Market Overview

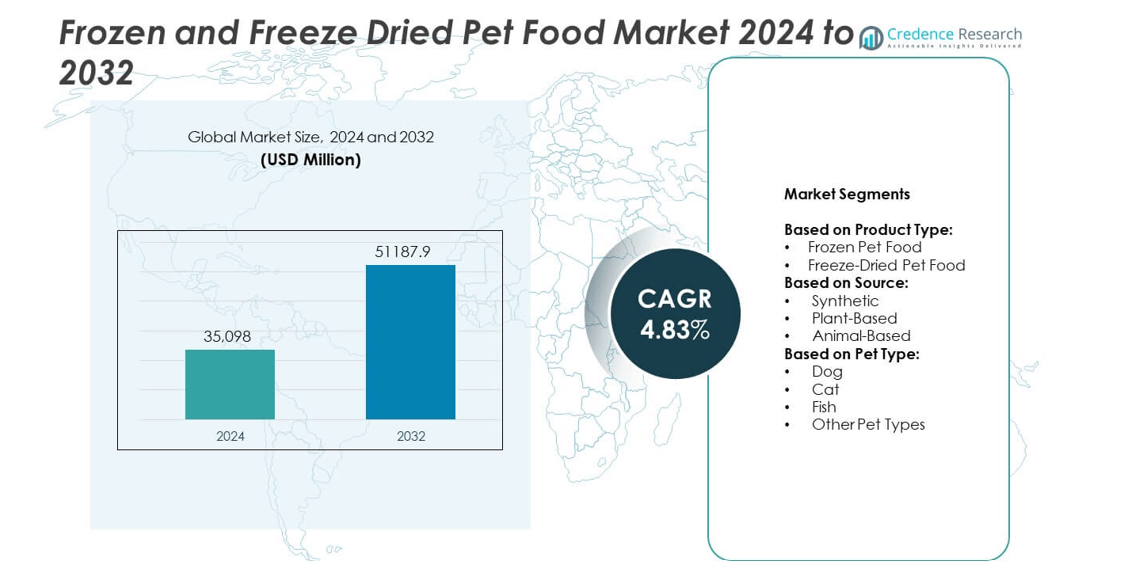

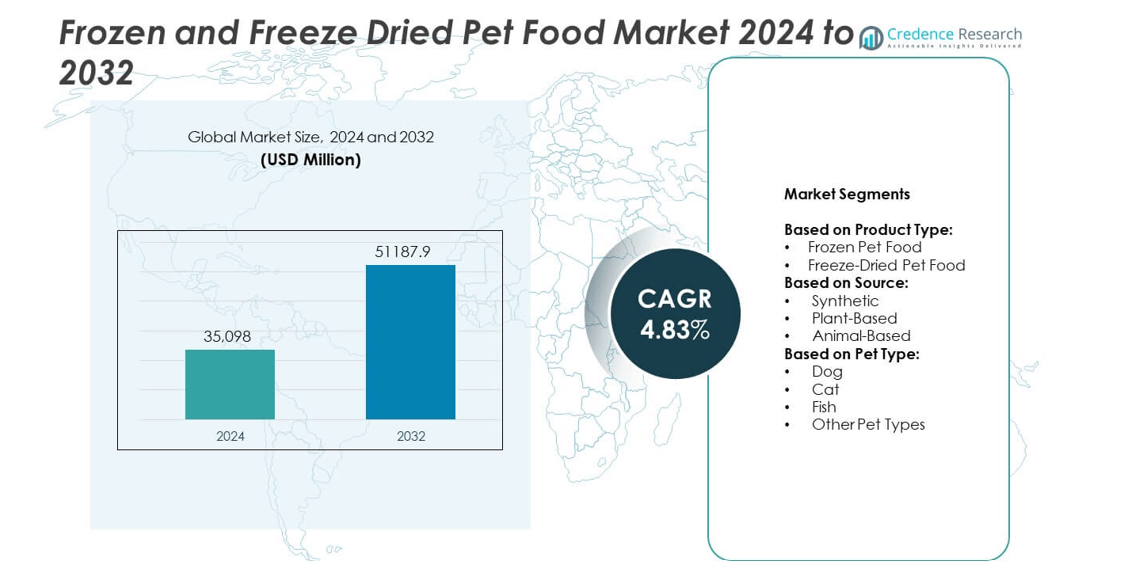

Frozen and Freeze Dried Pet Food Market size was valued at USD 35,098 Million in 2024 and is anticipated to reach USD 51187.9 Million by 2032, at a CAGR of 4.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen and Freeze Dried Pet Food Market Size 2024 |

USD 35,098 Million |

| Frozen and Freeze Dried Pet Food Market, CAGR |

4.83% |

| Frozen and Freeze Dried Pet Food Market Size 2032 |

USD 51187.9 Million |

Frozen and Freeze Dried Pet Food market growth is driven by rising pet humanization, premiumization, and demand for natural nutrition. Consumers prefer grain-free, raw, and high-protein diets that support health and wellness. Veterinary recommendations encourage adoption of functional formulations targeting digestion and immunity. E-commerce expansion and subscription models improve product accessibility and repeat purchases. Sustainability-focused packaging and clean-label products attract eco-conscious buyers. Continuous product innovation and diversification strengthen market penetration across both developed and emerging regions.

North America leads the Frozen and Freeze Dried Pet Food market, supported by high pet ownership and strong demand for premium nutrition. Europe follows with growth driven by clean-label regulations and preference for natural diets. Asia Pacific shows the fastest expansion with rising disposable incomes and urbanization. Key players include Champion, Stella & Chewy’s, Primal Pet Foods, and Vital Essentials. These companies focus on product innovation, e-commerce expansion, and sustainable sourcing to strengthen their global presence and capture growing consumer demand.

Market Insights

- Frozen and Freeze Dried Pet Food market was valued at USD 35,098 million in 2024 and is projected to reach USD 51,187.9 million by 2032 at a CAGR of 4.83%.

- Rising pet humanization and focus on premium, high-protein, and grain-free diets fuel strong demand.

- Trends highlight growth of freeze-dried formats, eco-friendly packaging, and subscription-based online sales.

- Leading players focus on innovation, clean labels, and partnerships with retailers to expand presence.

- High production and logistics costs create pricing challenges, limiting adoption in price-sensitive regions.

- North America leads with strong demand, Europe shows steady growth, and Asia Pacific records fastest expansion.

- Companies invest in emerging markets and alternative protein sources to capture new opportunities and address sustainability goals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Pet Humanization and Premiumization of Pet Diets

Frozen and Freeze Dried Pet Food market growth is driven by rising pet humanization trends. Pet owners demand nutrient-rich and minimally processed food. Premium products with high protein and clean labels gain attention. Consumers view pets as family and invest in their health. This shift encourages manufacturers to introduce natural and organic formulations. It supports higher spending on premium pet diets and functional nutrition. Brands focus on offering human-grade ingredients to attract health-conscious buyers.

- For instance, fresh & frozen pet foods saw unit sales increase by 15.8 in 2024; 100% freeze-dried pet food saw unit sales increase by 18.6 in 2024.

Increased Focus on Pet Health and Wellness

Health and wellness trends strongly influence the market. Pet owners prefer products supporting digestion, joint health, and immunity. Veterinary recommendations encourage use of specialized diets for health conditions. Freeze-dried and frozen formats preserve nutrients better than traditional kibble. It creates strong demand for balanced and high-quality pet nutrition. Brands highlight benefits like grain-free and raw formulations to build trust. The trend boosts product innovation in supplements and fortified meals.

- For instance, Carnivore Meat Company distributes its Vital Essentials and VE RAW BAR brands through more than 7,000 retailers in the U.S., in 14 international markets, and online.

Growth of E-Commerce and Specialty Distribution Channels

Expanding online retail accelerates market penetration. Direct-to-consumer platforms offer convenient access to premium pet food. Subscription models improve recurring sales and customer loyalty. Specialty stores provide education and personalized recommendations for pet diets. It helps build awareness about benefits of frozen and freeze-dried options. Digital marketing campaigns expand product visibility and consumer reach. This channel shift strengthens brand-customer relationships.

Innovation in Processing and Packaging Technologies

Technological advancements enhance product quality and shelf life. Manufacturers invest in freeze-drying equipment to maintain taste and nutrition. Eco-friendly packaging solutions appeal to sustainability-focused consumers. It supports efficient storage and transport of frozen pet food. New processing techniques reduce contamination risks and improve safety standards. Companies launch single-serve packs and resealable options for convenience. Innovation fuels differentiation in a competitive marketplace.

Market Trends

Rising Demand for Raw and Natural Pet Diets

Frozen and Freeze Dried Pet Food market witnesses a shift toward raw and minimally processed diets. Consumers seek products that mimic ancestral feeding patterns. Brands respond with grain-free, high-protein, and single-ingredient offerings. It appeals to pet owners prioritizing natural and wholesome nutrition. Transparency about ingredient sourcing becomes a major purchase driver. Companies emphasize clean labels to reassure safety and quality. Demand grows for hormone-free and antibiotic-free meat sources.

- For instance, Formula Raw Inc. opened a new 15,000-square-foot facility in Montreal, increasing monthly freeze-dried production from 7,500 kg to over 30,000 kg.

Expansion of Premium and Functional Pet Food Lines

Manufacturers invest in premium product development to capture value-conscious but health-focused buyers. Functional claims such as joint support, digestive health, and skin improvement gain attention. Frozen and freeze-dried formats enable inclusion of vitamins and probiotics. It drives innovation in specialized diets for pets with sensitivities. Companies introduce breed-specific and life-stage formulas for customization. Demand rises for fortified meals targeting aging pets and active breeds. Premiumization trend sustains growth across all regions.

- For instance, Farmina Pet Foods launched a new facility in Reidsville, North Carolina of 150,000 square feet, creating 200 jobs over five years.

Growing Popularity of Direct-to-Consumer and Subscription Models

E-commerce channels reshape purchasing behavior for pet owners. Subscription services ensure a steady supply of pet food and improve brand loyalty. It allows companies to collect data on customer preferences for targeted marketing. Digital platforms offer educational content to promote adoption of freeze-dried diets. Retailers provide flexible delivery and discounts for long-term subscribers. Growing online penetration supports smaller brands in reaching wider audiences. Direct-to-consumer presence becomes critical for future competitiveness.

Adoption of Sustainable Practices in Production and Packaging

Sustainability becomes a core focus for manufacturers. Companies shift toward recyclable and compostable packaging formats. It aligns with eco-conscious consumer expectations and regulatory trends. Brands explore alternative protein sources like insect meal to reduce environmental footprint. Investments in energy-efficient processing improve operational sustainability. Product launches highlight carbon-neutral certifications to build trust. Green practices enhance brand reputation and drive preference among younger pet owners.

Market Challenges Analysis

High Production Costs and Price Sensitivity

Frozen and Freeze Dried Pet Food market faces challenges from high manufacturing and distribution costs. Specialized freeze-drying equipment and cold-chain logistics raise expenses. It results in higher retail prices compared to conventional pet food. Price sensitivity among cost-conscious consumers limits adoption in developing regions. Manufacturers must balance premium positioning with affordability. Volatile raw material prices and supply chain disruptions further pressure margins. Companies invest in efficiency improvements to maintain competitiveness.

Limited Consumer Awareness and Storage Constraints

Lack of awareness about benefits of frozen and freeze-dried formats slows growth. Many pet owners remain loyal to kibble due to convenience. It requires education campaigns to communicate nutritional advantages. Frozen products need proper refrigeration, which creates storage issues in small households. Retailers face space constraints for frozen inventory. Distribution in warm climates can be complex without reliable cold-chain infrastructure. These barriers restrict wider market penetration despite rising interest in premium diets.

Market Opportunities

Expansion into Emerging Markets and Untapped Demographics

Frozen and Freeze Dried Pet Food market holds strong potential in emerging economies with rising pet ownership. Growing middle-class income levels support spending on premium nutrition. It creates opportunities for global brands to expand distribution networks. Local players can introduce affordable variants to capture price-sensitive consumers. Urbanization drives demand for convenient and healthier pet food formats. Companies targeting first-time pet owners can gain early brand loyalty. Partnerships with veterinary clinics and pet retailers can strengthen market entry.

Innovation in Product Formats and Ingredient Development

R&D investment opens opportunities for new product launches with functional benefits. Companies explore novel protein sources like plant-based and insect-based options. It helps address sustainability concerns and attract eco-conscious buyers. Advances in packaging improve convenience and extend shelf life. Brands can launch personalized nutrition solutions using data-driven insights. Growing demand for freeze-dried treats and single-serve meals supports premiumization. Innovation positions manufacturers to differentiate in a competitive landscape.

Market Segmentation Analysis:

By Product Type:

Frozen Pet Food accounts for the dominant share due to its ability to preserve freshness and taste. Pet owners prefer frozen diets for their high protein content and minimal processing. It appeals to consumers seeking nutrient retention and raw-style feeding options. Freeze-Dried Pet Food segment shows strong growth driven by its convenience and longer shelf life. These products require no refrigeration and offer easy storage for busy pet owners. Brands continue to expand flavor varieties and introduce single-serve packs to meet urban lifestyle needs

- For instance, Diamond Pet Foods is building a 700,000-square-foot manufacturing and distribution centre in Rushville, Indiana, to support its operations and supply chain

By Source:

Animal-Based products lead the Frozen and Freeze Dried Pet Food market due to high acceptance of meat-rich diets. Consumers choose animal protein for its superior amino acid profile and energy content. It supports growth in formulations for active and aging pets. Plant-Based products gain traction among owners interested in sustainable and allergen-free options. Synthetic sources remain a smaller segment, mainly used in fortified diets for balanced nutrition. It allows manufacturers to add essential vitamins and minerals efficiently. Demand for natural ingredient sourcing encourages companies to increase transparency.

- For instance, Royal Canin is expanding with a factory in Lewisburg, Ohio, of 450,000 square feet, designed to produce enough dry pet food to feed 4 million pets annually.

By Pet Type:

Dog segment dominates due to the higher number of dog owners worldwide. Dogs have larger daily food requirements, boosting sales volume in both frozen and freeze-dried categories. Cat segment records steady growth with increasing awareness of grain-free and protein-rich meals for feline health. Fish segment is smaller but growing with rising demand for premium aquarium diets. Other Pet Types such as birds and small mammals create niche opportunities for tailored formulations. It enables companies to diversify product lines and capture untapped market potential.

Segments:

Based on Product Type:

- Frozen Pet Food

- Freeze-Dried Pet Food

Based on Source:

- Synthetic

- Plant-Based

- Animal-Based

Based on Pet Type:

- Dog

- Cat

- Fish

- Other Pet Types

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Frozen and Freeze Dried Pet Food market, accounting for 38% of the global revenue. The region benefits from high pet ownership rates and strong consumer spending on premium pet nutrition. Pet humanization trend drives demand for raw, grain-free, and high-protein diets. It encourages manufacturers to focus on human-grade ingredients and sustainable sourcing. Growing adoption of e-commerce platforms and subscription models boosts convenience and repeat purchases. Veterinary recommendations and rising awareness of pet health support the shift toward functional formulations. Leading brands invest in expanding distribution networks across the U.S. and Canada to capture rising demand.

Europe

Europe represents the second-largest regional market with a share of 28%. Rising preference for organic and natural diets drives the adoption of frozen and freeze-dried formats. Pet owners in Germany, the UK, and France focus on nutrition quality and ingredient transparency. It supports premiumization and growth of specialized products for specific life stages. Regulatory support for clean-label claims and animal welfare standards strengthens consumer trust. Distribution through specialty pet stores and online platforms expands availability across the region. Manufacturers launch eco-friendly packaging solutions to cater to Europe’s strong sustainability focus.

Asia Pacific

Asia Pacific accounts for 22% of the market, emerging as the fastest-growing region. Rising disposable income and urbanization increase pet ownership, especially in China, Japan, and India. Consumers shift from homemade diets to commercially prepared premium food. It fuels demand for frozen and freeze-dried options that offer superior nutrition. Growth of online retail and smartphone penetration enhances access to international brands. Companies expand manufacturing facilities in the region to meet local demand and reduce logistics costs. Educational campaigns by pet food brands raise awareness about the benefits of nutrient-rich diets.

Latin America

Latin America holds 7% share of the global market and shows steady growth potential. Brazil and Mexico lead adoption due to rising pet population and growing middle-class spending. It supports demand for affordable yet premiumized pet food options. Local manufacturers introduce economy-friendly product lines while maintaining quality standards. Distribution through supermarkets and pet shops plays a key role in increasing reach. Regional players focus on marketing campaigns to educate consumers about frozen and freeze-dried benefits. Demand is gradually shifting from dry kibble toward more nutritious alternatives.

Middle East and Africa

Middle East and Africa capture 5% of the market, remaining a niche but growing segment. Rising pet adoption in urban centers like UAE, South Africa, and Saudi Arabia drives demand. It encourages retailers to stock a wider variety of premium pet diets. Limited cold-chain infrastructure and high product cost present challenges for wider adoption. International brands partner with local distributors to strengthen presence and address supply chain issues. Growing awareness of pet health and influence of western lifestyles boost long-term opportunities. Expansion of e-commerce platforms supports market penetration across key cities in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Champion

- Fresh Is Best

- K9 Natural

- Primal Pet Foods, LLC

- Stella & Chewy’s

- Carnivora

- Vital Essentials

- Bravo

- Canature Processing Ltd.

- Wisconsin Freeze Dried

- Steve’s Real Food

- Petfoods (Mars Petcare US, Inc.)

- Stewart Brand Dog Food

Competitive Analysis

The leading players in the Frozen and Freeze Dried Pet Food market include Champion, Fresh Is Best, K9 Natural, Primal Pet Foods, LLC, Stella & Chewy’s, Carnivora, Vital Essentials, Bravo, Canature Processing Ltd., Wisconsin Freeze Dried, Steve’s Real Food, Petfoods (Mars Petcare US, Inc.), and Stewart Brand Dog Food. These companies focus on premium, high-protein, and minimally processed pet food offerings to meet rising consumer demand for natural nutrition. They invest in innovative formulations that include grain-free, single-ingredient, and functional diets targeting digestion, joint health, and immunity. The players emphasize clean labels and transparency in ingredient sourcing to build consumer trust. Strong distribution networks through specialty stores, e-commerce, and subscription models expand their market reach. Companies leverage marketing campaigns and partnerships with veterinarians to educate pet owners about health benefits of frozen and freeze-dried products. Sustainability initiatives, such as eco-friendly packaging and responsible sourcing, enhance brand reputation. Continuous product innovation, including breed-specific and life-stage formulas, helps differentiate them in a competitive landscape. Strategic expansions into emerging markets and localized manufacturing improve cost efficiency and address regional preferences. These efforts position the leading players to maintain growth and strengthen market share.

Recent Developments

- In 2024, Stella & Chewy’s launched a direct-to-consumer e-commerce platform offering nearly 100 freeze-dried raw products, treats, and kibble to improve access for pet parents.

- In 2023, Vital Essentials rebranded its Butcher Cut Protein freeze-dried raw pet food with new packaging that reflects a “butcher shop” quality feel

- In 2022, Bravo was acquired by BrightPet Nutrition Group LLC which will leverage Bravo’s expertise and portfolio to expand in raw, fresh, and frozen pet food products

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Pet Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue steady growth driven by rising pet humanization trends.

- Premium and functional pet diets will gain stronger adoption across all regions.

- Freeze-dried formats will expand faster due to convenience and long shelf life.

- Brands will invest in sustainable sourcing and eco-friendly packaging solutions.

- E-commerce and subscription models will become a primary distribution channel.

- Pet owners will demand clean-label, grain-free, and high-protein formulations.

- Emerging markets will see faster adoption with rising disposable incomes.

- Innovation in alternative proteins will address sustainability and cost concerns.

- Veterinary recommendations will influence purchase decisions and drive functional product sales.

- Competition will intensify with new entrants and product differentiation strategies.