Market Overview

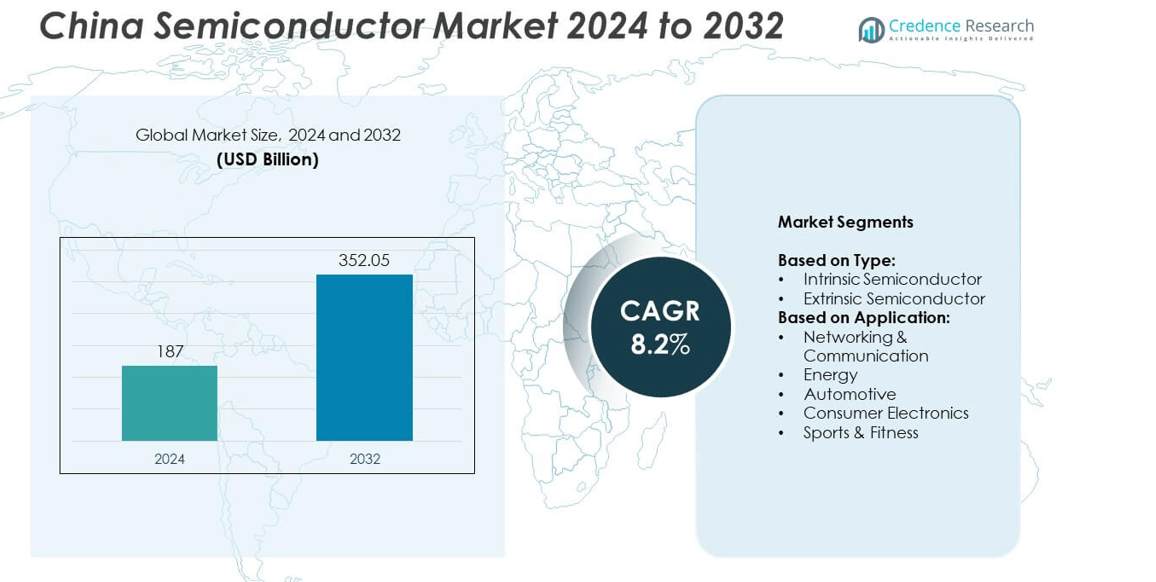

China Semiconductor market size was valued USD 187 Billion in 2024 and is anticipated to reach USD 352.05 Billion by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Semiconductor Market Size 2024 |

USD 187 Billion |

| China Semiconductor Market, CAGR |

8.2% |

| China Semiconductor Market Size 2032 |

USD 352.05 Billion |

The China semiconductor market is driven by key players such as SK hynix Inc, Micron Technology Inc, STMicroelectronics, Samsung Electronics, On Semiconductor, Infineon Technologies AG, Tianjin Zhonghuan Semiconductor Co. Ltd, OmniVision Technologies Inc., NXP Semiconductors N.V., and HiSilicon (Shanghai) Technologies Co. Ltd. (Huawei Technologies Co. Ltd.). These companies focus on expanding production capacity, advancing chip design, and developing energy-efficient solutions to meet rising demand from consumer electronics, networking, and electric vehicles. Regionally, Guangdong leads the market with nearly 28% share in 2024, supported by its strong electronics manufacturing base and government-backed semiconductor projects.

Market Insights

- The China semiconductor market was valued at USD 187 Billion in 2024 and is projected to reach USD 352.05 Billion by 2032, growing at a CAGR of 8.2% from 2025 to 2032.

- Rising demand from consumer electronics, 5G infrastructure rollout, and EV production are major drivers fueling semiconductor adoption across the country.

- Key trends include localization of supply chains, rapid adoption of AI and IoT-enabled devices, and growing investment in advanced packaging and chiplet technologies.

- The market is highly competitive with global and domestic players focusing on R&D, energy-efficient designs, and capacity expansion to capture increasing demand.

- Guangdong leads with 28% share, followed by Shandong at 20% and Henan at 16%, while intrinsic semiconductors dominate the type segment with over 55% share, driven by use in integrated circuits and processors for smartphones, networking equipment, and data centers across China.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Intrinsic semiconductors dominated the China semiconductor market in 2024, capturing over 55% share. Their dominance is driven by their wide use in microelectronics and integrated circuits supporting consumer electronics, networking, and data processing. Growing demand for energy-efficient devices and high-performance processors in smartphones and IoT applications is boosting intrinsic semiconductor adoption. Continuous innovation in silicon wafer fabrication, supported by government incentives for domestic chip production, strengthens this segment. Extrinsic semiconductors are expanding steadily, driven by demand for sensors, LEDs, and advanced optoelectronics in automotive and energy-efficient lighting applications.

- For instance, SMIC’s 12-inch wafer production capacity expansion is measured on a monthly basis, not as a cumulative total like 4.486 million. As of early 2025, several sources reported SMIC’s expansion efforts, TrendForce reported in January 2025 that SMIC planned to increase its 12-inch wafer monthly capacity by 60,000 wafers by the end of 2024.

By Application

Consumer electronics led the market, accounting for over 40% share in 2024. Rising smartphone production, adoption of smart wearables, and growth in connected home devices are major drivers. China’s robust electronics manufacturing ecosystem, coupled with domestic demand for feature-rich and affordable devices, continues to fuel this segment. Networking & communication follow closely, supported by the rollout of 5G infrastructure and data centers. Automotive applications are growing rapidly due to rising EV production and ADAS integration, while energy and sports & fitness segments show steady growth with demand for power electronics and health monitoring devices.

- For instance, In 2023, Sanan Optoelectronics had 15,439 employees. While the company is a major producer of full-color high-brightness LED wafers and chips

Market Overview

Rapid Expansion of Consumer Electronics

Consumer electronics is the primary growth driver, contributing over 40% of demand in 2024. The surge in smartphone manufacturing, wearable devices, and connected home products is fueling semiconductor consumption. China’s strong manufacturing base and government support for domestic chip production enhance supply chain resilience. Growing consumer preference for energy-efficient and AI-enabled devices continues to push demand for advanced microchips, boosting production capacity across the nation.

- For instance, Huawei’s HiSilicon Balong 5000 modem achieved a peak download speed of 4.6 Gbps, boosting performance in 5G smartphones and routers.

5G and Data Infrastructure Development

The rollout of 5G networks and rapid expansion of cloud data centers remain major growth drivers. Semiconductors are critical for base stations, routers, and high-speed communication devices, supporting China’s digital economy. Government initiatives to expand 5G coverage in rural and urban areas are further accelerating demand. This growth also strengthens domestic innovation, encouraging investment in high-performance processors, memory solutions, and networking chips.

- For instance, China had deployed about nearly 4.486 million 5G base stations as of end-May 2025.

Electric Vehicle and ADAS Integration

China’s rapid adoption of electric vehicles and advanced driver assistance systems (ADAS) significantly drives semiconductor demand. Power electronics, sensors, and microcontrollers are essential for EV battery management and vehicle safety systems. Government incentives for EV adoption and stricter emission norms are pushing automakers to integrate more semiconductor-based solutions. This creates opportunities for local players to expand production capacity and reduce dependency on imports.

Key Trends & Opportunities

Localization and Supply Chain Resilience

A major trend is China’s focus on building a self-sufficient semiconductor supply chain. Policies supporting domestic fabrication plants, R&D funding, and talent development aim to reduce reliance on foreign chipmakers. This shift opens opportunities for local players to capture a larger market share and attract foreign investments for joint ventures, strengthening domestic innovation and capacity.

- For instance, ChangXin Memory Technologies manufactured approximately 40,000 wafers per month in DRAM using 19 nm process node in recent years by the year 2020.

AI and IoT Integration

The growing adoption of artificial intelligence (AI) and Internet of Things (IoT) devices creates strong opportunities for semiconductor growth. AI-driven applications, such as edge computing, smart manufacturing, and healthcare analytics, require powerful processors and memory solutions. China’s investment in AI infrastructure and IoT ecosystems supports chipmakers in developing specialized semiconductors, driving innovation and expanding high-value segments.

- For instance, Alibaba’s chip unit T-Head supplied over 72% of the chips used in China Unicom’s Xining data centre project powered by domestic AI chips.

Key Challenges

Geopolitical and Trade Restrictions

Geopolitical tensions and trade restrictions remain significant challenges for China’s semiconductor market. Export controls on advanced chip manufacturing equipment limit access to leading-edge technology, slowing progress in achieving self-sufficiency. These restrictions compel domestic firms to invest heavily in R&D and develop indigenous solutions, increasing production costs and extending time-to-market.

High Capital Investment Requirements

The semiconductor industry requires substantial capital investment in fabrication plants, equipment, and talent development. Setting up advanced foundries demands billions of dollars and involves long payback periods. Smaller players face barriers to entry due to high costs, which may limit competition and innovation. This challenge puts pressure on government funding and private investment to maintain steady industry growth.

Regional Analysis

Guangdong

Guangdong accounted for nearly 28% of China’s semiconductor market share in 2024, making it the leading region. The province benefits from its strong electronics manufacturing base in Shenzhen and Guangzhou, which supports demand for integrated circuits, sensors, and microcontrollers. High investment in 5G infrastructure, consumer electronics, and AI-driven applications boosts semiconductor production and consumption. Government-backed initiatives to develop advanced fabs and strengthen supply chain resilience continue to attract domestic and foreign players. Guangdong’s strategic location and access to export hubs further enhance its role as the core driver of China’s semiconductor growth and innovation ecosystem.

Shandong

Shandong held about 20% share of the China semiconductor market in 2024, supported by its robust industrial base and increasing demand for power electronics. The region’s focus on renewable energy projects, including wind and solar, drives adoption of semiconductors for grid management and power conversion systems. Local governments encourage investment in semiconductor manufacturing parks, helping attract equipment and materials suppliers. Growth is also fueled by rising adoption of smart manufacturing and automation solutions across industries in Shandong. Strong support for research collaborations and workforce development is strengthening the province’s contribution to China’s domestic semiconductor ecosystem.

Henan

Henan represented approximately 16% of the market share in 2024, driven by expanding automotive and industrial electronics production. The province is focusing on developing semiconductor-related industrial clusters and establishing partnerships with major chipmakers to build advanced fabrication facilities. Rapid urbanization and infrastructure development are boosting demand for networking, communication chips, and sensors used in smart city projects. Henan’s central location supports logistics efficiency, allowing quick distribution of semiconductor products across China. Government initiatives to promote digital transformation and boost high-tech industries are further positioning Henan as a growing contributor to China’s semiconductor supply chain.

Sichuan

Sichuan captured close to 14% of China’s semiconductor market share in 2024, supported by its emerging electronics manufacturing ecosystem. The province has invested heavily in building integrated circuit design and production capabilities to strengthen its position in the semiconductor value chain. Strong demand comes from local energy and communication sectors, driving use of power electronics and networking chips. Government-backed projects promoting smart manufacturing and R&D innovation hubs have attracted both domestic and international semiconductor players. Sichuan’s skilled workforce and improving infrastructure continue to support its ambition of becoming a major semiconductor production and research center.

Jiangsu

Jiangsu accounted for roughly 12% share of the China semiconductor market in 2024, with Nanjing and Suzhou serving as key hubs for semiconductor design and manufacturing. The province’s strong presence of foundries and packaging facilities supports high-volume production for consumer electronics and automotive applications. Jiangsu’s proximity to Shanghai facilitates collaboration with research institutions and global technology firms. The region benefits from continued investments in advanced process technologies and material supply chains, strengthening its competitiveness. Rising demand for EV-related semiconductor solutions and networking chips is expected to drive further growth for Jiangsu’s semiconductor sector in coming years.

Market Segmentations:

By Type:

- Intrinsic Semiconductor

- Extrinsic Semiconductor

By Application:

- Networking & Communication

- Energy

- Automotive

- Consumer Electronics

- Sports & Fitness

By Geography:

- Guangdong

- Shandong

- Henan

- Sichuan

- Jiangsu

Competitive Landscape

The China semiconductor market is shaped by leading players such as SK hynix Inc, Micron Technology Inc, STMicroelectronics, Samsung Electronics, On Semiconductor, Infineon Technologies AG, Tianjin Zhonghuan Semiconductor Co. Ltd, OmniVision Technologies Inc., NXP Semiconductors N.V., and HiSilicon (Shanghai) Technologies Co. Ltd. (Huawei Technologies Co. Ltd.). These companies compete by focusing on innovation in memory solutions, logic chips, and power semiconductors to meet rising demand from consumer electronics, automotive, and networking sectors. Strategic investments in domestic fabrication facilities and partnerships with local manufacturers help strengthen market presence. Companies are also prioritizing energy-efficient designs, AI-enabled chips, and advanced packaging technologies to cater to China’s growing demand for high-performance computing and electric vehicle solutions. Continuous R&D initiatives, expansion of production capacity, and alignment with government policies supporting semiconductor self-sufficiency are critical strategies adopted to stay competitive and capture future growth opportunities within the Chinese semiconductor ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SK hynix Inc

- Micron Technology Inc

- STMicroelectronics

- Samsung Electronics

- On Semiconductor

- Infineon Technologies AG

- Tianjin Zhonghuan Semiconductor Co. Ltd

- OmniVision Technologies Inc.

- NXP Semiconductors N.V.

- HiSilicon (Shanghai) Technologies Co. Ltd. (Huawei Technologies Co. Ltd.)

Recent Developments

- In 2025 SK hynix completed internal certification for its next-generation HBM4 memory chips and is preparing for mass production.

- In 2025 HiSilicon launched a promotion/design-service account on Douyin to raise visibility of its custom chip design business.

- In 2024, Infineon strengthened its position in the Chinese semiconductor market by expanding its “In China, for China” strategy, focusing on localized product development and collaborative efforts with Chinese partners in the electric vehicle (EV) sector, such as their collaboration with Xiaomi EV.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The China semiconductor market will experience steady growth driven by consumer electronics and 5G expansion.

- Domestic chip production capacity will rise as government incentives support local fabrication plants.

- AI, IoT, and edge computing adoption will boost demand for advanced processors and memory solutions.

- Electric vehicle production and ADAS integration will remain key drivers of power semiconductor demand.

- Companies will invest in R&D for energy-efficient and high-performance chip designs to stay competitive.

- Localization of supply chains will reduce dependence on foreign semiconductor equipment and technology.

- Emerging demand from renewable energy and smart grid projects will create new opportunities for power electronics.

- Advanced packaging and chiplet technologies will gain traction to improve performance and reduce costs.

- Increased collaboration between local manufacturers and global players will strengthen technological capabilities.

- Geopolitical factors and trade policies will shape market strategies and influence future investment decisions.