Market Overview

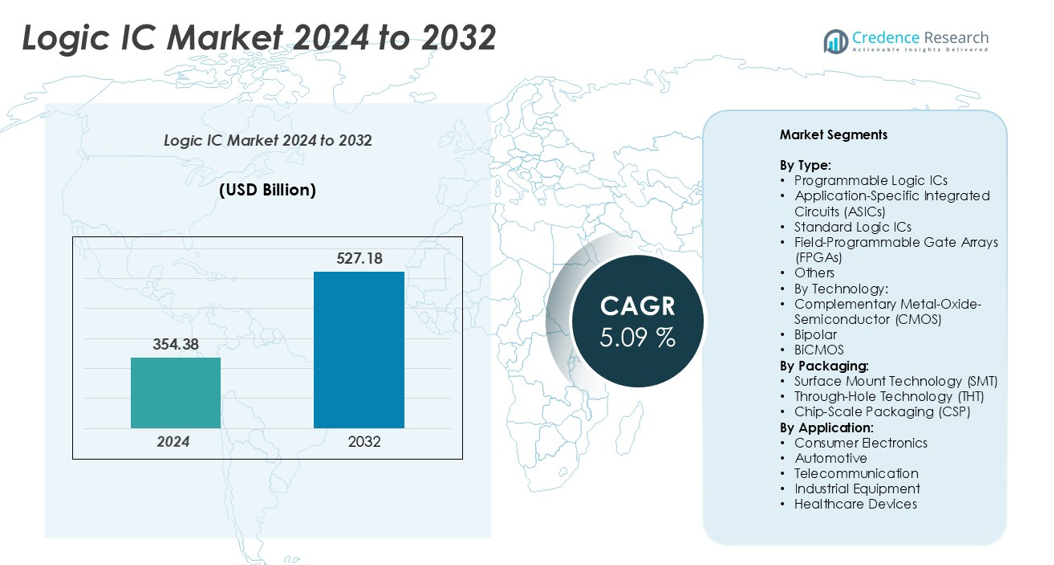

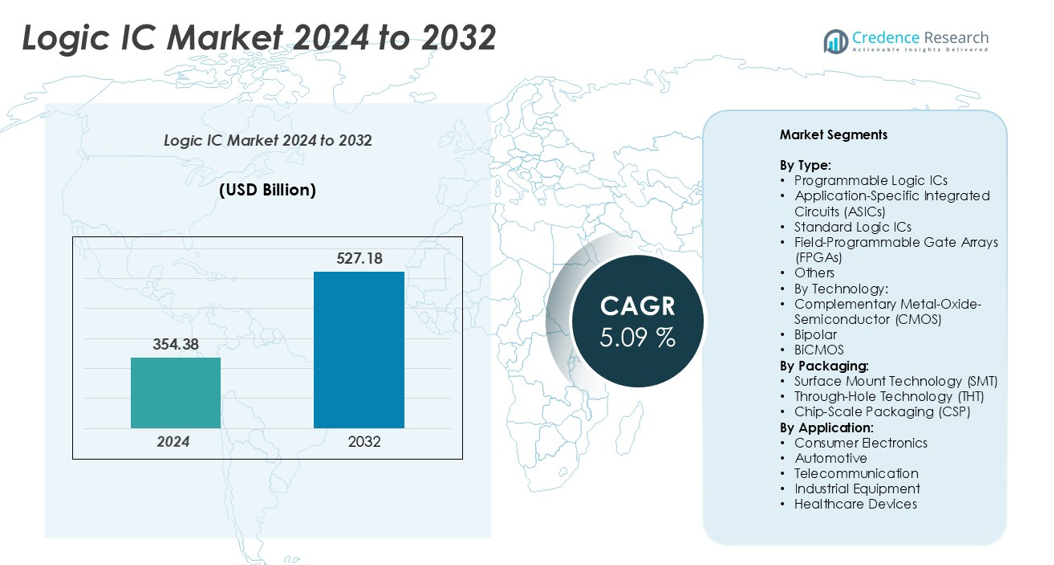

The Logic IC market size was valued at USD 354.38 billion in 2024 and is anticipated to reach USD 527.18 billion by 2032, at a CAGR of 5.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Logic IC market Size 2024 |

USD 354.38 billion |

| Logic IC market, CAGR |

5.09% |

| Logic IC market Size 2032 |

USD 527.18 billion |

The Logic IC market is led by prominent players such as Samsung Electronics Co., Ltd. (South Korea), Intel Corporation (U.S.), Texas Instruments Inc. (U.S.), Broadcom Inc. (U.S.), STMicroelectronics N.V. (Switzerland), Infineon Technologies AG (Germany), and NXP Semiconductors N.V. (Netherlands). These companies dominate through continuous innovation in semiconductor design, fabrication, and integration across consumer electronics, automotive, and industrial applications. Asia-Pacific emerges as the leading region, accounting for approximately 38% of the global market share, driven by strong manufacturing bases in South Korea, Taiwan, and China. North America follows with around 32%, supported by advanced R&D capabilities and the presence of major technology firms.

Market Insights

- The Logic IC market was valued at USD 354.38 billion in 2024 and is projected to reach USD 527.18 billion by 2032, growing at a CAGR of 5.09% during the forecast period.

- Growing demand for high-performance and energy-efficient integrated circuits in consumer electronics, automotive systems, and industrial automation is driving market growth globally.

- Key trends include the adoption of AI and IoT-enabled devices, miniaturization of chips, and advancements in semiconductor fabrication such as 3nm and 5nm process technologies.

- The market is competitive with major players like Samsung Electronics, Intel, Texas Instruments, Broadcom, and STMicroelectronics focusing on innovation, partnerships, and capacity expansion to maintain their market position.

- Asia-Pacific leads the market with 38% share, followed by North America at 32% and Europe at 24%; by type, Application-Specific Integrated Circuits (ASICs) dominate due to their high customization, performance efficiency, and widespread use in smart and connected devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Logic IC market by type is segmented into Programmable Logic ICs, Application-Specific Integrated Circuits (ASICs), Standard Logic ICs, Field-Programmable Gate Arrays (FPGAs), and Others. Application-Specific Integrated Circuits (ASICs) hold the dominant market share due to their high performance, energy efficiency, and customization for specific functions across consumer electronics and automotive systems. The increasing demand for compact and power-efficient chips in electric vehicles and AI-based devices drives ASIC adoption. Moreover, advancements in semiconductor fabrication technologies enhance design flexibility and operational speed, reinforcing ASICs’ leadership within this segment.

- For instance, Tesla’s Hardware 3 (HW3) computer, manufactured by Samsung on a 14nm FinFET process, includes two custom Full Self-Driving (FSD) chips. Each chip contains two neural network accelerators that deliver 72 trillion operations per second (TOPS), resulting in a combined total of 144 TOPS of neural network performance for redundancy. However, this hardware has been succeeded by the more powerful Hardware 4 (HW4), which began shipping in 2023, and the even more capable Hardware 5 (HW5), which is projected for late 2026.

By Technology:

Based on technology, the market is categorized into Complementary Metal-Oxide-Semiconductor (CMOS), Bipolar, and BiCMOS. The CMOS segment dominates the market, supported by its low power consumption, high noise immunity, and scalability advantages. Its widespread use in smartphones, processors, and memory devices makes it integral to modern electronics manufacturing. Continuous innovation in nanometer-scale fabrication and the development of FinFET architectures further boost CMOS performance and cost efficiency. These factors make CMOS technology the preferred choice among manufacturers focusing on energy-efficient and high-density integrated circuits.

- For instance, Intel’s 12th-generation Alder Lake processors were built on the “Intel 7” process, which was a rebrand of Intel’s 10nm Enhanced SuperFin (10ESF) technology. The chips featured a new performance hybrid architecture that combined Performance-cores and Efficient-cores, resulting in significant performance improvements over prior generations.

By Packaging:

In terms of packaging, the Logic IC market includes Surface Mount Technology (SMT), Through-Hole Technology (THT), and Chip-Scale Packaging (CSP). Surface Mount Technology (SMT) leads the segment, driven by its ability to support miniaturization, automated assembly, and superior circuit density. SMT packaging enables the production of lightweight and compact devices, which is crucial for smartphones, IoT modules, and wearable electronics. The increasing adoption of SMT in automotive electronics and consumer devices enhances manufacturing efficiency and reduces assembly costs, reinforcing its position as the dominant packaging technology in the Logic IC market.

Key Growth Drivers

Rising Demand for Advanced Consumer Electronics

The rapid expansion of consumer electronics, including smartphones, tablets, and smart home devices, is a major driver of the Logic IC market. Increasing adoption of high-performance computing and advanced functionalities such as artificial intelligence (AI), augmented reality (AR), and 5G connectivity is accelerating the demand for efficient and miniaturized integrated circuits. Logic ICs play a vital role in managing data processing and power distribution within these devices. Continuous innovations in chip design, such as FinFET and 3D transistor structures, further enhance processing speed and energy efficiency. The integration of logic ICs in compact and multifunctional consumer gadgets underscores their importance in delivering superior performance, thereby fueling market growth.

- For instance, Apple’s A17 Pro chip, built on TSMC’s 3-nanometer process technology, integrates 19 billion transistors. This allows for up to 20% faster GPU performance and 10% faster CPU speed when compared to the A16 Bionic chip.

Expansion of Automotive Electronics and ADAS Integration

The automotive sector’s digital transformation is significantly boosting the Logic IC market. The growing deployment of Advanced Driver-Assistance Systems (ADAS), electric vehicles (EVs), and infotainment units requires high-performance logic ICs for real-time data processing and sensor integration. Logic ICs enable advanced control systems for safety, connectivity, and automation. The demand for reliability, low latency, and efficient power management in vehicle electronics has increased the adoption of ASICs and FPGAs. Furthermore, regulatory mandates promoting vehicle safety and emissions control drive investments in semiconductor technologies. As automakers prioritize electronic innovation to enhance driving experiences and meet sustainability goals, the demand for logic ICs continues to expand globally.

- For instance, NVIDIA’s DRIVE Orin system-on-a-chip (SoC) delivers 254 trillion operations per second (TOPS) and is used by automakers like Volvo and NIO. While the processing power of a single Orin SoC enables advanced sensor processing necessary for high levels of autonomy, the achievement of Level 4 autonomous driving depends on a vehicle’s full, integrated hardware and software system.

Growth in Industrial Automation and IoT Connectivity

Industrial automation and the Internet of Things (IoT) are major contributors to Logic IC market growth. The proliferation of smart factories and Industry 4.0 initiatives necessitates efficient data processing and control systems, where Logic ICs serve as key enablers. These chips support machine learning, predictive maintenance, and real-time communication among connected devices. The increasing use of robotics, sensors, and embedded systems in manufacturing environments enhances productivity and operational accuracy. Additionally, the integration of low-power and high-speed logic ICs enables seamless connectivity across industrial networks. As industries increasingly adopt digital transformation strategies, the role of Logic ICs in optimizing performance and enabling edge computing becomes increasingly critical.

Key Trends & Opportunities

Miniaturization and Advanced Packaging Technologies

The trend toward miniaturization in semiconductor design is reshaping the Logic IC market. Compact devices with higher functionality are driving demand for advanced packaging solutions such as Chip-Scale Packaging (CSP) and 3D Integrated Circuits. These technologies improve space utilization, reduce signal loss, and enhance performance efficiency. Manufacturers are focusing on developing lightweight, high-density circuits suitable for next-generation electronics and wearable technologies. Additionally, integration of heterogeneous systems-on-chip (SoC) allows multiple functionalities within limited space, supporting the growing need for portability and performance. This trend presents lucrative opportunities for companies investing in microfabrication and advanced assembly technologies.

- For instance, Intel’s Foveros 3D packaging technology enables the vertical stacking of logic dies and other components, such as memory, allowing for highly dense and compact designs. Interconnect pitch has evolved over time with different versions of the technology.

Rising Adoption of AI and Edge Computing

Artificial intelligence (AI) and edge computing are emerging as transformative opportunities in the Logic IC market. The growing implementation of AI-driven applications in sectors such as healthcare, automotive, and industrial automation requires powerful processing at the device level. Logic ICs, especially ASICs and FPGAs, are increasingly used for accelerating machine learning algorithms and managing complex data workloads efficiently. Edge computing, which processes data closer to the source, reduces latency and enhances response time, creating high demand for compact, power-efficient ICs. Companies investing in AI-optimized chip architectures and neural processing units are poised to benefit from this accelerating shift toward intelligent computing environments.

- For instance, Google’s Edge TPU, designed for on-device AI inference, performs up to 4 trillion operations per second (TOPS) while consuming only 2 watts of power, enabling real-time processing in IoT devices and embedded systems.

Key Challenges

Rising Complexity and Manufacturing Costs

The increasing complexity of semiconductor design and shrinking process nodes present a major challenge for the Logic IC industry. Advanced fabrication technologies such as 5nm and 3nm require substantial capital investments in equipment and process optimization. As transistor density increases, maintaining performance, yield, and thermal efficiency becomes more difficult. These factors drive up production costs and extend time-to-market for new IC designs. Moreover, smaller geometries often introduce challenges in power management and signal integrity. The high research and development (R&D) costs associated with next-generation chip technologies can limit the participation of smaller manufacturers, potentially consolidating market power among a few dominant players.

Supply Chain Disruptions and Semiconductor Shortages

Global supply chain disruptions continue to challenge the Logic IC market. The semiconductor industry faces periodic shortages due to limited fabrication capacity, geopolitical tensions, and dependency on specific regions for raw materials and advanced manufacturing. Fluctuations in demand across consumer electronics, automotive, and industrial sectors further strain production cycles. These supply chain constraints lead to delayed product deliveries and increased costs for downstream industries. Additionally, reliance on a few foundries for advanced node production exposes manufacturers to risks related to trade restrictions and logistical bottlenecks. To mitigate these issues, companies are investing in supply chain diversification and domestic semiconductor manufacturing initiatives.

Regional Analysis

North America:

North America holds a significant share of the Logic IC market, driven by strong demand from consumer electronics, automotive, and data center industries. The region accounts for a substantial portion of global revenue due to the presence of major semiconductor manufacturers such as Intel, AMD, and Texas Instruments. Technological advancements in AI, 5G, and autonomous vehicles further boost regional growth. The United States leads the market, supported by robust R&D investments and government initiatives promoting domestic chip production. Overall, North America represents approximately 32% of the global Logic IC market share.

Europe:

Europe captures a considerable share of the Logic IC market, driven by increasing adoption of advanced semiconductor technologies in automotive, industrial automation, and healthcare sectors. Countries such as Germany, France, and the Netherlands are major contributors, supported by strong engineering capabilities and the presence of firms like Infineon Technologies and STMicroelectronics. The region’s emphasis on sustainable electronics manufacturing and EV production enhances demand for high-performance logic ICs. With growing investment in semiconductor self-reliance and innovation, Europe accounts for roughly 24% of the global Logic IC market share.

Asia-Pacific:

Asia-Pacific dominates the Logic IC market, holding the largest share globally, estimated at around 38%. The region’s leadership stems from its strong manufacturing ecosystem and high consumption of electronic devices. China, Japan, South Korea, and Taiwan are key markets, housing leading foundries such as TSMC and Samsung Electronics. The proliferation of consumer electronics, expanding 5G networks, and rising automotive electronics demand fuel growth. Additionally, government-backed semiconductor initiatives in China and India promote domestic production and R&D innovation, reinforcing Asia-Pacific’s position as the central hub for Logic IC development and manufacturing.

Latin America:

Latin America shows steady growth in the Logic IC market, supported by increasing digitalization and rising demand for electronic devices. Brazil and Mexico are the primary contributors, driven by expanding telecommunications infrastructure and automotive manufacturing. Growing investments in industrial automation and smart consumer devices further strengthen market penetration. Although the region’s semiconductor manufacturing base is limited, collaborations with global chipmakers and technology imports sustain supply chains. Latin America represents approximately 4% of the global Logic IC market share, with promising growth opportunities emerging in data centers and IoT applications.

Middle East & Africa:

The Middle East & Africa region holds a modest yet growing share of the Logic IC market, accounting for around 2% globally. Rising adoption of smart technologies, digital transformation initiatives, and expansion of telecommunication networks are key growth factors. The United Arab Emirates, Saudi Arabia, and South Africa lead regional adoption, supported by increasing investments in industrial automation and smart city projects. Although local semiconductor production remains limited, reliance on imports and growing demand for consumer electronics create potential for market expansion over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type:

- Programmable Logic ICs

- Application-Specific Integrated Circuits (ASICs)

- Standard Logic ICs

- Field-Programmable Gate Arrays (FPGAs)

- Others

By Technology:

- Complementary Metal-Oxide-Semiconductor (CMOS)

- Bipolar

- BiCMOS

By Packaging:

- Surface Mount Technology (SMT)

- Through-Hole Technology (THT)

- Chip-Scale Packaging (CSP)

By Application:

- Consumer Electronics

- Automotive

- Telecommunication

- Industrial Equipment

- Healthcare Devices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Logic IC market is highly competitive, characterized by the presence of several global semiconductor leaders focusing on innovation, product diversification, and strategic partnerships. Key players such as Intel Corporation, Samsung Electronics, Texas Instruments, Broadcom, and STMicroelectronics dominate the market through continuous advancements in chip design, process technologies, and energy-efficient architectures. Companies are investing heavily in R&D to develop high-performance, low-power logic ICs tailored for applications in AI, automotive electronics, and industrial automation. Mergers, acquisitions, and collaborations remain integral strategies to enhance production capabilities and expand regional presence. For instance, major firms are leveraging 5nm and 3nm fabrication technologies to gain a competitive edge in performance and scalability. Additionally, partnerships with foundries and technology providers help streamline supply chains and accelerate innovation. The competitive landscape is also marked by increasing focus on sustainability, with manufacturers optimizing materials and manufacturing processes to meet global environmental standards.

Key Player Analysis

- Samsung Electronics Co., Ltd. (South Korea)

- STMicroelectronics N.V. (Switzerland)

- Texas Instruments Inc. (U.S.)

- NXP Semiconductors N.V. (Netherlands)

- Analog Devices, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Qualcomm Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

- Intel Corporation (U.S.)

- ON Semiconductor Corporation (U.S.)

- Broadcom Inc. (U.S.)

- Maxim Integrated Products, Inc. (U.S.)

- Microchip Technology Inc. (U.S.)

Recent Developments

- In January 2025, TSMC committed USD 12 billion to lift 3 nm capacity by 50%, targeting production availability in Q4 2025.

- In December 2024, Intel secured USD 7.86 billion in CHIPS Act grants to progress 2 nm manufacturing at Ohio and Arizona sites.

- In December 2024, Siemens Digital Industries Software released Tessent Hi-Res Chain to improve 5 nm fault isolation.

- In November 2024, Samsung announced 2 nm Gate-All-Around process readiness with 12% speed gains over 3 nm, initial volume in 2026.

- In July 2024, Flex Logix enhanced its AI accelerators by using embedded FPGA technology to reduce memory bandwidth requirements up to 16 times, supporting new data representations and efficient operations. The solution aimed to improve AI performance, particularly in edge vision applications and cloud computing.

- In January 2023, Siemens launched the Questa Verification IQ software, designed to enhance integrated circuit verification by streamlining collaboration and project visibility using AI-driven data analytics. The solution integrates with Polarion Requirements to automate data capture throughout the project lifecycle.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Packaging, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Logic IC market will continue to expand with rising integration of AI and machine learning technologies across devices.

- Growth in electric and autonomous vehicles will drive higher adoption of customized ASICs and FPGAs.

- Advancements in semiconductor fabrication such as 3nm and below will enhance processing efficiency and reduce power consumption.

- The demand for energy-efficient and compact logic chips will increase with the growth of wearable and IoT devices.

- Edge computing applications will boost the need for high-speed, low-latency logic ICs.

- Strategic partnerships between chip manufacturers and foundries will strengthen global production capabilities.

- Investments in domestic semiconductor manufacturing will rise to reduce dependency on specific regions.

- Industrial automation and robotics will continue to create demand for reliable and high-performance logic circuits.

- Sustainability and eco-friendly chip production will gain greater focus among manufacturers.

- Asia-Pacific will maintain its dominance, supported by strong manufacturing and technological infrastructure.