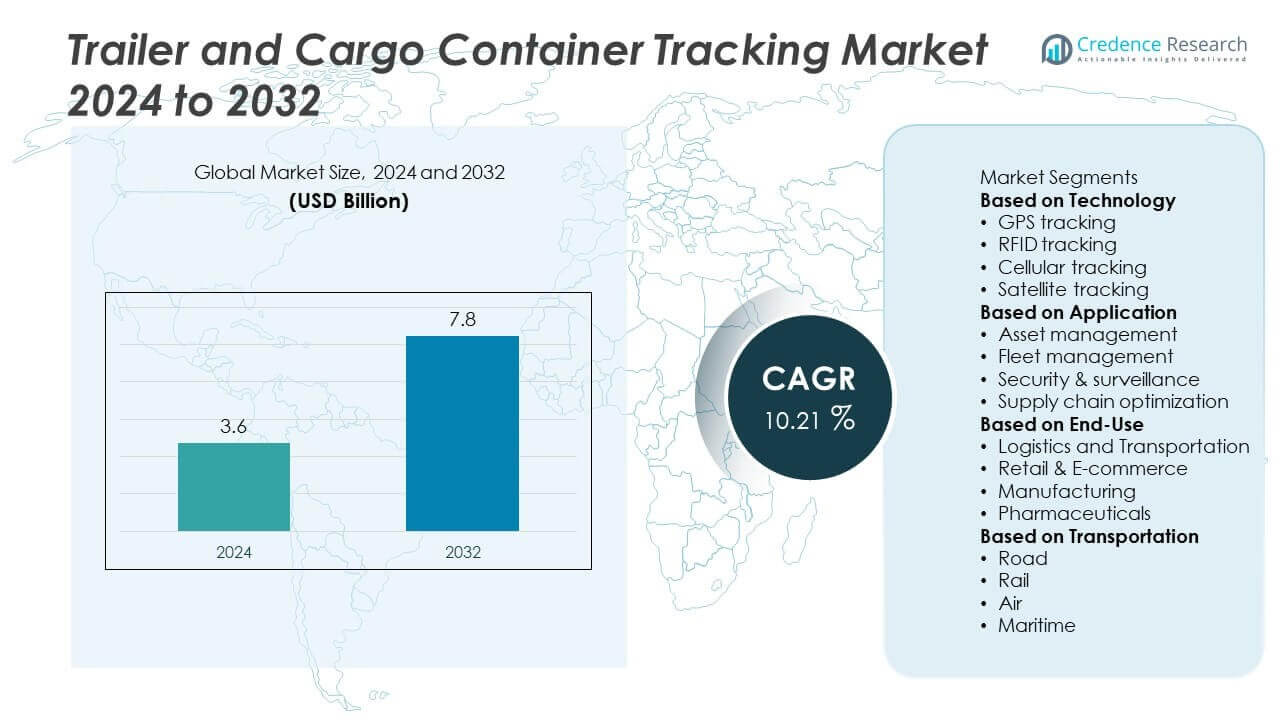

Trailer and Cargo Container Tracking Market size was valued at USD 3.6 billion in 2024 and is projected to reach USD 7.8 billion by 2032, growing at a CAGR of 10.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trailer and Cargo Container Tracking Market Size 2024 |

USD 3.6 Billion |

| Trailer and Cargo Container Tracking Market, CAGR |

10.21% |

| Trailer and Cargo Container Tracking Market Size 2032 |

USD 7.8 Billion |

The Trailer and Cargo Container Tracking Market grows through rising demand for supply chain visibility, cargo security, and compliance with international trade regulations. Companies adopt IoT-enabled sensors, GPS, and telematics to monitor location, temperature, and conditions of high-value or sensitive goods.

The Trailer and Cargo Container Tracking Market demonstrates strong geographical spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing unique growth drivers. North America leads with advanced logistics infrastructure, strict safety regulations, and high adoption of telematics. Europe emphasizes regulatory compliance and sustainable transport practices, with Germany, France, and the United Kingdom driving large-scale adoption. Asia-Pacific records rapid expansion, supported by industrial growth, rising e-commerce, and government investments in smart logistics hubs. Latin America and the Middle East & Africa show gradual adoption, with increasing focus on port modernization and trade efficiency. Key players shaping the market include Trimble, Samsara, Orbcomm, and Geotab, all of which focus on integrating IoT, AI-driven analytics, and global connectivity to deliver reliable real-time monitoring solutions that strengthen cargo security and operational transparency across diverse industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Trailer and Cargo Container Tracking Market was valued at USD 3.6 billion in 2024 and is projected to reach USD 7.8 billion by 2032, at a CAGR of 10.21%.

- Rising demand for supply chain visibility and cargo security drives adoption, supported by globalization, e-commerce expansion, and stricter compliance requirements in international trade.

- Key trends include integration of IoT-enabled sensors, AI-driven analytics, and cloud-based platforms, along with the adoption of 5G connectivity to improve real-time monitoring and predictive insights.

- Competitive dynamics feature leading players such as Trimble, Samsara, Orbcomm, and Geotab, which invest in telematics, advanced tracking solutions, and strategic partnerships to expand global reach.

- Market restraints include high implementation costs, infrastructure limitations in developing regions, and concerns over data security and regulatory complexities across cross-border logistics.

- Regional analysis highlights North America and Europe as early adopters with advanced logistics systems, while Asia-Pacific records rapid expansion driven by port modernization, smart logistics projects, and industrial growth.

- Overall, the Trailer and Cargo Container Tracking Market demonstrates strong resilience by leveraging digital technologies, addressing regulatory demands, and supporting global supply chains, ensuring steady expansion across diverse industries worldwide.

Market Drivers

Growing Demand for Supply Chain Visibility and Security

The Trailer and Cargo Container Tracking Market grows through rising demand for real-time visibility and cargo security. Global trade expansion and complex logistics networks require reliable tracking to reduce theft and loss. It provides fleet managers with accurate location and status updates across international routes. Businesses adopt advanced tracking systems to improve accountability and streamline operations. Growing e-commerce activity further strengthens the need for transparent supply chains. These factors position tracking solutions as essential tools for logistics efficiency.

- For instance, ORBCOMM reported that it had an installed base of nearly 1.6 million trailer and container tracking units worldwide at the end of 2023. A January 2025 report identified ORBCOMM as the largest provider of tracking solutions based on the number of devices deployed for trailers and containers.

Rising Adoption of IoT and Telematics Solutions

IoT-enabled sensors and telematics systems drive strong growth in the market. The Trailer and Cargo Container Tracking Market benefits from connected devices that provide temperature, humidity, and shock data. It enables shippers to monitor sensitive cargo such as pharmaceuticals, perishables, and electronics. Telematics platforms integrate with analytics software to optimize fleet performance and reduce operational costs. Companies invest in predictive maintenance using IoT data to avoid downtime. The integration of real-time tracking with intelligent systems accelerates adoption.

- For instance, Samsara launched its Smart Trailer platform, enabling fleets to track cargo conditions such as tire pressure, trailer power, and door status, with installation completed in under five minutes per trailer using its Powered Asset Gateway.

Expansion of International Trade and Cross-Border Logistics

Globalization and rising exports create strong demand for container tracking systems. The Trailer and Cargo Container Tracking Market benefits from increasing adoption by shipping companies, freight forwarders, and customs authorities. It helps reduce delays at ports by providing automated updates on cargo movement. Cross-border logistics companies adopt tracking to comply with trade regulations and security frameworks. The rise of intermodal transport strengthens reliance on reliable monitoring tools. These drivers ensure consistent demand across international supply chains.

Stringent Regulatory and Compliance Requirements

Governments and regulatory agencies enforce strict rules on cargo monitoring and reporting. The Trailer and Cargo Container Tracking Market aligns with compliance requirements set by organizations such as the International Maritime Organization (IMO) and Customs-Trade Partnership Against Terrorism (C-TPAT). It ensures secure transport of hazardous materials and high-value goods. Regulations on food safety and pharmaceutical logistics further drive system adoption. Companies adopt certified tracking solutions to avoid penalties and maintain trust. This regulatory environment creates steady demand for advanced tracking technologies.

Market Trends

Integration of Advanced IoT and Sensor Technologies

The Trailer and Cargo Container Tracking Market reflects a clear trend toward IoT-enabled devices and smart sensors. Companies deploy GPS trackers, RFID tags, and environmental sensors for real-time visibility. It allows monitoring of location, temperature, humidity, and shock to protect sensitive cargo. Integration with cloud-based platforms improves analytics and reporting. Logistics providers use this data to enhance decision-making and improve customer service. The adoption of advanced sensors ensures higher accuracy and reliability across supply chains.

- For instance, Sensitech’s TempTale GEO Ultra device provides real-time monitoring of temperature, light, and location for shipments, with data transmitted via a global cellular network using LTE Cat-M1 (4G) with a 2G fallback. The device is specifically designed for the pharmaceutical cold chain and generates data in compliance with regulatory standards like FDA 21 CFR Part 11 and EC Annex 11, automating and increasing compliance for temperature-sensitive products.

Adoption of Cloud and AI-Driven Platforms

Cloud-based platforms and artificial intelligence are reshaping tracking operations. The Trailer and Cargo Container Tracking Market benefits from predictive analytics, route optimization, and anomaly detection powered by AI. It enables logistics managers to anticipate disruptions and reduce delays. Cloud integration supports seamless sharing of cargo information with multiple stakeholders. Companies also deploy AI to improve predictive maintenance for trailers and containers. This trend highlights the shift from simple tracking to intelligent logistics management.

- For instance, Geotab processes over 80 billion telematics data points per day from more than 4.7 million vehicle subscriptions, serving over 55,000 global customers. This massive real-time dataset enables powerful AI-based predictive maintenance and anomaly detection for asset tracking.

Growing Focus on End-to-End Supply Chain Transparency

End-to-end visibility has become a top priority for logistics operators. The Trailer and Cargo Container Tracking Market supports this demand by offering integrated platforms that track cargo from origin to destination. It enhances accountability, reduces risks of theft, and improves regulatory compliance. Retailers and e-commerce companies adopt these solutions to strengthen customer trust through accurate delivery updates. Real-time data exchange with customs authorities helps reduce clearance times. The trend highlights a stronger focus on transparency across global supply chains.

Expansion of 5G Connectivity and Smart Logistics Networks

The rollout of 5G networks creates new opportunities for high-speed, low-latency tracking. The Trailer and Cargo Container Tracking Market benefits from improved connectivity that supports continuous monitoring. It enables advanced features such as live video feeds and real-time alerts during transit. Smart logistics hubs deploy 5G-enabled tracking for efficient cargo management. The expansion of connected infrastructure supports seamless integration of trailers, containers, and fleet systems. This trend accelerates the evolution of intelligent and highly connected logistics ecosystems.

Market Challenges Analysis

High Implementation Costs and Infrastructure Barriers

The Trailer and Cargo Container Tracking Market faces challenges from high upfront costs associated with advanced tracking systems. Deployment of IoT sensors, GPS devices, and cloud integration requires significant investment from logistics operators. It creates adoption barriers for small and mid-sized companies with limited budgets. Infrastructure limitations in developing regions further restrict widespread usage. Limited availability of reliable internet connectivity impacts real-time monitoring effectiveness. These challenges slow penetration in price-sensitive markets despite growing demand.

Data Security Concerns and Regulatory Complexities

Concerns over data security and privacy remain major obstacles to adoption. The Trailer and Cargo Container Tracking Market depends on continuous data exchange between fleets, shippers, and authorities. It increases exposure to cyber threats and unauthorized access to sensitive cargo information. Complex regulatory frameworks across borders add to operational difficulties. Companies must adapt tracking solutions to comply with varying standards on data protection and cargo security. The need for cybersecurity investments and regulatory alignment raises operational costs. These issues make scaling of solutions more difficult across global logistics networks.

Market Opportunities

Rising Demand for Smart Logistics and Cold Chain Management

The Trailer and Cargo Container Tracking Market holds strong opportunities through the expansion of smart logistics and cold chain operations. Global trade in pharmaceuticals, food, and perishable goods requires precise temperature and condition monitoring. It provides shippers with real-time visibility and alerts, ensuring cargo integrity across long-distance transport. Companies adopt advanced tracking systems to comply with safety standards and reduce spoilage. Growth in e-commerce further supports demand for end-to-end cargo visibility. These factors create new opportunities for providers offering intelligent tracking and monitoring solutions.

Expansion Across Emerging Markets and 5G Integration

Emerging economies present significant opportunities with rising investments in transport infrastructure and trade activities. The Trailer and Cargo Container Tracking Market benefits from rapid urbanization, expanding ports, and government initiatives to modernize logistics. It gains further momentum with the rollout of 5G, enabling faster data transfer and low-latency monitoring. Adoption of connected platforms in Asia-Pacific, Latin America, and Africa strengthens accessibility to advanced tracking technologies. Partnerships between logistics operators and technology firms create scalable solutions for these regions. The convergence of connectivity and infrastructure development positions the market for long-term growth.

Market Segmentation Analysis:

By Technology

The Trailer and Cargo Container Tracking Market segments by technology into GPS, RFID, and cellular-based systems. GPS dominates with widespread adoption due to its ability to provide real-time location updates across long distances. It ensures accuracy in global logistics and reduces risks of theft and misplacement. RFID systems support efficient inventory management and automated identification, particularly in port and warehouse operations. Cellular-based technologies are gaining ground with advancements in 4G and 5G, enabling continuous connectivity and low-latency communication. The combination of these technologies creates robust tracking solutions for diverse logistics requirements.

- For instance, Nexxiot built an installed base of approximately 1.0 million tracking units by the end of 2023, spanning containers and rail freight wagons, underscoring high adoption of satellite/GPS and cellular connectivity in intermodal tracking.

By Application

Segmentation by application highlights cargo tracking, asset management, and fleet management. Cargo tracking holds the largest share, supported by the need for end-to-end visibility of goods across supply chains. It provides monitoring of environmental conditions such as temperature, shock, and humidity, ensuring safety for sensitive goods. Asset management applications focus on optimizing the utilization and security of containers and trailers, reducing downtime and operational costs. Fleet management leverages telematics integration to track driver behavior, route optimization, and fuel efficiency. Together, these applications expand the role of tracking systems beyond location monitoring toward intelligent logistics management.

- For instance, Maersk fully outfitted its entire fleet of 360,000 refrigerated containers with tracking devices, enabling real-time environmental monitoring and location tracking across global shipping routes.

By End-Use

The market segments by end-use into transportation and logistics, retail, food and beverage, healthcare, and others. Transportation and logistics dominate, as fleet operators and freight forwarders increasingly adopt tracking to enhance security and efficiency. It also sees rising use in retail, where e-commerce growth demands transparency and real-time delivery updates. The food and beverage sector relies on tracking systems for cold chain monitoring, ensuring compliance with safety regulations. Healthcare applications grow rapidly with strict requirements for pharmaceutical logistics and condition-sensitive shipments. Other sectors such as chemicals and electronics also adopt tracking systems to safeguard valuable goods. This diverse adoption across industries highlights the critical role of tracking in supporting global trade and modern logistics.

Segments:

Based on Technology

- GPS tracking

- RFID tracking

- Cellular tracking

- Satellite tracking

Based on Application

- Asset management

- Fleet management

- Security & surveillance

- Supply chain optimization

Based on End-Use

- Logistics and Transportation

- Retail & E-commerce

- Manufacturing

- Pharmaceuticals

Based on Transportation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the leading position in the Trailer and Cargo Container Tracking Market with a 36% market share in 2024. The region benefits from advanced logistics infrastructure, high adoption of telematics, and strict security regulations. The United States drives growth with strong investments in supply chain visibility and technology-enabled fleet management. It gains further traction from increasing e-commerce demand, which requires real-time monitoring and delivery transparency. Canada supports adoption with cross-border logistics needs, while Mexico contributes through its growing role in trade and manufacturing exports. The region’s regulatory frameworks and emphasis on cargo safety ensure continued market dominance.

Europe

Europe accounts for a 28% market share in 2024, driven by strong trade activity and advanced logistics systems. Countries such as Germany, France, and the United Kingdom lead demand through widespread adoption of smart tracking for high-value goods and cold chain management. It benefits from strict EU regulations on cargo monitoring, food safety, and transport security, which drive system adoption. Eastern Europe also records rising usage as logistics hubs expand across Poland and Hungary. The region’s emphasis on sustainability encourages adoption of tracking solutions that optimize routes and reduce carbon emissions. Europe remains a key market with steady technological advancements and strong regulatory support.

Asia-Pacific

Asia-Pacific secures a 23% share in 2024, reflecting rapid industrialization, growing trade volumes, and large-scale port operations. China dominates with strong investments in logistics modernization and port infrastructure, while Japan and South Korea adopt advanced tracking systems to support high-tech exports. It also gains momentum in India and Southeast Asia, where e-commerce growth and smart city initiatives increase the need for efficient cargo monitoring. Governments in the region prioritize digital logistics platforms to streamline cross-border trade. Affordable connectivity solutions and expanding use of 5G strengthen regional adoption. Asia-Pacific is projected to record the fastest growth during the forecast period.

Latin America

Latin America represents an 8% market share in 2024, with Brazil and Mexico leading adoption. The region benefits from growing trade agreements, expanding retail markets, and rising use of telematics in fleet management. It also shows adoption in the agricultural and food sectors, where cold chain logistics require real-time monitoring. Challenges such as cost constraints and limited infrastructure slow broader adoption in smaller markets. However, ongoing investments in port modernization and logistics efficiency create new opportunities. The region demonstrates steady growth with strong potential in cross-border trade and regional e-commerce expansion.

Middle East & Africa

The Middle East & Africa hold a 5% market share in 2024, reflecting gradual adoption with growing opportunities. Gulf nations such as Saudi Arabia and the United Arab Emirates lead through investments in smart logistics hubs and advanced trade corridors. It also records adoption in South Africa, where modernization of transport systems drives demand for tracking technologies. Limited awareness and infrastructure constraints remain key challenges in parts of Africa. Still, increasing investments in smart port projects and diversification strategies across the Middle East support long-term potential. The region continues to evolve as an emerging market for container and trailer tracking systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sensitech

- Spireon

- Orbcomm

- AT&T Fleet Complete

- SkyBitz

- CalAmp

- Trimble

- Samsara

- Geotab

- Numerex

Competitive Analysis

The competitive landscape of the Trailer and Cargo Container Tracking Market features leading players such as AT&T Fleet Complete, CalAmp, Geotab, Numerex, Orbcomm, Samsara, Sensitech, SkyBitz, Spireon, and Trimble. These companies drive innovation by focusing on IoT-enabled tracking systems, advanced telematics, and cloud-based platforms that deliver real-time visibility and analytics for global supply chains. They prioritize integration of GPS, RFID, and sensor technologies to monitor cargo conditions, improve fleet efficiency, and enhance security across cross-border logistics. Strategic investments in AI, predictive analytics, and 5G connectivity strengthen their ability to provide accurate, low-latency monitoring solutions. Expansions into emerging markets and partnerships with logistics providers and fleet operators extend their global reach. Many players emphasize regulatory compliance and cybersecurity to address growing concerns over data protection and international standards. Competition remains intense as firms differentiate through technological advancements, cost-effective solutions, and end-to-end service offerings, ensuring long-term competitiveness in the evolving logistics landscape.

Recent Developments

- In June 2025, ORBCOMM launched CrewView, a visibility solution for smart refrigerated and dry containers at sea. This system enables real-time monitoring of containers during maritime transport, helping crews detect temperature deviations or power failures early to protect cargo integrity.

- In January 2025, ORBCOMM was identified as the largest provider in the market, with an installed base of nearly 1.6 million tracking units for trailers and containers—more than any other competitor.

- In January 2025, SkyBitz reached an installed base of approximately 750,000 tracking units, securing its position as the third-largest provider in trailers and container tracking devices.

- In 2025, Spireon expanded its leadership team by appointing Todd Abbott, Carla Fitzgerald, and Rick Gruenhagen to head sales, marketing, and technology, respectively. This strategic move supports the firm’s growth in GPS trailer and asset tracking through its FleetLocate platform, which already serves over 3 million active subscribers.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-Use, Transportation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for real-time supply chain visibility.

- IoT-enabled devices and smart sensors will play a central role in adoption.

- AI and predictive analytics will improve cargo monitoring and route optimization.

- 5G connectivity will enhance low-latency communication and continuous data transfer.

- Cloud-based platforms will support seamless collaboration across logistics stakeholders.

- Cold chain monitoring will create strong opportunities in food and pharmaceutical transport.

- Emerging markets will drive growth with infrastructure modernization and trade expansion.

- Strategic partnerships between technology providers and logistics operators will accelerate innovation.

- Cybersecurity solutions will gain importance to protect sensitive cargo data.

- Sustainable logistics practices will encourage adoption of energy-efficient tracking systems.