Market Overview:

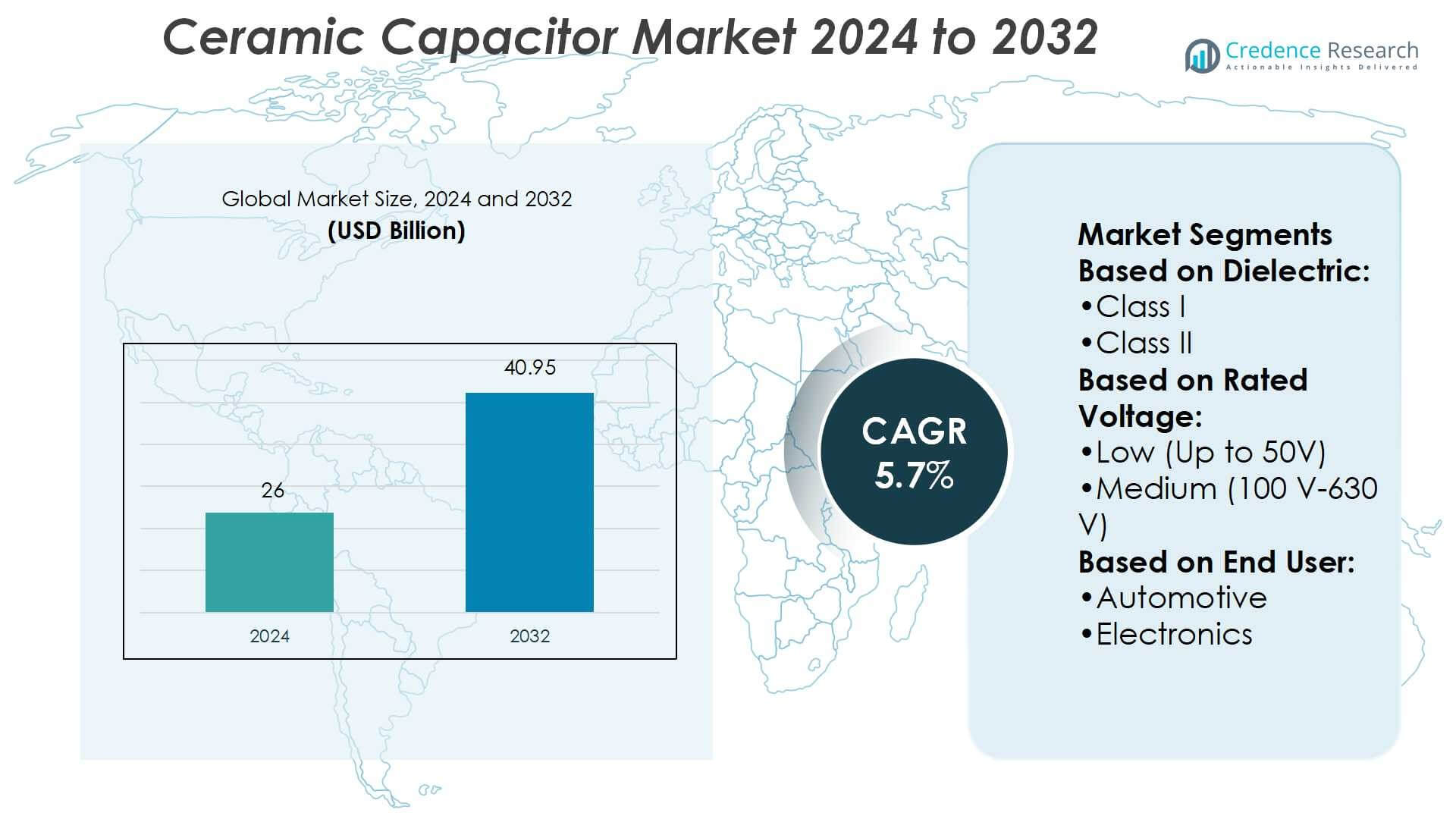

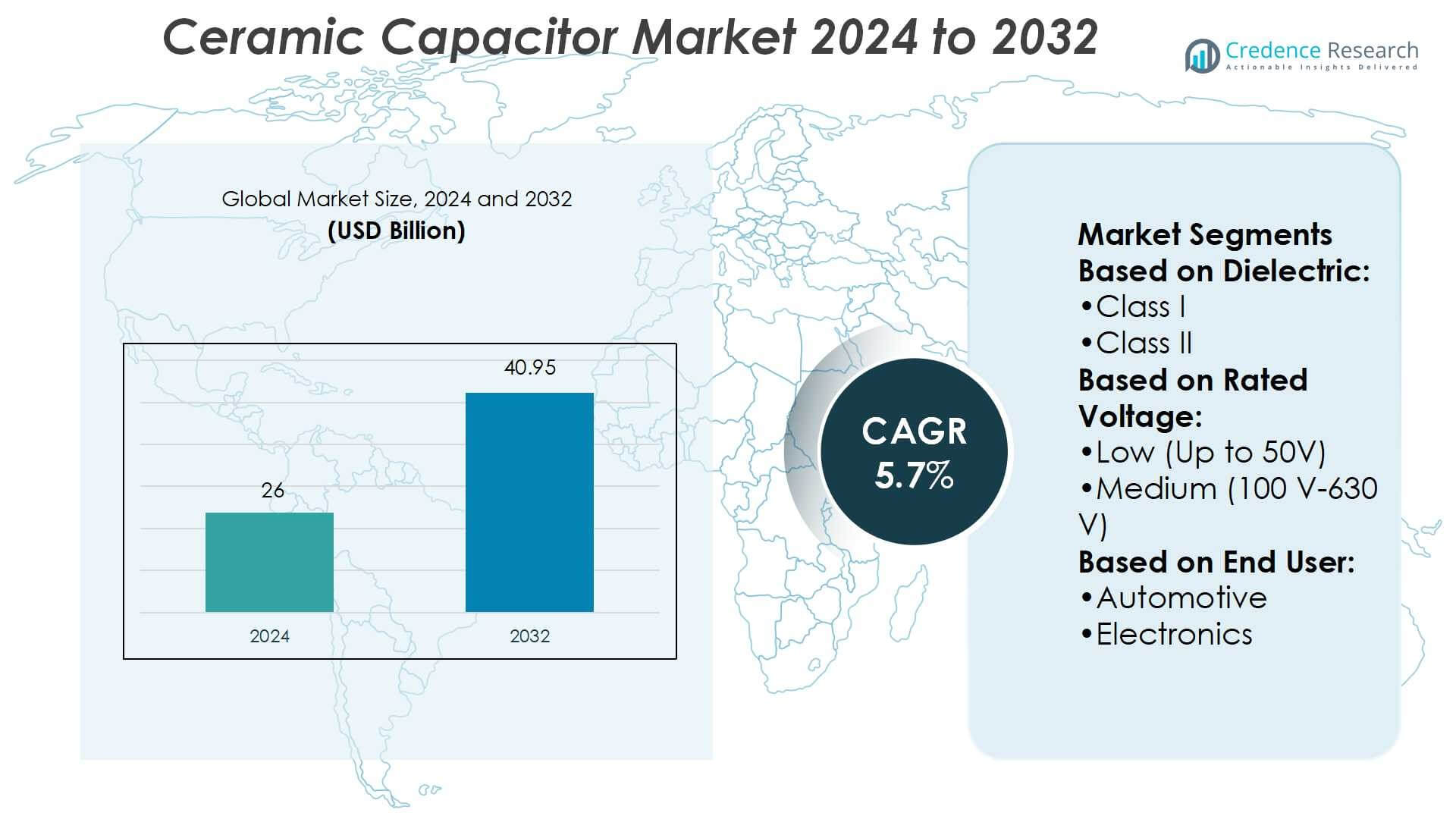

Ceramic Capacitor Market size was valued USD 26 billion in 2024 and is anticipated to reach USD 40.95 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Capacitor Market Size 2024 |

USD 26 Billion |

| Ceramic Capacitor Market, CAGR |

5.7% |

| Ceramic Capacitor Market Size 2032 |

USD 40.95 Billion |

The ceramic capacitor market is driven by prominent players including Eaton Corporation PLC, API Technologies Company, Nichicon Corporation, Abracon LLC, Hitachi AIC, Inc., TDK Corporation, KEMET Electronics Corporation, Panasonic Corporation, Samsung Electro-Mechanics, and Shenzhen Sunlord Electronics Co., Ltd. These companies focus on technological innovation, large-scale production, and diversified portfolios to serve electronics, automotive, and telecom industries. Asia-Pacific leads the global market with a 45% share, supported by strong manufacturing bases in China, Japan, South Korea, and Taiwan. The region’s dominance is reinforced by high consumer electronics demand, rapid 5G rollout, and expanding electric vehicle adoption, positioning it as the primary growth hub.

Market Insights

- The Ceramic Capacitor Market was valued at USD 26 billion in 2024 and is projected to reach USD 40.95 billion by 2032, growing at a CAGR of 5.7%.

- Rising demand from consumer electronics, electric vehicles, and 5G telecom infrastructure is a key driver, with low-voltage capacitors accounting for over 55% share.

- Miniaturization and high-capacitance multilayer ceramic capacitors remain strong trends, as top players emphasize innovation, scale, and eco-friendly manufacturing.

- Market restraints include raw material price volatility and intense pricing pressure, challenging profitability across large and small manufacturers.

- Asia-Pacific leads with 45% share, driven by China, Japan, South Korea, and Taiwan, while North America holds 25% and Europe 20%, reflecting strong electronics, automotive, and industrial adoption globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Dielectric

Class II capacitors hold the dominant share of the Ceramic Capacitor Market, accounting for over 60% of demand. Their high volumetric efficiency, better capacitance stability, and suitability for compact electronic devices make them the preferred option across consumer and industrial applications. Class I capacitors serve niche applications where precision and low loss are critical, while Others Class II remain limited to specialized uses. The growing miniaturization trend in smartphones, wearables, and IoT devices drives Class II adoption, reinforcing their dominance as manufacturers prioritize higher capacitance in smaller footprints.

- For instance, Eaton’s internally fused units are designed to meet IEEE Std 18-2012 performance down to −50 °C ambient temperature, targeting applications requiring minimal capacitance drift in cold conditions.

By Rated Voltage

The low voltage segment, covering up to 50V, represents the largest market share, exceeding 55%. This dominance stems from widespread use in smartphones, laptops, and consumer electronics where compact, high-density capacitors are required. Medium and high voltage segments serve industrial equipment, automotive power systems, and telecom base stations but remain smaller in comparison. Rising penetration of 5G-enabled devices, portable electronics, and low-power sensors continues to strengthen demand for low voltage ceramic capacitors, positioning them as the key growth engine in this category.

- For instance, API Technologies offers high-reliability multilayer ceramic capacitors (MLCCs) and EMI filters for demanding applications, such as power supply modules in 5G base stations. These components feature various voltage ratings and capacitance values to meet specific requirements.

By End User

Electronics lead the market with over 40% share, driven by high demand for capacitors in smartphones, tablets, PCs, and IoT products. Automotive follows as the fastest-growing segment, fueled by electric vehicles, advanced driver assistance systems (ADAS), and in-car electronics requiring reliable performance. Telecommunications and industrial equipment account for steady shares, particularly in power distribution and signal transmission systems. The electronics sector dominates due to rapid consumer adoption of compact, multifunctional devices, supported by ongoing innovation in high-capacitance, low-loss ceramic capacitor designs.

Key Growth Drivers

Key Growth Drivers

Rising Demand from Consumer Electronics

Consumer electronics remains the leading growth driver for the ceramic capacitor market. Smartphones, laptops, tablets, and IoT devices require compact, high-capacitance components to support advanced functions. The miniaturization trend in electronic devices pushes manufacturers to develop multilayer ceramic capacitors (MLCCs) with higher efficiency and reliability. With continuous innovations in 5G-enabled devices, wearable technology, and home automation, the demand for low-voltage, high-density ceramic capacitors is accelerating. This expansion positions consumer electronics as a long-term growth engine for the global ceramic capacitor market.

- For instance, Nichicon’s PCM (conductive polymer aluminum solid electrolytic) capacitors offer capacitance from 12 µF to 1000 µF, rated voltages between 16 V and 80 V, and guaranteed life of 8000 hours at +125 °C.

Expansion of Electric Vehicles and Automotive Electronics

The automotive sector has become a major growth driver as electric vehicles (EVs) and advanced driver assistance systems (ADAS) demand reliable, high-temperature capacitors. Ceramic capacitors support functions such as battery management, infotainment systems, and safety electronics. Their superior thermal stability, low inductance, and long lifecycle make them critical in automotive power electronics. The rising penetration of EVs worldwide and government support for clean mobility significantly boost market opportunities. Automotive applications increasingly drive investments in new product development and high-capacity ceramic capacitor production.

- For instance, Abracon’s ABS07AIG automotive quartz crystal operates over an ambient temperature range from −40 °C to +125 °C, offers frequency stability as low as 10 ppm, uses a load capacitance of 12.5 pF, and exhibits aging of ±3 ppm in its first year at 25 °C.

Technological Advancements in Telecommunications and 5G Infrastructure

The global rollout of 5G networks is fueling growth in the ceramic capacitor market. These capacitors are essential in base stations, small cells, and network equipment where high-frequency stability and low losses are required. Ceramic capacitors enable efficient data transmission and power management across telecom infrastructure. Rising mobile data consumption, higher bandwidth needs, and expanding telecom networks drive adoption. With 5G deployment accelerating globally, manufacturers are investing in high-performance capacitors to meet stringent telecom standards, creating sustained growth opportunities in this segment.

Key Trends & Opportunities

Miniaturization and High-Capacitance Development

A key trend shaping the ceramic capacitor market is the shift toward smaller, high-capacitance products. Miniaturized devices such as wearables, smartphones, and IoT systems demand capacitors that deliver higher power density within compact designs. Manufacturers are introducing advanced multilayer ceramic capacitors with improved dielectric materials to meet this demand. This trend presents significant opportunities for companies investing in R&D to deliver efficient, space-saving solutions. As electronic devices continue to shrink, the market for miniaturized ceramic capacitors is expected to expand steadily.

- For instance, in their plastic film capacitor line, AIC tech Inc. (formerly Hitachi AIC) provides MKCP4 and MKCP4T series units rated for 700 V to 1100 V DC, with the MKCP4 offering capacitance from 7 µF to 100 µF and the MKCP4T offering capacitance from 6 µF to 70 µF. Both series operate at temperatures up to +105 °C.

Sustainability and Eco-Friendly Manufacturing

Growing focus on sustainable manufacturing is creating opportunities in the ceramic capacitor industry. Companies are investing in environmentally friendly production processes, such as lead-free dielectric materials and reduced carbon emissions. End-users in consumer electronics and automotive increasingly favor suppliers adopting green initiatives, aligning with global environmental regulations. This trend not only supports compliance but also strengthens brand positioning. The emphasis on sustainable materials and processes is likely to drive differentiation in a competitive market, opening opportunities for eco-focused manufacturers.

- For instance, TDK has set goals to reduce absolute Scope 1 and 2 greenhouse gas emissions by 42% from fiscal 2021 levels by fiscal 2030, and to reduce Scope 3 emissions from purchased goods and sold products by 25% over the same baseline.

Key Challenges

Supply Chain Constraints and Raw Material Volatility

One of the primary challenges for the ceramic capacitor market is raw material price volatility. Key materials like palladium, nickel, and ceramic powders are subject to global supply disruptions and cost fluctuations. These uncertainties impact production costs and profitability, especially for high-volume manufacturers. Geopolitical tensions and resource shortages further strain supply chains, creating instability. Managing procurement risks and diversifying suppliers remain critical strategies for companies to maintain consistent production and competitive pricing in the global market.

Rising Competition and Pricing Pressure

The ceramic capacitor market faces intense competition among global and regional players. High-volume production, particularly of multilayer ceramic capacitors, has led to price erosion in several categories. Manufacturers struggle to balance cost efficiency with innovation, as demand for high-performance products continues to grow. Smaller firms face challenges in competing with established players who leverage economies of scale. This competitive pressure can limit profit margins and hinder smaller companies’ ability to invest in advanced technologies, slowing overall market progress.

Regional Analysis

North America

North America holds 25% share of the ceramic capacitor market, driven by strong demand in consumer electronics, automotive, and defense applications. The United States leads with heavy investments in 5G infrastructure and electric vehicle development, boosting adoption of high-performance capacitors. Growth is further supported by leading semiconductor and electronics manufacturers that rely on multilayer ceramic capacitors (MLCCs) for precision and efficiency. Increasing focus on energy-efficient technologies in industrial automation also contributes to regional expansion. Strong R&D capabilities and robust end-user industries position North America as a significant contributor to global market growth.

Europe

Europe accounts for 20% share of the ceramic capacitor market, supported by established automotive and industrial sectors. Germany, France, and the United Kingdom lead demand due to widespread adoption in electric vehicles, renewable energy systems, and advanced industrial equipment. European manufacturers prioritize high-quality capacitors that meet stringent environmental and safety standards, boosting regional reliability. The region’s push toward clean energy and sustainable mobility fosters adoption in automotive electronics and power systems. With increasing focus on next-generation communication networks, Europe continues to strengthen its role in the global ceramic capacitor landscape.

Asia-Pacific

Asia-Pacific dominates the ceramic capacitor market with a 45% share, supported by high-volume electronics production in China, Japan, South Korea, and Taiwan. The region’s leadership stems from extensive manufacturing of smartphones, laptops, and IoT devices requiring multilayer ceramic capacitors. Rapid growth in electric vehicle adoption, particularly in China, further strengthens market momentum. Telecommunications infrastructure expansion, including large-scale 5G rollouts, boosts demand for high-capacitance and reliable capacitors. Cost-effective manufacturing, advanced supply chains, and the presence of global capacitor leaders ensure Asia-Pacific remains the central hub for production and consumption in this market.

Latin America

Latin America represents 5% share of the ceramic capacitor market, driven primarily by Brazil and Mexico. Expanding consumer electronics manufacturing and growing adoption of automotive electronics support regional demand. Investments in telecommunications, including 5G infrastructure projects, further stimulate capacitor consumption. The industrial sector, particularly in renewable energy and manufacturing, also contributes to market expansion. However, the region faces challenges such as supply chain limitations and dependency on imports from Asia-Pacific producers. Despite these constraints, steady growth in consumer markets and rising technology adoption sustain Latin America’s role as an emerging participant in the global ceramic capacitor market.

Middle East & Africa

The Middle East & Africa holds 5% share of the ceramic capacitor market, with growth mainly concentrated in telecommunications and industrial automation. Expanding 4G and 5G network deployment across Gulf nations increases demand for stable, high-frequency capacitors. Industrial projects in sectors such as oil and gas, mining, and power utilities also contribute to adoption. While overall market size remains smaller compared to other regions, increasing investments in technology infrastructure and rising demand for consumer electronics create growth opportunities. Strategic partnerships with global suppliers are expected to enhance regional availability and competitiveness.

Market Segmentations:

By Dielectric:

By Rated Voltage:

- Low (Up to 50V)

- Medium (100 V-630 V)

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The ceramic capacitor market players such as Eaton Corporation PLC, API Technologies Company, Nichicon Corporation, Abracon LLC, Hitachi AIC, Inc., TDK Corporation, KEMET Electronics Corporation, Panasonic Corporation, Samsung Electro-Mechanics, and Shenzhen Sunlord Electronics Co., Ltd. The ceramic capacitor market is highly fragmented, with competition driven by innovation, cost efficiency, and large-scale production capacity. Manufacturers focus on expanding product portfolios to cater to diverse applications in consumer electronics, automotive systems, telecommunications, and industrial equipment. The growing demand for high-capacitance multilayer ceramic capacitors (MLCCs) has intensified research and development efforts, particularly in miniaturization and thermal stability. Companies also emphasize sustainable manufacturing practices to comply with environmental regulations and meet customer expectations. Strategic collaborations, capacity expansions, and technology advancements remain central strategies, while pricing pressures and supply chain challenges continue to shape competitive dynamics in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eaton Corporation PLC

- API Technologies Company

- Nichicon Corporation

- Abracon LLC

- Hitachi AIC, Inc.

- TDK Corporation

- KEMET Electronics Corporation

- Panasonic Corporation

- Samsung Electro-Mechanics

- Shenzhen Sunlord Electronics Co., Ltd.

Recent Developments

- In March 2025, KYOCERA AVX, a leading global manufacturer of advanced electronic components engineered to accelerate technological innovation and build a better future, successfully developed the world’s first compact, high-capacity multilayer ceramic chip capacitor (MLCC) with an industry-leading capacitance value of 47µF in the 0402-inch size (1.0mm x 0.5mm). This contributes significantly to securing the necessary capacitance and reducing the number of components.

- In July 2024, South Korean electronic component company Samsung Electro-Mechanics started production of a new compact high-capacitance multilayer ceramic capacitor (MLCC). The company used fine-particle ceramic and electrode materials, along with ultra-precision stacking techniques, to develop the MLCC.

- In July 2024, Murata Manufacturing Co., Ltd. is expanded its range of multilayer ceramic capacitors (MLCC) with the new GRM188C80E107M and GRM188R60E107 M. Designed to cater to the continuous demands for miniaturization in servers, data centers, and IT applications, this solution stands out as the world’s first MLCC to provide a capacitance of 100μF in a 0603-inch (1608mm) size package.

- In May 2023, Avatech announced a significant investment of 101.8 billion won in the Gumi 5 National Industrial Complex Hi-Tech Valley to expand its MLCC manufacturing plant. The expansion is planned to be completed by 2024. Avatech recently signed a memorandum of understanding with North Gyeongsang Province and Gumi City, reinforcing the investment agreement.

Report Coverage

The research report offers an in-depth analysis based on Dielectric, Rated Voltage, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ceramic capacitor market will see strong growth from expanding consumer electronics demand.

- Electric vehicles and advanced automotive electronics will continue driving adoption of high-reliability capacitors.

- Miniaturization and higher capacitance requirements will push innovation in multilayer ceramic capacitors.

- 5G infrastructure development will boost demand for high-frequency and stable capacitor solutions.

- Industrial automation and renewable energy systems will create steady opportunities for high-voltage capacitors.

- Supply chain diversification will become essential to reduce risks from raw material volatility.

- Manufacturers will increase focus on eco-friendly and lead-free production processes.

- Regional production hubs in Asia-Pacific will strengthen their dominance in global supply.

- Pricing pressures will encourage companies to balance cost efficiency with technological advancement.

- Continuous R&D investments will shape the development of next-generation capacitors for emerging applications.

Key Growth Drivers

Key Growth Drivers