Market Overview:

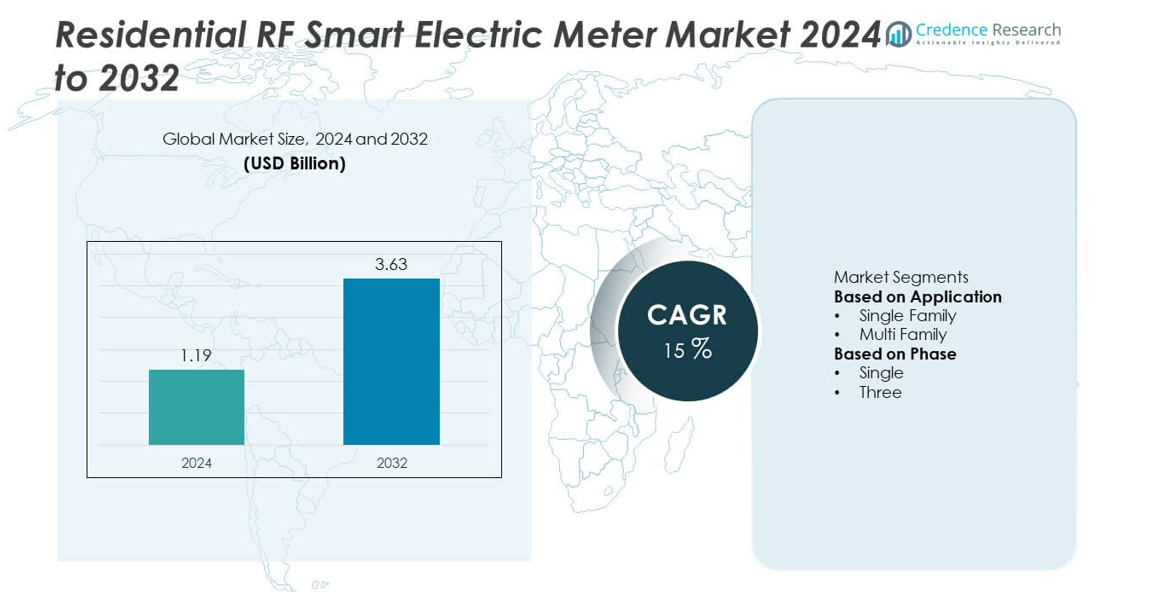

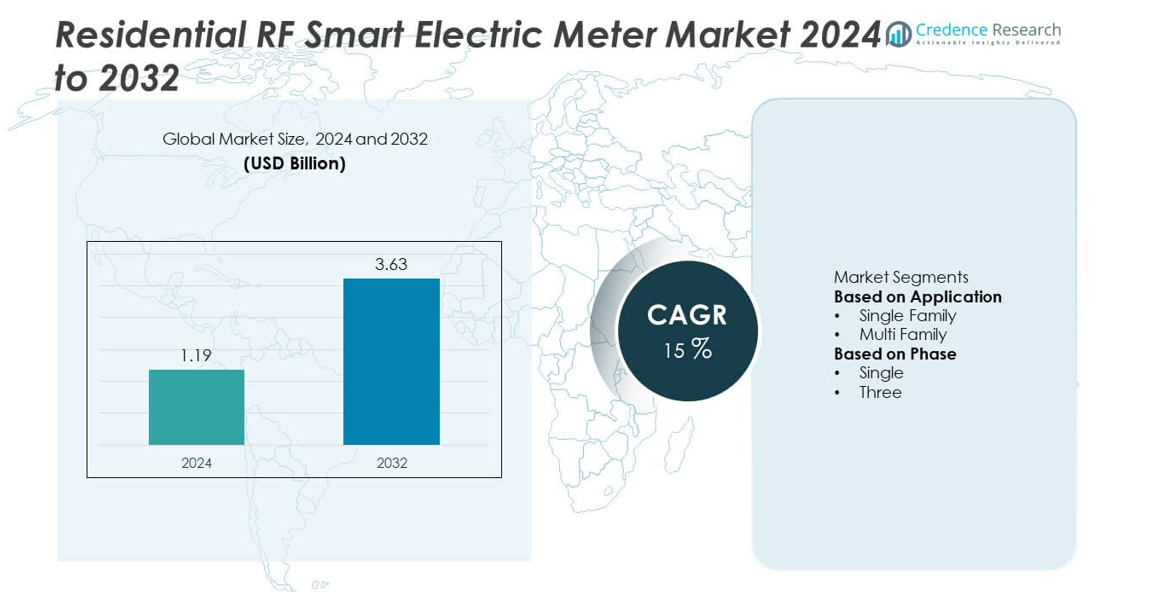

The Residential RF Smart Electric Meter Market was valued at USD 1.19 billion in 2024 and is projected to reach USD 3.63 billion by 2032, growing at a CAGR of 15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential RF Smart Electric Meter Market Size 2024 |

USD 1.19 billion |

| Residential RF Smart Electric Meter Market, CAGR |

15% |

| Residential RF Smart Electric Meter Market Size 2032 |

USD 3.63 billion |

The residential RF smart electric meter market is led by major companies such as CyanConnode, Apator SA, Honeywell International Inc., Circutor, Itron Inc., Cisco Systems, Inc., Advanced Electronics Company (AEC), Iskraemeco Group, General Electric, and Aclara Technologies LLC. These players drive innovation through advanced RF mesh communication, IoT integration, and energy data management platforms that enhance grid efficiency and reliability. Continuous investments in low-power wireless technologies and smart home connectivity strengthen their competitive position. North America dominated the market with a 37% share in 2024, supported by large-scale smart grid projects and favorable government policies, followed by Europe with 30%, driven by stringent energy efficiency mandates and nationwide metering rollouts.

Market Insights

- The residential RF smart electric meter market was valued at USD 1.19 billion in 2024 and is projected to reach USD 3.63 billion by 2032, growing at a CAGR of 15%.

- Rising demand for energy efficiency, real-time monitoring, and government-led smart grid programs are major growth drivers for the market.

- Key trends include the adoption of IoT-based communication modules, RF mesh networking, and AI-driven data management for enhanced grid reliability.

- The market is competitive, with leading players such as CyanConnode, Itron Inc., Honeywell International Inc., Cisco Systems, and General Electric focusing on product innovation and utility partnerships.

- North America held a 37% share, followed by Europe with 30% and Asia Pacific with 25%, while the single-family segment and single-phase meters dominated with 62% and 71% shares, respectively.

Market Segmentation Analysis:

By Application

The single-family segment dominated the residential RF smart electric meter market with a 62% share in 2024. Growth is driven by high installation rates in individual homes due to easier deployment and strong demand for real-time energy monitoring. Increasing adoption of smart home technologies and government initiatives promoting energy-efficient households further support this dominance. Utilities prefer single-family installations for cost-effective network connectivity and efficient data collection. Rising awareness of energy conservation and the integration of RF-based meters with home automation systems continue to boost demand across developed and emerging economies.

- For instance, CyanConnode deployed its Omnimesh RF communication modules in over 2 million endpoints across India, utilizing its narrowband RF mesh technology. The network employs a flexible, self-forming, and self-healing mesh system, with modules capable of creating links over distances far exceeding 250 meters, including a long-range version that can reach up to 10 kilometers per link in rural areas.

By Phase

The single-phase segment held the largest 71% share in 2024, driven by its extensive use in residential buildings and small-scale energy consumers. Single-phase meters are cost-effective, easy to install, and suitable for standard household electricity consumption. The growing penetration of smart grids and RF mesh communication systems enhances operational efficiency and real-time usage tracking. Rising adoption of smart metering programs in urban and suburban areas supports steady growth. Additionally, technological advancements in wireless data transmission and low-power metering systems strengthen the segment’s leadership in the global market.

- For instance, Itron Inc. implemented its Gen5 Riva single-phase smart meters with integrated RF mesh and Wi-Fi capabilities. The meters feature Distributed Intelligence (DI) edge computing to process and analyze data in real-time at the edge of the network.

Key Growth Drivers

Rising Smart Grid Deployment and Energy Efficiency Regulations

The rapid expansion of smart grid infrastructure is a major driver for residential RF smart electric meters. Governments and utilities are promoting energy-efficient solutions to reduce losses and enhance grid reliability. RF-based meters enable two-way communication, helping optimize energy distribution and detect faults faster. Regulatory mandates in regions like North America and Europe encourage utilities to replace traditional meters with smart versions. These initiatives, coupled with growing awareness of efficient energy management, are accelerating large-scale residential adoption of RF smart metering systems worldwide.

- For instance, Honeywell has partnered with Verizon to provide 5G connectivity for smart meters, enabling two-way data transmission for remote utility management and improved grid performance. The integration leverages Verizon’s secure cellular network and allows utilities to receive information about energy usage, grid conditions, and equipment performance.

Growing Integration of IoT and Wireless Communication Technologies

The increasing use of IoT and advanced wireless technologies such as RF mesh, Zigbee, and Wi-SUN is boosting market demand. These systems enable seamless data exchange between meters, utilities, and user interfaces. Real-time consumption tracking, remote billing, and predictive maintenance improve operational efficiency. As smart home adoption rises, connectivity between RF meters and intelligent energy management systems strengthens. This integration enhances user control and supports sustainable energy consumption, positioning RF smart meters as a cornerstone of digital energy ecosystems.

- For instance, Cisco Systems, Inc. integrated its IoT Field Network Director (FND) platform into utility-grade RF mesh networks to manage multi-service infrastructure for applications like Advanced Metering Infrastructure (AMI). This highly scalable platform simplifies the deployment and lifecycle management for thousands of routers and millions of endpoints, utilizing adaptive routing technology within the mesh networks.

Supportive Government Initiatives and Modernization of Power Infrastructure

Governments across regions are investing in upgrading outdated electricity grids with smart metering solutions. Incentives, funding programs, and national digitization plans encourage utilities to adopt RF-based smart meters. Countries such as the U.S., China, and India are implementing large-scale metering rollouts to enhance billing transparency and grid resilience. The integration of RF meters helps utilities manage peak load and reduce power theft. These modernization efforts are driving significant market growth and ensuring long-term sustainability of the energy distribution network.

Key Trends & Opportunities

Expansion of Advanced Metering Infrastructure (AMI)

The widespread deployment of AMI systems is a key trend shaping the residential RF smart electric meter market. AMI enables real-time data collection, remote disconnection, and enhanced analytics for utilities. Integration with RF mesh networks ensures reliable, secure, and scalable communication. Utilities are leveraging these systems to enhance operational transparency and customer engagement. The growing focus on grid automation and demand-side management creates new opportunities for manufacturers to develop high-performance meters with improved communication efficiency.

- For instance, Aclara Technologies LLC has deployed its RF-based AMI platform for residential connections in North America, utilizing a licensed 450–470 MHz sub-GHz frequency band for reliable, extended-range communication.

Emergence of Data-Driven Energy Management Solutions

Data analytics and AI-based energy optimization platforms are emerging as major opportunities in this market. RF smart meters generate detailed consumption data that utilities can analyze to predict demand patterns and improve energy distribution. Homeowners benefit from real-time energy insights through mobile apps and dashboards. As sustainability goals become central to energy policy, the integration of data-driven tools with RF metering infrastructure enables efficient load balancing and promotes renewable energy integration, unlocking long-term growth potential.

- For instance, General Electric integrated AI-based energy analytics within its GridOS platform, using a federated data fabric to access data from across the grid, including residential meters. The system leverages machine learning and AI for applications like load frequency control, predictive maintenance, and managing renewable energy sources in real-time.

Key Challenges

High Installation and Infrastructure Upgrade Costs

Despite strong adoption potential, high initial installation and network upgrade costs pose a challenge. Utilities face financial barriers when deploying large-scale RF smart meter networks, especially in developing regions. The need for compatible communication infrastructure and cybersecurity measures increases overall expenditure. Smaller residential utilities often struggle with budget constraints, slowing the pace of adoption. To overcome this, cost-effective RF modules and scalable deployment models are required to make the technology accessible across all market tiers.

Data Privacy and Cybersecurity Concerns

The increasing interconnectivity of smart metering systems raises significant data security and privacy risks. Unauthorized access or tampering with RF communication networks can lead to billing errors or service disruptions. Consumers remain cautious about data sharing due to potential misuse of personal consumption information. Utilities must implement strong encryption, secure data transmission protocols, and regular system audits. Ensuring compliance with international cybersecurity standards is crucial to maintaining user trust and supporting widespread market adoption of RF smart electric meters.

Regional Analysis

North America

North America held the leading 37% share of the residential RF smart electric meter market in 2024. The region’s dominance is driven by large-scale smart grid projects, strong government incentives, and advanced infrastructure. The U.S. remains a major contributor with extensive adoption of RF mesh technology and utility-driven modernization initiatives. Programs such as the U.S. Department of Energy’s Grid Modernization Strategy further support widespread deployment. High awareness of energy efficiency and real-time consumption tracking among homeowners also fuels demand. Continuous investment by utilities enhances network reliability and drives long-term growth across the region.

Europe

Europe accounted for a 30% share of the residential RF smart electric meter market in 2024. The region benefits from strict energy-efficiency regulations and government mandates promoting smart metering. Countries such as the U.K., Germany, and France are accelerating deployment through national rollout programs. Widespread integration of renewable energy and the need for dynamic consumption data are key growth factors. RF-based meters are increasingly used to support load balancing in distributed grids. Rising focus on sustainability, coupled with advanced IoT connectivity in European homes, continues to enhance market penetration across residential sectors.

Asia Pacific

Asia Pacific captured a 25% share of the residential RF smart electric meter market in 2024 and is projected to grow fastest through 2032. The region’s expansion is supported by rapid urbanization, grid digitization, and government initiatives in China, India, and Japan. Large-scale infrastructure investments and demand for reliable electricity distribution are driving adoption. Growing focus on reducing power theft and improving billing accuracy also contributes to market growth. Local manufacturing capabilities and public-private partnerships are enhancing deployment efficiency. Rising smart city developments further reinforce Asia Pacific’s growing role in the global market.

Latin America

Latin America represented a 5% share of the residential RF smart electric meter market in 2024. Market expansion is supported by modernization efforts in Brazil, Mexico, and Chile, where utilities are upgrading outdated grid systems. Government-backed energy reform programs promote the use of RF-based meters for efficient billing and power management. Despite limited infrastructure in some regions, foreign investments and technology transfers are accelerating adoption. The rising demand for transparent energy usage and growing utility focus on reducing losses continue to strengthen the market outlook across the region.

Middle East & Africa

The Middle East & Africa region held a 3% share of the residential RF smart electric meter market in 2024. Growth is driven by increasing investments in smart grid projects across the Gulf Cooperation Council (GCC) countries and South Africa. Governments are prioritizing digital transformation of energy networks to improve operational efficiency and sustainability. However, limited infrastructure and high installation costs restrain faster adoption in low-income areas. Ongoing partnerships between utilities and global meter manufacturers are expected to enhance deployment, creating steady growth opportunities in the coming years.

Market Segmentations:

By Application

- Single Family

- Multi Family

By Phase

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential RF smart electric meter market is characterized by strong competition among leading companies such as CyanConnode, Apator SA, Honeywell International Inc., Circutor, Itron Inc., Cisco Systems, Inc., Advanced Electronics Company (AEC), Iskraemeco Group, General Electric, and Aclara Technologies LLC. These players focus on developing advanced RF communication modules, interoperable metering systems, and data analytics platforms to enhance energy efficiency and grid visibility. Strategic initiatives such as partnerships with utilities, smart city collaborations, and government-backed pilot programs are central to their growth strategies. Companies are also investing in IoT-enabled solutions, cybersecurity frameworks, and AI-driven energy management tools to strengthen their market presence. Continuous innovation in low-power RF technologies and real-time data transmission capabilities supports improved scalability and performance, reinforcing competition across regional and global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CyanConnode

- Apator SA

- Honeywell International Inc.

- Circutor

- Itron Inc.

- Cisco Systems, Inc.

- Advanced Electronics Company (AEC)

- Iskraemeco Group

- General Electric

- Aclara Technologies LLC

Recent Developments

- In March 2025, Itron, Inc. announced that electric cooperative AVECC would deploy its “Gen5 Riva” smart meters with fiber-enabled communications for residential advanced metering infrastructure.

- In March 2025, Honeywell International Inc. announced its smart meters would incorporate Verizon 5G connectivity, enabling utilities and end-users to access real-time usage and grid information.

- In August 2024, CyanConnode Holdings plc announced the deployment of over 2 million RF communication endpoints in India under its Omnimesh narrow-band mesh network platform

Report Coverage

The research report offers an in-depth analysis based on Application, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience rapid expansion supported by smart grid modernization and utility digitization.

- Government mandates promoting energy-efficient metering will accelerate large-scale residential adoption.

- Integration of IoT and RF mesh networks will enhance real-time communication and grid visibility.

- Advanced data analytics and AI tools will optimize energy consumption and predictive maintenance.

- Demand for remote monitoring and wireless billing systems will increase among residential users.

- Partnerships between utilities and technology providers will drive innovation in smart metering infrastructure.

- The single-phase segment will remain dominant due to widespread residential electricity usage.

- Rising investments in smart city projects will further strengthen RF meter installations.

- Cybersecurity solutions for RF communication networks will become a major focus area.

- Asia Pacific will emerge as the fastest-growing region due to rapid urbanization and smart infrastructure development.