Market Overview

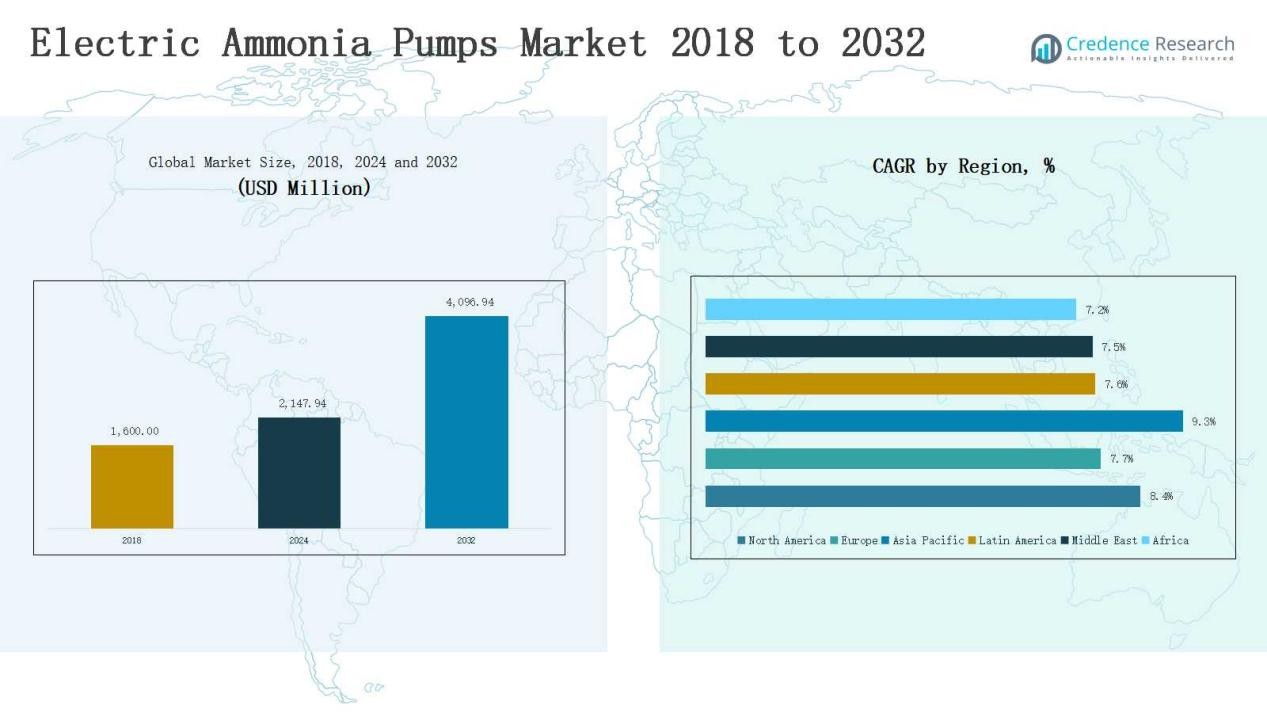

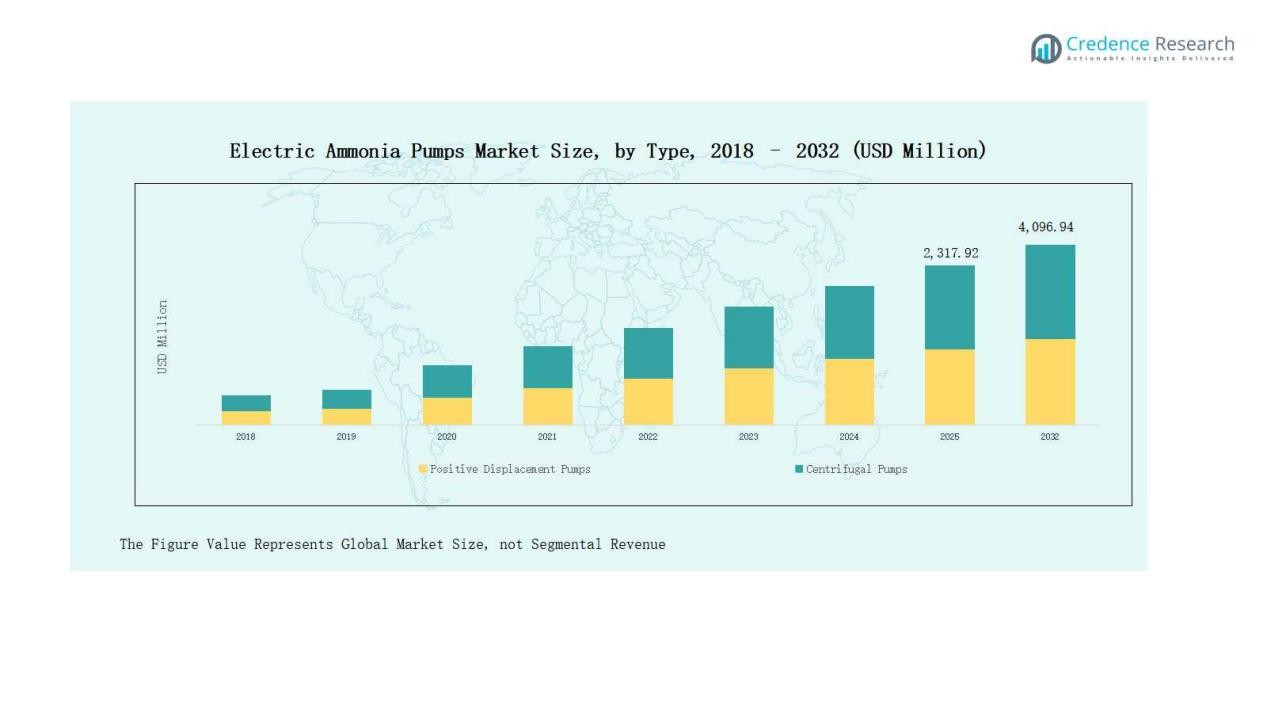

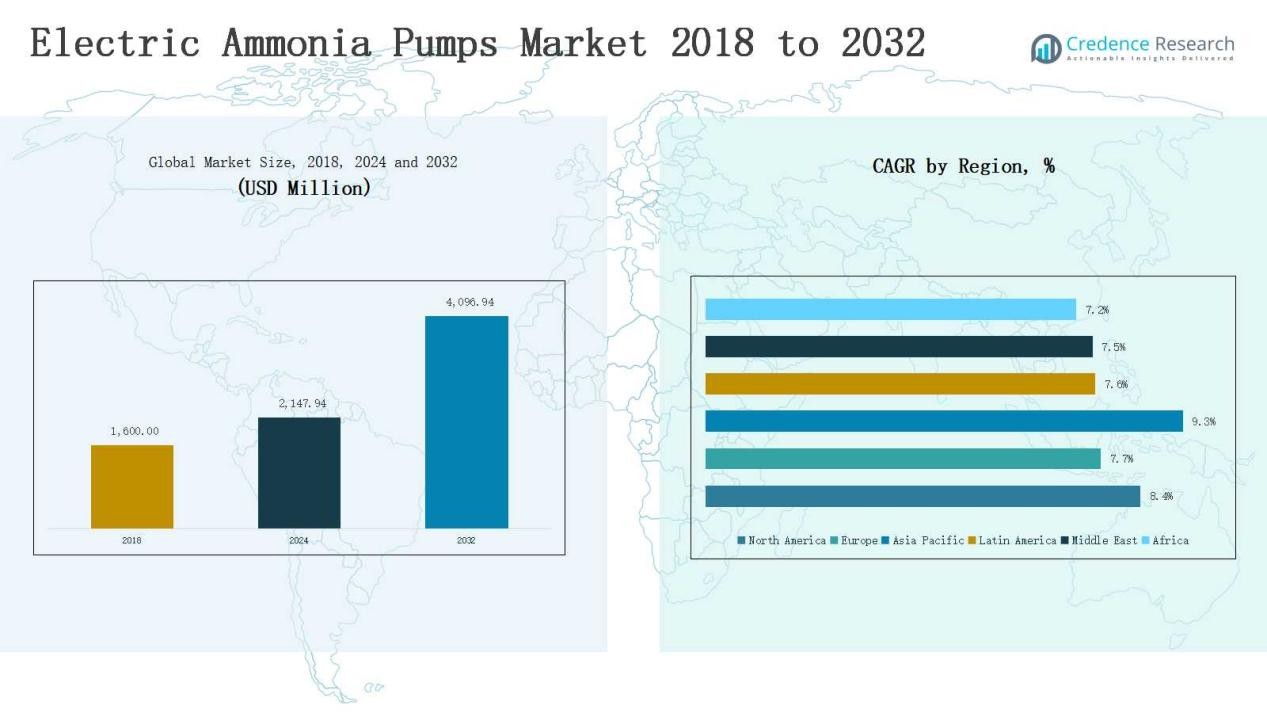

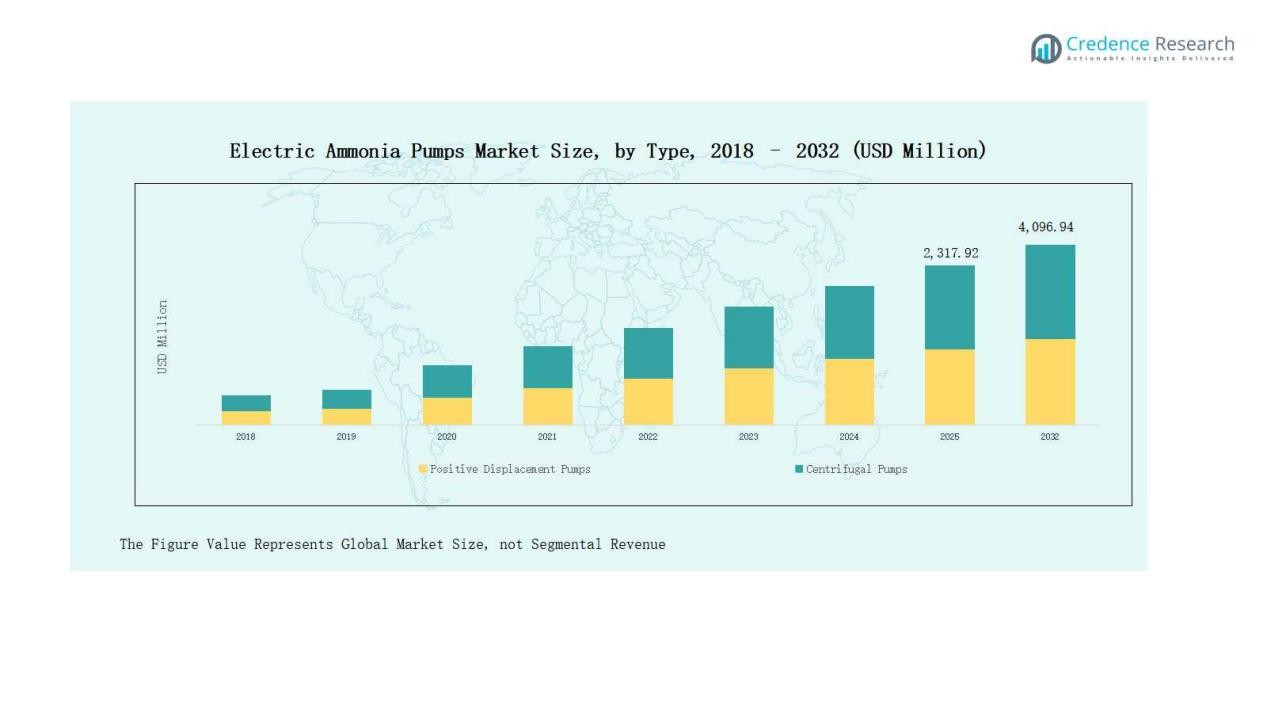

Electric Ammonia Pumps Market size was valued at USD 1,600.00 million in 2018 to USD 2,147.94 million in 2024 and is anticipated to reach USD 4,096.94 million by 2032, at a CAGR of 8.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Ammonia Pumps Market Size 2024 |

USD 2,147.94 Million |

| Electric Ammonia Pumps Market, CAGR |

8.48% |

| Electric Ammonia Pumps Market Size 2032 |

USD 4,096.94 Million |

The Electric Ammonia Pumps Market is shaped by key players such as Baker Hughes, Lutz Pumpen GmbH, WITTE PUMPS & TECHNOLOGY GmbH, PSG, Celeros Flow Technology, Cornell Pump, Hayward Tyler, and IWAKI Europe GmbH, each focusing on product innovation, energy efficiency, and compliance with environmental standards to strengthen their positions. These companies maintain competitive advantages through advanced materials, expanded electric-powered portfolios, and strong global distribution networks. Regionally, Asia Pacific led the market in 2024 with a dominant 40% share, supported by rapid industrialization, strong chemical processing demand, and expanding cold storage infrastructure across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Ammonia Pumps Market grew from USD 1,600.00 million in 2018 to USD 2,147.94 million in 2024 and is projected to reach USD 4,096.94 million by 2032.

- Positive displacement pumps led the market with 58% share in 2024, driven by reliability in high-pressure ammonia applications, while centrifugal pumps held 42% with rising use in cooling systems.

- Stainless steel dominated materials with 52% share in 2024 due to durability and corrosion resistance, while alloy materials held 33% and polymer-based designs captured 15%.

- Electric-powered pumps commanded 64% of the market in 2024, supported by energy efficiency and sustainability goals, whereas diesel-powered pumps retained 36% mainly in remote operations.

- Asia Pacific led the market with 40% share in 2024, followed by Europe and North America at 24% each, while Latin America, Middle East, and Africa collectively contributed 16%.

Market Segment Insights

By Type

Positive displacement pumps accounted for the largest share of the electric ammonia pumps market in 2024, holding 58% of total revenue. Their dominance is driven by superior handling of high-pressure ammonia applications, consistent flow delivery, and operational reliability across refrigeration and chemical processing plants. Centrifugal pumps, while representing 42% of the market, are gaining traction in large-scale industrial cooling systems due to their efficiency and lower maintenance costs.

- For instance, GEA Group supplied positive displacement ammonia pumps for a European food processing facility, ensuring stable flow in ultra-low temperature refrigeration lines

By Material

Stainless steel emerged as the leading material segment with a 52% market share in 2024, supported by its durability, corrosion resistance, and suitability for food-grade applications. Alloy materials captured 33% of revenue, favored in oil and gas sectors where high strength and temperature resistance are critical. Polymer-based materials accounted for the remaining 15%, growing steadily in lightweight pump designs and cost-sensitive applications.

- For instance, Flowserve announced supplying dry gas seals and systems for ADNOC’s carbon capture project in the UAE, utilizing its flow control technology.

By Power Source

Electric-powered pumps dominated the market with a 64% share in 2024, fueled by increasing demand for energy-efficient solutions, lower operating costs, and alignment with sustainability goals in manufacturing and chemical industries. Diesel-powered pumps retained a 36% share, mainly serving remote locations and oilfield operations where stable grid electricity is unavailable, though their growth is restrained by rising environmental regulations and fuel costs.

Key Growth Drivers

Rising Demand for Refrigeration and Cooling Systems

The increasing use of ammonia in refrigeration and industrial cooling systems is a major driver for electric ammonia pumps. Food processing, cold storage, and marine applications rely heavily on efficient and reliable ammonia circulation. Growing demand for frozen food, pharmaceuticals, and chemical storage is further accelerating adoption. Positive displacement and centrifugal pumps with electric power sources are increasingly preferred for their energy efficiency, operational stability, and cost savings, strengthening market growth across industries.

- For instance, GEA Group supplied its Grasso V-series ammonia screw compressors with electric drive for a new cold storage facility in France, designed to support the region’s frozen food supply chain.

Shift Toward Energy Efficiency and Sustainability

Global emphasis on sustainable operations and lower emissions is driving the adoption of electric-powered ammonia pumps. These pumps reduce fuel dependency, optimize energy use, and comply with stringent environmental regulations. Industries are transitioning from diesel-powered pumps to electric models to achieve long-term cost efficiency and align with corporate ESG commitments. Advancements in pump design, such as variable speed drives and high-efficiency motors, further support this shift, positioning electric ammonia pumps as a sustainable alternative in diverse industrial applications.

- For instance, Grundfos implemented electric ammonia pumps equipped with high-efficiency motors in industrial refrigeration systems, enabling clients to meet stricter emissions regulations while lowering operational costs.

Expansion of the Chemical and Oil & Gas Industries

The expansion of the chemical and oil & gas industries has boosted demand for reliable ammonia circulation systems. Electric ammonia pumps are essential for chemical processing, refining, and offshore operations where precision, durability, and continuous flow are critical. Growth in emerging economies, particularly in Asia Pacific and the Middle East, is fueling infrastructure investment in petrochemical plants and processing units. As companies seek durable and high-capacity pumping solutions, the reliance on advanced electric ammonia pumps continues to increase globally.

Key Trends & Opportunities

Technological Advancements in Pump Design

Technological innovation is reshaping the electric ammonia pumps market. Integration of smart monitoring, automation, and IoT-based controls is enabling predictive maintenance and reducing downtime. Manufacturers are investing in corrosion-resistant materials and advanced sealing systems to extend service life and reduce leakage risks. The development of energy-efficient motors and customized pump solutions for specialized industries presents a major opportunity for companies to differentiate their offerings and strengthen market share in both developed and emerging regions.

- For instance, EBARA Corporation announced the development of a leak-free canned motor pump for liquid ammonia, designed to minimize leakage risks in ammonia-handling environments within chemical and energy segments.

Growing Adoption in Emerging Economies

Emerging economies across Asia Pacific, Latin America, and Africa present strong growth opportunities. Rapid industrialization, urbanization, and rising demand for cold storage and chemical processing are fueling the adoption of electric ammonia pumps. Governments are investing in infrastructure and food security initiatives, further driving demand for refrigeration systems. Local manufacturers are also entering the market with cost-effective pump designs, increasing accessibility. These regions are expected to record the fastest growth rates, offering global players new opportunities for expansion.

- For instance, German-based GEA, a global technology supplier, introduced energy-efficient ammonia compressor and pump packages for industrial cold storage applications, including in Southeast Asia.

Key Challenges

High Initial Investment and Maintenance Costs

Despite long-term benefits, electric ammonia pumps require significant upfront investment. Installation of advanced electric-powered systems, particularly stainless-steel pumps, increases capital expenditure for industries with budget constraints. Maintenance of seals, motors, and electronic control systems adds to operational costs. For small and mid-scale businesses, this cost factor often limits adoption, creating challenges for widespread penetration of electric ammonia pumps, especially in price-sensitive markets.

Stringent Safety and Environmental Regulations

Ammonia is a hazardous substance, requiring strict compliance with safety and environmental standards. Industries using ammonia pumps must adhere to regulations on storage, handling, and emissions, which raises operational complexity and cost. Non-compliance can result in fines and operational shutdowns, discouraging smaller operators. Manufacturers are required to design pumps with advanced safety features, increasing design costs. These regulatory pressures challenge both producers and end-users, slowing down large-scale adoption in some regions.

Competition from Alternative Refrigerants and Systems

The increasing use of alternative refrigerants and advanced cooling technologies poses a challenge for the electric ammonia pumps market. Industries are exploring substitutes like CO₂-based systems and low-GWP refrigerants to meet environmental goals. These alternatives, combined with innovations in cooling equipment, could reduce ammonia dependency. If industries adopt these substitutes at scale, the growth potential for electric ammonia pumps may be restrained, pushing manufacturers to innovate further to maintain competitiveness in the global market.

Regional Analysis

North America

North America held a 24% share of the global electric ammonia pumps market in 2024, with revenue of USD 508.19 million. The region is projected to reach USD 964.38 million by 2032, expanding at a CAGR of 8.4%. Growth is driven by strong demand from industrial refrigeration, food processing, and oil & gas sectors. The U.S. leads adoption due to advanced infrastructure, while Canada and Mexico are expanding with investments in cold storage facilities and petrochemical industries. Favorable regulations supporting energy-efficient technologies also strengthen the region’s market position.

Europe

Europe accounted for 24% of the market in 2024, valued at USD 510.72 million, and is projected to reach USD 916.70 million by 2032, growing at a CAGR of 7.7%. Strong adoption in Germany, France, and the UK is supported by mature food processing industries and stringent environmental standards. The region’s emphasis on sustainable refrigeration technologies drives the shift from diesel-powered to electric-powered pumps. Increasing investments in pharmaceuticals and chemicals also contribute to stable demand. Eastern Europe is gradually expanding adoption, supported by industrial modernization initiatives.

Asia Pacific

Asia Pacific dominated the market with a 40% share in 2024, generating USD 848.11 million in revenue. It is expected to grow at the fastest CAGR of 9.3%, reaching USD 1,716.25 million by 2032. China, India, and Japan lead the regional market, supported by rapid industrialization, chemical processing, and rising demand for cold storage facilities. Government initiatives to expand food security infrastructure and renewable energy integration further strengthen growth. Asia Pacific remains the primary hub for manufacturing and exports, offering significant opportunities for pump manufacturers.

Latin America

Latin America represented a 7% share of the global market in 2024, with revenue of USD 144.75 million. It is projected to reach USD 257.57 million by 2032, expanding at a CAGR of 7.6%. Brazil dominates demand, supported by a large food and beverage industry and growing chemical processing sector. Argentina and Mexico contribute moderately, with rising adoption in industrial manufacturing. Despite economic fluctuations, government efforts to modernize cold storage and expand export-based industries are creating opportunities for electric ammonia pump suppliers in the region.

Middle East

The Middle East held a 6% share in 2024, valued at USD 106.52 million, and is forecasted to reach USD 188.89 million by 2032, growing at a CAGR of 7.5%. GCC countries lead regional adoption, supported by oil and gas investments and industrial expansion. Demand for ammonia-based refrigeration in petrochemicals and marine applications fuels pump installations. Israel and Turkey show rising adoption through chemical manufacturing growth. However, the market faces challenges from reliance on fossil fuel-driven industries, pushing companies to adopt electric-powered alternatives to align with sustainability goals.

Africa

Africa captured a 2% share in 2024, with market revenue of USD 29.65 million. The region is expected to reach USD 53.14 million by 2032, growing at a CAGR of 7.2%. South Africa leads adoption, driven by its food and beverage sector and rising industrial investments. Egypt and Nigeria are gradually expanding usage with new infrastructure and chemical processing projects. Limited access to advanced technology and high upfront costs remain challenges, but growing urbanization and regional trade agreements present opportunities for pump manufacturers to strengthen presence.

Market Segmentations:

By Type

- Positive Displacement Pumps

- Centrifugal Pumps

By Material

- Stainless Steel

- Alloy Materials

- Polymer-based Materials

By Power Source

- Electric-powered Pumps

- Diesel-powered Pumps

By End-User Industry

- Industrial Manufacturing

- Food and Beverage

- Oil and Gas

- Pharmaceuticals

- Others

By Application

- Refrigeration Systems

- Chemical Processing

- Marine and Offshore

- Industrial Cooling Systems

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The competitive landscape of the Electric Ammonia Pumps Market is defined by the presence of global leaders and specialized regional players competing on product innovation, efficiency, and industry-specific solutions. Key companies such as Baker Hughes, Lutz Pumpen GmbH, WITTE PUMPS & TECHNOLOGY GmbH, PSG, Celeros Flow Technology, Cornell Pump, Hayward Tyler, and IWAKI Europe GmbH dominate through extensive product portfolios and strong global distribution networks. These players focus on enhancing pump reliability, energy efficiency, and safety standards to meet the rising demand from industries including food and beverage, oil and gas, and chemical processing. Strategic investments in stainless-steel and polymer-based materials, along with electric-powered technologies, strengthen their ability to address regulatory compliance and sustainability goals. Partnerships, acquisitions, and expansions into emerging markets remain central growth strategies. Competition is also intensifying from regional manufacturers offering cost-effective solutions, creating a balanced mix of global innovation and localized affordability in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Baker Hughes

- Lutz Pumpen GmbH

- WITTE PUMPS & TECHNOLOGY GmbH

- PSG

- Celeros Flow Technology

- Cornell Pump

- Hayward Tyler

- IWAKI Europe GmbH

Recent Developments

- In September 2024, Svanehøj introduced a high-pressure centrifugal ammonia fuel pump capable of delivering injection pressure up to 100 bar with a hermetically sealed design.

- In June 2025, Honeywell completed the acquisition of Sundyne for USD 2.16 billion, strengthening its portfolio in advanced pumps and compressors for ammonia and process industries.

- In September 2025, Nikkiso Clean Energy & Industrial Gases Group launched a next-generation submerged electric ammonia pump at the Gastech 2025 Conference. The new pump is seal-less, copper-free, and integrated with a motor-pump design, offering over 2,500 cubic meters per hour capacity and industry-leading reliability with a mean time between outages exceeding 16,000 operating hours.

- In April 2025, CF Industries formed a joint venture with JERA Co., Inc. and Mitsui & Co., Ltd. to build a low-carbon ammonia production facility at the Blue Point Complex, Louisiana. The facility will include CO₂ capture, and the partners plan large-scale ammonia production.

- In May 2025, Marubeni and ExxonMobil signed a long-term offtake agreement for about 250,000 tonnes per year of low-carbon ammonia from ExxonMobil’s facility in Baytown, Texas. Marubeni also agreed to take an equity stake in the facility.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Power Source, End User Industry, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric ammonia pumps will rise with expanding refrigeration and cold storage facilities.

- Adoption will increase in chemical and oil & gas sectors for reliable ammonia circulation.

- Electric-powered pumps will continue replacing diesel-powered units due to efficiency and compliance.

- Stainless steel pumps will dominate material use because of durability and corrosion resistance.

- Asia Pacific will remain the leading growth region supported by industrial expansion.

- North America and Europe will sustain strong adoption driven by regulatory standards.

- Integration of smart monitoring and IoT-enabled controls will improve operational reliability.

- Manufacturers will focus on sustainable designs to meet stricter environmental regulations.

- Emerging economies will present new opportunities through infrastructure and food industry growth.

- Competitive intensity will increase as regional players offer cost-effective pump solutions.