Market Overview:

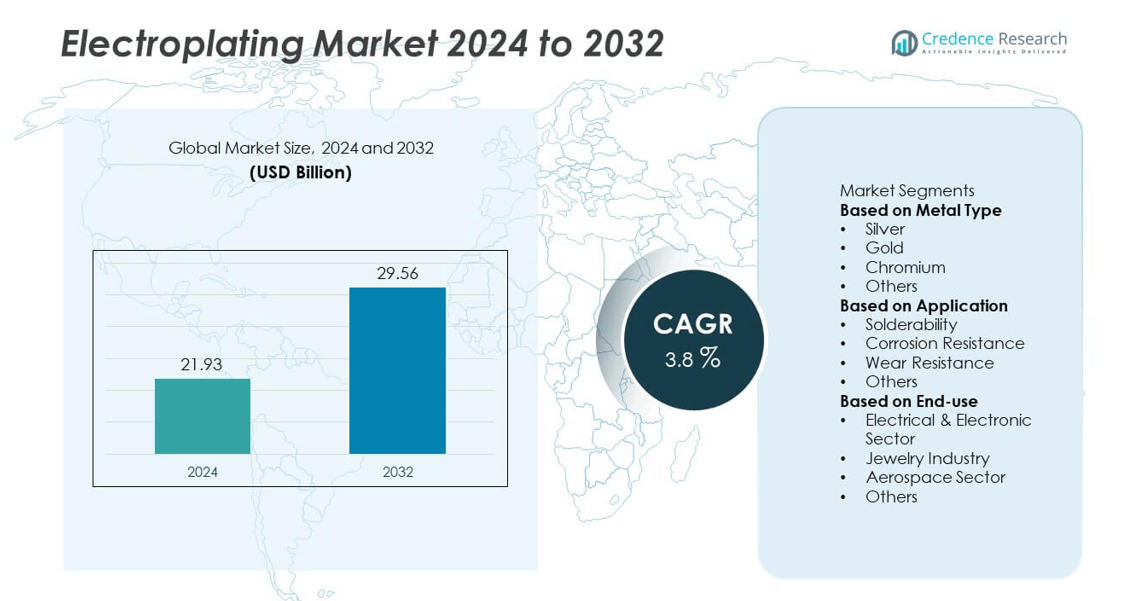

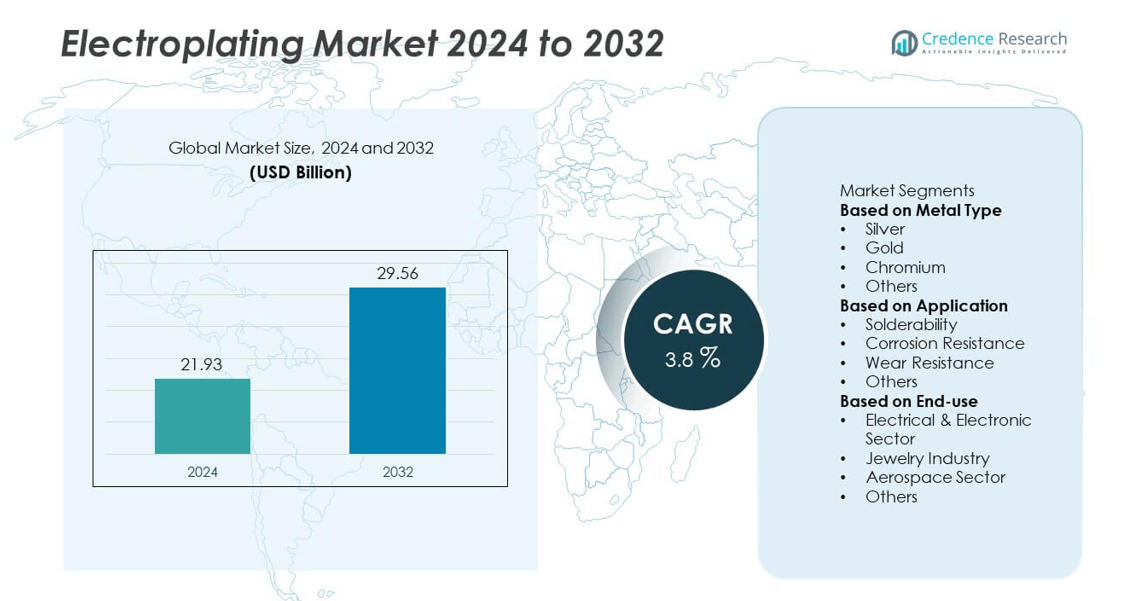

The electroplating market was valued at USD 21.93 billion in 2024 and is projected to reach USD 29.56 billion by 2032, expanding at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electroplating Market Size 2024 |

USD 21.93 billion |

| Electroplating Market, CAGR |

3.8% |

| Electroplating Market Size 2032 |

USD 29.56 billion |

The electroplating market is led by companies such as TOHO ZINC CO., LTD., Allied Finishing, Inc., Interplex Holdings Pte. Ltd., Precision Plating Co., Bajaj Electroplaters, and Roy Metal Finishing, Inc. These players dominate through advanced plating technologies, automation, and sustainable surface treatment solutions. Asia-Pacific emerged as the leading region, commanding a 38.9% market share in 2024, driven by strong manufacturing bases in China, Japan, and South Korea. North America followed with a 27.4% share, supported by technological innovation and stringent quality standards in automotive and aerospace industries. Europe maintained steady growth due to its focus on eco-friendly plating processes.

Market Insights

- The electroplating market was valued at USD 21.93 billion in 2024 and is projected to reach USD 29.56 billion by 2032, growing at a CAGR of 3.8%.

- Rising demand from automotive and electronics sectors drives market growth, with chromium plating holding a 38.6% share due to its superior corrosion and wear resistance.

- Advancements in eco-friendly plating technologies and automation systems are shaping market trends, improving efficiency and compliance with environmental regulations.

- The market is moderately fragmented, with key players such as TOHO ZINC CO., LTD., Interplex Holdings Pte. Ltd., and Allied Finishing, Inc. focusing on sustainable production and expansion in high-growth industries.

- Asia-Pacific led with a 38.9% share in 2024, followed by North America at 27.4% and Europe at 25.1%, driven by strong industrialization, rising EV production, and increasing demand for precision-coated components.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Metal Type

The chromium segment dominated the electroplating market in 2024, accounting for a 38.6% share. Its widespread use in automotive, aerospace, and industrial machinery applications drives this dominance. Chromium coatings offer excellent hardness, corrosion protection, and surface gloss, enhancing durability and appearance. The segment benefits from increasing demand for decorative and functional plating across consumer goods and vehicle components. Growth in electric vehicle production and precision-engineered parts further boosts chromium electroplating adoption due to its superior resistance to wear and oxidation under extreme conditions.

- For instance, Atotech, a key supplier of plating chemicals, offers several high-performance wear-resistant coating processes for automotive components. This includes both its traditional hard chrome processes, such as the HEEF® family, and its sustainable Cr(VI)-free BluCr® process.

By Application

The corrosion resistance segment held the largest 41.3% share of the market in 2024. This segment’s growth is fueled by rising demand for protective coatings in automotive, marine, and industrial equipment. Electroplating provides a durable barrier against rust and moisture, extending component life and reducing maintenance costs. Manufacturers emphasize environmentally friendly plating solutions such as trivalent chromium and low-cyanide zinc to comply with stringent environmental standards. Expanding use of corrosion-resistant coatings in renewable energy systems and offshore structures continues to strengthen this segment’s leadership globally.

- For instance, MacDermid Alpha Electronics Solutions introduced its TriMac™ Blue trivalent chromium system capable of reducing hexavalent emissions by over 95 mg per m² compared to traditional baths. The coating achieves 480 hours of neutral salt spray resistance (ASTM B117), demonstrating high corrosion protection for automotive fasteners and wind-turbine connectors.

By End-use

The electrical and electronic sector led the electroplating market in 2024, capturing a 46.9% share. Strong demand for conductive and solderable coatings in connectors, circuit boards, and semiconductors supports this dominance. Electroplating enhances electrical conductivity, minimizes contact resistance, and improves component durability under thermal stress. Growing miniaturization trends and high-performance requirements in consumer electronics drive innovation in gold and silver electroplating technologies. Additionally, the rapid expansion of 5G infrastructure and electric mobility further propels demand for precision-coated electrical components worldwide.

Key Growth Drivers

Rising Demand from Automotive and Electronics Industries

The growing use of electroplating in automotive and electronic components is a major market driver. Electroplated coatings enhance corrosion resistance, electrical conductivity, and appearance in parts like connectors, engine systems, and circuit boards. Expanding EV production and increased demand for miniaturized electronic devices boost metal plating applications. Automakers also prefer chromium and nickel coatings for decorative and protective finishes, supporting steady consumption across OEM and aftermarket sectors.

- For instance, Dowa Metaltech offers SilC plating™ (silver-carbon composite plating) for high-voltage connectors, which is engineered for superior wear resistance, low insertion force, and contact reliability. This technology has demonstrated superior wear resistance, passing sliding tests of 20,000 cycles with a 5 µm plating thickness.

Advancements in Plating Technologies

Technological innovations such as pulse electroplating and nano-coatings are improving process efficiency and coating quality. These methods enhance surface uniformity, adhesion, and functional performance while reducing material waste. Automation and real-time monitoring systems are optimizing production cycles, minimizing defects, and ensuring consistency in large-scale manufacturing. The integration of environmentally friendly chemistries further supports compliance with global sustainability regulations and encourages adoption across high-precision industries like aerospace and electronics.

- For instance, Atotech’s Uniplate® family of horizontal plating systems includes the Uniplate® Cu InPulse2 Advanced plater, which features reverse pulse current technology for high-performance copper through-hole and blind micro-via filling.

Growing Adoption in Aerospace and Defense Applications

Aerospace manufacturers increasingly rely on electroplating to enhance component strength, wear resistance, and temperature endurance. Nickel, gold, and chromium coatings are widely applied on turbine blades, landing gear, and electronic connectors. Rising aircraft production and maintenance activities globally fuel demand for precision electroplating. Stringent safety standards and the need for lightweight yet durable coatings drive technological upgrades in plating solutions designed for extreme operational environments.

Key Trends & Opportunities

Shift Toward Eco-Friendly Plating Processes

Environmental sustainability is shaping new developments in electroplating. Manufacturers are replacing hexavalent chromium and cyanide-based chemicals with trivalent chromium and non-cyanide alternatives. This transition reduces toxic emissions and aligns with REACH and RoHS directives. Companies investing in green plating solutions gain a competitive edge by ensuring compliance and attracting environmentally conscious clients across automotive, consumer electronics, and aerospace sectors.

- For instance, Coventya developed its Tristar 300 trivalent chromium process, which serves as an alternative to hexavalent baths for decorative plating. This system is known to improve production efficiency by reducing scrap and wastewater treatment costs, and it provides a deposit that is superior to hexavalent deposits in wear performance.

Integration of Automation and Smart Control Systems

Automation and digital process control are transforming electroplating operations. Advanced monitoring tools ensure consistent coating thickness, reduce labor costs, and improve yield rates. IoT-enabled systems provide predictive maintenance and energy optimization, enhancing productivity. These smart plating lines allow real-time data tracking, helping manufacturers meet strict quality standards while lowering operational costs and improving sustainability performance.

- For instance, MacDermid Enthone manufacture specialized chemical compounds for the surface finishing and plating industries. They and other automation providers create advanced automated plating lines featuring integrated controls, which aim to increase efficiency, reduce human error, and improve product quality in high-volume facilities.

Key Challenges

Environmental and Regulatory Constraints

Strict environmental regulations governing hazardous waste disposal and chemical emissions pose a major challenge. Traditional plating processes often involve heavy metals and toxic by-products that require costly treatment and compliance systems. Companies face increased operational costs to adopt cleaner technologies and maintain environmental certifications. Compliance with regional standards such as the EPA and REACH adds further complexity to global operations.

High Energy Consumption and Operational Costs

Electroplating is an energy-intensive process, especially in large-scale production. Maintaining optimal temperatures, chemical stability, and process control increases electricity demand. Rising global energy prices and the need for specialized waste treatment equipment elevate total production costs. Smaller manufacturers struggle to sustain profitability while investing in efficiency upgrades and advanced plating systems, limiting competitiveness in cost-sensitive markets.

Regional Analysis

North America

North America accounted for a 27.4% share of the electroplating market in 2024. Strong demand from the automotive, aerospace, and electronics industries drives regional growth. The U.S. leads with advanced manufacturing capabilities and the rapid adoption of environmentally sustainable plating technologies. Companies focus on automation, trivalent chromium, and high-performance coatings to meet strict environmental regulations. Increasing investments in electric vehicle production and defense equipment further strengthen the market. The presence of key players and ongoing R&D in precision metal finishing continue to support steady expansion across the region.

Europe

Europe held a 25.1% share of the electroplating market in 2024, driven by stringent environmental norms and robust automotive manufacturing. Germany, France, and the U.K. dominate due to their strong industrial base and demand for corrosion-resistant coatings in machinery and transportation. The region’s shift toward eco-friendly and recyclable materials supports the transition to non-toxic plating methods. European manufacturers invest heavily in automation and digital control systems to enhance efficiency and sustainability. Expanding aerospace programs and electric mobility initiatives continue to boost electroplating applications across critical components.

Asia-Pacific

Asia-Pacific led the electroplating market with a commanding 38.9% share in 2024. Rapid industrialization, expanding automotive production, and strong consumer electronics manufacturing in China, Japan, and South Korea drive this dominance. The region benefits from low production costs and significant technological upgrades in plating processes. Governments support industrial modernization and green manufacturing practices, fostering adoption of eco-friendly electroplating solutions. Growing demand for decorative and functional coatings in consumer goods, semiconductors, and precision equipment continues to propel market growth across the Asia-Pacific region.

Latin America

Latin America captured a 5.2% share of the electroplating market in 2024. Brazil and Mexico lead due to strong demand from automotive, oil and gas, and industrial machinery sectors. Expanding local manufacturing and increasing foreign investments in automotive component production are key growth factors. The shift toward corrosion-resistant coatings supports regional industrial growth. However, limited technological infrastructure and high environmental compliance costs pose challenges. Ongoing efforts to modernize production lines and adopt sustainable plating methods are expected to improve market competitiveness over the forecast period.

Middle East & Africa

The Middle East & Africa region accounted for a 3.4% share of the electroplating market in 2024. Growth is supported by rising infrastructure development, oilfield equipment manufacturing, and expansion in automotive assembly units. The UAE and Saudi Arabia lead in adopting metal finishing technologies for industrial and decorative applications. Increased investment in local manufacturing and diversification efforts under national industrialization plans drive steady progress. However, dependence on imports for plating chemicals and limited skilled workforce slightly constrain large-scale expansion. Nonetheless, growing demand for durable coatings supports long-term growth prospects.

Market Segmentations:

By Metal Type

- Silver

- Gold

- Chromium

- Others

By Application

- Solderability

- Corrosion Resistance

- Wear Resistance

- Others

By End-use

- Electrical & Electronic Sector

- Jewelry Industry

- Aerospace Sector

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The electroplating market is highly competitive, featuring key players such as Bajaj Electroplaters, TOHO ZINC CO., LTD., Allied Finishing, Inc., Interplex Holdings Pte. Ltd., Precision Plating Co., Roy Metal Finishing, Inc., Klein Plating Works, Inc., KEI – Premium Plated & Painted Products, Allenchrome, and J & N Metal Products, LLC. These companies focus on expanding product quality, surface durability, and environmental compliance to meet global standards. Strategic initiatives such as facility upgrades, technology integration, and mergers strengthen their market presence. Leading firms invest in automated electroplating systems and eco-friendly solutions to reduce hazardous waste and enhance efficiency. Many are adopting trivalent chromium and cyanide-free processes to align with tightening environmental regulations. Continuous R&D in coating uniformity and metal adhesion also drives competitive differentiation. Regional players emphasize customized plating services for automotive, electronics, and aerospace clients, ensuring flexibility and faster turnaround in high-demand applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bajaj Electroplaters

- Precision Plating Co.

- TOHO ZINC CO., LTD.

- Allied Finishing, Inc.

- J & N Metal Products, LLC

- KEI – Premium Plated & Painted Products

- Allenchrome

- Klein Plating Works, Inc.

- Interplex Holdings Pte. Ltd.

- Roy Metal Finishing, Inc.

Recent Developments

- In October 2025, Precision Plating Co. continued its emphasis on electrolytic and electroless metal plating finishes for safety-critical devices, leveraging over 100 years of experience to deliver high-quality solutions for electronics and automotive sectors

- In September 2025, TOHO ZINC CO., LTD. issued a notice regarding a fire at its Onahama smelter and refinery.

- In December 2024, TOHO ZINC compiled a Business Revitalisation Plan to reorganise its zinc smelting business and exit unprofitable resources ventures.

Report Coverage

The research report offers an in-depth analysis based on Metal Type, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and cyanide-free plating solutions will continue to increase.

- Automation and digital monitoring systems will enhance process precision and productivity.

- The automotive and electronics industries will remain major contributors to market growth.

- Asia-Pacific will retain its dominance due to strong manufacturing expansion and industrial investment.

- Adoption of trivalent chromium and low-emission chemicals will accelerate across regions.

- Aerospace applications will grow as plating improves component durability and performance.

- Strategic collaborations between plating service providers and OEMs will strengthen global supply chains.

- Research on nano-coatings and composite platings will open new performance opportunities.

- Recycling and metal recovery from plating waste will gain focus for cost efficiency.

- Continued regulatory pressure will push companies toward greener and more energy-efficient operations.