Market Overview:

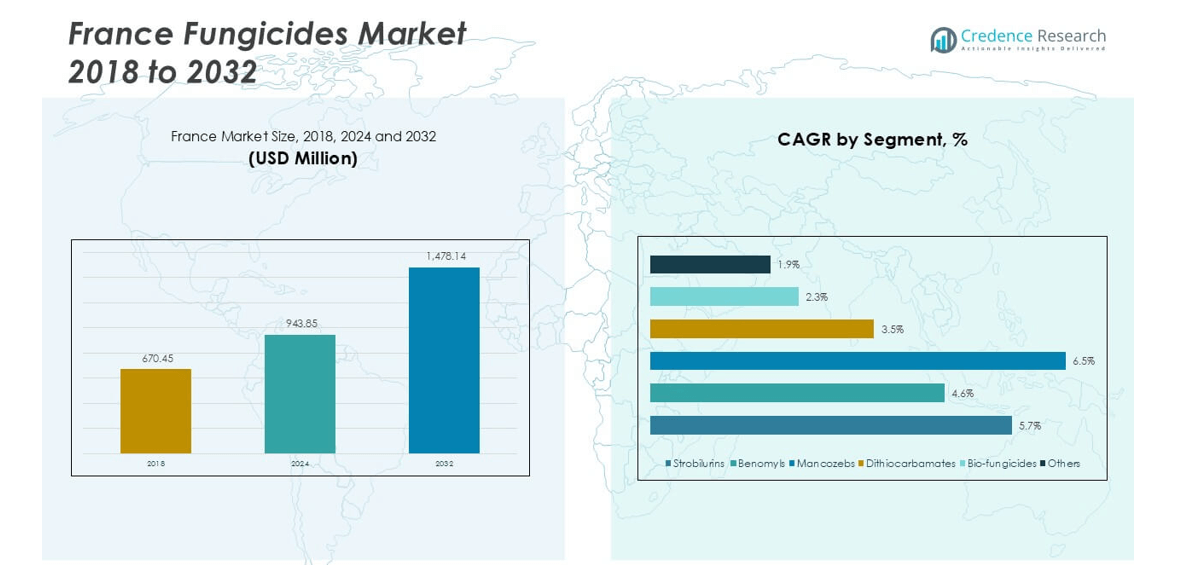

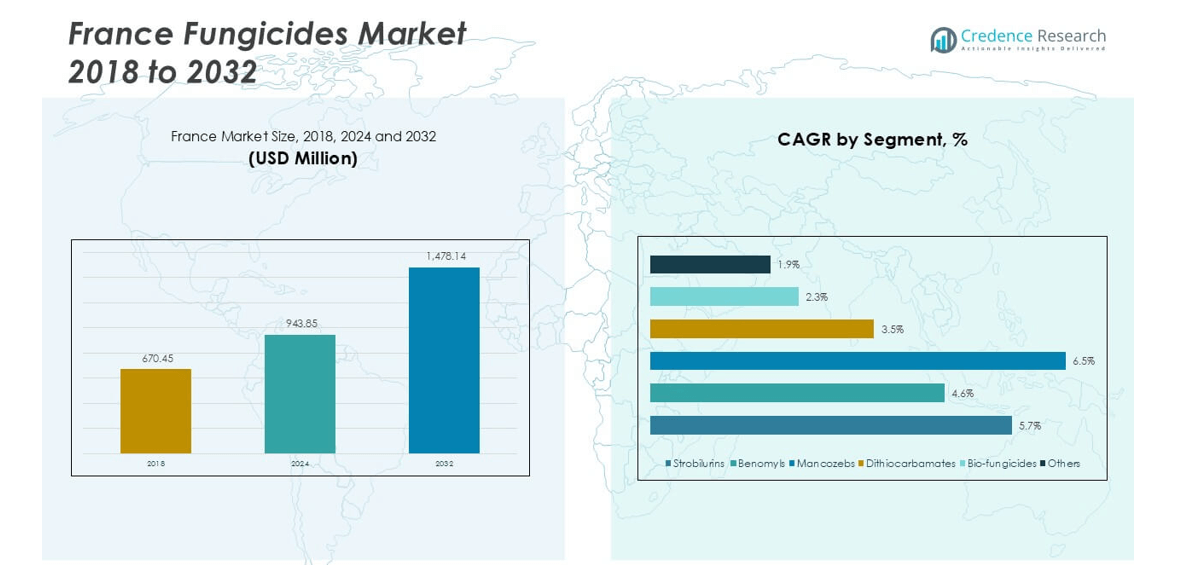

France Fungicides market size was valued at USD 670.45 million in 2018, grew to USD 943.85 million in 2024, and is anticipated to reach USD 1,478.14 million by 2032, at a CAGR of 5.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Fungicides Market Size 2024 |

USD 943.85 million |

| France Fungicides Market, CAGR |

5.66% |

| France Fungicides Market Size 2032 |

USD 1,478.14 million |

The France fungicides market is led by key players including Bayer AG, Syngenta Group, BASF SE, Corteva Agriscience, FMC Corporation, and UPL Limited, which dominate through advanced formulations, bio-fungicides, and integrated crop protection solutions. Bayer AG and Syngenta maintain strong positions in cereals and high-value fruits and vegetables, while BASF and Corteva focus on innovative chemical and low-residue products. Domestic companies such as Sipcam France and Monbio strengthen regional reach with eco-friendly solutions. Regionally, Northern France leads with 28% market share, driven by extensive cereal and vegetable cultivation. Southern France follows with 24%, supported by high-value fruit and vegetable production. Eastern France holds 18%, Western France 16%, and Central France 14%, reflecting crop diversity and disease prevalence. The combination of strong player presence and region-specific crop protection needs shapes the competitive landscape and market growth across France.

Market Insights

- The France fungicides market was valued at USD 943.85 million in 2024 and is projected to reach USD 1,478.14 million by 2032, growing at a CAGR of 5.66%. Strobilurins dominate the product type segment, while fruits & vegetables lead the application segment.

- Rising demand for high-value crops, disease management, and sustainable agriculture drives consistent fungicide adoption across the country. Increasing awareness of bio-fungicides and low-residue products supports market growth.

- Trends include growing use of bio-fungicides, precision spraying technologies, and integrated pest management solutions. Companies are developing eco-friendly formulations to meet EU regulations and export-quality standards.

- The competitive landscape is led by Bayer AG, Syngenta Group, BASF SE, Corteva Agriscience, and FMC Corporation, focusing on R&D, mergers, and strategic partnerships. Domestic players strengthen regional penetration with localized solutions.

- Northern France holds 28% market share, Southern 24%, Eastern 18%, Western 16%, and Central 14%, reflecting crop diversity and regional disease pressure. Strobilurins and mancozebs remain key sub-segment contributors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the France Fungicides market, strobilurins dominate the product type segment, accounting for approximately 32% of total sales. Their high efficacy against a broad spectrum of fungal pathogens and compatibility with integrated pest management practices drive adoption. Mancozebs and dithiocarbamates follow, valued for preventive protection and cost-effectiveness. Bio-fungicides are gaining traction due to growing demand for sustainable and environmentally friendly crop protection solutions. Rising awareness of residue limits in food and stricter EU regulations further encourage farmers to adopt advanced fungicide formulations, supporting consistent market growth across conventional and bio-based products.

- For instance, in December 2020, the European Union (EU) decided not to renew the approval of the fungicide mancozeb. The ban took effect in January 2021, and all authorizations for products containing mancozeb in EU member states, including France, were to be withdrawn by June 2021, with final grace periods for use ending in January 2022.

By Application

Fruits & vegetables represent the leading application segment, contributing around 40% of fungicide consumption in France. High-value crops such as grapes, apples, and tomatoes face significant disease pressure, necessitating frequent fungicide use. Cereals & grains and pulses & oilseeds follow, supported by large-scale cultivation and yield protection requirements. Ornamentals and specialty crops also drive demand due to aesthetic standards and disease susceptibility. Drivers include increasing focus on food security, rising crop intensification, and adoption of modern agriculture practices that prioritize both productivity and quality, ensuring steady growth for fungicide usage across all applications.

- For instance, Syngenta’s fungicide Switch is used in French vineyards to protect against Botrytis cinerea, also known as gray mold.

Market Overview

Rising Demand for High-Value Crops

The France Fungicides market is driven by increasing cultivation of high-value crops such as grapes, apples, and tomatoes. These crops are highly susceptible to fungal diseases, necessitating frequent fungicide applications. Farmers prioritize yield protection and quality standards to meet both domestic and export requirements. Government initiatives supporting crop intensification and modern farming techniques further enhance adoption. The combination of disease prevalence and economic incentives ensures continuous fungicide usage, making high-value crop protection a primary growth driver in the French agricultural sector.

- For instance, Bayer’s Luna Experience fungicide is used on various tomato farms, including some in France, to combat fungal diseases. The fungicide helps improve the quality and marketability of the produce, which is beneficial for export markets. In France, greenhouse tomato production is significant in regions like Provence-Alpes-Côte d’Azur and the Loire Valley.

Stringent Regulatory Compliance and Food Safety

Strict EU regulations on pesticide residues and food safety standards drive fungicide adoption in France. Farmers use advanced formulations, including strobilurins and bio-fungicides, to comply with residue limits while maintaining crop productivity. Regulatory pressure encourages integrated pest management practices, promoting efficient and targeted fungicide use. Compliance requirements create steady demand for high-performance products that protect crops and ensure consumer safety. This regulatory landscape reinforces market growth, as farmers and agrochemical companies invest in innovative solutions aligned with European sustainability and safety standards.

- For instance, Corteva Agriscience launched Inatreq active in France in 2021, which was applied to over 400,000 hectares of cereals by 2022, designed to meet residue compliance and resistance management needs.

Advancements in Fungicide Formulations

Technological advancements in fungicide chemistry and delivery systems support market expansion. Novel formulations offer broader-spectrum control, improved residual activity, and reduced environmental impact. Liquid concentrates, wettable powders, and bio-based fungicides provide flexibility for diverse crop needs. Innovations also enhance compatibility with other crop protection products, enabling integrated management strategies. These improvements reduce application frequency and increase efficacy, driving farmer preference. Continuous research and development, coupled with rising awareness of sustainable agriculture, ensure that advanced fungicide solutions remain a key market growth driver in France.

Key Trends & Opportunities

Growing Adoption of Bio-Fungicides

Bio-fungicides are gaining traction as French farmers seek sustainable and eco-friendly crop protection alternatives. These products, derived from microorganisms or plant extracts, reduce chemical residues and environmental impact. Rising consumer demand for organic produce and EU incentives for sustainable agriculture create opportunities for market expansion. Agrochemical companies are investing in R&D to improve bio-fungicide efficacy and shelf life. Increasing adoption in fruits, vegetables, and cereals presents a significant growth avenue, while partnerships between biotech firms and traditional agrochemical companies accelerate innovation and commercial availability.

- For instance, UPL expanded its Natural Plant Protection (NPP) portfolio trials to over 10,000 hectares of French vineyards and vegetable farms in 2022, focusing on low-residue crop protection.

Integration of Digital Agriculture

Digital agriculture solutions, including precision spraying, disease monitoring apps, and predictive analytics, enhance fungicide application efficiency. Farmers can target fungal outbreaks accurately, minimizing wastage and optimizing costs. Integration with IoT sensors and drones supports timely interventions and data-driven decisions. This trend improves crop yields and reduces environmental impact, creating opportunities for agrochemical companies to offer smart crop protection packages. The combination of fungicide products and digital tools fosters market growth, enabling precision farming adoption while addressing sustainability and regulatory compliance goals.

Emerging Opportunities in Specialty Crops

Specialty crops, such as ornamentals and niche vegetables, present growth potential due to high aesthetic and quality standards. Fungicide demand in these segments is increasing to prevent cosmetic and yield losses. Export-oriented farming further drives the need for disease-free produce. Companies can develop targeted formulations and customized application solutions for specialty crops. These opportunities encourage product diversification and innovation, positioning the market for steady expansion beyond traditional crops while meeting evolving consumer preferences for high-quality, disease-free agricultural produce.

Key Challenges

Environmental and Health Concerns

The France Fungicides market faces challenges due to growing awareness of environmental and health impacts of chemical fungicides. Regulatory restrictions on certain active ingredients limit usage and create compliance burdens. Overreliance on chemical products can lead to soil and water contamination, prompting farmers to adopt safer alternatives. Public concern over pesticide residues in food adds pressure on the industry to develop eco-friendly solutions. Addressing these concerns while maintaining crop protection efficacy remains a critical challenge for manufacturers and users in the French market.

Resistance Development in Pathogens

Fungal resistance to commonly used fungicides poses a significant challenge in France. Repeated and improper applications can reduce effectiveness, forcing higher dosages or alternative products. Resistance management requires rotation of fungicide classes, integrated pest management strategies, and farmer awareness programs. Failure to address resistance can result in yield losses, increased costs, and market disruption. Developing new chemical formulations and bio-based alternatives, alongside training programs, is essential to mitigate resistance risks and ensure sustainable growth in the French fungicides sector.

Regional Analysis

Northern France

Northern France accounted for approximately 28% market share in 2018. The region’s large-scale cultivation of cereals, sugar beets, and vegetables drives consistent demand for fungicides. Frequent fungal disease outbreaks in wheat, potatoes, and root crops necessitate applications of strobilurins, mancozebs, and dithiocarbamates. Farmers increasingly adopt integrated pest management and advanced formulations to maintain high yields while complying with EU food safety standards. Supportive government policies and rising awareness of sustainable crop protection further boost market growth, making Northern France a leading region in the national fungicides market.

Southern France

Southern France held around 24% market share in 2018, driven by extensive cultivation of high-value fruits and vegetables such as grapes, tomatoes, and citrus. Warm and humid conditions create recurring disease outbreaks, supporting regular fungicide usage. The adoption of bio-fungicides and advanced chemical formulations is rising due to export-quality requirements and strict EU residue regulations. Farmers focus on sustainable practices to protect crop yield and quality. The combination of high-value crops and favorable climatic conditions ensures steady growth and strong fungicide demand in Southern France.

Eastern France

Eastern France represented approximately 18% market share in 2018. The region cultivates cereals, maize, and pulses, which face significant fungal disease pressure under humid conditions. Fungicides such as strobilurins, dithiocarbamates, and mancozebs are widely applied to safeguard crop yields. Farmers increasingly integrate precision application techniques and sustainable crop protection solutions. Government initiatives promoting modern agriculture and integrated pest management further support fungicide adoption. Disease management and yield protection priorities make Eastern France a key contributor to the overall fungicides market.

Western France

Western France held roughly 16% market share in 2018, with high fungicide demand driven by fruit, vegetable, and high-density orchard cultivation. Frequent fungal infections necessitate applications of strobilurins, bio-fungicides, and mancozebs. Compliance with EU food safety standards and residue limits encourages the use of advanced and sustainable formulations. Farmers increasingly adopt integrated pest management and precision spraying techniques to enhance efficacy. Disease prevalence and the importance of high-quality produce contribute to steady growth in fungicide usage in Western France, supporting the overall national market.

Central France

Central France accounted for approximately 14% market share in 2018. The region cultivates cereals, pulses, and oilseeds that experience moderate fungal disease pressure, driving consistent fungicide demand. Chemical and bio-fungicides are widely applied to maintain crop quality while adhering to EU regulatory standards. Farmers adopt integrated management practices, including rotational applications and precision spraying, to optimize effectiveness. Supportive government programs promoting sustainable agriculture and food safety strengthen adoption. Central France plays a significant role in maintaining national fungicide consumption through yield protection and sustainable crop management practices.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- Northern France

- Southern France

- Eastern France

- Western France

- Central France

Competitive Landscape

The France fungicides market is highly competitive, dominated by leading global and domestic players such as Bayer AG, Syngenta Group, BASF SE, Corteva Agriscience, FMC Corporation, UPL Limited, Sipcam France, Monbio, Sumitomo Chemical, and Cheminova A/S. These companies focus on product innovation, portfolio diversification, and sustainable crop protection solutions to maintain market leadership. Bayer AG and Syngenta leverage advanced strobilurins and bio-fungicides, while BASF and Corteva emphasize high-efficiency chemical formulations. FMC and UPL prioritize precision application technologies and integrated pest management strategies. Domestic players such as Sipcam France and Monbio increasingly compete through localized solutions and eco-friendly products. Market competition also intensifies through mergers, acquisitions, and strategic partnerships aimed at expanding regional reach and enhancing research capabilities. Companies invest heavily in R&D to develop low-residue, environmentally safe, and high-performance fungicides, catering to both cereal and high-value fruit and vegetable segments. This competitive environment drives continuous innovation and efficiency across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer AG

- Syngenta Group

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Sipcam France

- Monbio

- Sumitomo Chemical Co., Ltd.

- Cheminova A/S

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In September 2022, BASF, a well-known agriculture nutrition manufacturer, announced the launch of its all-new innovative fungicide product called Revylution, which received approval for use in New Zealand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- France fungicides market is expected to grow steadily driven by high-value crop cultivation.

- Adoption of bio-fungicides and low-residue products will increase across all regions.

- Strobilurins and mancozebs will remain the dominant product types.

- Integrated pest management and precision application technologies will see wider implementation.

- Northern and Southern France will continue leading in market demand due to cereal and fruit production.

- Domestic players will expand their regional presence with eco-friendly solutions.

- R&D investments will focus on sustainable, high-performance fungicide formulations.

- Regulatory compliance with EU standards will drive adoption of safer crop protection products.

- Strategic partnerships and acquisitions among key players will strengthen market competitiveness.

- Demand for disease-resistant crops and yield protection will remain a primary growth driver.