Market Overview

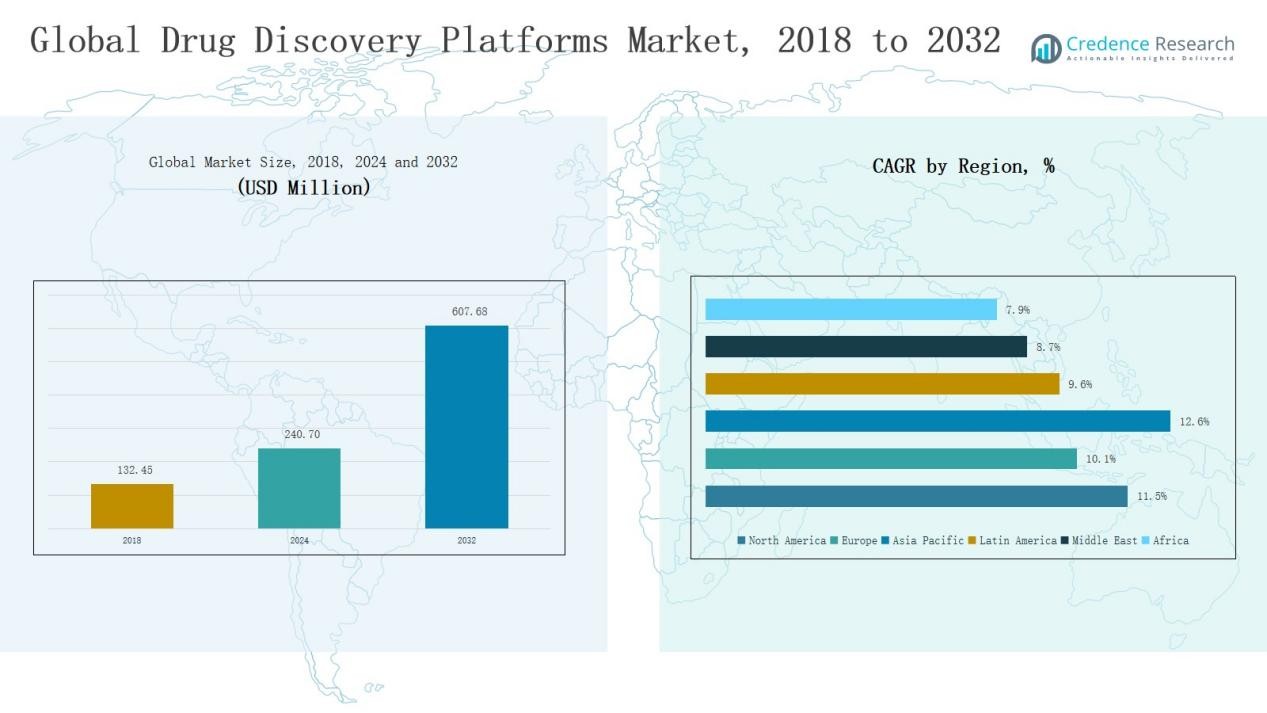

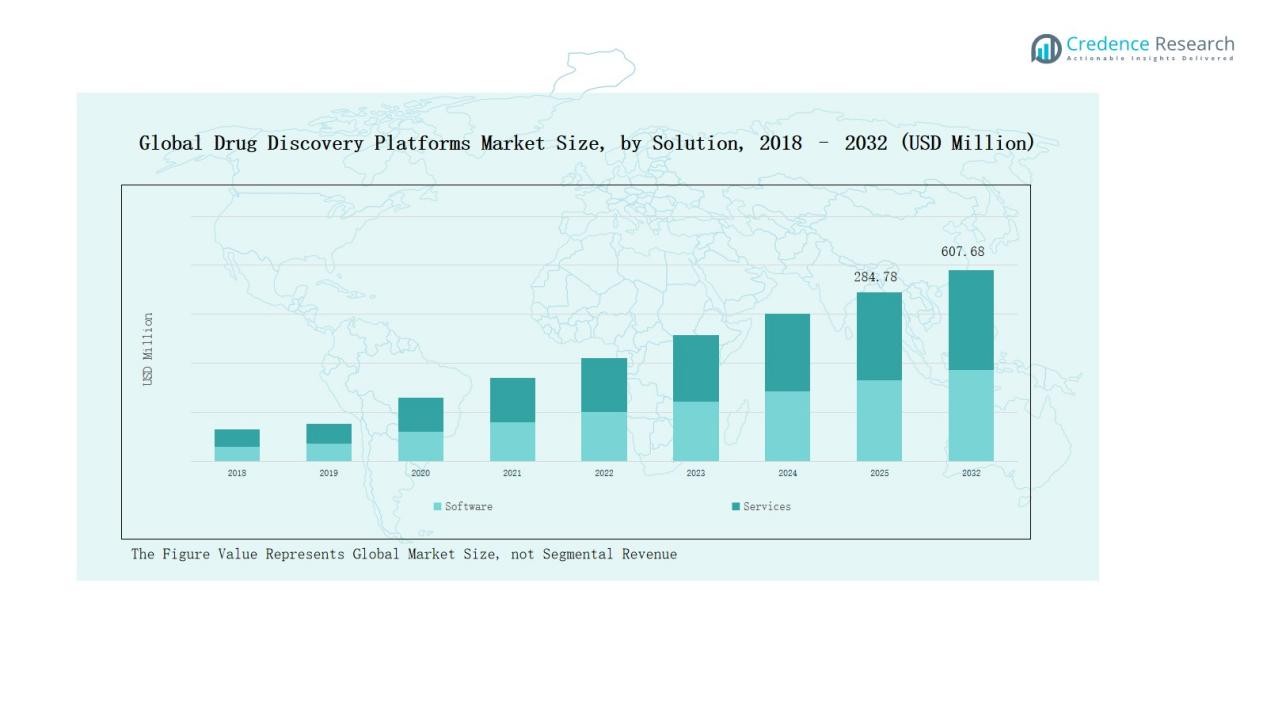

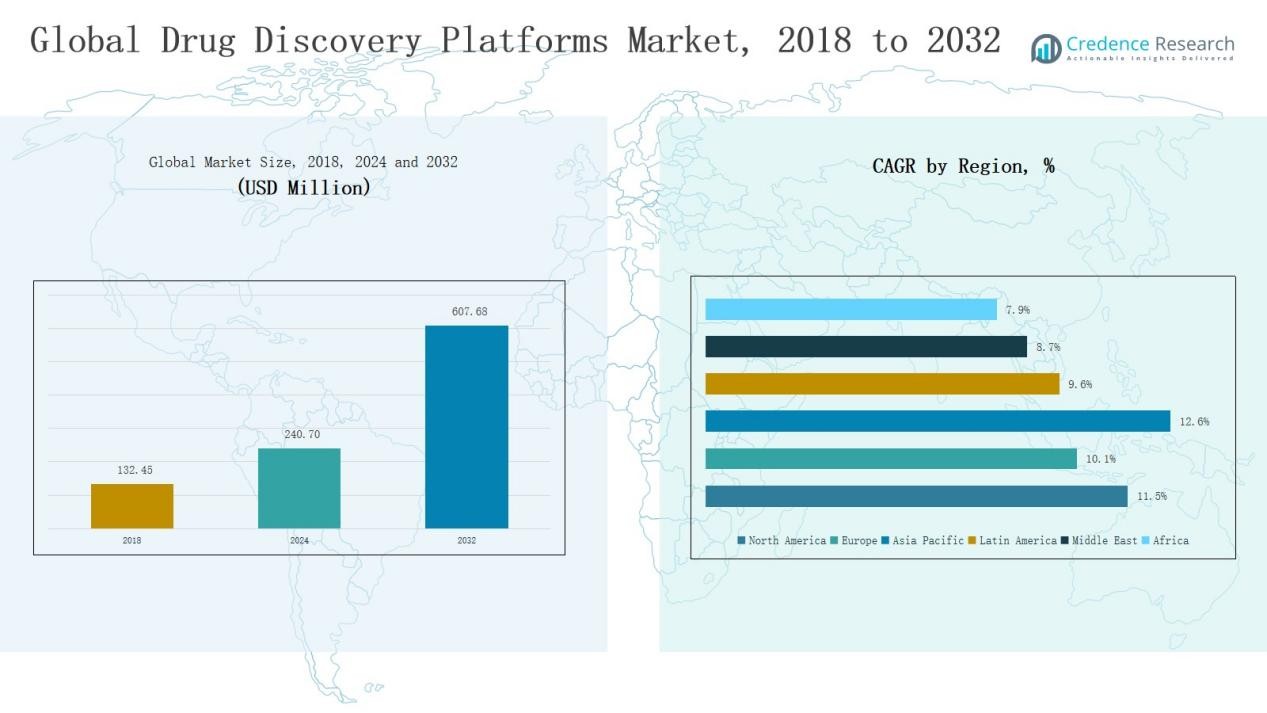

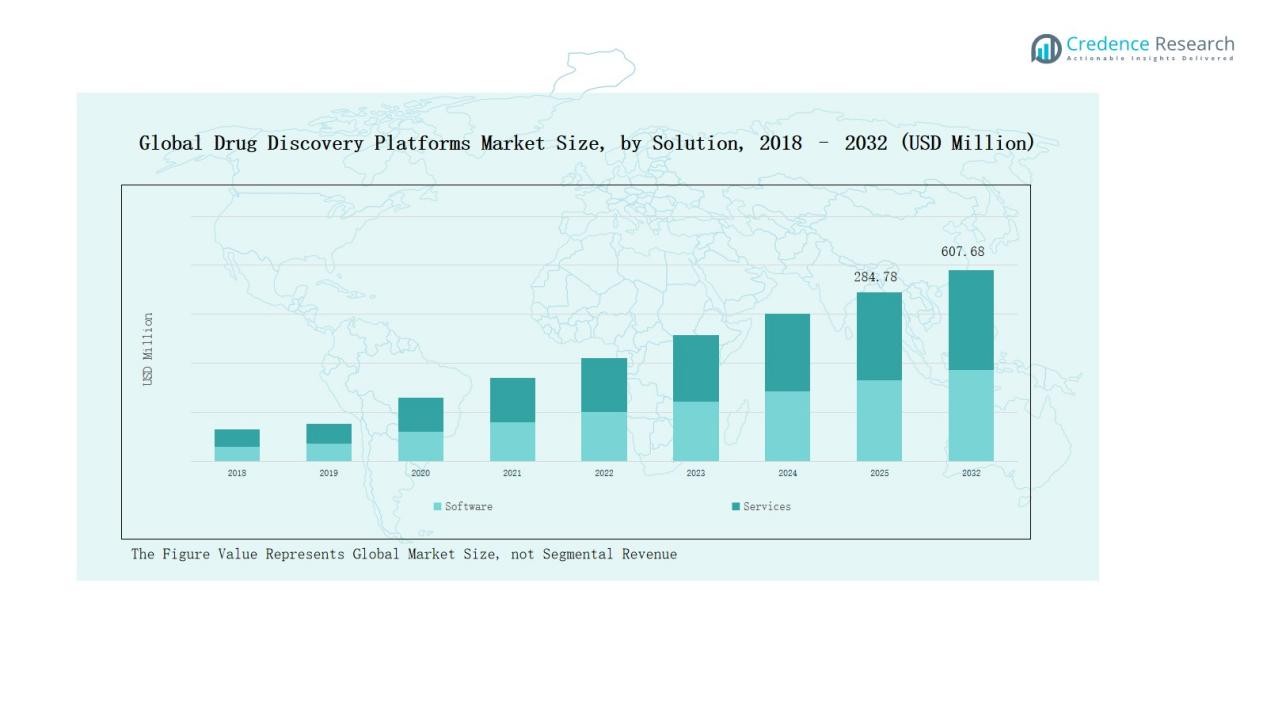

Drug Discovery Platforms Market size was valued at USD 132.45 million in 2018 to USD 240.70 million in 2024 and is anticipated to reach USD 607.68 million by 2032, at a CAGR of 11.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug Discovery Platforms Market Size 2024 |

USD 240.70 Million |

| Drug Discovery Platforms Market, CAGR |

11.44% |

| Drug Discovery Platforms Market Size 2032 |

USD 607.68 Million |

The Drug Discovery Platforms Market is shaped by prominent players including Schrödinger, Certara, PerkinElmer (Revvity), Merative, Charles River Laboratories, Evotec SE, Chemaxon, OpenEye (Cadence Molecular Sciences), and Genedata. These companies maintain strong market positions through advanced software solutions, AI-driven analytics, and strategic collaborations with pharmaceutical and biotechnology firms. Competition focuses on enhancing molecular modeling, sequencing, and database management capabilities to accelerate drug development. Regionally, North America leads the market with a 38% share in 2024, supported by significant R&D investments, advanced healthcare infrastructure, and early adoption of digital discovery technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Drug Discovery Platforms Market grew from USD 132.45 million in 2018 to USD 240.70 million in 2024 and is projected to reach USD 607.68 million by 2032.

- Software led with 62% share in 2024, driven by AI-enabled tools and predictive analytics, while services held 38% share, boosted by rising outsourcing and integration support.

- Sequencing and Target Data Analysis dominated with 35% share in 2024, followed by docking at 25% and molecular modeling at 20%, supporting advanced screening and structural biology.

- Pharmaceutical companies held 48% share in 2024, followed by biotechnology firms at 28% and CROs at 18%, reflecting heavy investment in digital pipelines and outsourcing.

- North America led with 38% share in 2024, followed by Asia Pacific at 27% and Europe at 15%, supported by R&D spending, biotech growth, and regulatory initiatives.

Market Segment Insights

By Solution

Software accounts for the dominant share of the Drug Discovery Platforms Market, holding 62% in 2024. Its leadership is driven by the growing adoption of AI-enabled platforms, machine learning algorithms, and cloud-based computational tools that streamline drug development. Software platforms improve predictive accuracy in target identification and reduce development costs, making them preferred by pharmaceutical and biotechnology firms. Services, with the remaining 38% share, are gaining traction due to increasing demand for outsourced expertise, customization, and integration support.

- For instance, Exscientia reported that its AI-driven drug discovery platform had identified a novel molecule that advanced into Phase 1 clinical trials, reducing timeline and cost compared to conventional methods.

By Function

Sequencing and Target Data Analysis leads the function segment with 35% share in 2024, supported by rapid advancements in next-generation sequencing and data analytics for personalized medicine. Docking and molecular modeling follow with 25% and 20% shares respectively, as they play critical roles in virtual screening and structural biology. Library & database preparation holds around 12%, driven by the need for high-quality compound databases, while others collectively contribute 8%, including niche tools for specialized research areas.

- For instance, Illumina launched the NovaSeq X Plus sequencer, capable of generating over 20,000 whole genomes annually, significantly boosting large-scale sequencing capacity.

By End User

Pharmaceutical companies dominate the end-user segment, holding 48% share in 2024, as they invest heavily in digital platforms to accelerate drug pipelines and reduce attrition rates. Biotechnology companies follow with 28% share, leveraging platforms for niche therapies and precision medicine. Contract Research Organizations (CROs) account for 18%, driven by increasing outsourcing of discovery processes. Others, including academic and research institutes, hold 6%, supporting early-stage innovation and collaborative projects.

Key Growth Drivers

Rising Demand for AI and Machine Learning Integration

The integration of AI and machine learning is a major driver in the Drug Discovery Platforms Market. These technologies enable faster target identification, predictive modeling, and optimization of clinical outcomes, reducing both time and cost of development. Companies are increasingly deploying AI-enabled software to analyze large biomedical datasets, improving accuracy in drug design. This shift enhances efficiency and supports the growing pipeline of precision medicine, positioning AI-driven solutions as a cornerstone of modern discovery processes.

- For instance, Atomwise’s AI platform AtomNet uses deep convolutional neural networks to predict small molecule-protein binding in days, bypassing lengthy traditional screening methods and tackling 600+ unique disease targets.

Growing Investments in Precision Medicine

Expanding focus on precision medicine continues to accelerate platform adoption. Pharmaceutical and biotechnology companies rely on advanced discovery platforms to design therapies tailored to genetic, molecular, and patient-specific profiles. Rising prevalence of chronic and genetic disorders has fueled funding in targeted drug development, driving demand for sequencing and molecular modeling functions. Government and private sector investments in genomics, coupled with broader adoption of personalized therapies, are strengthening the market’s growth trajectory and reshaping traditional R&D models.

- For instance, in February 2025, the Government of Canada launched the Canadian Genomics Strategy with an investment of $175.1 million over seven years to accelerate commercialization and adoption of genomics in personalized medicine, advanced diagnostics, and novel therapeutics for conditions such as rare diseases and cancer.

Increasing Outsourcing to CROs

Pharmaceutical and biotech companies are outsourcing more discovery functions to Contract Research Organizations (CROs) to lower operational costs and improve efficiency. CROs provide specialized expertise, advanced tools, and access to global research networks, allowing companies to streamline drug pipelines. This outsourcing trend also reduces the burden of maintaining in-house infrastructure, particularly for small and mid-sized enterprises. Growing reliance on CROs for sequencing, molecular modeling, and database preparation is a significant factor propelling the expansion of services in the market.

Key Trends & Opportunities

Adoption of Cloud-Based Platforms

Cloud deployment is emerging as a transformative trend in the Drug Discovery Platforms Market. Cloud-enabled solutions allow seamless access to data, scalability of operations, and improved collaboration across global research teams. The shift to cloud reduces upfront infrastructure costs, promotes faster data processing, and enables real-time analytics, which is vital in accelerating discovery cycles. This trend creates opportunities for platform providers to offer secure, integrated, and subscription-based models tailored to diverse research needs.

- For instance, BenevolentAI announced a strategic overhaul focusing on AI-driven drug discovery powered by cloud platforms, enabling scalable and faster analysis of complex datasets to accelerate research pipelines.

Expansion in Emerging Markets

Emerging markets such as Asia-Pacific and Latin America are creating new opportunities for drug discovery platforms. Growing healthcare investments, rising patient pools, and increasing government support for life sciences research drive demand in these regions. Countries like China and India are witnessing rapid adoption of sequencing and AI-based platforms, supported by biotech startups and academic partnerships. This expansion provides significant opportunities for global players to establish strategic collaborations, offer cost-effective solutions, and strengthen regional market presence.

- For instance, WuXi AppTec announced the launch of a new drug discovery facility in Changzhou, China, equipped with AI-powered screening technologies to serve both domestic and international biopharma clients.

Key Challenges

High Implementation Costs

Despite technological progress, high upfront costs for deploying advanced discovery platforms remain a critical barrier. Smaller biotech firms and academic institutions often face funding constraints, limiting adoption of comprehensive software and services. Expenses related to AI integration, cloud infrastructure, and data security further raise financial hurdles. These costs challenge widespread market penetration, especially in resource-limited regions, slowing growth despite rising demand for precision-driven drug development.

Data Privacy and Security Concerns

Data integrity and security present major challenges for market players. Drug discovery relies on sensitive patient data, proprietary compound libraries, and genomic databases that are vulnerable to breaches and misuse. Compliance with stringent regulations such as GDPR and HIPAA further complicates data management. Ensuring secure handling of research data while maintaining global collaboration creates operational hurdles for platform providers, raising concerns among pharmaceutical and biotechnology stakeholders.

Regulatory Complexity in Drug Approval

The complex regulatory environment governing drug discovery slows market expansion. While platforms accelerate early-stage research, they must align with evolving global standards for safety, efficacy, and ethical compliance. Lengthy approval processes and variations across regions create inefficiencies, discouraging rapid adoption. Companies face delays in translating discoveries into clinical success, reducing the overall impact of digital platforms. This challenge underscores the need for harmonized regulations and supportive frameworks to streamline innovation pathways.

Regional Analysis

North America

North America dominates the Drug Discovery Platforms Market with a 38% share in 2024, generating USD 105.11 billion, up from USD 58.44 billion in 2018. It is projected to reach USD 266.10 billion by 2032, advancing at a CAGR of 11.5%. The region’s leadership is driven by high pharmaceutical R&D spending, rapid adoption of AI-enabled platforms, and a strong clinical trial ecosystem. The U.S. leads, supported by advanced infrastructure, robust government and private investments, while Canada and Mexico add momentum through rising CRO activities.

Europe

Europe holds a 15% share in 2024, with revenue of USD 41.64 billion, compared to USD 24.27 billion in 2018. The market is expected to grow to USD 95.41 billion by 2032, at a CAGR of 10.1%. Growth stems from strong regulatory backing for precision medicine, high demand for sequencing technologies, and strong collaborations between pharma firms and academic research institutions. Germany, France, and the UK dominate the regional landscape, supported by strong healthcare systems and investment in genomics innovation.

Asia Pacific

Asia Pacific accounts for a 27% share in 2024, valued at USD 74.25 billion, rising from USD 38.72 billion in 2018. It is projected to reach USD 204.25 billion by 2032, making it the fastest-growing region with a CAGR of 12.6%. China, Japan, and India drive demand through large patient pools, rapid healthcare digitization, and increased biotech investment. Regional governments’ support for AI-driven discovery and strong cost advantages in R&D outsourcing further position Asia Pacific as a key growth hub.

Latin America

Latin America represents a 4% share in 2024, with revenue of USD 10.48 billion, up from USD 5.84 billion in 2018. The market is expected to reach USD 23.20 billion by 2032, expanding at a CAGR of 9.6%. Brazil and Argentina are leading markets, supported by growing healthcare investment and modern drug discovery adoption. Rising outsourcing demand from pharmaceutical firms adds further growth, although infrastructure limitations and uneven funding remain barriers across the broader region.

Middle East

The Middle East accounts for a 2% share in 2024, valued at USD 5.47 billion, compared to USD 3.33 billion in 2018. The market is forecasted to reach USD 11.37 billion by 2032, advancing at a CAGR of 8.7%. Growth is fueled by healthcare modernization in GCC countries, digital transformation initiatives, and international collaborations. Israel strengthens the region’s profile with its innovation-driven biotech ecosystem, while demand for AI-powered discovery solutions gradually gains traction across emerging healthcare hubs.

Africa

Africa contributes a 1% share in 2024, generating USD 3.75 billion, rising from USD 1.85 billion in 2018. By 2032, the market is expected to reach USD 7.34 billion, at a CAGR of 7.9%. South Africa dominates with advanced infrastructure and expanding clinical research networks. Egypt and other nations are beginning to adopt digital drug discovery tools, though challenges such as limited funding and infrastructure gaps persist. Nevertheless, increasing partnerships, high disease burden, and government healthcare initiatives offer gradual growth opportunities.

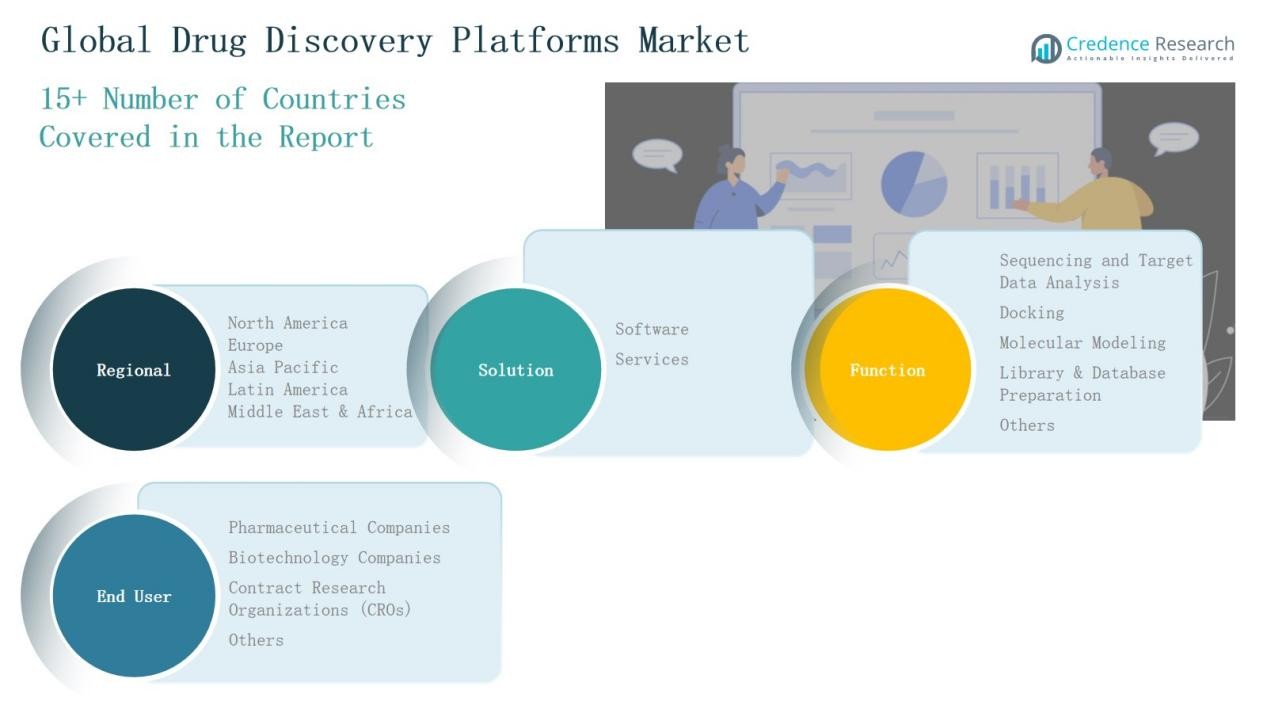

Market Segmentations:

By Solution

By Function

- Sequencing and Target Data Analysis

- Docking

- Molecular Modeling

- Library & Database Preparation

- Others

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The competitive landscape of the Drug Discovery Platforms Market is characterized by a mix of established pharmaceutical technology providers, specialized biotech firms, and Contract Research Organizations (CROs) competing to deliver advanced solutions. Leading companies such as Schrödinger, Certara, PerkinElmer (Revvity), Merative, and Charles River Laboratories hold significant market presence through comprehensive software portfolios, strong service networks, and global collaborations. Players like Evotec SE, Chemaxon, OpenEye (Cadence Molecular Sciences), and Genedata further strengthen competition with specialized offerings in molecular modeling, sequencing analytics, and database solutions. Strategic partnerships, mergers, and acquisitions are frequent as companies expand capabilities in AI, machine learning, and cloud-based platforms to gain a competitive edge. Firms increasingly focus on precision medicine, personalized therapies, and outsourcing services to align with evolving industry demand. Competition remains intense as emerging regional players in Asia-Pacific and Europe leverage cost advantages and niche expertise, creating a dynamic and innovation-driven market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Schrödinger

- Certara

- PerkinElmer (Revvity)

- Merative (formerly IBM Watson Health)

- Charles River Laboratories

- Evotec SE

- Chemaxon

- OpenEye (Cadence Molecular Sciences)

- Genedata

Recent Developments

- In September 2025, Eli Lilly launched TuneLab, an AI/ML platform that provides biotech firms access to discovery models trained on Lilly’s internal R&D data.

- In January 2025, Valo Health and Novo Nordisk expanded their partnership to cover more drug programs for obesity, type 2 diabetes, and cardiovascular disease using Valo’s AI-driven discovery platform.

- In July 2025, Elix and the Life Intelligence Consortium (LINC) announced the commercial launch of an AI-based drug discovery platform that uses advanced algorithms to accelerate drug development.

- In July 2025, Eisai partnered with Elix, Inc. to use the Elix Discovery™ generative and predictive AI platform for small molecule discovery with advanced molecular design tools.

Report Coverage

The research report offers an in-depth analysis based on Solution, Function, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and machine learning will enhance accuracy in drug discovery.

- Cloud-based platforms will expand collaboration and data integration across global research teams.

- Precision medicine will drive demand for sequencing and molecular modeling solutions.

- Pharmaceutical companies will increase reliance on digital platforms to reduce R&D timelines.

- Biotechnology startups will accelerate adoption of specialized discovery tools.

- Outsourcing to CROs will grow as firms seek cost-effective research solutions.

- Emerging markets will play a larger role in expanding platform adoption.

- Strategic partnerships between tech firms and pharma companies will intensify.

- Data security and compliance solutions will become integral to platform offerings.

- Continuous innovation will shape competitive differentiation in advanced drug discovery platforms.