Market Overview

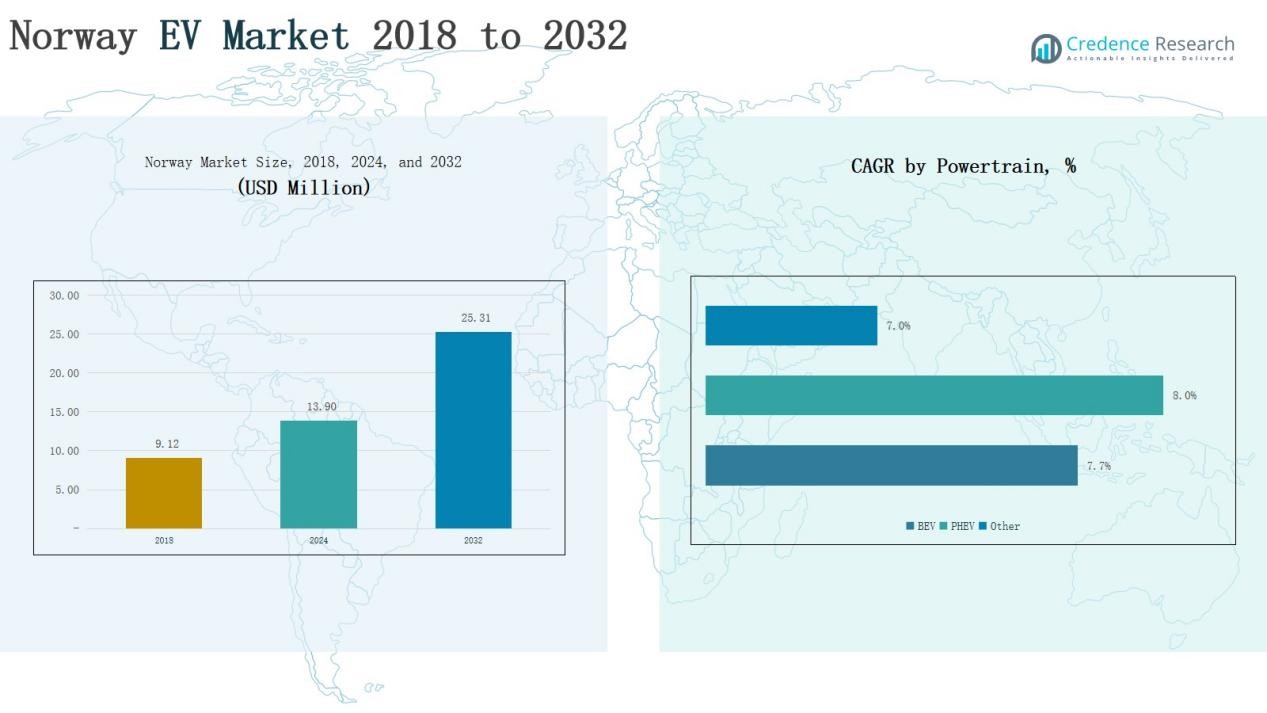

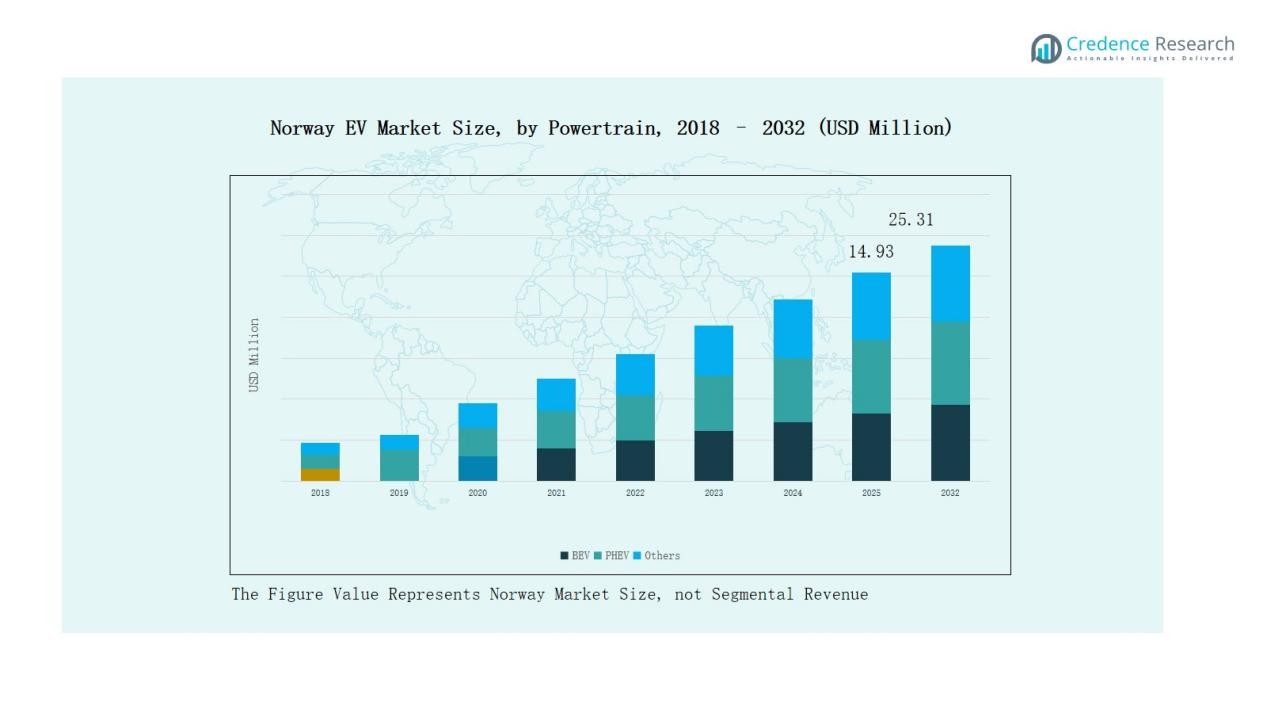

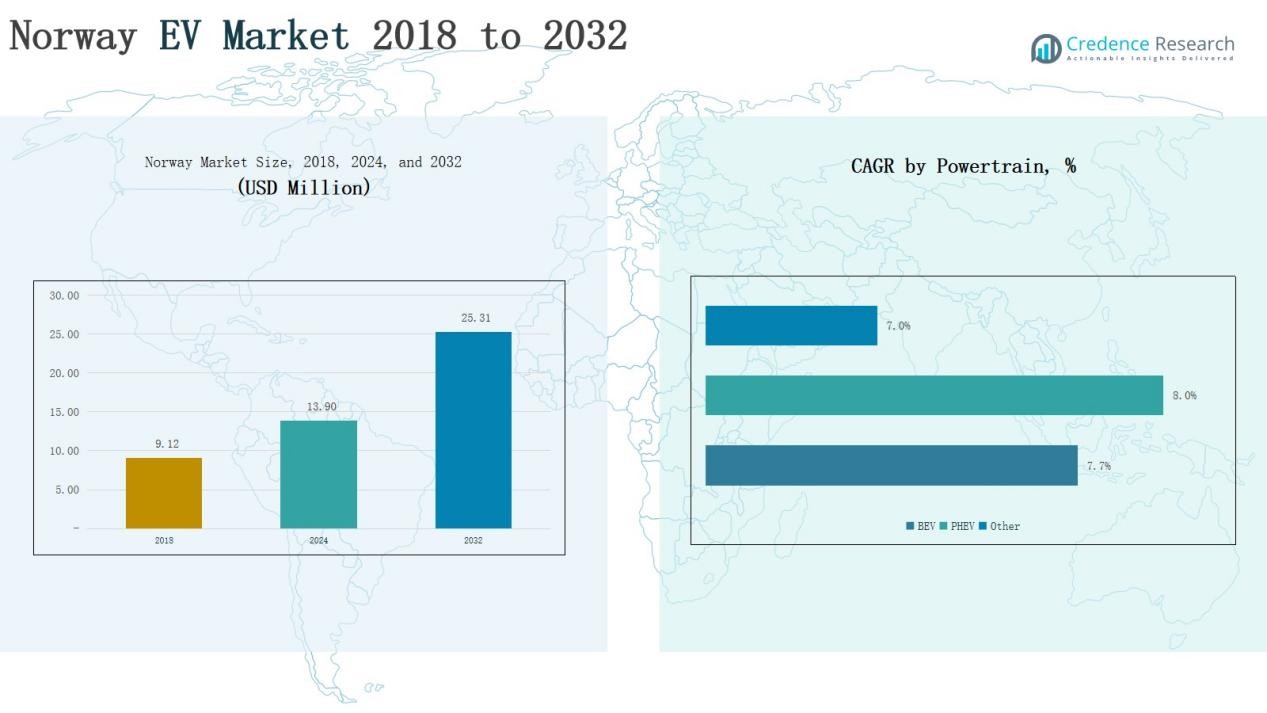

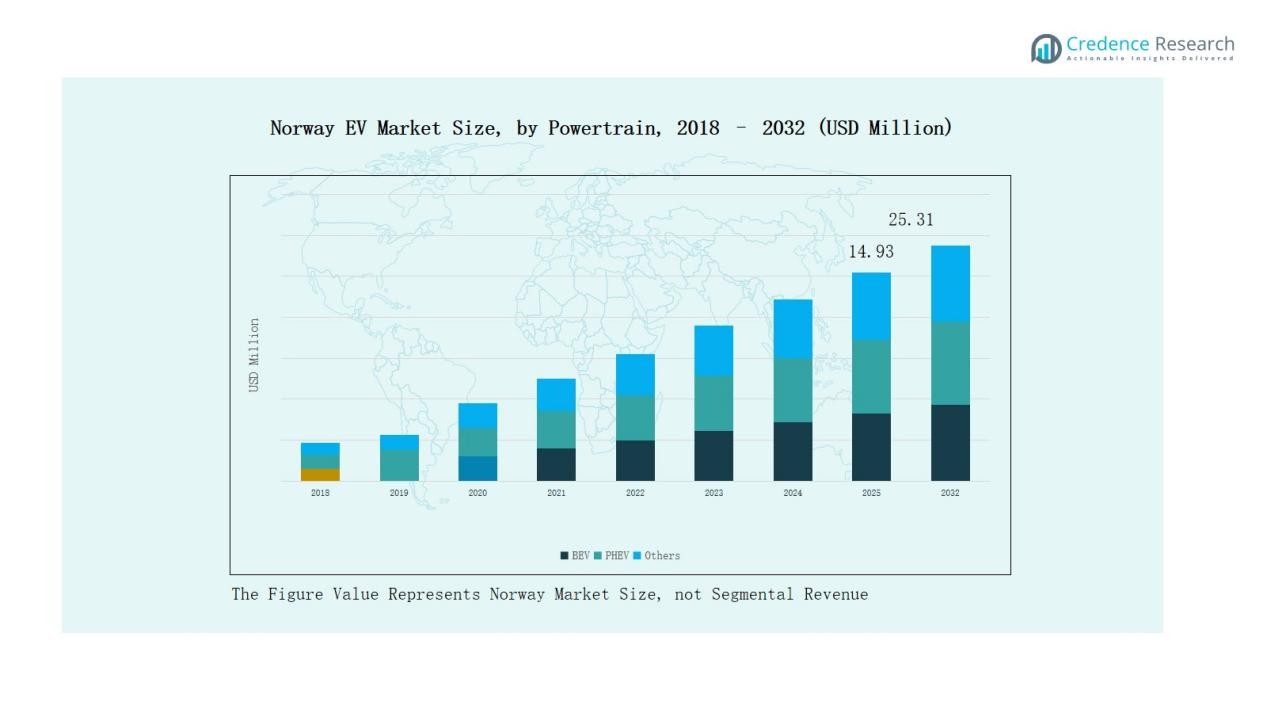

Norway Electric Vehicle (EV) Market size was valued at USD 9.12 million in 2018 to USD 13.90 million in 2024 and is anticipated to reach USD 25.31 million by 2032, at a CAGR of 7.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Norway EV Market Size 2024 |

USD 13.90 Million |

| Norway EV Market, CAGR |

7.78% |

| Norway EV Market Size 2032 |

USD 25.31 Million |

The Norway EV Market is shaped by strong competition among leading automakers including Volkswagen, BMW, Mercedes-Benz, Tesla, Volvo, Audi, Skoda, Nissan, and Geely. Tesla leads the premium BEV category with advanced technology and strong brand positioning, while Volkswagen and Volvo dominate mass-market adoption through diversified product portfolios aligned with government-backed incentives. Luxury brands such as BMW, Mercedes-Benz, and Audi reinforce their presence by offering performance-oriented EVs targeting affluent buyers. Nissan and Geely focus on affordability and fleet-friendly options, expanding accessibility across customer segments. Regionally, Eastern Norway commanded the largest share at 45% in 2024, driven by dense urbanization, extensive charging infrastructure, and Oslo’s leadership in EV penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Norway EV Market grew from USD 9.12 million in 2018 to USD 13.90 million in 2024 and is projected to reach USD 25.31 million by 2032.

- Battery Electric Vehicles held 75% share in 2024, supported by incentives, charging availability, and strong consumer preference for zero-emission mobility.

- Private buyers dominated with 70% share in 2024, while corporate buyers contributed 30% through fleet electrification and sustainability-driven adoption.

- Passenger cars led with 85% share in 2024, followed by commercial vehicles at 12% and two- and three-wheelers at 3%.

- Eastern Norway commanded the highest regional share with 45% in 2024, supported by Oslo’s leadership, dense urbanization, and advanced charging infrastructure.

Market Segment Insights

By Powertrain

Battery Electric Vehicles (BEVs) dominate the Norway EV market, accounting for nearly 75% of market share in 2024. Their leadership stems from generous government incentives, widespread charging infrastructure, and consumer preference for zero-emission mobility. Plug-in Hybrid Electric Vehicles (PHEVs) hold around 20% share, catering to buyers seeking range flexibility, while other powertrains such as fuel cell EVs and extended range EVs collectively represent less than 5%, reflecting limited adoption due to cost and infrastructure constraints.

- For instance, Tesla Model Y was Norway’s best-selling car for the third consecutive year in 2024, with 16,858 units registered, reflecting the strong popularity of BEVs.

By End User

Private buyers represent the largest share in Norway’s EV market, holding close to 70% of total sales in 2024. This dominance is driven by strong consumer subsidies, tax exemptions, and an environmentally conscious population. Corporate buyers account for nearly 30% share, supported by fleet electrification programs, company tax benefits, and sustainability targets, which are encouraging businesses to transition to EV fleets.

- For instance, Volkswagen Group announced that more than half of ID. Buzz sales in Norway were to commercial fleet buyers, encouraged by government tax savings on company cars.

By Vehicle Type

Passenger cars lead the market with an overwhelming 85% share in 2024, positioning Norway as a global leader in personal EV adoption. Rising household incomes, high urban adoption, and policy-driven support strengthen this segment. Commercial vehicles, including light and heavy-duty models, hold around 12% share, with growth supported by logistics companies shifting to green fleets.

Key Growth Drivers

Strong Government Incentives and Policies

The Norway EV Market benefits significantly from robust government incentives, making EV adoption highly attractive. Buyers receive exemptions from registration taxes, road tolls, and reduced VAT, which lower upfront costs. In addition, EV drivers enjoy access to bus lanes and discounted parking. These measures have created one of the most supportive policy environments worldwide, ensuring BEVs dominate sales. Continued alignment with Norway’s carbon neutrality targets further strengthens demand, reinforcing the role of government initiatives as the foundation for market expansion.

- For instance, Norwegian Road Federation (OFV) reported that BEVs accounted for 82.3% of all new car sales, with models like the Tesla Model Y leading registrations.

Extensive Charging Infrastructure

Norway has developed one of the most advanced EV charging networks in Europe, providing nationwide accessibility. The country has thousands of fast and ultra-fast charging points strategically placed along highways and in urban centers. This comprehensive infrastructure reduces range anxiety, ensuring both private buyers and corporate fleets can rely on EVs for daily use and long-distance travel. Continuous investments by government agencies and private firms are improving capacity, speed, and coverage, making infrastructure a strong growth catalyst for EV adoption in Norway.

- For instance, Recharge has expanded its network to more than 4,400 charging points across the Nordics, with a significant presence in Norway and strong highway coverage.

Rising Consumer Environmental Awareness

Environmental consciousness plays a vital role in accelerating EV demand in Norway. A growing share of consumers prioritize sustainability and are shifting away from combustion engine vehicles to reduce carbon footprints. High levels of awareness about climate change, combined with the government’s vision of phasing out fossil fuel car sales by 2025, strengthen this behavior. The Norwegian population demonstrates strong readiness to adopt clean mobility solutions, creating a favorable environment where EVs are viewed as both eco-friendly and future-proof investments.

Key Trends & Opportunities

Growth in Corporate Fleet Electrification

Corporate electrification is emerging as a major trend in the Norway EV Market, driven by sustainability commitments. Businesses across logistics, ride-hailing, and corporate mobility are investing heavily in EV fleets to reduce emissions and operating costs. Supportive tax deductions and fleet-targeted incentives make corporate adoption more appealing. This trend creates opportunities for automakers to launch tailored models with higher range, faster charging, and total cost-of-ownership benefits, positioning corporate fleets as a high-growth area in the coming years.

- For instance, Kempower, a leading Finnish supplier, installed over 3,000 DC fast chargers across Norway by mid-2025, including in remote areas, supporting fleet operators with reliable, distributed charging infrastructure crucial for corporate electrification.

Expansion of Vehicle Segments Beyond Passenger Cars

While passenger cars dominate, new opportunities are arising in commercial vehicles and two-wheelers. Logistics firms are electrifying vans and trucks to comply with stricter emission regulations and reduce fuel costs. Similarly, growth in e-mobility solutions is fueling interest in two-wheelers and three-wheelers for last-mile delivery services. These segments, though smaller today, are poised to expand as infrastructure develops further and specialized EV offerings become available, allowing Norway to diversify EV adoption beyond its core passenger car market.

- For instance, Einride launched electric freight mobility services in Norway with PostNord, targeting a reduction of 2,100 tonnes of CO2e emissions over three years, signaling strong interest in electrifying heavy-duty trucks for logistics compliance and cost savings.

Key Challenges

High Upfront Vehicle Costs

Despite subsidies, the Norway EV Market faces challenges from the high upfront cost of EVs compared to conventional vehicles. Premium BEVs dominate the market, limiting affordability for lower-income households. While running costs are lower, the initial purchase price still creates a barrier for broader adoption. Unless manufacturers expand affordable EV models and battery costs decline further, cost sensitivity may slow growth, especially in smaller towns and rural areas where financial incentives alone may not sufficiently offset purchase barriers.

Battery Supply Chain and Raw Material Dependence

The Norway EV Market depends on global supply chains for critical battery materials like lithium, cobalt, and nickel. Price volatility and limited availability of these resources pose risks to production stability and affordability. Norway does not have a strong domestic raw material supply base, making it reliant on imports and international suppliers. This dependency exposes the market to geopolitical tensions and cost fluctuations, creating a significant challenge for sustainable EV growth in the long term.

Charging Infrastructure Load and Grid Capacity

Although Norway has advanced charging coverage, the rapid increase in EV adoption strains the national grid. High demand during peak hours, especially from fast-charging stations, creates pressure on capacity and stability. Grid upgrades require substantial investments and time, and any delay in expansion risks slowing EV adoption momentum. Without continuous modernization and integration of renewable energy sources, charging reliability may face bottlenecks, potentially discouraging consumers and fleet operators from fully transitioning to electric mobility.

Regional Analysis

Eastern Norway

Eastern Norway leads the Norway EV Market with a 45% share in 2024. The region benefits from dense urbanization, high purchasing power, and extensive charging infrastructure. Oslo, the capital, acts as the hub of EV adoption with strong consumer preference for zero-emission vehicles. It demonstrates the highest penetration of passenger BEVs supported by municipal subsidies and environmental goals. Corporate buyers also contribute significantly through fleet electrification. It remains the core growth engine, supported by both government policy and consumer demand.

Western Norway

Western Norway holds a 25% share in 2024, driven by strong environmental awareness and sustainable transport programs. The region features challenging terrains and long commutes, creating a preference for EVs with higher ranges. Bergen and surrounding cities promote clean mobility through regional initiatives and tax exemptions. It benefits from expanding charging networks along coastal highways. The market shows strong adoption among private buyers, while commercial fleets are gradually electrifying. It continues to strengthen demand through eco-conscious consumers and growing tourism-related mobility services.

Northern Norway

Northern Norway accounts for a 15% share in 2024, with adoption supported by national subsidies and infrastructure expansion. Harsh weather conditions and long travel distances make reliability and fast-charging access critical. It still faces barriers due to fewer charging stations compared to the south. The region is gradually improving accessibility through state-backed projects. Private buyers dominate, but fleet adoption is gaining momentum in logistics. It represents a region with untapped potential for growth as infrastructure continues to expand.

Central Norway

Central Norway represents a 15% share in 2024, supported by regional development programs and growing demand for EVs in mid-sized cities. Trondheim plays a leading role, promoting EV adoption through incentives and smart mobility projects. The region benefits from improved road networks and increasing investments in fast-charging stations. Corporate buyers are beginning to transition fleets, while private buyers remain the main contributors. It provides a balanced market with both passenger cars and light commercial EVs gaining share. The region continues to evolve as policies and infrastructure align.

Market Segmentations:

By Powertrain

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Other Powertrains (Fuel Cell EVs, Extended Range EVs, etc.)

By End User

- Private Buyers

- Corporate Buyers

By Vehicle Type

- Passenger Cars

- Commercial Vehicles (LCVs, HCVs, Buses)

- Two-Wheelers & Three-Wheelers

By Charging Type

- Home Charging

- Public Charging (Slow & Fast)

By Region

- Eastern Norway

- Western Norway

- Northen Norway

- Central Norway

Competitive Landscape

The Norway EV Market is highly competitive, shaped by global automakers and regional players focusing on electrification. Tesla leads the premium BEV category, supported by advanced technology, strong charging ecosystems, and high brand recognition. Volkswagen and Volvo dominate mass-market segments, leveraging broad product portfolios and government-backed programs that support large-scale adoption. BMW, Mercedes-Benz, and Audi strengthen their positions in the luxury segment with performance-driven EV models tailored to affluent buyers. Nissan and Hyundai contribute to accessibility through mid-range, affordable EVs suited for private buyers, while BYD and Geely gain traction with competitively priced models targeting fleet and corporate customers. The market’s competitive intensity is reinforced by frequent product launches, battery innovations, and partnerships aimed at expanding charging networks. It continues to evolve rapidly, with players focusing on range, affordability, and sustainability to capture share in a country where EV penetration outpaces global averages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Volkswagen AG

- BMW AG

- Mercedes-Benz Group AG

- Tesla, Inc.

- Volvo Car Corporation

- Audi AG

- Skoda Auto

- Nissan Motor Co., Ltd.

- Geely Holding Group

- Others

Recent Developments

- In June 2025, Tesla launched its updated Model Y in Norway, achieving record sales and boosting EV registrations across the country.

- In June 2024, Volkswagen’s charging unit Elli partnered with Norwegian solar firm Otovo to integrate home solar panels, storage solutions, and EV charging services.

- In 2024, Toyota increased its fully electric model portfolio in Norway from one to five to strengthen its EV market presence and compete with Tesla and others.

Report Coverage

The research report offers an in-depth analysis based on Powertrain, End User, Vehicle Type, Charging Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- EV adoption will continue to rise as Norway maintains its 2025 zero-emission vehicle target.

- Battery electric vehicles will strengthen dominance, supported by consistent policy incentives.

- Plug-in hybrid sales will remain steady but face pressure from stricter emission regulations.

- Charging infrastructure expansion will focus on ultra-fast stations across highways and remote areas.

- Corporate fleet electrification will accelerate, driven by sustainability commitments and cost advantages.

- Growth in commercial EV adoption will increase, especially in logistics and public transport fleets.

- Innovation in battery technology will reduce costs and improve range for private buyers.

- Competition among global and regional automakers will intensify with frequent new model launches.

- Integration of renewable energy with charging networks will gain importance for grid stability.

- Consumer preference for eco-friendly transport will sustain long-term demand across all vehicle categories.