Market Overview

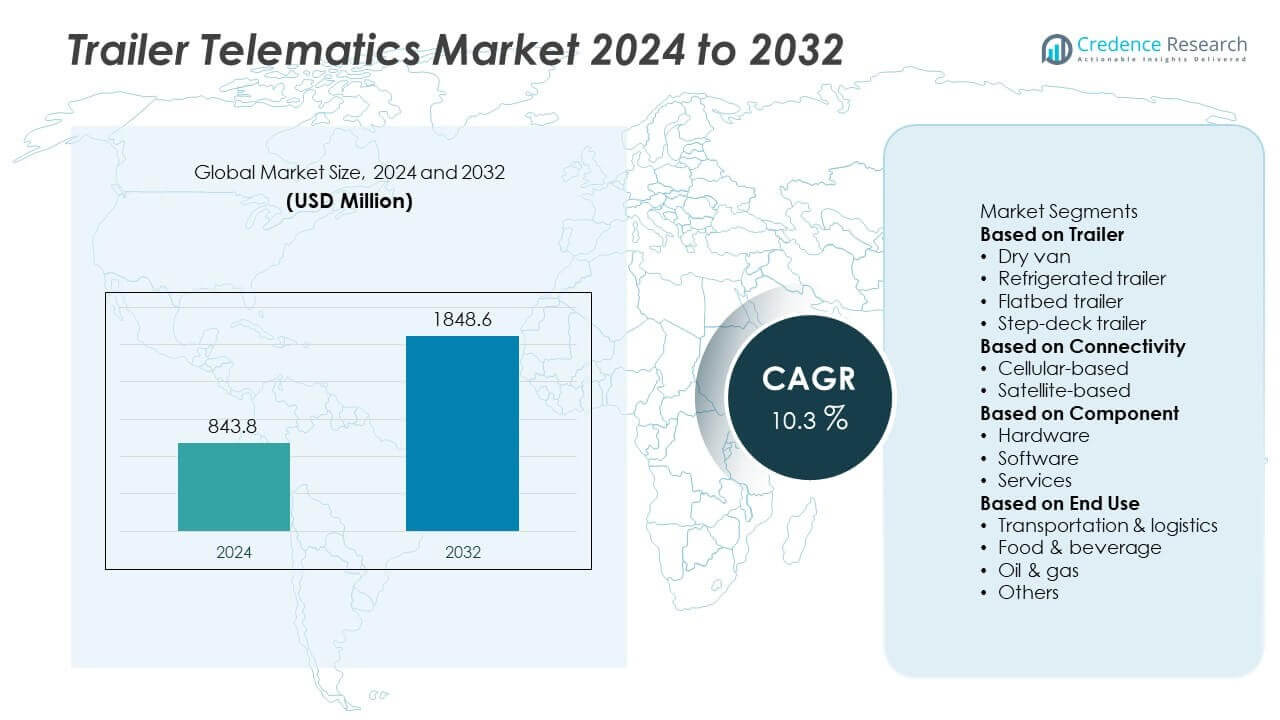

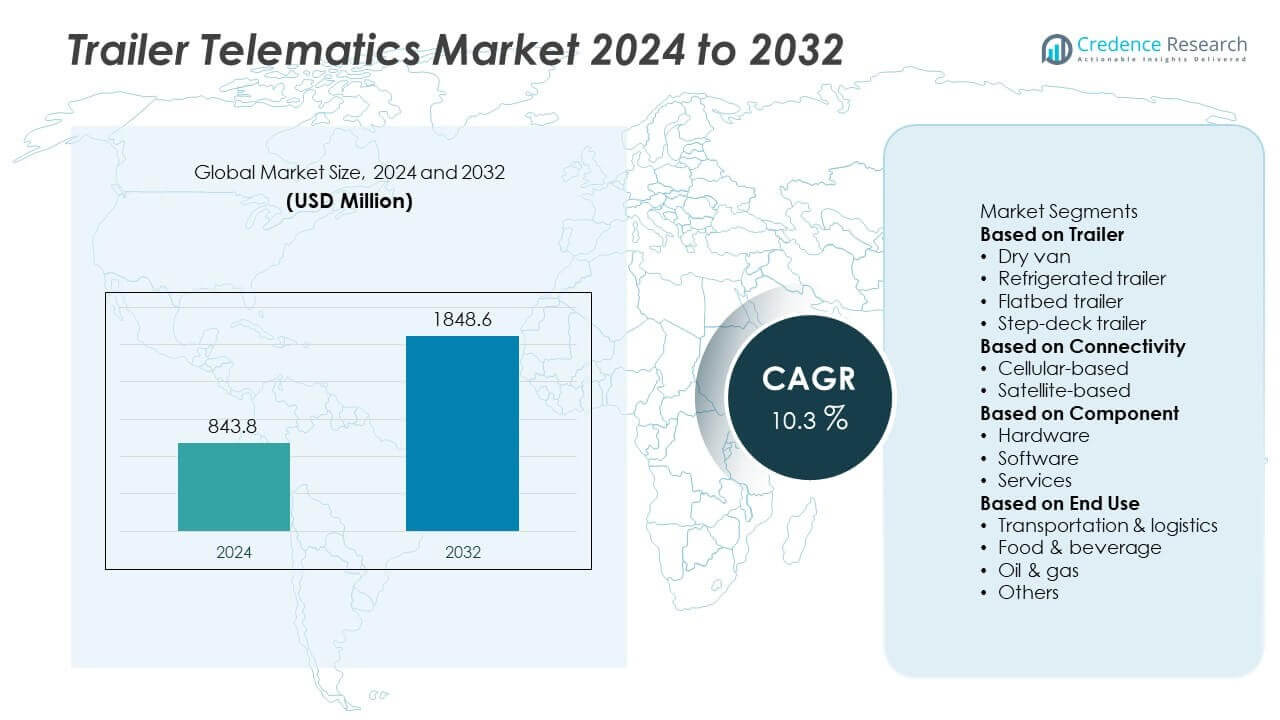

The Trailer Telematics Market size was valued at USD 843.8 million in 2024 and is projected to reach USD 1,848.6 million by 2032, growing at a CAGR of 10.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trailer Telematics Market Size 2024 |

USD 843.8 Million |

| Trailer Telematics Market, CAGR |

10.3% |

| Trailer Telematics Market Size 2032 |

USD 1,848.6 Million |

The Trailer Telematics Market grows through rising demand for fleet efficiency, safety, and real-time monitoring across logistics and transportation. Companies adopt telematics to optimize route planning, reduce fuel costs, and enhance asset utilization. It supports predictive maintenance and compliance with strict regulatory standards, strengthening adoption across industries.

The Trailer Telematics Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing unique growth factors. North America leads adoption through advanced logistics infrastructure, regulatory compliance, and strong penetration of digital fleet management solutions. Europe emphasizes sustainability and transport efficiency, with countries like Germany, France, and the United Kingdom driving adoption in both premium logistics and mid-segment operations. Asia-Pacific records rapid growth supported by industrialization, smart city projects, and the expansion of e-commerce logistics in China, India, and Southeast Asia. Latin America and the Middle East & Africa show gradual adoption, fueled by modernization of transport corridors and growing investments in connected fleet technologies. Key players shaping the market include Verizon Connect, Samsara, CalAmp, and Geotab, all focusing on integrating IoT, AI-driven analytics, and real-time monitoring features to strengthen global supply chain efficiency and security.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Trailer Telematics Market was valued at USD 843.8 million in 2024 and is projected to reach USD 1,848.6 million by 2032, growing at a CAGR of 10.3%.

- Rising demand for fleet efficiency, real-time monitoring, and regulatory compliance drives the adoption of trailer telematics across logistics and transportation sectors.

- Integration of IoT, AI-driven analytics, and 5G connectivity defines key market trends, enabling predictive maintenance, route optimization, and enhanced visibility in global supply chains.

- Competitive dynamics feature key players such as Verizon Connect, Samsara, Geotab, CalAmp, and Phillips Connect, which invest in advanced connectivity, AI-powered platforms, and strategic partnerships to expand their market presence.

- High installation and operational costs, along with infrastructure limitations in developing regions, restrain widespread adoption, particularly among small and mid-sized fleet operators.

- North America leads the market with advanced logistics systems and strong regulatory frameworks, while Europe emphasizes sustainability and efficient transport practices, and Asia-Pacific records the fastest growth driven by e-commerce expansion and industrialization.

- The overall market outlook remains positive as telematics solutions increasingly support smarter, connected logistics ecosystems, providing fleet operators with tools to improve safety, transparency, and long-term operational efficiency worldwide.

Market Drivers

Rising Demand for Fleet Efficiency and Real-Time Monitoring

The Trailer Telematics Market grows through rising demand for efficiency and operational transparency in fleet management. Logistics operators adopt telematics to monitor vehicle location, driver behavior, and trailer utilization. It reduces fuel consumption, lowers idle times, and improves route optimization. Real-time visibility helps companies minimize delays and enhance customer satisfaction. Telematics solutions also provide insights for preventive maintenance, reducing downtime. This focus on efficiency and cost reduction strengthens adoption across the logistics and transport sectors.

- For instance, Geotab announced in early September 2025 that its platform now processes over 100 billion telematics data points per day across more than 5 million active subscriptions. This provides fleet operators with predictive insights to optimize trailer use, improve safety, and reduce downtime.

Emphasis on Cargo Security and Regulatory Compliance

Security and compliance requirements strongly drive growth in the Trailer Telematics Market. Companies use telematics systems to track sensitive or high-value cargo in transit, ensuring protection against theft and tampering. It also assists in compliance with regulations related to driver hours, cargo safety, and reporting obligations. Regulatory frameworks in North America and Europe promote the adoption of electronic logging and trailer monitoring solutions. Such compliance enhances safety standards while reducing risks of penalties. Secure, compliant operations increase trust among logistics providers and customers alike.

- For instance, Schmitz Cargobull introduced its S .KO COOL refrigerated box-body semi-trailer, which comes standard-equipped with TrailerConnect® telematics, integrated temperature controls, door and EBS monitoring via the TrailerConnect® Data Management Center, and meets TAPA security standards.

Expansion of IoT and Advanced Connectivity Solutions

The growth of IoT integration fuels strong demand for advanced trailer telematics solutions. The Trailer Telematics Market leverages connected devices, sensors, and wireless communication for continuous monitoring. It enables tracking of trailer conditions such as temperature, humidity, and door status in real time. The adoption of 4G and 5G networks improves accuracy and ensures uninterrupted data transfer. These systems support predictive analytics and decision-making for fleet operators. Rapid technological innovation continues to expand telematics applications across logistics and transportation.

Rising E-commerce and Global Supply Chain Growth

The surge in e-commerce and expanding global trade creates robust demand for trailer telematics. The Trailer Telematics Market benefits from logistics companies that require reliable tracking and optimized delivery performance. It supports end-to-end visibility, ensuring timely shipments in fast-paced supply chains. High customer expectations for on-time deliveries further strengthen the role of telematics solutions. Growing adoption across retail, food, and pharmaceuticals highlights the system’s importance in diverse industries. Expanding supply chains across emerging economies ensure long-term demand for intelligent trailer management.

Market Trends

Adoption of IoT and Sensor-Based Technologies

The Trailer Telematics Market reflects a strong trend toward IoT-enabled and sensor-based solutions. Companies integrate smart sensors to monitor temperature, door activity, tire pressure, and cargo conditions. It improves visibility across logistics chains and ensures cargo integrity. Real-time alerts help operators respond quickly to abnormal conditions and avoid losses. Growing demand for intelligent trailers drives innovation in connected hardware and analytics platforms. This trend emphasizes the role of telematics in modernizing fleet operations.

- For instance, Phillips Connect achieved the milestone delivery of its 150,000th Smart-Trailer Gateway, along with over 1 million sensors shipped, illustrating widespread industry uptake of IoT-enabled monitoring systems.

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics are shaping the future of trailer telematics. The Trailer Telematics Market benefits from AI-driven platforms that forecast maintenance needs and optimize fleet usage. It helps reduce downtime by identifying potential failures before they occur. Predictive insights also support route optimization and fuel management. Logistics operators increasingly value data-driven decision-making enabled by AI. This trend positions telematics as a key tool for operational resilience and cost savings.

- For instance, Samsara introduced enhanced Smart Trailer features—such as tire inflation monitoring, power loss diagnostics, and mismatch alerting—powered by its Asset Gateway. The device installs in under five minutes per trailer, enabling fast deployment of AI-enhanced trailer insights.

Expansion of Cloud-Based Platforms and Remote Access

Cloud technology has become central to trailer telematics solutions. The Trailer Telematics Market advances through platforms that provide remote access to real-time data across multiple devices. It allows fleet managers to monitor trailers from anywhere, ensuring greater control. Cloud integration also enables seamless data sharing among supply chain stakeholders. Enhanced collaboration supports better planning and coordination in logistics operations. This trend highlights the industry’s shift toward connected, cloud-enabled ecosystems.

Rising Demand Across E-Commerce and Cold Chain Logistics

The growth of e-commerce and temperature-sensitive supply chains fuels strong adoption of telematics. The Trailer Telematics Market gains momentum as logistics providers prioritize transparency and reliable monitoring. It ensures compliance with regulations in food, pharmaceuticals, and perishable goods transport. Real-time tracking enhances trust with customers expecting faster deliveries and condition monitoring. Cold chain operators adopt specialized sensors to maintain product quality. This trend reinforces telematics as an essential solution across diverse logistics applications.

Market Challenges Analysis

High Implementation Costs and Adoption Barriers

The Trailer Telematics Market faces challenges from high upfront costs of hardware, installation, and software integration. Many small and medium-sized fleet operators hesitate to adopt advanced telematics due to limited budgets. It becomes harder to justify investment in regions where logistics margins remain low. Ongoing subscription costs for data management platforms add financial pressure. Lack of standardized solutions also creates complexity in deployment. These factors slow down large-scale adoption despite clear operational benefits.

Data Security Concerns and Infrastructure Limitations

Data protection and connectivity gaps present significant hurdles in the Trailer Telematics Market. Constant data exchange between trailers, fleet managers, and cloud systems increases exposure to cyber threats. It raises concerns about unauthorized access, data theft, or manipulation. Infrastructure limitations in rural areas or developing regions further weaken real-time monitoring capabilities. Limited network coverage reduces effectiveness in long-haul and cross-border operations. Addressing these challenges requires robust cybersecurity frameworks and reliable communication infrastructure.

Market Opportunities

Expansion Through Smart Logistics and Fleet Digitization

The Trailer Telematics Market presents strong opportunities through the expansion of smart logistics and digital fleet management. Companies adopt telematics to optimize route planning, reduce downtime, and improve fuel efficiency. It supports predictive maintenance by tracking trailer health and minimizing costly breakdowns. Rising demand for real-time cargo visibility creates opportunities in industries such as retail, food, and pharmaceuticals. Governments promote intelligent transport systems, encouraging adoption of connected trailer solutions. These factors create favorable conditions for accelerated growth across global logistics networks.

Integration with IoT and Emerging Technologies

The Trailer Telematics Market gains opportunities from integration with IoT, AI, and 5G technologies. IoT-enabled platforms enhance condition monitoring by tracking temperature, vibration, and load security in real time. It enables predictive analytics that reduce operational risks and improve efficiency. Expansion of 5G networks strengthens low-latency data transfer, ensuring continuous communication across long-haul operations. Partnerships between technology providers and fleet operators expand tailored solutions for diverse industries. These advancements support the evolution of highly connected and intelligent logistics ecosystems.

Market Segmentation Analysis:

By Trailer

The Trailer Telematics Market segments by trailer into dry van, refrigerated, tankers, and flatbed trailers. Dry vans hold the largest share due to their extensive use in retail, e-commerce, and general freight transport. It supports tracking of location, load status, and security, ensuring efficient fleet operations. Refrigerated trailers gain strong demand as industries such as food, pharmaceuticals, and chemicals require temperature-controlled monitoring. Tanker trailers integrate telematics for safety and compliance in hazardous material transport. Flatbed trailers also benefit from telematics by enhancing visibility and reducing risks of theft. The diverse trailer types strengthen adoption across multiple logistics sectors.

- For instance, Utility Trailer equipped over 1,200 refrigerated trailers operated by Hirschbach with Phillips Connect’s Smart7 telematics system—enabling GPS tracking, light-out detection, tire inflation monitoring, and support for additional sensors such as door and cargo detection.

By Connectivity

Segmentation by connectivity includes cellular, satellite, and hybrid systems. Cellular connectivity dominates the Trailer Telematics Market, supported by widespread 4G and growing 5G coverage that ensures real-time communication. It offers cost-effective solutions for fleets operating in urban and regional networks. Satellite connectivity addresses long-haul and remote operations where cellular networks are unreliable, ensuring global coverage. Hybrid systems combine both technologies, offering redundancy and reliability in critical operations. Growing investments in connected logistics platforms support wider adoption of all three connectivity modes. This segmentation highlights the critical role of seamless communication in fleet performance.

- For instance, Carrier Transicold’s Lynx Fleet telematics system—deployed in refrigerated trailers—offers seamless switching between 4G LTE and satellite signals, along with built-in backup battery and solar charging to ensure uninterrupted connectivity for temperature-controlled cargo monitoring.

By Component

The Trailer Telematics Market also segments by component into hardware, software, and services. Hardware holds strong demand, with sensors, GPS devices, and control units enabling accurate location and condition monitoring. It supports load management, fuel tracking, and security applications. Software drives significant growth through platforms that process real-time data and deliver actionable insights to fleet managers. Services, including installation, maintenance, and cloud integration, ensure long-term system performance and customer support. The integration of predictive analytics and AI within software enhances value delivery. Together, these components establish a complete ecosystem that supports efficiency, safety, and compliance in logistics operations.

Segments:

Based on Trailer

- Dry van

- Refrigerated trailer

- Flatbed trailer

- Step-deck trailer

Based on Connectivity

- Cellular-based

- Satellite-based

Based on Component

- Hardware

- Software

- Services

Based on End Use

- Transportation & logistics

- Food & beverage

- Oil & gas

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Trailer Telematics Market at 35% in 2024. The region benefits from advanced logistics infrastructure, high adoption of fleet digitization, and strict regulatory requirements on cargo safety and driver compliance. The United States leads with widespread use of telematics across large fleets in retail, e-commerce, and industrial supply chains. It also gains momentum from rapid adoption of predictive maintenance and smart tracking in refrigerated trailers. Canada supports growth through strong cross-border trade activities, while Mexico contributes with expanding manufacturing and export sectors. Growing emphasis on reducing downtime and optimizing fleet efficiency strengthens adoption across the region.

Europe

Europe accounts for 28% of the Trailer Telematics Market in 2024, supported by strict EU transport regulations, sustainability initiatives, and advanced fleet management practices. Germany, France, and the United Kingdom lead adoption, driven by high logistics activity and strong demand for smart trailer solutions in retail and cold chain logistics. It gains further support from EU policies promoting fuel efficiency and emission reductions, encouraging the integration of connected technologies. Eastern Europe records growing demand as logistics hubs expand in Poland and Hungary. The region’s emphasis on green logistics and compliance with safety standards reinforces its strong market position.

Asia-Pacific

Asia-Pacific secures a 23% share in 2024, reflecting rapid expansion fueled by industrialization, rising e-commerce, and large-scale logistics infrastructure projects. China dominates regional adoption through smart logistics hubs and government initiatives promoting digital supply chain modernization. India records strong growth supported by smart city projects, increasing freight volumes, and government-backed transportation reforms. Japan and South Korea contribute with advanced fleet management solutions, focusing on safety and operational efficiency. Southeast Asian countries such as Vietnam, Indonesia, and Thailand add momentum with growing cross-border trade and rising logistics modernization. Asia-Pacific is projected to record the fastest growth during the forecast period due to its scale, population, and rapid economic development.

Latin America

Latin America represents an 8% share of the Trailer Telematics Market in 2024, with Brazil and Mexico leading adoption. The region benefits from rising investments in logistics modernization, urban freight solutions, and retail supply chain expansion. It records growing use of telematics in cold chain logistics, especially in agriculture and food industries. Mexico strengthens adoption with integration into North American supply chains, while Brazil drives demand through large-scale agribusiness and export sectors. Challenges such as high system costs and infrastructure gaps limit broader adoption in smaller markets. However, ongoing modernization of logistics systems ensures steady regional growth.

Middle East & Africa

The Middle East & Africa hold a 6% share in the Trailer Telematics Market in 2024, reflecting gradual but emerging adoption. Gulf nations such as Saudi Arabia and the United Arab Emirates lead with smart city projects, advanced logistics hubs, and rising demand for connected fleets. South Africa contributes through modernization of transportation and retail logistics. It faces barriers from limited awareness, high system costs, and uneven connectivity infrastructure across several African nations. Government diversification strategies and investments in port modernization create new opportunities for adoption. The region shows long-term potential as infrastructure and logistics networks continue to expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Trailer Telematics Market features leading players such as CalAmp, Clarience, Geotab, Phillips Connect, Samsara, Schmitz Cargobull, Solera, Spireon, Trendfire, and Verizon Connect. These companies focus on enhancing trailer connectivity, fleet safety, and operational transparency through advanced telematics platforms. They invest heavily in IoT-enabled devices, AI-driven analytics, and 5G-ready solutions that provide real-time monitoring of trailer location, cargo conditions, and driver behavior. Strategic partnerships with logistics providers and OEMs strengthen their market penetration, while expansions into emerging regions broaden their global presence. Product innovation remains a core strategy, with emphasis on predictive maintenance, fuel efficiency, and cold chain monitoring solutions. Compliance with international safety and transport regulations further enhances their competitive edge. Companies differentiate by offering scalable, cost-efficient solutions tailored to both large fleets and mid-sized operators, ensuring adaptability across diverse logistics networks. Intense competition drives continuous innovation, making technology integration and service quality critical factors in sustaining market leadership.

Recent Developments

- In May 2025, At Transport Logistic 2025, Schmitz showcased its TrailerConnect telematics platform with real-time monitoring for location, tire pressure, door status, and temperature. The offering also included new services—FleetTrack and FleetWatch—for condition and event reporting and proactive maintenance.

- In March 2025, At ATA’s TMC Annual Meeting in Nashville in March 2025, Samsara introduced enhancements to its Smart Trailer platform.

- In 2025, At Geotab Connect 2025, Geotab unveiled IOX-Keybox, enabling digital key management to streamline operations and reduce trailer downtime. They also introduced IOX-COLD, a cold chain tracking solution that delivers near real-time temperature visibility for trailers.

- In 2025, Spireon introduced a solar-powered trailer tracking device for its FleetLocate solution. This innovation ensures continuous GPS tracking even in remote locations by harnessing renewable energy. The product supports extended uptime, aiding users with limited access to charging infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Trailer, Connectivity, Component, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand for real-time fleet monitoring and efficiency.

- IoT and AI-driven analytics will enhance predictive maintenance and operational visibility.

- 5G connectivity will improve data transfer speed and responsiveness in logistics networks.

- Cold chain logistics adoption will expand as demand for temperature-sensitive transport rises.

- Integration with cloud platforms will support seamless data sharing across stakeholders.

- Sustainability initiatives will drive adoption of fuel-efficient and eco-friendly telematics solutions.

- Emerging economies will record strong growth with infrastructure development and e-commerce expansion.

- Strategic alliances between OEMs and telematics providers will accelerate technology deployment.

- Advanced driver safety and compliance monitoring features will strengthen adoption.

- Modular and scalable telematics systems will increase accessibility for small and mid-sized fleets.